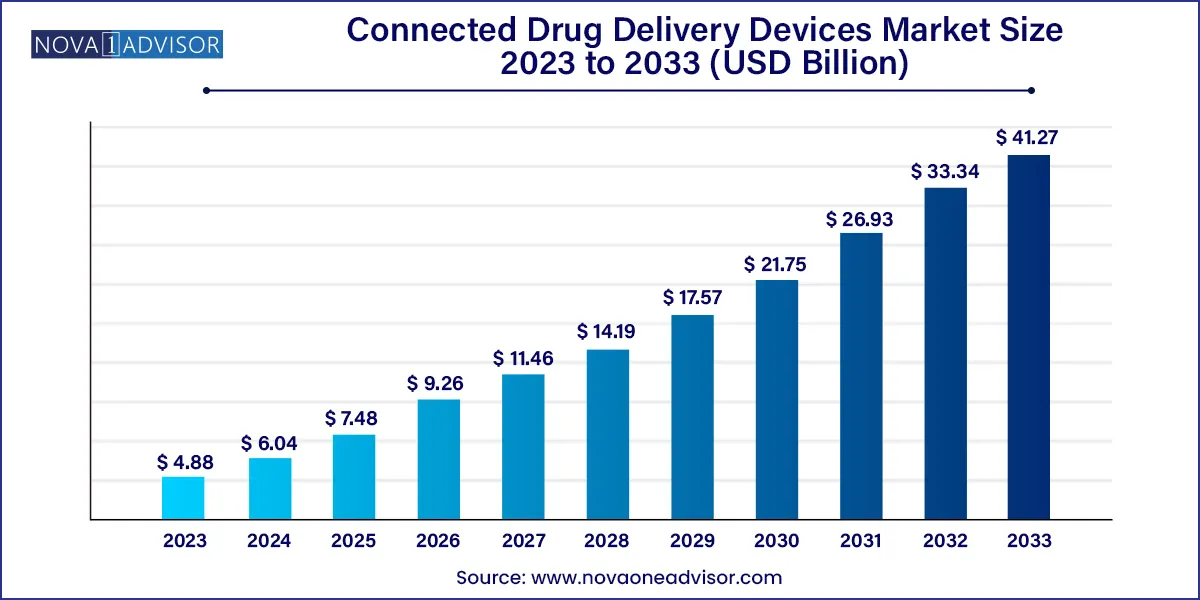

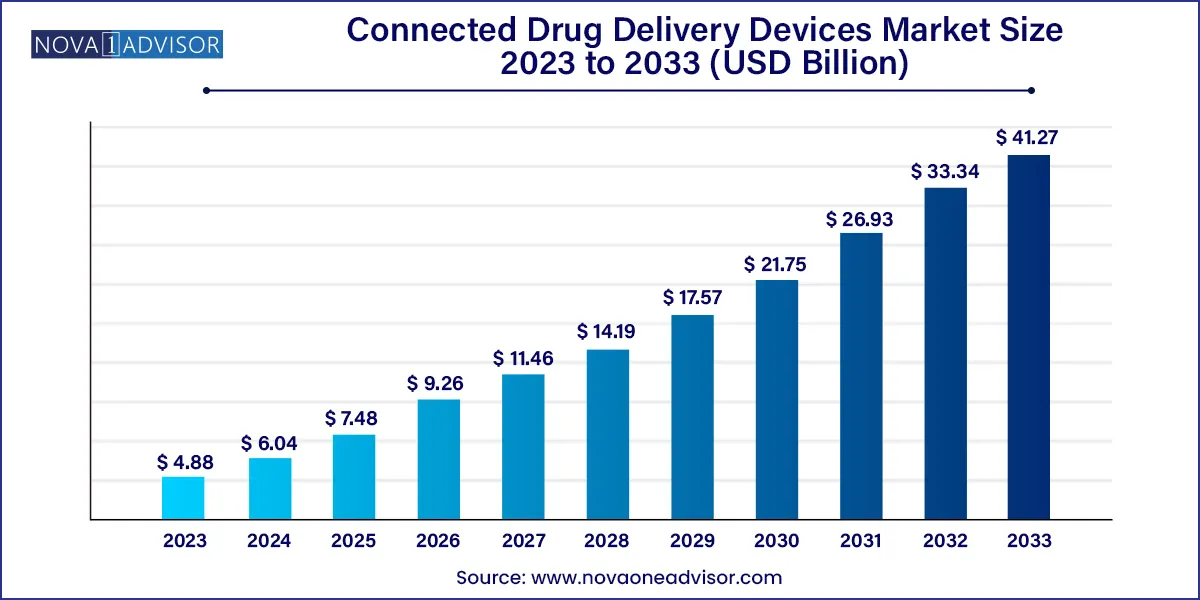

The global connected drug delivery devices market size was exhibited at USD 4.88 billion in 2023 and is projected to hit around USD 41.27 billion by 2033, growing at a CAGR of 23.8% during the forecast period 2024 to 2033.

Key Takeaways:

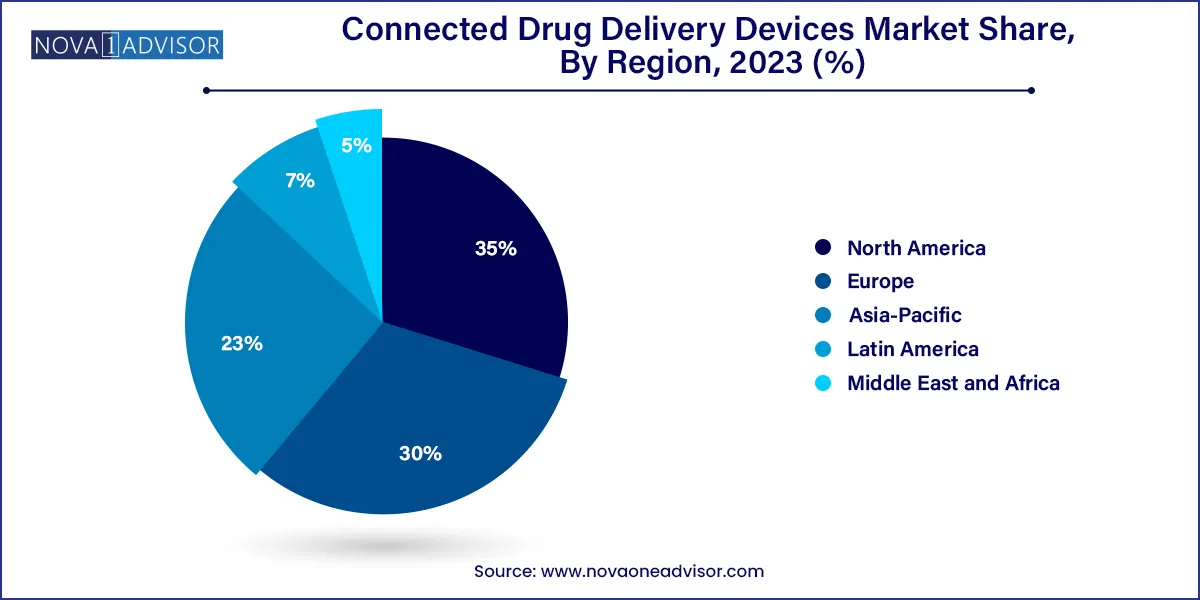

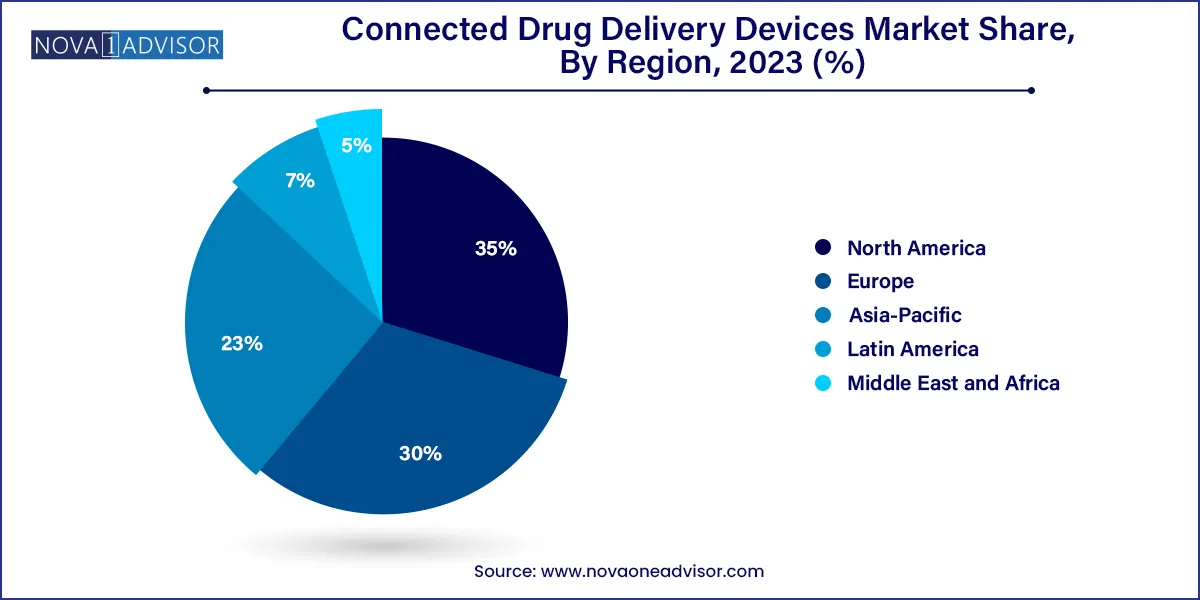

- North America led the global market in 2023 and accounted for a revenue share of over 35% in the year 2023.

- The standalone components and software segment dominated the market in 2023.

- The Parenteral devices segment held the highest share of the market in 2023,

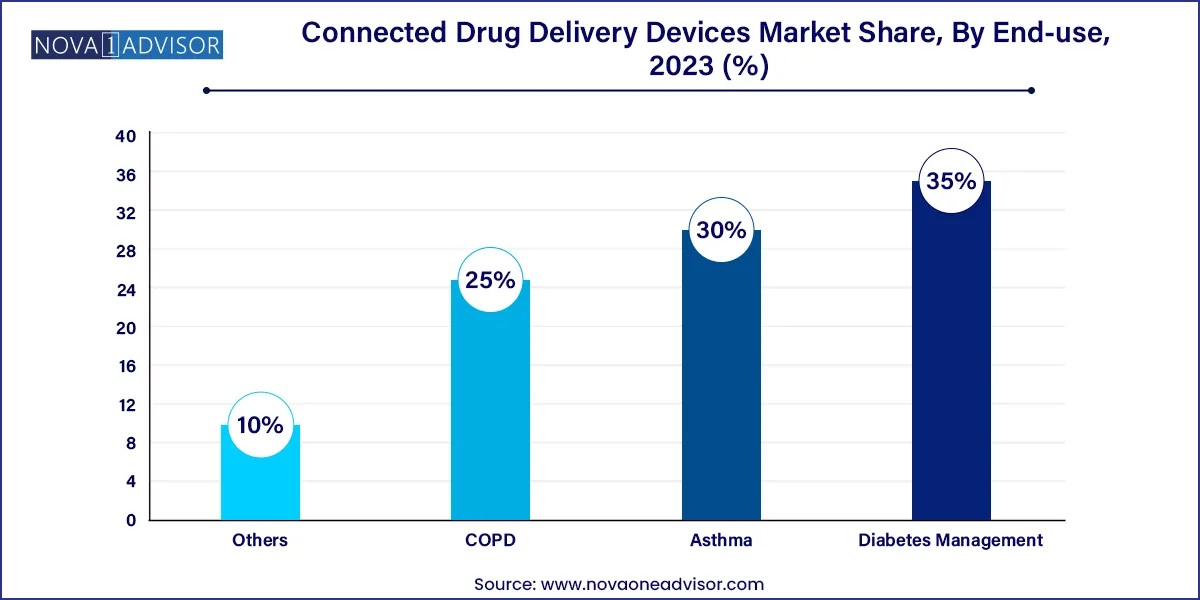

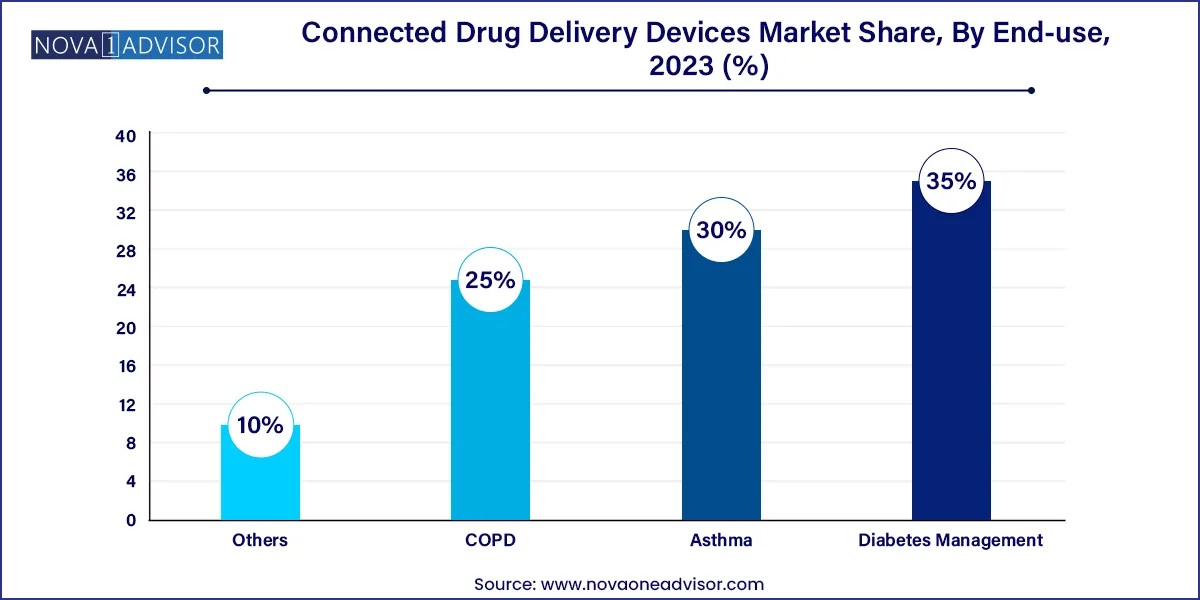

- On the basis of application, Diabetes Management dominated the market with a share of over 35% in 2023.

Market Overview

The connected drug delivery devices market is emerging as a transformative segment within the broader digital health and pharmaceutical landscape. These innovative systems merge traditional drug delivery tools with digital interfaces, sensors, and wireless communication technologies to enable real-time data tracking, personalized dosing, adherence monitoring, and better clinical decision-making. By embedding connectivity features into inhalers, injectors, pens, and wearable drug delivery systems, manufacturers are addressing two of the most persistent challenges in healthcare: non-adherence to prescribed therapy and the need for continuous, real-world data.

As global healthcare systems shift toward value-based care and patient-centered delivery models, connected drug delivery devices are becoming instrumental in improving treatment outcomes. The increasing prevalence of chronic diseases such as asthma, COPD, diabetes, and cardiovascular disorders is pushing demand for devices that can support long-term, self-managed care. Simultaneously, technological advancements in Bluetooth-enabled components, smartphone applications, cloud platforms, and data analytics are supporting the scalability and affordability of these devices.

Regulatory agencies, including the FDA and EMA, are increasingly embracing digital health integration, opening pathways for faster approvals and reimbursement incentives. These regulatory trends, along with growing partnerships between pharmaceutical and technology firms, signal that connected drug delivery devices will be central to the future of personalized medicine.

Major Trends in the Market

-

Increased integration of Bluetooth and NFC in inhalers and injectors

-

Adoption of smart pens and pumps in diabetes management

-

Partnerships between medtech and digital health companies to enable connected platforms

-

Cloud-based remote patient monitoring becoming standard in chronic disease care

-

Development of AI-enabled adherence tracking features in apps and wearables

-

Inclusion of connected features in clinical trials for real-time data capture

-

Growing use of inhalational and parenteral routes for at-home chronic therapies

-

Increased focus on regulatory pathways for software-as-a-medical-device (SaMD)

Connected Drug Delivery Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.04 Billion |

| Market Size by 2033 |

USD 41.27 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 23.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Route Of Administration, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Teva Respiratory, LLC; Novo Nordisk A/S; Phillips-Medisize, LLC; Medtronic; Adherium Limited; Tandem Diabetes Care, Inc.; Biocorp; Propeller health; Ypsomed AG; Aptar Pharma |

Market Driver: Rising Prevalence of Chronic Diseases and Self-administered Therapies

A principal driver of the connected drug delivery devices market is the rising burden of chronic diseases, which require long-term management and frequent dosing. According to the CDC, approximately 60% of adults in the U.S. have at least one chronic condition. Inhalers for asthma and COPD, insulin pens for diabetes, and wearable injectors for autoimmune diseases are now integral to outpatient care.

Traditional delivery systems face significant challenges related to adherence, especially in diseases requiring daily medication. Connected devices solve this by sending reminders, recording doses, and sharing adherence data with caregivers and healthcare providers. For instance, connected inhalers embedded with sensors can alert patients when doses are missed and send performance feedback, improving both behavior and outcomes. This fusion of digital tech with therapeutics enhances patient engagement and ensures accountability in chronic care.

Market Restraint: Data Privacy and Cybersecurity Concerns

While connected drug delivery devices offer significant benefits, they also bring forth serious concerns regarding data security and patient privacy. Devices often transmit sensitive health information such as medication schedules, biometric parameters, and behavioral data to cloud-based servers or mobile applications. Without robust encryption and cybersecurity infrastructure, these data streams are vulnerable to breaches, misuse, or unauthorized access.

Healthcare data is among the most targeted by cybercriminals due to its value. Regulatory standards such as HIPAA in the U.S. and GDPR in Europe require compliance frameworks that may be costly and time-consuming for developers. Additionally, patient hesitancy over sharing personal health data can affect user adoption. Ensuring end-to-end security and transparent data use policies is therefore crucial for widespread market growth.

Market Opportunity: Integration with Telehealth and Remote Patient Monitoring

One of the most promising opportunities for connected drug delivery devices lies in their seamless integration with telehealth platforms and remote patient monitoring (RPM) systems. The COVID-19 pandemic drastically accelerated the adoption of virtual care models, highlighting the need for tools that provide accurate, real-time data outside clinical settings. Connected devices meet this demand by enabling physicians to track medication adherence, dosing trends, and therapeutic efficacy without in-person visits.

For example, diabetes patients using connected insulin pens can automatically sync their dosing data to apps that clinicians access during teleconsultations. Similarly, COPD patients using connected inhalers can have their usage data monitored for signs of disease exacerbation. This level of visibility allows for timely interventions, better therapy adjustments, and improved outcomes. As RPM and telehealth become permanent fixtures in healthcare delivery, demand for connected drug delivery solutions is expected to soar.

Segments Insights:

Product Insights

Integrated devices dominate the connected drug delivery devices market, offering all-in-one solutions that combine drug formulation, delivery mechanism, and connectivity features. These are particularly prevalent in asthma and diabetes care, where devices like connected inhalers and insulin pens not only deliver medication but also track dosage and usage patterns. Integration enhances convenience and simplifies the user experience, driving higher adherence and patient satisfaction. The combination of medication and data in a single device also aligns with pharmaceutical company strategies for branded, high-value therapeutic systems.

Standalone components and software are the fastest-growing segment, largely due to their retrofit potential and flexibility. These include add-on sensors, smart caps, and digital sleeves that can be attached to existing drug delivery devices. For instance, Propeller Health’s sensors can be affixed to standard inhalers, converting them into connected devices without altering the medication or its delivery mechanism. This approach reduces development time and regulatory burden while expanding connectivity across legacy device portfolios.

Route Of Administration Insights

Parenteral route dominates the market, especially in chronic conditions such as diabetes, rheumatoid arthritis, and oncology, where self-injectable biologics and insulin delivery devices are common. Devices like smart pens, autoinjectors, and wearable patch pumps are being designed with connectivity features to log injection times, notify users of missed doses, and share logs with caregivers. These tools are transforming at-home care by making parenteral therapy less intimidating and more manageable.

Inhalational devices are the fastest-growing, particularly in respiratory care. Diseases like asthma and COPD require consistent inhalation therapy, and connected inhalers offer a significant advantage by tracking usage patterns and environmental conditions. Companies like Teva Pharmaceuticals and Novartis have launched connected inhalers that integrate with digital platforms for adherence tracking, personalized coaching, and even environmental trigger alerts, making this route highly innovative and fast-evolving.

Application Insights

Asthma and COPD dominate the application segment, due to the chronic and episodic nature of these conditions. Connected inhalers enable not only drug delivery but also monitoring of technique and adherence. This is crucial since improper use of inhalers is a leading cause of treatment failure. Devices in this segment often include sensors that detect actuation, inhalation flow, and dose timing, feeding data to mobile apps that coach patients in real-time. These technologies significantly reduce hospitalizations and emergency visits, justifying their integration into public and private healthcare plans.

Diabetes management is the fastest-growing application, reflecting the global epidemic of type 1 and type 2 diabetes. Connected insulin pens and smart pumps are revolutionizing diabetes care by offering real-time glucose-linked dosing, automated logs, and dosage calculators. Companies such as Medtronic, Novo Nordisk, and Bigfoot Biomedical are developing integrated systems that combine continuous glucose monitors (CGMs) with connected delivery tools. These platforms empower users with insights and alerts that simplify insulin therapy and improve glycemic control.

Regional Insights

North America is the dominant region in the connected drug delivery devices market, driven by high digital health adoption, robust reimbursement models, and strong collaborations between tech firms and healthcare providers. The presence of major industry players and supportive regulatory agencies like the FDA also facilitates faster product approvals. The U.S. healthcare landscape, with its emphasis on remote care, chronic disease management, and personalized medicine, provides fertile ground for market expansion.

Asia-Pacific is the fastest-growing region, buoyed by increasing healthcare digitization, rising chronic disease prevalence, and supportive government initiatives in countries like China, India, Japan, and South Korea. The region is witnessing rapid uptake of mobile health technologies and remote monitoring tools. Additionally, the growth of local medtech startups and partnerships with global pharma companies is accelerating the rollout of connected devices across urban and semi-urban populations.

Some of the prominent players in the Connected drug delivery devices market include:

- Teva Respiratory, LLC

- Novo Nordisk A/S

- Phillips-Medisize, LLC

- Medtronic

- Adherium Limited

- Tandem Diabetes Care, Inc.

- Biocorp

- Propeller health

- Ypsomed AG

- Aptar Pharma

Recent Developments

-

In April 2025, Teva Pharmaceuticals expanded its Digihaler line with a new integrated sensor inhaler for COPD.

-

In February 2025, Novo Nordisk announced FDA clearance of its connected insulin pen compatible with digital health platforms.

-

In December 2024, Propeller Health partnered with a major insurer to provide smart inhaler access as part of a chronic care management plan.

-

In October 2024, Medtronic launched its next-generation insulin pump with integrated Bluetooth and cloud monitoring.

-

In August 2024, Adherium Ltd. received CE mark approval for its new Hailie® sensor, designed for asthma medication adherence.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global connected drug delivery devices market.

Product Type

- Standalone Components & Software

- Integrated Devices

Route of Administration

Application

- Asthma

- COPD

- Diabetes Management

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)