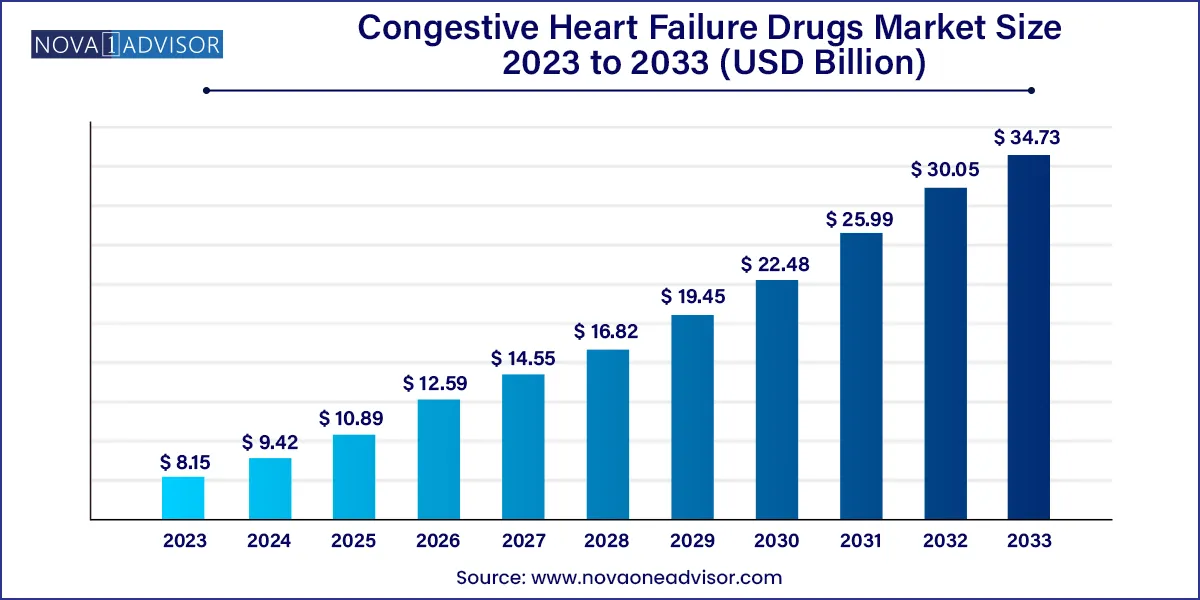

The global congestive heart failure drugs market size was exhibited at USD 8.15 billion in 2023 and is projected to hit around USD 34.73 billion by 2033, growing at a CAGR of 15.6% during the forecast period 2024 to 2033.

Key Takeaways:

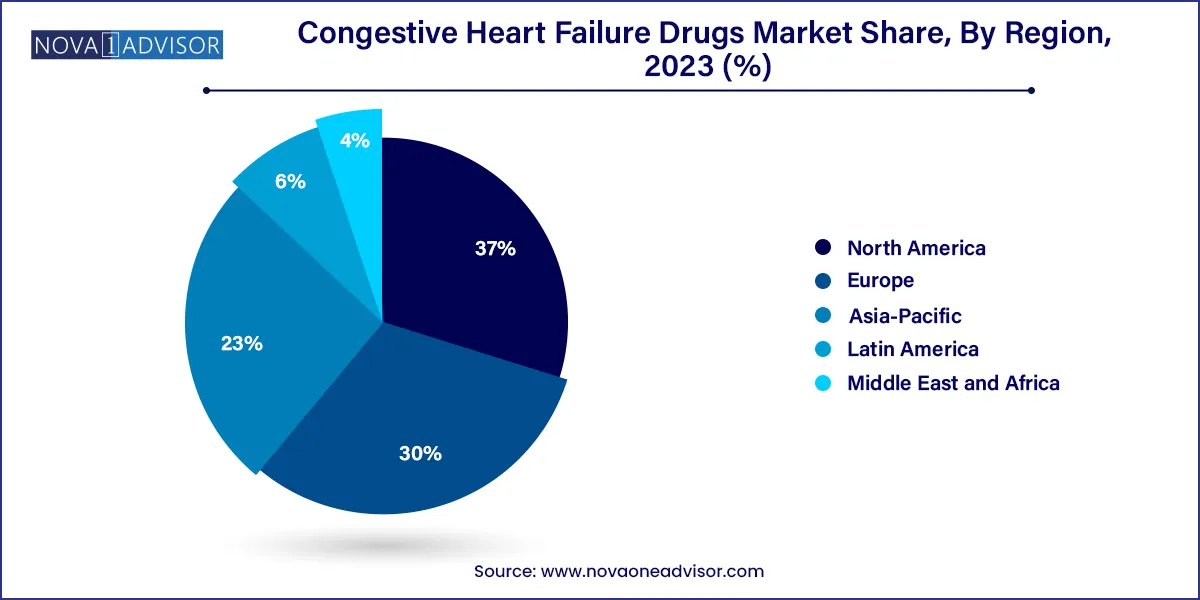

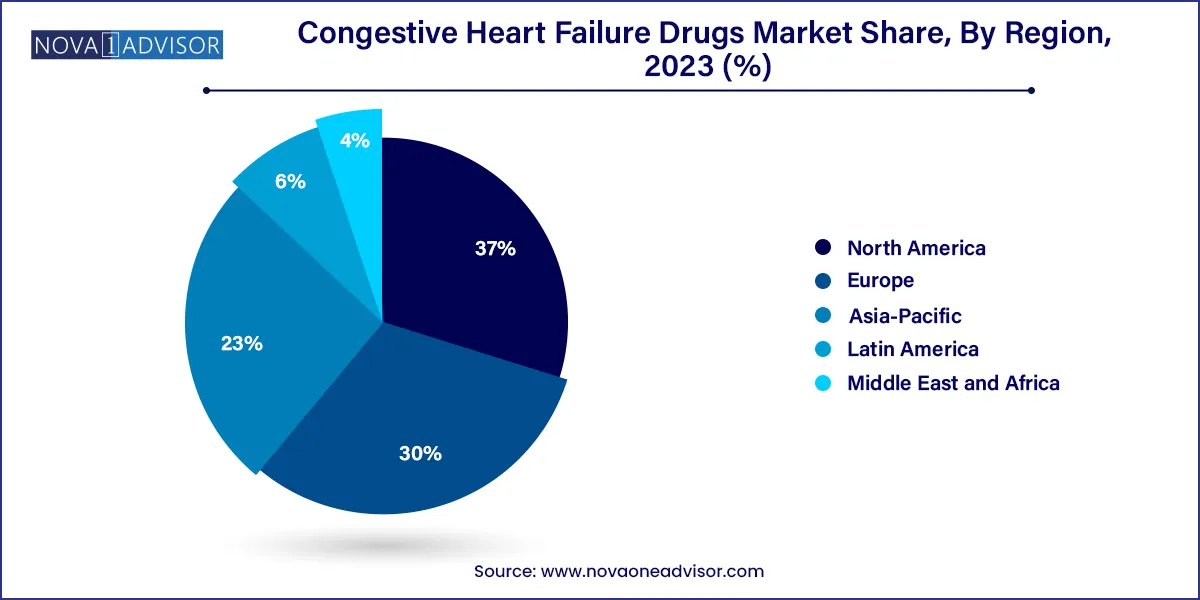

- North America held the largest share of over 37.0% in 2023.

- The Asia Pacific region is expected to register the highest CAGR of 15.7% over the forecast period.

- The angiotensin-converting enzyme (ACE) inhibitors segment dominated the market in 2023 with a revenue share of over 30.0%.

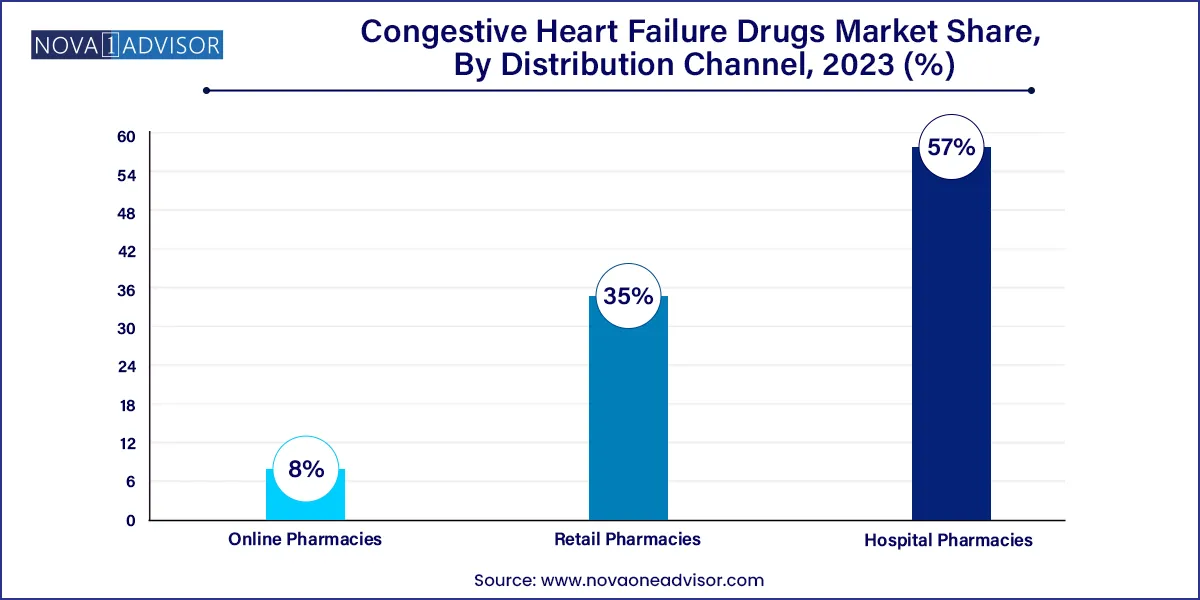

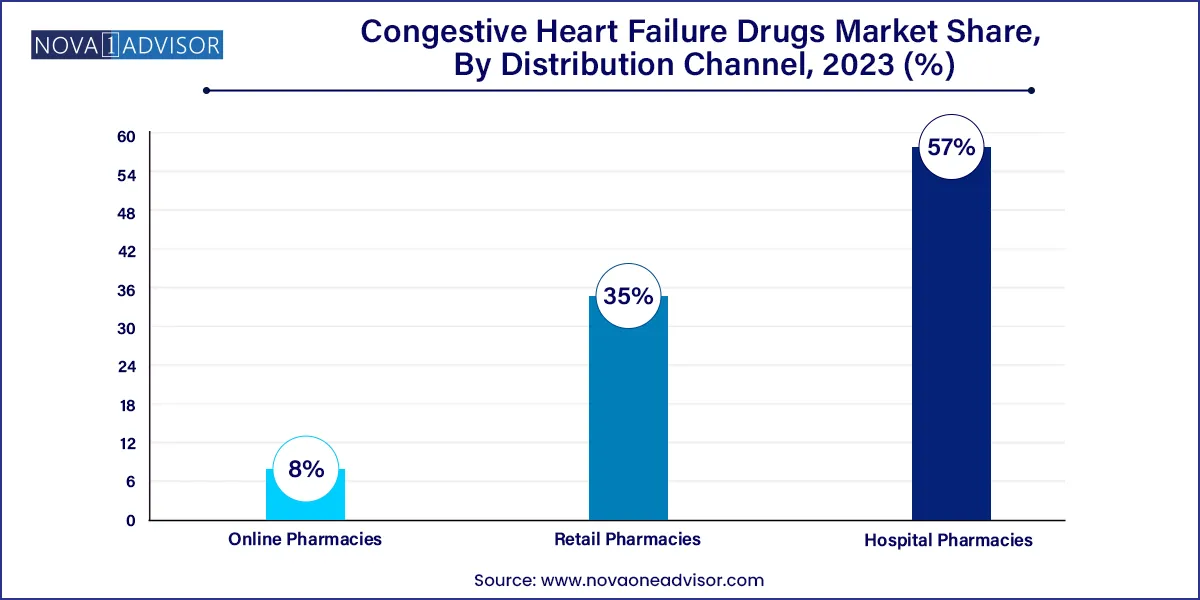

- The hospital pharmacies held the largest share of over 57.0% in 2023.

- The online pharmacies segment is expected to expand at a CAGR of 13.6% during the forecast period.

Market Overview

Congestive Heart Failure (CHF), a chronic and progressive condition characterized by the heart’s inability to pump blood efficiently, remains a major global health concern, particularly among the aging population and individuals with comorbidities like hypertension, diabetes, and coronary artery disease. The CHF drugs market has emerged as a critical segment of the global cardiovascular therapeutics landscape, offering a wide array of pharmacological solutions designed to manage symptoms, slow disease progression, and reduce hospitalization rates.

The market is largely fueled by the increasing prevalence of cardiovascular diseases and the aging demographic across developed and emerging regions. CHF affects more than 64 million people globally, according to recent estimates from the Global Burden of Disease Study, and this number is expected to rise. Consequently, drug manufacturers and healthcare systems are facing immense pressure to improve treatment efficacy, optimize costs, and ensure access to essential medicines.

From diuretics that provide symptomatic relief to advanced beta-blockers and angiotensin-converting enzyme (ACE) inhibitors that modify the disease course, the treatment paradigm for CHF continues to evolve. Innovations in molecular pharmacology, including the use of SGLT2 inhibitors originally developed for diabetes management have demonstrated substantial cardiovascular benefits, further expanding therapeutic options in recent years. Additionally, growing awareness about early diagnosis and preventive care has amplified the demand for effective CHF drug regimens in both inpatient and outpatient settings.

Major Trends in the Market

-

Rise in Combination Therapies: Increasing prescription of dual or triple therapy regimens combining ACE inhibitors, beta-blockers, and diuretics to achieve synergistic effects.

-

Adoption of SGLT2 Inhibitors: Originally developed for type 2 diabetes, these drugs have shown promising results in heart failure patients, expanding their clinical application.

-

Focus on Patient-Centric and Personalized Medicine: Greater emphasis on tailoring drug regimens to individual patient profiles and genetic markers.

-

Growth in Digital Prescription Platforms: Surge in online pharmacies and telemedicine fueling drug sales, especially in remote and rural regions.

-

Increased R&D in Heart Failure with Preserved Ejection Fraction (HFpEF): Drug development is shifting toward the less-addressed subtype of CHF where treatment options remain limited.

-

Regulatory Support for Orphan Drug Designation: Incentives and fast-track approvals from agencies like the FDA and EMA for breakthrough therapies targeting advanced heart failure.

-

Biologics and Novel Agents Pipeline Expansion: Introduction of novel molecular entities, such as gene therapy candidates and anti-inflammatory agents, in early-phase trials.

-

Global Health Programs Addressing Cardiac Care: WHO-backed and regional initiatives promoting access to CHF management in low-income countries.

Congestive Heart Failure Drugs Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.42 Billion |

| Market Size by 2033 |

USD 34.73 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Drug Class, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Bayer AG; Novartis AG; Merck & Co., Inc.; AstraZeneca; Bristol-Myers Squibb Company; Amgen Inc.; Boehringer Ingelheim International GmbH; Pfizer, Inc.; Johnson & Johnson Services, Inc.; Otsuka Pharmaceutical Co., Ltd.; Eli Lilly and Company; Novo Nordisk A/S. |

Market Driver: Rising Prevalence of Cardiovascular and Lifestyle Diseases

A primary catalyst for the growth of the CHF drugs market is the global surge in cardiovascular and lifestyle-related diseases. Sedentary lifestyles, poor dietary habits, smoking, obesity, and stress contribute significantly to hypertension, coronary artery disease, and diabetes leading risk factors for CHF. According to the CDC, about 6.2 million adults in the U.S. alone suffer from heart failure, and similar alarming statistics are seen in countries like India and China.

This demographic trend is not confined to developed nations; in fact, low- and middle-income countries are witnessing a sharp increase in heart failure cases due to urbanization and lack of access to preventive care. As the disease burden escalates, healthcare providers are under pressure to implement long-term pharmacological interventions. This has directly influenced demand for maintenance therapies such as beta-blockers, ACE inhibitors, and aldosterone antagonists that can prolong life expectancy and reduce hospital readmissions.

Market Restraint: High Cost of Advanced Therapies

Despite innovation, the CHF drugs market is hampered by high costs associated with novel therapies and chronic treatment adherence. Many patients require lifelong medication, and branded therapies—especially those under patent protection—can be prohibitively expensive. For example, SGLT2 inhibitors like empagliflozin and dapagliflozin have shown significant benefits in reducing heart failure-related events, but their costs remain a barrier in low-income countries and uninsured populations.

Additionally, reimbursement limitations in certain healthcare systems, particularly in emerging economies, restrict patient access to newer drug classes. Even in developed regions, out-of-pocket expenditures for CHF medications can add a significant financial burden, particularly for elderly patients with multiple prescriptions. The lack of widespread availability of generic alternatives and biosimilars in some drug categories further exacerbates this issue.

A promising opportunity lies in the expansion of telehealth and digital pharmacy platforms, particularly in underserved and remote regions. The COVID-19 pandemic accelerated the adoption of digital health services, making it easier for CHF patients to consult healthcare providers and obtain prescriptions without in-person visits. The rise of online pharmacies has made chronic disease medications, including those for heart failure, more accessible and convenient to purchase, thus improving medication adherence.

In regions such as Southeast Asia, sub-Saharan Africa, and Latin America, where brick-and-mortar healthcare infrastructure is limited, mobile health (mHealth) apps and e-pharmacy models are bridging gaps in chronic disease management. This trend provides drug manufacturers with new distribution channels and market penetration strategies, helping to increase global access to CHF medications.

Segments Insights:

Congestive Heart Failure Drugs Market By Drug Class Insights

ACE inhibitors dominated the market due to their long-standing efficacy in managing CHF symptoms and delaying disease progression. As a first-line treatment recommended by global guidelines, ACE inhibitors such as enalapril and lisinopril are widely prescribed across all heart failure stages. They work by relaxing blood vessels, reducing the workload on the heart, and improving blood flow. Their affordability and availability in generic form further contribute to their widespread usage, especially in developing countries. Moreover, continuous medical education and physician familiarity with ACE inhibitors have sustained their prominence in treatment regimens.

SGLT2 inhibitors, classified under “Others,” are emerging as the fastest growing sub-segment in recent years. Initially approved for diabetes, drugs like dapagliflozin (Farxiga) and empagliflozin (Jardiance) have shown significant cardiovascular benefits in clinical trials such as DAPA-HF and EMPEROR-Reduced. These results have led to regulatory approvals for CHF indications, even among non-diabetic patients. Their unique mechanism promoting osmotic diuresis and reducing preload makes them a novel addition to the CHF treatment armamentarium. Their rise reflects a paradigm shift in heart failure therapeutics, opening new growth avenues for pharmaceutical companies.

Congestive Heart Failure Drugs Market By Distribution Channel Insights

Hospital pharmacies lead the distribution channel segment, owing to the acute nature of CHF and the frequent hospitalization of patients for disease management and exacerbations. Hospitals maintain a wide formulary that includes essential drugs for immediate intervention, including intravenous inotropes and high-dose diuretics. Inpatient treatment settings often initiate or modify CHF regimens, making hospital pharmacies crucial in dispensing high-value medications. Additionally, integrated care models ensure continuity of care from hospitals to outpatient follow-ups, solidifying their role in overall CHF drug distribution..

Online pharmacies are projected to witness the highest growth rate, driven by increasing consumer preference for home delivery, subscription-based medication refills, and digital health consultations. Chronic conditions like CHF require regular medication intake, making e-pharmacy platforms ideal for prescription renewals and dosage adjustments. The convenience of door-step delivery, combined with discounts and auto-refill features, enhances patient adherence. Moreover, strategic partnerships between pharmaceutical companies and digital health firms are expanding this channel’s footprint, particularly in urbanized and tech-savvy populations.

Congestive Heart Failure Drugs Market By Regional Insights

North America continues to dominate the CHF drugs market, supported by advanced healthcare infrastructure, high disease prevalence, and strong presence of leading pharmaceutical firms. The U.S. accounts for the largest revenue share due to its aging population, high obesity and diabetes rates, and well-established clinical guidelines for CHF management. Medicare and private insurance coverage ensure wide accessibility to branded and generic CHF medications. Furthermore, continuous R&D investments, extensive clinical trials, and prompt regulatory approvals (e.g., FDA fast-track designations) foster innovation and product availability.

Asia-Pacific is emerging as the fastest growing region, driven by rapid urbanization, increasing awareness about heart failure, and healthcare reforms across nations like China, India, and Indonesia. The region’s large population base, rising incidence of cardiovascular disorders, and expanding middle class are key market accelerators. Public-private initiatives to improve cardiac care infrastructure, along with the growing presence of global and regional pharmaceutical manufacturers, are enhancing access to life-saving CHF drugs. Additionally, countries like Japan and South Korea, with their strong healthcare systems, are quickly adopting novel therapies, contributing to regional growth.

Recent Developments

-

March 2025: AstraZeneca announced expanded approval of Farxiga (dapagliflozin) in Japan for the treatment of heart failure with preserved ejection fraction (HFpEF), following new positive outcomes from the DELIVER trial.

-

February 2025: Boehringer Ingelheim and Eli Lilly received FDA label expansion for Jardiance (empagliflozin), including use in patients across all ejection fraction spectrums.

-

December 2024: Novartis launched a patient support initiative in India to improve access to Entresto (sacubitril/valsartan) through tiered pricing strategies for low-income populations.

-

October 2024: Merck & Co. entered into a partnership with Verily Life Sciences to utilize AI in identifying novel biomarkers for early-stage heart failure treatment targeting.

-

August 2024: Pfizer announced a Phase 3 trial for a novel dual-action aldosterone blocker, aimed at reducing mortality in acute decompensated heart failure.

Some of the prominent players in the Congestive heart failure drugs market include:

- Bayer AG

- Novartis AG

- Merck & Co., Inc.

- AstraZeneca

- Bristol-Myers Squibb Company

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- Pfizer, Inc.

- Johnson & Johnson Services, Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Eli Lilly and Company

- Novo Nordisk A/S

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global congestive heart failure drugs market.

Drug Class

- ACE Inhibitors

- Angiotensin 2 Receptor Blockers

- Beta Blockers

- Diuretics

- Aldosterone Antagonists

- Inotropes

- Others

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)