Clinical Trial Supplies Market Size and Trends

The clinical trial supplies market size was exhibited at USD 3.55 billion in 2023 and is projected to hit around USD 8.49 billion by 2033, growing at a CAGR of 9.11% during the forecast period 2024 to 2033.

.webp)

Key Takeaways:

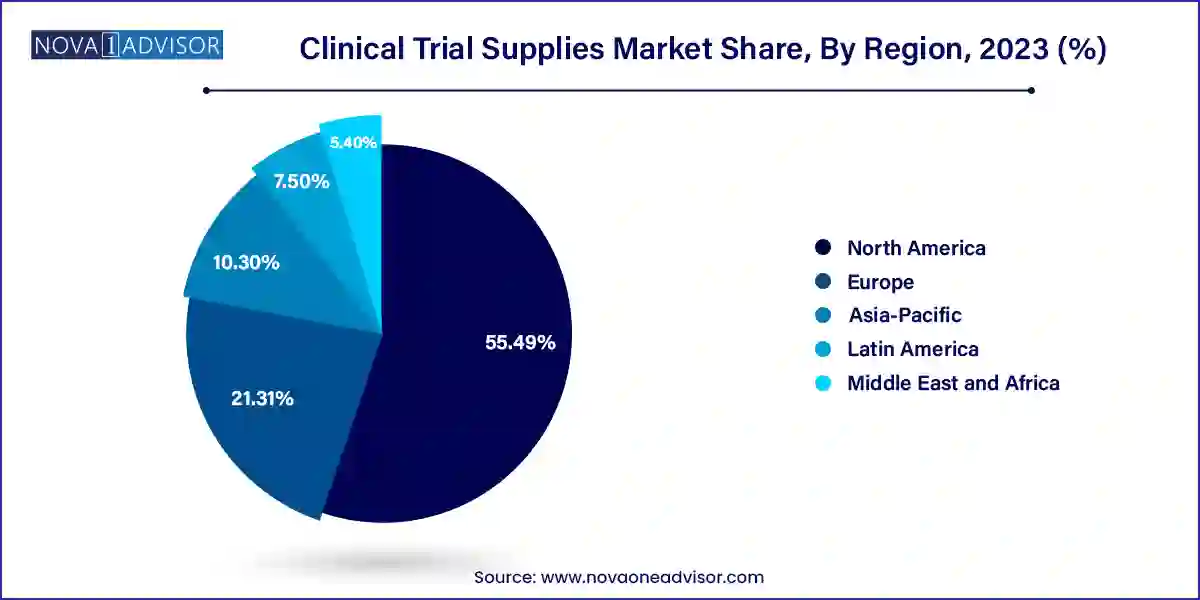

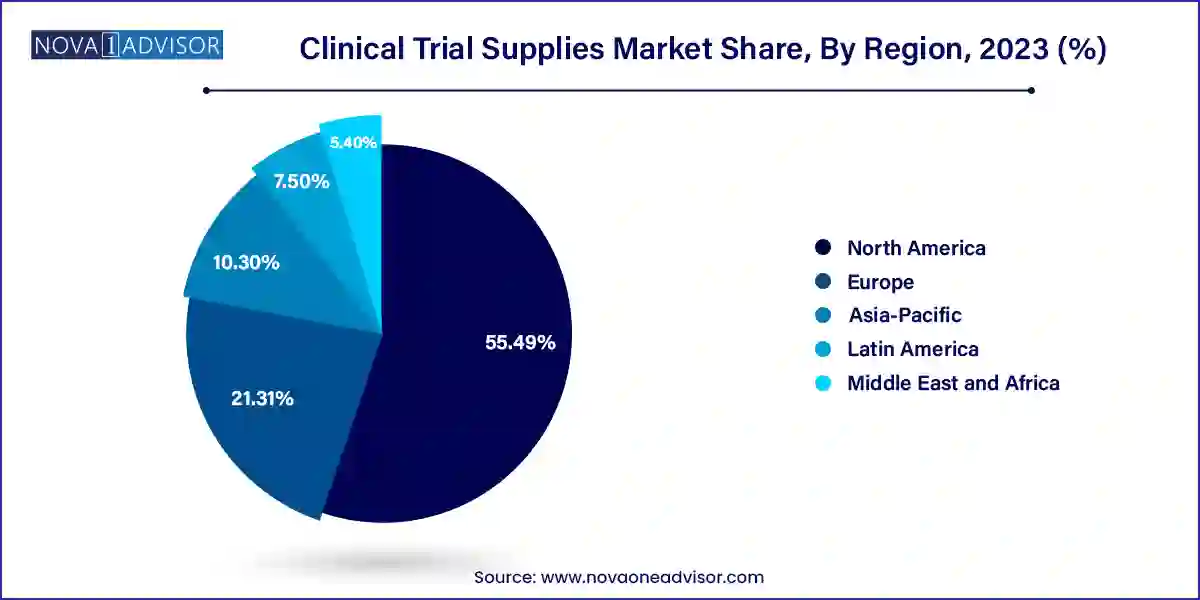

- North America accounted for the largest market share of 55.49% in 2023.

- The U.S. clinical trial supplies market is anticipated to witness significant growth rate over the forecast period.

- Phase III led the market and accounted for 52.75% of the global revenue in 2023.

- Phase I clinical trials are anticipated to register the fastest CAGR of 7.0% during the forecast period.

- Supply chain management accounted for the largest market revenue share in 2023.

- The manufacturing segment is anticipated to witness significant growth at a CAGR of over 6.6% during the forecast period.

- On the other hand, cardiovascular disease trials is anticipated to register a 6.9% growth over the forecast period.

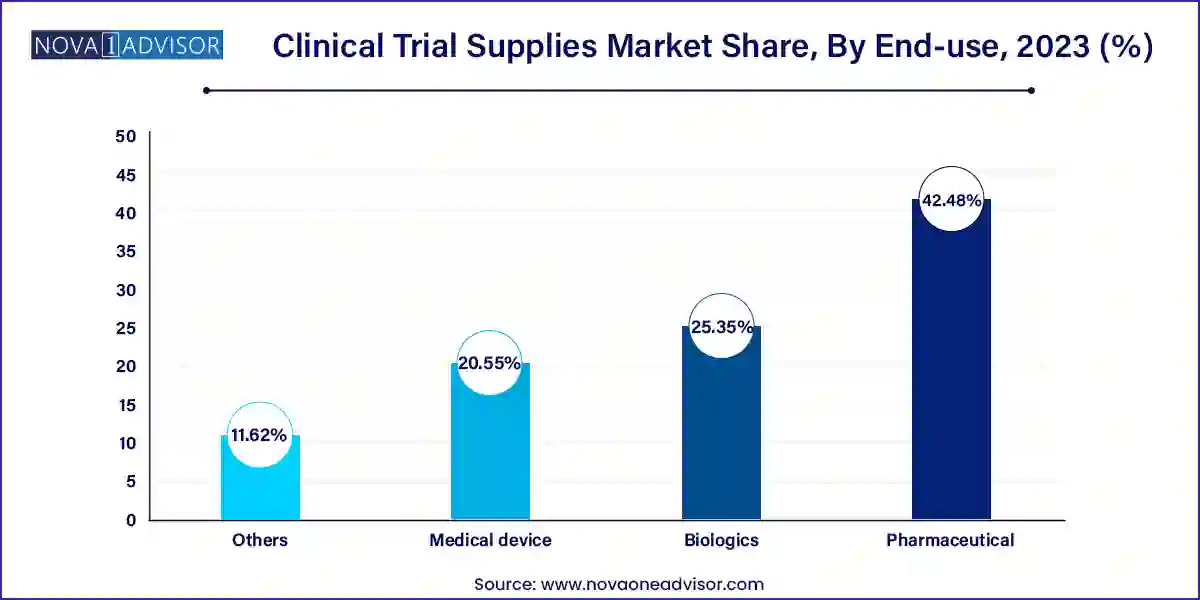

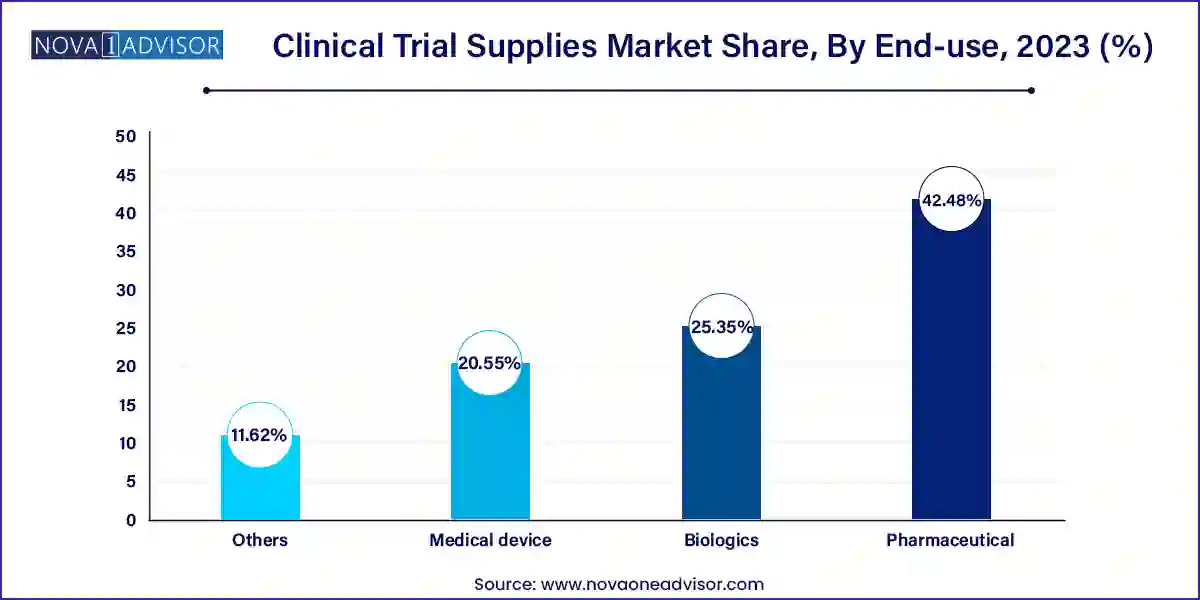

- Pharmaceuticals accounted for the largest market share of 42.48% in 2023.

U.S Clinical Trial Supplies Market Size and Share Report, 2033

The U.S clinical trial supplies Market is valued at USD 1.38 Billion in 2023 and is projected to reach a value of USD 3.35 Billion by 2033 at a CAGR (Compound Annual Growth Rate) of 8.77% between 2024 and 2033.

.webp)

North America leads the clinical trial supplies market, supported by a robust clinical research infrastructure, top-tier CROs, and a high concentration of pharmaceutical R&D activities. The United States is home to the majority of the world’s clinical trial sites and hosts headquarters for many global sponsors. Regulatory agencies such as the FDA provide clear guidance for clinical operations, enhancing predictability for trial supply providers.

Moreover, the region is a hub for innovation in supply chain digitization and direct-to-patient models. Companies such as Thermo Fisher Scientific and Catalent have expanded their logistics capabilities, warehousing networks, and technology platforms in response to growing demand. Public-private partnerships during the COVID-19 response further reinforced North America’s capabilities in large-scale clinical supply coordination.

Asia-Pacific is the fastest-growing region, propelled by increasing trial activity in China, India, South Korea, and Australia. Sponsors are drawn to the region due to large, treatment-naïve populations, lower trial costs, and improving regulatory efficiency. Governments are actively encouraging clinical research through reforms, digital health initiatives, and investments in biopharma hubs.

With more regional manufacturing facilities and packaging hubs emerging, sponsors are reducing dependency on Western supply chains and enabling quicker turnaround for local trials. Additionally, Asia-Pacific is witnessing rapid adoption of decentralized trials, especially in Japan and Australia, where remote patient management and mobile supply delivery are gaining regulatory acceptance. This dynamic regional landscape presents both challenges and immense opportunities for global and local supply chain players.

Market Overview

The Clinical Trial Supplies Market has evolved into a mission-critical component of the global clinical research ecosystem. As clinical trials become increasingly complex, multinational, and precision-driven, the demand for robust and agile supply chains has grown exponentially. Clinical trial supplies encompass a wide array of materials and services required to conduct clinical trials efficiently from investigational drug product manufacturing and comparator sourcing to storage, packaging, labeling, distribution, and return logistics. Without these components functioning seamlessly, clinical trials risk delays, budget overruns, or even failure.

The clinical research landscape has transformed over the past decade, driven by the rise of personalized medicine, biologics, rare disease research, and decentralized trial models. As pharmaceutical, biotech, and medical device companies strive to bring products to market faster and more cost-effectively, ensuring the timely availability and quality of clinical trial supplies has become a strategic priority.

This market is particularly influenced by globalization, regulatory complexity, and technological innovation. Trials increasingly span diverse geographies to ensure population diversity, and this globalization heightens the logistical challenges of compliance, documentation, temperature control, and demand forecasting. The COVID-19 pandemic exposed the vulnerabilities in existing supply frameworks and simultaneously accelerated the adoption of digital solutions, remote monitoring tools, and direct-to-patient logistics.

The market continues to expand due to increased R&D spending, a growing number of clinical trials (especially for oncology and CNS disorders), and the pressure to reduce trial cycle times. Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), and logistics specialists are playing a growing role, providing end-to-end solutions to sponsors looking to outsource critical operations.

Major Trends in the Market

-

Decentralized Clinical Trials (DCTs) and Direct-to-Patient Models: DCTs have reshaped supply chain logistics by requiring delivery of investigational products to patients’ homes, especially in post-pandemic studies.

-

Cold Chain Supply Management Evolution: Increasing research in biologics and vaccines has intensified demand for precise cold chain capabilities, including real-time temperature tracking and insulated packaging.

-

Adoption of Interactive Response Technology (IRT): IRT systems are now widely used for inventory management, demand forecasting, and site resupply, improving the efficiency of trial logistics.

-

Emergence of Sustainable Supply Practices: Sponsors and CROs are incorporating eco-friendly packaging, waste reduction protocols, and carbon tracking to make clinical trial logistics more sustainable.

-

Growth in Comparator Sourcing Services: As trials become more competitive and reference products are required for head-to-head studies, comparator sourcing has gained traction, especially for biosimilars.

-

Personalized and Adaptive Trial Protocols: Trials involving personalized treatments demand flexible and agile supply chains capable of last-minute formulation changes and small batch production.

-

Blockchain and Real-Time Tracking Integration: Transparency, compliance, and tamper-proof documentation are driving adoption of blockchain in trial supply chains for authentication and audit trails.

-

Regulatory Harmonization Initiatives: Regions are working toward harmonized Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP), improving consistency in multi-country trials.

Report Scope of Clinical Trial Supplies Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.87 Billion |

| Market Size by 2033 |

USD 8.49 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Clinical Phase, Product & Service, End-use, Therapeutic Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Key Companies Profiled |

Almac Group; Biocair; Catalent Inc.; KLIFO; Movianto; PCI Pharma Services; Sharp Services, LLC; Thermo Fischer Scientific Inc.; Marken; PAREXEL International Corporation |

Market Driver: Rising Number of Clinical Trials and R&D Investments

A primary driver for the clinical trial supplies market is the escalating number of clinical trials globally, coupled with increased R&D investments by pharmaceutical, biotechnology, and medical device companies. As of 2025, there are over 450,000 active clinical trials registered globally a sharp increase compared to pre-pandemic figures. This surge is due to advances in genomics, cell and gene therapy, immuno-oncology, and personalized medicine.

Governments are also supporting trial activity through funding and policy incentives. The U.S. FDA and EMA have approved more expedited trial protocols in the past five years than ever before. With faster trial approvals and shorter development cycles, companies must ensure that supplies are pre-positioned and synchronized with trial timelines. This has created a favorable environment for suppliers offering integrated manufacturing, packaging, and distribution services tailored to dynamic trial demands.

Market Restraint: Regulatory Complexity and Global Logistics Challenges

A significant restraint facing the market is the complexity of global regulatory requirements and the logistical burdens of multinational trial execution. Regulatory requirements differ markedly across countries, creating hurdles for companies running global trials. Issues such as customs delays, misaligned labeling requirements, and import/export permit challenges often disrupt timelines.

For example, a sponsor shipping investigational products from Europe to Asia may face vastly different documentation requirements, stability testing expectations, and packaging laws. Moreover, ensuring chain-of-custody and temperature compliance during cross-border shipping particularly for cold chain products poses risks of non-compliance and product loss. These regulatory and logistical bottlenecks can increase costs, cause trial delays, or even force redesigns in study protocols.

Market Opportunity: Technological Integration and Supply Chain Digitization

A promising opportunity lies in the digital transformation of clinical trial supply chains. Technologies such as IRT, cloud-based inventory systems, and AI-driven forecasting tools are enabling real-time visibility, reduced wastage, and better site resupply strategies. As trials adopt more decentralized elements, the need for responsive, patient-centric logistics is growing creating opportunities for digital innovation.

Wearables and ePRO (electronic patient-reported outcomes) systems are also being linked with supply workflows, ensuring synchronized medication shipments based on patient-reported adherence. For supply vendors and logistics providers, offering tech-enhanced services can create differentiation and increase trial success rates. Blockchain for chain-of-custody assurance and machine learning for adaptive inventory management represent high-growth innovation pathways within this evolving market.

Clinical Trial Supplies Market By Clinical Phase Insights

Phase III trials dominate the clinical phase segment, accounting for the largest share of trial supply spending. These late-stage studies involve large patient cohorts across multiple countries, requiring complex logistics, bulk manufacturing, and extensive regulatory documentation. The stakes are high, and any delays or supply issues can compromise years of prior R&D investments. This phase often includes comparator drugs, ancillary supplies, and packaging adjustments based on local regulatory standards.

Phase I is the fastest-growing segment, due to the proliferation of early-stage drug candidates and novel modalities such as gene therapy and RNA-based therapeutics. These trials require smaller volumes but more specialized handling, especially when testing biologics or first-in-human formulations. With the rise of precision medicine, many sponsors are running multiple Phase I trials simultaneously across different demographics, increasing demand for agile and flexible supply providers.

Clinical Trial Supplies Market By Product & Service Insights

Storage and distribution services dominate this segment, particularly cold chain logistics. With more than 40% of drugs under development requiring temperature-controlled handling, sponsors are partnering with vendors capable of managing deep-frozen, frozen, refrigerated, and controlled ambient storage environments. Real-time GPS and temperature sensors are now commonly embedded in shipments to ensure data integrity.

Comparator sourcing is the fastest-growing service, driven by a surge in biosimilar and generic drug development. As head-to-head trials become the norm, sponsors are seeking reliable access to branded drugs globally, often under strict confidentiality. Companies like Clinigen and Inceptua have emerged as leaders in sourcing hard-to-obtain comparators within regulatory frameworks, helping sponsors accelerate trial timelines.

Clinical Trial Supplies Market By Therapeutic Use Insights

Oncology dominates the therapeutic area segment, representing nearly 30% of global clinical trials. The complexity of oncology protocols frequent dosing, multiple arms, biomarker-based eligibility translates into sophisticated and high-volume supply requirements. Oncology trials often extend over years and require strict tracking of dosing regimens, making real-time inventory control crucial.

Infectious diseases are the fastest-growing therapeutic area, largely accelerated by the global focus on pandemic preparedness, antimicrobial resistance, and vaccine development. COVID-19 was a catalyst, but ongoing research in HIV, hepatitis, tuberculosis, and novel viral threats has sustained momentum. These trials are typically large-scale and time-sensitive, demanding rapid comparator sourcing, centralized labeling, and just-in-time delivery to global trial sites.

Clinical Trial Supplies Market By End-use Insights

Pharmaceutical companies dominate the end-use segment, as they are the largest sponsors of clinical trials globally. Their expansive portfolios across therapeutic areas and emphasis on time-to-market place high importance on reliable supply partnerships. Additionally, large pharmaceutical firms often run concurrent trials across several continents, adding to the complexity and volume of supply requirements.

Biologics is the fastest-growing end-use segment, fueled by advancements in monoclonal antibodies, cell therapies, and mRNA platforms. These therapies often require specialized storage conditions, careful dosage preparation, and chain-of-identity verification necessitating tailored supply chain solutions. Biotech firms, both large and emerging, are increasingly turning to full-service providers to manage these complexities.

Recent Developments

-

March 2025: Catalent announced the expansion of its Singapore facility to include advanced cold chain storage and comparator sourcing services, aiming to serve the booming Asia-Pacific market.

-

December 2024: Thermo Fisher Scientific acquired a supply chain software platform specializing in AI-based inventory forecasting for global trials, enhancing their IRT capabilities.

-

October 2024: Marken launched a new direct-to-patient logistics service in North America, offering same-day delivery for investigational products to support decentralized trials.

-

July 2024: Parexel partnered with a leading blockchain startup to pilot a secure trial supply tracking system across select oncology trials in Europe.

-

May 2024: Clinigen Group expanded its comparator sourcing network in Latin America through local distribution partnerships, improving speed and regulatory compliance.

Some of the prominent players in the Clinical trial supplies market include:

- Almac Group

- Biocair

- Catalent Inc.

- KLIFO

- Movianto

- PCI Pharma Services

- Sharp Services, LLC

- Thermo Fischer Scientific Inc.

- Marken

- PAREXEL International Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the clinical trial supplies market

Clinical Phase

- Phase I

- Phase II

- Phase III

- Phase IV

- BA/BE Studies

Product & Services

- Manufacturing

- Storage & Distribution

-

- Cold chain distribution

- Non-cold chain

- Supply chain management

- Comparator Sourcing

- Other Services (Solutions and Ancillary supplies)

End-use

- Pharmaceutical

- Biologics

- Medical device

- Others

Therapeutic Use

- Oncology

- CNS

- Cardiovascular

- Infectious disease

- Metabolic disorders

- Others

Regional

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

.webp)

.webp)