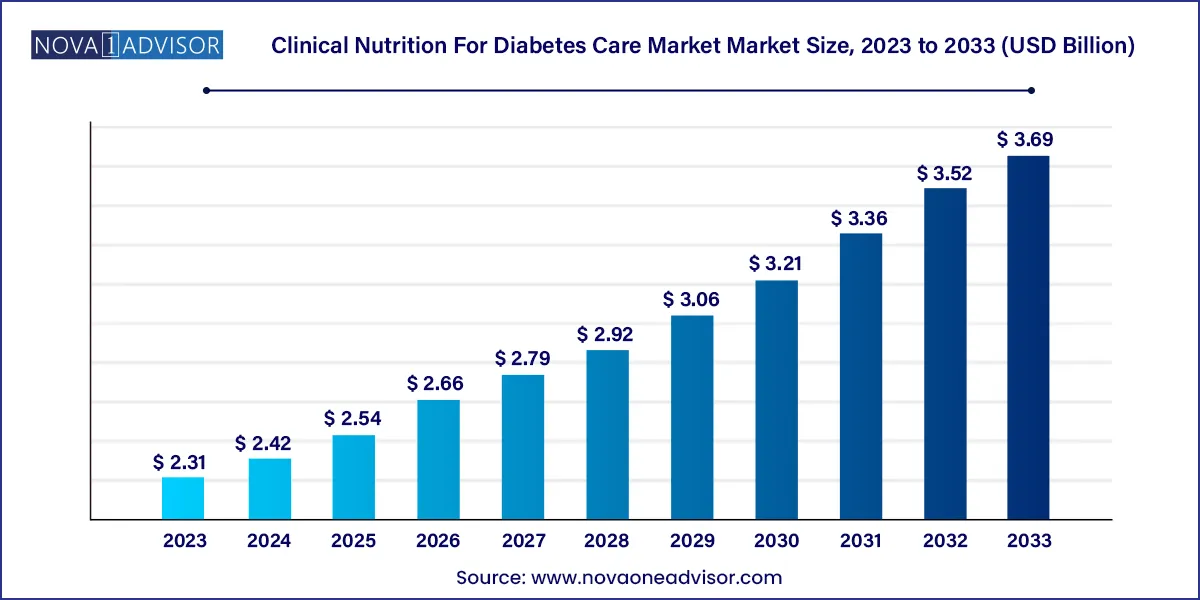

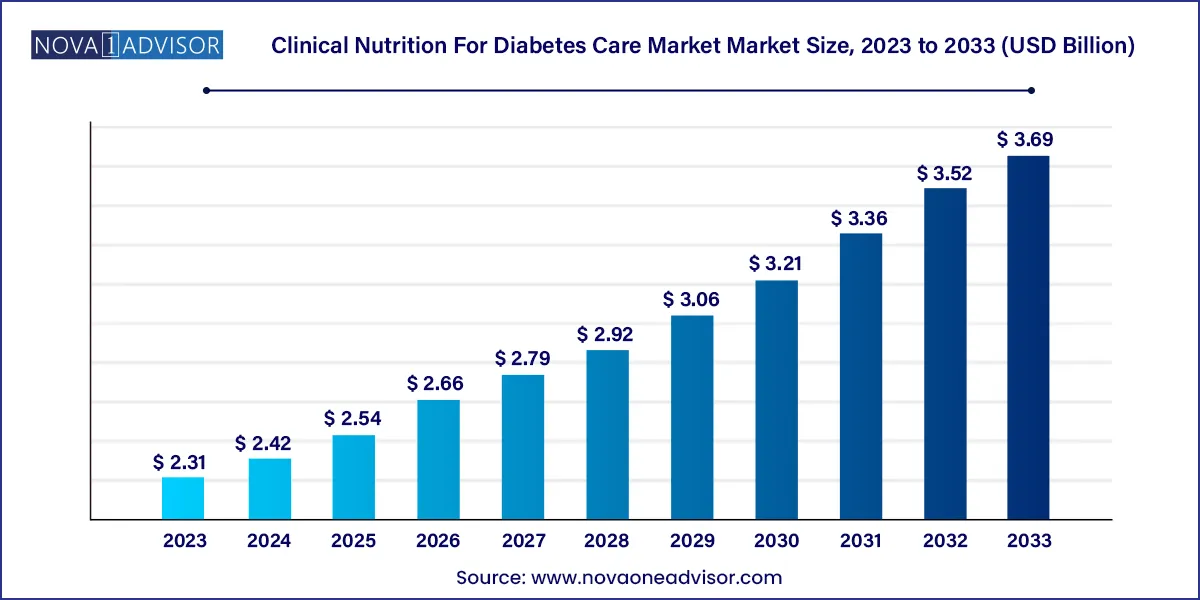

The global clinical nutrition for diabetes care market size was estimated at USD 2.31 billion in 2023 and is projected to hit around USD 3.69 billion by 2033, growing at a CAGR of 4.79% during the forecast period from 2024 to 2033.

Key Takeaways:

- North America clinical nutrition for diabetes care market accounted for a share of 33.48% in 2023.

- The U.S. clinical nutrition market for diabetes care dominated the North American region with approximately 87% revenue share.

- Clinical nutrition for diabetes care market in Europe was the second-largest regional market in 2023.

- Germany clinical nutrition for diabetes care market dominated Europe a share of over 19.9% in 2023

- Clinical nutrition for diabetes care market in Asia Pacific is anticipated to witness lucrative CAGR of nearly 6.1% from 2024 to 2033.

- China clinical nutrition for diabetes care market recorded the largest revenue share of over 32.7% in Asia pacific in 2023 and is expected to grow at a lucrative CAGR over the forecast period.

- Clinical nutrition for diabetes care market in India is anticipated to witness the fastest growth during the forecast period.

- Japan clinical nutrition market for diabetes care is a significant part of the Asia Pacific region and is expected to see lucrative growth during the forecast period.

- Oral clinical nutrition for diabetes care dominated the market in 2023, commanding a 71.9% market share.

- Enteral feeding formulas in diabetes care are expected to grow at the fastest pace over the forecast period.

- Adults segment led the diabetes clinical nutrition market with a share of over 85.11% in 2023.

- The adults segment is also anticipated to grow the fastest over the forecast period.

- The institutional sales segment dominated the market with over 40.12% revenue share in 2023.

- The online sales segment is anticipated to witness fastest growth over the forecast period.

Market Overview

The Clinical Nutrition for Diabetes Care Market represents an increasingly vital component of diabetes management, driven by the growing global burden of diabetes and the shift toward holistic, preventive healthcare. Clinical nutrition is more than just dietary supplementation it is a scientifically formulated, evidence-based approach to improve glycemic control, mitigate diabetes-related complications, and support metabolic health through nutritional interventions. These include specialized oral nutrition supplements, enteral formulas, and parenteral nutrition customized for diabetic patients.

Diabetes, particularly type 2, is a chronic condition closely tied to diet, lifestyle, and metabolic function. With over 537 million adults globally living with diabetes (as per IDF 2023), and nearly 1 in 3 Americans prediabetic, nutrition-based therapies have emerged as a frontline strategy in both management and prevention. Clinical nutrition products designed for diabetes care offer carbohydrate-controlled, low-glycemic index, high-fiber, and nutrient-enriched formulations that address key needs such as weight control, blood glucose regulation, and reduced insulin resistance.

Beyond outpatient diabetes management, these solutions are crucial in inpatient and institutional care settings, where patients often require precise nutritional support during recovery, surgery, or intensive care. Clinical nutrition also plays a pivotal role in pediatric diabetes management, especially in insulin-dependent type 1 diabetes cases.

The market includes a range of stakeholders: medical nutrition manufacturers, hospitals, diabetes educators, online health platforms, and specialty retail channels. With increasing patient awareness, expanding clinical research validating nutritional interventions, and technological innovations in product formulation, the clinical nutrition market tailored for diabetes is entering a period of rapid evolution and growth.

Major Trends in the Market

-

Rising Demand for Low-Glycemic, Protein-Enriched Formulas: Products formulated to maintain stable blood glucose levels while offering satiety and muscle mass preservation are increasingly preferred.

-

Emergence of Personalized Nutrition Plans: AI-driven and DNA-based personalized nutrition programs are integrating clinical nutrition products into precision diabetes care.

-

Increased Integration into Telehealth & Digital Platforms: Clinical nutrition counseling and delivery are increasingly integrated into virtual diabetes management programs, enabling better adherence.

-

Growth in Pediatric Clinical Nutrition for Type 1 Diabetes: Specialized formulations for pediatric patients are expanding, with careful micronutrient balance and insulin-supportive properties.

-

Plant-Based and Clean Label Product Expansion: Consumer interest in organic, plant-derived, and additive-free diabetic nutrition is influencing R&D pipelines.

-

Hospital-to-Home Transition: As more diabetes patients shift to at-home care post-discharge, demand for clinically approved, easy-to-administer nutritional products is growing.

-

Focus on Medical Food Regulations and Approvals: Regulatory pathways are becoming more structured, especially in markets like the U.S., driving standardized product development.

Clinical Nutrition For Diabetes Care Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 2.42 Billion |

| Market Size by 2033 |

USD 3.69 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.79% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, stage, sales channel, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott Nutrition; Pfizer Inc.; Bayer AG; Nestlé Health Science S.A..; GlaxoSmithKline plc; Baxter International Inc.; Otsuka Holdings Co., Ltd.; Mead Johnson & Company, LLC; Danone Nutricia; Victus, Inc. |

Market Driver: Growing Prevalence of Diabetes and Associated Complications

A major driver propelling the clinical nutrition for diabetes care market is the exponential increase in diabetes prevalence, particularly in emerging economies and aging populations. As per the CDC, more than 11% of the U.S. population has diabetes, and millions more are at risk. Similar trends are observed globally, with Asia-Pacific experiencing a diabetes epidemic due to rapid urbanization, sedentary lifestyles, and changing diets.

This escalating disease burden is accompanied by higher rates of complications such as diabetic nephropathy, retinopathy, cardiovascular disease, and neuropathy. These conditions often require enhanced nutritional support to manage malnutrition, glycemic instability, and systemic inflammation. Clinical nutrition products, especially those tailored to diabetic patients, offer a way to improve outcomes, lower hospital readmissions, and reduce insulin dependency in some cases.

Furthermore, public health agencies are actively encouraging nutrition-based interventions as part of national diabetes strategies, further reinforcing the relevance and market growth of clinically approved nutrition solutions.

Market Restraint: High Cost and Limited Reimbursement Coverage

A key barrier limiting broader adoption of clinical nutrition in diabetes care is the high cost of specialty nutrition products and the patchy insurance reimbursement landscape. Clinical-grade nutrition products are typically more expensive than over-the-counter supplements or traditional food items, which can deter long-term adherence, especially in low- and middle-income segments.

In the U.S., while Medicare Part B may cover enteral and parenteral nutrition under certain conditions, many oral nutritional supplements for diabetes are not reimbursed unless deemed medically necessary. This lack of standardized insurance support places a financial burden on patients, caregivers, and even long-term care facilities. Additionally, in emerging markets, where healthcare access is fragmented, affordability remains a major concern.

Manufacturers also face challenges around regulatory classification—whether a product is considered a medical food, dietary supplement, or pharmaceutical nutrition affects labeling, marketing, and pricing. This ambiguity can slow down new product approvals and limit physician-led prescription.

Market Opportunity: Integration of Clinical Nutrition into Preventive Care Models

One of the most promising opportunities in this market is the integration of clinical nutrition into preventive care and early diabetes intervention programs. As healthcare systems globally transition from reactive to preventive models, medical nutrition is increasingly viewed as a strategic tool to delay or prevent the onset of full-blown diabetes in high-risk populations.

Prediabetes affects more than 90 million people in the U.S. alone, many of whom are unaware of their condition. Introducing low-sugar, nutrient-dense clinical nutrition products during this stage can help maintain glycemic stability, support weight loss, and improve metabolic function—thereby reducing progression risk.

Digital health platforms and primary care providers are beginning to integrate medical nutrition therapy (MNT) into lifestyle intervention programs, supported by dietitians, AI-driven meal planning tools, and clinical-grade nutrition kits. Companies that align their product offerings with preventive care reimbursement pathways and chronic care management models stand to benefit from both volume and loyalty.

By Product

Oral Nutrition dominated the market by product type. Oral nutritional supplements (ONS) tailored for diabetic patients are the most widely consumed due to their ease of administration, palatability, and availability across retail and institutional settings. These products include ready-to-drink shakes, protein powders, bars, and fortified snacks. Formulations such as Glucerna by Abbott and Boost Glucose Control by Nestlé offer controlled carbohydrate release and insulin sensitivity support. The convenience factor, coupled with broad consumer accessibility and minimal risk, contributes to this segment’s dominance.

Enteral Feeding Formulas are the fastest-growing segment, particularly in hospital and long-term care settings. As the elderly diabetic population increases, many patients with dysphagia, stroke, or post-surgical conditions require enteral support. Enteral products are formulated to maintain glycemic control while preventing muscle wasting and inflammation. Innovations in tube-feeding formulas that optimize carbohydrate-to-protein ratios for glycemic control are propelling this segment forward. Furthermore, regulatory clarity around enteral nutrition coverage under Medicare is helping expand clinical adoption.

By Stage

Adults remain the dominant user group in the diabetes clinical nutrition market. Type 2 diabetes prevalence is significantly higher in adults aged 45 and older, and clinical nutrition is an essential component of managing long-term glycemic control, insulin sensitivity, and comorbidity risk. Adult patients with metabolic syndrome, cardiovascular disease, or renal complications often receive tailored nutritional support during hospitalization or as part of outpatient chronic disease programs.

Pediatric nutrition is the fastest-growing subsegment, owing to the rise in type 1 diabetes among children and adolescents. Pediatric clinical nutrition formulations require balanced micronutrient levels, high protein quality, and taste masking for compliance. Companies are developing pediatric-specific diabetes nutrition products that support growth without compromising glycemic control. With better diagnostic capabilities and more aggressive early-intervention strategies, the pediatric diabetes care market is driving innovation in this niche.

By Sales Channel

Institutional Sales dominated the market. Hospitals, rehabilitation centers, diabetes clinics, and long-term care facilities remain the largest buyers of clinical nutrition products. Institutional sales are driven by clinical recommendations, dietitian oversight, and higher product standardization. These channels typically manage patients with complex or acute diabetic conditions who require enteral, parenteral, or regulated oral nutrition. Bulk purchasing contracts and insurance reimbursements in some cases also support institutional procurement.

Online sales are the fastest-growing channel, boosted by the consumerization of healthcare, telemedicine expansion, and e-pharmacy growth. Platforms like Amazon, Walmart Health, and online pharmacies now offer diabetic nutrition products with subscription options. Patients increasingly prefer the convenience and privacy of ordering clinical nutrition products online, often based on physician recommendations. Companies are also leveraging digital marketing, product customization, and AI-powered meal kits to enhance customer retention and engagement.

By Regional Insights

North America, particularly the United States, dominates the clinical nutrition for diabetes care market due to high diabetes prevalence, mature healthcare infrastructure, and strong clinical awareness. According to the CDC, over 37 million Americans have diabetes, with an additional 96 million classified as prediabetic. Clinical nutrition is widely integrated into care protocols across outpatient clinics, hospitals, and elder care centers. Reimbursement mechanisms like Medicare and Medicaid also partially support enteral and parenteral nutrition, strengthening market uptake.

Moreover, North American players such as Abbott, Nestlé Health Science, and Kate Farms have developed comprehensive diabetic nutrition portfolios, including oral and tube-feeding products. Institutions like the American Diabetes Association (ADA) and Academy of Nutrition and Dietetics have published evidence-based nutrition guidelines, encouraging clinical adoption. The growing interest in personalized medical nutrition and wellness-based prevention is further amplifying market penetration.

Asia-Pacific is the fastest-growing region.

Asia-Pacific is witnessing explosive growth in diabetes prevalence, especially in China, India, Indonesia, and Southeast Asia. Factors such as urbanization, dietary shifts, genetic predisposition, and sedentary lifestyles are accelerating the disease burden. However, awareness about clinical nutrition remains nascent, representing a substantial untapped opportunity.

In recent years, governments in China and India have increased focus on chronic disease management through community health programs, offering platforms to introduce diabetic nutrition interventions. Global players are entering these markets through partnerships with local healthcare providers and distributors. Additionally, the expansion of online retail and mobile health in these regions is enhancing access to clinical nutrition products. As regulations mature and public awareness grows, Asia-Pacific is expected to become a major driver of volume-based growth in the coming decade.

Recent Developments

-

March 2025: Abbott expanded its Glucerna product line with a new plant-based, high-fiber formulation aimed at younger, health-conscious diabetics. The launch coincided with Diabetes Alert Month in the U.S.

-

February 2025: Nestlé Health Science announced the acquisition of a medical nutrition startup specializing in AI-driven personalized diabetes nutrition plans, aiming to integrate data from wearable glucose monitors into product recommendations.

-

January 2025: Danone Nutricia launched a clinical trial in partnership with a major U.S. academic hospital to study the effects of high-protein enteral nutrition in post-surgical diabetic patients.

-

November 2024: Kate Farms introduced a new line of organic, allergen-free diabetic nutrition shakes available via Amazon and CVS, targeting type 2 diabetes patients managing multiple comorbidities.

-

October 2024: Meiji Holdings (Japan) announced a strategic expansion of its diabetic nutrition line into Southeast Asia, collaborating with local health ministries to incorporate clinical nutrition into diabetes screening programs.

Key Clinical Nutrition for Diabetes Care Companies:

The following are the leading companies in the clinical nutrition for diabetes care market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Nutrition

- Pfizer Inc.

- Bayer AG

- Nestlé Health Science S.A.

- GlaxoSmithKline plc

- Baxter International Inc.

- Otsuka Holdings Co., Ltd.

- Mead Johnson & Company, LLC

- Danone Nutricia,

- Victus, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Clinical Nutrition For Diabetes Care market.

By Product

- Oral Nutrition

- Parenteral Nutrition

- Enteral Feeding Formulas

By Stage

By Sales Channel

- Online

- Retail

- Institutional Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)