Clinical Laboratory Tests Market Size, Share and Trends Analysis 2026 to 2035

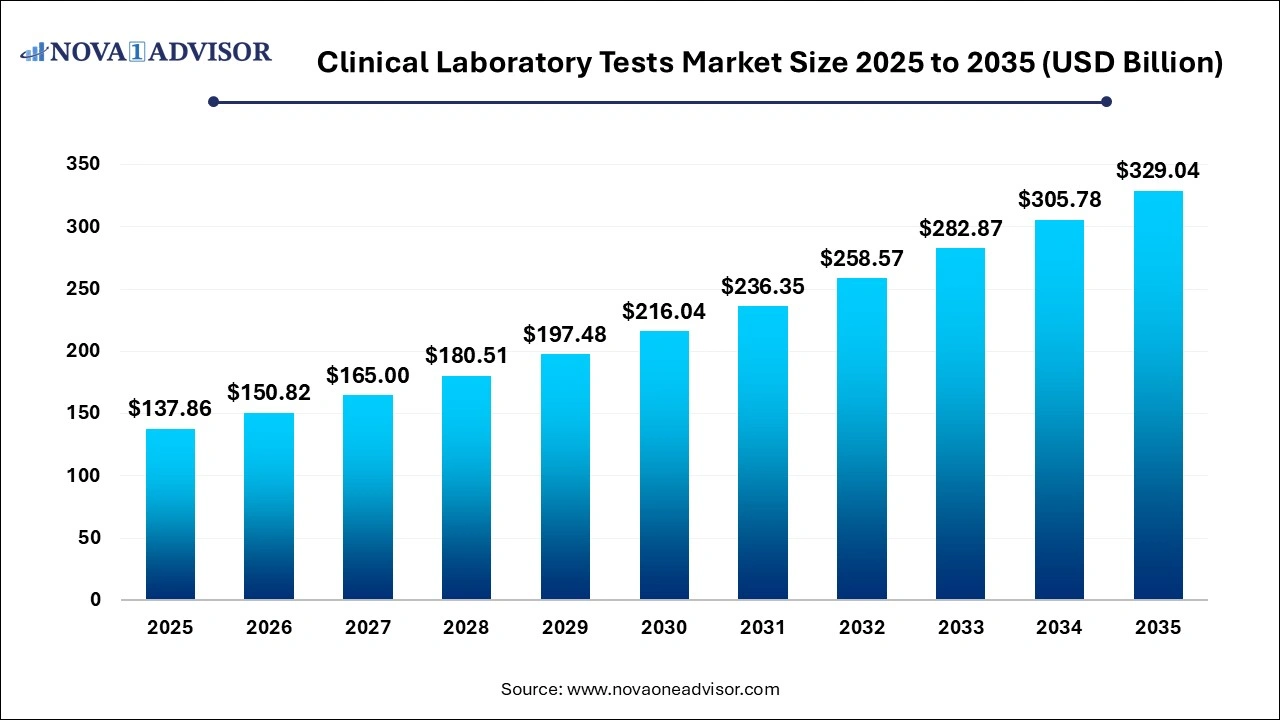

The global clinical laboratory tests market size was valued at USD 137.86 billion in 2025 and is anticipated to reach around USD 329.04 billion by 2035, growing at a CAGR of 9.09% from 2026 to 2035.

Clinical Laboratory Tests Market Key Takeaways

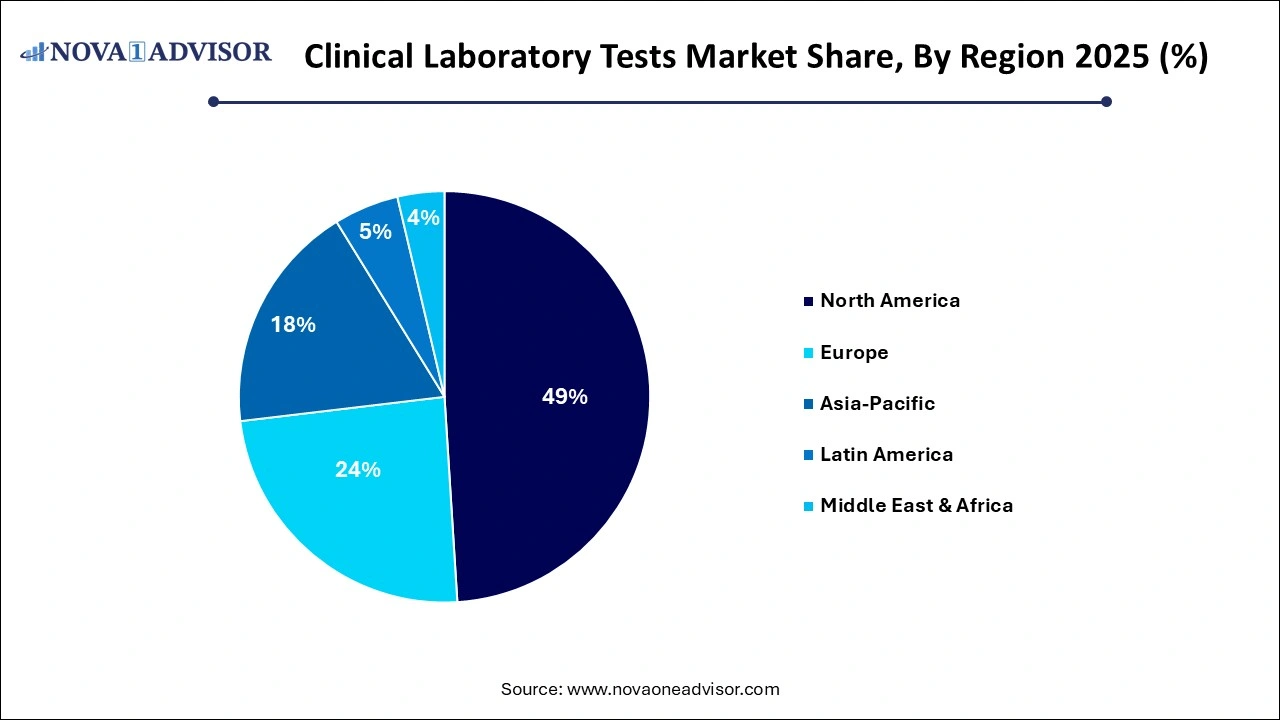

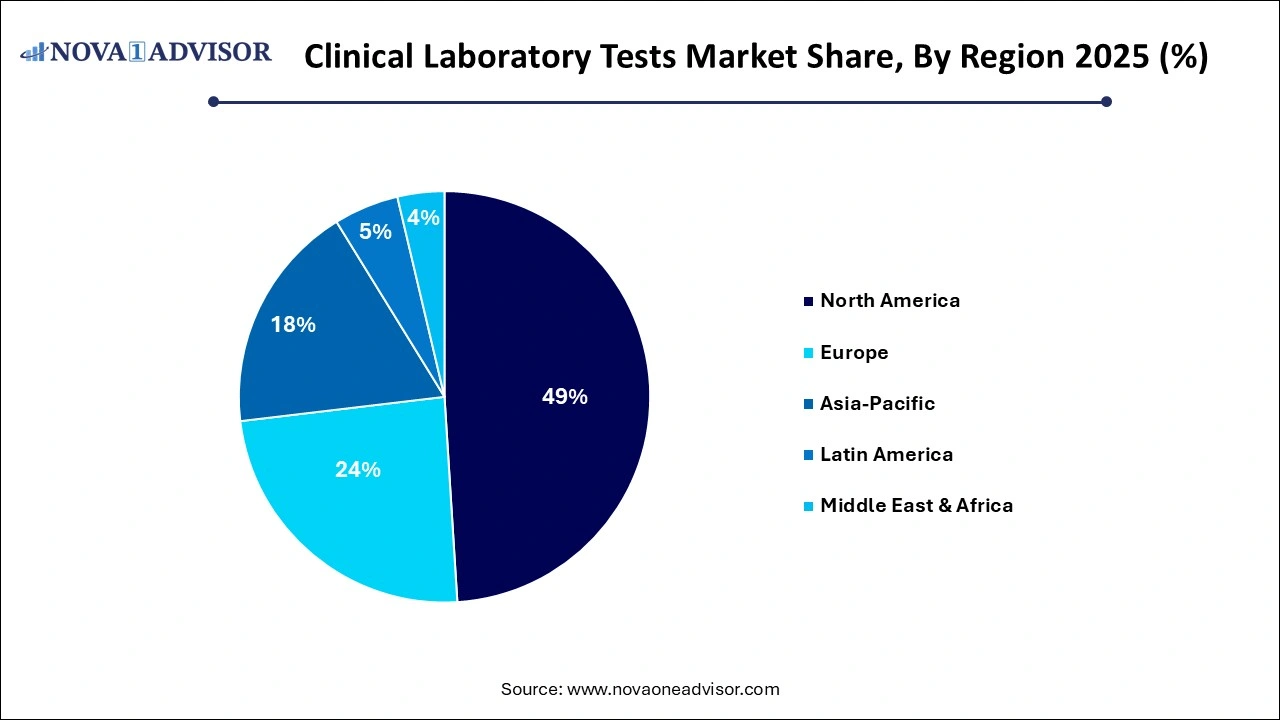

- North America held largest share of market in 2025 with a share of 49.01% and is expected to maintain its dominant position, in terms of share, throughout the forecast period.

- Asia Pacific is estimated to show the fastest growth in clinical laboratory tests market over the forecast period.

- HbA1c tests segment held largest revenue share in 2025 and is attributable to the increasing prevalence of diabetic population

- HGB/HCT tests segment is expected to show fastest growth rate over the forecast period owing to the growing prevalence of blood-related disorders

- Central laboratories segment dominated the market in 2025 attributable to the high market penetration and procedure volumes

Clinical Laboratory Tests Market Overview

The Clinical Laboratory Tests Market plays a vital role in modern healthcare, offering essential diagnostic tools for detecting, monitoring, and managing diseases. Clinical laboratory testing covers a wide array of blood, urine, and tissue assessments that help physicians make informed decisions about patient care. As healthcare shifts toward a preventative and value-based model, the demand for routine and specialized laboratory tests is expanding rapidly across developed and emerging economies. This growth is further amplified by the rising global burden of chronic diseases, an aging population, and heightened awareness of early diagnostic screening.

In recent years, technological advancements have dramatically transformed clinical laboratory operations. Automation, artificial intelligence (AI), and machine learning (ML) are increasingly integrated into lab workflows to improve test accuracy, reduce turnaround times, and enhance operational efficiency. Additionally, the COVID-19 pandemic accelerated investments in diagnostic infrastructure and demonstrated the critical role of laboratories in crisis response. As more nations prioritize healthcare innovation and diagnostics accessibility, the clinical laboratory tests market is poised for sustained expansion through 2034 and beyond.

Major Trends in the Clinical Laboratory Tests Market

-

Increasing use of AI and machine learning to automate test processing and data analysis.

-

Rising demand for point-of-care testing (POCT) and decentralized lab services.

-

Growing popularity of personalized medicine, driving demand for tailored diagnostic panels.

-

Surge in home-based and remote sample collection services.

-

Consolidation among diagnostic laboratories through mergers and acquisitions.

-

Integration of electronic health records (EHRs) with lab information systems (LIS).

-

Expansion of direct-to-consumer (DTC) testing platforms.

-

Investment in molecular diagnostics and genomics-based testing.

-

Government initiatives promoting regular health screenings and diagnostics.

Clinical Laboratory Tests Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 150.82 Billion |

| Market Size by 2035 |

USD 329.04 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Type, end-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Quest Diagnostics Incorporated., Abbott, Cinven, Laboratory Corporation of America Holdings, ARUP Laboratories, OPKO Health, Inc., UNILABS, Clinical Reference Laboratory, Inc., Synnovis Group LLP, Sonic Healthcare Limited. |

Key Market Driver

Rising Incidence of Chronic Diseases

One of the primary drivers of the clinical laboratory tests market is the escalating prevalence of chronic diseases worldwide. Conditions such as diabetes, cardiovascular disease, chronic kidney disease (CKD), and liver dysfunction require ongoing monitoring through regular laboratory tests. For instance, HbA1c testing is a standard diagnostic and monitoring tool for diabetes, while renal panel and BUN creatinine testing are crucial in assessing kidney function. According to the International Diabetes Federation, nearly 537 million adults were living with diabetes in 2021, a figure projected to rise substantially in the coming decades.

This growing patient population increases the demand for routine lab assessments that support timely diagnosis and disease management. The ability to track disease progression and therapeutic response through lab tests improves clinical outcomes, reduces complications, and lowers long-term healthcare costs. As a result, clinical laboratories are seeing increased patient volumes and test orders, driving market growth.

Key Market Restraint

Reimbursement Challenges and High Operational Costs

Despite strong demand, the clinical laboratory tests market faces notable headwinds, particularly in the form of reimbursement constraints and high operational costs. Reimbursement policies for diagnostic testing vary significantly across countries and payers, often leading to delayed payments or lower-than-expected compensation. Laboratories operating under fee-for-service models may face financial strain due to pricing pressure from insurers and government agencies.

Furthermore, the costs associated with maintaining modern laboratory infrastructure are substantial. Investment in automated systems, accreditation processes, quality control programs, and skilled personnel significantly impacts profit margins. Smaller labs, especially in developing regions, may struggle to maintain sustainability amid these financial pressures. These factors may limit expansion plans and hinder the introduction of innovative testing services.

Key Market Opportunity

Expansion of Preventative and Personalized Healthcare

As healthcare systems pivot toward prevention and patient-centric care, a major opportunity is emerging in the form of preventative and personalized diagnostic testing. Governments and healthcare providers are increasingly focused on identifying diseases early, even before symptoms appear. Routine health check-ups that include comprehensive metabolic panels, lipid testing, and cardiovascular panel tests are being promoted as standard protocol for adult patients.

Personalized healthcare is also gaining momentum, with laboratory tests forming the backbone of tailored treatment strategies. Genetic profiling, hormone level monitoring, and advanced liver panel diagnostics are being used to design customized care plans. As this approach becomes mainstream, it opens new avenues for labs to develop specialized panels, offer subscription-based wellness testing, and collaborate with digital health platforms to provide at-home test kits. The convergence of technology and individualized care presents immense potential for growth.

Clinical Laboratory Tests Market Segment Insights

By Type Insights

Complete Blood Count (CBC) tests dominate the clinical laboratory tests market, primarily due to their wide applicability across numerous medical conditions. CBC tests are among the most commonly ordered tests globally, offering a broad assessment of general health and detecting disorders such as anemia, infection, and blood cancers. Hospitals, clinics, and primary care centers routinely include CBC as part of health screening panels. Their affordability, rapid processing, and high diagnostic value contribute to their leading market share.

HbA1c testing is the fastest-growing segment, driven by the global diabetes epidemic. Unlike glucose tests that reflect short-term levels, HbA1c provides a long-term view of blood sugar control, making it critical for both diagnosis and management. With healthcare authorities advocating for early detection of diabetes, the number of annual HbA1c tests has surged. Additionally, home collection kits and point-of-care analyzers are making this test more accessible to patients, contributing to robust market expansion.

By End-use Insights

Central laboratories currently dominate the market due to their capacity to process high volumes of diverse tests efficiently. These labs are typically affiliated with hospitals or operate as large, independent diagnostic chains. Equipped with automated systems and advanced analyzers, central labs can deliver comprehensive panels such as liver, renal, cardiovascular, and complete metabolic tests with high throughput. Their economies of scale, certified staff, and established logistics networks make them the go-to choice for complex testing needs.

Primary clinics are emerging as the fastest-growing end-use segment, especially in rural and suburban areas. Clinics are increasingly offering diagnostic testing on-site or through nearby partnerships to enhance care accessibility. As more patients seek convenient, point-of-care services, clinics are investing in compact analyzers for tests such as CBC, HbA1c, lipid, and metabolic panels. This trend is supported by telehealth models, allowing sample collection at home with results delivered through electronic medical records.

U.S. Clinical Laboratory Tests Market Size and Research 2026 to 2035

The U.S. Clinical Laboratory Tests market size was exhibited at USD 47.53 Billion in 2025 and is projected to hit around USD 115.07 Billion by 2035, growing at a CAGR of 9.24% during the forecast period 2026 to 2035.

North America dominates the clinical laboratory tests market, driven by a well-established healthcare infrastructure, a high prevalence of chronic diseases, and strong insurance coverage. The United States, in particular, boasts a robust diagnostics ecosystem with leading players such as Quest Diagnostics and LabCorp. Government health programs like Medicare and Medicaid routinely cover routine lab tests for elderly and low-income populations. The integration of electronic health records (EHRs) with lab systems enhances test coordination and patient monitoring.

North America dominates the clinical laboratory tests market, driven by a well-established healthcare infrastructure, a high prevalence of chronic diseases, and strong insurance coverage. The United States, in particular, boasts a robust diagnostics ecosystem with leading players such as Quest Diagnostics and LabCorp. Government health programs like Medicare and Medicaid routinely cover routine lab tests for elderly and low-income populations. The integration of electronic health records (EHRs) with lab systems enhances test coordination and patient monitoring.

Furthermore, North America is at the forefront of technological adoption, with labs deploying AI tools, robotic analyzers, and cloud-based platforms to optimize operations. The growing emphasis on preventative care and wellness screening continues to drive testing volumes. As regulatory bodies encourage value-based care, laboratories in the region are well-positioned to evolve with changing healthcare paradigms.

Asia-Pacific is the fastest-growing region in the clinical laboratory tests market, spurred by rapid healthcare infrastructure development, rising disposable incomes, and increased disease awareness. Countries such as China, India, and Japan are investing in diagnostic centers to meet the needs of expanding urban and semi-urban populations. The region’s large patient pool, combined with the increasing burden of diabetes, cardiovascular disease, and liver disorders, is fueling demand for routine and specialized tests.

Moreover, governments in the region are actively promoting healthcare access through public insurance schemes and mobile diagnostic units. Local and international diagnostic chains are expanding their presence in tier-2 and tier-3 cities, offering affordable testing services. The growth of digital health platforms and mobile labs is also making diagnostic testing more accessible to remote populations, contributing to the region's exponential growth.

Clinical Laboratory Tests Market Top Key Companies:

- Quest Diagnostics Incorporated.

- Abbott

- Cinven

- Laboratory Corporation of America Holdings

- ARUP Laboratories

- OPKO Health, Inc.

- UNILABS

- Clinical Reference Laboratory, Inc.

- Synnovis Group LLP

- Sonic Healthcare Limited.

Clinical Laboratory Tests Market Recent Developments

-

April 2025: Quest Diagnostics announced the launch of a comprehensive at-home wellness test kit portfolio, enabling consumers to collect blood samples for metabolic, liver, and lipid panel testing.

-

March 2025: LabCorp expanded its artificial intelligence-powered diagnostic platform to include cardiovascular and renal panel result interpretation.

-

January 2025: SRL Diagnostics opened a state-of-the-art reference lab in Bangalore, India, with an annual capacity of over 10 million tests.

-

December 2024: Roche Diagnostics received CE marking for its high-sensitivity liver panel analyzer, improving early detection of hepatitis and cirrhosis.

-

October 2024: Abbott Laboratories partnered with primary care clinics across Southeast Asia to deploy rapid HbA1c and CBC analyzers.

Clinical Laboratory Tests Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Clinical Laboratory Tests market.

By Type

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

By End-use

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)