Clinical Oncology Next Generation Sequencing Market Size and Trends

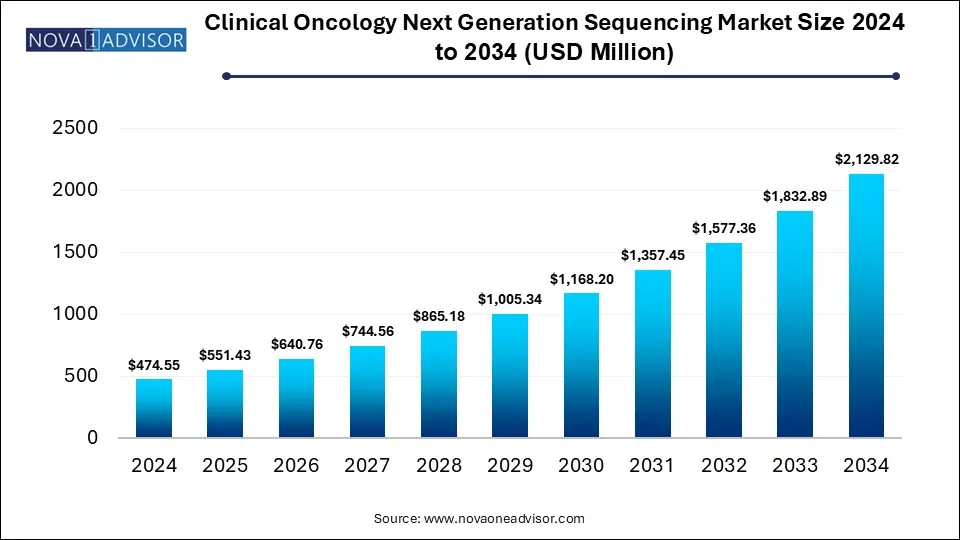

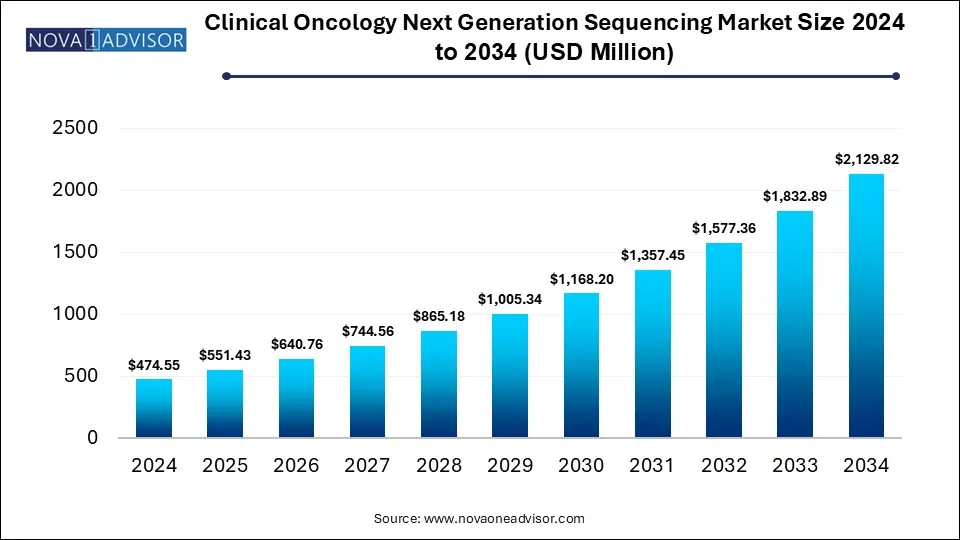

The global clinical oncology next generation sequencing market size is calculated at USD 474.55 million in 2024, grows to USD 551.43 million in 2025, and is projected to reach around USD 2,129.82 million by 2034, at a 16.2% CAGR during the forecast period for 2025-2034.The clinical oncology next generation sequencing market growth is driven by advancements in NGS platforms, focus on precision medicine, increasing healthcare expenditure and expansion of service offerings.

Clinical Oncology Next Generation Sequencing Market Key Takeaways

- North America dominated the global clinical oncology next generation sequencing market in 2024.

- Asia Pacific is expected to register the fastest CAGR over the forecast period.

- By technology, the targeted sequencing & resequencing segment dominated the market with the largest share in 2024.

- By technology, the whole genome sequencing (WGS) segment is expected to show the fastest growth over the forecast period.

- By workflow, the NGS sequencing segment accounted for the highest market share in 2024 and is expected to register fast growth during the forecast period.

- By workflow, the NGS data analysis segment is expected to register significant growth during the predicted timeframe.

- By application, the companion diagnostics segment held the largest market share in 2024.

- By application, the screening segment is expected to register fastest growth during the forecast period.

- By end use, the laboratories segment captured the largest market share in 2024.

- By end use, the clinics segment is expected to show the fastest growth during the forecast period.

How Is the Clinical Oncology Next Generation Sequencing Market Evolving?

Implementation of next generation sequencing in clinical oncology is transforming workflows by providing a broad understanding of cancer at the molecular level, leading to development of more precise and tailored treatment strategies. Continuous advancements in precision medicine, rising cancer incidences, technological innovations in NGS technology and increased healthcare spending are driving the growth of the clinical oncology next generation sequencing market. Growing adoption of companion diagnostics and liquid biopsies which involves use of NGS technology is creating opportunities for market expansion.

What Are the Key Trends in the Clinical Oncology Next Generation Sequencing Market in 2025?

- In June 2025, the Florida Cancer Specialists & Research Institute, LLC (FCS), launched its liquid biopsy testing services offering remarkable benefits for diagnosis and treatment of most common cancers such as breast, lung colorectal and prostate cancer as well as cancers of the blood, leading to improved cure rates and enhanced patient experience.

- In May 2025, Illumina Inc., expanded its clinical oncology portfolio by unlocking new standard of care and improving access to precision therapies. Along with the expansion of its in vitro diagnostic (IVD) portfolio, Illumina is also collaborating with Pillar Biosciences to offer Pillar oncoReveal CDx which is a highly accurate, actionable, and reimbursable next-generation sequencing testing.

Integration of artificial intelligence (AI) in next-generation sequencing is transforming clinical oncology by providing new tools for personalizing cancer treatments. Large amounts of genomic data are generated through NGS technologies and requires sophisticated bioinformatics tools for analysis. AI algorithms such as deep learning and machine learning can be deployed for analyzing these large datasets to pinpoint patterns, for predicting drug responses and classifying tumors accurately. Integration of NGS data with patient information like clinical history and medical images through AI can enable generation of personalized treatment recommendations. Applications of AI algorithms in precision oncology with NGS can facilitate biomarker discovery, drug repurposing, targeted therapy development, predicting treatment outcomes and monitoring treatment response.

Clinical Oncology Next Generation Sequencing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 551.43 Million |

| Market Size by 2034 |

USD 2,129.82 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 16.2% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Technology, Workflow, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Andersen Sterilizers, ASP (Fortive), E-BEAM Services, Inc, Infinity Laboratories, Midwest Sterilization Corporation, Prince Sterilization Services, LLC, STERIS, Sterigenics U.S., LLC - A Sotera Health company, VPT Rad, Inc. |

Market Dynamics

Drivers

Rising Cancer Prevalence

Increasing cancer diagnoses across the world, especially in the aging demographics and due to lifestyle factors are driving the demand for comprehensive tumor profiling services through NGS for detailed characterization of cancer and gaining better understanding of the disease pathology. Early detection of cancer and risk assessment though non-invasive methods like liquid biopsy utilizing NGS are enabling proactive management. Furthermore, NGS is an indispensable tool in clinical oncology research and development for addressing the rising disease burden, further expanding the market growth.

- For instance, in April 2024, Global Cancer Statistics, 2024, were released by the American Cancer Society which stated that an estimated 20 million cancer cases were freshly diagnosed in 2022 and about 9.7 million lost their lives from the disease globally. The number of cancer cases is predicted to reach 35 million by 2050.

Restraints

High Costs of NGS Technologies

Significant upfront investment for installation of NGS systems and associated consumables can be challenging for academic institutions, small labs and under-resourced regions. Maintenance of NGS infrastructure such as data storage, lab automation systems and high-performance computing can add to the financial burden. Additionally, skilled professionals required for operating complex NGS instruments, analyzing data and result interpretation is costly and potentially restrains the market growth.

Opportunities

Innovations in Sequencing Technologies

Reduced costs of sequencing technologies over the years have made the it more accessible and affordable for adoption on a large scale, especially in clinical settings. Innovations in NGS technology such as high-throughput sequencing platforms and advancements in bioinformatics tools are improving the speed, efficiency, accuracy and cost-effectiveness of workflows, leading to faster turnaround times and increased throughput. NGS technology is important for analysis of circulating tumor DNA (ctDNA) which allows non-invasive profiling of tumor as well as real-time cancer surveillance. Rising strategic collaborations among healthcare providers, research institutions and diagnostic companies are accelerating the development and adoption of innovative NGS-based solutions.

Segmental Insights

What Made Targeted Sequencing & Resequencing Dominant Segment in 2024?

By technology, the targeted sequencing & resequencing segment accounted for the largest market share in 2024. Targeted sequencing & resequencing involves prioritizing predefined and specific regions of genome for analysis, instead of sequencing the whole genome. Several advantages such as reduced sequencing costs, improved efficiency, faster turnaround times as well as advancements in clinical applications such as identification of disease-causing mutations and development of targeted therapeutics for cancer are driving the adoption targeted sequencing and resequencing technologies. Established clinical guidelines by the National Comprehensive Cancer Network (NCCN) and American Society of Clinical Oncology (ASCO) recommending NGS for pre-treatment evaluation of several cancers through targeted panels are boosting the market growth.

By technology, the whole genome sequencing (WGS) segment is expected to register the fastest growth during the forecast period. Whole genome sequencing offers comprehensive view of the entire cancer genome which facilitates the discovery of novel and rare cancer related variants such as copy number variations (CNVs), insertions/deletions (indels), single nucleotide variants (SNVs), and complex structural variations like duplications and translocations. Identification of non-coding driver mutations through WGS is enabling better understanding of their role in tumorigenesis. Furthermore, development of sophisticated bioinformatics pipelines, increasing clinical applications beyond targeted therapies such as in pharmacogenomics, large-scale genomics initiatives and increased emphasis on early cancer detection are the factors anticipated to fuel the market growth.

Why Did the NGS Sequencing Segment Dominate the Market in 2024?

By workflow, the NGS sequencing segment dominated the market with the highest share in 2024 and is expected to show fast CAGR over the forecast period. NGS sequencing is widely used for detailed characterization of cancer genomes, identification of rare mutations, immunotherapy biomarker integration, to guide personalized therapies, and in liquid biopsy and minimal residual disease (MRD) assessment, further enabling effective management and treatment of cancer. Technological advancements in NGS technologies such as development of high-throughput platforms, leading to improved accuracy and quick turnaround times. Reduced sequencing costs have increased accessibility to these technologies. Moreover, government initiatives and funding for advancing precision oncology R&D are contributing to the market growth.

By workflow, the NGS data analysis segment is expected to register significant growth during the predicted timeframe. Large amounts of sequencing data in the form of FASTQ files are generated through NGS, which includes nucleotide sequences and quality scores. In clinical oncology, NGS data analysis plays an important role in accelerating personalized cancer treatment strategies through the identification of actionable mutations, in detecting hereditary cancer syndromes and in tracking minimal residue disease. Advancements in bioinformatics tools, demand for actionable clinical insights and increased adoption of comprehensive genomic profiling (CGP) are the factors fueling the market expansion.

- For instance, in May 2025, Illumina Inc., launched DRAGEN™ version 4.4 software (v4.4) which includes groundbreaking oncology applications and will also support Illumina’s newly announced multiomics assays. The upgraded software will assist customers in simplifying NGS analysis and expand their capabilities

How Companion Diagnostics Segment Dominated the Market in 2024?

By application, the companion diagnostics segment captured the largest market share in 2024. Companion diagnostics (CDx) in clinical oncology are specialized tests designed for assisting oncologists in selecting the most effective treatment plan by identification of specific biomarkers or genetic mutations in the tumor of a patient. Pharmaceutical companies are actively integrating CDx into their drug development workflows due to various advantages such as reduced costs, enhanced clinical trial success rates and increased FDA approvals. Rising healthcare expenditure, increased adoption of comprehensive genomic profiling (CGP), continuous innovations in NGS technologies and growing emphasis on personalized medicine are the factors driving the market dominance of this segment.

By application, the screening segment is expected to show fastest growth over the forecast period. Globally rising shift towards identification of cancer at early stages for timely interventions, improving treatment outcomes and enhancing patient survival rates are driving the adoption of NGS-based screening solutions. Advancements in liquid biopsy using NGS for analyzing ctDNA from blood sample are offering a non-invasive diagnostic approach compared to traditional biopsies. Furthermore, decreased sequencing costs, development of multi-cancer early detection (MCED) tests, integration of precision medicine, and government initiatives for cancer research and screening programs are the factors boosting the market growth.

What Drives Dominance of the Laboratories Segment in 2024?

By end use, the laboratories segment generated the highest market revenue share in 2024. Laboratories are equipped with the specialized infrastructure and skilled personnel required for handling complex processes in NGS such as preparation of samples, sequencing and data analysis. Decreased sequencing costs, increased cancer prevalence and advancements in sequencing technologies are driving the market potential. Increased outsourcing trend by hospitals and research institutions for NGS services through accredited laboratories is expanding the market. Furthermore, adoption of smaller, benchtop sequencers and cloud-based data analysis solutions by laboratories is facilitating decentralized NGS testing.

By end use, the clinics segment is expected to expand rapidly during the predicted timeframe. Integration of NGS technological in routine clinical practices is facilitating decentralized testing and streamlining workflows, leading to increased adoption of NGS for clinical diagnostics. Expansion of service offerings by clinics through non-invasive liquid biopsies and comprehensive genomic profiling (CGP) for monitoring cancer disease progression, identification of biomarkers and effective treatment planning are fuelling the market growth. Rising awareness among patients and healthcare providers about genomics in cancer treatment is driving the demand for NGS-based testing within clinics for early detection and screening of cancer.

Regional Insights

How is North America Dominating the Clinical Oncology Next Generation Sequencing Market?

North America dominated the global clinical oncology next generation sequencing market with the largest share in 2024. Rising cancer incidences, well-established healthcare infrastructure, increased adoption of precision medicine, robust research infrastructure and deployment of advanced NGS-based diagnostic technologies are driving the market growth. Major market players in the region heavily investing in clinical research and genomic technologies for strengthening clinical trial pipelines is bolstering the market.

In the U.S., favorable reimbursement policies and insurance coverage such as the Medicare program are improving patient access to cancer treatments. Government agencies like the National Institutes of Health (NIH) providing funding and grants for advancing cancer research as well as early and accelerated approvals by the FDA for NGS-based diagnostics are creating opportunities for market expansion.

What Fuels Expansion of the Asia Pacific Clinical Oncology Next Generation Sequencing Market?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The region’s market growth is can be attributed to the increasing cancer burden in the huge and rapidly aging population, continuous improvements in healthcare infrastructure and rising investments in genomics research. Several governments in the Asia Pacific region are supporting the adoption of NGS technologies through precision medicine initiatives. Increased collaborations among regional healthcare institutions and global NGS technology providers are making NGS technologies more readily available. Increased health awareness and focus on early cancer detection as well as reduced costs of NGS solutions is driving the demand for NGS-based diagnostics.

Some of the Prominent Players in the Clinical Oncology Next Generation Sequencing Market

- Andersen Sterilizers

- ASP (Fortive)

- E-BEAM Services, Inc

- Infinity Laboratories

- Midwest Sterilization Corporation

- Prince Sterilization Services, LLC

- STERIS

- Sterigenics U.S., LLC - A Sotera Health company

- VPT Rad, Inc.

Recent Developments

- In April 2025, the All-India Institute of Medical Sciences (AIIMS) Jammu, inaugurated the Centre for Advanced Genomics and Precision Medicine for boosting cost-effective, precision-driven cancer care via advanced Next Generation Sequencing (NGS) technology.

- In January 2025, Tempus AI, Inc., declared the national launch its FDA approved, NGS-based in vitro diagnostic device, xT CDx which is a 648-gene next-generation sequencing test designed for solid tumor profiling and comprises of microsatellite instability status and companion diagnostic claims for colorectal cancer patients.

- In August 2024, Beckman Coulter Life Sciences collaborated with Illumina for accelerating oncology research with the launch of Illumina’s TruSight Oncology 500 DNA/RNA assay on Beckman Coulter Life Sciences’ Biomek NGeniuS System. The assay automation solution provides an innovative approach for comprehensive genomic profiling (CGP) of tumor samples, further making cutting-edge research more accessible to labs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Clinical Oncology Next Generation Sequencing market.

By Technology

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

By Workflow

- NGS Pre-Sequencing

- NGS Sequencing

- NGS Data Analysis

By Application

- Screening

- Sporadic Cancer

- Inherited Cancer

- Companion Diagnostics

- Other Diagnostics

By End-use

- Hospitals

- Clinics

- Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)