Collagen Market Size and Trends

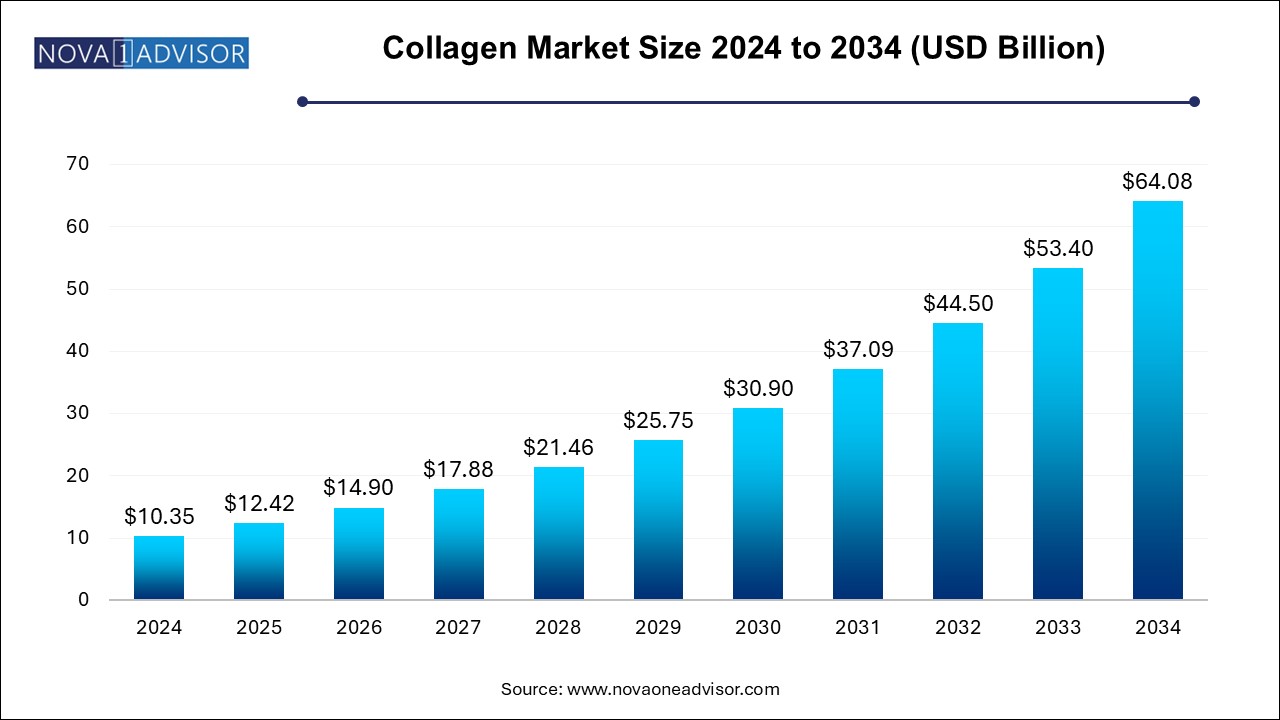

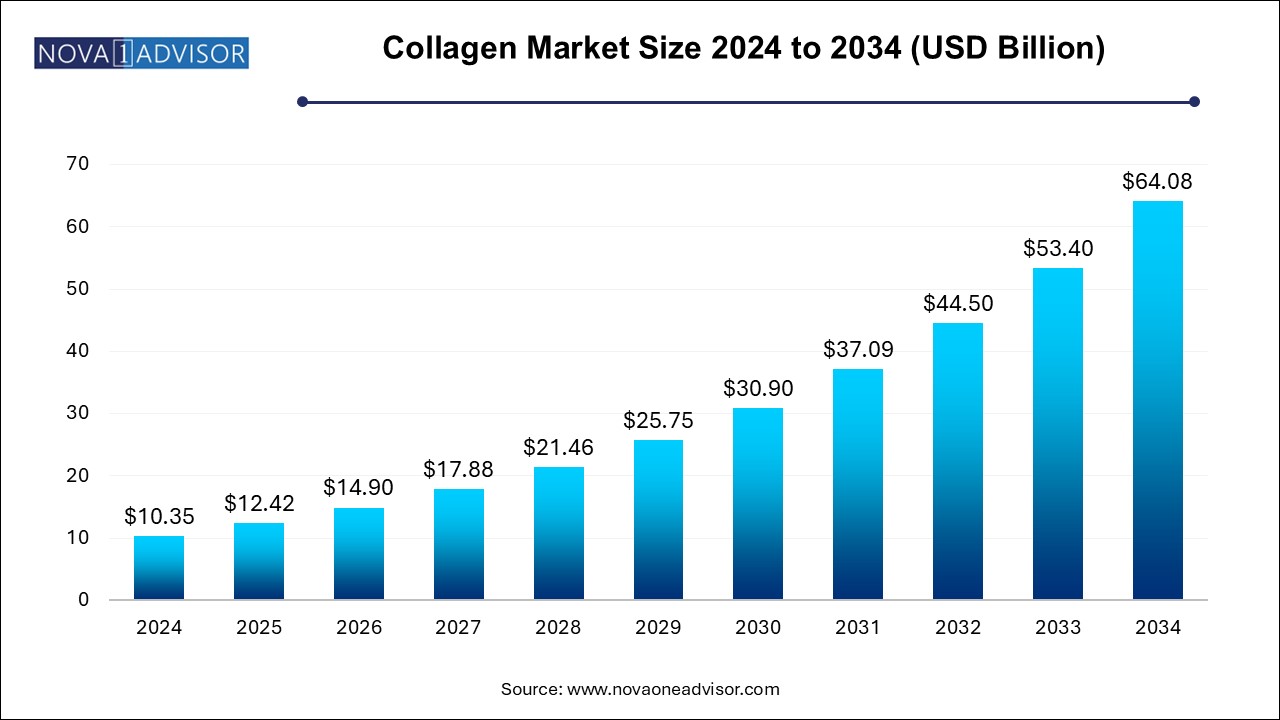

The collagen market size was exhibited at USD 10.35 billion in 2024 and is projected to hit around USD 64.08 billion by 2034, growing at a CAGR of 20.0% during the forecast period 2024 to 2034.

Collagen Market Key Takeaways:

- Gelatin dominated the market with a revenue share of 66.7% in 2024.

- Bovine source dominated the market with the highest revenue share of 34.9% in 2024.

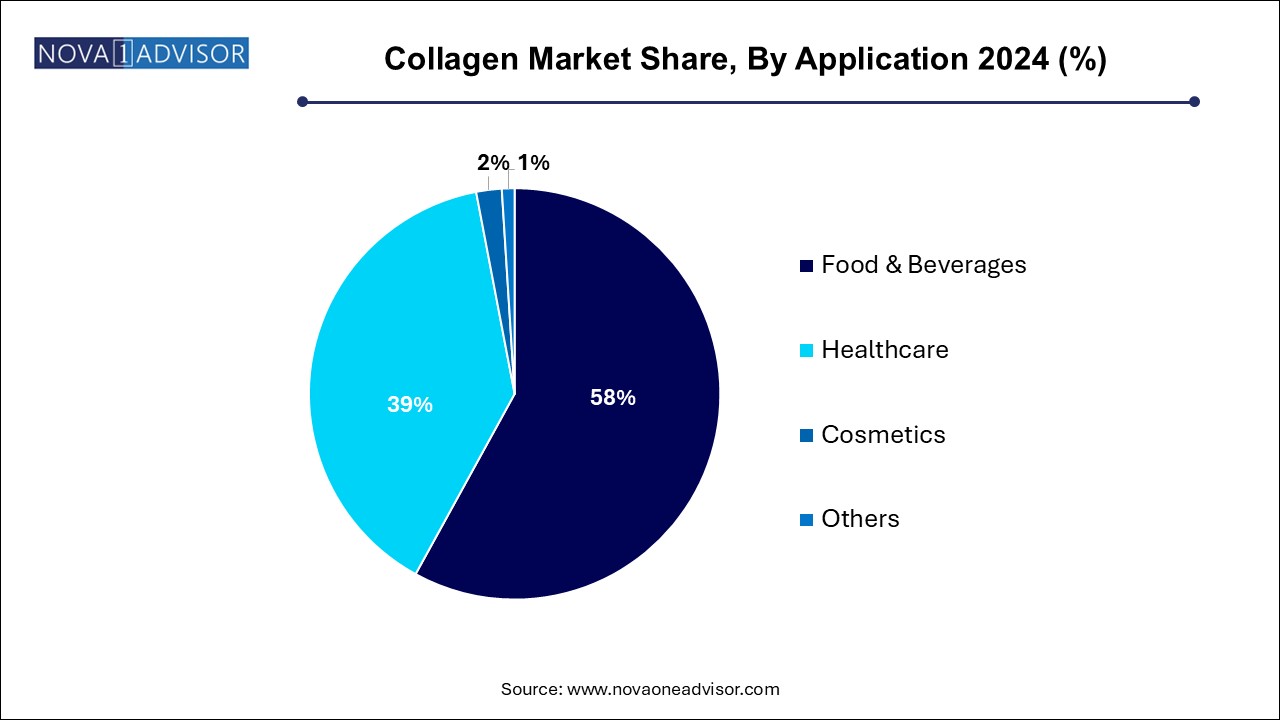

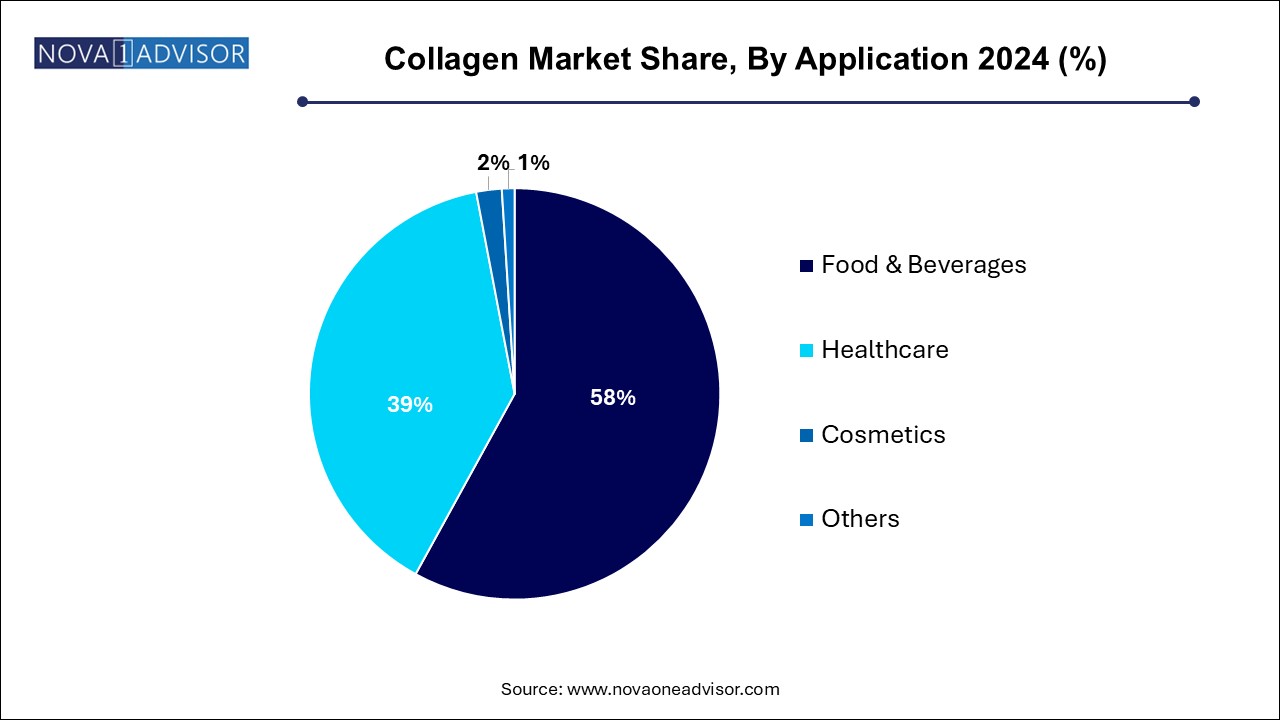

- The food and beverages application dominated the market with the highest revenue share of 58.0% in 2024.

- The Asia pacific region dominated the market with the highest revenue share of 22.4% in 2024.

Market Overview

The global collagen market has witnessed significant growth over the last decade, evolving from a niche health supplement sector into a sprawling, multidisciplinary industry intersecting food, pharmaceuticals, biomedical sciences, cosmetics, and personal care. Collagen, the most abundant protein in the human body, serves as a structural foundation for skin, bones, muscles, tendons, and ligaments. It plays a crucial role in wound healing, tissue regeneration, and maintaining skin elasticity and joint mobility.

The commercial market for collagen is built on the ability to extract this protein from various animal and marine sources and convert it into formats such as gelatin, hydrolyzed collagen (also known as collagen peptides), native collagen, and synthetic collagen. These products are utilized across a range of sectors from nutritional supplements and fortified beverages to dermatological fillers, tissue scaffolding in regenerative medicine, and orthopedic implants.

Market growth is being driven by several intersecting forces: rising health awareness among consumers, growing demand for clean-label and functional foods, the surge in nutraceuticals consumption, aging populations, and increasing applications of collagen in medical and cosmetic procedures. Furthermore, advancements in biotechnology and extraction techniques have improved product quality, safety, and sustainability enabling collagen to cater to a broader audience.

While bovine collagen remains the most widely used due to availability and cost-effectiveness, marine and synthetic alternatives are gaining traction for their better absorption, halal/kosher compliance, and sustainability appeal. Despite concerns about animal-borne diseases and dietary restrictions, innovation, research-backed efficacy, and evolving consumer preferences are reinforcing the collagen market’s upward trajectory.

Report Scope of Collagen Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 12.42 Billion |

| Market Size by 2034 |

USD 64.08 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 20.0% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Source, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Gelita AG; Nitta Gelatin; NA Inc.; Darling Ingredients Inc.; Weishardt International; Nippi Collagen NA Inc.; Rousselot B.V.; Collagen Matrix; Inc.; Koninklijke DSM N.V.; CONNOILS LL; Advanced BioMatrix; Inc. |

Collagen Market By Product Insights

Gelatin dominates the product segment, thanks to its versatility in food & beverages, pharmaceuticals, and nutraceuticals. Derived by partial hydrolysis of collagen, gelatin is extensively used in confectionery, dairy, meat processing, and capsule production. Its ability to form gels, bind water, and stabilize emulsions makes it a valuable ingredient in both industrial and consumer goods. In pharmaceutical applications, gelatin capsules offer a tasteless, odorless, and digestible medium for drug delivery. Its long-standing familiarity with consumers further supports its dominance in traditional and functional products alike.

Hydrolyzed collagen (collagen peptides) is the fastest-growing segment, especially in the beauty, fitness, and wellness sectors. This form of collagen is enzymatically broken down into smaller peptides for improved digestibility and bioavailability. It is the preferred format in dietary supplements and is often added to beverages, smoothies, and ready-to-eat snacks. Hydrolyzed collagen is also making inroads into the sports nutrition market, promoted for its benefits in muscle recovery, connective tissue repair, and post-exercise inflammation reduction. Its neutral taste, water solubility, and evidence-backed benefits are driving exponential demand.

Collagen Market By Source Insights

Bovine collagen is the most widely used source, due to its high availability, cost-effectiveness, and compatibility with multiple applications. It is predominantly used in food processing, pharmaceutical gelatin, and orthopedic implants. Its Type I and III collagen composition closely mimics human collagen, making it particularly effective for joint and skin health. However, religious and ethical limitations may restrict its use in certain regions.

Marine collagen is the fastest-growing source segment, driven by its superior absorption rate, sustainability profile, and fewer religious restrictions. Extracted from fish skin, scales, and bones, marine collagen is primarily composed of Type I collagen and is popular in cosmetic, nutricosmetic, and premium supplement categories. The environmental narrative of valorizing fish by-products and its alignment with pescatarian and halal diets make it an attractive alternative to traditional collagen sources.

Collagen Market By Application Insights

Food and beverage applications dominate the collagen market, particularly in dietary supplements, functional foods, and beverages. This is fueled by growing awareness of the link between collagen intake and aesthetic wellness, bone density, and joint lubrication. Collagen-enriched snack bars, waters, gummies, and dairy products are now common in Western and Asian supermarkets alike. Functional beverages infused with collagen are especially trending in countries like Japan, South Korea, and the U.S., appealing to younger demographics seeking convenient health fixes.

Healthcare applications are the fastest-growing segment, supported by collagen’s crucial role in tissue regeneration, surgical wound care, and implantable medical devices. In bone and joint supplements, collagen works synergistically with minerals like calcium and magnesium to improve skeletal integrity. Collagen matrices are now being used as drug delivery vehicles and biodegradable sutures. Regulatory approvals for these advanced biomedical applications are rising, and with it, the demand for pharmaceutical- and medical-grade collagen.

Collagen Market By Regional Insights

North America leads the global collagen market, owing to its mature nutraceuticals sector, high disposable income, and early adoption of functional foods and personal care products. The U.S. is home to numerous wellness-focused collagen brands and has a strong presence of manufacturers specializing in bovine and marine collagen. The region also invests significantly in R&D for medical applications of collagen, particularly in orthopedics and regenerative medicine.

Consumer demand for beauty-from-within products, especially among millennials and Gen Z, is soaring. Collagen peptide supplements, collagen-infused lattes, and keto/paleo-friendly collagen powders have become staples in retail chains, health food stores, and e-commerce platforms. The presence of robust regulatory frameworks and transparent labeling practices further strengthens consumer trust in collagen-based offerings.

Asia-Pacific is the fastest-growing collagen market, driven by rising health consciousness, beauty-focused culture, and increasing disposable income. Japan and South Korea are pioneers in collagen-infused drinks and nutricosmetics, while China and India are rapidly adopting dietary supplements and functional foods.

The aging population across countries like Japan and South Korea, coupled with government encouragement of healthy aging initiatives, is creating strong demand for joint health and anti-aging products. Additionally, the expansion of e-commerce and social media marketing in the region has made collagen-based products more accessible, particularly among young adults. Local manufacturers are also scaling up production of marine and poultry collagen to meet diverse consumer preferences.

Some of the prominent players in the collagen market include:

- Rousselot

- GELITA AG

- Tessenderlo Group

- STERLING GELATIN

- Weishardt Holding SA

- Juncà Gelatines SL

- Xiamen Yiyu Biological Technology Co., Ltd.

- Symatese

- Collagen Matrix, Inc.

- Collagen Solutions Plc

- ConnOils LLC

- Advanced BioMatrix, Inc.

- Nitta Gelatin, NA Inc.

Recent Developments

-

March 2025: Gelita AG introduced a new fast-dissolving collagen peptide formula designed for instant beverage mixes, targeting the fitness and wellness industry.

-

January 2025: Rousselot launched a next-generation marine collagen ingredient under the brand name “Peptan® Vital,” emphasizing sustainability and superior absorption.

-

November 2024: Tessenderlo Group expanded its collagen production capacity in Belgium to meet growing European demand for clean-label and medical-grade gelatin products.

-

August 2024: Vital Proteins (acquired by Nestlé Health Science) launched a collagen shot series combining collagen peptides with adaptogens and vitamins for on-the-go immunity and stress relief.

-

May 2024: Nitta Gelatin announced a strategic partnership with a Japanese biotech firm to co-develop synthetic collagen for tissue engineering applications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the collagen market

By Product

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

By Source

- Bovine

- Porcine

- Poultry

- Marine

- Others

By Application

-

- Functional Food

- Functional Beverages

- Dietary Supplements

- Confectionary

- Desserts

- Meat Processing

-

- Bone & Joint Health Supplements

- Wound Dressing

- Tissue Regeneration

- Medical Implants

- Cardiology

- Drug Delivery

-

- Beauty Supplements (Nutricosmetics)

- Topical Cosmetic Products

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)