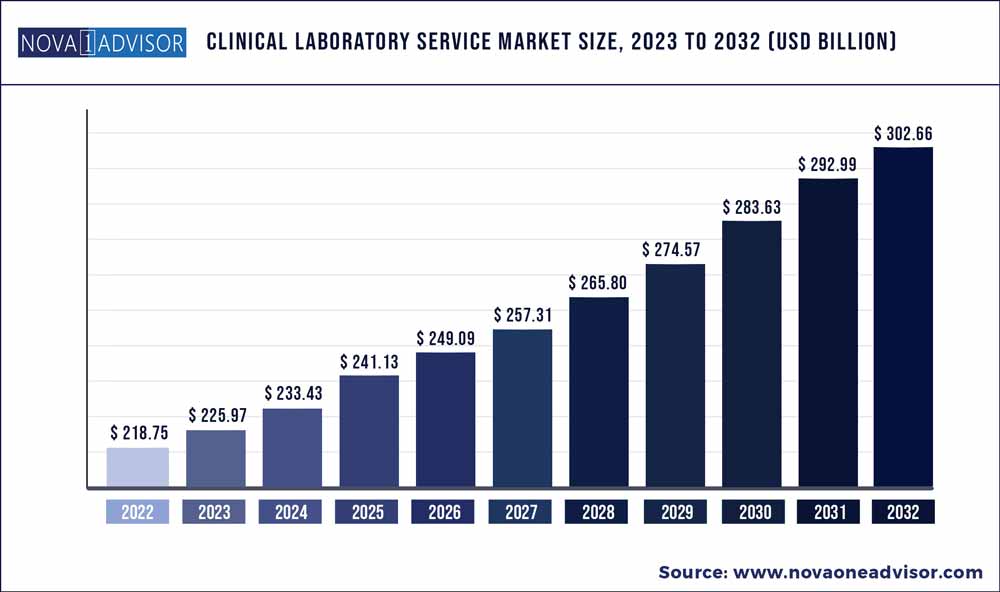

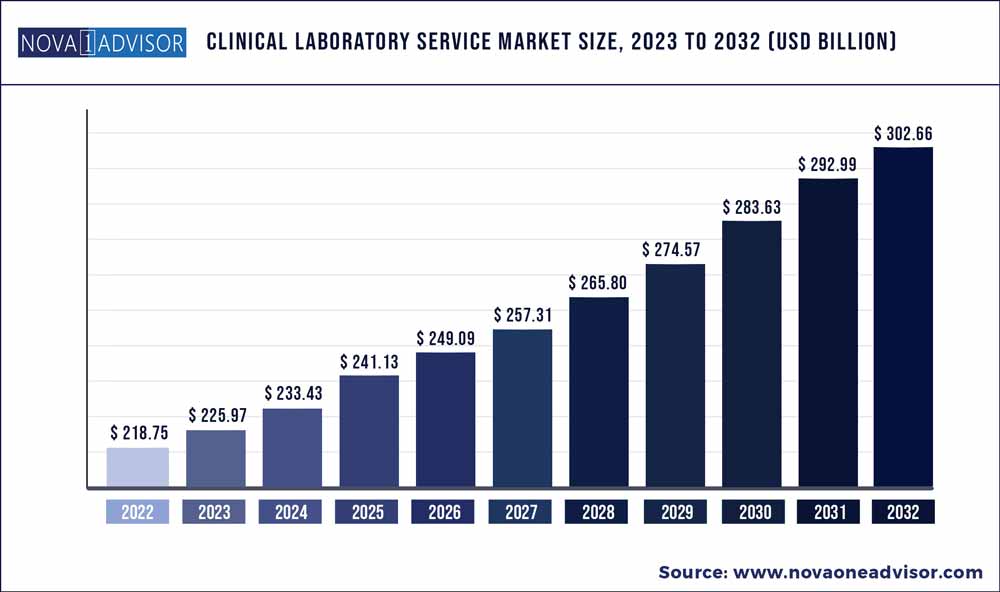

The global clinical laboratory service market size was exhibited at USD 218.75 billion in 2022 and is projected to hit around USD 302.66 billion by 2032, growing at a CAGR of 3.3% during the forecast period 2023 to 2032.

Key Pointers:

- North America is also estimated to dominate the market in 2022 with a revenue share of 38.19%

- Asia Pacific is expected to be the fastest-growing regional market at a CAGR of 4.9% during the forecast period.

- The clinical chemistry segment accounted for the largest revenue share of more than 55.09% in 2022.

- The human & tumor genetics tests segment is expected to register the fastest CAGR of 6.9% during the forecast period.

- The hospital-based laboratories segment held the largest revenue share of more than 53.11 in 2022 and is expected to grow at the fastest CAGR over the forecast period.

- This would help in increasing patient access to laboratory services. The standalone laboratories segment is expected to show a steady CAGR of 2.3% over the forecast period

- The bioanalytical & lab chemistry services segment accounted for the largest revenue share of more than 52.19% in 2022.

- The toxicology testing services segment is expected to register the fastest growth rate of 7.6% from 2023 to 2032.

Clinical Laboratory Service Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 225.97 Billion

|

|

Market Size by 2032

|

USD 302.66 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 3.3%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Test type, service provider, application

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

QIAGEN; Quest Diagnostics Inc.; OPKO Health, Inc.; Abbott; Siemens Medical Solutions USA, Inc.; NeoGenomics Laboratories; Fresenius Medical Care; ARUP Laboratories; Sonic Healthcare; Laboratory Corp. of America Holdings (LabCorp)

|

The growth of the industry can be attributed to the increasing prevalence of the geriatric population, which, in turn, is propelling the demand for early disease diagnosis. The growing prevalence of target diseases, such as diabetes and Cardiovascular Diseases (CVDs), is a high impact-rendering driver for industry growth over the forecast period. Cardiovascular disease is the leading cause of death globally. The presence of unmet medical needs pertaining to disease management and the subsequent increase in patient awareness in more regions are expected to boost the demand for clinical laboratory testing.

Improvements in laboratory testing technology throughbreakthrough and incremental advances are high-impact-rendering drivers for industry growth. Market firms are engaged in introducing new services to serve the unmet demand of patients. For instance, in May 2022, Hamilton County entered into a partnership with Ethos Laboratories for the launch of no-cost COVID-19 testing sites. In July 2022, Mayo Clinic laboratories launched monkeypox tests to increase availability and accessibility to a wider target population. Moreover, in January 2022, Quest Diagnostics launched COVID-19 rapid antigen tests available through QuestDirect in collaboration with eMed to provide access to testing for COVID-19 at home. The pandemic affected millions of people globally. According to the CDC and WHO, the standard for diagnosis of COVID-19 is RT-PCR for samples from the respiratory tract.

The adoption of PCR technology for the diagnosis of COVID-19 and the genetic sequencing of the virus for the development of a cure is driving the industry. Due to this pandemic, there is an increase in the approval of tests for the diagnosis of the novel coronavirus, with most of these tests approved under Emergency Use Authorization (EUA) by federal agencies. Furthermore, the industry operates through different sales channels—laboratories and hospitals. The presence of prominent players in various regions is expected to drive the industry. For instance, in February 2022,Labcorp entered into a comprehensive partnership with Ascension. Through this collaboration, Labcorp will handle Ascension’s hospital-based labs situated in ten states for buying assets for its outreach laboratory business.

Test Type Insights

The clinical chemistry segment accounted for the largest revenue share of more than 55.09% in 2022. The dominance of the segment is attributed to the presence of numerous clinical chemistry tests involved in the pathology analysis of body fluids, including analysis of urine, plasma, serum, and other body fluids. For instance, in July 2022, EDAN Instruments, Inc. launched a next-generation ABG solution designed to reduce the burden in a patient care setting. Clinical chemistry tests form an integral part of basic-level diagnosis and laboratory testing. Techniques, such as spectrophotometry, immunoassay, and electrophoresis, are used to measure the concentration of different types of molecules present in the collected sample.

Increasing automation to enhance customer experience is gaining traction in the segment. The human & tumor genetics tests segment is expected to register the fastest CAGR of 6.9% during the forecast period. This can be attributed to a rise in intensive research activities on genetic & proteomic studies, in the context of hereditary & gene-mutation-related disorders. Moreover, there is an increasing demand for personalized care with accurate and early diagnosis in oncology. This is expected to fuel the segment's growth. For instance, in March 2022, Illumina Inc. launched TruSight oncology, a single test that can determine the precise genetic makeup of a patient’s cancer by evaluating various tumor genes and biomarkers.

Service Provider Insights

The hospital-based laboratories segment held the largest revenue share of more than 53.11 in 2022 and is expected to grow at the fastest CAGR over the forecast period. This is attributed to the high turnaround number of patients’ tests majorly for complex and severe disease conditions that are comparatively more cost-intensive. It is expected to maintain its dominance owing to the increasing number of hospitals integrating laboratories into their premises. The growing number of outreach programs by hospitals, coupled with the high turnaround of patients suffering from complex and major diseases, is expected to drive the segment. For instance, in October 2022, Quest Diagnostics announced buying a share of Summa Health’s outreach laboratory services commercial in an all-cash agreement.

This would help in increasing patient access to laboratory services. The standalone laboratories segment is expected to show a steady CAGR of 2.3% over the forecast period due to efforts to improve patient outcomes by providing diagnostic facilities at the retail level. The Center for Breakthrough Medicines (CBM) consists of a stand-alone safety testing facility separate from GMP activities on one campus. Moreover, the ability of standalone labs to handle large volumes of diagnostic tests at an expedited rate and provide better results at comparatively lower prices is likely to offer economies of scale to service providers. There has been rapid growth in the standalone market since COVID-19. Emerging players providing standalone clinical lab services are also expected to make a significant contribution to the segment's growth.

Application Insights

The bioanalytical & lab chemistry services segment accounted for the largest revenue share of more than 52.19% in 2022. Bioanalytical & lab chemistry laboratories use a wide range of techniques and technology platforms to fulfill diagnostic needs. ELISA, chromatography, immunochemistry, mass spectroscopy, and molecular biology are the most commonly used technologies in bioanalytical & lab chemistry applications. Bioanalytical services are an essential tool in drug discovery and development for determining the concentration of drugs and their metabolites. For instance, in November 2021, Labcorp launched a bioanalytical laboratory in Singapore expanding its bioanalytical presence in Asia Pacific.

The toxicology testing services segment is expected to register the fastest growth rate of 7.6% from 2023 to 2032. Toxicology testing services include the identification of chemicals, drugs, and other toxic elements that affect patients and help clinicians in predicting future toxic effects, confirming a different diagnosis, or guiding a therapy. For instance, in August 2022, LifeNet Health LifeSciences launched a human-relevant cell-based assay service by the acquisition of IONTOX, aiding in cytotoxic screening, biocompatibility assay, and a next-generation multi-organ platform. The main services in toxicity testing include urine testing, hair testing, blood testing, and saliva testing.

Regional Insights

Asia Pacific is expected to be the fastest-growing regional market at a CAGR of 4.9% during the forecast period. The rapid growth can be attributed to the various scientific research activities, high unmet medical needs, economic growth, and an improving healthcare regulatory scenario. Moreover, positive changes related to healthcare benefits, increasing awareness among the population, and availability of high-end medical treatments are projected to support the region’s growth. Clinical laboratories have gained immense importance during the COVID-19 pandemic owing to the increasing demand for testing. Key players are focusing on collaborations for providing new lab testing services.

For instance, in March 2022, GC Labs entered into a service agreement with Bio Lab in Bahrain and Biotrust in Cambodia, expanding its presence in Asia & Middle East. North America is also estimated to dominate the market in 2022 with a revenue share of 38.8% due to the increasing geriatric population, prevalence of chronic diseases, and presence of a well-established healthcare system & reimbursement framework for clinical lab services. For instance, in July 2022, Abbott demonstrated diagnostic innovations to enhance patient care at the American Association for Clinical Chemistry (AACC) Clinical Lab expo. Leading clinical labs offer patients and healthcare professionals with crucial diagnostic information and are represented by the American Clinical Laboratory, a national trade group.

Some of the prominent players in the Clinical Laboratory Service Market include:

- QIAGEN

- Quest Diagnostics Inc.

- OPKO Health, Inc.

- Abbott

- Siemens Medical Solutions USA, Inc.

- NeoGenomics Laboratories

- Fresenius Medical Care

- ARUP Laboratories

- Sonic Healthcare

- Laboratory Corporation of America Holdings (LabCorp)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Clinical Laboratory Service market.

By Test Type

- Human & Tumor Genetics

- Clinical Chemistry

- Medical Microbiology & Cytology

- Other Esoteric Tests

By Service Provider

- Hospital-based Laboratories

- Stand-alone Laboratories

- Clinic-based Laboratories

By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Other Clinical Laboratory Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

- Frequently Asked Questions