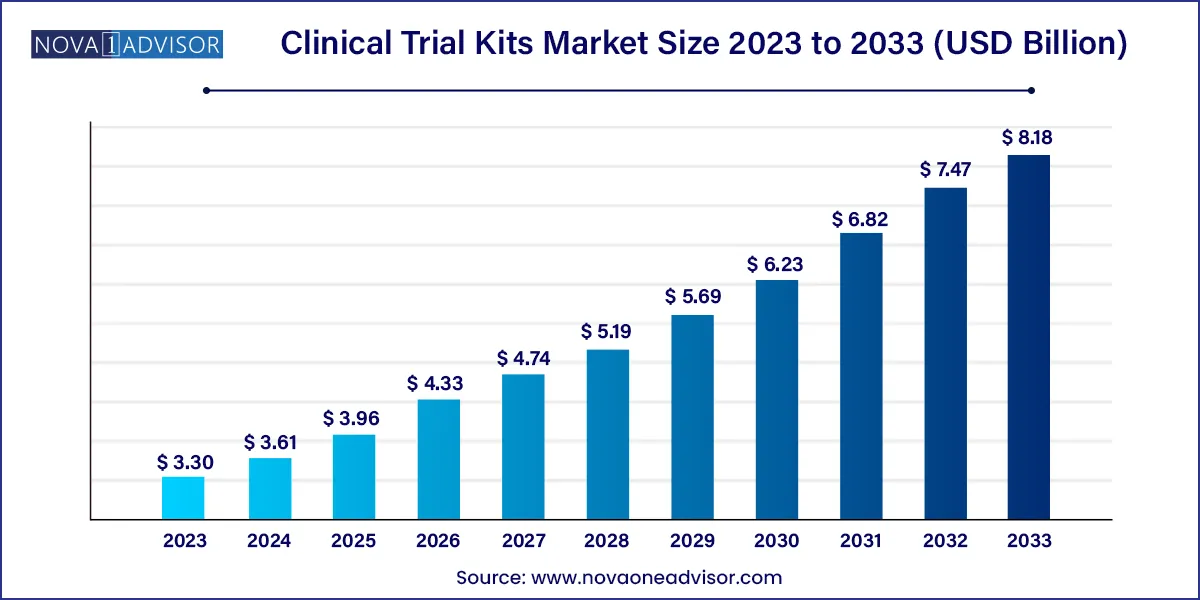

The global clinical trial kits market size was exhibited at USD 3.30 billion in 2023 and is projected to hit around USD 8.18 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2024 to 2033.

Key Takeaways:

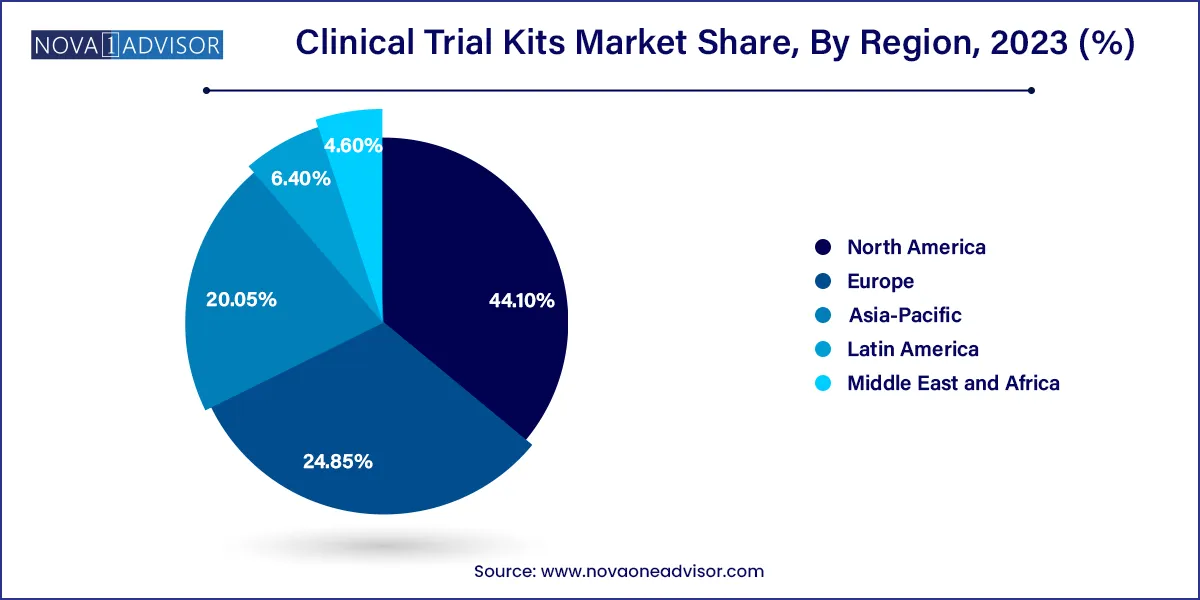

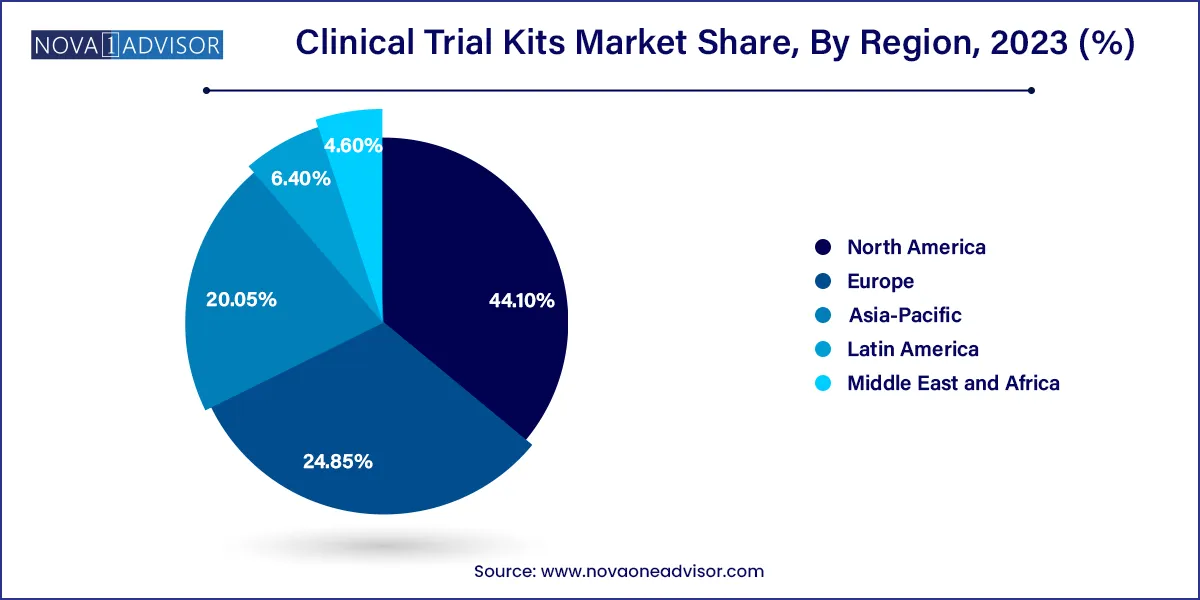

- North America dominated the clinical trial kits market and accounted for the largest revenue share of 44.1% in 2023.

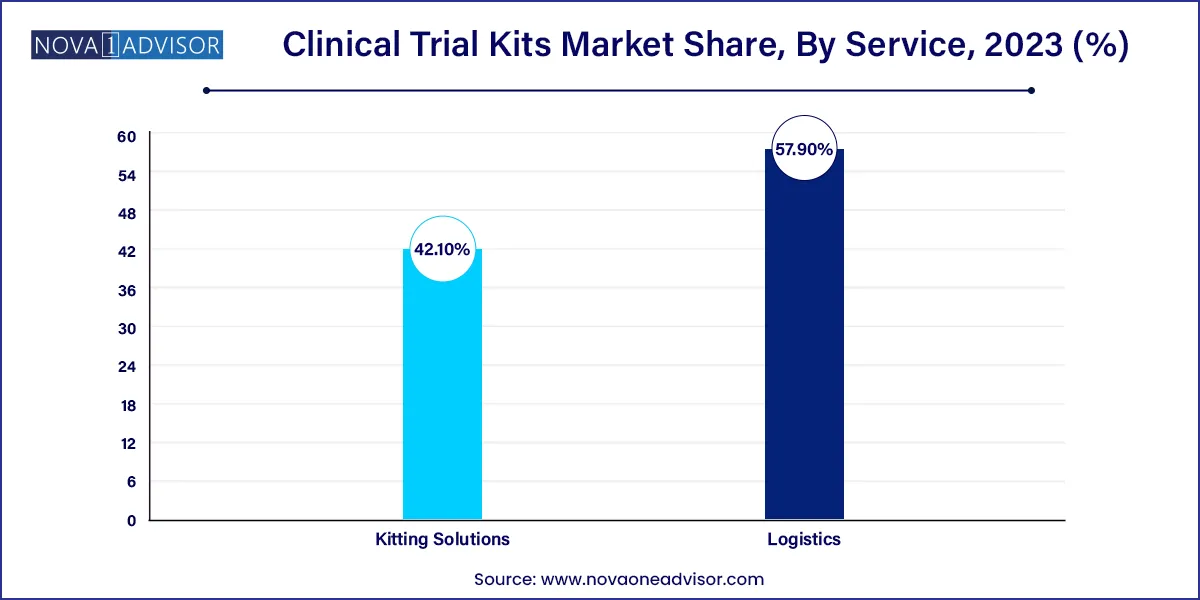

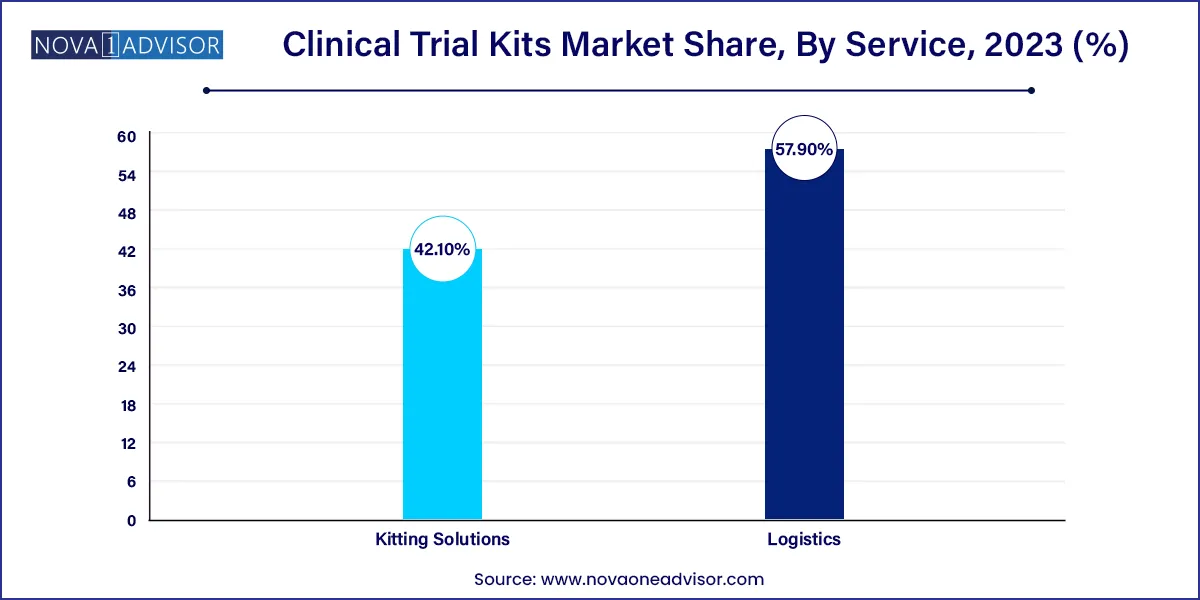

- The logistics segment dominated the market for clinical trial kits and accounted for the largest revenue share of 57.9% in 2023.

- The phase III segment dominated the market for clinical trial kits and accounted for the largest revenue share of 53.3% in 2023

- In Asia Pacific, the market for clinical trial kits is projected to witness the fastest CAGR of 9.9% over the forecast period.

Market Overview

The Clinical Trial Kits Market is a critical component of the broader clinical trial supply chain ecosystem, facilitating the organized and compliant collection, transportation, and storage of biological samples and therapeutic products. Clinical trial kits are custom-designed packages that typically contain items such as sample collection tubes, swabs, syringes, medication, diagnostic materials, and instructions tailored to specific study protocols. These kits are essential for ensuring the consistency, accuracy, and reliability of clinical data, especially in global, multicenter studies.

As clinical trials continue to expand in complexity and scale, especially with the rise of decentralized and remote studies, the demand for robust and flexible kitting solutions has surged. Pharmaceutical, biotechnology, and medical device companies, as well as CROs, are increasingly relying on specialized kit providers for the timely delivery and collection of materials. The kits must comply with Good Clinical Practice (GCP) standards, regulatory requirements, and must be tailored to various trial phases and therapeutic areas.

Further driving market growth is the increase in personalized medicine and biomarker-based studies, which often require precise handling of biological samples. Cold chain logistics, real-time tracking, and automation are enhancing the efficiency and traceability of clinical trial kits across regions. Together, these dynamics are shaping a market that is both indispensable and rapidly evolving.

Major Trends in the Market

-

Rising Popularity of Decentralized Clinical Trials (DCTs): Remote delivery of trial kits to participants' homes is on the rise.

-

Customization of Kits for Precision Trials: Increasing demand for trial-specific packaging and components, including genetic and diagnostic materials.

-

Integration of Smart Labels and RFID Tracking: Enhancing visibility and traceability of kits across logistics networks.

-

Outsourcing of Kit Management to Specialized Providers: Sponsors are focusing on R&D while logistics experts handle kitting and distribution.

-

Increased Demand for Temperature-Controlled Logistics: Cold chain innovations are essential for transporting biologics and sensitive samples.

-

Automation in Kit Assembly: Robotics and software are speeding up production while minimizing human error.

-

Sustainability in Kit Design: Eco-friendly packaging and reusable components are gaining attention.

Report Scope of the Clinical Trial Kits Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.61 Billion |

| Market Size by 2033 |

USD 8.18 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Phase, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Brooks life science; Q2 solutions; Patheon (Thermo fisher scientific); LabCorp drug development; Charles river laboratories; LabConnect; Almac group; Precision medicine group; Cerba research; Alpha laboratories; Marken; Clinigen |

Key Market Driver: Growth in Clinical Trial Activity

The primary driver of the Clinical Trial Kits Market is the ongoing growth in global clinical trial activity. As more pharmaceutical and biotechnology firms invest in drug and vaccine development, the need for structured, reliable, and scalable clinical trial kits has intensified. Trials are no longer confined to centralized hospital settings; rather, they extend into outpatient centers, local clinics, and even patients' homes.

For instance, COVID-19 catalyzed the adoption of at-home trial kits for diagnostic testing and therapeutic monitoring. Similarly, oncology and rare disease trials now require frequent sample collection across broad geographic regions, making standardized kits indispensable. As a result, companies offering kit assembly, labeling, and distribution services are seeing heightened demand, particularly in Phase II and III studies.

Key Market Restraint: Supply Chain Disruptions

A significant challenge facing the market is supply chain disruptions and logistical complexity, especially in multinational trials. The pandemic exposed vulnerabilities in raw material sourcing, transportation networks, and customs clearance procedures. Even minor delays in kit delivery can compromise study timelines, protocol adherence, and sample viability.

Moreover, kitting solutions depend on precision inventory management and timely replenishment. Shortages of critical components like swabs, vials, or dry ice can halt distribution. Ensuring consistent global delivery, while adhering to country-specific import/export regulations, requires high operational resilience and contingency planning, often lacking among smaller service providers.

Key Market Opportunity: Technological Integration in Kit Logistics

One of the most promising opportunities in the market lies in technological integration across kit assembly and logistics. Innovations such as barcode-based inventory tracking, real-time temperature monitoring, and blockchain for chain-of-custody verification are transforming how trial kits are handled.

Technology not only enhances transparency and reduces manual errors but also ensures regulatory compliance and traceability. Companies investing in integrated logistics platforms are enabling sponsors to monitor kit usage, sample collection, and returns in real-time. Such platforms can interface with electronic data capture (EDC) systems and trial management software, offering a seamless digital experience that improves efficiency and data quality.

Segments

Clinical Trial Kits Market By Service Insights

Kitting solutions dominate the market, as they form the foundational element of any clinical trial kit. Drug kits and sample collection kits are central to nearly every trial protocol. These kits ensure standardization in materials provided to clinical sites or patients, reducing variability and improving data integrity. Drug kits are especially critical in blinded studies, where uniformity in labeling and packaging prevents bias.

Logistics services are the fastest-growing segment, particularly with the rise of global and decentralized trials. Transportation and warehousing now require sophisticated temperature controls, customs expertise, and just-in-time delivery capabilities. As personalized therapies grow, the logistics of trial kits becomes more intricate, demanding specialized handling solutions. Companies offering end-to-end logistic services, including packaging, shipment, storage, and returns, are increasingly sought after by global sponsors.

Clinical Trial Kits Market By Phase Insights

Phase III trials account for the largest share of kit demand, given their scale and complexity. These trials involve large patient populations and require repeated sample collection and dosing regimens, which translates into high-volume and high-frequency kit distribution. Kit customization and efficient resupply logistics are critical to prevent disruptions during this critical stage of development.

Phase I trials are the fastest-growing segment, fueled by the increasing number of early-stage biotech firms and novel therapy exploration. These studies often require unique formulations, special handling, or small-batch production, necessitating bespoke kit solutions. Given the sensitivity of these early-phase studies, precision in kit assembly and delivery is crucial to ensuring protocol adherence and patient safety.

Clinical Trial Kits Market By Regional Insights

North America dominates the Clinical Trial Kits Market, driven by its leadership in clinical trial initiation, biopharmaceutical R&D investment, and presence of top CROs and kit vendors. The United States, in particular, hosts a large number of trial sites and benefits from a mature logistics infrastructure. Regulatory support from the FDA for remote trial methods further accelerates the demand for home-delivered trial kits.

Asia-Pacific is the fastest-growing regional market, thanks to the rapid expansion of clinical trials in countries such as China, India, and South Korea. The region offers cost advantages, large patient populations, and increasingly supportive regulatory environments. As trials become more international, local vendors and global logistics firms are expanding operations in Asia-Pacific to support trial kit distribution and management.

Some of the prominent players in the Clinical trial kits market include:

- Brooks life science

- Q2 solutions

- Patheon (Thermo fisher scientific)

- LabCorp drug development

- Charles river laboratories

- LabConnect

- Almac group

- Precision medicine group

- Cerba research

- Alpha laboratories

- Marken

- Clinigen

Recent Developments

-

April 2025 – Marken (a UPS company) announced the expansion of its temperature-controlled packaging solutions tailored for decentralized trial kits.

-

February 2025 – Catalent partnered with a biotech firm to provide end-to-end kit production and distribution for a global Phase III oncology trial.

-

December 2024 – Thermo Fisher Scientific launched a new automated kitting center in Europe to meet growing demand for personalized trial kits.

-

October 2024 – Almac Clinical Services introduced eco-friendly clinical trial kit packaging as part of its sustainability initiative.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical trial kits market.

Service

-

- Drugs kits

- Sample collection kits

-

- Transportation

- Warehousing & Storage

- Others

Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)