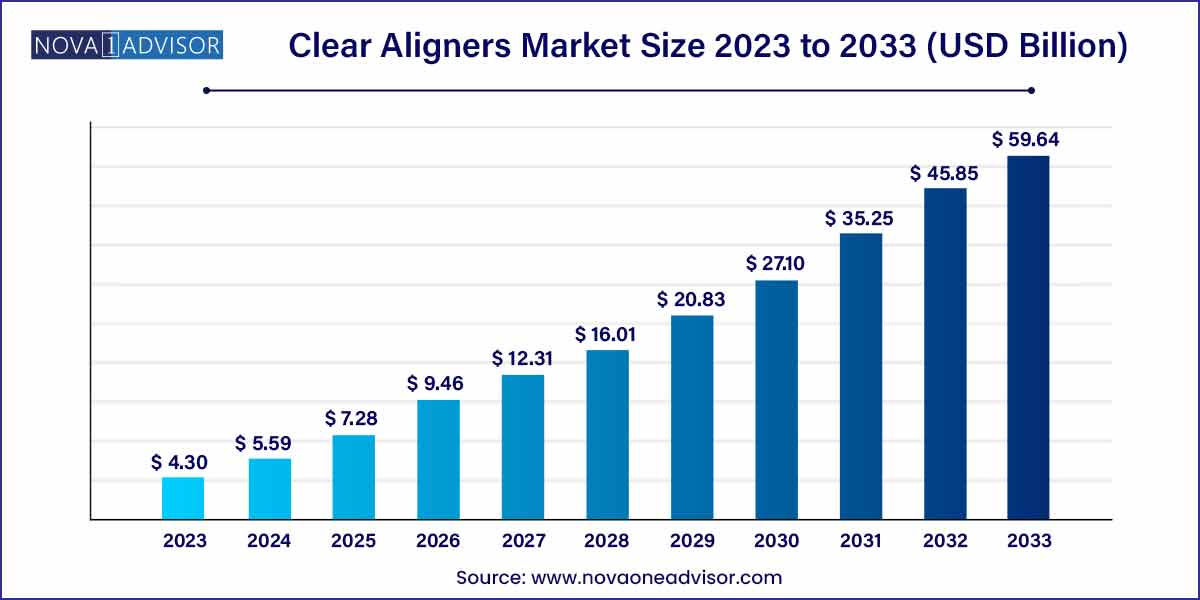

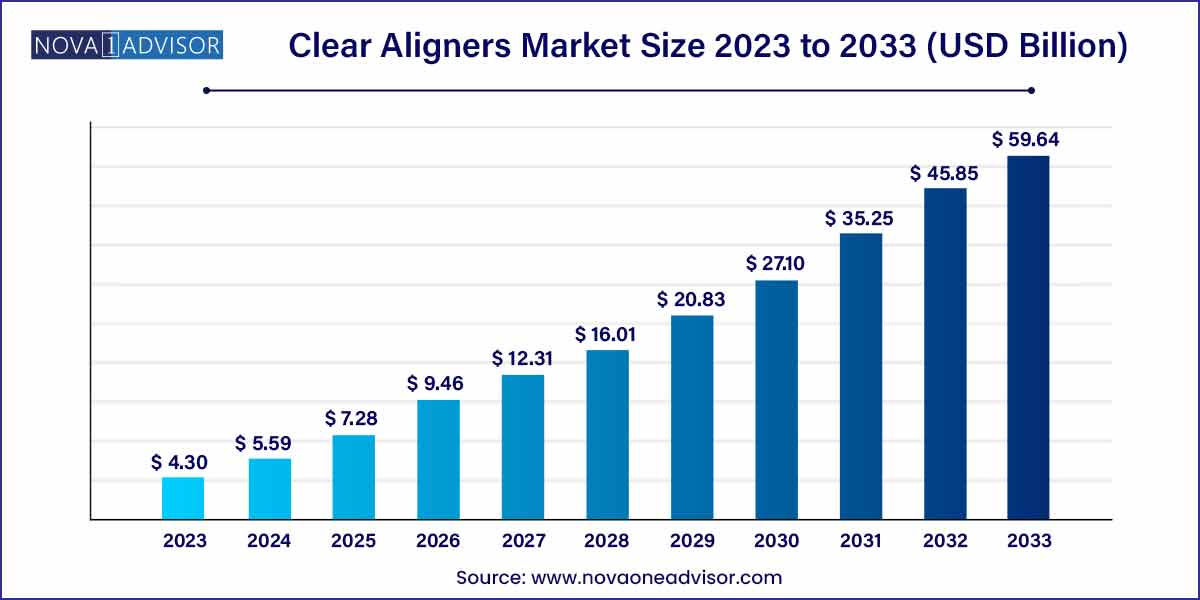

The global clear aligners size was exhibited at USD 4.30 billion in 2023 and is projected to hit around USD 59.64 billion by 2033, growing at a CAGR of 30.08% during the forecast period of 2024–2033.

Key Takeaways:

- The adult segment held the largest market share of 61.2% in 2023 and is expected to grow at a significant CAGR over the forecast period.

- The polyurethane segment held the largest market share of 78.0% in 2023, owing to the presence of invisalign clear aligners that are made of polyurethane material.

- The standalone practitioners segment held the highest market share of 52.7% in 2023 and is also experiencing a significant CAGR over the forecast period.

- The orthodontists segment held the highest market share of 67.9% in 2023 and is expected to exhibit a significant CAGR over the forecast period.

- The medium treatment duration segment accounted for the highest market share of 49.3% in 2023 and is expected to grow over the forecast period.

- The offline segment held the highest market share of 75.0% in 2023.

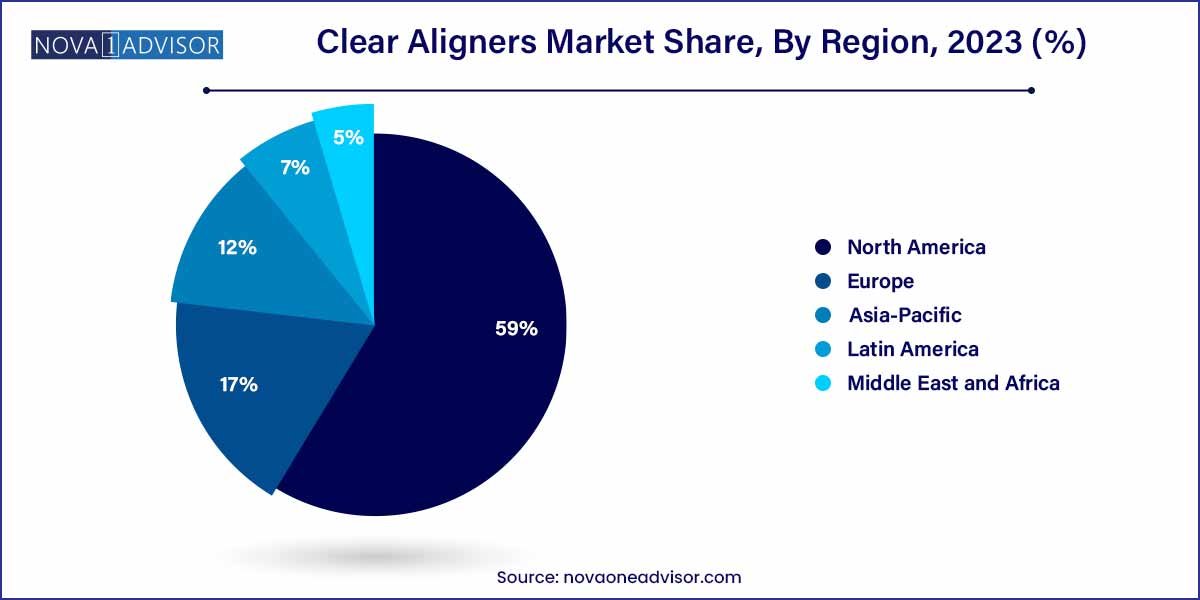

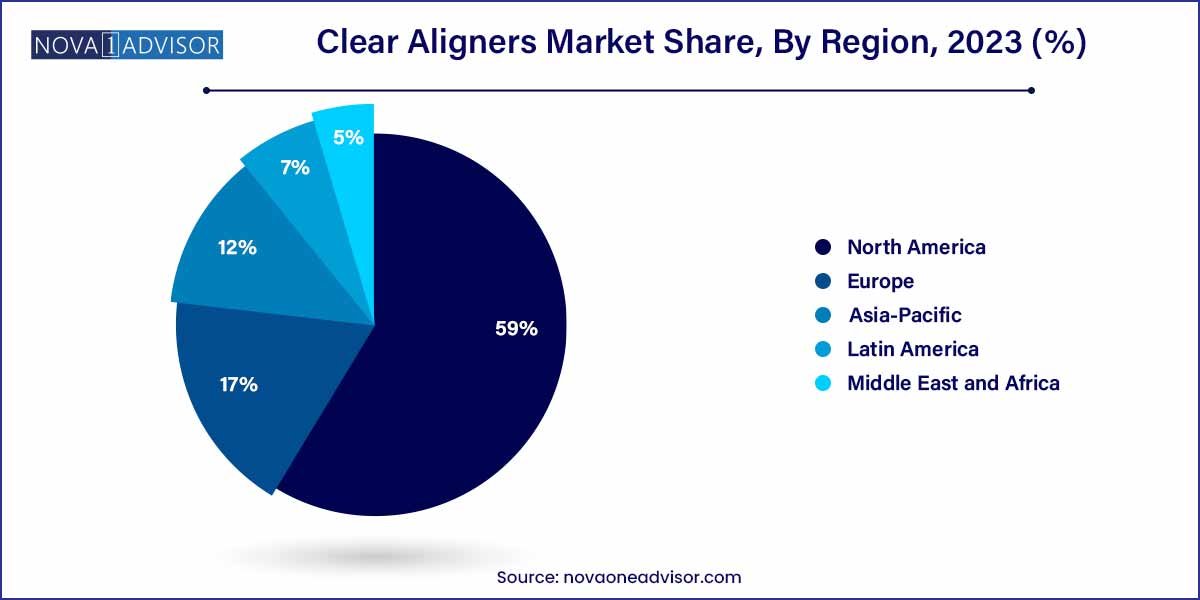

- North America dominated the market, capturing 59.0% of the market share in 2023, and is expected to showcase a significant CAGR in the forecast period.

Market Overview

The clear aligners market has revolutionized the orthodontic landscape by offering a discreet, comfortable, and effective alternative to traditional braces. Clear aligners, often known through brands like Invisalign and SmileDirectClub, provide a removable and nearly invisible method to correct dental malocclusions. Their growing acceptance across all age groups, driven by aesthetic consciousness and technological innovations in dentistry, has spurred significant market growth.

Initially targeted primarily at teenagers, clear aligners have seen massive uptake among adults seeking orthodontic correction without the inconvenience and appearance of metal braces. The convenience of remote consultations, at-home impression kits, and direct-to-consumer (DTC) models has further expanded access to orthodontic care. Meanwhile, dental clinics and orthodontists are increasingly integrating advanced digital scanners and 3D printing technologies to customize aligners with greater precision.

The market is characterized by robust competition, with traditional dental companies, emerging startups, and tech-driven orthodontic platforms vying for market share. Factors such as growing disposable incomes, increasing healthcare awareness, technological advancements, and shifting cultural attitudes toward dental aesthetics continue to drive momentum.

Major Trends in the Market

-

Rising Adoption Among Adults: Clear aligners are becoming popular among working professionals and older adults seeking discreet orthodontic solutions.

-

Technological Advancements: Digital scanning, 3D printing, and AI-based treatment planning are improving aligner precision and treatment outcomes.

-

Growth of Direct-to-Consumer (DTC) Models: Companies are offering at-home impression kits and remote treatment monitoring, bypassing traditional dental visits.

-

Personalization and Shorter Treatment Cycles: Aligners are increasingly tailored for faster, more targeted treatments using AI-driven predictive modeling.

-

Strategic Partnerships Between Dental Practices and Aligner Companies: Collaborations are strengthening clinical credibility while expanding market reach.

-

Expansion into Emerging Markets: Companies are aggressively targeting growing middle-class populations in Asia-Pacific and Latin America.

-

Focus on Teledentistry: Virtual consultations and monitoring platforms are gaining traction post-pandemic.

-

Eco-friendly Materials: Manufacturers are investing in sustainable, biodegradable aligner materials to address environmental concerns.

Clear Aligners Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.30 Billion |

| Market Size by 2033 |

USD 59.64 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 30.08% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Age, Material Type, End-use, Dentist Type, Duration, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Align Technology; Dentsply Sirona; Institute Straumann; Envista Corporation; 3M ESPE, Argen Corporation; Henry Schein Inc; TP Orthodontics Inc; SmileDirect Club; Angel Aligner. |

Driver: Growing Demand for Aesthetic and Convenient Orthodontic Treatments

One of the major drivers for the clear aligners market is the increasing demand for aesthetic and convenient orthodontic solutions. Consumers, particularly adults and teenagers, are seeking treatments that align with their lifestyle and appearance preferences. Traditional metal braces, often perceived as unsightly and cumbersome, are falling out of favor compared to nearly invisible clear aligners.

Furthermore, clear aligners offer lifestyle flexibility — they can be removed during meals and for cleaning, improving oral hygiene compared to fixed appliances. Social media culture, cosmetic consciousness, and the rising influence of "smile makeovers" showcased by celebrities and influencers are accelerating this trend. Dental clinics reporting a surge in adult orthodontic consultations underline the growing shift toward clear aligner adoption.

Restraint: High Treatment Costs

Despite their advantages, the high cost associated with clear aligner treatment remains a key barrier to widespread adoption. Depending on complexity, treatment costs can range from $3,000 to over $8,000, making it inaccessible to large sections of the population, especially in emerging economies.

Insurance coverage for orthodontic treatments often remains limited, further burdening out-of-pocket expenses. While DTC models offer somewhat more affordable alternatives, complex cases requiring clinical supervision continue to be expensive. Cost pressures could slow adoption rates, particularly among younger demographics and price-sensitive markets.

Opportunity: Expansion of Digital Orthodontics and Teledentistry

An exciting opportunity in the clear aligners market is the integration of digital orthodontics and teledentistry. Digital impressions, AI-powered treatment planning, and remote monitoring technologies are not only enhancing the patient experience but also expanding access to orthodontic care.

Companies are increasingly offering smartphone apps for virtual progress tracking, reducing the need for frequent in-office visits. This shift caters especially to rural populations and busy urban professionals. SmileDirectClub, for example, has leveraged teledentistry to offer affordable aligner treatments remotely, illustrating the disruptive potential of digital channels. The fusion of AI and telehealth is set to democratize orthodontic care, opening new revenue streams for market players.

Age Insights

Adults dominated the clear aligners market in 2024, accounting for the largest revenue share. Traditionally perceived as a treatment for teens, clear aligners are now widely adopted by adults who seek an inconspicuous way to improve dental alignment while maintaining a professional appearance. Adult patients also tend to have greater financial autonomy, enabling them to invest in premium dental treatments. Companies such as Align Technology have tailored marketing campaigns to target adult consumers, highlighting convenience, aesthetics, and self-confidence.

Conversely, the teen segment is expected to register the fastest growth over the forecast period. Rising orthodontic needs among teenagers, increased parental willingness to invest in aesthetic treatments for their children, and the launch of teen-specific products like "Invisalign Teen" are driving adoption. Features like eruption tabs to accommodate growing teeth and compliance indicators to monitor usage are making clear aligners a preferred option among teens and parents alike.

Material Type Insights

Polyurethane-based clear aligners dominated the market in 2024. Polyurethane offers superior elasticity, transparency, and durability compared to traditional plastics, ensuring better comfort and aesthetic appeal for users. Major brands favor polyurethane for its adaptability to tooth movements and its ability to withstand daily wear and tear.

Meanwhile, Plastic Polyethylene Terephthalate Glycol (PETG) aligners are forecasted to witness rapid growth. PETG-based aligners offer advantages in manufacturing flexibility, environmental sustainability, and affordability, attracting manufacturers focusing on eco-conscious consumers. As demand for cost-effective and greener options increases, PETG materials are gaining traction across new entrants and value-focused market segments.

End-use Insights

Hospitals dominated the end-use segment in 2024, leveraging their multidisciplinary teams and comprehensive dental facilities to offer complex orthodontic treatments. Hospitals are often the preferred choice for patients requiring interdisciplinary collaboration, such as cases involving orthognathic surgery or periodontic complications.

However, stand-alone practices are projected to experience the fastest growth. Specialized orthodontic and cosmetic dental practices provide personalized treatment plans, quicker service delivery, and a high-touch patient experience, making them attractive to patients seeking customized clear aligner solutions. The proliferation of digital intraoral scanners and chairside 3D printers is empowering small practices to deliver high-quality aligner services competitively.

Dentist Type Insights

Orthodontists dominated the dentist type segment in 2024, owing to their specialized training in tooth movement and jaw alignment. Patients with complex malocclusions or bite issues often prefer treatment under the supervision of certified orthodontists. Orthodontic practices have also been early adopters of digital technologies, facilitating the successful integration of clear aligner systems into treatment portfolios.

Meanwhile, general dentists are emerging as the fastest-growing user segment. Clear aligner companies are offering training programs and simplified treatment planning tools to enable general dentists to expand their service offerings. This trend is particularly strong in suburban and rural areas where specialist orthodontists may be less accessible.

Duration Insights

Comprehensive malfunction treatments (>12 months) dominated the market in 2024. Patients seeking significant bite correction, severe crowding, or complex dental shifts often require prolonged aligner treatments with multiple refinements. Comprehensive cases contribute higher revenues per patient, benefiting clinics and manufacturers.

Small little beauty alignments (<4-6 months) are expected to grow the fastest. Driven by growing demand for cosmetic improvements like minor spacing adjustments or single-tooth rotations, these quick fixes are attracting patients who seek minimal intervention at a lower cost. Providers offering "smile touch-ups" with short treatment plans are capitalizing on this burgeoning segment.

Distribution Channel Insights

Offline channels, including dental clinics and hospitals, dominated the clear aligners market in 2024. Professional consultation, personalized treatment planning, and supervised progress monitoring are critical factors driving patient preference for in-person services.

However, the online channel is growing rapidly, particularly through DTC brands that offer at-home impression kits and remote treatment plans. Companies like SmileDirectClub and Candid Co. are democratizing access to orthodontics through e-commerce platforms, subscription models, and virtual consultations, reshaping the distribution landscape.

Regional Insights

North America remained the largest market for clear aligners in 2024. High awareness of dental aesthetics, a well-established dental care infrastructure, strong presence of leading manufacturers like Align Technology, and high disposable incomes drive the region's dominance. The U.S. market, in particular, has witnessed widespread adoption among both teens and adults. Favorable insurance policies increasingly covering orthodontic treatments and the willingness to invest in premium cosmetic procedures further support market leadership.

Asia-Pacific is anticipated to register the fastest growth during the forecast period. Factors such as a burgeoning middle class, increasing disposable incomes, heightened cosmetic awareness, and expanding access to advanced dental services contribute to this trend. Markets like China, India, South Korea, and Japan are witnessing a surge in dental tourism and cosmetic dentistry.

Leading players are aggressively expanding in the region, offering affordable pricing models and localized marketing strategies. The growing adoption of digital dental solutions and teledentistry platforms is bridging access gaps, further propelling demand in Asia-Pacific.

Recent Developments

-

March 2025: Align Technology launched "Invisalign Outcome Simulator Pro," a chairside tool integrated with the iTero scanner to improve patient visualization of treatment outcomes.

-

February 2025: SmileDirectClub announced a new line of nighttime-only aligners, offering treatment solutions requiring less daily wear time.

-

December 2024: Straumann Group expanded its clear aligner business in India by launching a new DTC platform aimed at millennial consumers.

-

October 2024: Candid Co. partnered with dental chains in Europe to offer hybrid orthodontic models combining in-person assessments with remote monitoring.

-

August 2024: 3M Oral Care introduced "Clarity Aligners Flex" featuring a new proprietary material designed for enhanced patient comfort and durability.

Some of the prominent players in the Clear aligners include:

- Align Technology

- Dentsply Sirona

- Institute Straumann

- Envista Corporation

- 3M ESPE

- Argen Corporation

- Henry Schein Inc

- TP Orthodontics Inc

- SmileDirect Club

- Angel Aligner

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clear aligner

Age

Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

End-Use

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

Dentist Type

- General Dentists

- Orthodontists

Duration

- Comprehensive malfunction (treatment > 12 month/ > 40 sets of Aligner)

- Medium treatments (treatment > 6-12 month/ 20-40 sets of Aligner)

- Small little beauty Alignments (treatment <4-6 month/ <20 sets Aligner)

Distribution Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)