Clinical Decision Support Systems Market Size and Trends

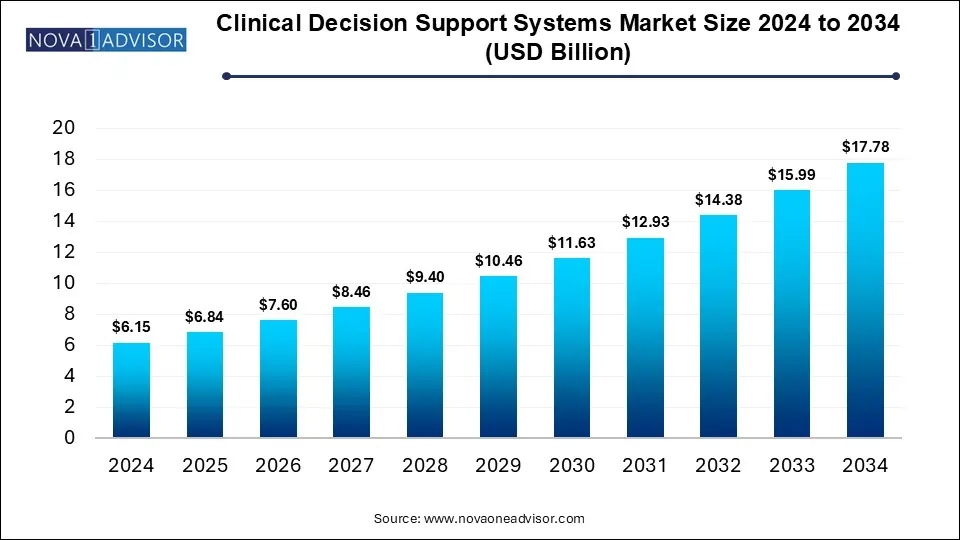

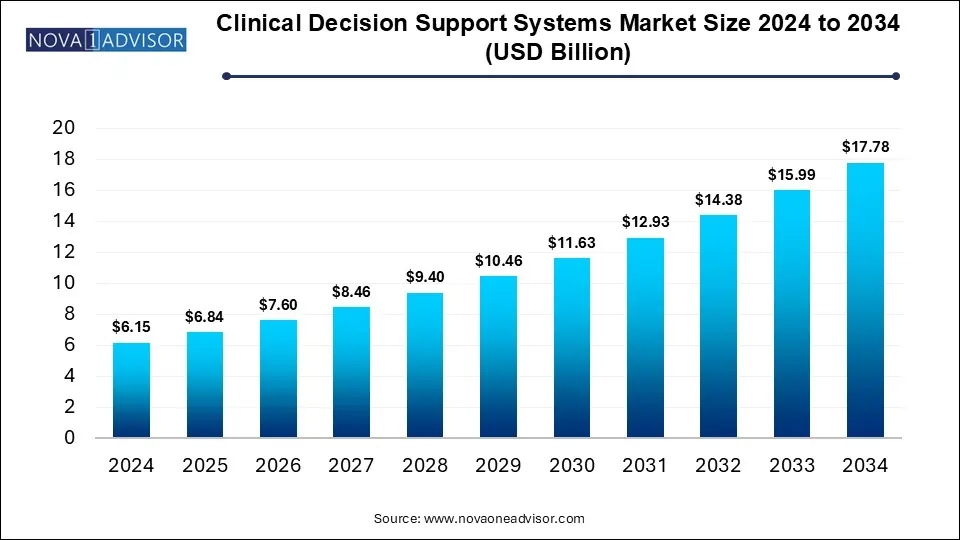

The global clinical decision support systems market size was exhibited at USD 6.15 billion in 2024 and is projected to hit around USD 17.78 billion by 2034, growing at a CAGR of 11.2% during the forecast period of 2025 to 2034.

Key Takeaways:

- Standalone CDSS held the largest market share of 31% in 2024

- Drug allergy alerts accounted for the largest market share of 26% in 2024.

- CDSS services held the largest market share of 43% in 2024

- On-premise segment in delivery mode dominated the market with the largest share of 42% in 2024.

- North America clinical decision support systems market dominated the global market with over 44% revenue share in 2024.

Market Overview

The Clinical Decision Support Systems (CDSS) market is reshaping modern healthcare delivery by empowering clinicians with real-time, data-driven insights for enhanced decision-making. CDSS refers to health information technology systems designed to assist physicians, nurses, and other healthcare providers in making clinical decisions. These systems integrate patient data with clinical guidelines, evidence-based knowledge, and advanced algorithms to deliver personalized recommendations at the point of care.

With rising complexities in patient care, expanding datasets from electronic health records (EHRs), and a growing need to minimize medical errors, CDSS has emerged as an indispensable tool in hospitals, clinics, and research institutions. From flagging potential drug-drug interactions to recommending evidence-based treatment pathways, CDSS enhances diagnostic accuracy, optimizes therapy plans, and supports preventive care.

The CDSS market includes standalone systems and those integrated with Computerized Physician Order Entry (CPOE) and Electronic Health Records (EHRs). These solutions are offered through web-based, cloud-based, and on-premise platforms, addressing diverse healthcare IT needs globally.

Driven by the digitization of healthcare, increasing healthcare costs, and the global shift toward value-based care, the CDSS market is undergoing rapid transformation and expansion. Regulatory mandates, such as MACRA in the U.S. and similar digital health incentives globally, have further catalyzed CDSS adoption. Moreover, the emergence of AI-enabled CDSS and interoperable systems is pushing the market toward a more connected, intelligent, and predictive future.

Major Trends in the Market

-

AI-Powered Clinical Decision Support

Integration of artificial intelligence and machine learning is enabling predictive analytics and precision recommendations in real-time.

-

Migration to Cloud-Based and SaaS Models

Cloud infrastructure is gaining traction due to scalability, lower upfront costs, and remote access capabilities.

-

Increasing Focus on Patient-Centric Care

CDSS solutions are being adapted to include patient-generated health data and facilitate shared decision-making models.

-

Integration with Mobile Health and Telemedicine Platforms

CDSS tools are being embedded into mobile health apps and telehealth consultations for remote patient management.

-

Specialty-Specific CDSS Tools Emerging

Custom solutions tailored to oncology, cardiology, mental health, and infectious diseases are growing in demand.

Clinical Decision Support Systems Market Report Scope

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.84 Billion |

| Market Size by 2034 |

USD 17.78 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Delivery Mode, Component, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

McKesson Corporation; Cerner Corporation; Siemens Healthineers GmbH; Allscripts Healthcare, LLC; athenahealth, Inc.; NextGen Healthcare Inc.; Koninklijke Philips N.V. (Royal Philips); IBM Corporation; Agfa-Gevaert Group; Wolters Kluwer N.V. |

Market Driver: Rising Demand for Quality Healthcare and Error Reduction

A key driver of the CDSS market is the growing global demand for improved patient safety, diagnostic accuracy, and standardized clinical care. Medical errors, many of which are preventable, are a major concern for healthcare systems worldwide. The World Health Organization (WHO) has highlighted that medication errors alone cost billions annually in avoidable expenses and patient harm.

CDSS plays a pivotal role in mitigating such risks by delivering context-aware alerts, drug-allergy warnings, and dosing recommendations. For example, a physician prescribing a new medication might be automatically alerted by a CDSS if the patient has a known allergy or is already on a potentially conflicting drug.

Beyond risk reduction, CDSS contributes to evidence-based medicine, reducing practice variability and enabling adherence to clinical guidelines. As healthcare shifts toward performance-based reimbursement and quality metrics, CDSS supports clinicians in delivering optimal care pathways with measurable outcomes.

Market Restraint: Interoperability and Data Integration Challenges

Despite their benefits, the adoption of CDSS systems is often hampered by interoperability issues and fragmented health IT ecosystems. Many hospitals and clinics operate legacy systems that are incompatible with modern CDSS platforms, making seamless data exchange difficult.

A fully functional CDSS depends on real-time access to patient records, lab results, imaging data, and clinical notes. Disparate systems or inconsistent data formats can lead to incomplete inputs, undermining the effectiveness of the decision support.

Moreover, integration with existing EHRs can be complex and costly, requiring customization, workflow re-engineering, and staff retraining. These technical and organizational barriers delay implementation and diminish the potential return on investment especially in resource-constrained healthcare settings.

Market Opportunity: Expansion of Precision Medicine and Genomic Integration

An emerging opportunity within the CDSS market lies in its application to precision medicine particularly in genomics and personalized therapies. With the increasing use of genomic sequencing in oncology, pharmacogenomics, and rare disease diagnosis, clinicians need advanced tools to interpret complex datasets.

Modern CDSS platforms are evolving to incorporate genetic profiles, biomarker data, and risk scores into decision-making algorithms. For example, a CDSS integrated with pharmacogenomics data can recommend personalized drug choices and dosages based on a patient’s genetic makeup.

This next-generation CDSS not only supports personalized treatment but also enhances clinical trial recruitment, helping identify eligible patients based on genomic markers. As precision medicine becomes a cornerstone of modern healthcare, CDSS solutions that bridge clinical and genomic data will unlock substantial market growth.

Segments Insights:

By Product Insights

CDSS integrated with Electronic Health Records (EHRs) dominates the product landscape due to the growing push toward unified digital health platforms. These integrated systems allow real-time decision support directly within physician workflows, ensuring high user adoption and clinical relevance.

The seamless availability of patient histories, lab results, and prior diagnoses enhances CDSS utility, making it an essential part of clinical documentation. As healthcare systems aim for operational efficiency, bundled EHR-CDSS solutions offer greater interoperability, cost efficiency, and patient safety benefits compared to standalone systems.

The integration of CDSS with both Computerized Physician Order Entry (CPOE) and EHR platforms is the fastest growing segment. These comprehensive systems support end-to-end clinical workflows, from order entry to care delivery, offering deeper insights and automated checks at every step.

Such systems are particularly valued in acute care and inpatient settings where time-sensitive decisions are critical. Hospitals are increasingly opting for fully integrated platforms to minimize medical errors, enhance communication among care teams, and ensure consistent application of evidence-based guidelines.

By Application Insights

Drug-drug interaction (DDI) alerts represent the most commonly utilized CDSS application. These systems cross-check prescriptions in real-time to flag potentially dangerous combinations, thereby reducing the risk of adverse events and medication errors.

Given the increasing number of polypharmacy patients, especially in geriatrics and chronic disease care, DDI modules are indispensable tools in both hospitals and outpatient clinics. Their ability to instantly assess complex medication profiles strengthens medication safety protocols and supports regulatory compliance.

The clinical guidelines application is the fastest-growing area, as hospitals seek to align treatment plans with evolving medical evidence and protocols. These CDSS modules analyze patient conditions and suggest recommended pathways based on validated clinical practice guidelines (CPGs).

They are highly valuable in managing chronic diseases, oncology, and infectious disease cases, where standard protocols are essential for optimizing outcomes and resource use. Integration with AI is further improving the adaptability and personalization of guideline-based support.

By Component Insights

Software represents the largest component of the CDSS market. The core of any CDSS lies in its algorithms, databases, interfaces, and decision rules that drive recommendations. As medical knowledge expands and software-as-a-service (SaaS) models gain traction, this segment continues to dominate.

Vendors offer modular software suites that can be tailored for hospital departments (e.g., oncology, ICU, cardiology) or clinical roles, enhancing customization and clinical workflow alignment.

Services are growing rapidly, encompassing installation, integration, training, support, and analytics consulting. Given the complexity of implementing CDSS within legacy IT environments, expert services are crucial to ensure smooth deployment and user acceptance.

Service providers are also expanding into post-implementation optimization, helping healthcare systems fine-tune CDSS recommendations and improve clinical ROI.

Delivery Mode Insights

Web-based CDSS platforms are the most widely adopted, especially in medium-sized hospitals and outpatient care facilities. These systems provide centralized updates, remote access, and lower maintenance requirements compared to traditional on-premise systems.

They are ideal for organizations seeking a balance between cost-efficiency and functionality, allowing easier integration with web-based EHRs and other cloud services.

Cloud-based CDSS platforms are witnessing the fastest growth, driven by increased demand for scalability, lower infrastructure costs, and real-time data sharing across locations. These platforms support multi-institution collaboration and remote healthcare delivery, including telemedicine and virtual consultations.

Cloud delivery is particularly beneficial for multi-site healthcare systems, CROs, and rural clinics with limited IT staff. As security frameworks improve, concerns around data privacy are diminishing, further boosting adoption.

By Regional Insights

North America leads the CDSS market, primarily due to advanced healthcare infrastructure, regulatory mandates, and EHR adoption. In the U.S., the Health Information Technology for Economic and Clinical Health (HITECH) Act, along with Meaningful Use incentives, has significantly accelerated digital health adoption.

Major healthcare networks and academic medical centers are deploying CDSS to improve care quality and reduce malpractice risks. Furthermore, a strong presence of technology vendors and innovation clusters contributes to rapid advancements and adoption.

Asia-Pacific is the fastest-growing region, supported by rising healthcare IT investments, government digitization programs, and growing clinical research activity. Countries like China, India, and Japan are investing in healthcare infrastructure modernization, with CDSS adoption being part of smart hospital initiatives.

With increasing focus on universal healthcare, cost-effective treatment models, and population health management, the region presents lucrative opportunities for CDSS vendors offering cloud-based and scalable solutions.

Some of the prominent players in the clinical decision support systems market include:

- McKesson Corporation

- Cerner Corporation

- Siemens Healthineers GmbH

- Allscripts Healthcare, LLC

- athenahealth, Inc.

- NextGen Healthcare Inc.

- Koninklijke Philips N.V. (Royal Philips)

- IBM Corporation

- Agfa-Gevaert Group

- Wolters Kluwer N.V.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical decision support systems market.

Product

- Standalone CDSS

- Integrated CPOE with CDSS

- Integrated EHR with CDSS

- Integrated CDSS with CPOE & EHR

Application

- Drug-drug interactions

- Drug allergy alerts

- Clinical reminders

- Clinical guidelines

- Drug dosing support

- Others

Delivery Mode

- Web-based Systems

- Cloud-based Systems

- On -premise Systems

Component

- Hardware

- Software

- Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)