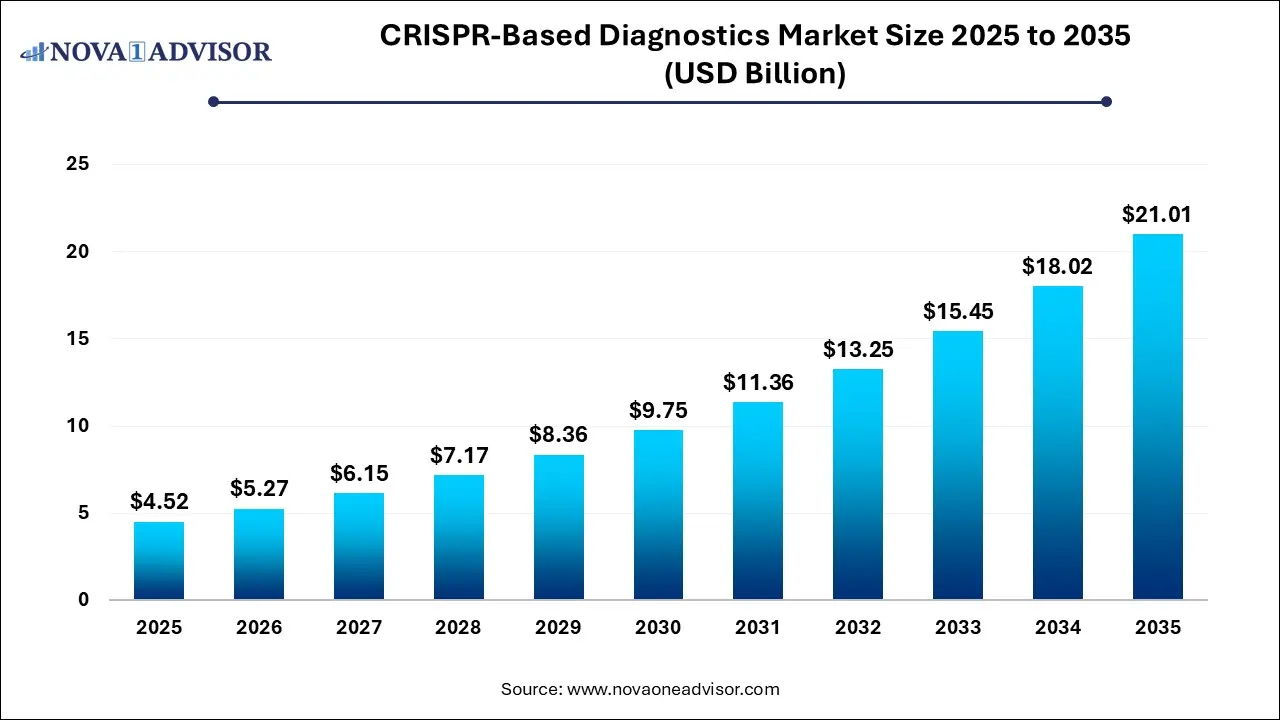

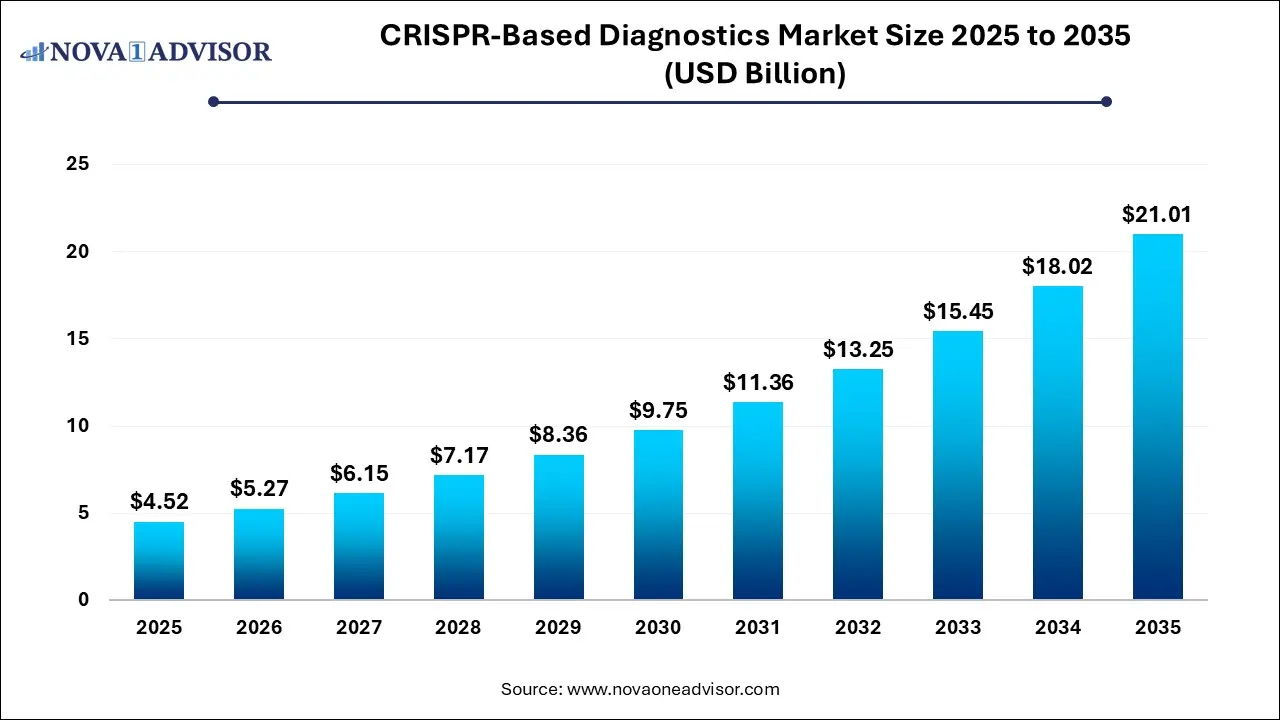

CRISPR-Based Diagnostics Market Size and Growth

The CRISPR-based diagnostics market size was exhibited at USD 4.52 billion in 2025 and is projected to hit around USD 21.01 billion by 2035, growing at a CAGR of 16.61% during the forecast period 2026 to 2035.

Key Takeaways:

- In 2025, kits and reagents led the market with a 62%.

- The software and libraries segment is projected to expand at a CAGR of 17.12% over the forecast period

- The Cas9 segment secured the dominant market share in 2025.

- The infectious disease diagnostics held the largest market share of 53% in 2025.

- Laboratories are expected to dominate the market in 2025 with share of 44%.

Market Overview

The CRISPR-based diagnostics market represents a transformative frontier in molecular diagnostics, integrating gene-editing technology with rapid, sensitive, and specific detection of pathogens and genetic mutations. CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats) systems, particularly those based on Cas9, Cas12, and Cas13 enzymes, have evolved from genome editing tools into powerful platforms for diagnostic applications. The ability of CRISPR-associated enzymes to target and cleave nucleic acids with exceptional precision has led to the development of novel diagnostic techniques that can identify infectious diseases, genetic disorders, and cancer biomarkers with unprecedented speed and accuracy.

The market has gained traction in recent years due to the global urgency to enhance diagnostic capabilities, especially during pandemics like COVID-19. The CRISPR diagnostic ecosystem includes a diverse set of products, from enzymes and reagent kits to bioinformatics software and data libraries. With increasing investments in life sciences and biotechnology, and rising demand for point-of-care testing (POCT), CRISPR diagnostics are being incorporated into clinical workflows and research protocols across hospitals, laboratories, and pharmaceutical companies.

Emerging economies, growing disease burden, and innovations in CRISPR platforms such as SHERLOCK and DETECTR have expanded commercial potential. Partnerships between academia and biotech firms are driving product pipelines, regulatory approvals, and market entry strategies. As the healthcare industry shifts toward precision medicine, CRISPR-based diagnostics are poised to redefine the landscape of early disease detection and personalized care.

Major Trends in the Market

-

Proliferation of Point-of-Care CRISPR Test Kits: Companies are increasingly developing CRISPR-based POCT kits, especially for respiratory viruses like COVID-19 and influenza, enabling decentralized testing.

-

Integration with Microfluidics and Paper-based Platforms: The convergence of CRISPR diagnostics with lab-on-a-chip and paper strip technologies enhances accessibility in resource-limited settings.

-

Adoption in Oncology Diagnostics: Rising use of CRISPR-based assays for identifying tumor mutations and guiding immunotherapy strategies is boosting demand.

-

Open-Source and Cloud-Based Bioinformatics Platforms: Several companies are releasing open-access software and cloud tools for CRISPR assay design and data analysis.

-

Growing CRISPR Licensing Deals: Startups are licensing CRISPR patents from universities and research institutes, fostering commercial product development.

-

Expansion in Veterinary and Agricultural Diagnostics: CRISPR-based tools are being tailored for detecting pathogens in livestock and crops, creating new market avenues.

-

Government Funding for CRISPR R&D: National research agencies are allocating grants to academic institutions for CRISPR-based diagnostic research.

-

Collaborations Between Diagnostic Giants and CRISPR Startups: Established diagnostic firms are acquiring or collaborating with CRISPR innovators to enter the molecular diagnostics segment.

Report Scope of CRISPR-based Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 5.27 Billion |

| Market Size by 2035 |

USD 21.01 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 16.61% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Technology, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Integrated DNA Technologies, Inc.; Molbio Diagnostics; Horizon Discovery; Synthego Corporation; Mammoth Biosciences; Sherlock Biosciences; Caribou Biosciences; CrisprBits; ToolGen Inc. |

Market Driver: Rising Incidence of Infectious Diseases

One of the primary drivers of the CRISPR-based diagnostics market is the escalating prevalence of infectious diseases globally. Emerging pathogens, antimicrobial resistance, and recurring epidemics are challenging the capacity of traditional diagnostic systems. CRISPR’s ability to detect specific nucleic acid sequences in real time offers a game-changing solution for infectious disease management. The COVID-19 pandemic provided a significant boost to the visibility and utility of CRISPR diagnostics. Technologies like SHERLOCK (developed by Sherlock Biosciences) and DETECTR (developed by Mammoth Biosciences) demonstrated the feasibility of deploying rapid, portable, and scalable CRISPR tests for SARS-CoV-2. This driver is not limited to pandemics CRISPR platforms are being used to diagnose tuberculosis, Zika, and even antibiotic resistance genes. As health systems move toward proactive screening and containment, CRISPR diagnostics will remain vital.

Market Restraint: Regulatory and Validation Challenges

Despite the scientific enthusiasm, regulatory hurdles pose a significant challenge to CRISPR-based diagnostics. Unlike conventional diagnostic technologies, CRISPR-based tools must navigate uncharted regulatory pathways that evaluate gene-editing components for safety, specificity, and reproducibility. Regulatory bodies like the FDA, EMA, and others require rigorous clinical validation, data transparency, and standardized protocols for CRISPR diagnostics, which can delay commercialization. Additionally, issues such as false positives, off-target effects, and lack of consensus on quality control standards can hinder mass adoption. For many emerging companies, regulatory compliance demands high capital investment and specialized expertise, creating a barrier to entry and slowing market growth.

Market Opportunity: Personalized Medicine and Genomic Surveillance

The integration of CRISPR diagnostics into personalized medicine presents a significant opportunity. These diagnostics can be tailored to detect patient-specific mutations or genetic risk factors, enabling early disease prediction and customized treatment plans. In oncology, for example, CRISPR-based tests can identify BRCA1/2 mutations or KRAS variants to guide targeted therapies. Moreover, CRISPR diagnostics are revolutionizing genomic surveillance, especially in epidemiology and public health. By monitoring pathogen evolution in near real-time, CRISPR platforms help detect mutations in viruses like influenza or SARS-CoV-2, enhancing outbreak response. The scalability and affordability of CRISPR-based tools make them ideal for deployment in population-wide genomic screening programs, positioning the technology at the forefront of future healthcare innovation.

Segmental Analysis

Product Outlook

Kits and reagents dominated the product segment, accounting for the largest revenue share. These products are essential components in CRISPR diagnostic assays and are widely used in both research and clinical settings. The growing demand for ready-to-use, standardized reagent kits that include CRISPR-Cas components, buffers, and detection molecules has fueled this segment’s growth. Diagnostic developers often prefer these kits for their ease of integration into workflows and reduced risk of variability, which is especially important in clinical diagnostics. Key players have introduced pathogen-specific kits, such as SARS-CoV-2 detection panels, contributing to mass testing capabilities.

Software and libraries are projected to be the fastest-growing segment during the forecast period. With increasing reliance on data analytics, machine learning, and AI-driven assay optimization, the role of computational tools has grown. These solutions assist researchers and clinicians in designing CRISPR guide RNAs, minimizing off-target effects, and automating assay result interpretation. Startups and academic labs are also developing shared libraries of validated CRISPR sequences, accelerating innovation across the ecosystem. As CRISPR-based diagnostics scale up, robust software platforms will be vital to ensure precision and reproducibility.

Technology Outlook

Cas9 technology held the largest market share due to its foundational role in the CRISPR revolution. Initially developed for genome editing, Cas9's versatility in binding and cleaving DNA has been adapted for diagnostics. Cas9-based assays have found application in detecting single nucleotide polymorphisms (SNPs) and other genomic alterations linked to inherited diseases and cancer. Its robust scientific background and availability of supporting literature have made Cas9 the go-to system for academic and clinical developers.

Cas12 is expected to exhibit the fastest growth, attributed to its unique ability to cleave single-stranded DNA in a collateral manner upon target recognition. This mechanism underpins the SHERLOCK and DETECTR platforms, enabling fluorescent and lateral-flow-based detection formats. Cas12’s efficiency in signal amplification and multiplexing positions it as an ideal candidate for point-of-care and field applications. Its growing use in COVID-19 and other infectious disease diagnostics is a testament to its expanding relevance in commercial applications.

Application Outlook

Infectious disease diagnostics dominated the application segment, driven by the urgent global need for rapid and accurate detection of pathogens. CRISPR’s ability to identify viral and bacterial DNA or RNA with high specificity makes it a frontline technology in combating public health threats. During the COVID-19 pandemic, CRISPR-based assays received emergency use authorizations in multiple countries, validating their efficacy in real-world settings. Emerging infectious threats such as monkeypox and Ebola have further accelerated investment in this segment.

Cancer diagnostics are anticipated to witness the fastest growth due to increasing demand for liquid biopsies, early detection tools, and companion diagnostics in oncology. CRISPR platforms are being employed to identify tumor-specific mutations, DNA methylation patterns, and fusion genes in bodily fluids. The technology’s potential for non-invasive, real-time cancer monitoring offers significant clinical advantages. As precision oncology becomes standard practice, CRISPR diagnostics will play a key role in stratifying patients and tailoring treatments.

End-use Outlook

Hospitals and clinics dominated the end-use segment, leveraging CRISPR diagnostics for rapid decision-making in patient care. These institutions benefit from CRISPR’s minimal equipment needs, allowing deployment even in emergency and intensive care settings. The ability to reduce turnaround times and improve diagnostic accuracy aligns with hospital goals for improved outcomes and reduced operational costs.

Pharmaceutical and biotechnology companies are the fastest-growing end-users, driven by their adoption of CRISPR diagnostics in drug development pipelines, clinical trials, and biomarker validation. These companies are integrating CRISPR assays into R&D protocols for screening gene targets and assessing therapeutic responses. With the rise of gene and cell therapies, the demand for high-precision diagnostics to monitor genetic integrity and treatment efficacy is set to increase.

Regional Analysis

North America dominated the CRISPR-based diagnostics market, holding the largest revenue share due to advanced healthcare infrastructure, substantial R&D funding, and a high concentration of biotechnology firms. The U.S. is home to pioneering companies such as Sherlock Biosciences and Mammoth Biosciences, which have received both venture capital and regulatory support for CRISPR diagnostic platforms. In addition, collaboration between research institutions like the Broad Institute and Stanford University with startups accelerates innovation. Favorable regulatory pathways, particularly the FDA’s support for emergency use authorizations, further strengthen North America’s leadership in this space.

Asia Pacific is the fastest-growing regional market, fueled by increased investments in genomics, expanding biotechnology sectors in China, India, and South Korea, and government support for diagnostic innovation. For instance, China has made CRISPR research a national priority, with several universities and startups developing indigenous diagnostic platforms. The region’s large population and disease burden, especially in infectious and chronic diseases, offer vast market opportunities. Furthermore, low manufacturing costs and growing adoption of POCT devices in rural healthcare settings are accelerating regional expansion.

Recent Developments

-

January 2025 – Sherlock Biosciences announced the launch of its CRISPR-powered SHERLOCK Select platform, optimized for at-home and decentralized testing of respiratory infections, including influenza and RSV.

-

December 2024 – Mammoth Biosciences entered into a strategic collaboration with Illumina, aiming to integrate CRISPR diagnostics with next-generation sequencing workflows for oncology diagnostics.

-

September 2024 – Caspr Biotech, a CRISPR diagnostics startup based in Argentina, received funding from the World Bank to expand its COVID-19 and dengue virus test kits across Latin America.

-

July 2024 – Indian biotech firm CrisprBits launched its CRISPRDx platform, the first indigenously developed CRISPR diagnostic toolkit approved by Indian regulatory authorities for infectious disease detection.

-

March 2024 – The U.K. government granted £5 million to a consortium including Oxford University for developing rapid CRISPR diagnostics for antimicrobial resistance surveillance.

Some of The Prominent Players in The CRISPR-based diagnostics market Include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Enzymes

- Kits and Reagents

- Software and Libraries

By Technology

By Application

- Infectious Disease Diagnostics

- Genetic Disorder Diagnostics

- Cancer Diagnostics

- Others

By End-use

- Hospitals and Clinics Diagnostic

- Laboratories

- Pharmaceutical and Biotechnology Companies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)