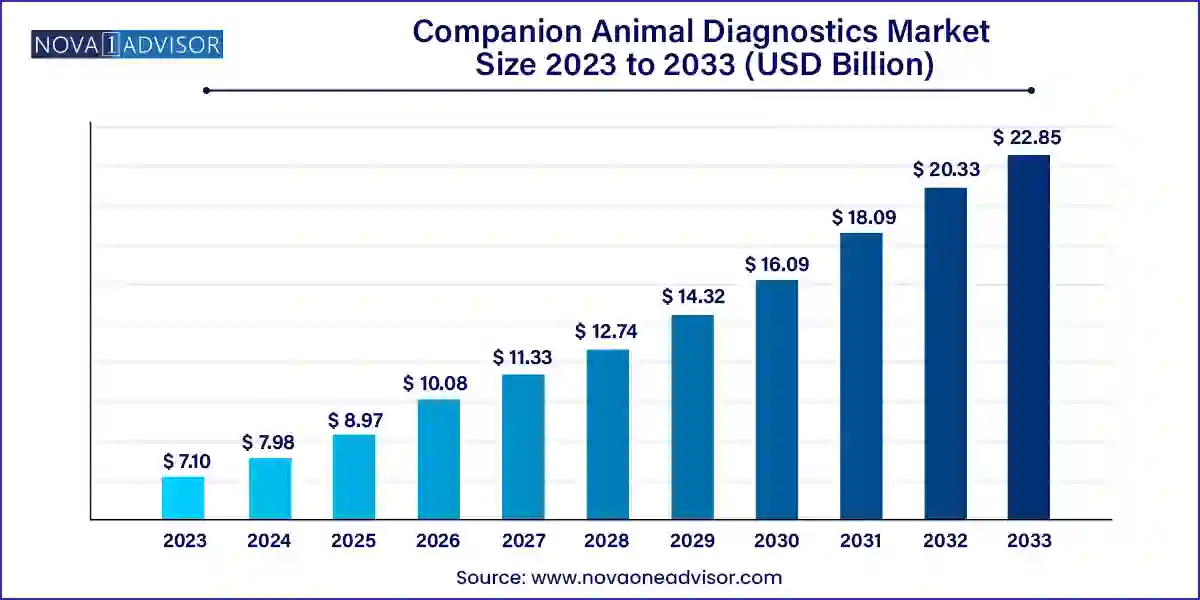

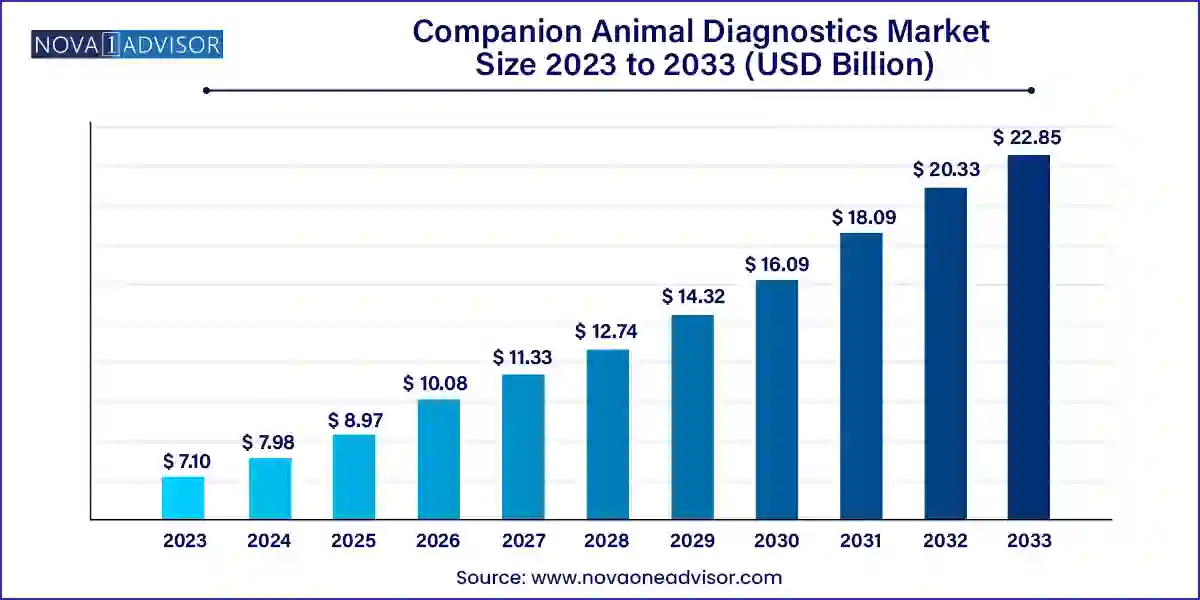

The global companion animal diagnostics market size was exhibited at USD 7.10 billion in 2023 and is projected to hit around USD 22.85 billion by 2033, growing at a CAGR of 12.4% during the forecast period 2024 to 2033.

Key Takeaways:

- North America accounted for the largest revenue share in 2023, owing to favorable healthcare structure and rising government initiatives.

- The equine segment is anticipated to grow at a steady CAGR throughout the forecast period

- The clinical biochemistry segment held the largest market share in 2023, attributed to increased use of clinical tests in companion animals.

- The molecular diagnostics segment is expected to exhibit the fastest CAGR over the forecast period.

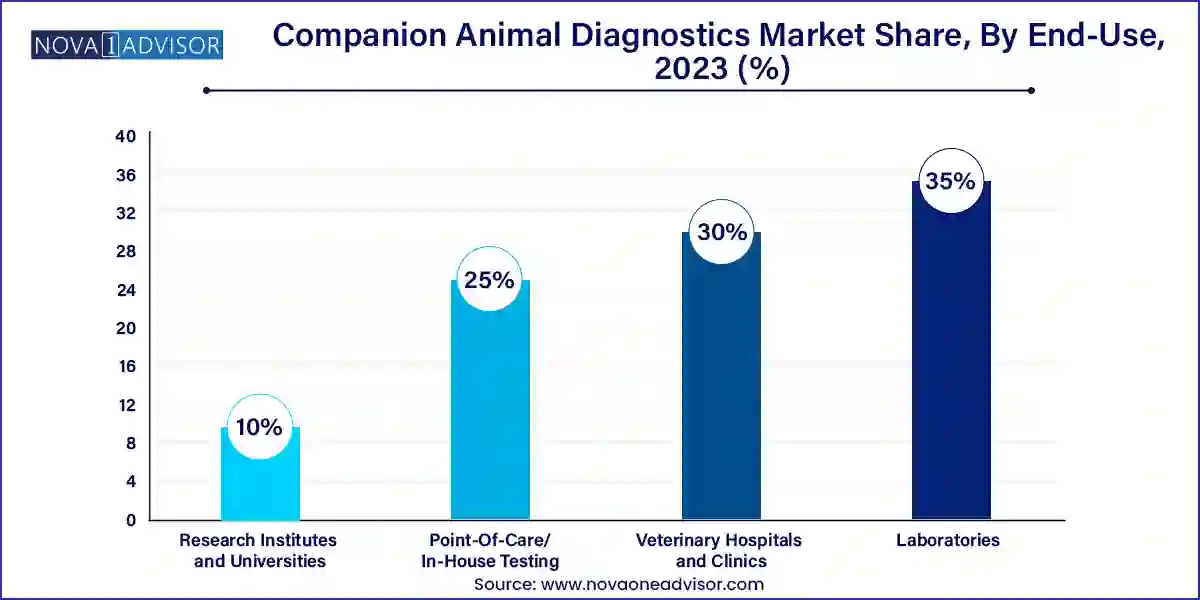

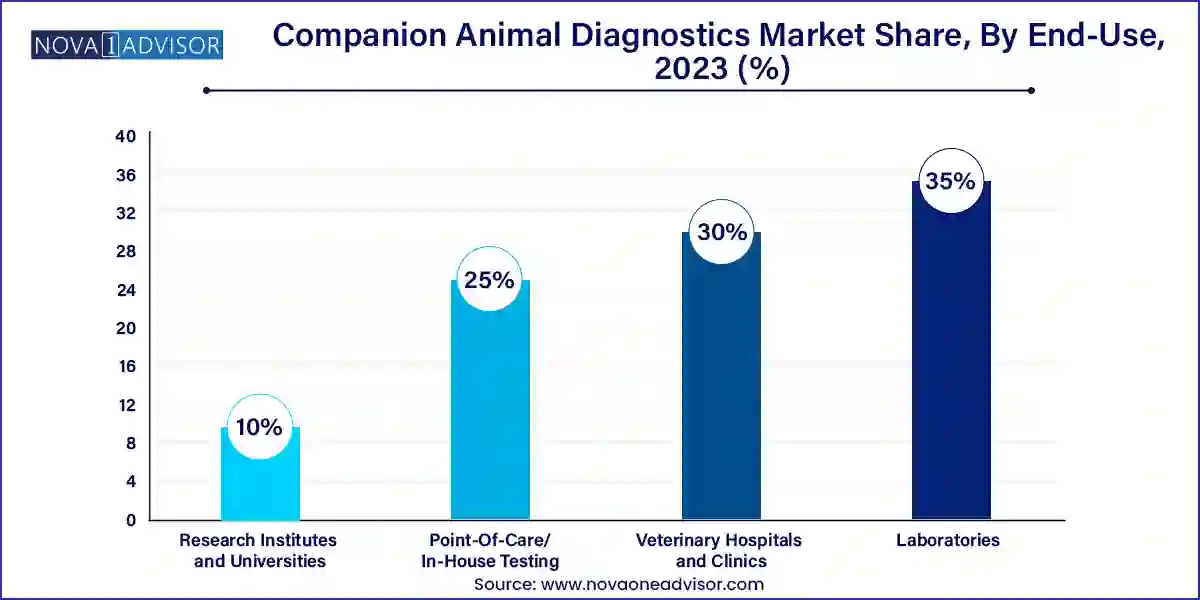

- The laboratories held the largest market share of over 35% in 2023.

Market Overview

The Companion Animal Diagnostics Market represents a rapidly expanding segment within the global animal healthcare industry. As the human-animal bond strengthens and pet ownership becomes more prevalent, the demand for timely, accurate, and convenient veterinary diagnostics continues to grow. This market encompasses a wide range of diagnostic tools and techniques used to detect, monitor, and manage various diseases and conditions in companion animals such as dogs, cats, and equines.

Driven by rising pet adoption rates, increasing awareness about preventive veterinary care, and technological advancements in diagnostic platforms, the companion animal diagnostics market has witnessed considerable growth over the past decade. Veterinarians and pet owners alike are increasingly relying on diagnostics for accurate disease detection, routine checkups, and treatment monitoring, leading to a consistent surge in demand for advanced in-house and laboratory diagnostic services.

Emerging economies, with growing middle-class populations and improved access to veterinary services, are also contributing to market expansion. The integration of point-of-care diagnostics, telemedicine, and digital pathology into veterinary workflows has further enhanced diagnostic efficiency, thus propelling the industry forward.

Major Trends in the Market

-

Increased Preference for In-House Testing: Veterinary clinics and hospitals are increasingly adopting point-of-care testing to provide immediate results and improve treatment timelines.

-

Growing Popularity of Pet Insurance: As pet insurance coverage expands globally, more owners are opting for routine diagnostics and early disease screening.

-

Integration of Artificial Intelligence (AI): AI tools are being integrated into diagnostic platforms, particularly in image analysis and predictive analytics, enhancing diagnostic accuracy.

-

Expansion of Molecular Diagnostics: There's a significant uptick in molecular-based testing methods, particularly for infectious and hereditary conditions in companion animals.

-

Telehealth and Remote Diagnostics: The COVID-19 pandemic accelerated the adoption of telemedicine in veterinary care, boosting the use of remote diagnostics and digital veterinary tools.

-

Development of Companion Animal Genetic Testing Kits: Direct-to-consumer genetic tests are gaining traction for breed identification, trait analysis, and early disease prediction.

-

Rise in Zoonotic Disease Monitoring: With growing awareness of zoonotic risks, there’s an increased focus on diagnostics that can detect zoonotic pathogens in companion animals.

Report Scope of The Companion Animal Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.98 Billion |

| Market Size by 2033 |

USD 22.85 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Animal Type, Application, Technology, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Zoetis Inc.; Idexx Laboratories Inc.; Heska Corporation; Thermo fisher Scientific; Neogen |

Driver: Rising Pet Humanization and Health Spending

The primary driver fueling the companion animal diagnostics market is the rising trend of pet humanization, where pets are increasingly viewed as integral family members. This societal shift has led to a significant increase in spending on pet health and wellness. Pet parents are now more inclined to invest in high-quality, comprehensive medical care for their animals, including advanced diagnostics for preventive and curative purposes. This trend is most visible in developed nations like the U.S., Germany, and Japan, where annual pet care expenditure often mirrors human healthcare spending. This increasing willingness to pay for sophisticated diagnostics not only boosts product sales but also encourages innovation in veterinary diagnostic tools.

Restraint: High Cost of Advanced Diagnostic Equipment

Despite the market's robust growth, the high cost of advanced diagnostic equipment remains a significant barrier to wider adoption, particularly in low- and middle-income countries. Sophisticated diagnostic systems such as molecular analyzers, digital hematology systems, and immunodiagnostic platforms require significant upfront investment and maintenance costs. Small veterinary practices and clinics often find it economically unfeasible to acquire these technologies, thereby relying on basic or outsourced services. Moreover, the lack of reimbursement models for veterinary diagnostics, unlike human healthcare, places the entire cost burden on pet owners, limiting market penetration in cost-sensitive regions.

Opportunity: Expansion of Veterinary Services in Emerging Markets

A noteworthy opportunity lies in the expansion of veterinary services in emerging economies, particularly in Asia-Pacific and Latin America. With growing urbanization, higher disposable incomes, and rising awareness about animal health, these regions are witnessing increased pet ownership and veterinary service utilization. Governments and private players are investing in veterinary infrastructure, which includes setting up diagnostics labs, training programs, and mobile health units. Global companies have a prime opportunity to tap into these markets by offering cost-effective, easy-to-use diagnostic tools and partnering with local entities for distribution and education.

Segments:

Companion Animal Diagnostics Market By Animal Type Insights

Dogs lead the animal type segment, accounting for the majority share due to their higher adoption rates globally and frequent veterinary visits compared to other animals. Dogs are more prone to chronic conditions like arthritis, cancer, and diabetes, which necessitate regular diagnostic evaluations. Pet parents are also more likely to invest in diagnostics for dogs, including routine checkups, dental exams, and genetic screenings, especially in North America and Europe.

Cats represent the fastest-growing sub-segment, particularly in urban settings where they are preferred for their low-maintenance nature. The feline population is steadily increasing, and so is the demand for specialized diagnostic solutions tailored to their unique physiological characteristics. Veterinary practices are now focusing on improving feline-friendly diagnostics, such as non-invasive urinalysis and specialized imaging techniques, to cater to this growing pet demographic.

Companion Animal Diagnostics Market By Application Insights

Clinical Pathology holds the dominant position in terms of application, encompassing blood work, cytology, and biopsy evaluations. It forms the backbone of diagnostic services offered by veterinary practices. From identifying anemia and infections to evaluating cancer and hormonal imbalances, clinical pathology provides crucial insights into the internal health of animals. Diagnostic labs and clinics rely heavily on this segment for routine testing and disease confirmation.

Parasitology is emerging as the fastest-growing application area, driven by increasing awareness about zoonotic and vector-borne diseases. Tests for parasites such as giardia, heartworms, and fleas are becoming routine, particularly in tropical and subtropical regions. Diagnostic advancements like ELISA-based parasite detection kits and fecal antigen testing are enabling quicker and more accurate identification of parasitic infections, improving treatment outcomes.

Companion Animal Diagnostics Market By Technology Insights

Clinical Biochemistry dominated the technology segment, thanks to its widespread usage in diagnosing metabolic and organ function-related conditions. Within this category, glucose monitoring has particularly gained momentum due to the rising prevalence of diabetes in pets, especially senior dogs and cats. Clinical chemistry analyzers are now commonplace in veterinary clinics, offering rapid and reliable results for parameters such as liver enzymes, electrolytes, and cholesterol. These tools are essential for baseline health screening and pre-anesthetic evaluations, making them indispensable in daily veterinary operations.

On the other hand, molecular diagnostics is the fastest-growing sub-segment, fueled by its increasing utility in identifying infectious agents, genetic disorders, and cancer markers. PCR-based kits, DNA microarrays, and next-generation sequencing are being adapted for veterinary use, offering precise and early disease detection capabilities. For instance, molecular assays are being used to detect canine parvovirus and feline leukemia virus more efficiently than traditional methods. As the technology becomes more accessible, its adoption is expected to rise exponentially.

Companion Animal Diagnostics Market By End-Use Insights

Veterinary Hospitals and Clinics dominate the end-use landscape, as they remain the primary touchpoints for diagnostic testing. These facilities are equipped with in-house labs and trained personnel to conduct a wide range of tests. With increasing pet visits and chronic disease management, hospitals and clinics rely on quick and accurate diagnostics to provide immediate interventions.

Point-of-Care/In-House Testing is the fastest-growing sub-segment, gaining popularity for its speed, convenience, and ability to deliver real-time results. Portable analyzers, handheld devices, and rapid test kits are enabling veterinarians to perform diagnostics at the site of care, even during home visits or in mobile clinics. The ability to instantly diagnose conditions such as diabetes, infections, and hormonal disorders without sending samples to external labs is revolutionizing veterinary practices, particularly in rural and underserved areas.

Companion Animal Diagnostics Market By Regional Insights

North America dominates the companion animal diagnostics market, accounting for the highest market share. The United States, in particular, boasts a mature veterinary healthcare infrastructure, a high rate of pet insurance penetration, and a culture of preventive veterinary care. Companion animals receive advanced diagnostics, often mirroring human-grade care, thanks to the presence of leading veterinary diagnostic companies such as IDEXX Laboratories and Zoetis. The region is also at the forefront of innovation, with frequent launches of novel testing platforms and AI-driven diagnostic aids.

Asia-Pacific is the fastest-growing region, fueled by a surge in pet adoption across countries like China, India, Japan, and South Korea. Rising disposable incomes, coupled with a shift in societal attitudes towards pets, have led to a boom in the demand for veterinary diagnostics. Governments are improving animal healthcare infrastructure, and local players are entering the market with affordable diagnostic kits. International companies are also setting up manufacturing units and distribution networks to cater to the burgeoning demand.

Some of the prominent players in the Companion animal diagnostics market include:

- Zoetis Inc.

- Idexx Laboratories Inc.

- Heska Corporation

- Thermo Fisher Scientific

- Neogen

Recent Developments

-

IDEXX Laboratories (February 2025): IDEXX launched a new point-of-care hematology analyzer that leverages machine learning for faster and more accurate white blood cell differentiation, enhancing diagnostic accuracy in clinical settings.

-

Zoetis (November 2024): The company expanded its reference lab network in Europe and introduced a molecular diagnostics portfolio targeting viral and bacterial diseases in pets.

-

Heska Corporation (August 2024): Heska unveiled a next-generation urinalysis system for veterinary use, capable of detecting up to 10 parameters in under 2 minutes, improving workflow efficiency for in-clinic testing.

-

Antech Diagnostics (June 2024): Antech partnered with a startup focused on AI pathology to co-develop a cloud-based diagnostic platform for digital slide analysis, reducing the turnaround time for cytology results.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global companion animal diagnostics market.

Technology

-

- Clinical Chemistry Analyzers

- Glucose Monitoring

- Immunodiagnostics

- Hematology

- Molecular diagnostics

- Urinalysis

- Others

Animal Type

Application

- Clinical Pathology

- Bacteriology

- Parasitology

- Others

End-Use

- Laboratori

- Veterinary Hospitals and Clinics

- Point-Of-Care/In-House Testing

- Research Institutes and Universities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)