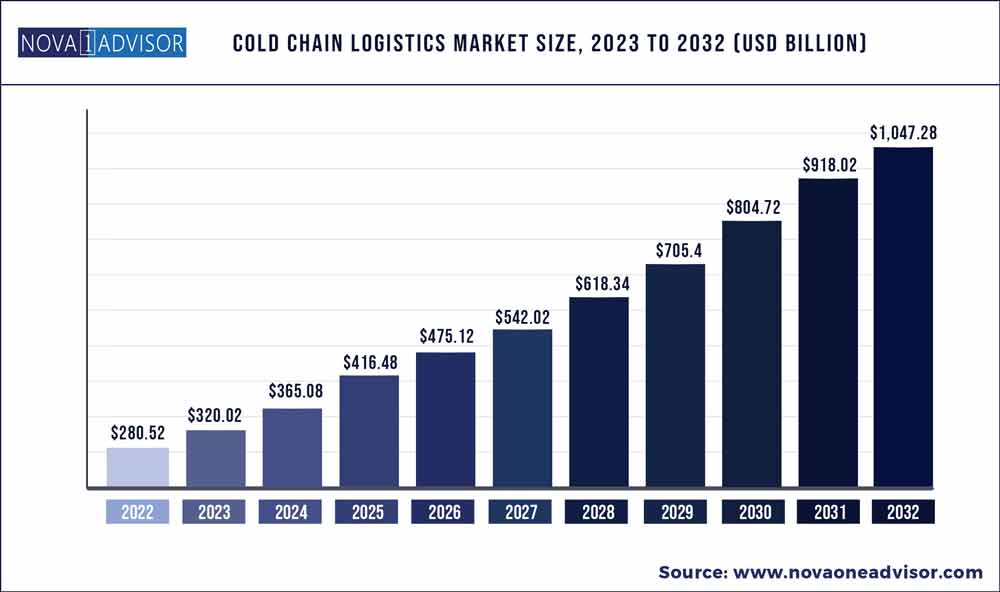

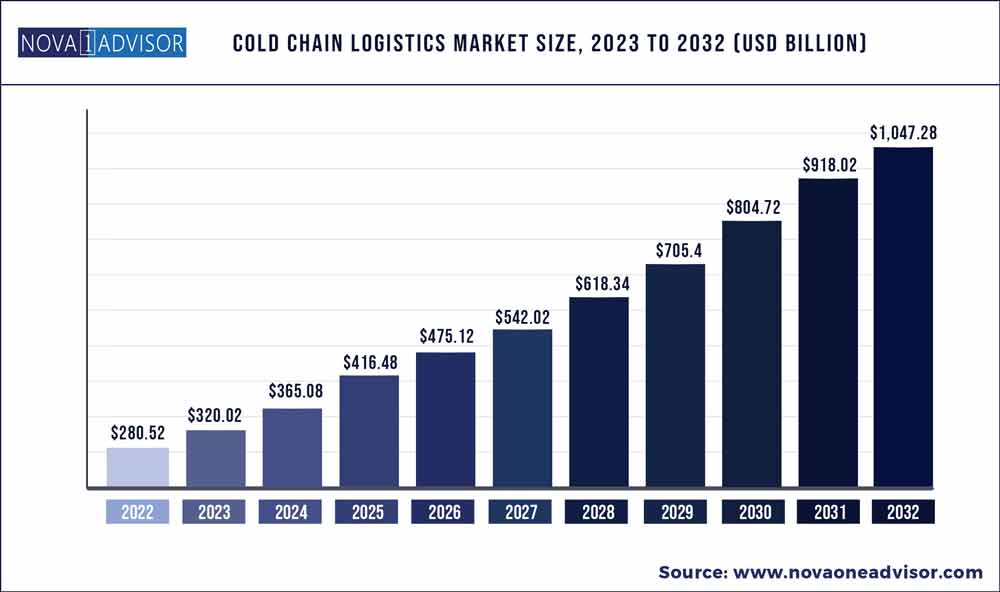

The global cold chain logistics market size was exhibited at USD 280.52 billion in 2022 and is projected to hit around USD 1,047.28 billion by 2032, growing at a CAGR of 14.08% during the forecast period 2023 to 2032.

Key Pointers:

- North America cold chain logistics market was reached at USD 98.7 billion in 2022

- Europe region will grow at a highest CAGR of around 15.9% from 2023-2032

- By application, the dairy and frozen desserts segment had accounted 25% revenue share in 2022

- The fruits and vegetables application segment garnered 21% market share in 2022

- By type, the refrigerated warehouse segment accounted largest market share of 62% in 2022

- The refrigerated transportation type segment has garnered 40% revenue share in 2022

Cold Chain Logistics Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 320.02 Billion

|

|

Market Size by 2032

|

USD 1,047.28 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 14.08%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Type, Temperature Type, Technology, Process, Application

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Lineage Logistics Holdings LLC, Snowman Logistics Ltd., AmeriCold Logistics LLC, Nichirei Corporation, Preferred Freezer Services Inc.

|

Cold chain logistics is the technology and process that allows safe transport of temperature-sensitive goods and products such as fresh agricultural products, seafood, frozen food, photographic film, chemicals, and pharmaceutical drugs along with the supply chain. It impacts every stage of the supply chain, from purchase to transportation, storage, and last-mile delivery. The transportation modes for product supply include refrigerated trucks, refrigerated railcars, refrigerated cargo, and air cargo. The process further involves utilization of temperature-controlled warehouses for storage and cold-insulated transport vehicles for product distribution. Furthermore, cold chains are essential for extending marketing, preventing over capacity, reducing transport bottlenecks during peak period, and maintaining product quality.

In addition to providing quality and safe products to consumers, cold supply chain logistics largely contributes to the economy and workforce. Quality products led to higher demand and contribute to economic growth. Moreover, it plays an essential role in reducing the wastage of perishable products & commodities, thus providing remunerative prices to farmers. In India, new initiatives such as a planned infrastructure investment of around INR 100 lakh crore boost the rural economy, and has put the food processing sector on a high growth trajectory, which, in turn, has increased the demand for cold chain logistics in the processed food sector. In addition, implementation of technology in cold chain logistics delivers modern warehouse management by using modern heavy-duty refrigeration systems that help maintain proper temperature during transportation & storage of goods. The adoption of innovative IoT-based automated software for cold chain management provides live data to operators, thus allowing unmatched visibility into every process and transaction within cold chain logistics. Operators can connect to intermodal shipping containers, cargo, vessels, and trailers with enterprise IT systems via sensors, GPS, mobile networks, and cloud-based platform.

Factors such as an increase in the number of refrigerated warehouses and growth in the pharmaceutical sector are expected to drive the growth of the cold chain logistics market. In addition, growth in the processed food sector is anticipated to boost the market growth. However, factors such as lack of standardization and high operational cost restrain the market growth. On the contrary , radiofrequency identification technology (RFID) technology for cold chain applications and the adoption of software for cold chain logistics provide lucrative growth opportunities for the market players.

Warehouse is a large storage area for storing goods. Dozens of cold chain systems warehouses are intended to provide temperature-sensitive products with ideal storage and transportation conditions .. Owing to the fluctuating market demand for products, the need to store goods has increased necessitating the need for a warehouse.. Businesses invest millions of dollars in their cold chain operations to create effective, efficient, and reliable processes, as end-to-end cold chain security is the weak link in the system. The introduction of refrigerated warehouses significantly satisfies the manufacturers of these temperature-sensitive products.

In Vietnam, owing to the rise in the middle-class population, the food processing industry has grown in recent years. In 2019, the food and pharmaceutical markets, which require refrigerated transport in the Vietnamese retail market, were estimated to grow to about $10.9 billion in 2020 as per the Euromonitor study. Furthermore, in 2022, Lineage Logistics Holding, LLC announced the strategic expansion of its facility network near the major port in Savannah, Georgia, that provides additional capacity for imported and exported frozen and refrigerated products. Thus, an increase in refrigerated warehouses fuels the growth of the cold chain logistics market.

Pharmaceutical manufacturers focus on product quality and sensitivity. Factors such as the development of complex biological-based medicines, shipments of hormone treatments, vaccines, and complex proteins that require cold chain refinements result in the need for temperature-controlled transportation and warehousing. Moreover, the demand for effective cold chain logistics services to maintain the quality of goods fuels the market growth. In addition, cold chain, supply chain, and logistics for the pharmaceutical industry are becoming more strategic and reliable. Since the vaccinations for COVID-19 have already been given during the global pandemic outbreak, cold chain logistics for pharmaceutical products necessitates a robust cold chain with specific quality assurance criteria.. In 2019, the International Air Transport Association (IATA) estimated 6%increase in cold chain logistics for pharmaceutical industry by 2022, reaching $397 billion in global biopharma sales. Accordingly, logistics companies and airlines specializing in pharma transportation offer services that match the higher demands. Hence, high-value pharmaceutical products transportation solutions across the entire distribution network drive worldwide growth.

Some of the prominent players in the Cold Chain Logistics Market include:

- Lineage Logistics Holdings LLC

- Snowman Logistics Ltd.

- AmeriCold Logistics LLC

- Nichirei Corporation

- Preferred Freezer Services Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Cold Chain Logistics market.

By Type

- Refrigerated Transport

- Railways

- Airways

- Roadways

- Waterways

- Refrigerated Warehouse

By Temperature Type

By Technology

- Dry Ice

- Gel Packs

- Eutectic Plates

- Liquid Nitrogen

- Quilts

By Process

- Pre-Cooling Facilities

- Cold Storage

- Refrigerated Carriers

- Packaging

- Information Management System

By Application

- Pharmaceuticals

- Dairy and frozen desserts

- Fruits and vegetables

- Bakery and confectionery

- Process food

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)