Clinical Trial Equipment & Ancillary Solutions Market Size, Share, Growth, Report 2025 to 2034

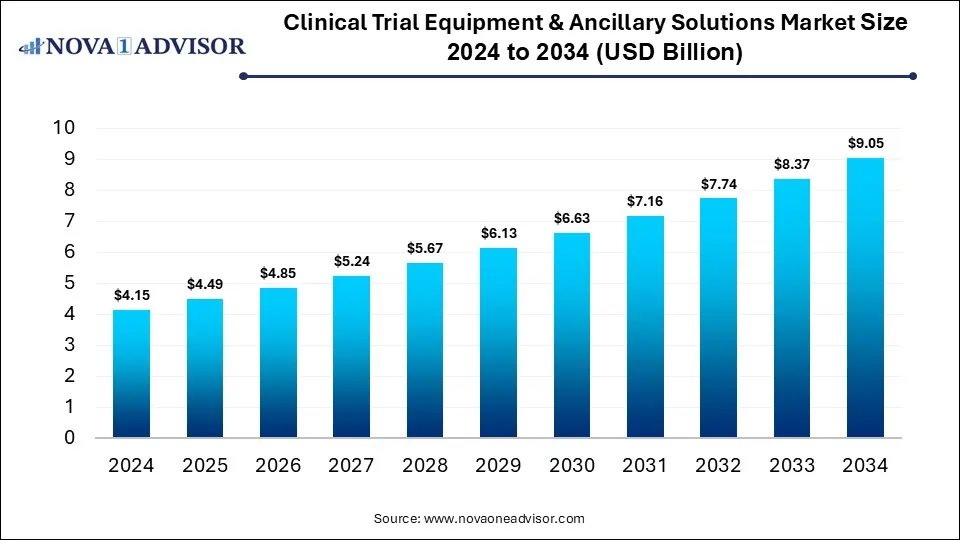

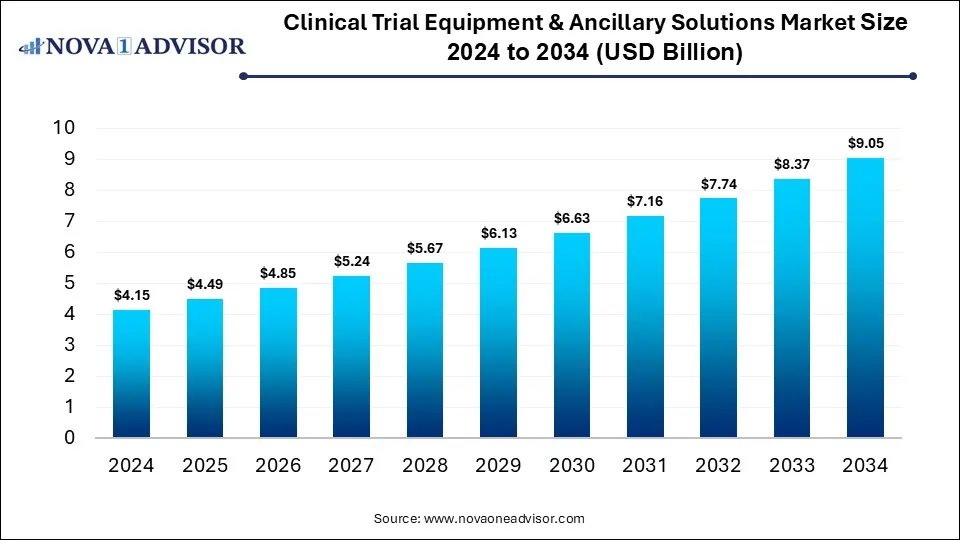

The global clinical trial equipment & ancillary solutions market size was exhibited at USD 4.15 billion in 2024 and is projected to hit around USD 9.05 billion by 2034, growing at a CAGR of 8.11% during the forecast period 2025 to 2034.

Key Takeaways:

- North America dominated the clinical trial equipment & ancillary solutions market with a 41% revenue share in 2024.

- The supply/logistics segment accounted for a dominant revenue share of 42% in 2024.

- The phase III segment dominated the market in 2024 and is expected to maintain its dominance through 2034.

Market Overview

The Clinical Trial Equipment & Ancillary Solutions Market represents a vital component of the global clinical research ecosystem. As clinical trials grow in complexity, scope, and regulatory scrutiny, the demand for specialized equipment and ancillary services continues to surge. These solutions span a wide range from procurement and rental of medical equipment to logistics and maintenance services ensuring that trial protocols are executed smoothly across diverse geographies and trial phases.

Clinical trials are increasingly conducted in a decentralized manner, often spanning multiple countries, which presents logistical and operational challenges. Here, ancillary solutions come into play by supporting site readiness, equipment calibration, temperature-sensitive packaging, and timely transportation. For example, in a multi-country oncology trial, the need for uniform infusion pumps and patient monitoring devices makes sourcing and calibration services indispensable.

Furthermore, regulatory agencies such as the FDA and EMA have laid stringent requirements concerning the operational infrastructure of clinical trials. This has led pharmaceutical companies, CROs (Contract Research Organizations), and site management organizations to rely heavily on expert ancillary solution providers to ensure compliance, reduce trial delays, and minimize risks.

This market is not only witnessing expansion in developed regions such as North America and Europe, but also rapid growth in emerging markets, particularly Asia-Pacific, where increasing R&D investments and the presence of a large patient population create conducive environments for trial outsourcing. Moreover, digital health integration and demand for real-time monitoring are encouraging the adoption of smart, connected devices in trials, further advancing the scope of ancillary services.

Major Trends in the Market

-

Rising Demand for Decentralized Clinical Trials (DCTs): The shift from centralized to decentralized trials is fueling demand for mobile medical equipment, remote monitoring tools, and at-home sample collection kits.

-

Integration of IoT and Smart Devices: Equipment embedded with IoT sensors is being used for real-time data monitoring and maintenance tracking, enhancing the reliability and efficiency of clinical trials.

-

Growing Emphasis on Regulatory Compliance: The need for GxP-compliant logistics and calibrated, validated equipment is increasing due to tightening global regulations.

-

Expansion of Cold Chain Logistics: The rise in trials involving biologics and gene therapies is intensifying the requirement for temperature-sensitive logistics and specialty packaging.

-

Vendor Consolidation for End-to-End Solutions: Stakeholders are seeking integrated service providers that can deliver procurement, maintenance, and logistics under one umbrella.

-

Increased Outsourcing to Specialized Vendors: Biopharma companies and CROs are outsourcing non-core functions such as equipment servicing and supply chain logistics to specialized ancillary providers.

-

Focus on Sustainable Solutions: Environmentally conscious packaging materials and reusable equipment rental models are gaining traction, reflecting the industry's sustainability push.

-

High Growth of Asia-Pacific Markets: The region is becoming a hotbed for clinical research, prompting global players to expand their ancillary infrastructure locally.

Report Scope of the Clinical Trial Equipment & Ancillary Solutions Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.49 Billion |

| Market Size by 2034 |

USD 9.05 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.11% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Phase, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Ancillare, LP; Imperial CRS, Inc.; Woodley Equipment Company Ltd.; Thermo Fisher Scientific, Inc.; Parexel International (MA) Corporation; Emsere (MediCapital Rent); Quipment SAS; IRM; Marken; Myonex; Yourway |

Key Market Driver: Growth of Complex Clinical Trials

A significant driver propelling the Clinical Trial Equipment & Ancillary Solutions Market is the increasing complexity of modern clinical trials. As drug development shifts toward personalized medicine, biologics, and rare disease therapies, trials are becoming more intricate, requiring highly specialized equipment and logistics. For instance, trials involving gene editing technologies such as CRISPR demand cryogenic storage, advanced centrifugation equipment, and complex calibration services.

This complexity translates to a heightened need for reliable ancillary support to handle equipment variability, site-specific customization, and stringent timelines. Furthermore, patient-centric approaches require tools for remote monitoring and mobile sample collection, increasing the demand for multifunctional equipment with seamless interoperability. As a result, sponsors and CROs are turning to solution providers capable of delivering end-to-end ancillary services with high responsiveness and regulatory awareness.

Key Market Restraint: High Cost and Supply Chain Disruptions

One of the key restraints in the market is the high cost associated with clinical trial equipment procurement, maintenance, and global logistics, especially for small to mid-sized biotech firms. As these trials often span across continents, the associated transportation, calibration, and storage costs can be prohibitive.

Moreover, global supply chain disruptions such as those experienced during the COVID-19 pandemic exacerbate these challenges. For example, a delay in the delivery of cold storage equipment to a trial site can result in sample degradation and trial timeline setbacks. These risks often lead to increased trial costs and make sponsors hesitant to initiate multi-regional trials unless robust contingency support is available.

Key Market Opportunity: Technological Integration in Equipment Tracking and Servicing

A pivotal opportunity in this market lies in the integration of advanced technologies such as RFID, blockchain, and IoT to streamline equipment tracking, servicing, and calibration. Currently, one of the most persistent inefficiencies in clinical trial equipment management is the lack of real-time visibility into equipment usage, maintenance schedules, and location tracking.

By embedding IoT devices and RFID tags into clinical equipment, solution providers can ensure proactive maintenance alerts, minimize downtimes, and enhance operational transparency. For instance, a blockchain-enabled system can provide immutable audit trails for equipment servicing, critical for compliance in audits. Providers offering such intelligent asset management solutions will have a significant competitive advantage in the evolving landscape.

Segments

Clinical Trial Equipment & Ancillary Solutions Market By Product Insights

Sourcing – Equipment procurement dominates the sourcing segment. Clinical trial sponsors often opt for procurement over rental for long-duration or phase III trials, where permanent access to highly specialized equipment is necessary. In this segment, equipment such as infusion pumps, ECG machines, and diagnostic kits are commonly sourced. Procurement offers customization benefits and allows better integration into trial protocols. Large pharmaceutical companies and CROs prefer owning equipment for use across multiple trials or geographies.

Conversely, rental services are witnessing the fastest growth. With shorter trial durations, limited budgets, and increasing trial diversity, rental solutions provide greater flexibility. For example, a small biotech firm conducting a six-month oncology trial may prefer renting cryogenic freezers and imaging devices rather than investing in costly procurement. Moreover, rentals include maintenance and servicing, further reducing the overhead burden on sponsors.

Supply/Logistics services especially transportation and packaging are seeing rising demand. The surge in temperature-sensitive biological drugs requires specialized insulated packaging and GPS-tracked transportation. Real-time monitoring of sample integrity is vital for regulatory compliance. For instance, services like real-time cold chain tracking with temperature excursions alerts are becoming standard.

Service offerings such as calibrations and equipment maintenance are increasingly important for compliance. Calibration ensures that equipment performs within validated parameters, a non-negotiable requirement in GCP-regulated trials. Outsourced calibration services are especially crucial for decentralized trial sites or new investigators lacking on-site expertise.

Clinical Trial Equipment & Ancillary Solutions Market By Phase Insights

Phase III trials dominate the market in terms of revenue generation. These large-scale, multi-country trials typically span several months to years, requiring extensive ancillary support. Equipment needs range from monitoring tools to diagnostic kits across hundreds of sites. Due to the high stakes involved in regulatory approval, sponsors are heavily invested in ensuring seamless equipment logistics, validated packaging, and real-time servicing.

However, Phase I trials are witnessing the fastest growth. With the rise in early-stage clinical research and exploratory drug development in rare diseases and niche therapies, there’s increasing investment in well-supported Phase I trials. These trials may require specialized equipment such as microdosing tools, biosensors, or wearable devices. Additionally, academic institutions and biotech startups initiating first-in-human studies are partnering with niche ancillary providers for sourcing and logistics.

Clinical Trial Equipment & Ancillary Solutions Market By Regional Insights

North America leads the market as the dominant region. The presence of global pharmaceutical giants, world-class research institutions, and highly regulated clinical environments makes the region a hub for clinical trials. The U.S. contributes significantly due to its advanced healthcare infrastructure, favorable regulatory pathways, and strong presence of ancillary service providers. Companies in North America are also investing in AI-powered clinical logistics and smart warehousing solutions to enhance efficiency and scalability.

Asia-Pacific is the fastest growing region in the market. Countries such as India, China, and South Korea are attracting clinical research due to their large, diverse patient populations, lower costs, and improving regulatory frameworks. Multinational sponsors are setting up regional hubs to streamline trial execution, which is fostering local development of equipment rental, calibration, and logistics services. For example, in 2024, a major global CRO announced a new equipment warehouse in Hyderabad, India, to support upcoming oncology trials.

Recent Developments

-

February 2025: Avantor, Inc. expanded its clinical trial services by launching a new centralized logistics hub in the Netherlands to support clinical research across Europe and improve temperature-controlled transportation for sensitive biologics.

-

January 2025: Thermo Fisher Scientific introduced a new service for predictive maintenance of clinical trial equipment using IoT sensors integrated with its SmartMonitor platform, enabling real-time alerts for equipment failures.

-

December 2024: Parexel International announced a strategic partnership with a Japanese logistics company to enhance its clinical trial ancillary services across Asia, focusing on remote site accessibility and efficient equipment rental models.

-

October 2024: Marken (a UPS company) unveiled its blockchain-based chain-of-custody platform for clinical trial logistics, offering clients improved traceability of medical devices and samples.

Some of the prominent players in the Clinical trial equipment & ancillary solutions market include:

- Ancillare, LP

- Imperial CRS, Inc.

- Woodley Equipment Company Ltd.

- Thermo Fisher Scientific, Inc.

- Parexel International (MA) Corporation

- Emsere (formerly MediCapital Rent)

- Quipment SAS

- IRM

- Marken

- Myonex

- Yourway

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the global clinical trial equipment & ancillary solutions market.

Product

-

- Transportation

- Packaging

- Others

-

- Calibrations

- Equipment Servicing

- Others

Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)