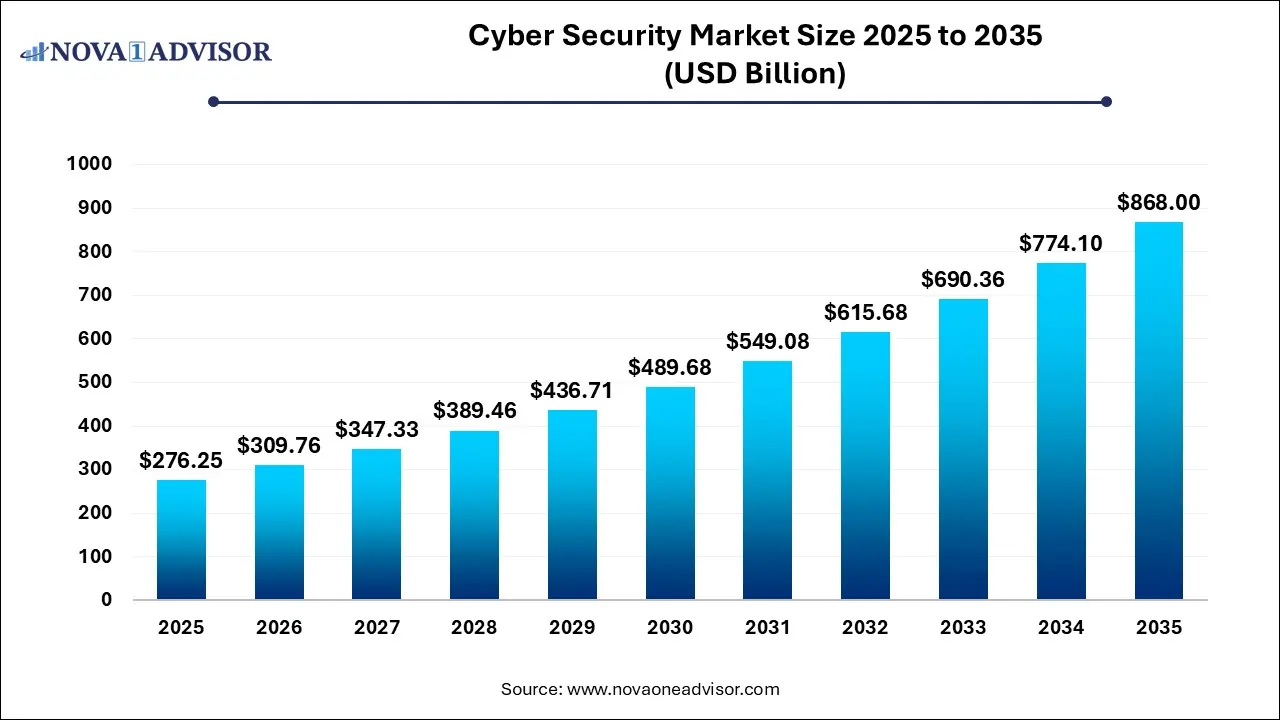

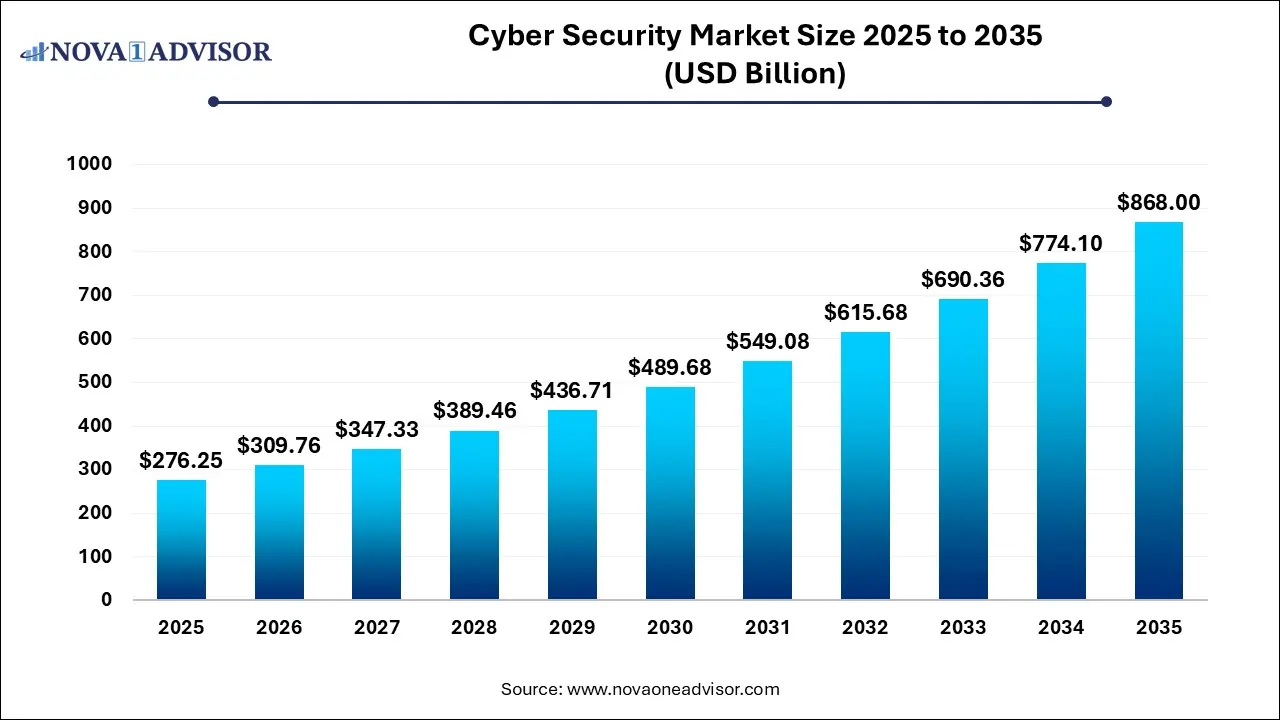

Cyber Security Market Size and Growth

The cyber security market size was exhibited at USD 276.25 billion in 2025 and is projected to hit around USD 868.00 billion by 2035, growing at a CAGR of 12.13% during the forecast period 2026 to 2035.

Cyber Security Market Key Takeaways:

- The hardware segment led the market in 2025, accounting for over 57.0%.

- The infrastructure protection segment accounted for the largest market revenue share in 2025.

- The cloud segment accounted for the largest market revenue share in 2025.

- The large enterprises segment accounted for the largest market revenue share in 2025.

- The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period.

- The Identity and Access Management (IAM) segment accounted for the largest market revenue share in 2025.

- The IT and telecommunications segment accounted for the largest market revenue share in 2025.

- The healthcare segment is anticipated to exhibit the highest CAGR over the forecast period.

- North America cyber security market dominated with a revenue share of over 35.0% in 2025.

Market Overview

The Cyber Security Market is one of the most vital pillars of the global digital economy, serving as a safeguard for organizations, governments, and individuals navigating increasingly complex and hostile cyber environments. As enterprises transition to cloud-native infrastructures, remote workforces, and hyperconnected ecosystems, the attack surface for cyber threats has dramatically widened. From phishing and ransomware to supply chain attacks and insider threats, cybercriminals are exploiting vulnerabilities with unprecedented speed and sophistication.

Cybersecurity solutions now encompass a broad array of technologies, including endpoint security, identity and access management, cloud security, network firewalls, data loss prevention, and threat intelligence platforms. With the global digital transformation accelerating, cybersecurity is no longer a back-office concern but a boardroom priority. Regulatory compliance frameworks such as GDPR (EU), CCPA (US), and APPI (Japan) are also compelling enterprises to implement more robust data governance and incident response protocols.

Enterprises are increasingly turning to AI-powered threat detection, automated response tools, and zero-trust architectures to stay ahead of evolving cyber risks. In parallel, demand for managed services is growing, as resource-strapped organizations seek third-party expertise for 24/7 monitoring, forensics, and recovery. With cyberattacks becoming costlier and more disruptive, the cybersecurity market is expected to witness sustained double-digit growth across all regions and industry verticals.

Major Trends in the Market

-

Rise of Zero Trust Architecture: Organizations are shifting from perimeter-based defense to "never trust, always verify" models to prevent lateral movement of threats.

-

Cloud-native Security Solutions: As cloud adoption grows, cloud security posture management (CSPM) and secure access service edge (SASE) are in high demand.

-

Artificial Intelligence and Automation: AI and ML are used to detect anomalies, automate incident response, and enable behavioral analytics.

-

XDR and Consolidated Threat Detection: Extended Detection and Response (XDR) platforms unify telemetry across endpoints, networks, and clouds.

-

Cyber Insurance Integration: Businesses are increasingly investing in cyber insurance as part of risk management strategies.

-

DevSecOps Integration: Security is being embedded earlier into development pipelines to mitigate vulnerabilities in production environments.

-

Cybersecurity Skills Shortage: The talent gap is driving demand for managed services, automation tools, and cybersecurity training platforms.

Report Scope of Cyber Security Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 309.76 Billion |

| Market Size by 2035 |

USD 868.00 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.13% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Offering, Security, Deployment, Organization Size, Solution, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Fortinet, Inc.; IBM Corporation; Microsoft; BAE Systems Plc; Broadcom, Inc.; Centrify Corporation; Check Point Software Technology Ltd.; Palo Alto Networks, Inc.; Proofpoint, Inc.; Sophos Ltd. |

Key Market Driver: Escalating Frequency and Sophistication of Cyber Threats

One of the primary drivers accelerating the cybersecurity market is the surging volume and sophistication of cyberattacks targeting both public and private organizations. From ransomware-as-a-service (RaaS) to advanced persistent threats (APTs), cybercriminals are now equipped with tools that rival those of nation-states. In 2025, high-profile ransomware incidents affected critical infrastructure providers, educational institutions, and healthcare systems, causing widespread disruption and financial losses.

These attacks not only compromise sensitive data but also erode public trust, disrupt operations, and attract regulatory penalties. For example, the 2021 Colonial Pipeline ransomware attack, which caused fuel shortages across the U.S. East Coast, was a watershed moment that elevated cybersecurity into national security discussions. As digital adoption surges across sectors, organizations must invest in real-time threat intelligence, endpoint protection, and security orchestration tools to stay resilient in the face of evolving threats.

Key Market Restraint: Complexity and Fragmentation of Security Infrastructure

A significant restraint in the cybersecurity market is the growing complexity and fragmentation of security solutions, especially in large enterprises managing hybrid IT environments. Many organizations rely on dozens of point solutions from different vendors for threat detection, access control, data protection, and compliance. This fragmented approach often leads to visibility gaps, tool fatigue among security teams, and challenges in threat correlation.

Moreover, integrating these disparate systems to form a unified security posture requires skilled professionals, substantial budgets, and customized configurations. For small and medium businesses, the cost and expertise required to implement such security stacks may be prohibitive. This fragmentation hampers incident response capabilities and increases the risk of overlooking vulnerabilities—ironically undermining the very security it seeks to enforce.

An exciting opportunity lies in the growing adoption of Managed Security Services (MSS) and Extended Detection and Response (XDR) platforms. As cyber threats grow in scale and complexity, many organizations—especially SMEs—lack the internal resources to monitor, detect, and respond effectively. Managed services bridge this gap by offering 24/7 monitoring, rapid incident response, and proactive threat hunting at a predictable cost.

XDR platforms, on the other hand, consolidate data from endpoints, cloud workloads, email, and networks into a single pane of glass. This centralized visibility helps security analysts detect hidden threats, reduce false positives, and automate remediation efforts. As threat actors use multi-vector attacks, integrated solutions like XDR are becoming essential. Both MSS and XDR offer scalable and cost-effective alternatives to traditional, siloed cybersecurity approaches.

Cyber Security Market By Offering Insights

Software solutions dominate the cybersecurity market, driven by the wide adoption of firewalls, intrusion prevention systems (IPS), endpoint protection platforms (EPP), and identity and access management (IAM) tools. These tools form the core of most enterprise security strategies. Demand for cloud-native and AI-enhanced software is especially high among financial institutions, healthcare providers, and digital-native companies.

Managed services are the fastest-growing segment, with enterprises outsourcing key security functions such as threat monitoring, compliance audits, and incident response. Managed Detection and Response (MDR) and Security Operations Center (SOC)-as-a-service offerings are seeing rapid uptake, particularly among mid-market firms that lack dedicated security teams.

Cyber Security Market By Security Insights

Network security holds the largest market share, as organizations prioritize securing perimeter infrastructure, internal segmentation, and remote access. Technologies like next-generation firewalls (NGFW), secure web gateways (SWG), and network access control (NAC) are widely deployed across enterprises.

Cloud security is the fastest-growing segment, reflecting the shift toward SaaS, IaaS, and hybrid cloud architectures. Cloud workload protection platforms (CWPP), cloud security posture management (CSPM), and CASBs (Cloud Access Security Brokers) are becoming indispensable tools to secure dynamic cloud environments.

Cyber Security Market By Deployment Insights

On-premises deployment continues to dominate, especially among government bodies, financial institutions, and critical infrastructure providers who prioritize control, compliance, and customization. These environments often involve legacy systems and sensitive data, which are less suited for cloud-based deployment.

Cloud deployment is expanding rapidly, as cloud-native startups and digitally transforming enterprises seek scalability, agility, and remote management capabilities. Cloud-based security tools are also easier to update and integrate with DevOps workflows, enabling rapid threat response and policy enforcement.

Cyber Security Market By Organization Size Insights

Large enterprises are the primary contributors to cybersecurity spending, driven by complex infrastructure, regulatory obligations, and high-value assets. These organizations invest heavily in multi-layered defenses, threat intelligence feeds, and AI-driven automation.

SMEs represent the fastest-growing segment, as targeted attacks on mid-sized businesses rise and compliance requirements become stricter. Cloud-based cybersecurity tools and MSSPs allow SMEs to access enterprise-grade protection without high capital investment or internal expertise.

Cyber Security Market By Solution Insights

Identity and Access Management (IAM) leads in adoption, especially with the rise in remote work and hybrid access models. IAM platforms enforce least privilege access, manage user roles, and authenticate users via multi-factor and biometric methods.

Security Information and Event Management (SIEM) is growing rapidly, as organizations seek centralized log management, real-time alerting, and forensic analysis capabilities. With advanced correlation and anomaly detection, SIEM systems are essential for proactive threat hunting.

Cyber Security Market By End Use Insights

BFSI (Banking, Financial Services, and Insurance) dominates the market, owing to the sector’s stringent regulatory environment and its attractiveness as a target for cybercriminals. Financial firms invest in fraud detection, endpoint protection, and secure transaction platforms.

Healthcare is the fastest-growing vertical, following a sharp rise in ransomware attacks and the digitization of patient records. Hospitals and clinics are now prioritizing EHR protection, medical device security, and HIPAA/GDPR compliance. Cybersecurity has become integral to both patient safety and operational continuity.

Cyber Security Market By Regional Insights

North America is the global leader in the cybersecurity market, driven by robust digital infrastructure, early technology adoption, and a strong regulatory landscape. The presence of cybersecurity giants like Palo Alto Networks, Cisco, CrowdStrike, and Fortinet further accelerates innovation and deployment. The U.S. federal government is also investing heavily in securing critical infrastructure, election systems, and national cybersecurity preparedness.

Regulatory requirements such as CISA mandates, PCI DSS, and HIPAA have made cybersecurity a mandatory investment across sectors. The region’s sophisticated threat landscape ensures continued demand for advanced solutions and services.

Asia Pacific is the fastest-growing region, due to increasing digitization, expanding cloud adoption, and heightened awareness of cybersecurity threats. Countries like India, China, Japan, and Australia are witnessing surges in phishing, ransomware, and APTs targeting both private and public sectors.

Governments across the region are implementing national cybersecurity strategies and data protection laws. Rapid industrialization and the growth of IoT ecosystems in Southeast Asia further elevate the importance of cybersecurity in APAC. Local tech hubs are also producing competitive cybersecurity startups contributing to regional resilience.

Some of the prominent players in the cyber security market include:

Cyber Security Market Recent Developments

-

April 2025: Palo Alto Networks launched Cortex XSIAM 2.0 with new AI models for real-time incident triage and autonomous SOC functions.

-

March 2025: CrowdStrike acquired a European MDR provider to expand its threat detection and managed response capabilities in the EU.

-

February 2025: Microsoft announced a $3 billion investment in AI-enhanced cybersecurity tools as part of its Secure Future Initiative.

-

January 2025: Fortinet unveiled FortiAI 3.0, a self-learning AI platform for threat detection in OT and IoT environments.

-

December 2024: Check Point Software Technologies introduced a unified SASE platform, combining SD-WAN, cloud security, and threat prevention under a single console.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the cyber security market

By Offering

- Hardware

- Software

- Services

-

-

- Consulting

- Governance, Risk, and Compliance (GRC)

- Incident Response and Readiness

- Implementation and Integration

- Training & Education

- Others

-

-

- Managed Detection and Response

- Managed Protection and Controls

- Managed Security Functions

- Others

By Security

- Endpoint security

- Cloud Security

- Network Security

- Application Security

- Infrastructure Protection

- Data Security

- Others

By Deployment

By Organization Size

- Large Enterprises

- SMEs

- Solution Outlook (Revenue, USD Billion; 2017-2030)

- Unified Threat Management (UTM)

- Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- Data Loss Prevention (DLP)

- Identity and Access Management (IAM)

- Security Information and Event Management (SIEM)

- DDoS

- Risk and Compliance Management

- Others

By End Use

- IT and Telecommunications

- Retail and E-Commerce

- BFSI

- Healthcare

- Government and Defense

- Manufacturing

- Energy and Utilities

- Automotive

- Marine

- Transportation and Logistics

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)