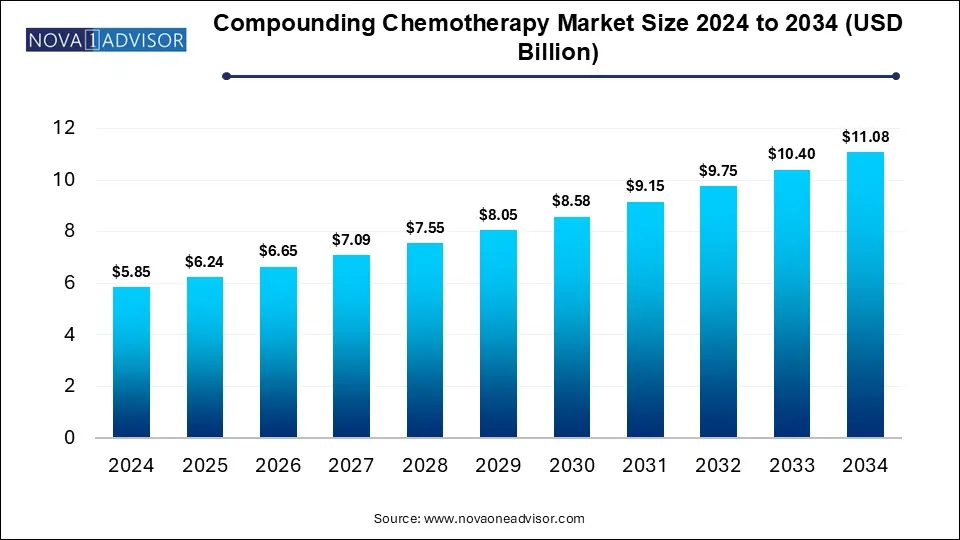

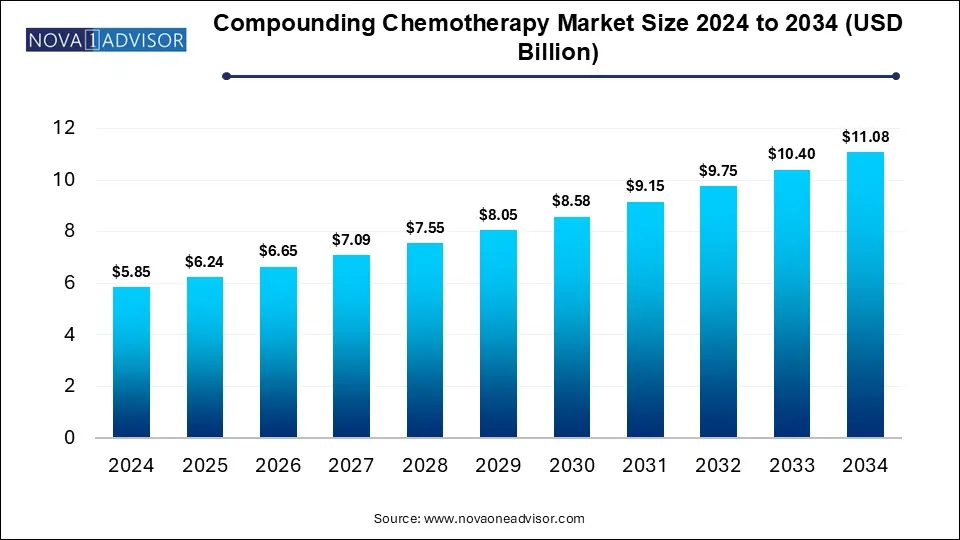

Compounding Chemotherapy Market Size and Growth

The global compounding chemotherapy market size is calculated at USD 5.85 billion in 2024, grows to USD 6.24 billion in 2025, and is projected to reach around USD 11.08 billion by 2034. at the CAGR of 6.6%. Enhanced safety standards and sterile compounding technologies are fueling market growth.

Key Takeaways:

- North America dominated the compounding chemotherapy market in 2024.

- Asia-Pacific is anticipated to experience rapid growth in the market during the forecast period.

- By technology, the robotic arm segment accounted largest share in the market in 2024.

- By technology, the without robotic arm segment held the fastest growth of the market.

- By dose, the chemotherapy segment was dominant in the market in 2024.

- By dose, the non-chemotherapeutic segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By compounding, the pharmaceutical dosage alteration segment led the market.

- By compounding, the currently unavailable pharmaceutical manufacturing segment is projected to grow at the highest CAGR in the market during the studied years.

- By delivery method, the gravimetric automated compounding device segment was dominant in the market in 2024.

- By delivery method, the volumetric automated compounding devices segment is anticipated to grow at the fastest rate in the market during the forecast period.

- By sterility, the sterile segment held a dominant presence in the compounding chemotherapy market in 2024.

- By sterility, the non-sterile segment is anticipated to grow at the fastest rate in the market.

Market Overview

Compounding chemotherapy refers to the customized preparation of chemotherapy drugs by a licensed pharmacist to meet specific needs, such as unique dosages or formulations. This process ensures precise, sterile, and personalized cancer treatment when commercial options are unavailable or unsuitable. The market is growing due to increasing cancer prevalence, rising demand for personalized treatments, drug shortages, and a shift towards outpatient care. Advances in sterile compounding technologies and strict safety regulations further support market expansion.

Compounding Chemotherapy Market Trends

- In July 2023, Revelation Pharma acquired Eagle Pharmacy and Lee Silsby Pharmacy to expand its compounding services. Eagle supports over 29 U.S. states, enhancing Revelation’s medication supply and growth potential. Lee Silsby adds broader reach, serving patients and providers in more than 45 states.

- In October 2023, FarmaKeio Custom Compounding revealed its new location in Conway. The company aims to advance healthcare by providing personalized compounded medications and outstanding service to patients and healthcare providers across the country.

How can AI affect the Compounding Chemotherapy Market?

AI is set to transform the compounding chemotherapy market by improving accuracy, reducing human error, and enhancing workflow efficiency. It can optimize dosing, automate compounding processes, and ensure better compliance with safety standards, ultimately leading to safer, faster, and more personalized cancer treatment.

Report Scope of Compounding Chemotherapy Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.24 Billion |

| Market Size by 2034 |

USD 11.08 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Technology, By Dose type, By Compounding Type, By Delivery method, By Sterility, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Biovalley Group S.p.A., Loccioni, Dedalus S.p.A., Omnicell Inc., Simplivia, ATS Corporation, ARxIUM, Kapsam Health Products, Grifols, S.A., EQUASHIELD |

Market Dynamics

Driver

Rising Cancer Incidence

The global increase in cancer cases is a primary driver. According to the World Health Organization, cancer was responsible for approximately 10 million deaths in 2023, making it a leading cause of mortality worldwide. This surge in cancer prevalence has heightened the demand for chemotherapy treatments, including compounded formulations tailored to individual patients’ needs.

Restraint

Regulatory Compliance Challenges

Compounding pharmacies must adhere to stringent regulations set by authorities like the FDA and EMA to ensure patient safety and drug quality. Compliance requires substantial investments in specialized facilities, skilled personnel, and regular inspections, increasing operational costs and creating barriers for smaller players.

Opportunity

Growing Demand for Personalized Medicine

The rise of personalized medicine supports compounding chemotherapy by allowing pharmacists to custom-design combinations and dosages for each patient, leading to better clinical outcomes, higher patient satisfaction, and increased market demand for tailored therapies.

Segmental Insights

The Robotic Arm Segment: Largest Shares

By technology, the robotic arm segment accounted largest share in the market in 2024 due to its precision, reduced contamination risk, and ability to handle hazardous drugs safely. These systems enhance workflow efficiency, ensure dosage accuracy, and minimize exposures for healthcare workers, driving widespread adoption in hospital and oncology pharmacy settings.

The Without Robotic Arm Segment: Fastest Growing

By technology, the without robotic arm segment held the fastest growth of the market, due to cost-effectiveness and adaptability, especially in smaller healthcare settings. These systems offer flexibility and customization without the high investment required for robotic technology, making them ideal for facilities seeking an efficient yet affordable compounding solution.

The Chemotherapy Segment Dominated

By dose, the chemotherapy segment was dominant in the market in 2024 due to the widespread use of potent chemotherapy drugs requiring precise dosing to effectively treat cancer while minimizing side effects. The high prevalence of cancer and the necessity for tailored treatments further drive demand for compounding chemotherapy market formulations.

The Non-chemotherapeutic Segment is: Fastest CAGR

By dose, the non-chemotherapeutic segment is expected to grow at the fastest CAGR in the market during the forecast period, due to rising demand for adjunct therapies that improve patients' quality of life during cancer treatments. These include antiemetic, analgesic, and nutritional supplements, which are increasingly compounded to meet individuals' patient needs, especially in outpatient and personalized treatment settings.

The Pharmaceutical Dosage Alteration Segment Led

By compounding, the pharmaceutical dosage alteration segment led the market due to its ability to tailor drug formulation to individual patient needs, especially in oncology. This includes modifying dosage, combining multiple agents, and adjusting delivery forms to improve efficacy, minimize side effects like age, weight, and comorbidities, and enhance personalized cancer care.

The Currently Unavailable Pharmaceutical Manufacturing Segment Highest CAGR

By compounding, the currently unavailable pharmaceutical manufacturing segment is projected to grow at the highest CAGR in the market during the studied years because it addresses critical drug shortages and supply chain gaps. Compounding enables the reproduction of essential, yet commercially unavailable chemotherapy drugs, ensuring uninterrupted cancer treatment and meeting rising demand for personalized and timely oncology care.

The Gravimetric Automated Compounding Device Segment Dominated

By delivery method, the gravimetric automated compounding device segment was dominant in the compounding chemotherapy market in 2024 due to its superior accuracy and safety in preparing complex oncology drugs. These devices measure ingredients by weight, ensuring precise dosage and minimizing errors, which is crucial for patient safety. Their user-friendly design and integration with robotic arms further enhance efficiency and compliance with stringent healthcare standards.

The Volumetric Automated Compounding Devices Segment: Fastest Growing

By delivery method, the volumetric automated compounding devices segment is anticipated to grow at the fastest rate in the market during the forecast period due to high precision, efficiency, and enhanced safety in chemotherapy drug preparation. This system reduces human error and contamination risk, supports complex regimens, and ensures regulatory compliance, making them increasingly preferred in oncology settings aiming for accuracy, safety, and streamlined workflows.

The Sterile Segment Dominated

By sterility, the sterile segment held a dominant presence in the compounding chemotherapy market in 2024 due to the critical need for contamination-free formulations in cancer treatment. Sterile compounding ensures patient safety, meets stringent regulatory standards, and prevents infection risks, making it essential for intravenous chemotherapy. The growing emphasis on safety and compliance further reinforced the dominance of sterile preparation.

The Non-sterile Segment: Fastest Growing

By sterility, the non-sterile segment is anticipated to grow at the fastest rate in the compounding chemotherapy market due to increased demand for personalized oral chemotherapy formulations, ease of administration, and lower preparation costs. Advancements in targeted oral therapies and growing outpatient treatments are also driving the need for non-sterile compounding options that support patient convenience and compliance.

Regional Insights

Well-established Healthcare Infrastructure Propels North America

North America dominated the compounding chemotherapy market in 2024, due to its well-established healthcare infrastructure, high incidence of cancer, and early adoption of advanced automated compounding technologies. The region also benefits from strong regulatory oversight, significant healthcare expenditure, and the presence of major pharmaceutical and compounding device companies. These factor collectively supports the widespread implementation of safe, accurate, and efficient chemotherapy compounding practices.

For instance, In January 2025, reports indicated that GSK was close to finalizing a nearly $1 billion acquisition of IDRx, a U.S.-based biotech company focused on therapies for rare gastrointestinal tumors. IDRx’s main drug candidate is designed to treat gastrointestinal stromal tumors (GIST) by targeting resistance mutations that limit the effectiveness of existing treatment options.

Rising Cancer Cases Drive Asia-Pacific

Asia-Pacific is anticipated to experience rapid growth in the compounding chemotherapy market during the forecast period due to rising cancer cases, expanding healthcare infrastructure, and increased access to treatment. Economic development, supportive government initiatives, and growth in pharmaceutical manufacturing also contribute. Additionally, evolving regulatory frameworks in countries like China and India are compounding pharmacy practices.

For instance, In 2024–25, the Union Budget provided a boost to cancer care in India, with an increase of approximately ₹4,000 crore in funding for the NHM. This funding is directed toward improving primary and secondary healthcare services, which are vital for preventive cancer care and early detection.

Rising Adoption of Precision Medicine Promotes Europe

Europe is expected to see significant growth in the compounding chemotherapy market during the forecast period, due to the rising adoption of precision medicine. EU-led initiatives to improve oncology research and access to advanced therapies further support this growth, while stringent healthcare standards drive innovation in personalized medicine drug preparation across the region.

Some of The Prominent Players in The Compounding chemotherapy market Include:

- Baxter International Inc.

- Fresenius Kabi AG

- Cardinal Health, Inc.

- Amgen Inc.

- Teva Pharmaceutical Industries Ltd.

- Calea Ltd.

- Accord Healthcare Inc.

- Sandoz

Recent Developments in the Compounding Chemotherapy Market

- In March 2024, Simplivia launched SmartCompounders, a cutting-edge robotic system that automates chemotherapy drug preparation. Integrated with the Chemfort Closed System Drug-Transfer Device (CSTD), it aims to boost accuracy, efficiency, and safety in the compounding process. Its modular, plug-and-play design is compact yet high-performing, helping minimize healthcare workers' exposure to hazardous drugs while streamlining pharmacy operations.

- In January 2024, Simplivia Healthcare Ltd. acquired a 70% stake in Novamed Ltd., an Israeli company known for its advanced diagnostic solutions. Novamed, with a team of around 100 experts including researchers and engineers, operates from a modern manufacturing facility.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Technology

- With Robotic Arm

- Without Robotic Arm

By Dose Type

- Non-chemotherapeutic

- Chemotherapeutic

By compounding Type

- Pharmaceutical Ingredient Alteration

- Currently Unavailable Pharmaceutical Manufacturing

- Pharmaceutical Dosage Alteration

By Delivery Method

- Gravimetric Automated Compounding Devices

- Volumetric Automated Compounding Devices

By Sterility

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)