The global custom procedure kits market size was exhibited at USD 6.69 billion in 2023 and is projected to hit around USD 18.93 billion by 2033, growing at a CAGR of 10.96% during the forecast period of 2024 to 2033.

.jpg)

Key Takeaways:

- Disposables held the largest market share of around 56.60% in 2023.

- The orthopedic segment held the largest market share of 19.52% in 2023.

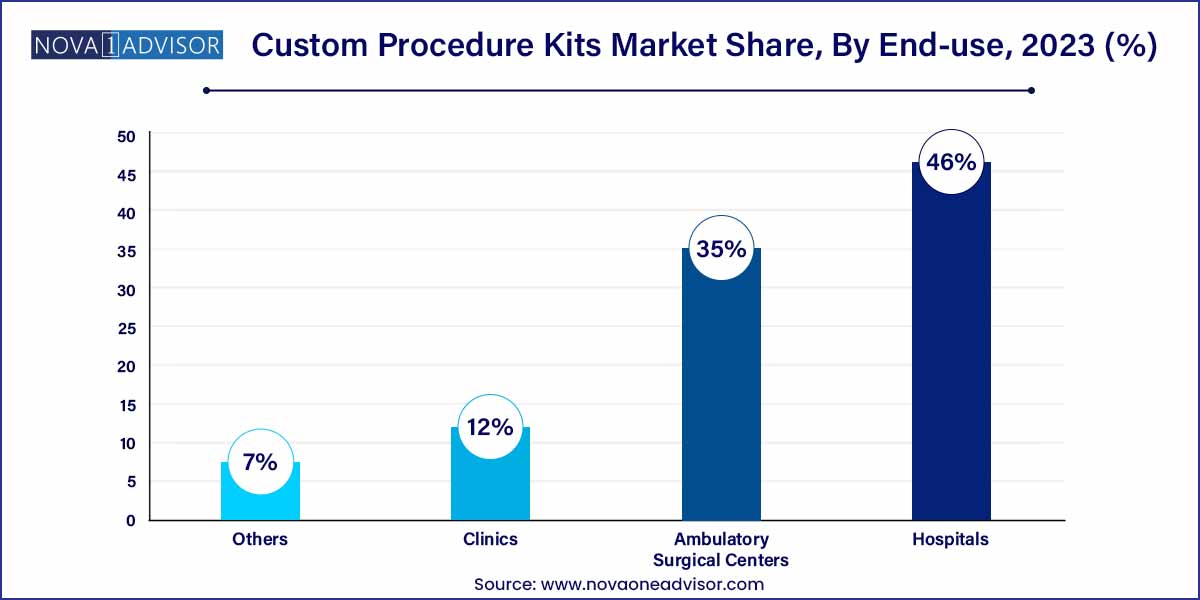

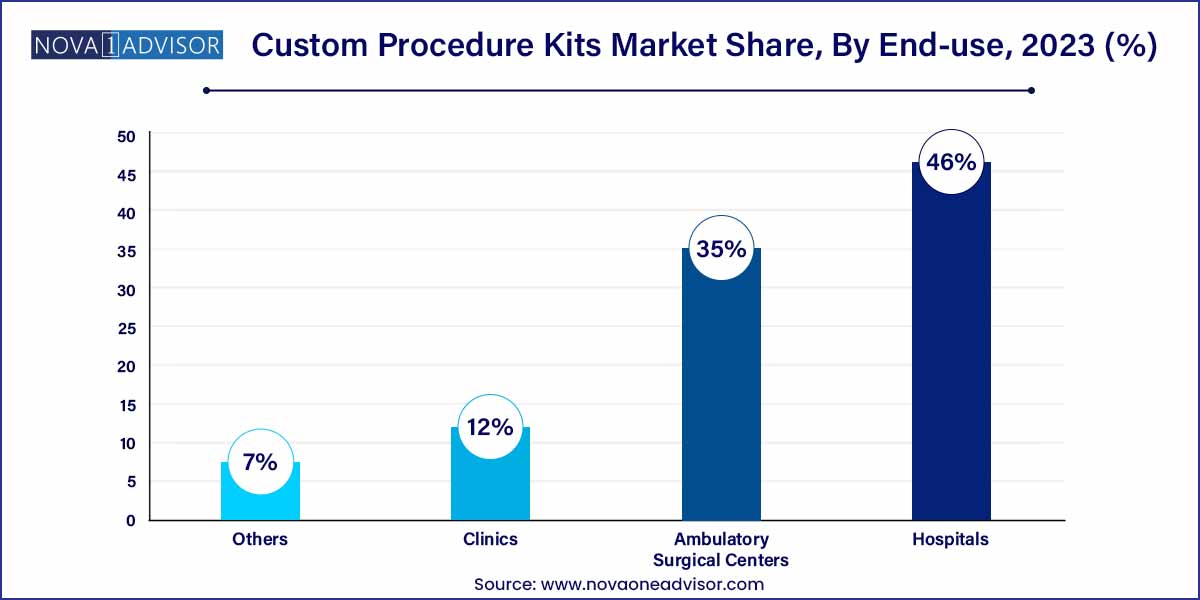

- Hospitals held the largest market share of around 46.0% in 2023.

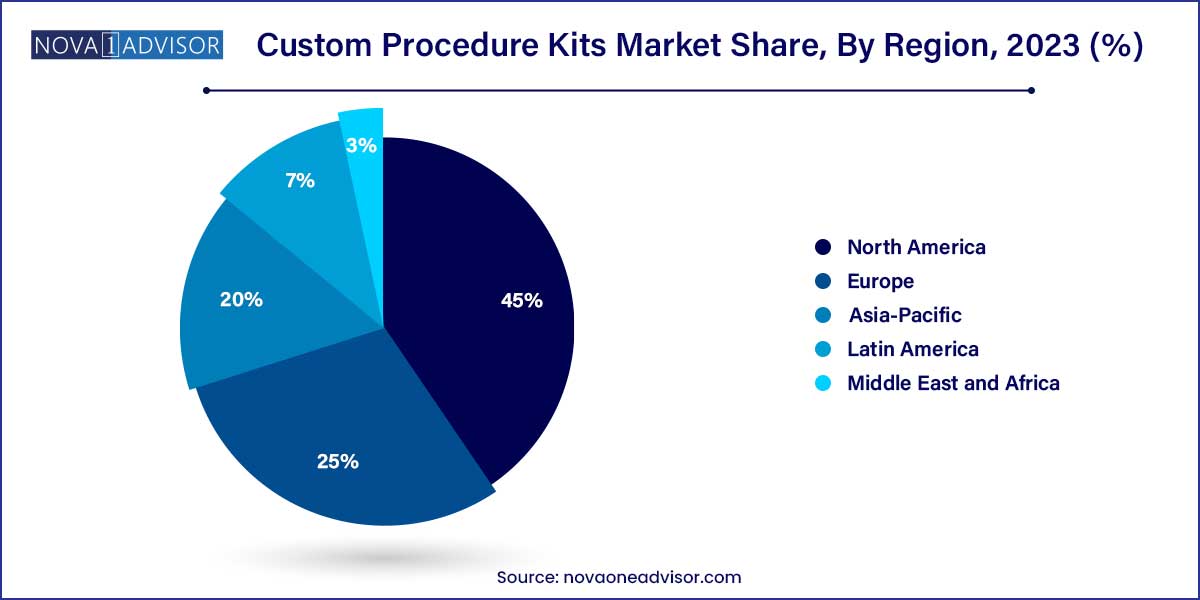

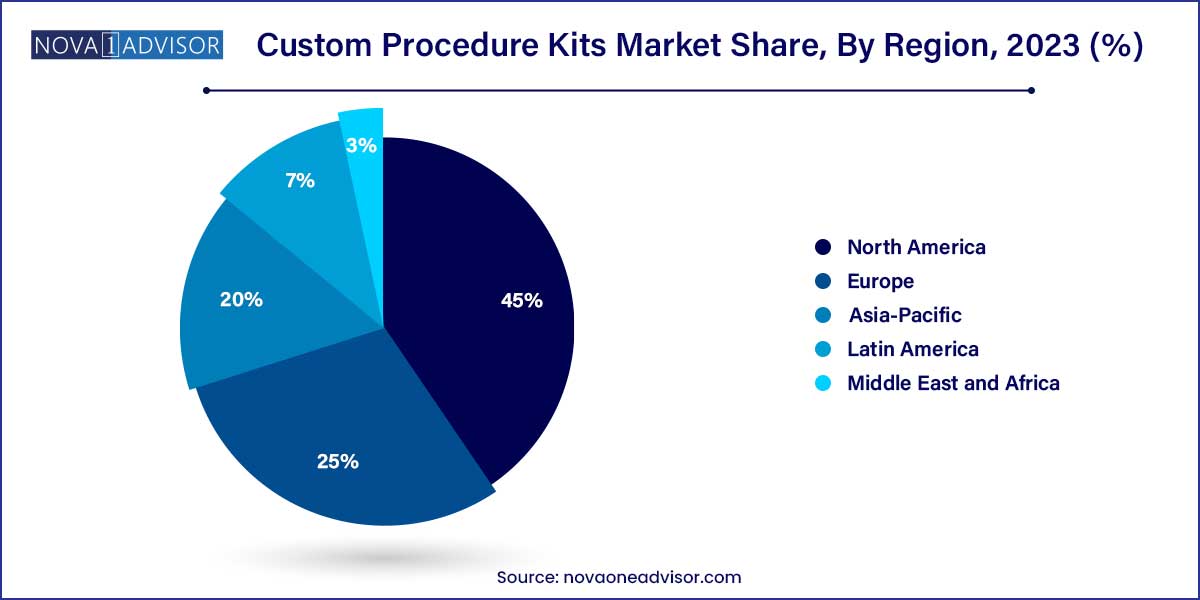

- North America held the largest market share of around 45.0% in 2023.

- Asia-Pacific is expected to exhibit the fastest growth during the forecast period.

Market Overview

The custom procedure kits market represents a critical evolution in the surgical and interventional landscape, offering healthcare providers a streamlined, cost-effective, and highly efficient approach to preparing for and executing medical procedures. These kits, which are tailored to specific surgical needs, contain pre-selected, sterilized instruments, disposables, and drapes arranged in a procedure-specific sequence. Custom procedure kits (CPKs) enhance operational efficiency, reduce surgical setup time, and ensure clinical consistency making them indispensable across modern operating rooms and ambulatory care settings.

The increasing complexity of surgical procedures, pressure to reduce hospital-acquired infections, and ongoing demand for cost containment have driven a substantial uptick in the adoption of CPKs. Furthermore, the rise in chronic conditions, surgical volumes, and minimally invasive procedures is fueling demand for customized surgical solutions that minimize waste, simplify logistics, and improve patient outcomes.

As of 2024, the global custom procedure kits market is valued at approximately USD 10 billion and is projected to grow at a compound annual growth rate (CAGR) exceeding 7% through 2030. North America remains the largest market due to its established healthcare infrastructure and adoption of advanced surgical protocols. Meanwhile, Asia-Pacific is emerging as the fastest-growing region due to expanding surgical capacity, increasing investments in healthcare automation, and the growing penetration of outpatient procedures.

Major players in the market such as Medline Industries, Owens & Minor, Cardinal Health, and Molnlycke are focusing on product optimization, automation, and regional expansion to strengthen their global footprint.

Major Trends in the Market

-

Growing Preference for Single-Use, Disposable Surgical Kits: Hospitals are shifting toward disposable kits to reduce cross-contamination risks and improve infection control compliance.

-

Rising Adoption in Ambulatory Surgical Centers (ASCs): ASCs are increasingly leveraging CPKs to accelerate procedure turnover and maximize space efficiency.

-

Integration of Digital Scanning and Inventory Management: RFID-enabled kits and barcoding systems are helping hospitals track usage, inventory levels, and reordering cycles.

-

Demand for Customization Based on Surgeon Preference: Surgeons are requesting procedure kits that reflect their specific workflows, reducing intra-operative delays.

-

Sustainability-Focused Kit Design: Manufacturers are exploring recyclable materials and biodegradable packaging to address growing environmental concerns.

-

Growth of Robotic and Minimally Invasive Surgery Applications: Custom kits are evolving to support laparoscopic and robotic-assisted surgery instruments.

-

Expansion into Emerging Markets: Localized assembly and kit customization are increasing in Asia and Latin America, targeting cost-sensitive healthcare systems.

-

Mergers and Partnerships for Facility Expansion: Companies are investing in new assembly and sterilization facilities to improve turnaround and regional responsiveness.

Custom Procedure Kits Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.69 Billion |

| Market Size by 2033 |

USD 18.93 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.96% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Procedure, End-User, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Mölnlycke Health Care; Medline Industries; Teleflex Incorporated; Owens & Minor; Medtronic; Cardinal Health; McKesson Corporation; Smith’s Medical (ICU Medical; Inc.); Terumo Cardiovascular Systems Corporation; Santex S.p.A. |

Market Driver: Increasing Demand for Surgical Efficiency and Infection Control

A primary driver for the custom procedure kits market is the intensifying global focus on surgical efficiency and infection prevention. Operating rooms are among the most resource-intensive environments in hospitals, with procedures requiring coordination between surgical teams, nurses, and sterilization units. Custom procedure kits offer a proven method to reduce set-up time, ensure that all necessary instruments are available, and decrease the risk of human error.

In addition, infection control has become a top priority particularly post-pandemic with hospitals seeking to minimize touchpoints and reduce potential exposure pathways. Custom kits are sterilized and sealed at the point of manufacture, reducing reliance on in-house sterilization and mitigating risks associated with contamination. The kits are configured to the hospital’s protocol or surgeon’s preference, which also reduces surgical delays and procedure variability.

A case study from a mid-sized U.S. hospital found that switching to custom kits reduced the average orthopedic surgery preparation time by 25%, while decreasing waste by 18%. This operational efficiency, combined with improved clinical outcomes, makes CPKs an increasingly attractive solution for modern healthcare systems.

Market Restraint: High Upfront Costs and Supply Chain Complexity

Despite their long-term benefits, the high initial costs of custom procedure kits and the complexity of managing supply chains pose significant market restraints. Unlike off-the-shelf instruments or generic surgical packs, CPKs require bespoke manufacturing, sterile assembly, and inventory coordination that increase per-unit cost particularly in low-volume settings.

Hospitals and smaller clinics may struggle with the capital investment required for transitioning to a custom kit model, especially in developing economies. Additionally, the customization process itself can be complex and time-consuming, involving coordination between clinical teams, purchasing departments, and manufacturers. Delays in communication or specification errors can result in surgical disruptions or wastage.

Supply chain disruptions, as witnessed during the COVID-19 pandemic, also revealed vulnerabilities in relying on globally dispersed manufacturing models. Sterilization facility bottlenecks, material shortages (e.g., polypropylene), and logistics constraints can delay delivery, leading to surgical backlog or force healthcare providers to revert to manual setups.

Market Opportunity: Expansion into Outpatient and Same-Day Surgery Markets

A compelling opportunity lies in the rapid expansion of outpatient surgical centers and same-day surgery units, especially in developed healthcare systems. With healthcare providers under mounting pressure to reduce inpatient costs and improve surgical throughput, ambulatory surgical centers (ASCs) have become essential in delivering high-quality care at lower cost. These centers demand rapid operating room turnover, minimal setup, and low inventory overhead factors where custom procedure kits offer clear advantages.

Custom kits enable ASCs to conduct standardized, low-complexity procedures such as cataract surgery, hernia repairs, endoscopies, and orthopedic interventions with fewer personnel and better inventory control. As value-based care models proliferate and reimbursement frameworks favor outpatient care, CPKs can play a central role in enhancing procedural efficiency, minimizing downtime, and improving profitability for ASCs.

Manufacturers that can tailor CPKs for outpatient settings emphasizing compact packaging, rapid customization, and lower cost-per-kit models stand to gain substantial market share in this fast-evolving healthcare landscape.

Segmental Analysis

By Product

Disposable custom procedure kits dominate the market, representing the preferred choice for most hospitals and surgical centers due to their sterility, convenience, and infection control benefits. These kits are particularly common in general surgery, ophthalmology, and cardiac procedures, where contamination risks are high and regulatory compliance is strict. Disposable kits offer standardized components and are easily traceable—attributes that align with modern OR safety protocols.

Reusable kits, while less prevalent, are seeing selective uptake in orthopedic and neurosurgery procedures, where high-value instruments and precision devices are required. These kits involve sterilizable trays and tools that can be reused after reprocessing. Although cost-effective over time, their use is limited by higher sterilization overhead, longer turnover times, and greater regulatory scrutiny. As sustainable healthcare practices gain traction, some institutions are exploring hybrid kits—combining disposable consumables with reusable core instruments—to balance cost and ecological impact.

By Procedure Insights

Orthopedic procedures dominate the custom procedure kits market, due to the high volume of joint replacement, spine, and trauma surgeries globally. These procedures are hardware-intensive and benefit greatly from kits that include implants, bone drills, guides, and sterile drapes in a unified format. Orthopedic kits also reduce waste and avoid errors associated with manual assembly of complex surgical components.

Ophthalmology is the fastest-growing procedure segment, driven by a sharp rise in cataract surgeries and LASIK procedures across aging populations. The small footprint, high frequency, and short duration of ophthalmic procedures make them ideal for CPK standardization. Custom kits in this space often include microsurgical blades, viscoelastic solutions, lens cartridges, and disposable instruments simplifying the workflow for surgeons and ensuring compliance with sterile field protocols.

By End-user Insights

Hospitals remain the primary end-users of custom procedure kits, owing to their comprehensive surgical departments, higher case complexity, and need for volume-based efficiencies. Tertiary care hospitals and academic medical centers are the main consumers of large-scale CPK solutions, often collaborating with suppliers to co-develop kits tailored to specialist teams or institutional protocols.

Ambulatory Surgical Centers (ASCs) are the fastest-growing user segment, as outpatient care expands globally. ASCs benefit from compact, procedure-specific kits that reduce inventory burden, cut OR preparation time, and minimize waste. Many ASCs operate on lean staffing models, and custom kits allow them to maintain throughput without compromising safety or quality. The segment is particularly strong in the U.S., where Medicare policies now reimburse a broader range of outpatient surgeries.

By Regional Insights

North America leads the custom procedure kits market, driven by advanced healthcare infrastructure, high surgical volumes, and early adoption of sterile, efficient OR solutions. The U.S. alone accounts for over 40% of the global market, supported by strong demand from hospitals and growing ASC penetration. Companies like Medline, Cardinal Health, and Owens & Minor have well-established supply networks and customized service models catering to American healthcare providers.

The region also benefits from favorable reimbursement policies, regulatory clarity, and strong infection control mandates. Technological integration such as RFID-based inventory tracking and real-time procedure analytics is widely adopted, further driving demand for digitally integrated CPKs.

Asia-Pacific is witnessing the fastest market growth, propelled by rapid expansion in surgical infrastructure, aging populations, and rising incidence of lifestyle diseases. Countries like China, India, and South Korea are investing heavily in building hospitals and surgical centers, while also seeking cost-efficient tools to improve patient throughput.

Growing awareness of infection control, government investments in healthcare digitization, and the expansion of private hospital chains are also fueling the shift toward standardized surgical kits. Local and global manufacturers are establishing assembly hubs and sterilization facilities in Asia to meet regional demand with shorter turnaround times and lower logistics costs.

Some of the prominent players in the Vascular Grafts Market include:

- Mölnlycke Health Care

- Medline Industries

- Teleflex Incorporated

- Owens & Minor

- Medtronic

- Cardinal Health

- McKesson Corporation

- Smith’s Medical (ICU Medical, Inc.)

- Terumo Cardiovascular Systems Corporation

- Santex S.p.A.

Recent Developments

-

March 2024 – Owens & Minor opened a new custom surgical kit assembly facility in Texas, expanding its U.S. footprint and aiming to reduce kit delivery time by 20% in southern states.

-

February 2024 – Medline Industries launched a next-generation custom procedure kit series optimized for ophthalmic and orthopedic surgeries, featuring compact designs and AI-powered usage tracking.

-

January 2024 – Cardinal Health announced a strategic partnership with a leading hospital chain in Canada to co-develop neurosurgical kits that align with local clinical pathways and reduce OR turnover time by 15%.

-

December 2023 – Mölnlycke Health Care expanded its portfolio in Europe with biodegradable packaging options for disposable kits, targeting sustainability-focused hospitals.

-

October 2023 – Becton Dickinson (BD) introduced new urology-focused kits under its CPK line, aimed at increasing efficiency in high-volume ambulatory clinics.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova One Advisors, Inc. has segmented the global vascular grafts market.

Product

Procedure

- Colorectal

- Thoracic

- Orthopedic

- Ophthalmology

- Neurosurgery

- Cardiac Surgery

- Gynecology

- General Surgery

- Urology

- Others

End-user

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)