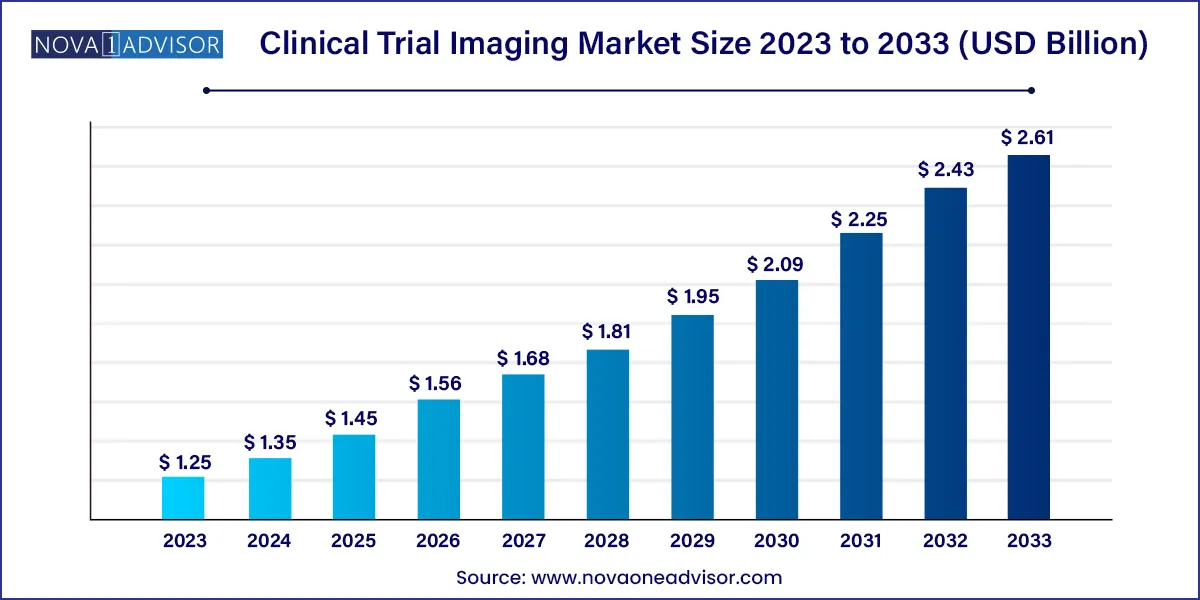

The global clinical trial imaging market size was exhibited at USD 1.25 billion in 2023 and is projected to hit around USD 2.61 billion by 2033, growing at a CAGR of 7.65% during the forecast period 2024 to 2033.

Key Takeaways:

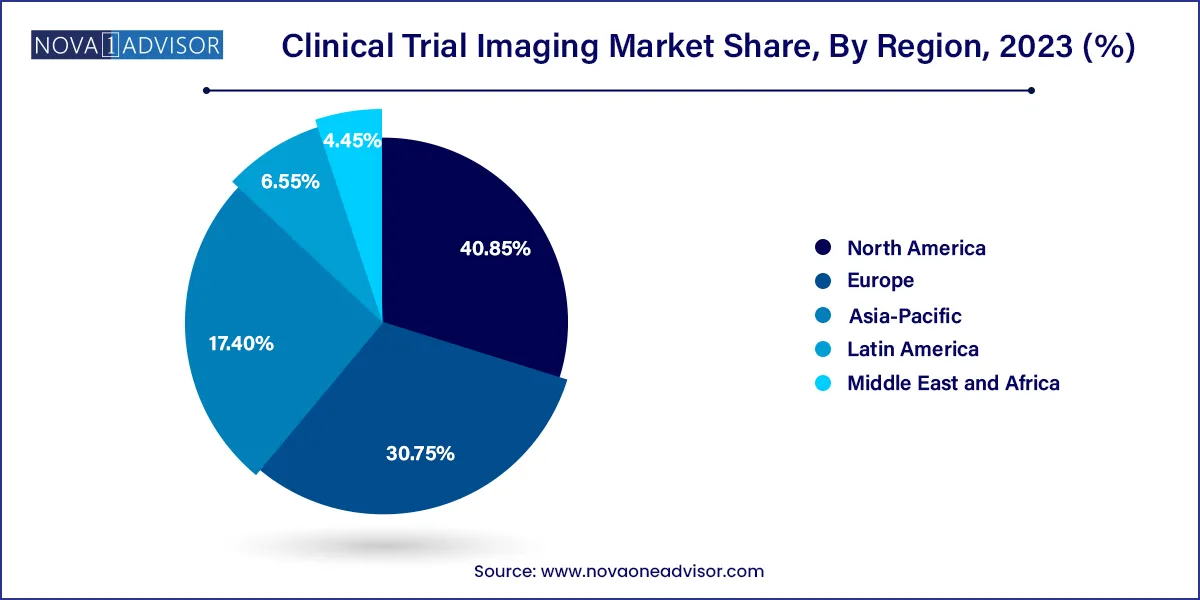

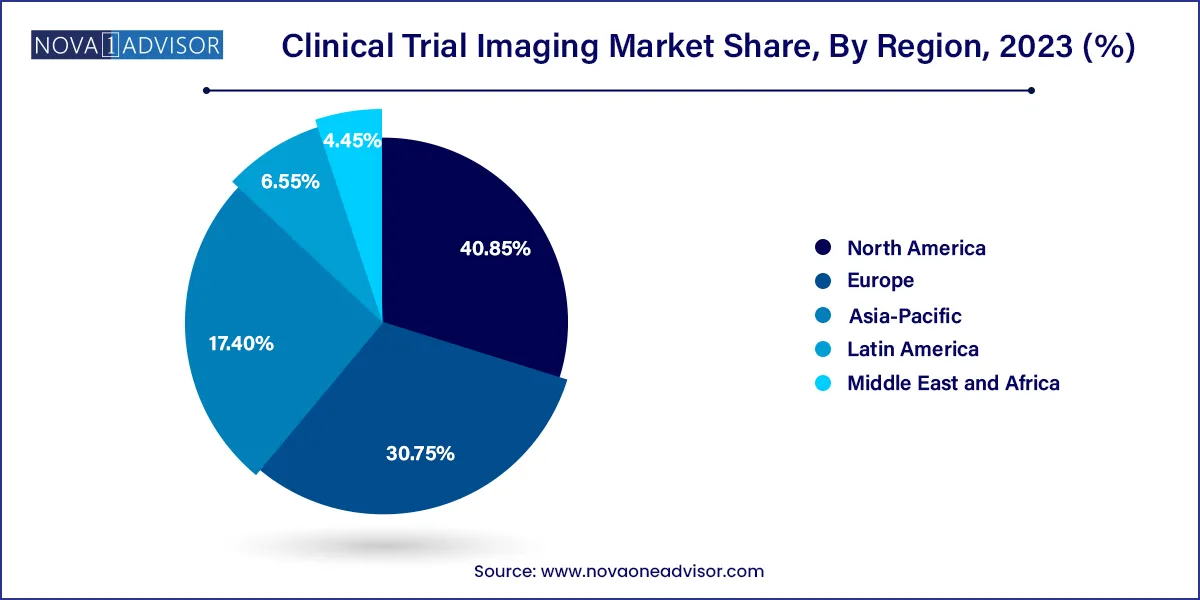

- North America dominated the market with a revenue share of 40.85% in 2023.

- The Asia Pacific market is anticipated to grow at the fastest CAGR of 7.93% during the forecast period.

- Based on service, the project and data management services segment held the market with the largest revenue share of 28.73% in 2023.

- The operational imaging services segment also led the market with significant revenue share and are projected to grow the fastest CAGR of 7.32% from 2024 to 2033.

- Based on modality, the computed tomography scanners segment led the market with the largest revenue share of 29.13% in 2023.

- The ultrasound segment is expected to grow at a fastest CAGR of 8.01% from 2024 to 2033.

- In terms of application, the oncology segment held the market with the largest revenue share of 28.98% in 2023.

- The non-alcoholic steatohepatitis is expected to grow at the fastest CAGR of 9.75% during the forecast period.

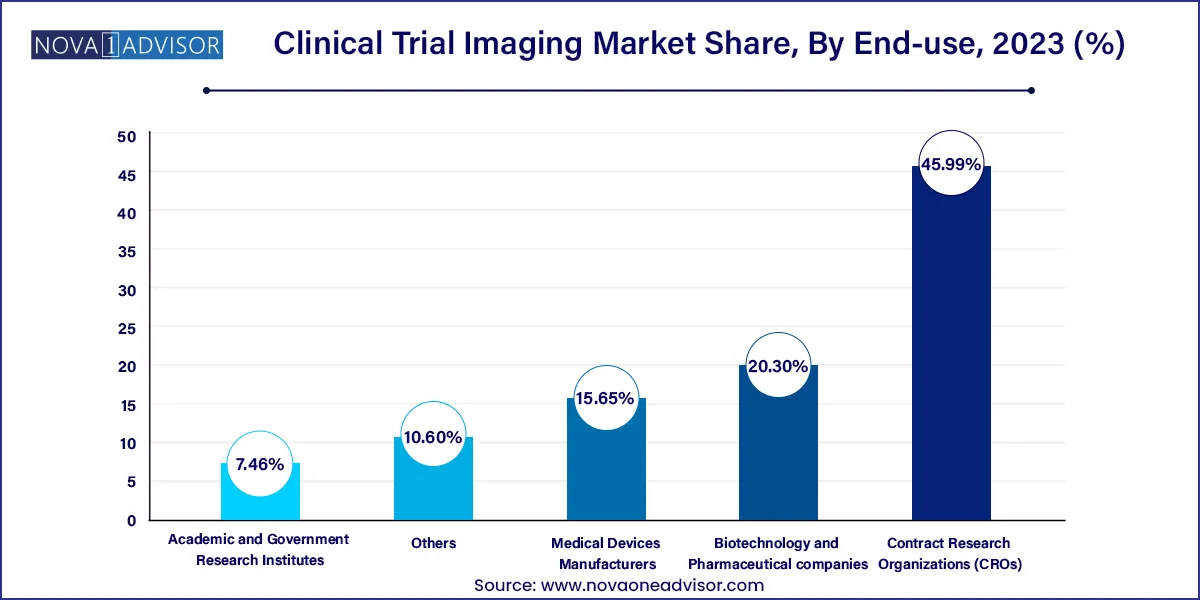

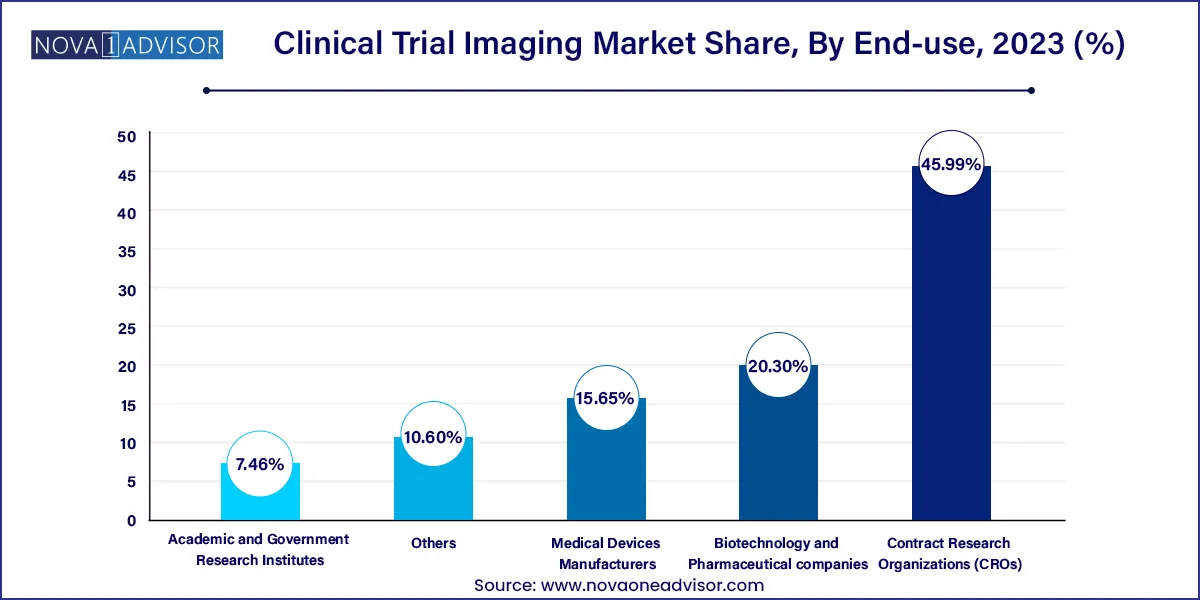

- Based on end-use, the contract research organizations (CROs) segment led the market with the largest revenue share of 45.99% in 2023.

- The biotechnology and pharmaceutical segment is expected to grow the fastest CAGR of 7.97% over the forecast period.

Market Overview

The Clinical Trial Imaging Market plays a pivotal role in the broader landscape of drug and device development, offering critical insights into treatment efficacy, disease progression, and safety. Imaging modalities like MRI, CT, X-rays, and emerging tools such as Optical Coherence Tomography (OCT) are instrumental in both early-phase and late-phase clinical trials. The integration of imaging technologies enables more objective and quantitative assessments of biological responses, making them indispensable for sponsors, investigators, and regulatory agencies alike.

Over the years, imaging in clinical trials has evolved from being a supplementary tool to a core component, especially in areas like oncology, neurology, and cardiology. The demand for clinical trial imaging is rapidly growing, driven by the increasing number of clinical studies, rising complexity of trials, and an emphasis on precision medicine. Imaging services encompass a wide array of operations, from trial design consultation to data management, image acquisition, reading, and central review, often facilitated by specialized service providers and Contract Research Organizations (CROs).

As the pharmaceutical and biotechnology industries continue to push the boundaries of scientific discovery, the role of imaging in demonstrating mechanism of action, patient stratification, and treatment outcomes has become more critical than ever. Advancements in imaging software, AI-enabled analysis, and cloud-based image storage are further accelerating the adoption of imaging solutions across trials worldwide.

Major Trends in the Market

-

Rising Adoption of AI in Imaging Analysis: Automation and machine learning are improving image interpretation speed, accuracy, and standardization.

-

Growth of Decentralized Trials with Remote Imaging Capabilities: Tele-imaging and cloud-enabled transfer are supporting remote trial models.

-

Increased Demand for Multimodal Imaging: Complex diseases are requiring integration of multiple imaging types (e.g., PET-MRI).

-

Regulatory Emphasis on Imaging Biomarkers: Agencies like the FDA are encouraging the inclusion of imaging endpoints in trials.

-

Emergence of Imaging Core Labs and Specialist CROs: Centralized reading and analysis services are gaining popularity.

-

Data Security and Cloud-Based Platforms: Image data management is increasingly migrating to secure, cloud-hosted environments.

-

Personalized Medicine Impact: Imaging is playing a bigger role in targeted therapy trials through biomarker validation.

Report Scope of the Clinical Trial Imaging Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.35 Billion |

| Market Size by 2033 |

USD 2.61 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.65% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Modality, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

IXICO plc; Navitas Life Sciences; Resonance Health; ProScan Imaging; Radiant Sage LLC; Medpace; Biomedical Systems Corp; Cardiovascular Imaging Technologies; Intrinsic Imaging; BioTelemetry |

Key Market Driver: Increasing Complexity of Clinical Trials

One of the primary drivers of the clinical trial imaging market is the increasing complexity of modern clinical trials. As new therapies become more targeted and personalized, traditional endpoints such as blood biomarkers or patient-reported outcomes are often insufficient. Imaging offers non-invasive, reproducible, and quantifiable insights into disease progression and therapeutic effect.

For instance, in oncology trials, imaging is indispensable in determining tumor response through criteria like RECIST (Response Evaluation Criteria in Solid Tumors). In cardiovascular studies, echocardiography and CT angiography help monitor treatment impact on heart structure and blood flow. The rising need for imaging biomarkers, coupled with the push for accelerated regulatory approvals, is making imaging services a cornerstone in study protocols.

Key Market Restraint: High Cost and Technical Complexity

Despite its advantages, the high cost and technical complexity of imaging in clinical trials remain key restraints. Implementing imaging protocols across multi-center trials requires significant investment in hardware, software, training, and standardization. Moreover, the variability in imaging equipment across sites can affect image quality and consistency, requiring additional harmonization efforts.

Furthermore, managing and analyzing large volumes of image data necessitates sophisticated IT infrastructure and expert radiologists. For smaller sponsors or early-stage biotech firms, these costs can be prohibitive, limiting their ability to fully leverage imaging in their clinical programs.

Key Market Opportunity: Integration of Imaging Biomarkers

The integration of imaging biomarkers represents a significant opportunity within the clinical trial imaging market. Imaging biomarkers provide objective measures of biological processes and responses to therapy, enabling better patient selection, early efficacy readouts, and adaptive trial designs.

This opportunity is particularly promising in fields like neurology and immuno-oncology. For example, amyloid PET imaging is being used in Alzheimer’s trials to track plaque build-up and clearance. In immuno-oncology, advanced imaging techniques are monitoring immune cell infiltration in tumors. The standardization and qualification of new imaging biomarkers, often through public-private partnerships, are paving the way for their broader use in precision trials.

Segments

Clinical Trial Imaging Market By Service Insights

Reading and analytical services dominate the clinical trial imaging services market, largely due to their essential role in ensuring data quality, consistency, and regulatory compliance. These services involve centralized image review by trained radiologists or image analysts, who apply standardized criteria and ensure blinded assessments. In oncology and cardiology trials, accurate interpretation of imaging data can significantly impact the trial's outcome and subsequent regulatory decisions.

System and technology support services are the fastest-growing service segment, driven by the increasing reliance on digital platforms, AI-powered image analysis tools, and cloud-based solutions. As imaging trials become more complex and decentralized, demand is rising for integrated systems that facilitate image acquisition, storage, transfer, and secure access. Vendors offering end-to-end technology platforms are gaining traction among CROs and pharma sponsors.

Clinical Trial Imaging Market By Modality Insights

Computed Tomography (CT) is the most widely used imaging modality in clinical trials, especially in oncology, cardiovascular, and lung disease studies. CT offers high-resolution, cross-sectional imaging and is often used to monitor tumor size, plaque burden, or organ function. Its fast scan time and wide availability make it suitable for large-scale, multicenter studies.

Optical Coherence Tomography (OCT) is the fastest-growing modality, particularly in ophthalmology and dermatology trials. OCT provides high-resolution, real-time imaging of tissues, which is critical in evaluating retinal layers or skin structures. With the rise in vision-related clinical programs and non-invasive diagnostics, OCT is becoming a preferred imaging choice.

Clinical Trial Imaging Market By Application Insights

Oncology is the dominant application in the clinical trial imaging market, owing to the central role of imaging in staging, monitoring, and evaluating tumor responses. Imaging endpoints such as progression-free survival and objective response rate rely heavily on CT, MRI, and PET scans. Trials for novel cancer immunotherapies, gene therapies, and combination regimens increasingly integrate imaging at multiple points.

Ophthalmology is the fastest-growing application, driven by a surge in trials for age-related macular degeneration (AMD), diabetic retinopathy, and glaucoma. These studies rely extensively on OCT, fundus photography, and fluorescein angiography. With an aging population and rising diabetic prevalence, eye disease trials are on the rise, bringing increased focus to imaging innovation in this field.

Clinical Trial Imaging Market By End-use Insights

Biotechnology and pharmaceutical companies are the largest end-users, accounting for the majority of imaging service demand. These organizations depend on imaging to validate mechanism of action, identify responders, and provide visual proof of treatment efficacy. Imaging also supports go/no-go decisions in early-phase trials, helping save time and resources.

Contract Research Organizations (CROs) are the fastest-growing end-use segment, as outsourcing becomes the norm in drug development. CROs offer bundled imaging solutions, including data management, image acquisition protocols, and regulatory support. Their flexible service models and global reach make them attractive partners for both large pharma and smaller biotech firms.

Clinical Trial Imaging Market By Regional Insights

North America dominates the global clinical trial imaging market, led by the United States. This leadership is driven by the region's advanced healthcare infrastructure, strong regulatory framework, and high concentration of clinical trial activity. The presence of top CROs, core labs, and imaging software providers further cements North America's position. Regulatory agencies like the FDA actively support the integration of imaging biomarkers, contributing to robust demand for centralized image services.

Asia-Pacific is the fastest-growing regional market, fueled by the expansion of clinical trials in countries such as China, India, Japan, and South Korea. These nations offer large patient populations, lower operational costs, and increasingly supportive regulatory environments. Government initiatives, such as China's recent reforms to accelerate drug trials, are encouraging sponsors to conduct imaging-intensive studies in the region. As local CROs upgrade their imaging capabilities, the Asia-Pacific region is emerging as a global hub for trial imaging services.

Recent Development

-

March 2025 – Bioclinica (now part of Clario) launched a cloud-native image repository system to streamline image storage, access, and sharing across global trials.

-

January 2025 – Medpace announced the expansion of its imaging core lab in Cincinnati, with enhanced capabilities for advanced MRI and OCT analysis.

-

November 2024 – ICON plc signed a strategic partnership with a Korean imaging AI firm to enhance automated tumor segmentation in oncology trials.

-

September 2024 – ERT (now part of Clario) rolled out its new imaging biomarker validation framework, targeting neurology and rare disease trials.

Some of the prominent players in the Clinical trial imaging market include:

- IXICO plc

- Navitas Life Sciences

- Resonance Health

- ProScan Imaging

- Radiant Sage LLC

- Medpace

- Biomedical Systems Corp

- Cardiovascular Imaging Technologies

- Intrinsic Imaging

- BioTelemetry

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical trial imaging market.

Service

- Clinical Trial Design and Consultation Services

- Reading and Analytical Services

- Operational Imaging Services

- System and Technology Support Services

- Project and Data Management

Modality

- Computed Tomography

- Magnetic Resonance Imaging

- X-Ray

- Ultrasound

- Optical Coherence Tomography (OCT)

- Others

Application

- NASH

- CKD

- Diabetes

- Cardiovascular Diseases

- Ophthalmology

- Musculoskeletal

- Oncology

- Gastroenterology

- Pediatrics

- Others

End-use

- Biotechnology and Pharmaceutical companies

- Medical Devices Manufacturers

- Academic and Government Research Institutes

- Contract Research Organizations (CROs)

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)