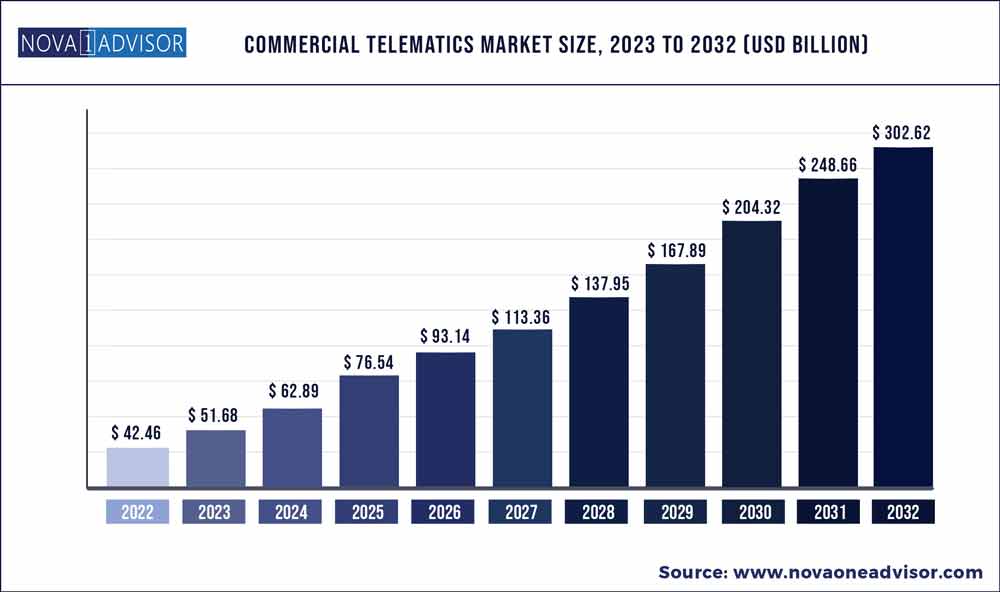

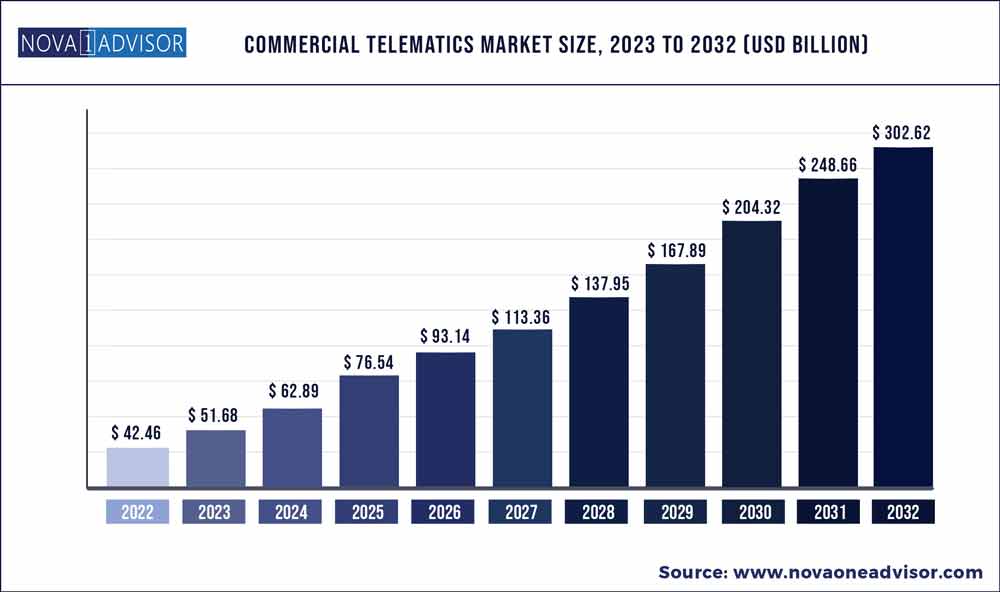

The global commercial telematics market size was exhibited at USD 42.46 billion in 2022 and is projected to hit around USD 302.62 billion by 2032, growing at a CAGR of 21.7% during the forecast period 2023 to 2032.

Key Pointers:

- North America market was valued at USD 12.18 billion in 2022.

- North America represented highest market share 53% in 2022.

- Asia Pacific is supposed to create at the speediest rate with a CAGR of 26.6% from 2023 to 2032.

- By application, the solution segment accounted market share of around 83% in 2022.

- By end user, the transportation and operations segment accounted 33% market share in 2022.

- The OEM segment is expected to grow at a CAGR of 15.3% over the forecast timeframe 2023 to 2032.

- The services segment is expected to reach at a CAGR of 15.4% from 2023 to 2032.

Commercial Telematics Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 51.68 Billion

|

|

Market Size by 2032

|

USD 302.62 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 21.7%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Type, Application, System Type, End-User,

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Zonar Systems, Inc., Trimble Inc., Verizon Telematics, Inc., Omnitracs LLC, Inseego Corporation

|

Telematics is methodology of monitoring the location and movement of vehicle by combination of Global Positioning System (GPS) and on-boards diagnostics systems. With the help of GPS and diagnostics system, it is possible to record the speed and internal behavior of the vehicle. Telematics systems are majorly adopted by the automobile insurance companies, fleet management companies, and others to monitor the location and behavior of the vehicle. The global commercial telematics market refers to the services and solutions that are adopted for monitoring and controlling a commercial vehicle through a telecommunication device. A Fleet Telematics System (FTS) allows the exchange of information between a commercial vehicle fleet and the central authority, which enables them to keep a track of vehicle diagnostics and location.

The spread of the COVID-19 pandemic has negatively impacted the global commercial telematics market, owing to commute restrictions and expected weak financial performance of the market players in 2020. The economic impact of the pandemic is visible with organizations preparing strategic cost-saving plans. Organizations with vehicle assets are considering sale and leaseback options to improve cash flow. The major risk factors of the commercial telematics market participants are supply chain execution, regulatory & policy changes, dependency on labor, working capital management, and liquidity & solvency management. Commercial telematics is a high-end technological solution dealing with intense capital investment for the end users. In 2020, market participants of the commercial telematics market as well as end users, such as OEM, fleet owners, insurers, and others, witnessed weak financial performance. This expected weak business performance directly impacts the overall sales of the system and service of commercial telematics.

For the commercial telematics market, 2020 is estimated to be a negative performing year, owing to the negative demand and supply outlook from the COVID-19 crisis restrictions in end users such as automotive manufacturer, insurance, and fleet owner. The demand from end users has reduced as there is limited operational activity and their main focus shifted to the core competencies of the origination. The overall production activities of these industries have declined, owing to operations with limited workforce capacity, inadequate health safety measures, and change in consumer sentiments.

In addition, end users, such as automotive OEM, automotive dealer, insurer, and fleet operators, are expected to focus on the working capital management and there are very less chances for heavy investment in advanced technology. However, there are most probable chances of sales momentum for the commercial telematics technology from 2021, owing to its high installation cost and additional infrastructural requirements. Market participants of commercial telematics are following certain approaches to manage the operations by slashed budgets, extended equipment lifecycles, decreased staff sizes, and reduced salaries in the short term to overcome the financial downturn.

The commercial telematics market is segmented on the basis of solution type, application, service, end user, and region. By solution type, the market is bifurcated into OEM and aftermarket. By application, it is classified into solutions, and services. By end user, it is further divided into transportation and logistics, insurance, healthcare, media & entertainment, vehicle manufacturers/dealers, and government agencies. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some of the prominent players in the Commercial Telematics Market include:

- Zonar Systems, Inc.

- Trimble Inc.

- Verizon Telematics, Inc.

- Omnitracs LLC

- Inseego Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Commercial Telematics market.

By Type

By Application

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional services

- Managed services

By System Type

- Embedded

- Tethered

- Smartphone Integrated

By End user

- Government Agencies.

- Media and Entertainment

- Insurers

- Vehicle Manufacturers/Dealers

- Transportation & Logistics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)