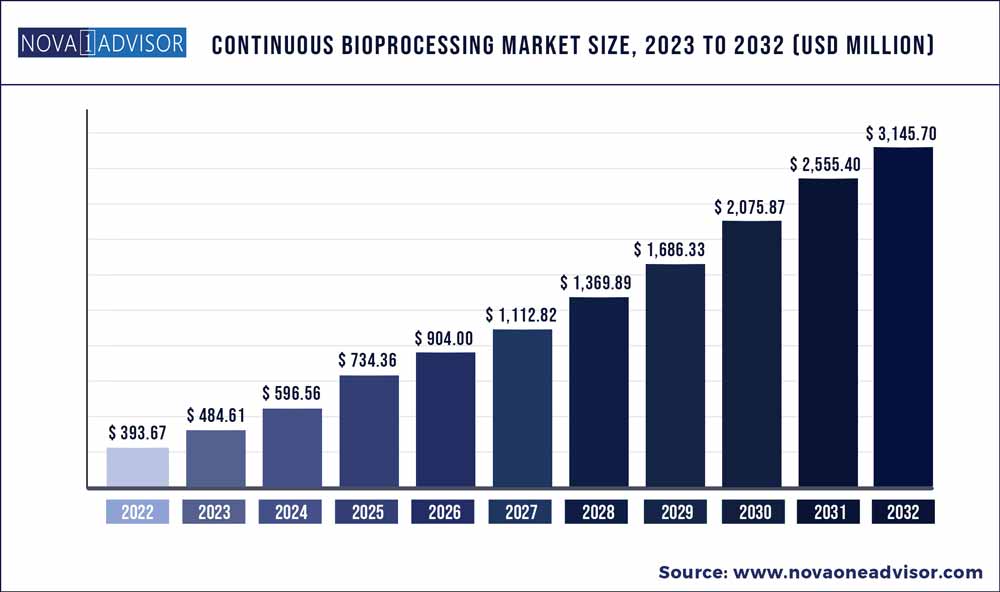

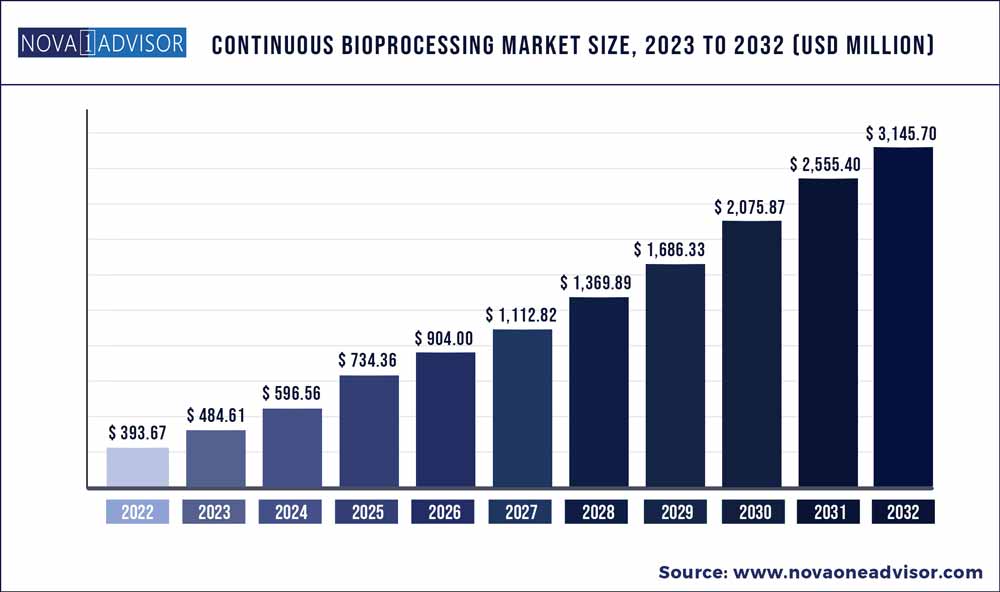

The global continuous bioprocessing market size was exhibited at USD 393.67 million in 2022 and is projected to hit around USD 3145.7 million by 2032, growing at a CAGR of 23.1% during the forecast period 2023 to 2032.

Key Pointers:

- Based on product, the filtration systems and consumables commanded the largest share of the market in 2022.

- Based on application, the continuous bioprocessing market is segmented into commercial and R&D. The R&D segment is expected to grow at the highest CAGR.

- In 2022, the pharmaceutical and biotechnology companies segment accounted for the largest share of the market.

Continuous bioprocessing involves manufacturing biopharmaceuticals where continuous unit operations are physically connected with minimal hold volume. Some of the major factors driving the growth of this market include the growing demand for biopharmaceuticals, technological developments in continuous bioprocessing, product launches in the area of continuous bioprocessing, and global initiatives supporting the adoption of biopharmaceuticals. The growing shift towards the bioprocess 4.0 industry, growing opportunities in developing countries, and rising preference for personalized medicine are expected to create significant market growth opportunities.

Continuous Bioprocessing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 484.61 Million |

| Market Size by 2032 |

USD 3,145.7 million |

| Growth Rate from 2023 to 2032 |

CAGR of 23.1% |

| Base year |

2022 |

| Forecast period |

2023 to 2032 |

| Segments covered |

Product, Application, End User |

| Regional scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key companies profiled |

3M (U.S.), Cytiva (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Merck KGaA (Germany), Sartorius AG (Germany), Repligen Corporation (U.S.), Eppendorf AG (Germany), Applikon Biotechnology (Netherlands), Pall Corporation (U.S.), and Bionet (Spain). |

The global biosimilars market is fast-growing and possesses strong economic value. Pricing for biosimilars is usually 30-50% lower than that of biologics. This cost advantage gives greater access to biosimilars, further lowering the health expenditure in many countries. As per the Center for Medical Economics and Innovation at the Pacific Research Institute (PRI), U.S., expanding the use of biosimilars to treat serious illnesses like autoimmune diseases or cancer can help reduce the out-of-pocket spending by 17% for the patient.

Between 2017-2024, it is projected that near about biologics worth USD 100 billion will go off patent, creating opportunities for the biosimilars. The U.S. FDA is expecting the review of over 66 biosimilars as 66 biologics are going off-patent between 2020 and 2025. Knowing the high potential in the biosimilars business, market players such as Mylan N.V (U.S.), Biocon Limited (India), and Aurobindo Pharma Limited (India) are investing in biosimilars. Growing developments in the space of biosimilars are further fueled by supportive initiatives across various countries worldwide.

In February 2020, the U.S. FDA transitioned to a new regulatory pathway to boost the competition between biological products. The U.S. FDA and the Federal Trade Commission (FTC) signed a joint statement regarding enhanced collaboration to support a robust marketplace for biological products like biosimilars and interchangeable products.

China and India are among the leading countries in terms of the development and commercialization of biosimilars. The Chinese government offers multiple initiatives facilitating the development and adoption of biosimilars. The Marketing Authorization Holder (MAH) pilot scheme was launched in China, allowing license holders to sell drugs in China using a contract manufacturer, driving innovations and accelerating the speed at which international companies can introduce products in China, facilitating the growth of CDMOs. Such initiatives are driving the adoption of biosimilars globally, thereby positively impacting the demand for continuous bioprocessing technologies.

Growing advances in proteomic and genomic sciences have boosted the emergence of personalized therapies. The wave of personalized medicines has entered a mainstream clinical approach, changing the identification, classification, or treatment of diseases. The recognition for personalized medicines is growing among the policymakers, driving the innovative approaches of developing and producing personalized therapies. Continuous bioprocessing and greater accuracy through data analytics and monitoring allow for higher concentrations of next-generation biologics drug dosages, enabling more personalized and effective medicines in potentially smaller/less frequent administration and dosages.

With the pharmaceutical industry moving towards the development of personalized therapies, new manufacturing approaches are being adopted to meet the growing market demand. Advancing continuous bioprocessing has emerged as one of the innovative approaches for manufacturing therapies cost-effectively and on a relatively small scale, offering multiple advantages.

Some of the prominent players in the Continuous Bioprocessing Market include:

- 3M (U.S.),

- Cytiva (U.S.),

- Thermo Fisher Scientific, Inc. (U.S.),

- Merck KGaA (Germany),

- Sartorius AG (Germany),

- Repligen Corporation (U.S.),

- Eppendorf AG (Germany),

- Applikon Biotechnology (Netherlands),

- Pall Corporation (U.S.),

- Bionet (Spain).

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Continuous Bioprocessing market.

By Product

- Filtration Systems and Consumables

- Chromatography Systems and Consumables

- Bioreactors

- Sterilizers

- Centrifuges

- Incubators and Shakers

- Mixing Systems

- Cell Culture Media, Buffers, and Reagents

- Other instruments and consumables

By Application

- Commercial

- Vaccines

- mAb production

- Recombinant Protein Production

- Cell and Gene Therapy Production

- R&D

By End User

- Pharmaceutical and Biotechnology Companies

- Contract Development and Manufacturing Organizations and Contract Research Organizations

- Academic and Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)