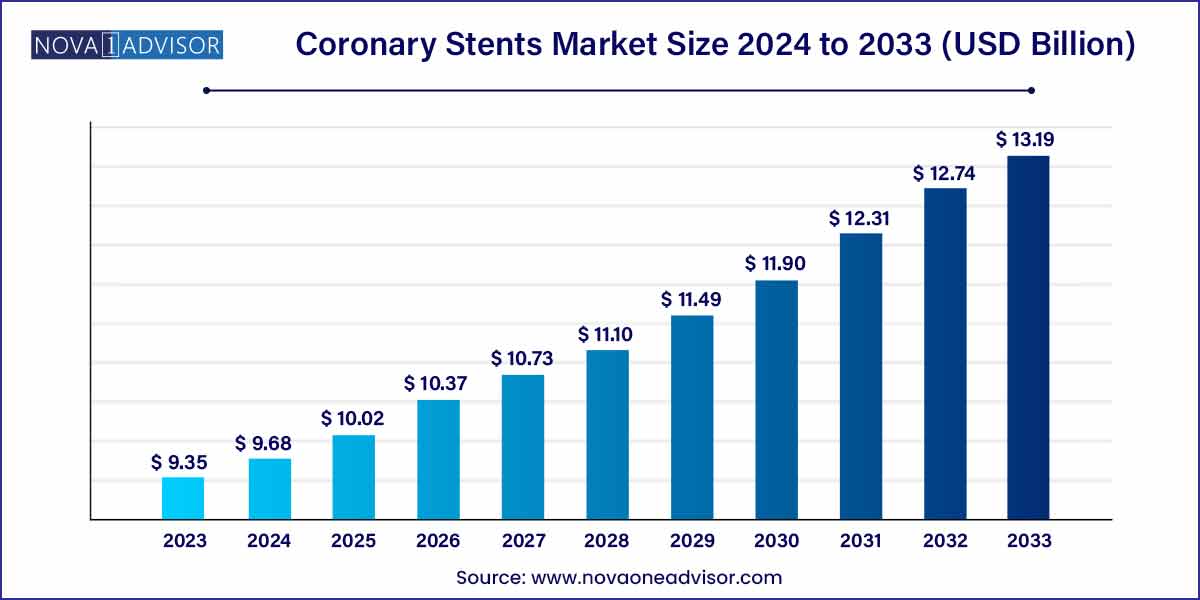

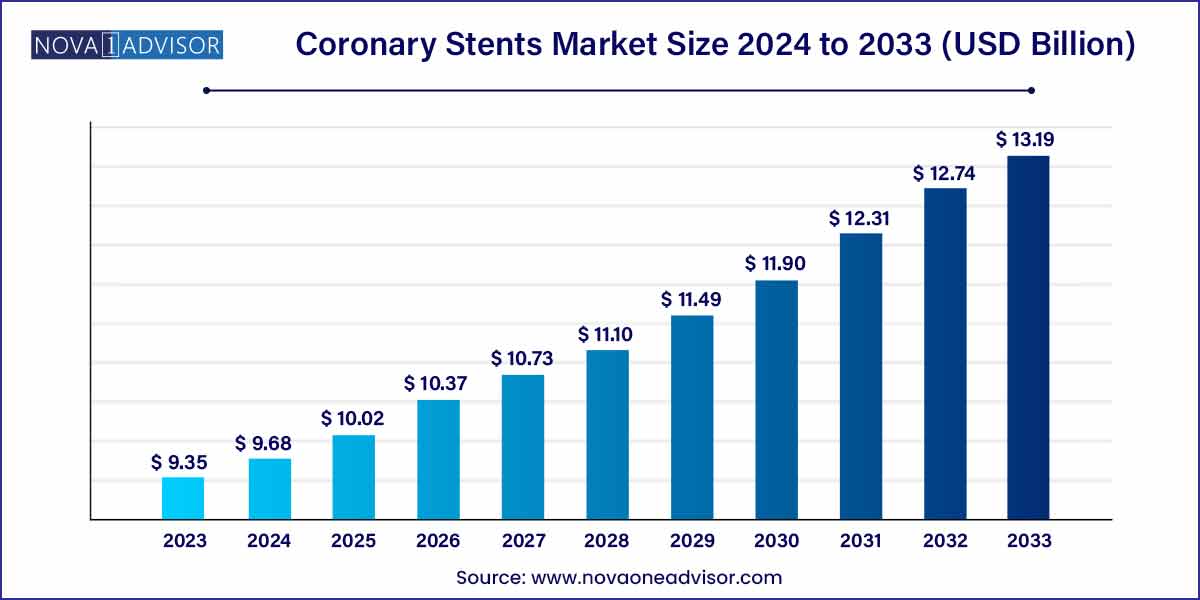

The global coronary stents market size was exhibited at USD 9.35 billion in 2023 and is projected to hit around USD 13.19 billion by 2033, growing at a CAGR of 3.5% during the forecast period of 2024 to 2033.

Key Takeaways:

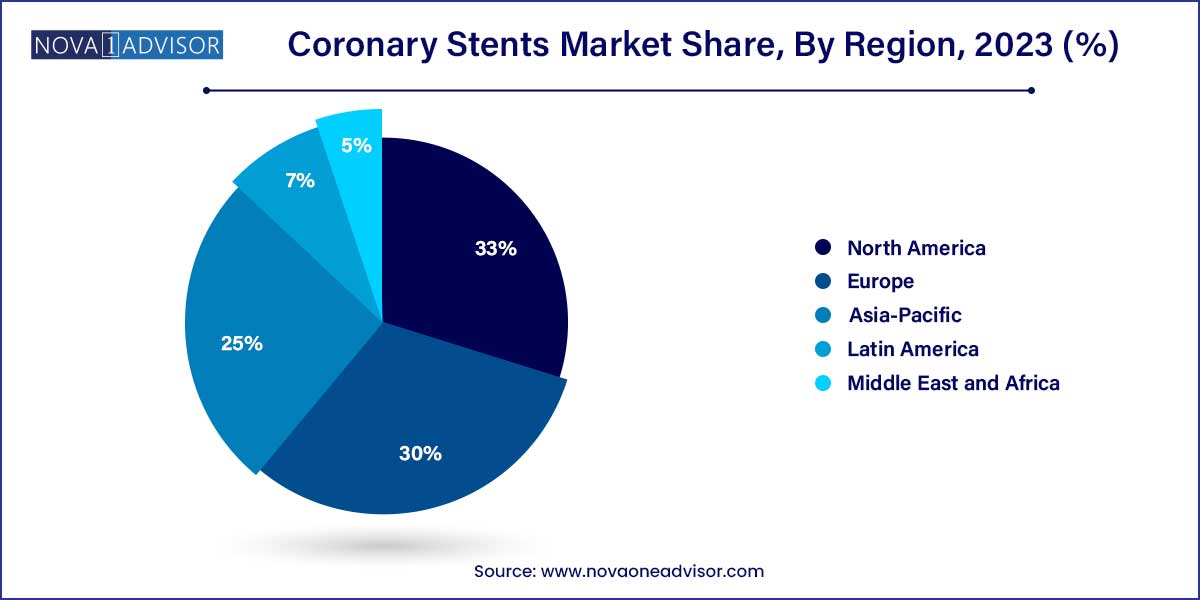

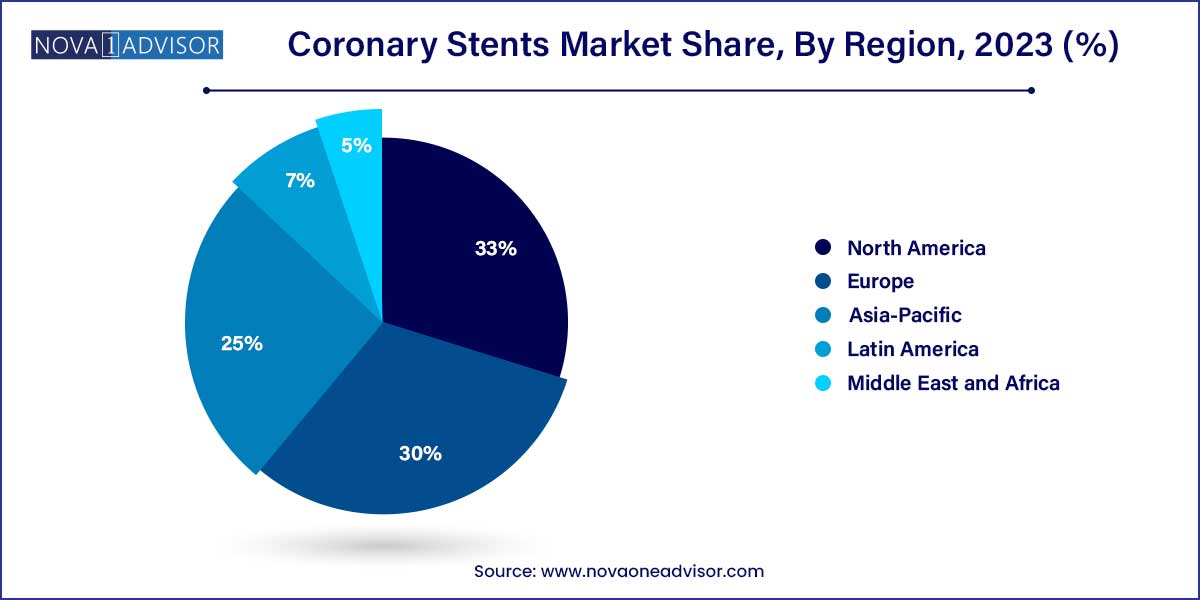

- North America dominated the coronary stents market and accounted for the largest revenue share of 33.0% in 2023 and is anticipated to witness the same trend over the foreseeable future.

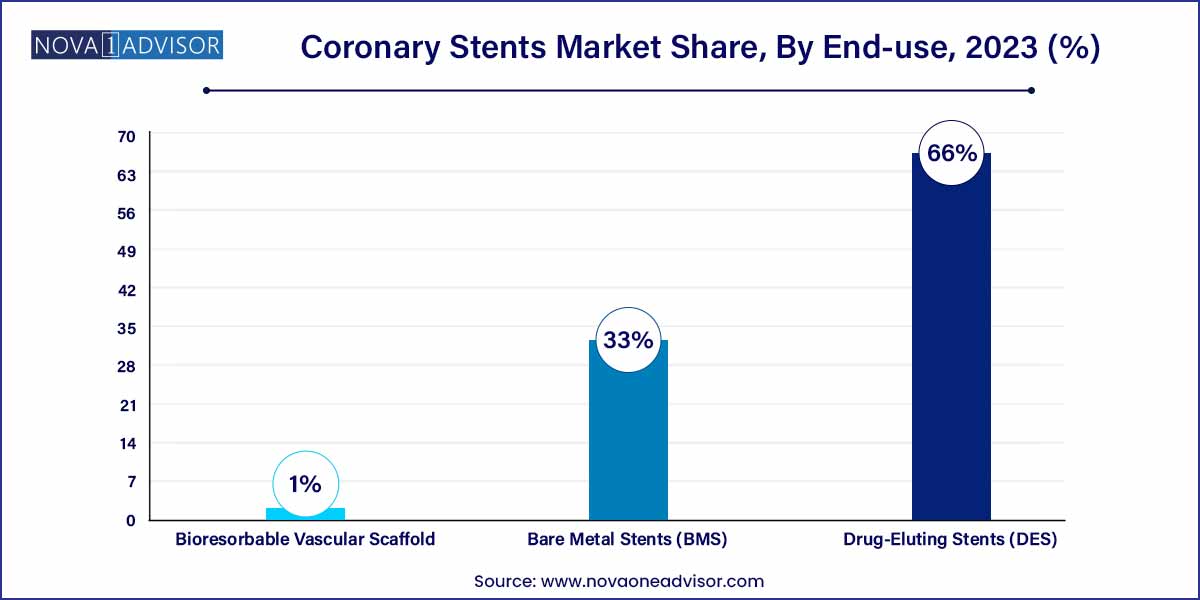

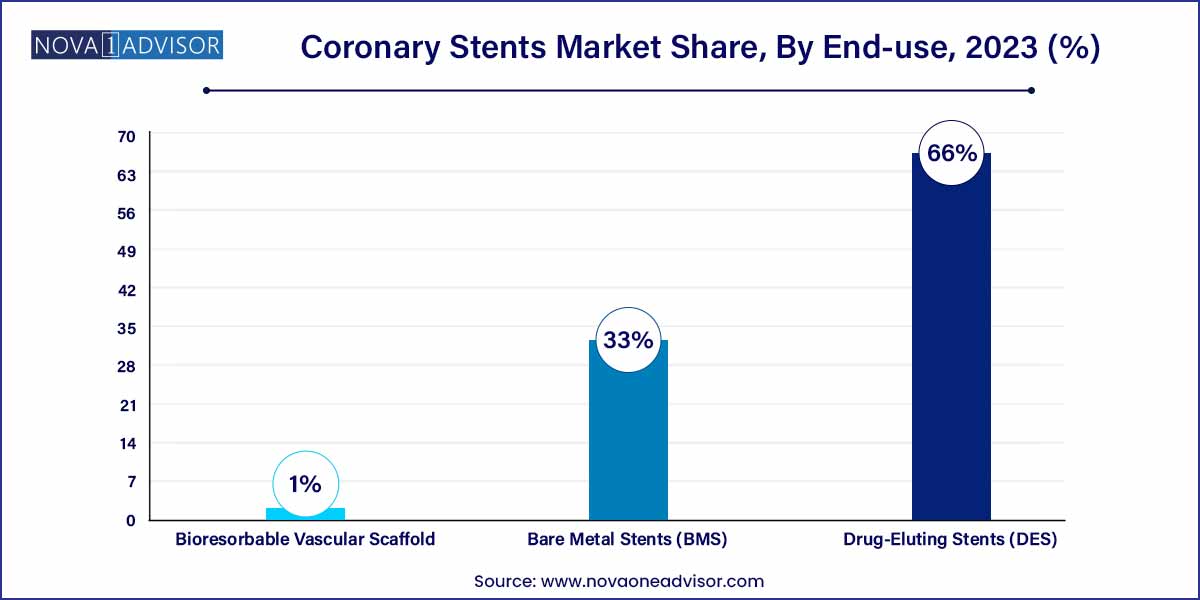

- The Drug-Eluting Stents (DES) segment dominated the market for coronary stents and held the largest revenue share of 66.5% in 2023.

Coronary Stents Market: Overview

The coronary stents market plays a pivotal role in cardiovascular care, offering innovative solutions for the treatment of coronary artery disease. This overview aims to provide insights into the key dynamics, trends, and factors shaping the coronary stents market landscape.

Coronary Stents Market Growth

The growth of the coronary stents market is driven by several key factors. Firstly, the rising prevalence of cardiovascular diseases, notably coronary artery disease, fuels demand for coronary stents as a primary treatment modality. With the increasing incidence of risk factors such as hypertension, diabetes, and obesity, the need for coronary interventions, including percutaneous coronary intervention (PCI), is on the rise. Moreover, advancements in stent technology, particularly the development of drug-eluting stents (DES), have significantly improved patient outcomes by reducing rates of restenosis and repeat revascularization procedures compared to bare-metal stents (BMS). Additionally, the growing adoption of minimally invasive procedures and increasing awareness of preventive cardiovascular care further contribute to the market growth.

Coronary Stents Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.35 Billion |

| Market Size by 2033 |

USD 13.19 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abbott; Medtronic; Boston Scientific Corporation; Terumo Corporation; B Braun Melsungen AG; Biotronik; Stentys SA; MicroPort Scientific Corporation; C. R. Bard, Inc.; Cook Medical |

Coronary Stents Market Dynamics

- Technological Advancements and Innovation:

A key dynamic shaping the coronary stents market is the continuous advancement of technology and innovation in stent design and materials. Manufacturers are constantly developing new generations of coronary stents with enhanced features such as thinner struts, biocompatible coatings, and novel drug delivery systems. These technological advancements aim to improve stent deliverability, conformability, and biocompatibility, thereby reducing the risk of restenosis and thrombosis and improving long-term clinical outcomes for patients. Additionally, the emergence of bioresorbable stents, which gradually dissolve over time, offers a promising alternative to traditional metallic stents by potentially restoring vessel function and minimizing long-term complications associated with permanent implants.

- Regulatory Landscape and Clinical Evidence Requirements:

Another significant dynamic influencing the coronary stents market is the regulatory landscape and clinical evidence requirements governing stent approval and market access. Regulatory bodies worldwide impose stringent requirements for the safety, efficacy, and quality of coronary stents, necessitating comprehensive preclinical testing and clinical trials to demonstrate product performance and patient outcomes. Moreover, the regulatory landscape is constantly evolving, with changes in regulatory requirements, guidelines, and standards impacting the approval process and market entry for new stent technologies. Additionally, the importance of generating robust clinical evidence, including randomized controlled trials and long-term follow-up data, to support the safety and effectiveness of coronary stents cannot be overstated.

Coronary Stents Market Restraint

- Pricing Pressures and Healthcare Cost Containment Measures:

One notable restraint in the coronary stents market is the pricing pressures exerted by healthcare payers and purchasing organizations. The high cost of coronary stents, particularly drug-eluting stents (DES), may pose financial challenges for healthcare systems, insurers, and patients, leading to increased scrutiny and negotiation over pricing and reimbursement rates. Moreover, healthcare cost containment measures, such as bundled payment models and value-based reimbursement initiatives, further intensify pricing pressures on medical device manufacturers, impacting profit margins and pricing strategies. Additionally, the presence of multiple players in the coronary stents market intensifies competition, driving down prices and limiting opportunities for price differentiation.

- Competition from Alternative Treatment Modalities:

Another significant restraint in the coronary stents market is competition from alternative treatment modalities for coronary artery disease, such as coronary artery bypass grafting (CABG) surgery and medical therapy. While coronary stents offer minimally invasive treatment options for patients with coronary artery disease, CABG surgery remains a viable alternative for certain patient populations, particularly those with complex coronary lesions or multivessel disease. Additionally, advancements in medical therapy, including optimal medical management with antiplatelet agents, statins, and lifestyle modifications, may reduce the need for coronary interventions in some cases. Moreover, the emergence of novel treatment modalities, such as bioresorbable scaffolds and external counterpulsation therapy, further diversifies the treatment landscape for coronary artery disease, posing challenges for market penetration and adoption of coronary stents.

Coronary Stents Market Opportunity

- Emerging Markets and Untapped Patient Populations:

One prominent opportunity in the coronary stents market lies in the expansion into emerging markets and reaching previously untapped patient populations. Emerging economies, particularly in Asia-Pacific, Latin America, and the Middle East, exhibit growing healthcare infrastructure and increasing prevalence of cardiovascular diseases, presenting significant market potential for coronary stent manufacturers. Moreover, there is a considerable proportion of underserved patient populations in these regions who lack access to advanced cardiovascular care and interventions, creating opportunities for market penetration and addressing unmet medical needs.

- Technological Innovation and Personalized Medicine:

Another significant opportunity within the coronary stents market is technological innovation and the advancement of personalized medicine approaches. Rapid advancements in stent technology, including the development of bioresorbable stents, bioactive coatings, and drug-eluting platforms, offer opportunities for improving stent efficacy, safety, and long-term outcomes for patients. Additionally, the integration of advanced imaging modalities, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), into stent implantation procedures enables more precise stent selection, sizing, and optimization of stent deployment. Furthermore, the advent of personalized medicine approaches, including genetic testing and biomarker profiling, holds promise for identifying patient-specific factors influencing stent response and optimizing treatment strategies tailored to individual patient needs.

Coronary Stents Market Challenges

- Thrombosis and Restenosis:

One notable challenge in the coronary stents market is the occurrence of thrombosis and restenosis following stent implantation. Despite advancements in stent technology, there remains a risk of thrombotic events, including stent thrombosis, acute myocardial infarction, and ischemic stroke, particularly in the early post-implantation period. Additionally, restenosis, characterized by the re-narrowing of the treated vessel due to neointimal hyperplasia, remains a significant clinical concern, especially with bare-metal stents (BMS). While drug-eluting stents (DES) have demonstrated superior outcomes in reducing restenosis rates compared to BMS, there are still instances of late or very late stent thrombosis and restenosis, necessitating ongoing surveillance and management strategies.

- Complications and Adverse Events:

Another significant challenge facing the coronary stents market is the occurrence of complications and adverse events associated with stent implantation procedures. Despite advancements in procedural techniques and stent technology, there remains a risk of procedural complications, including access site bleeding, vascular injury, and contrast-induced nephropathy. Moreover, stent-related complications, such as stent malapposition, edge dissection, and stent fracture, can occur during or after stent implantation, leading to suboptimal clinical outcomes and the need for additional interventions. Additionally, patient factors, such as comorbidities, renal impairment, and advanced age, may increase the risk of adverse events and complicate the management of coronary stent patients.

Segments Insights:

Product Insights

The Drug-Eluting Stents (DES) segment dominated the market for coronary stents and held the largest revenue share of 66.0% in 2023. The continued advancement and launch of new devices are important factors in strengthening DES's dominance as the preferred device for PCI procedures. The competitors in the market continue to develop and launch technologically advanced DES, such as some of the notable launches are Abbott Laboratories Laboratories' XIENCE Skypoint, Medtronic's Resolute Onyx, and Boston Scientific's Synergy. In comparison to the previous generation devices, these newer-generation DES provide greater stent integrity, higher deliverability, and lower complication rates.

According to the National Library of Medicine (NLM) in February 2023,when compared to bare metal stents, drug-eluting stents (DES) displayed higher effectiveness. The design of stent platforms is continually being improved to maximize efficacy and safety, particularly due to the demand for more complicated lesions and difficult patients being treated. Constant DES development comprises the employment of novel scaffold materials, new design types, enhanced overexpansion capacities, new polymer coatings, and improved antiproliferative agents.

The bioresorbable vascular scaffold segment is expected to be the second fastest growing segment due to its several advantages in treating coronary artery disease including temporary placement in the patient heart, ease for future treatments as it degrades over 3 years, and it dissolve completely in the patient body. According to CDC analysis, the most prevalent kind of heart disease is the coronary heart disease in the U.S., claimed 375,476 lives in 2021. Such factors are expected to drive the segment growth over the forecast period.

The bare metal stents (BMS) segment is expected to have a steady growth rate over the coming year. Considering growing competition for the BRS and DES device types, the BMS has become less appealing to competitors due to low technological barriers to entry and clinical evidence demonstrating BMS's inferiority to DES. The BMS stent type managed to maintain its foothold in the market in 2023, owing to factors such as its low device cost.

Regional Insights

North America dominated the coronary stents market and accounted for the largest revenue share of 33.0% in 2023 and is anticipated to witness the same trend over the foreseeable future. A sedentary lifestyle resulting in obesity and other cardiovascular diseases such as heart attack, stroke, ischemic heart diseases (IHD), etc., are primarily driving the market in North America. Technological advancements in coronary stent technologies, such as Drug-eluting stents and the use of biodegradable materials, have further augmented the market growth. The presence of mature market players such as Medtronic, Abbott & Boston Scientific is fueling market growth in this region.

The Asia-Pacific market for coronary stents is expected to exhibit the fastest growth rate in terms of revenue generation. This market is driven by some additional variables of enhanced screening for CAD, economic growth, regulatory updates, and notable beneficial reimbursement in some the countries such as Australia and South Korea. Increased government investment in healthcare and conducting new initiatives to bring in devices at affordable prices in cost constraint markets such as India and China are influencing this market as well. For instance, in China, to address inflated pricing and other issues in the delivery of expensive medical supplies, the Chinese government launched a centralized procurement scheme for high-value medical consumables in January 2021. The government aims to use this initiative to skip the associated suppliers and buy the items straight from the manufacturers, lowering the inflated pricing. As a result, the cost of coronary stents has dropped dramatically in China. The average price of coronary stents has been reduced by 93% since 2019 to grab the national tender.

Some of the prominent players in the coronary stents market include:

- Abbott

- Medtronic

- Boston Scientific Corporation

- Terumo Corporation

- B Braun Melsungen AG

- Biotronik

- Stentys SA

- MicroPort Scientific Corporation

- C. R. Bard, Inc.

- Cook Medical

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global coronary stents market.

Product

- Bare Metal Stents (BMS)

- Drug-Eluting Stents (DES)

-

- Biodegradable

- Non-Biodegradable

- Bioresorbable Vascular Scaffold

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)