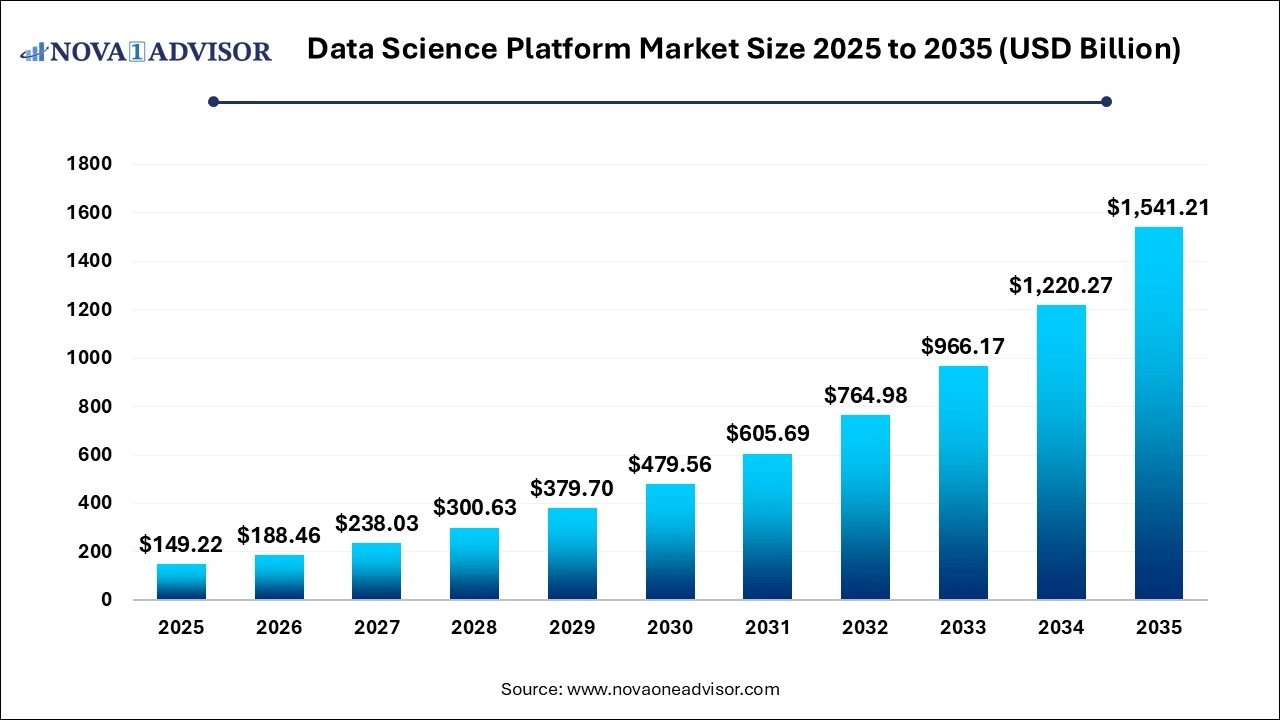

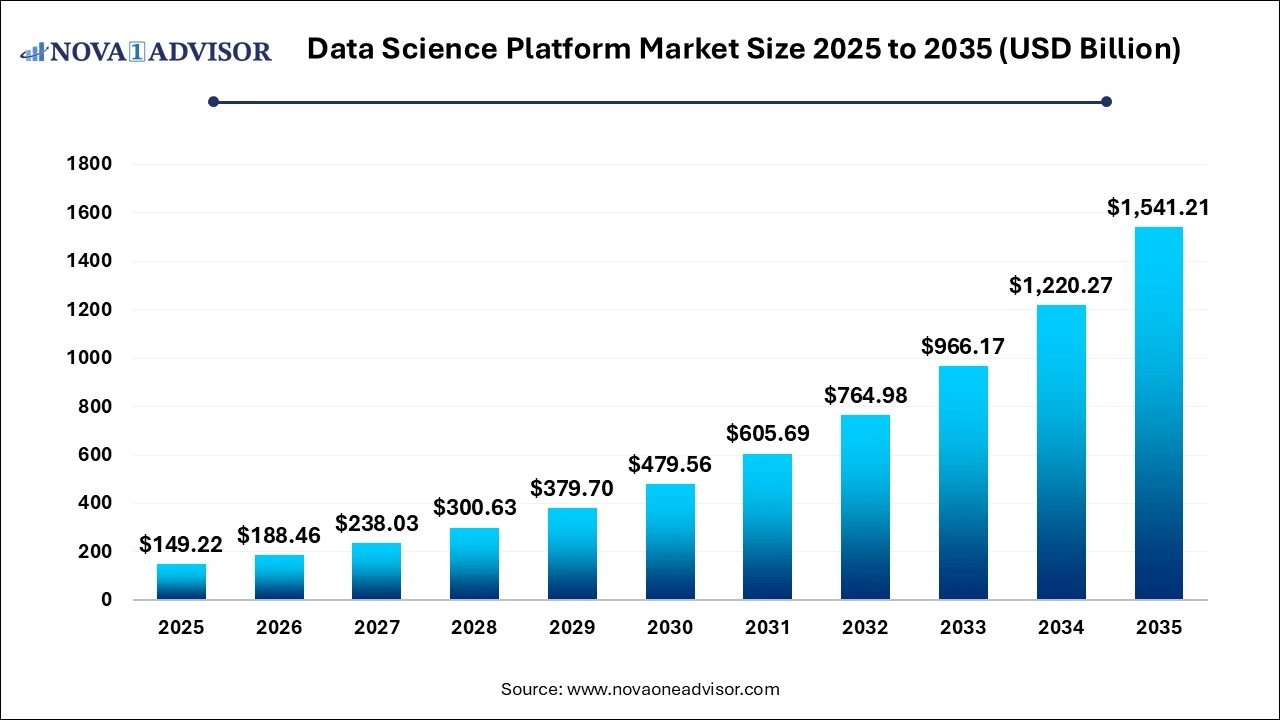

The data science platform market size was exhibited at USD 149.22 billion in 2025 and is projected to hit around USD 1,541.21 billion by 2035, growing at a CAGR of 26.3% during the forecast period 2026 to 2035.

- The platform segment held the largest market revenue share of 84.0% in 2025.

- The services segment is projected to grow at the fastest CAGR over the forecast period.

- The marketing and sales segment held the largest market revenue share in 2025.

- The logistics segment is projected to grow at the fastest CAGR over the forecast period.

- The BFSI segment dominated the market in 2025.

- The healthcare segment is projected to grow at the fastest CAGR over the forecast period.

- North America held the largest data science platform market revenue share of 35.0% in 2025.

Market Overview

The Data Science Platform Market has become a pivotal force behind data-driven innovation across modern enterprises. As companies increasingly generate massive volumes of structured and unstructured data, the need to transform this data into actionable insights has never been greater. Data science platforms provide an integrated environment for data ingestion, preparation, modeling, and deployment, facilitating collaboration between data scientists, analysts, engineers, and business users.

These platforms enable organizations to streamline data workflows, adopt advanced analytics techniques, and leverage artificial intelligence (AI) and machine learning (ML) models to enhance decision-making. Unlike isolated development environments, data science platforms unify disparate tools and frameworks—often supporting Python, R, SQL, and Jupyter notebooks—under a single ecosystem that promotes scalability, reproducibility, and collaboration.

Fueled by the growing importance of predictive analytics in customer engagement, financial forecasting, logistics optimization, and fraud detection, demand for flexible and secure data science platforms is rising rapidly. Organizations are shifting from traditional BI tools to platforms capable of supporting complex ML algorithms and real-time analytics pipelines, thus unlocking competitive advantages across industries.

Major Trends in the Market

-

AutoML and Citizen Data Science: Platforms are incorporating AutoML to allow non-technical users to build ML models without deep coding expertise.

-

Integration with Cloud-Native Ecosystems: Seamless deployment across AWS, Azure, and GCP is becoming a standard feature.

-

Unified MLOps Pipelines: End-to-end machine learning lifecycle management is being prioritized, including versioning, monitoring, and rollback capabilities.

-

Open-Source Toolchain Adoption: Enterprises are demanding platforms that integrate with open-source libraries such as TensorFlow, PyTorch, Scikit-learn, and Spark MLlib.

-

Real-time and Streaming Analytics: With IoT and edge data growing, platforms are enabling real-time processing via Kafka and Flink integrations.

-

Security and Governance: Regulatory compliance and responsible AI features, including explainability and bias mitigation, are becoming critical components.

-

Vertical-specific Customization: Vendors are developing tailored solutions for healthcare, finance, telecom, and retail based on domain needs.

| Report Coverage |

Details |

| Market Size in 2026 |

USD 188.46 Billion |

| Market Size by 2035 |

USD 1,541.21 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 26.30% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Application, Vertical, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Google LLC; Microsoft; IBM Corporation; H2O.ai.; Oracle; Alteryx; Cloud Software Group, Inc.; SAS Institute Inc.; SAP; The MathWorks, Inc. |

Key Driver: Surge in AI and Machine Learning Adoption Across Industries

The primary driver for the data science platform market is the exponential rise in AI and ML deployment across sectors. From fraud detection in financial services to personalized recommendations in e-commerce and predictive maintenance in manufacturing, organizations are increasingly investing in intelligent systems to enhance efficiency and improve customer experiences.

These use cases require platforms that support rapid data exploration, feature engineering, model training, and deployment at scale. For example, in banking, risk modeling teams leverage platforms like DataRobot or H2O.ai to automate model development for credit scoring and default prediction. In healthcare, researchers use platforms like SAS or IBM Watson Studio to develop diagnostic tools using medical imaging data. The scalability and flexibility of data science platforms are enabling such applications to proliferate.

Key Restraint: Talent Shortage and Integration Complexity

One of the most significant restraints facing the market is the shortage of skilled data scientists and the complexity of integrating platforms into legacy environments. Despite advancements in usability and AutoML, building and deploying sophisticated models still require expertise in statistics, computer science, and domain knowledge.

Moreover, many enterprises operate on legacy infrastructure that lacks compatibility with modern data science platforms. Integrating platforms with traditional databases, ERP systems, and on-premise security protocols can be time-consuming and expensive. Organizations often struggle with fragmented data silos, incomplete data pipelines, and inadequate governance, limiting the full utilization of platform capabilities.

Key Opportunity: Expansion of Data Science-as-a-Service (DSaaS)

A notable opportunity lies in the growing demand for Data Science-as-a-Service (DSaaS) offering organizations access to data science capabilities on-demand via cloud-based subscription models. This democratizes access to advanced analytics, especially for small and mid-sized businesses that lack in-house talent and infrastructure.

Leading vendors now offer managed environments where clients can upload data, choose prebuilt models, and receive insights without managing the backend. DSaaS helps shorten time-to-value, reduce capital expenses, and improve scalability. With growing awareness of its value, even traditionally conservative sectors like insurance and manufacturing are exploring DSaaS for agile data experimentation and deployment.

Platforms dominate the market, accounting for the largest share due to their central role in enabling collaborative development and deployment of machine learning models. These platforms provide toolkits for data preparation, exploration, feature engineering, model building, and orchestration—often integrated with CI/CD pipelines for seamless deployment. Examples include Microsoft Azure Machine Learning, Google Cloud Vertex AI, and IBM Watson Studio.

Services are the fastest-growing segment, encompassing consulting, integration, training, and support. As organizations face challenges in customizing platforms, aligning tools with business workflows, and managing model governance, demand for specialized services has surged. These services are essential for onboarding, fine-tuning environments, and providing post-deployment support, especially in regulated industries.

Marketing and Sales is the dominant application segment, leveraging platforms for customer segmentation, campaign optimization, and lead scoring. For instance, telecom companies use data science to predict churn and personalize offers. Retailers apply predictive models to forecast demand and improve cross-selling through real-time recommendation engines.

Finance and Accounting is the fastest-growing application, driven by the need for real-time fraud detection, risk modeling, and automated financial forecasting. Financial institutions use ML algorithms to flag suspicious transactions, assess creditworthiness, and streamline compliance reporting. The complexity and regulatory demands of financial operations make data science platforms essential in this domain.

IT & Telecommunications leads the vertical segmentation, driven by high data volumes, competitive pressure, and strong digital maturity. Telcos use platforms to optimize network performance, detect anomalies, and personalize customer experiences. The integration of data science with 5G and IoT use cases is further driving adoption.

Healthcare is the fastest-growing vertical, fueled by use cases in disease prediction, imaging diagnostics, and clinical trial optimization. Hospitals and research institutions are adopting platforms to predict patient readmissions, triage emergency cases using NLP, and develop genomics-based personalized treatments. The explosion of health data from wearables and EMRs is making data science indispensable.

North America is the dominant region in the data science platform market, owing to strong technology infrastructure, early adoption of AI/ML, and presence of major players such as IBM, Google, Microsoft, and AWS. The U.S. government and large enterprises have invested heavily in data-driven innovation, with sectors like healthcare, defense, and banking driving platform adoption.

Moreover, the region boasts a high concentration of skilled professionals and academic institutions contributing to AI research. Venture funding for AI startups remains robust, and enterprise data initiatives are maturing rapidly, ensuring continued market leadership.

Asia Pacific is the fastest-growing region, with countries like China, India, and Singapore making strategic investments in AI and analytics infrastructure. The region’s rapidly digitizing economies and mobile-first populations generate vast volumes of data, ripe for advanced analytics.

Governments are funding AI labs and offering incentives to promote smart city initiatives, predictive healthcare, and financial inclusion—all of which depend on data science platforms. Furthermore, APAC’s large base of SMEs is increasingly adopting cloud-based DSaaS platforms to remain competitive, especially in e-commerce and logistics sectors.

-

April 2025: Google Cloud released Vertex AI X, a new version of its unified platform that integrates real-time MLOps, generative AI tools, and an advanced model registry for enterprise-scale ML lifecycle management.

-

March 2025: DataRobot announced its partnership with Snowflake to enhance end-to-end automated machine learning workflows directly within Snowflake's data cloud.

-

February 2025: Microsoft launched Fabric ML Studio, a low-code AI development environment within Microsoft Fabric, aiming to boost citizen data science and integrate Power BI with AutoML capabilities.

-

January 2025: H2O.ai expanded its AI Cloud offering with domain-specific models for retail, insurance, and manufacturing, targeting small and mid-sized businesses.

-

December 2024: IBM enhanced its Watsonx.ai platform with foundation model libraries and prebuilt pipelines for regulated industries such as banking and healthcare.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the data science platform market

By Type Product

By Application

- Marketing and Sales

- Logistics

- Finance and Accounting

- Customer Support

- Others

By Vertical

- IT & Telecommunication

- Healthcare

- BFSI

- Manufacturing

- Retail

- Energy and Utilities

- Government

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)