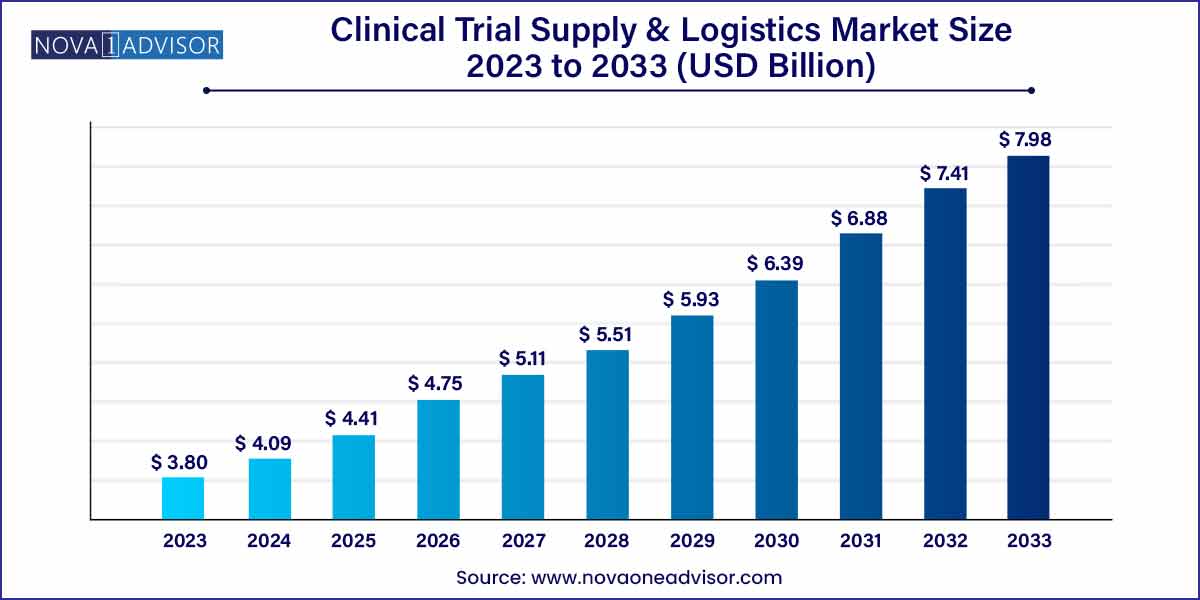

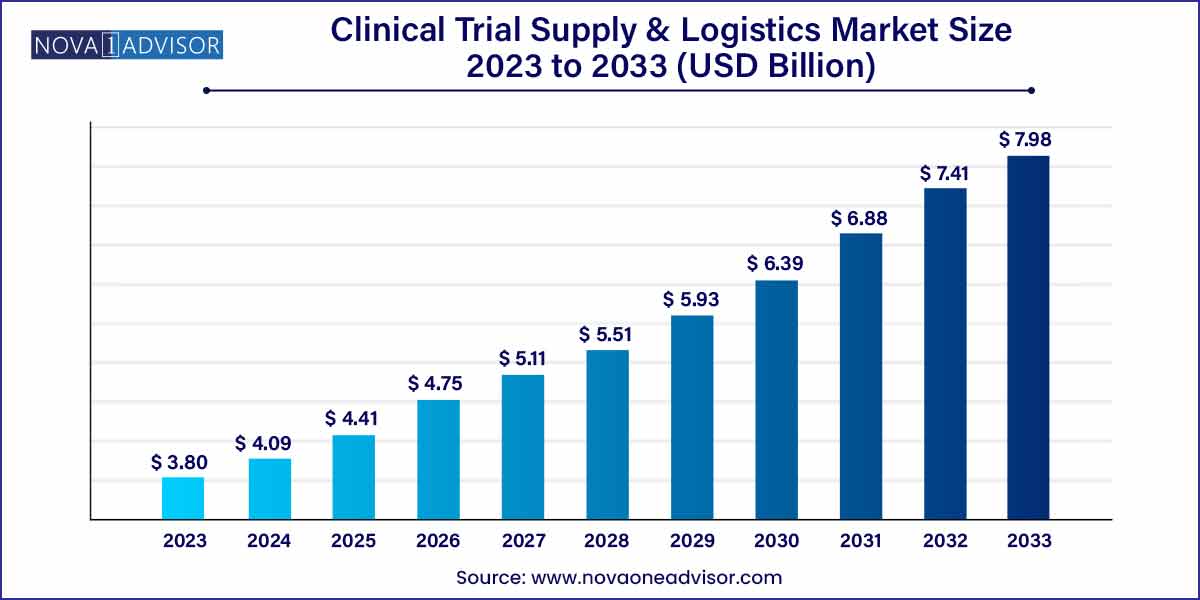

The global clinical trial supply and logistics market size was exhibited at USD 3.80 billion in 2023 and is projected to hit around USD 7.98 billion by 2033, growing at a CAGR of 7.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- The logistics & distribution segment held the largest share of over 48.0% in 2023.

- The phase III segment accounted for the largest revenue share in 2023.

- The cardiovascular diseases segment dominated the market in 2023.

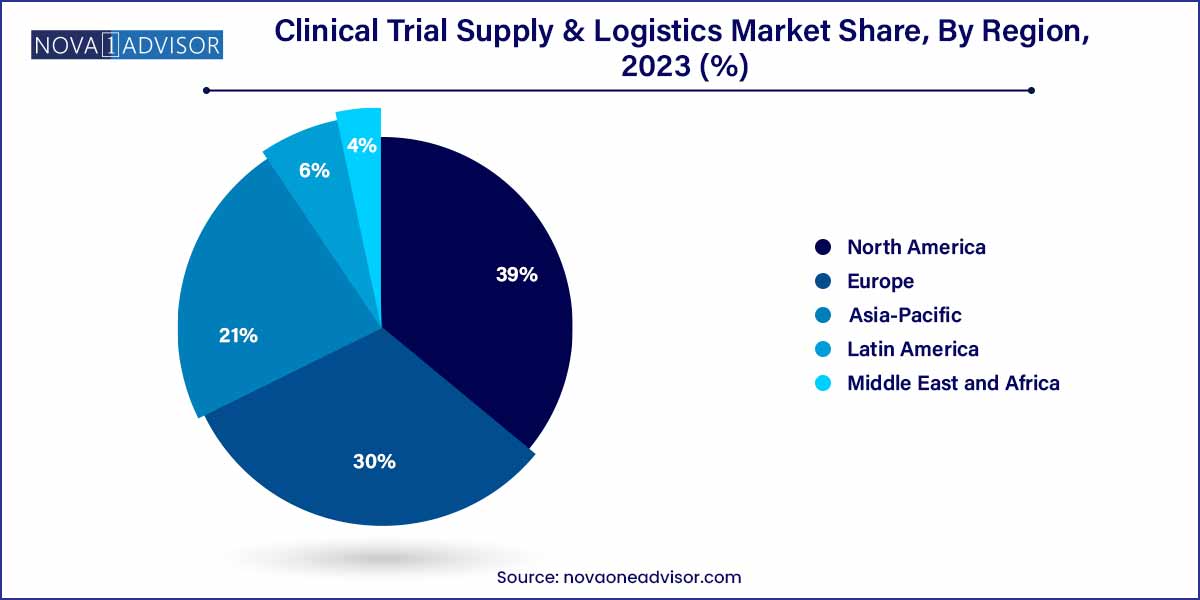

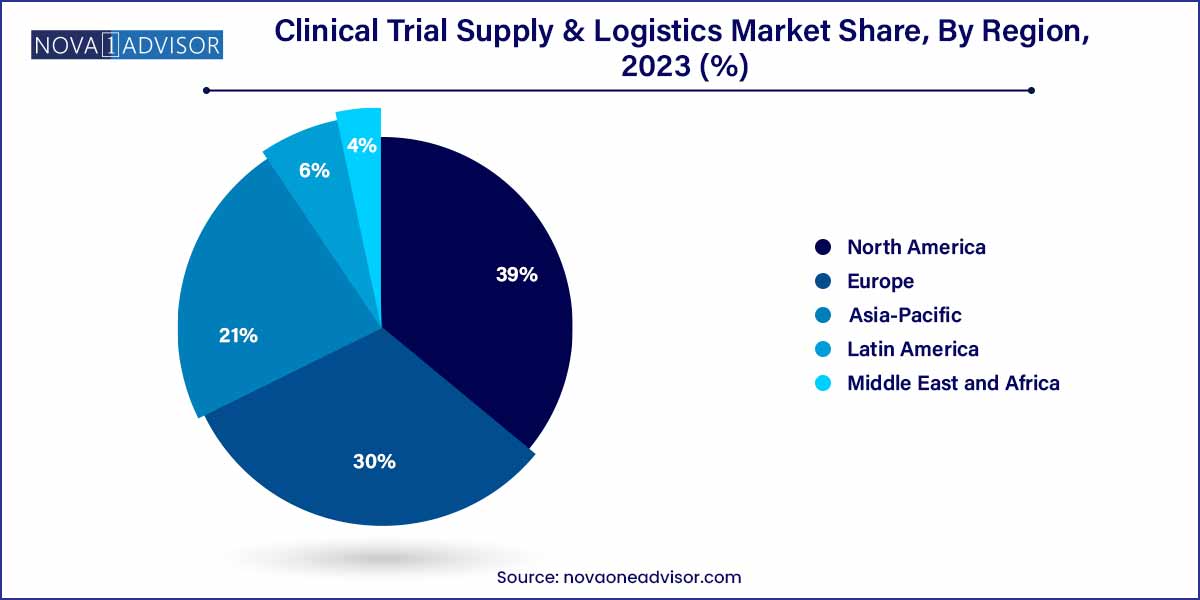

- North America dominated the market with a share of 39.0% in 2023.

Market Overview

The clinical trial supply and logistics market plays a pivotal role in the seamless execution of clinical research activities globally. This market ensures that investigational products, necessary materials, and supporting documentation reach clinical trial sites safely, securely, and within regulated timelines. As clinical trials become more complex, involving numerous locations, diverse patient populations, and stringent regulatory frameworks, the importance of robust supply and logistics strategies has magnified.

The market has witnessed significant growth, fueled by the increasing number of clinical trials across therapeutic areas, the rising complexity of clinical studies, the globalization of clinical research, and the growing emphasis on personalized medicine. Pharmaceutical, biotechnology, and medical device companies increasingly rely on specialized clinical trial logistics providers to manage intricate supply chains, ensure compliance with regulatory requirements, and maintain product integrity. With a strong focus on temperature-sensitive therapies, including biologics and cell & gene therapies, the market has adapted to offer innovative cold chain solutions and advanced packaging technologies.

Major Trends in the Market

-

Decentralized Clinical Trials (DCTs) Expansion: A surge in virtual and hybrid clinical trials has driven demand for direct-to-patient logistics services.

-

Growing Adoption of Cold Chain Logistics: Increasing reliance on biologics and cell therapies necessitates ultra-cold storage and transportation.

-

Rising Focus on Sustainability: Companies are adopting eco-friendly packaging and greener transportation practices to minimize carbon footprint.

-

Technological Integration: Use of real-time tracking, blockchain for data transparency, and AI for supply chain optimization is growing rapidly.

-

Personalized Medicine Impact: The shift toward personalized therapies demands highly customized supply and logistics services.

-

Stringent Regulatory Compliance: Greater emphasis on GxP (Good Practice) standards enforcement is reshaping operational practices.

-

Expansion in Emerging Markets: Growth in Asia-Pacific and Latin America clinical research activities is creating new supply chain complexities.

Clinical Trial Supply & Logistics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.80 Billion |

| Market Size by 2033 |

USD 7.98 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Phase, Therapeutic Area, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific (Patheon); Catalent, Inc.; Parexel International (MA) Corporation; Almac Group; Marken; Piramal Pharma Solutions; UDG Healthcare; DHL; FedEx; Movianto; Packaging Coordinators Inc. |

Key Market Driver

Increasing Complexity of Clinical Trials

Modern clinical trials are no longer confined to single centers or limited patient populations. Multi-regional studies, personalized treatments, adaptive trial designs, and stringent regulatory requirements have all heightened the complexity of managing clinical supplies. Trials for rare diseases, oncology, and precision medicines often require handling small, highly sensitive batches that must be delivered under exact conditions. For instance, the growing prevalence of cell and gene therapies, which often require cryogenic storage, demands specialized logistics capabilities. Companies like Marken and Catalent have invested heavily in state-of-the-art facilities to meet these complex needs. The challenge of coordinating manufacturing, packaging, distribution, and site-specific logistics across continents has underscored the criticality of sophisticated supply chain management in ensuring trial success.

Key Market Restraint

High Cost of Cold Chain and Specialized Logistics

One of the most significant barriers to market growth is the prohibitive cost associated with maintaining cold chain logistics, especially for biologics and advanced therapies. Temperature excursions during transit can compromise drug efficacy, leading to trial failures and financial losses. Ensuring integrity involves expensive infrastructure investments such as cryogenic freezers, GPS-enabled temperature monitoring systems, specialized packaging, and contingency planning. Small and mid-sized biopharmaceutical companies often struggle to bear these costs, impacting their ability to conduct expansive or global clinical trials. Moreover, regulatory scrutiny demands additional documentation and validation activities, further inflating operational expenses.

Key Market Opportunity

Adoption of Decentralized Clinical Trials (DCTs)

The post-pandemic era has catalyzed the shift towards decentralized clinical trials, offering a massive opportunity for clinical trial supply and logistics providers. DCTs involve delivering investigational products directly to patients' homes, bypassing traditional site-based models. This model requires sophisticated logistics planning, real-time tracking, and strict compliance with local regulations for home delivery of temperature-sensitive medications. Companies that can innovate and adapt to this new paradigm, ensuring patient-centric logistics while maintaining rigorous quality controls, stand to capture significant market share. For example, the rise of home nursing services linked to clinical trials in the United States and Europe has necessitated the development of new logistics hubs closer to patient populations.

Service Insights

Logistics & Distribution dominated the service segment in 2023. Logistics and distribution services accounted for the largest share, attributed to the indispensable role they play in ensuring timely delivery of trial materials across global clinical sites. With clinical trials expanding into remote and emerging regions, the necessity for specialized logistics providers capable of handling multi-temperature products, customs clearance, and site-specific delivery is crucial. Companies are increasingly relying on third-party logistics providers with advanced capabilities to track shipments in real-time, provide contingency plans, and ensure regulatory compliance. Services like direct-to-patient delivery models have also expanded the logistics landscape, enhancing its dominance.

Comparator Sourcing is projected to be the fastest-growing service segment. The rise in complex clinical trials, especially for biosimilars and oncology therapies, demands the procurement of comparator drugs sourced ethically and efficiently. Comparator sourcing involves acquiring marketed drugs for use in clinical studies to establish equivalency or superiority. This segment's growth is fueled by the increasing number of trials requiring comparators, challenges in sourcing drugs globally, and the need for quality assurance and regulatory adherence. Vendors offering end-to-end solutions from sourcing to labeling and packaging are increasingly favored, driving segment growth.

Phase Insights

Phase III trials held the largest share in the clinical trial supply and logistics market in 2023. Phase III trials are the most extensive and resource-intensive, involving thousands of patients across multiple geographies. The need for high volumes of investigational products, placebos, comparators, and ancillary supplies makes logistics for Phase III particularly complex. Additionally, the regulatory scrutiny at this stage demands rigorous quality assurance and documentation, further bolstering the need for advanced supply chain management solutions. The financial stakes involved in Phase III, often the final hurdle before product approval, amplify the importance of reliable logistics services.

Phase I is witnessing the fastest growth rate in the market. The increasing focus on early-stage research, fueled by personalized medicine, orphan drugs, and biotech innovation, has led to a surge in Phase I trials. These trials require smaller quantities of investigational products but demand heightened temperature control, handling precision, and real-time monitoring due to the experimental nature of treatments. Logistics providers specializing in agile, customizable services are gaining prominence, and the need for adaptive supply solutions is driving the rapid expansion of this segment.

Therapeutics Area Insights

Oncology dominated the therapeutic area segment in 2023. Oncology remains the primary area of clinical research investment, accounting for the largest number of ongoing trials worldwide. Cancer therapies, particularly immunotherapies and personalized medicines, demand complex logistics solutions such as cryogenic storage and specialized handling. With a growing pipeline of oncology drugs in late-stage development, the reliance on robust clinical trial supply chains continues to intensify.

CNS and Mental Disorders are the fastest-growing therapeutic segment. There is a renewed global focus on mental health, spurring an increase in trials for depression, schizophrenia, Alzheimer's disease, and related conditions. Given the complexity of CNS disorders and the need for long-term, multi-phase studies, clinical trial logistics must accommodate ongoing supply needs across extended periods, often with a requirement for patient-friendly packaging and delivery.

End-use Insights

Pharmaceuticals dominated the end-use segment in 2023. Traditional pharmaceutical companies continue to lead in conducting clinical trials, given their expansive drug pipelines across diverse therapeutic areas. Their global footprint demands sophisticated supply chain solutions capable of supporting multi-regional studies, leading to high demand for comprehensive clinical trial logistics services.

Biologicals are expected to be the fastest-growing end-use segment. The surge in biologics development, including monoclonal antibodies, vaccines, and advanced cell therapies, has transformed clinical trial supply requirements. Biological products are often highly sensitive to temperature and environmental conditions, requiring specialized cold chain solutions. With innovations in biotechnology and the rising number of biologics in clinical pipelines, this segment is poised for rapid expansion.

Regional Insights

North America dominated the clinical trial supply and logistics market in 2023. North America's leadership is attributed to its robust clinical research ecosystem, presence of major pharmaceutical and biotechnology companies, sophisticated healthcare infrastructure, and favorable regulatory support. The United States, in particular, hosts a majority of global clinical trials, necessitating efficient supply chain operations. Additionally, the region's early adoption of decentralized trials and direct-to-patient models has further strengthened its dominance in the market.

Asia-Pacific is the fastest-growing region in the market. Increasing clinical research investments, rising patient recruitment rates, cost advantages, and regulatory harmonization efforts have positioned Asia-Pacific as a key growth engine for the market. Countries like China, India, South Korea, and Australia are seeing a surge in clinical trial activities. This growth necessitates the establishment of new supply chain hubs, cold chain facilities, and regulatory-compliant logistics operations to meet burgeoning demand.

Recent Developments

-

April 2025: Catalent announced the expansion of its clinical supply services network with a new facility in Japan to better serve the Asia-Pacific market, focusing on cell and gene therapies.

-

March 2025: Marken launched a new direct-to-patient logistics service offering in Europe, enhancing its capabilities for decentralized trials.

-

February 2025: Thermo Fisher Scientific completed the acquisition of a specialty clinical supply company to strengthen its cold chain logistics capabilities.

-

January 2025: World Courier introduced a blockchain-based real-time tracking system for clinical trial shipments, offering enhanced transparency and data security.

Some of the prominent players in the clinical trial supply and logistics market include:

- Thermo Fisher Scientific (Patheon)

- Catalent, Inc.

- Parexel International (MA) Corporation

- Almac Group

- Marken

- Piramal Pharma Solutions

- UDG Healthcare

- DHL

- FedEx

- Movianto

- Packaging Coordinators Inc

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical trial supply & logistics market.

Service

- Logistics & Distribution

- Storage & Retention

- Packaging, Labeling, And Blinding

- Manufacturing

- Comparator Sourcing

- Other Services

Phase

- Phase I

- Phase II

- Phase III

- Phase IV

Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Respiratory Diseases

- CNS And Mental Disorders

- Others

End-use

- Pharmaceuticals

- Biologicals

- Medical Devices

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)