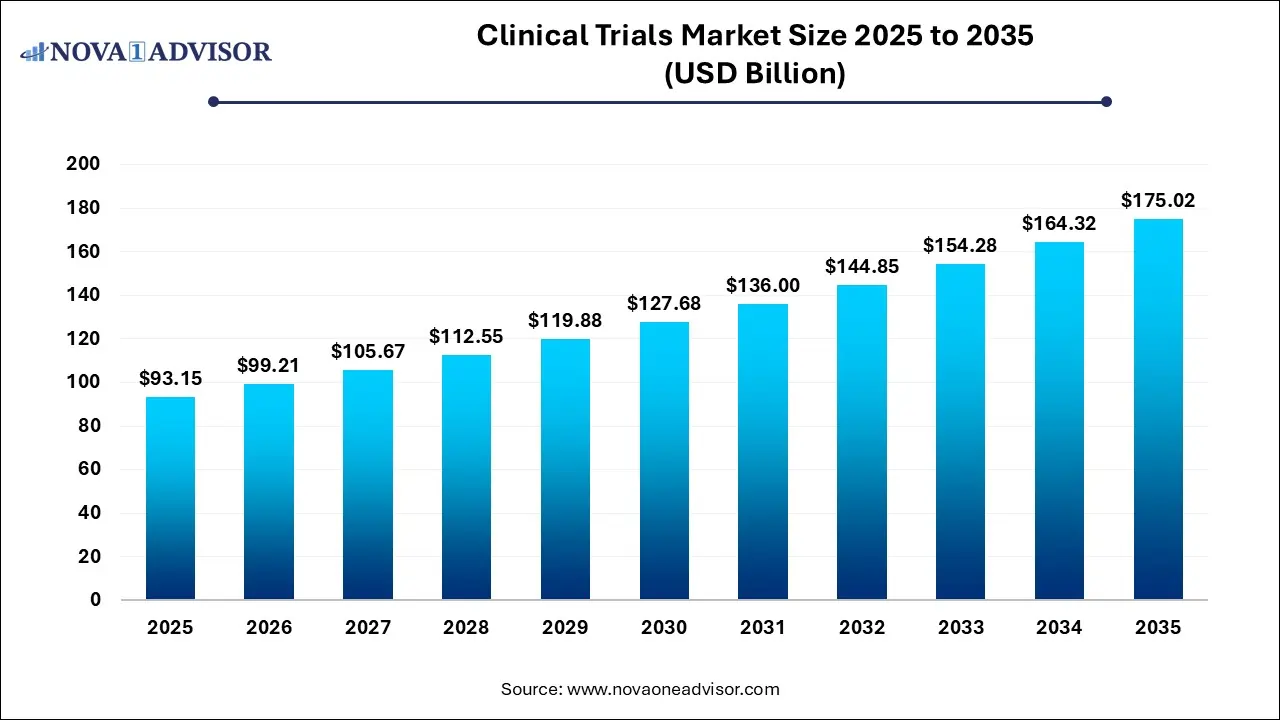

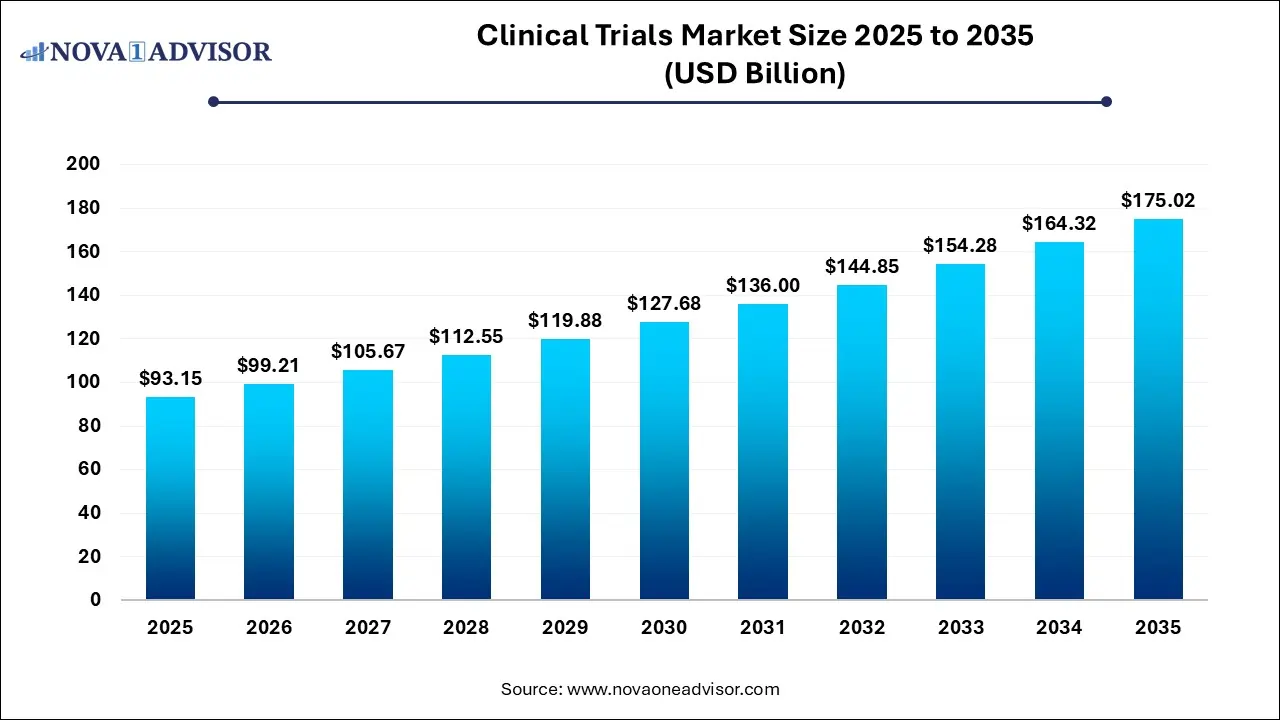

Clinical Trials Market Size and Growth 2026 to 2035

The global clinical trials market size was estimated at USD 93.15 billion in 2025 and is projected to hit around USD 175.02 billion by 2035, growing at a CAGR of 6.51% during the forecast period from 2026 to 2035.

Key Takeaways:

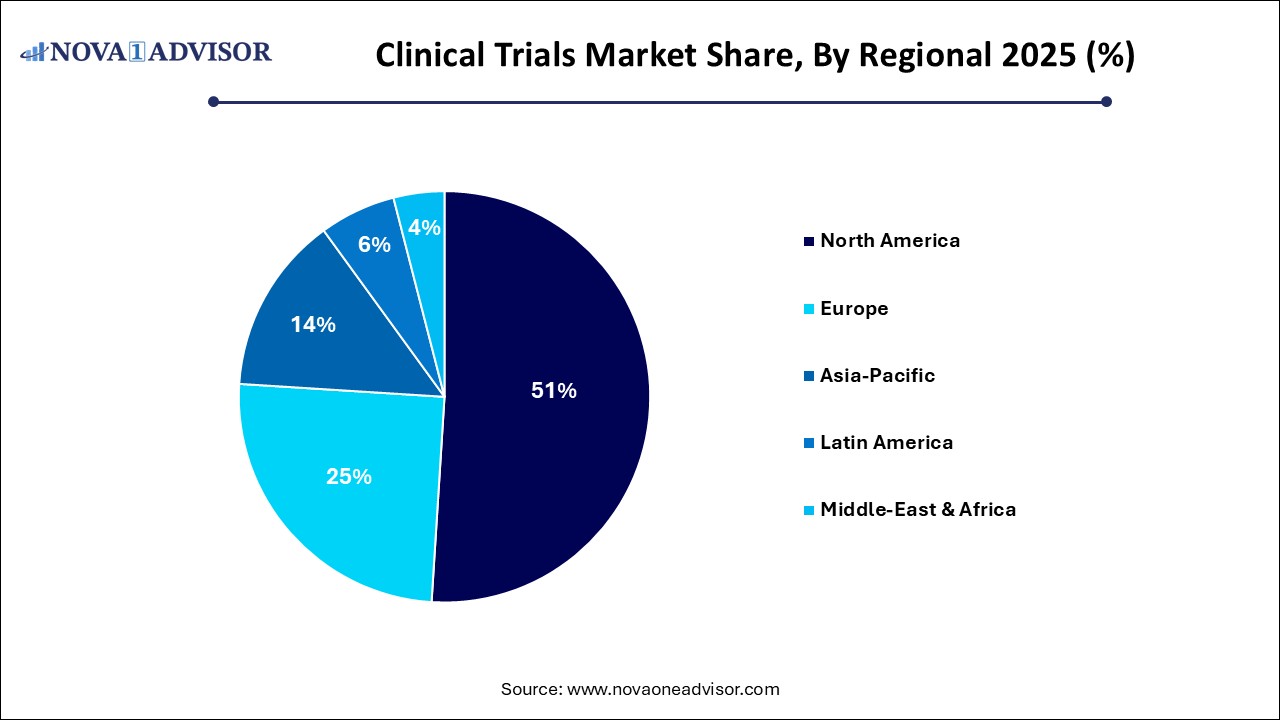

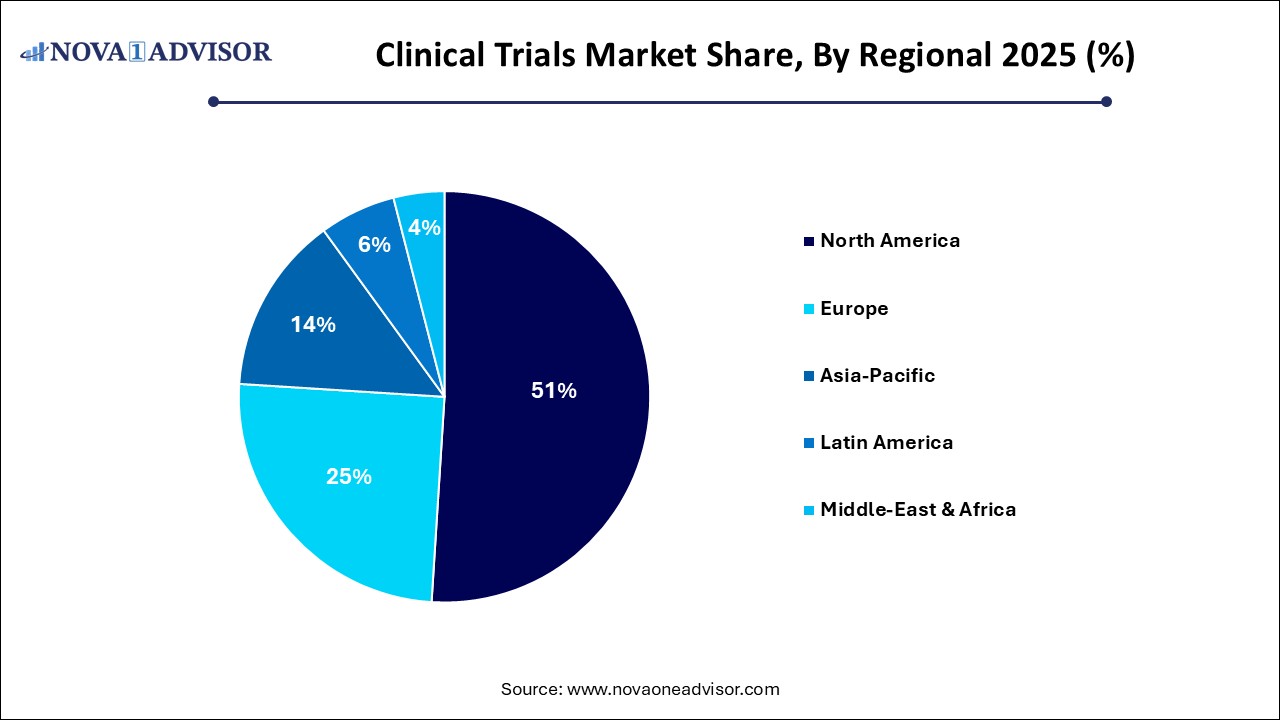

- North America accounted for 51% of the global market in 2025

- Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period

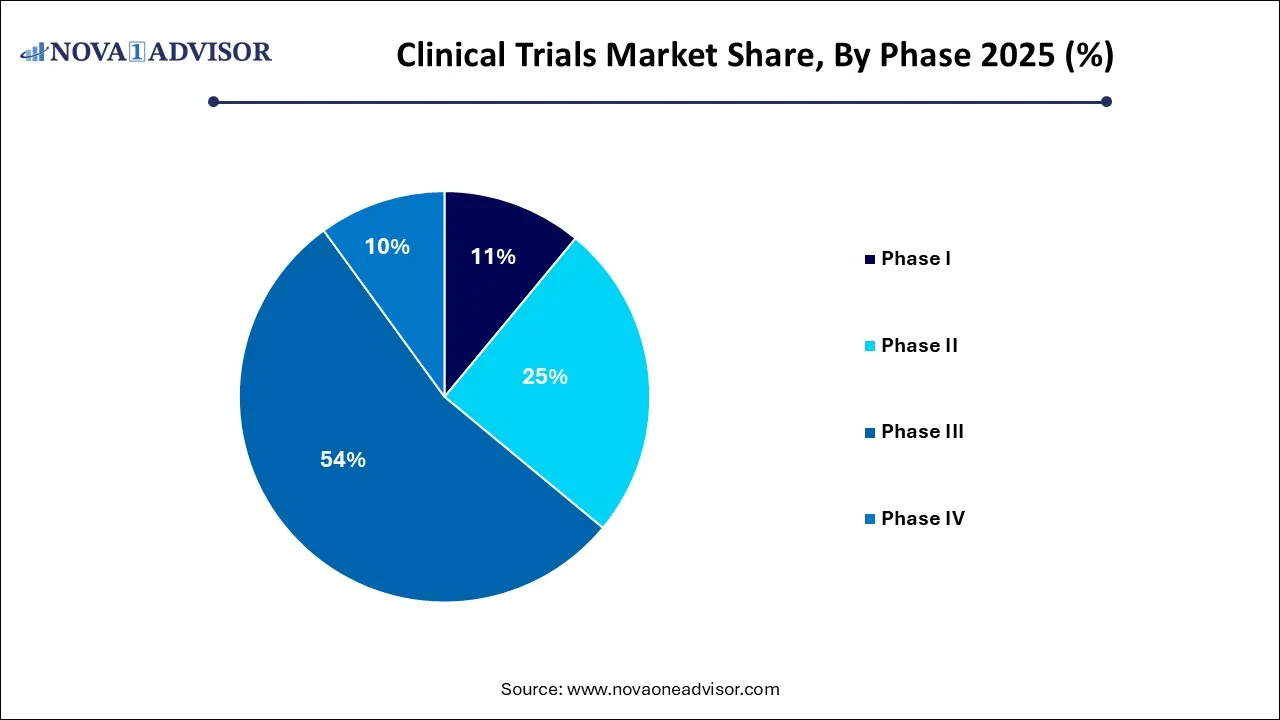

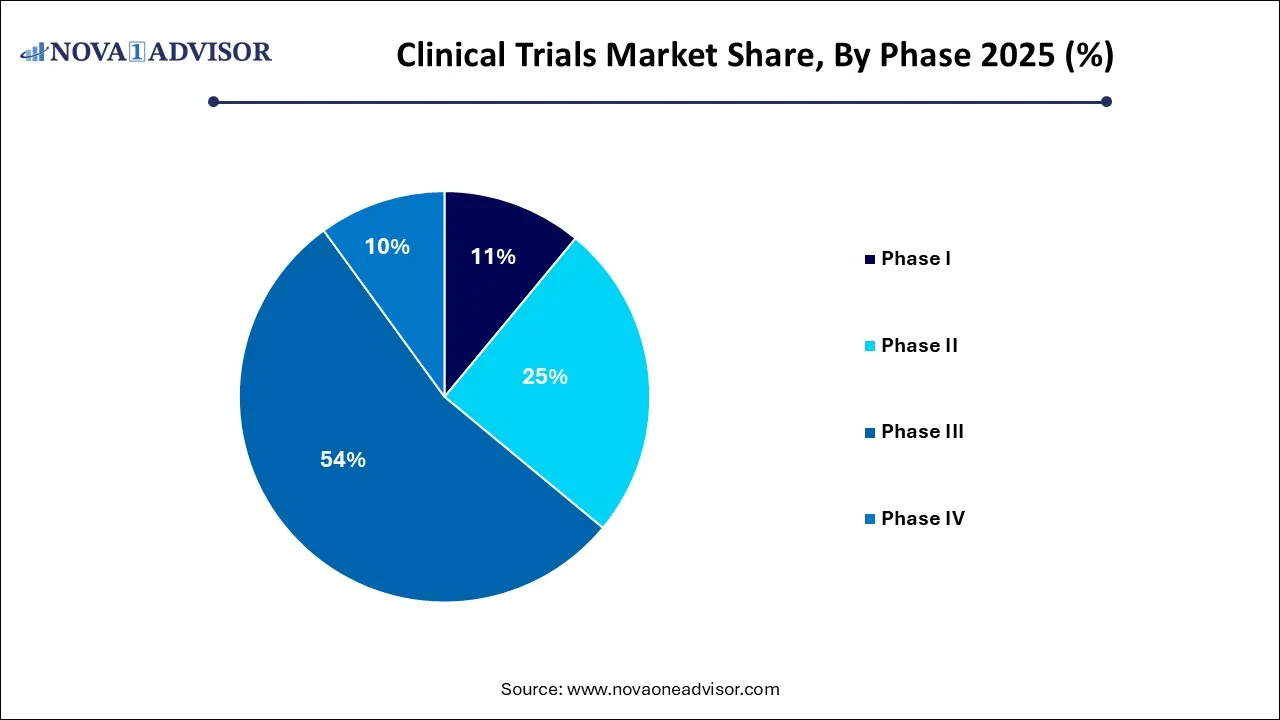

- Phase III segment led the market and accounted for 54% of the total revenue share in 2025.

- Phase II segment is expected to witness considerable growth over the analysis period.

- The interventional studies segment dominated the market in 2025.

- The expanded access trials segment also referred to as compassionate use trials, is anticipated to register notable CAGR during the forecast period.

- The interventional trials market for autoimmune/inflammation accounted for the largest revenue share in 2025.

- Oncology segment accounted for the largest revenue share in 2025.

- Pharmaceutical & biopharmaceutical companies accounted for the largest revenue share in 2025.

- Patient recruitment and retention segment garnered a significant share in 2025.

- Data management segment held a significant share in 2025 and is anticipated to show a similar trend over the forecasted period.

Market Overview

The clinical trials market plays a pivotal role in the global healthcare and pharmaceutical ecosystem. It forms the cornerstone of drug and treatment innovation, offering a structured and scientifically validated path for evaluating the safety and efficacy of therapeutic interventions. Clinical trials are not only critical for regulatory approval processes but also form the basis of advancing precision medicine and evidence-based practice.

Driven by rising healthcare demands, increasing chronic disease prevalence, and a shift towards personalized and value-based healthcare, the market for clinical trials has been undergoing transformative change. Technological advancements such as decentralized clinical trials (DCTs), AI-integrated data management, and telemedicine are rapidly reshaping how trials are designed, monitored, and conducted.

In monetary terms, the global clinical trials market is anticipated to continue its upward trajectory, with growth propelled by innovations in biotech, an expanding pipeline of drug development, and increased funding from public and private sectors. Especially in emerging economies, supportive regulatory reforms and infrastructure development are unlocking new potential.

Major Trends in the Market

-

Rise of Decentralized Clinical Trials (DCTs): Enabled by digital platforms, remote monitoring tools, and wearable devices, DCTs are reducing patient burden and improving recruitment and retention.

-

Integration of Artificial Intelligence and Machine Learning: AI is being used for protocol design, patient selection, trial monitoring, and predictive analytics to improve outcomes and reduce operational costs.

-

Patient-Centric Trial Design: Increased focus on patient experience is leading to greater inclusion, transparency, and improved adherence during trials.

-

Expansion of Clinical Trials in Emerging Markets: Asia-Pacific, Latin America, and parts of Africa are becoming key destinations due to lower costs, high patient pools, and government incentives.

-

Adoption of Real-World Evidence (RWE): Observational studies and real-world data are gaining traction, especially in post-marketing surveillance and Phase IV trials.

-

Increased Collaboration between CROs and Pharma Companies: Strategic partnerships are driving efficiency, resource optimization, and expertise sharing.

-

Digitization of Clinical Trial Operations: From eConsent to ePRO (electronic patient-reported outcomes) and EDC (electronic data capture), digitization is streamlining trial execution.Q

Clinical Trials Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 99.21 Billion |

| Market Size by 2035 |

USD 175.02 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.51% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Phase, Study Design, Indication, Sponsor, Indication By Study Design, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Pharmaceutical Product Development, inc. (Thermo Fisher Scientific, Inc.), ICON plc, Charles River Laboratories International, Inc., IQVIA, Syneos Health, SGS SA, PAREXEL International Corporation, Wuxi AppTec, Inc, Chiltern International Ltd (Laboratory Corporation of America), Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Clinipace (Caidya) |

Key Market Driver: Rising Chronic Disease Burden

One of the most significant drivers of the clinical trials market is the global rise in chronic and lifestyle-related diseases. Conditions such as diabetes, cancer, cardiovascular diseases, and neurological disorders are increasing at an alarming rate, demanding continuous innovation in treatment solutions. Clinical trials are indispensable in the development of new drug formulations, combination therapies, and biologics tailored to these diseases.

For example, oncology alone constitutes nearly a third of all clinical trials globally, given the complexity of cancer treatment and the growing need for immunotherapy and gene therapy options. Similarly, diseases like Type 2 diabetes and rheumatoid arthritis are seeing large-scale trials aimed at understanding metabolic responses and immune modulation.

As patient populations grow and diversify, so does the necessity for robust clinical testing to support regulatory approval and market authorization. Consequently, the demand for diverse trial designs and sophisticated trial management systems is also surging.

Key Market Restraint: Regulatory and Ethical Complexities

Despite the growth prospects, the clinical trials market is often restrained by complex regulatory environments and stringent ethical standards. Global harmonization remains a challenge, as each country or region has its own protocols, approval timelines, and compliance requirements, which can delay trial initiation and increase costs.

Moreover, ethical concerns around patient consent, data privacy (e.g., GDPR in Europe), and transparency in reporting are intensifying. Trials involving vulnerable populations or novel therapies like gene editing are subjected to even more scrutiny. Navigating these regulatory minefields demands significant expertise, legal compliance, and adaptive trial design all of which add to operational burdens for sponsors and contract research organizations (CROs).

Key Market Opportunity: Expansion in Rare Disease Trials

Rare diseases present a compelling opportunity for the clinical trials market. There are over 7,000 known rare diseases, but treatments exist for only a small fraction. With regulatory incentives such as orphan drug designation, fast-track approvals, and extended exclusivity, pharmaceutical companies are increasingly investing in therapies for rare conditions.

This niche has catalyzed specialized trial designs such as adaptive and basket trials, which are more flexible and statistically efficient. For instance, companies like Ultragenyx and Bluebird Bio are leading rare disease trials in gene therapy and enzyme replacement. Moreover, the patient-centric approach of rare disease trials promotes close collaboration with advocacy groups, which can enhance recruitment and retention.

Segmental Analysis

By Phase

Phase III dominated the market and is expected to maintain its stronghold due to its pivotal role in regulatory approval. These trials involve a large patient population and are often multicentric and global in nature. They are critical in establishing the safety and efficacy of a new treatment compared to current standards. Due to their scale, Phase III trials also attract the highest financial investment from sponsors. Drugs entering Phase III have already shown promise in earlier phases, making this a high-stakes, high-cost endeavor. Oncology, cardiovascular, and CNS condition-related trials are prominent in this phase due to their complex treatment pathways and endpoints.

Conversely, Phase I is the fastest-growing segment as new startups and biotech firms continue to explore innovative therapies, particularly in gene editing, mRNA platforms, and immunotherapy. These trials are small-scale and focus on determining safety and dosing. Their rise can be attributed to increased investment in early-stage discovery and the use of biomarkers and genetic profiling to identify potential candidates for further development.

By Study Design

Interventional studies dominate the study design landscape, given their structured methodology and direct intervention protocols. These are the gold standard for evaluating new treatments, encompassing randomized controlled trials (RCTs) which are essential for drug approvals. Interventional trials are used across nearly every major therapeutic area and continue to draw significant resources and technological integration, such as adaptive trial designs.

However, Observational studies are gaining momentum as the fastest-growing segment due to their role in post-marketing surveillance, real-world evidence gathering, and long-term patient monitoring. These are especially relevant in Phase IV studies, chronic disease management, and rare conditions where randomized designs may not be feasible.

By Indication

Oncology continues to dominate the indication segment, contributing to the largest share of global trials. The complexity of cancer pathophysiology necessitates a continuous pipeline of treatments ranging from chemotherapy to CAR-T and immune checkpoint inhibitors. Solid tumors account for the majority of oncology trials, followed by blood cancers. The high incidence rate and ongoing discovery of cancer biomarkers also contribute to this trend.

CNS conditions, particularly Parkinson’s and ALS, are the fastest-growing indications. Neurodegenerative diseases are challenging to treat and often require long follow-up periods and sensitive outcome measures. As novel delivery methods (e.g., intrathecal gene therapy) emerge, so do clinical trial opportunities for these previously underserved patient groups.

By Indication by Study Design

Oncology interventional studies dominate the combination segment. Due to the high standards for therapeutic approval and the need for direct comparison with standard of care, most oncology trials use interventional designs. These trials often span multiple countries, use advanced statistical designs, and increasingly incorporate molecular diagnostics for patient selection.

On the other hand, CNS conditions with observational studies are gaining traction. Due to the progressive and often unpredictable nature of neurological diseases, observational registries and cohort studies are proving valuable in understanding disease progression and treatment outcomes, especially when interventional trials face recruitment or ethical barriers.

Pharmaceutical and biopharmaceutical companies are the largest sponsors of clinical trials. With robust R&D budgets and expansive therapeutic portfolios, they drive innovation in both blockbuster and specialty drugs. Partnerships with CROs, academic institutions, and government agencies further strengthen their role in the ecosystem.

Medical device companies are emerging as the fastest-growing sponsor segment, particularly in diagnostics, neurostimulation, and cardiac monitoring devices. Regulatory frameworks for medical devices are becoming more stringent, necessitating formal clinical evaluations before market access.

By Service Type

Clinical trial data management services dominate the service type landscape. As trials generate vast amounts of complex data, the need for robust electronic data capture (EDC), validation, and statistical analysis has surged. The push for digitization, compliance, and real-time monitoring fuels this segment.

Patient recruitment services are expanding rapidly, addressing one of the biggest challenges in trial execution. Digital advertising, patient registries, AI-powered matching, and community outreach initiatives are enhancing recruitment timelines and diversity.

Regional Analysis

North America dominates the clinical trials market, particularly the United States, which accounts for nearly half of all global clinical trials. Factors contributing to this dominance include a robust regulatory framework (FDA), large and diverse patient population, world-class research infrastructure, and strong industry-academia collaboration. Additionally, the region is home to the headquarters of numerous pharma giants and CROs. The adoption of AI, telemedicine, and decentralized trial models is also highest in North America, fostering innovation and efficiency.

Asia-Pacific is the fastest-growing region, led by countries like China, India, South Korea, and Singapore. This growth is fueled by increasing healthcare investment, regulatory reforms, availability of treatment-naïve patient populations, and cost-effectiveness. Governments in the region are promoting clinical research through public-private partnerships and infrastructure development. China’s expansion of clinical trial sites and India’s digital health push are major catalysts.

Recent Developments

-

March 2025 – Pfizer announced the initiation of a multi-country Phase III trial for its new RSV vaccine in older adults and immunocompromised patients.

-

February 2025 – Medpace expanded its bioanalytical laboratory in Cincinnati to enhance service offerings in support of early and late-phase clinical trials.

-

January 2025 – ICON plc collaborated with digital health startup HumanFirst to streamline remote trial monitoring using wearable devices and real-world data.

-

December 2024 – IQVIA launched a cloud-based platform to accelerate decentralized clinical trials, integrating AI for real-time monitoring and compliance management.

-

November 2024 – Parexel and China-based Hillhouse Capital formed a strategic alliance to expand clinical trial operations and access in Asia.

Some of the prominent players in the Clinical Trials Market include:

- Pharmaceutical Product Development, INC. (Thermo Fisher Scientific, Inc.)

- ICON plc

- Charles River Laboratories International, Inc.

- IQVIA

- SYNEOS HEALTH

- SGS SA

- PAREXEL International Corporation

- Wuxi AppTec, Inc

- Chiltern International Ltd (Laboratory Corporation of America)

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer

- Clinipace (Caidya)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Clinical Trials market.

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional

- Observational

- Expanded Access

By Indication

- Autoimmune/Inflammation

- Rheumatoid arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Oncology

- Blood Cancer

- Solid Tumors

- Other

- CNS Condition

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

By Indication by Study Design

- Autoimmune/Inflammation

- Interventional

- Observational

- Expanded Access

- Pain Management

- Interventional

- Observational

- Expanded Access

- Oncology

- Interventional

- Observational

- Expanded Access

- CNS Condition

- Interventional

- Observational

- Expanded Access

- Diabetes

- Interventional

- Observational

- Expanded Access

- Obesity

- Interventional

- Observational

- Expanded Access

- Cardiovascular

- Interventional

- Observational

- Expanded Access

- Others

- Interventional

- Observational

- Expanded Access

By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By Service Type

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

- Bioanalytical Testing Services

- Clinical Trial Data Management Services

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)