Clinical Trials Support Software Solutions Market Size, Share | Forecast- 2034

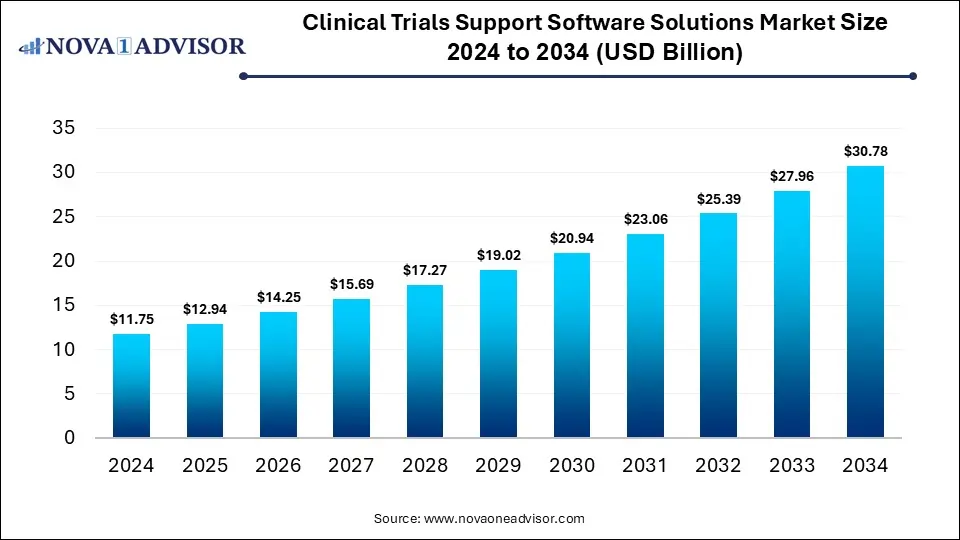

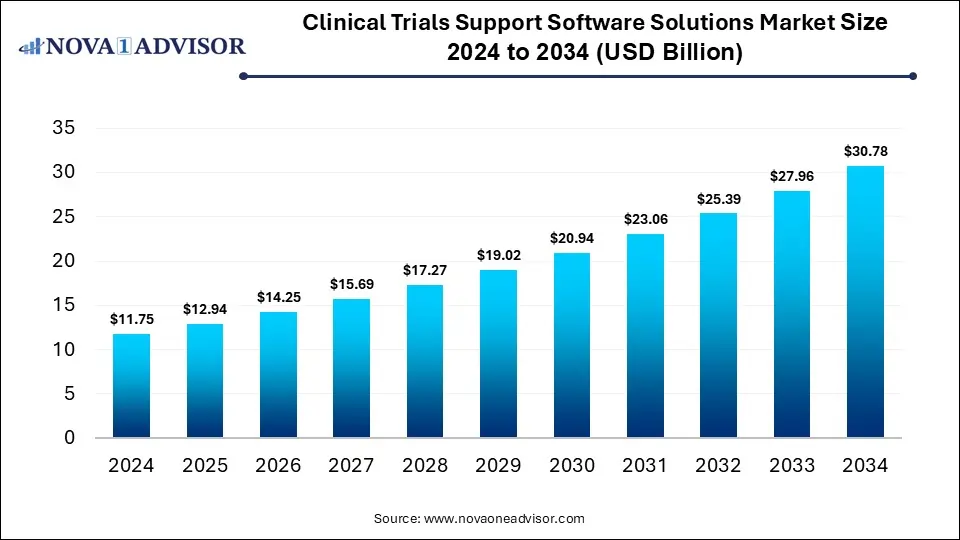

The global clinical trials support software solutions market size was estimated at USD 11.75 billion in 2024 and is expected to reach USD 30.78 billion in 2034, expanding at a CAGR of 10.11% during the forecast period of 2025 and 2034. The growth of the market is attributed to the growing number of clinical trials and rising investments in R&D by pharma and biotech firms.

Clinical Trials Support Software Solutions Market Key Takeaways

- By region, North America held the largest share of the clinical trials support software solutions market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By product, the clinical trial management system (CTMS) segment led the market in 2024.

- By product, the payments / investigator payments solutions segment is expected to expand at the fastest CAGR during the forecast period.

- By delivery mode, the cloud and web-based segment led the market in 2024.

- By delivery mode, the on-premises segment is likely to grow at the fastest rate in the coming years.

- By phase, the phase III segment dominated the market in 2024.

- By phase, the phase I segment is expected to expand at the highest CAGR over the projection period.

- By end use, the contract research organizations (CROs) segment contributed the largest market share in 2024.

- By end use, the biopharmaceutical companies segment is expected to grow at a significant rate in the upcoming period.

Impact of AI on the Clinical Trials Support Software Solutions Market

Artificial Intelligence (AI) is significantly transforming the market for clinical trials support software solutions by enhancing trial efficiency, accuracy, and decision-making. AI-powered platforms streamline patient recruitment by analyzing real-world data to identify eligible participants more effectively, reducing delays and dropout rates. Machine learning algorithms assist in predictive analytics, enabling better trial design and adaptive protocols that optimize outcomes. Additionally, AI-driven natural language processing (NLP) automates data extraction from clinical records and trial documents, saving time and improving data accuracy. As AI continues to evolve, it is expected to further reduce costs and accelerate timelines in the clinical trial lifecycle.

- In February 2025, Inovalon launched Clinical Research Patient Finder, an AI-powered solution that integrates with EHRs to accelerate clinical trial recruitment. It enables real-time patient identification and continuous data monitoring, reducing delays and improving trial efficiency.

Market Overview

The clinical trials support software solutions market encompasses digital platforms and tools designed to streamline the planning, execution, management, and monitoring of clinical trials. These solutions offer key benefits such as enhanced data accuracy, real-time monitoring, efficient patient recruitment, simplified regulatory compliance, and automated payment processing. They are widely used by pharmaceutical companies, CROs, and academic institutions to reduce trial timelines, minimize errors, and optimize resource utilization.

The market is experiencing significant growth due to the rising number of clinical trials, increasing complexity of trial protocols, and demand for AI-driven analytics. As the life sciences industry continues to focus on faster drug development and improved trial efficiency, the demand for robust software solutions is expected to rise significantly. The rising development of cloud-based software solutions further boosts the growth of the market.

- In January 2025, EDETEK Inc. launched R&D Cloud, a customizable software ecosystem built on its CONFORM and eClinical platforms. It allows users to tailor trials end-to-end, integrate third-party tools, and manage workflows securely via multi-SSO access for internal and external stakeholders.

What are the Major Trends in the Clinical Trials Support Software Solutions Market?

- AI and Machine Learning Integration

Advanced AI algorithms are being integrated into clinical trial software to enhance patient recruitment, trial design, and predictive analytics. These technologies enable faster decision-making and improve trial outcomes by identifying patterns across large datasets.

- Growth of Decentralized Clinical Trials (DCTs)

There is a rising shift toward decentralized trials, where technology enables remote participation and monitoring of patients. Clinical trial software is evolving to support virtual visits, electronic consent, and remote data collection, increasing accessibility and patient engagement.

- Adoption of Cloud-Based Solutions

Cloud-based clinical trial platforms are gaining popularity due to their scalability, real-time data access, and cost-efficiency. These solutions support global trials by offering centralized data storage, collaboration tools, and enhanced regulatory compliance.

- Emphasis on Real-Time Data Analytics and Reporting

Sponsors and CROs are prioritizing software that offers real-time data tracking, dashboards, and automated reporting features. This trend helps improve trial transparency, reduce delays, and ensure data-driven decision-making throughout the trial lifecycle.

Report Scope of Clinical Trials Support Software Solutions Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 12.94 Billion |

| Market Size by 2034 |

USD 30.78 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.11% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Delivery Mode, Phase, End use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Globalization of Clinical Trials

The globalization of clinical trials is driving the growth of the clinical trials support software solutions market, as sponsors increasingly conduct multi-regional studies to access diverse patient populations and accelerate drug development. Managing trials across different countries requires advanced software solutions that ensure standardized data collection, regulatory compliance, and seamless collaboration among stakeholders. Clinical trial support platforms enable real-time monitoring, centralized data management, and multilingual interfaces, making them essential for navigating the complexities of global operations. Additionally, these tools help address challenges such as varying regulatory requirements and logistical hurdles across regions. As the pharmaceutical industry continues to expand its global research footprint, the demand for robust, scalable, and integrated trial management solutions is expected to rise significantly.

Regulatory Pressure for Accurate Data & Compliance

Regulatory pressure for accurate data and strict compliance is also driving the growth of the market. Regulatory bodies like the FDA, EMA, and ICH require clinical trials to follow rigorous standards for data integrity, patient safety, and documentation. Software solutions help meet these demands by providing automated audit trails, real-time data validation, and centralized reporting features, ensuring transparency and traceability throughout the trial process. As non-compliance can lead to delays, fines, or rejection of drug approvals, sponsors and CROs are increasingly adopting these platforms to reduce risk and improve regulatory readiness. This growing emphasis on data accuracy and compliance is fueling the demand for reliable and sophisticated clinical trial software.

Restraints

High Implementation Costs and Data Integration Challenges

High implementation costs and data integration challenges are significant factors restraining the growth of the clinical trials support software solutions market. Many organizations, especially smaller biotech firms and research institutions, face budget constraints that limit their ability to invest in advanced trial management platforms. Additionally, integrating new software with existing systems such as electronic health records (EHRs), lab databases, and legacy IT infrastructure can be complex and time-consuming. These integration issues often lead to data silos, inconsistencies, and workflow disruptions, reducing the overall efficiency of clinical trial operations. As a result, despite the long-term benefits, these barriers can slow adoption rates and hinder market expansion.

Data Security and Regulatory Complexity

Data security and regulatory complexity are also restraining the growth of the market. Clinical trials involve the handling of sensitive patient data, which must comply with stringent privacy regulations like HIPAA, GDPR, and region-specific clinical guidelines. Ensuring end-to-end data protection, secure cloud storage, and encrypted communication adds layers of technical and financial burden, especially for smaller organizations. Additionally, navigating diverse regulatory frameworks across countries creates operational challenges, requiring continuous updates and customization of software systems. These concerns can slow adoption, as stakeholders may hesitate to implement new technologies that could pose compliance risks or cybersecurity vulnerabilities.

Opportunities

Adoption of Decentralized and Virtual Trials

The growing adoption of decentralized and virtual clinical trials is creating immense opportunities in the clinical trials support software solutions market. As trials shift away from traditional site-based models, there is increasing demand for digital tools that enable remote patient monitoring, electronic consent (eConsent), telemedicine, and real-time data capture. These technologies enhance patient accessibility and engagement, particularly in diverse or hard-to-reach populations, while also reducing trial costs and timelines. Software solutions that support virtual trial operations are now essential for sponsors and CROs aiming to improve flexibility and scalability. This shift is opening new markets and accelerating the digital transformation of clinical research worldwide.

Expansion in Emerging Markets and Technological Advancements

Expansion in emerging markets and rapid technological advancements are likely to create novel opportunities. Emerging economies in Asia Pacific, Latin America, and the Middle East offer access to large, treatment-naïve patient populations, lower operational costs, and faster patient recruitment, making them attractive destinations for clinical research. As clinical trial activity rises in these regions, the demand for software solutions to manage compliance, data collection, and remote coordination is increasing. Simultaneously, advancements in AI, cloud computing, and data analytics are enhancing the functionality, scalability, and efficiency of these platforms. Together, these trends are driving global adoption and opening up new growth avenues for software providers across the clinical trials ecosystem.

How Macroeconomic Variables Influence the Clinical Trials Support Software Solutions Market?

GDP Growth

GDP growth can drive the growth of the market by increasing healthcare spending and enabling greater investment in research and development. Higher economic growth boosts funding availability for pharmaceutical and biotech companies, encouraging adoption of advanced clinical trial technologies. Conversely, slow or negative GDP growth can restrain market expansion by limiting budgets and reducing investment in new software solutions.

Inflation

Inflation generally restrains the growth of the market by increasing operational and development costs for both software providers and clinical trial sponsors. Higher inflation can lead to budget constraints, reducing investments in new technologies and slowing down adoption rates. However, in some cases, rising costs may also push companies to seek more efficient, software-driven solutions to optimize clinical trial processes and control expenses.

Exchange Rates

Fluctuating exchange rates can both drive and restrain the growth of the market. Favorable exchange rates make outsourcing clinical trials and purchasing software from foreign vendors more cost-effective, boosting market expansion. Conversely, volatile or unfavorable exchange rates increase costs and financial risks, potentially limiting cross-border investments and slowing market growth.

Segment Outlook

Product Insights

Why Did the CTMS Segment Dominate the Clinical Trials Support Software Solutions Market in 2024?

The clinical trial management system (CTMS) segment dominated the market with the largest share in 2024. This is mainly due to its critical role in streamlining and centralizing trial operations. CTMS platforms enable sponsors, CROs, and research institutions to efficiently manage trial planning, site selection, budgeting, patient recruitment, and regulatory documentation. The growing complexity and scale of clinical trials have made these systems essential for maintaining compliance, ensuring data integrity, and improving trial timelines. Additionally, the adoption of cloud-based and AI-integrated CTMS solutions has enhanced real-time tracking and remote collaboration, further driving demand. As the industry moves toward more digitized and decentralized trial models, CTMS remains the foundational tool for operational oversight.

The payments / investigator payments solutions segment is expected to grow at the fastest CAGR during the projection period, owing to increasing complexity in managing multi-site and global clinical trials. These solutions streamline the calculation, tracking, and disbursement of payments to investigators and research sites, reducing administrative burden and minimizing payment delays. As regulatory scrutiny around financial transparency and compliance intensifies, sponsors and CROs are prioritizing automated, auditable payment systems. Additionally, faster and more accurate payments help improve investigator satisfaction and site retention, both critical to maintaining trial timelines. The shift toward digitization and the need for operational efficiency are further accelerating adoption of these solutions.

Delivery Mode Insights

What Made Cloud and Web-Based the Dominant Segment in the Market in 2024?

The cloud and web-based segment dominated the clinical trials support software solutions market in 2024 due to its scalability, cost-effectiveness, and ease of deployment across multiple trial sites. These platforms enable real-time data access, remote monitoring, and seamless collaboration among sponsors, CROs, and research teams, all are critical features for modern, decentralized trials. Their ability to support automatic updates, data backup, and compliance with global regulatory standards has further driven adoption. Additionally, cloud-based solutions reduce the need for heavy IT infrastructure and support faster implementation, which is especially beneficial for small to mid-sized organizations. The growing demand for flexible, secure, and remote-accessible platforms has solidified cloud-based delivery as the preferred mode in clinical trial operations.

The on-premises segment is expected to expand at the fastest growth rate in the upcoming period due to increasing concerns around data security, privacy, and regulatory compliance. Many pharmaceutical companies and research institutions handling sensitive patient data prefer on-premises deployment to maintain full control over their IT infrastructure and meet strict internal and regional data protection requirements. This is particularly relevant in regions with stringent data residency laws or where cloud adoption is still maturing. Additionally, organizations with legacy systems or highly customized workflows often find on-premises solutions better suited to their operational needs. As cyber threats continue to rise, the demand for secure, internally managed systems is likely to accelerate growth in this segment.

Phase Insights

Why Did the Phase III Segment Lead the Market in 2024?

The phase III segment led the clinical trials support software solutions market in 2024 due to the high complexity, cost, and scale associated with this stage of drug development. Phase III trials involve large patient populations across multiple sites and often span several countries, requiring advanced software solutions for data management, regulatory compliance, patient tracking, and site coordination. The need for robust systems to manage vast amounts of clinical data and ensure real-time monitoring drives the adoption of specialized support software in this phase. As Phase III trials are critical for regulatory approval, there is a strong emphasis on accuracy, transparency, and efficiency, further fueling the demand for digital tools.

The phase I segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the rising number of early-stage clinical trials driven by innovation in biotech, personalized medicine, and rare disease research. These trials demand precise subject recruitment, real-time monitoring, and strict safety data collection, all of which benefit from advanced digital tools. As more small and mid-sized biotech firms enter the market, there's increasing reliance on software solutions to streamline operations and reduce time-to-trial. Additionally, the push for decentralized and adaptive trial designs is encouraging the adoption of flexible, cloud-based support systems from the very first phase. This growing emphasis on efficiency, safety, and data accuracy is fueling rapid adoption of trial support software in Phase I studies.

End Use Insights

How Does CROs Contribute the Largest Share of the clinical trials support software solutions market?

The contract research organizations (CROs) segment dominated the market by capturing the largest share in 2024. This is primarily due to the increasing trend of outsourcing clinical research activities by pharmaceutical and biotechnology companies. CROs manage a significant portion of global clinical trials and rely heavily on digital solutions to streamline trial design, patient recruitment, regulatory compliance, and data management across diverse geographies. Their need for scalable, multi-functional platforms that enhance efficiency and reduce trial timelines has driven widespread adoption of advanced software solutions. Additionally, CROs often operate on tight deadlines and budgets, making integrated trial support systems essential for delivering timely and high-quality results. As sponsors continue to prioritize cost savings and faster go-to-market strategies, CROs remain central to the digital transformation of clinical research.

The biopharmaceutical companies segment is expected to expand at a significant CAGR during the forecast period, driven by their increasing investment in R&D and the growing number of complex, targeted therapies in development. These companies are under pressure to accelerate time-to-market while ensuring compliance with strict regulatory standards, driving demand for advanced digital tools that streamline trial operations. Software solutions help optimize patient recruitment, data capture, and site management, all are critical for managing the high costs and risks associated with innovative drug development. Additionally, the shift toward decentralized and adaptive trial designs is prompting biopharma firms to adopt flexible, cloud-based platforms.

Clinical Trials Support Software Solutions Market Size 2024 to 2034 (USD Billion)

| Year |

Hospitals/Healthcare Providers |

Contract Research Organizations (CROs) |

Academic & Research Institutions |

Pharmaceutical Companies |

Biopharmaceutical Companies |

Medical Device Companies |

| 2024 |

2.12 |

2.59 |

1.41 |

2.12 |

2.35 |

1.18 |

| 2025 |

2.34 |

2.86 |

1.56 |

2.33 |

2.6 |

1.26 |

| 2026 |

2.58 |

3.16 |

1.72 |

2.57 |

2.88 |

1.34 |

| 2027 |

2.85 |

3.5 |

1.91 |

2.82 |

3.19 |

1.43 |

| 2028 |

3.14 |

3.87 |

2.11 |

3.11 |

3.52 |

1.52 |

| 2029 |

3.47 |

4.28 |

2.33 |

3.42 |

3.9 |

1.62 |

| 2030 |

3.83 |

4.73 |

2.58 |

3.77 |

4.31 |

1.72 |

| 2031 |

4.23 |

5.23 |

2.85 |

4.15 |

4.77 |

1.82 |

| 2032 |

4.67 |

5.79 |

3.15 |

4.57 |

5.28 |

1.93 |

| 2033 |

5.16 |

6.4 |

3.48 |

5.03 |

5.84 |

2.04 |

| 2034 |

5.69 |

7.08 |

3.85 |

5.54 |

6.46 |

2.15 |

Regional Analysis

What Made North America the Dominant Region in the Market?

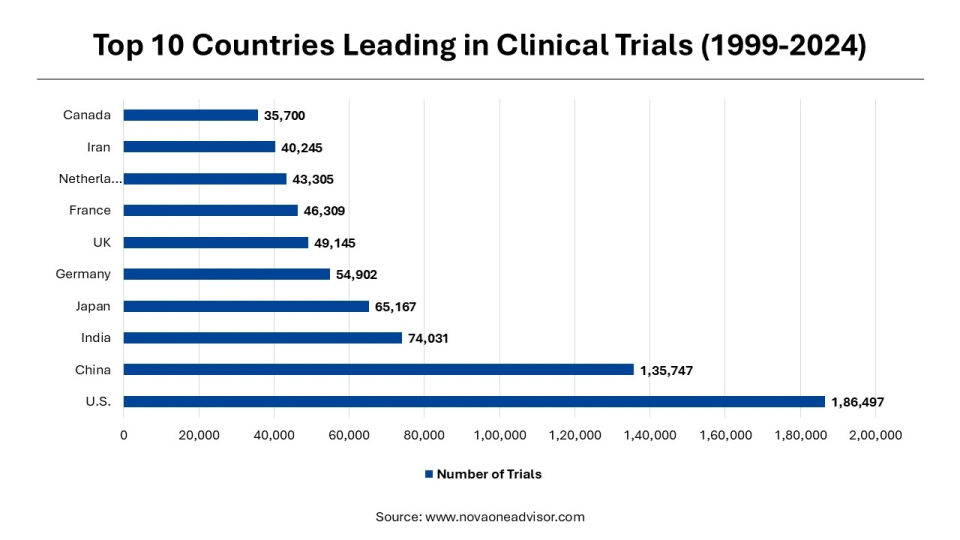

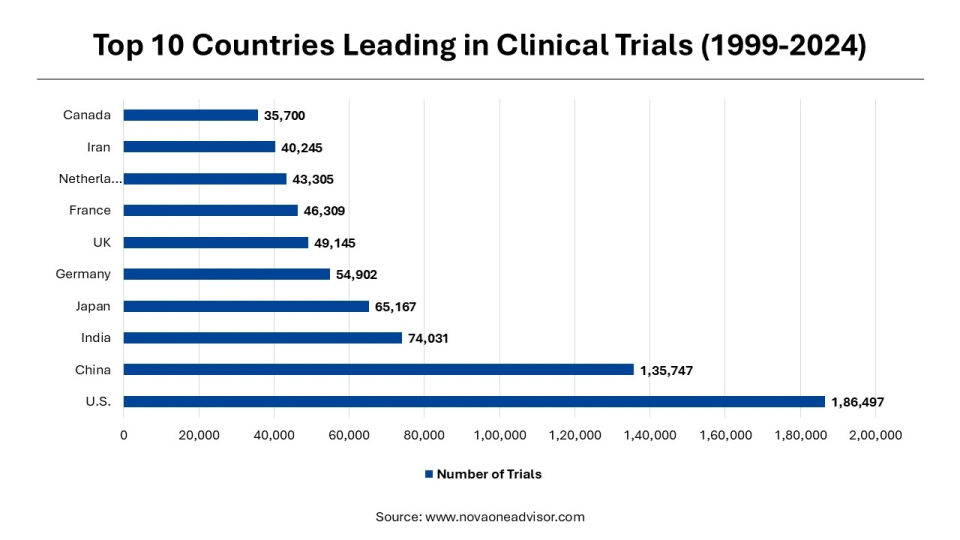

North America sustained dominance in the clinical trials support software solutions market while holding the largest share in 2024. The region’s dominance is primarily attributed to its well-established pharmaceutical and biotechnology industries, along with a high volume of ongoing clinical trials. The region benefits from advanced digital infrastructure, strong regulatory frameworks, and widespread adoption of clinical trial technologies among CROs, sponsors, and research institutions. The presence of major market players and robust R&D investment further supports the widespread deployment of trial management and patient engagement platforms. Additionally, the U.S. FDA’s support for digital tools and decentralized trial models has accelerated adoption of innovative software solutions.

The U.S. is a major contributor to the North American clinical trials support software solutions market due to its status as a global leader in pharmaceutical research and development. The country hosts a large number of clinical trials annually, supported by significant investments from both private and public sectors, including the National Institutes of Health (NIH). The presence of numerous leading biopharmaceutical companies, CROs, and technology providers fosters innovation and widespread implementation of trial support solutions. Additionally, its advanced healthcare infrastructure, stringent regulatory environment, and regulatory pressure for data compliance drive the adoption of sophisticated clinical trial software to ensure compliance and data integrity.

- In June 2025, the U.S. Department of Health and Human Services (HHS) introduced updated HIPAA regulations to address the rise of telemedicine, expanded use of electronic health records (EHRs), and increasing cyber threats like ransomware. These changes aim to strengthen data security, enhance patient access rights, and ensure greater transparency. While healthcare organizations face stricter cybersecurity requirements and added operational complexity, patients gain improved control over their health information. The updates also impact third-party vendors, emphasizing the need for robust data protection across the healthcare ecosystem.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for clinical trials support software solutions. This is due to the region’s expanding pharmaceutical industry, large patient pool, and increasing clinical trial activity. Countries like China, India, South Korea, and Australia are becoming key destinations for outsourced trials due to lower operational costs and faster patient recruitment. Additionally, governments in the region are investing heavily in digital health infrastructure and regulatory reforms, encouraging the adoption of advanced trial management solutions. The growing presence of global CROs and biopharma companies in Asia Pacific is also driving demand for scalable, compliant, and tech-driven platforms. As the region embraces decentralized and hybrid trial models, the need for robust clinical trial software is expected to surge rapidly.

China is a major player in the Asia Pacific clinical trials support software solutions market due to its rapidly growing pharmaceutical industry and increasing number of clinical trials. The country offers a large and diverse patient population, which accelerates patient recruitment and trial timelines. Additionally, significant government initiatives and regulatory reforms aimed at streamlining clinical trial approvals have boosted trial activities and digital adoption. The expanding presence of global pharmaceutical companies and CROs in China is also driving demand for advanced clinical trial software solutions.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 4.9 Bn |

5.89% |

Strong pharma/biotech R&D, advanced infrastructure, regulatory support |

High costs, supply chain complexities, regulatory hurdles |

Mature market with steady, sustained growth |

| Asia Pacific |

USD 3.4 Bn |

7.06% |

High unmet medical needs, increasing prevalence of chronic diseases, outsourcing of trials to countries like China and India |

Infrastructure gaps, cost sensitivity, uneven standardization |

Fastest-growing region with high potential |

| Europe |

USD 2.7 Bn |

10.12% |

Emphasis on personalized medicine, increasing clinical trials in oncology and rare diseases, strong regulatory frameworks |

Reimbursement limits, slower tech adoption, data privacy concerns |

Stable with innovation focus |

| Latin America |

USD 0.9 Bn |

5.37% |

Untapped opportunities in emerging countries, evolving regulatory landscape, improving healthcare systems |

Political instability, limited lab infrastructure, data privacy concerns |

Emerging market with promising growth |

| MEA |

USD 0.6 Bn |

3.75% |

Development of health amenities, increased funding toward medical research and technology |

Skilled workforce shortages, raw material supply fluctuations, data privacy concerns |

Gradual uptake; emerging and underpenetrated |

Clinical Trials Support Software Solutions Market Value Chain Analysis

1. Software Development & Innovation

This stage involves the design, development, and continuous improvement of clinical trials support software solutions, including CTMS, EDC, and payment systems. Companies invest heavily in R&D to enhance functionalities such as data security, usability, and compliance with regulatory standards.

- Key players: Medidata Solutions, Oracle Corporation, Veeva Systems, Parexel International.

2. Clinical Trial Planning & Management

In this stage, the software is used to streamline trial design, protocol development, site selection, and resource management. Effective clinical trial management software (CTMS) helps optimize timelines and reduce costs by improving operational efficiency.

- Key players: IBM Watson Health, Medidata Solutions, BioClinica.

3. Data Collection & Monitoring

Electronic Data Capture (EDC) and remote monitoring tools facilitate accurate, real-time data collection and management during trials. This stage ensures data integrity, minimizes errors, and accelerates decision-making for sponsors and CROs.

- Key players: Oracle Corporation, Medidata Solutions, Castor EDC.

4. Payment & Investigator Management

Payment solutions automate and track financial transactions, ensuring timely and accurate payments to investigators and sites. This improves transparency, compliance, and investigator engagement throughout the trial.

- Key players: Clinical Conductor, TrialPay, Medidata.

5. Regulatory Compliance & Reporting

Software solutions support compliance with regulatory requirements by facilitating audit trails, reporting, and secure data handling. This stage is critical to ensure trials meet global standards such as FDA, EMA, and ICH-GCP guidelines.

- Key players: Veeva Systems, Oracle Corporation, Medidata Solutions.

6. Post-Trial Data Analysis & Reporting

After data collection, advanced analytics and reporting tools provide insights for decision-making, publication, and regulatory submissions. This stage helps stakeholders understand trial outcomes and plan future studies.

- Key players: IBM Watson Health, SAS Institute, Medidata Solutions.

Clinical Trials Support Software Solutions Market Companies

1. Medidata Solutions

It provides a comprehensive suite of cloud-based clinical trial management software including CTMS, EDC, and patient engagement tools. Medidata’s platforms enhance trial efficiency, data accuracy, and regulatory compliance, making it a preferred choice among pharmaceutical companies and CROs.

2. Oracle Corporation

Oracle offers a broad range of clinical trial software solutions such as Oracle Health Sciences Clinical One platform that integrates data management, CTMS, and safety systems. Oracle’s solutions support scalable and secure clinical trials worldwide, helping sponsors accelerate drug development.

3. Veeva Systems

The company specializes in cloud-based software for clinical data management and regulatory compliance. Veeva’s Vault Clinical Suite streamlines clinical trial operations and ensures data integrity with robust regulatory compliance features, widely adopted by biopharma companies.

4. IBM Watson Health

It leverages AI and analytics to optimize clinical trial design, patient recruitment, and data analysis. IBM Watson Health’s solutions help reduce trial timelines and costs by enabling smarter decision-making through advanced data insights.

5. Parexel International

It provides both clinical research services and proprietary trial management software. Parexel’s technology supports end-to-end trial management, offering customized solutions that improve operational efficiency and regulatory adherence.

6. BioClinica

The company offers integrated clinical trial software and imaging solutions, focusing on data collection and monitoring. BioClinica’s platforms facilitate remote monitoring and data analytics, enhancing trial transparency and data quality.

7. Castor EDC

Castor EDC is known for user-friendly electronic data capture (EDC) software that simplifies data collection and management for clinical trials. Castor’s cloud-based solutions enable real-time access to trial data and compliance with global regulations.

8. Clinical Conductor

It specializes in investigator payment and financial management solutions, automating payments and enhancing transparency. This improves site engagement and reduces administrative burdens in clinical trials.

9. SAS Institute

It provides advanced analytics and reporting software that supports post-trial data analysis and regulatory submissions. SAS’s solutions enable sponsors to derive actionable insights and ensure compliance with industry standards.

Recent Developments

- In December 2024, ConcertAI and NeoGenomics have launched CTO-H, a joint SaaS solution for hematologic malignancies, aimed at advancing research analytics, clinical trial design, and operational efficiency. The platform offers unparalleled scale, longitudinal data, and biomarker depth, with findings to be presented at the 2024 ASH Meeting.

- In June 2024, IQVIA launched One Home for Sites, a unified technology platform that offers clinical research sites a single sign-on and dashboard to manage all key systems and tasks across multiple trials. By consolidating numerous applications into one interface, the platform reduces technology overload, streamlines workflows, and frees up site staff to focus on patient care and research. Acting as a neutral aggregator, One Home enables seamless integration between sponsors, software vendors, and research sites to improve trial efficiency.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the global clinical trials support software solutions market.

By Product

- Electronic Clinical Outcome Assessment (eCOA) / ePRO)

- Electronic Data Capture (EDC) & CDMS

- Clinical Analytics Platforms

- Clinical data integration platforms

- Safety solutions

- Clinical Trial Management System (CTMS)

- Randomization and Trial Supply Management (RTSM)

- Electronic Trial Master File (eTMF)

- eConsent

- Payments / Investigator Payments Solutions

- Electronic Investigator Site File (eISF)

- Patient Matching / Feasibility Solutions

By Delivery Mode

- Cloud and Web Based

- On-Premise

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV (Post-marketing)

By End Use

- Hospitals/Healthcare Providers/Healthcare providers

- Contract Research Organizations (CROs) (R&D covered)

- Academic & Research Institutions

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Medical Device Companies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)