Dental Bone Grafts And Substitutes Market Size and Trends

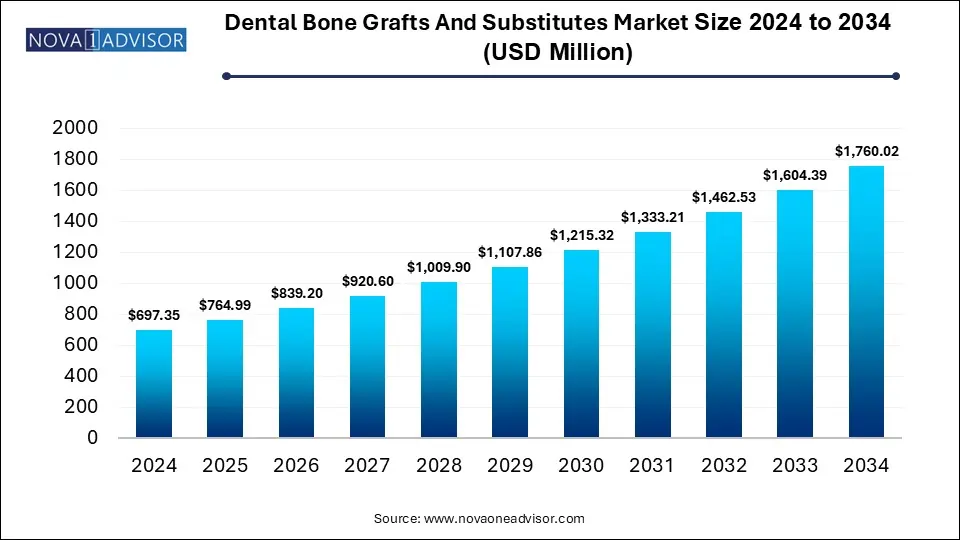

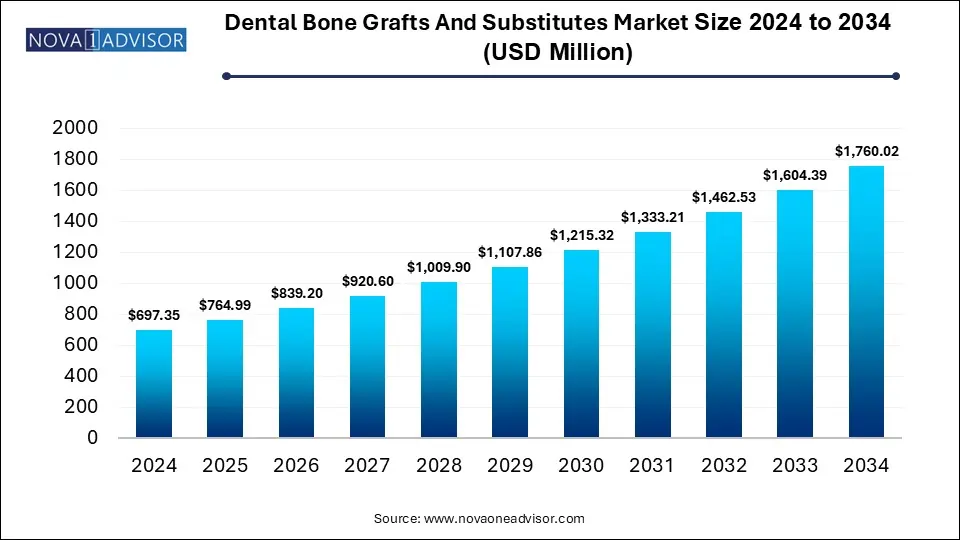

The global dental bone grafts and substitutes market size is calculated at USD 697.35 million in 2024, grows to USD 764.99 million in 2025, and is projected to reach around USD 1,760.02 million by 2034, growing at a CAGR of 9.7% from 2025 to 2034. The growth of the dental bone grafts and substitutes market can be attributed to rising cases if dental disorders, increased demand for dental implants and technological advancements in bone grafting materials.

Dental Bone Grafts and Substitutes Market Key Takeaways

- North America dominated the global dental bone grafts and substitutes with the largest revenue share in the market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By material type, the xenograft segment dominated the market with the largest share in 2024.

- By material type, the synthetics segment is expected to show the fastest growth over the forecast period.

- By application, the socket preservation segment accounted for the highest market share in 2024.

- By application, the sinus lift segment is expected to expand rapidly during the predicted timeframe.

- By end-user, dental clinics segment held the largest market share in 2024.

- By end-user, hospitals segment is expected to register fastest growth during the forecast period.

How is the Dental Bone Grafts and Substitutes Market Evolving?

Dental bone graft refers to a surgical procedure involving placement of bone material procured from the patient, a donor, or synthetic into the jaw area for increasing the density and volume of the jawbone, due to bone loss or insufficient bone. Bone grafting procedures are necessary for supporting dental implants, preventing bone loss, improving oral health and reducing the need for future interventions.

The dental bone graft and substitutes market is experiencing growth due to various factors such as increased incidences of tooth loss and dental disorders, aging population, growing public awareness of oral health supportive reimbursement policies, expansion of dental clinics and medical tourism.

What are the Key Trends in the Dental Bone Grafts and Substitutes Market in 2025?

- In May 2025, the ADA Living Guideline Program was launched through a pioneering collaboration between the American Dental Association (ADA) and the Center for Integrative Global Oral Health at Penn Dental Medicine. The program is the first and only known living clinical practical guideline program for providing oral health care providers and patients with more common and evidence-based recommendations for advancing oral and overall health.

- In February 2025, LifeNet Health, a globally leading regenerative medicine company, launched its first-of-a-kind viable dental bone allograft, OraGen which is made up of cryopreserved corticocancellous bone containing endogenous lineage-committed bone cells in combination with demineralized bone matrix.

What Role Does AI Play in the Dental Bone Grafts and Substitutes Market?

Artificial intelligence (AI) is playing an important role in the dental bone grafts and substitutes market from disease diagnosis to post-operative care. AI algorithms can be applied for analyzing images from Cone-Beam Computed Tomography (CBCT) scans for precise identification of bone density and anatomical structures. AI-powered robotic-assisted surgery is providing real-time guidance to surgeons, further allowing precise implant placement. Implant designs can be optimized with help of AI for reducing stress at the implant-bone interface. AI-driven material design can enable development of innovative bine substitute materials with enhanced biocompatibility and mechanical properties. Personalized scaffolds tailored to specific needs can be generated with AI. Additionally, AI models can be used for predicting implant success and osteointegration, further allowing clinicians to make informed decisions.

Report Scope of Dental Bone Grafts And Substitutes Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 764.99 Million |

| Market Size by 2034 |

USD 1,760.02 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 9.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Material Type; Application; End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Biohorizons Inc., Dentsply Sirona, Dentium Co, Ltd., Geistlich Pharma Ag, Orthogen AG, Lifenet Health, Medtronic, RTI Surgical, Zimmer Biomet |

Market Dynamics

Drivers

Increased Adoption of Dental Implant Procedures

Dental implants are the gold standard for tooth repair, owing to long-term efficacy and success for missing teeth. Globally rising aging demographics and prevalence of dental disorders such as periodontal disease, severe dental caries and dental trauma are contributing to higher cases of tooth loss. Bone grafting procedures such as ridge augmentation, socket preservation and sinus lift are effective techniques for building bone to support implant placement, further driving the market growth.

Restraints

High Costs of Materials and Procedures

Dental bone grafting procedures such as those using complex techniques or advanced bone grafting materials can be quite expensive and lead to opting less costly alternatives like traditional dentures or bridges by patients. Furthermore, associated costs such as pre-operative diagnostic scans, surgical fees and post-operative care are not affordable for many patients. High costs of bone grafting materials and procedures can limit patient access to these treatments which can potentially restrict the market growth.

Opportunities

Ongoing Advancements and Aesthetic Dentistry

Increased research and development activities for improving the properties and biocompatibility of bone grafts is improving patient outcomes. Synthetic grafts are offering high consistency by eliminating risks associated with donor materials such as disease transmission and immunogenicity. Deployment of 3D printing techniques is enabling creation of patient specific grafts based on CBCT scans, further allowing customized shapes and sizes, improved fitting, less surgical time and predictable outcomes. Development of minimally invasive techniques such as injectables and flowable bone graft substitutes are improving patient adherence and accelerating recovery times.

Moreover, many patients are visiting dental clinics seeking dental treatments for aesthetic improvement which uses procedures such as socket preservation and ridge augmentation. These procedures help in achieving optimal aesthetic results by utilizing bone graft materials.

Segmental Insights

What Made Xenograft the Dominant Segment in 2024?

By material type, the xenograft segment captured the largest market share in 2024. Xenografts such as deproteinized bovine bone (DBBM) and porcine bine are being applied in dentistry since a long period of time, due to their proven efficacy and predictable outcomes in several bone regeneration procedures. Increased popularity for dental implant solutions and globally rising prevalence of dental disorders is driving the demand for bone grafting materials. High availability of xenografts, ease of processing, reduced patient morbidity, reliability in handling during dental procedures and affordability are the factors driving the market dominance of this segment.

By material type, the synthetics segment is expected register the fastest CAGR over the forecast period. Synthetic grafts offer reduced risk of disease transmission and immunogenicity compared to xenografts and allografts, leading to enhanced patient safety and compliance. Modern synthetic grafts use highly biocompatible materials such as hydroxyapatite and tricalcium phosphate which are highly osteoconductive, acting as an excellent scaffold for promoting bone growth. Furthermore, continuous advancements in material science and manufacturing processes, integration of 3D printing technology, streamlined regulatory approval processes and increased acceptance among patients and dental professionals is boosting the growth of the synthetic grafts segment.

Why Did the Socket Preservation Segment Dominated the Market in 2024?

By application, the socket preservation segment dominated the market with the largest share in 2024. The market dominance of this segment can be linked to the rising demand for dental implants, increased emphasis on patient education regarding oral health, high incidences of tooth loss in aging population and focus on maintaining the natural contours of the gum and the jawbone. Socket preservation is a crucial step in dental implant placement for creating a stable foundation for implants, leading to less invasive and efficient procedures for patients. Advancements in dental bone graft materials, availability of wider graft materials suitable to individual patient needs, customization of grafts with 3D printing and development of bioactive materials are enhancing efficacy and success rates of socket preservation procedures, further driving their adoption.

By application, the sinus lift segment is expected to show the fastest growth during the forecast period. Dental bone graft materials are widely used in sinus lift procedures, especially in upper back teeth such as molars and premolars for building support and stable foundation for implant placement. Rising incidences of dental disorders such as periodontal diseases and tooth loss as well as aging population suffering from bone deficiencies in the upper jaw is creating the demand for reconstructive procedures such as sinus lift for restoring bone volume. Improvements in surgical protocols and development of minimally invasive sinus lift techniques is leading to improved patient comfort, faster recovery times and reduced risk of potential complications.

How Dental Clinics Segment Dominated the Market in 2024?

By end-user, the dental clinics segment accounted for the highest market share in 2024. Dental clinics are primary point of care many patients seeking routine and specialized dental procedures which include use of bone grafts. Large number of geographically accessible dental clinics with skilled surgeons and offering safe same-day procedures in outpatient settings at affordable costs attracts a huge patient population. Rising number of private dental practices and specialized clinics, increased adoption of advanced diagnostic and surgical technologies, growing awareness of oral health and aesthetics as well as surging demand for cosmetic dentistry and comprehensive oral care are the factors fuelling the market growth of this segment.

- For instance, in March 2025, the Delhi government in collaboration with the Maulana Azad Institute of Dental Sciences (MAIDS) launched six advanced mobile dental clinics for offering modern day dental care at the doorsteps of Delhi residents, especially in underserved areas.

By end-user, the hospitals segment is anticipated to witness fastest growth over the forecast period. Hospitals are equipped with specialized surgical tools, operating theatres and advanced diagnostic imaging tools along with skilled healthcare professionals offering wide range of medical and dental services. Bone grafts and their substitutes are used in complex reconstructive procedures which includes dental implant surgeries as well as maxillofacial surgeries for congenital defects, cancer and trauma, usually performed in a hospital setting. Hospitals offer comprehensive care for patients with complex dental and maxillofacial cases often requiring a multidisciplinary approach which involves periodontists, oral surgeons, maxillofacial surgeons, anesthesiologists and other medical specialists.

Regional Insights

How is North America Dominating the Dental Bone Grafts and Substitutes Market?

North America dominated the global dental bone grafts and substitutes market in 2024. Significant aging population with increasing cases of dental issues is creating high demand for restorative procedures such as dental implants requiring bone grafting materials. Well-developed healthcare infrastructure with large number of hospitals, specialized dental clinics and ambulatory surgical centers equipped with advanced technologies for diagnosis, surgical procedures and post-operative care are facilitating access and adoption of complex dental procedures. Additionally, presence of key market players, increased healthcare spending, increased awareness, focus on aesthetic dentistry and favourable reimbursement policies are driving the region’s dominance in the market.

What Fuels Expansion of the Dental Bone Grafts and Substitutes Market in Asia Pacific?

Asia Pacific is expected to witness the fastest growth in the market over the forecast period. The region’s huge population with rising cases of dental disorders, especially in the aging demographics is necessitating the use of bone grafting procedures for restoration and improving oral health. Rising disposable, incomes, growing awareness of oral health, improving healthcare infrastructure, adoption of advanced dental technologies and increased emphasis on local manufacturing are the factors fuelling the market expansion. Furthermore, trend of dental tourism in countries such as India, South Korea and Thailand is gaining traction due to access to high-quality dental treatments at low costs.

Some of the Prominent Players in the Dental Bone Grafts and Substitutes Market

- Biohorizons Inc.

- Dentsply Sirona

- Dentium Co, Ltd.

- Geistlich Pharma Ag

- Orthogen AG

- Lifenet Health

- Medtronic

- RTI Surgical

- Zimmer Biomet

Recent Developments in the Dental Bone Grafts and Substitutes Market

- In September 2024, Regenity Biosciences, an international leader in regenerative medicine and portfolio company of Linden Capital Partners, received China’s NMPA regulatory approval for its innovative crosslinked bioresorbable, implantable collagen dental membrane designed for use in oral surgical procedures.

- In July 2024, TBS Dental, a leading provider of dental instruments and solutions, introduced its new product line, REGEN which is made up of bone and membrane materials, further enhancing the outcomes of regenerative dental procedures such as socket preservation and soft tissue regeneration.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Dental Bone Grafts And Substitutes Market.

By Material Type

-

- Demineralized Bone Matrix

- Others

By Application

- Ridge Augmentation

- Sinus Lift

- Periodontal Defect Regeneration

- Implant Bone Regeneration

- Socket Preservation

By End-use

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)