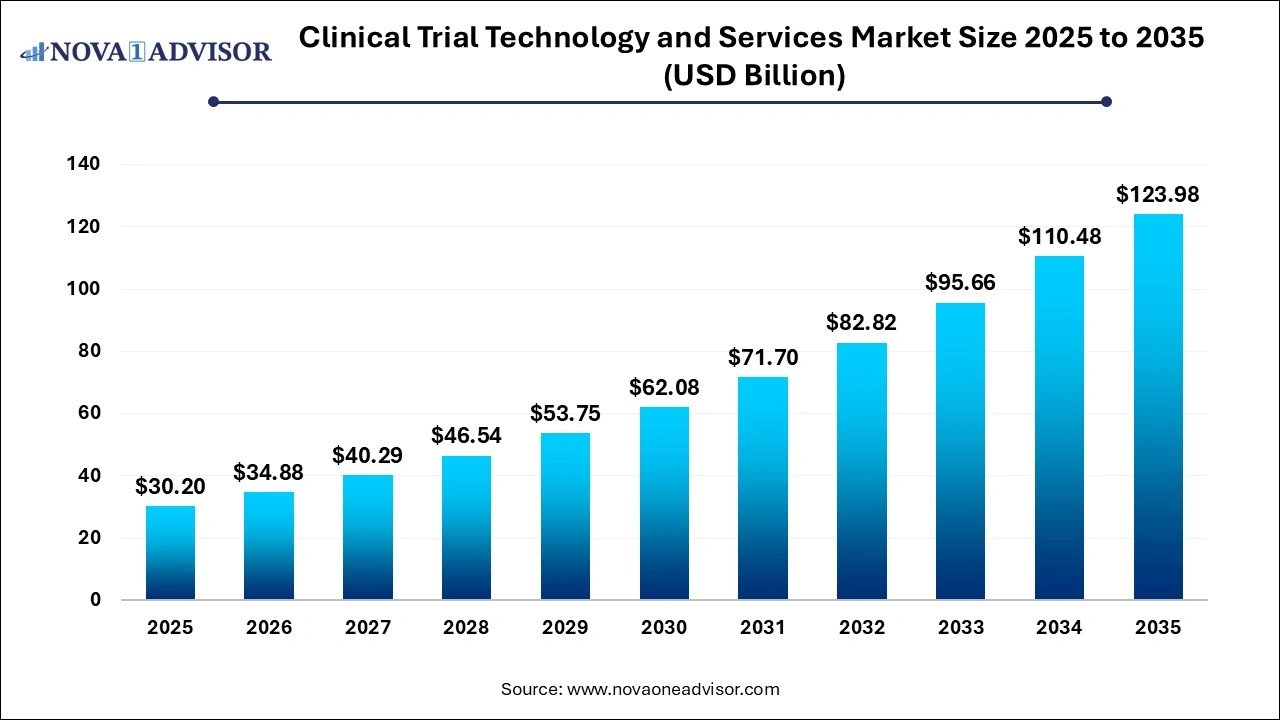

Clinical Trial Technology and Services Market Size and Growth 2026 to 2035

The clinical trial technology and services market size was exhibited at USD 30.2 billion in 2025 and is projected to hit around USD 123.98 billion by 2035, growing at a CAGR of 15.17% during the forecast period 2026 to 2035.

Clinical Trial Technology and Services Market Key Takeaways:

- The data collection and analytics segment held the largest revenue share of 67% in 2025.

- The trial management segment is expected to register a significant CAGR over the forecast period.

- The phase III segment held the largest revenue share of 54% in 2025.

- The phase I segment is expected to grow at the fastest CAGR of 16.4% over the forecast period.

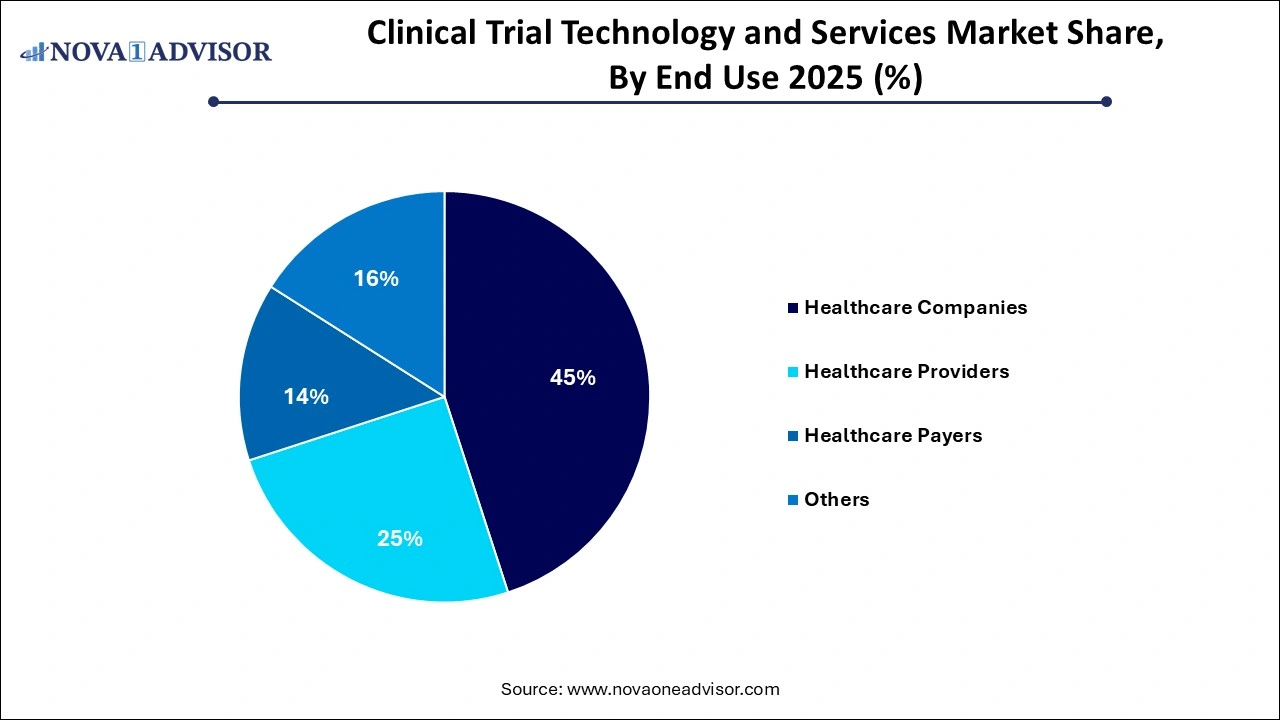

- The healthcare companies segment dominated the market with the largest revenue share of 45% in 2025.

- The healthcare providers’ segment is expected to register the fastest CAGR over the forecast period.

- North America's clinical trial technology and services industry is driven by advanced technological innovations and the increasing complexity of clinical trials.

Clinical Trial Technology and Services Market Overview

The global clinical trial technology and services market is undergoing a period of rapid transformation, driven by the integration of digital tools and data-centric solutions into the traditionally manual and fragmented trial processes. As the global healthcare industry experiences an increased demand for faster, safer, and more cost-effective drug development, clinical trials have emerged as a focal point for innovation. From artificial intelligence (AI) to decentralized clinical trials (DCTs), the convergence of technology and service-based solutions is modernizing how trials are designed, managed, monitored, and reported.

The market is being propelled by the growing complexity of clinical trials, stringent regulatory demands, and the rising volume of trial data requiring management and analysis. In addition, the COVID-19 pandemic served as an inflection point, forcing pharmaceutical companies, contract research organizations (CROs), and healthcare institutions to adopt remote, virtual, and technology-driven trial models to maintain continuity during global lockdowns.

In 2024, the market continues to witness increased investment in digital platforms such as eConsent tools, electronic patient-reported outcomes (ePRO), and clinical trial management systems (CTMS). The shift toward real-world evidence (RWE), patient-centric designs, and global expansion of trial operations are further reinforcing the demand for integrated technologies and end-to-end service offerings.

Major Trends in the Clinical Trial Technology and Services Market

-

Adoption of AI in Patient Recruitment and Site Feasibility: Companies are leveraging machine learning algorithms to match eligible patients with appropriate trials, significantly reducing recruitment time.

-

Expansion of Decentralized Clinical Trials (DCTs): Increasing use of wearables, remote monitoring, and telemedicine technologies to conduct trials outside traditional clinical settings.

-

Growth in Electronic Data Capture (EDC) and eCOA Solutions: The transition from paper-based methods to digital platforms for data input and patient feedback is becoming the standard.

-

Integration of Real-World Evidence (RWE): Sponsors are incorporating RWE from claims data, EHRs, and registries to enhance trial design and outcomes assessment.

-

Cloud-based Clinical Trial Management Systems: Scalable, secure, and interoperable platforms are streamlining trial planning, documentation, and site coordination.

-

Increased Focus on Pharmacovigilance Tools: Regulatory bodies require better safety monitoring tools across all trial phases, boosting the adoption of automated PV systems.

Report Scope of Clinical Trial Technology and Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 34.88 Billion |

| Market Size by 2035 |

USD 123.98 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 15.17% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology Solutions, Clinical Trials Phases, End use, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

IQVIA, Inc., Medidata (Dassault Systèmes), Oracle, DATATRAK International, Inc., Veeva Systems, Koninklijke Philips N.V., Cognizant, Allscripts Healthcare LLC, Optum Inc.Aris Global LLC, Clinevo Technologies, MasterControl Solutions, Inc., Ennov, Accenture, IBM, Capgemini, Clinquest Group B.V., (Linical Americas), Medidata Solutions, Inc., Calyx, ICON PLC, PPD, Inc. (Acquired by Thermo Fisher Scientific, Inc.), McKesson Corporation, Epic Systems Corporation, Experian Information Solutions, Inc. |

Key Market Driver

Digital Transformation in Clinical Trials

One of the most significant drivers of the clinical trial technology and services market is the digital transformation sweeping across the pharmaceutical and healthcare sectors. Traditionally reliant on manual processes, clinical trials are now embracing AI-driven analytics, digital patient engagement tools, wearable technology, and cloud-based platforms.

Digital transformation not only improves operational efficiency but also accelerates trial timelines, reduces costs, and enhances data quality and regulatory compliance. For instance, Medable’s digital trial platform claims to reduce trial timelines by up to 50%, illustrating the direct impact of technological advancement on market growth. As biopharma companies face pressure to bring drugs to market quickly, the demand for streamlined, digital-first trial models is set to increase exponentially.

Key Market Restraint

Regulatory and Data Privacy Challenges

While technology adoption offers numerous benefits, it also introduces new complexities—particularly in regulatory compliance and data privacy. With clinical trial data being highly sensitive, ensuring compliance with GDPR in Europe, HIPAA in the U.S., and similar regulations worldwide is challenging.

Cross-border data transfers in multinational trials further complicate matters. For instance, using cloud-based data platforms requires rigorous security protocols to avoid data breaches. Additionally, variations in regulatory requirements across geographies create compliance burdens for sponsors and CROs. The risk of non-compliance can result in severe financial penalties and trial disruptions, posing a substantial restraint to market expansion.

Key Market Opportunity

Rise of Personalized Medicine and Adaptive Trials

The growing emphasis on personalized medicine presents a unique opportunity for clinical trial technologies. As treatments become more targeted based on genetic, biomarker, and lifestyle data, trials need to be more adaptive and responsive to real-time outcomes. This complexity necessitates the use of AI, advanced analytics, and interoperable platforms capable of handling vast volumes of heterogeneous data.

Companies such as Parexel and ICON are increasingly supporting personalized therapy trials with tailored technology stacks and real-world data integration. These advanced methodologies enable faster adjustments to protocols and improved patient stratification, opening doors to next-generation trial design and execution.

Clinical Trial Technology And Services Market Segmental Insights

By Technology Solutions Insights

Dominated by Data Collection and Analytics Solutions

In 2025, data collection and analytics solutions continue to dominate the market, owing to the explosive growth in trial-related data and the need for real-time decision-making. Solutions such as electronic data capture (EDC), eCOA, and clinical analytics provide a digital backbone to modern trials. For example, Veeva Systems’ cloud-based clinical data platform is widely adopted for integrating EDC, CTMS, and eTMF into one centralized solution, reducing data silos and expediting regulatory submissions.

Additionally, RWE platforms have emerged as critical tools, especially in post-marketing surveillance and Phase IV studies. Pharmaceutical sponsors are using real-world insights to inform trial design, predict patient dropouts, and determine long-term drug efficacy. With regulatory agencies encouraging RWE use in clinical submissions, this segment is expected to maintain its lead.

Fastest Growing: AI Integration Solutions

The AI integration solutions segment is the fastest-growing, driven by increasing use cases in patient recruitment, protocol optimization, and predictive analytics. Companies like Saama and Deep 6 AI are transforming clinical research with platforms that rapidly identify patient populations using EHR and genomic data. AI also enables adaptive trial designs by forecasting trial outcomes, reducing risks, and enhancing cost-efficiency.

The rise of AI chatbots and virtual assistants in patient engagement is another frontier. For instance, digital companions can guide patients through trial protocols, monitor adherence, and provide reminders, enhancing overall retention and compliance.

By Clinical Trial Phases Insights

Dominated by Phase III Trials

Phase III trials currently dominate the market due to their scale, complexity, and critical role in regulatory approval. These trials involve large populations and multi-site operations, requiring extensive use of CTMS, randomization tools (RTSM), and pharmacovigilance systems. For example, Pfizer’s Phase III COVID-19 vaccine trial spanned multiple countries and heavily relied on digital infrastructure for coordination and data collection.

Due to the high stakes involved in Phase III, sponsors invest significantly in risk-based monitoring, data analytics, and patient safety systems. This increases demand for comprehensive technological and service support in this segment.

Fastest Growing: Phase I Trials

Phase I trials are the fastest-growing, driven by the rise in novel therapies such as gene and cell therapies that require early and intensive safety evaluations. These trials are increasingly adopting technologies like eConsent, AI-driven trial simulations, and wearables for real-time safety monitoring. Furthermore, early-phase trials are now leveraging decentralized models, enabling rapid recruitment and data collection from diverse demographics.

Start-ups and biotech companies launching first-in-human studies often partner with tech-enabled CROs for turnkey solutions. This trend, coupled with an uptick in orphan drug development, is accelerating the growth of this segment.

By End Use Insights

Dominated by Pharmaceutical and Biotechnology Firms

Among end users, pharmaceutical and biotechnology firms remain the primary drivers of clinical trial technology demand. These organizations are responsible for most trial sponsorships and have substantial budgets for technology adoption. Global giants such as Novartis and Roche are at the forefront of implementing digital tools in trial planning, monitoring, and data integration to expedite development timelines.

Moreover, biopharma firms face pressure from shareholders and regulators to demonstrate pipeline progress, further incentivizing them to adopt tech-enabled trial models that minimize time-to-market.

Fastest Growing: Contract Research Organizations (CROs)

CROs are the fastest-growing end-user group, propelled by outsourcing trends across the drug development lifecycle. As pharmaceutical companies reduce in-house capabilities, CROs like ICON, Syneos Health, and Labcorp are enhancing their technology stacks to offer integrated services from eClinical platforms to AI analytics.

These firms are also expanding into emerging markets, supporting both local and global trial execution. Their expertise in regulatory compliance, coupled with turnkey digital solutions, makes them indispensable partners in modern trial ecosystems.

Clinical Trial Technology And Services Market By Regional Insights

Dominant Region: North America

North America dominates the clinical trial technology and services market, underpinned by a robust pharmaceutical industry, advanced healthcare infrastructure, and favorable regulatory frameworks. The U.S. Food and Drug Administration (FDA) actively supports innovations like RWE and digital health technologies in trials. Additionally, the presence of major tech players such as Medidata, Oracle Health Sciences, and Parexel contributes to a vibrant and competitive ecosystem.

The region also benefits from a high number of trial initiations, with more than 30% of global clinical trials conducted in the U.S. alone. Investment from venture capital in biotech start-ups further fuels demand for efficient and scalable trial solutions.

Fastest Growing Region: Asia Pacific

Asia Pacific is the fastest-growing region, driven by a rapidly expanding pharmaceutical sector, large patient populations, and cost-effective trial sites. Countries like China, India, and South Korea are investing heavily in research infrastructure and attracting foreign sponsors for multi-regional trials.

Regulatory reforms, such as China's National Medical Products Administration (NMPA) adopting fast-track review pathways, have made the region more trial-friendly. Moreover, local CROs are forming strategic alliances with global tech companies to bring AI, remote monitoring, and decentralized capabilities to the regional market.

List of Top Companies

- Medidata Solutions (Dassault Systèmes)

- Veeva Systems

- Oracle Health Sciences

- Parexel International

- ICON plc

- IQVIA

- Labcorp Drug Development

- Syneos Health

- Medable

- Saama Technologies

- Science 37

- Signant Health

- Clario

- Deep 6 AI

- eClinicalWorks

Clinical Trial Technology And Services Market Recent Developments

- In October 2024, the International Myeloma Foundation (IMF) teamed up with SparkCures to offer myeloma patients and caregivers a personalized service that helps them find clinical trials based on diagnosis, treatment history, and individual preferences.

- In June 2024, IQVIA introduced the "One Home" clinical trial technology platform, which addresses challenges and minimizes the burden on trial sites.

- In April 2024, IQVIA announced an expansion of its strategic partnership with Salesforce, aiming to expedite the advancement of Life Sciences Cloud of Salesforce. This initiative represents a next-gen customer interaction platform for the life sciences sector. Through these strategic partnerships, IQVIA aims to advance the development of technological solutions designed to accelerate decision-making processes across various domains, including RWE, discovery, clinical development, medical affairs, and patient safety.

- In April 2024, Parexel partnered with Palantir Technologies Inc. to leverage AI for accelerating & enhancing the delivery of effective and safe clinical trials for global biopharmaceutical clients. The partnership facilitates enhanced clinical trial processes and expands capabilities of Paraxel in advanced analytics, RWE, and Health Outcomes.

- In December 2022, EnlivenHealth, the retail pharmacy solutions division of Omnicell, Inc., introduced the Patient Engagement Network (PEN). This comprehensive solution integrates EnlivenHealth's national pharmacy network with advanced data insights and digital engagement technologies, aiming to enhance patient health outcomes, boost brand loyalty, and drive revenue growth.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the clinical trial technology and services market

By Technology Solutions

-

-

- Patient and Site Recruitment Solutions

- Trial and Protocol Design Solutions

-

-

- Clinical Trial Management Systems (CTMS)

- Randomization and Trial Supply Management (RTSM/IRT/IWSM)

- Compliance/ETMF

- Safety/Pharmacovigilance (PV)

-

- Data Collection and Analytics

-

-

- Interoperability/Connectivity Solutions

- Electronic Data Capture (EDC)/Electronic Patient-Reported Outcomes (ePRO)/Electronic Clinical Outcome Assessment (eCOA)/eSource

- Clinical Analytics

- Real-World Evidence (RWE)

- Patient Engagement

-

- Site & Patient Recruitment Services (AI-driven recruitment strategies, decentralized trial solutions)

- Training & Support Services (CTMS training, pharmacovigilance education, protocol compliance)

- Consulting (Integration of real-world data into clinical trials, Guidance on compliance with FDA, EMA, and other regulatory agencies)

- Others

By Clinical Trial Phases

- Phase I

- Phase II

- Phase III

- Phase IV

By End Use

-

- Pharmaceutical and Biotechnology Firms

- Medical Device Firms

- CROs

- Healthcare Providers

- Healthcare Payers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)