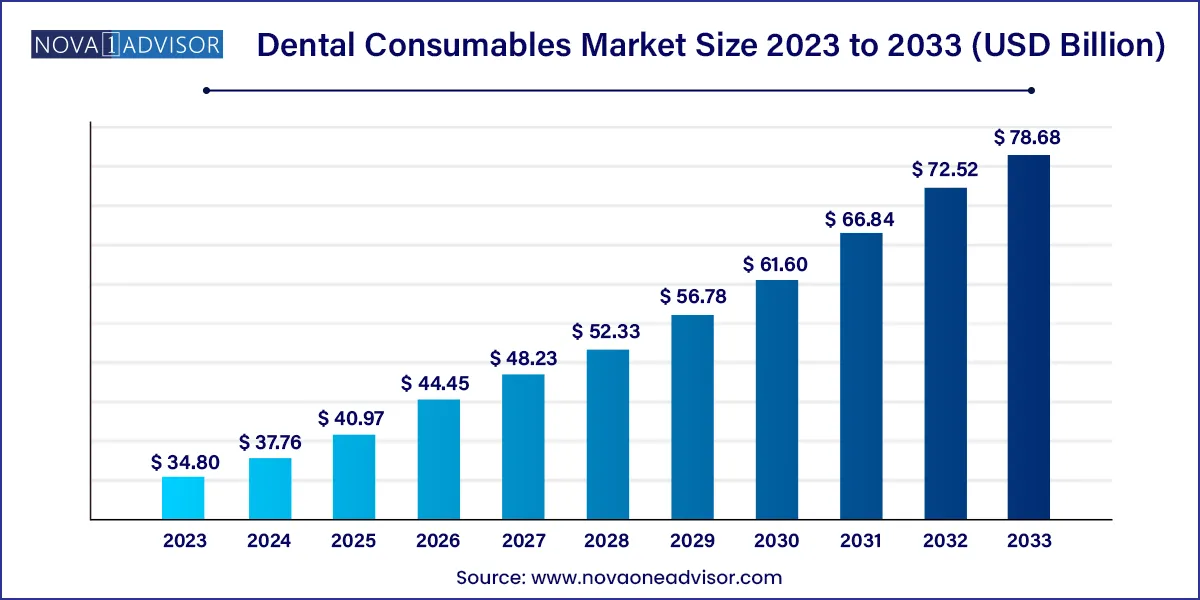

The global dental consumables market size was exhibited at USD 34.80 billion in 2023 and is projected to hit around USD 78.68 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2024 to 2033.

Key Takeaways:

- North America dominated the global market with a share of 48.0% in 2023 and is expected to maintain the leading position throughout the forecast period.

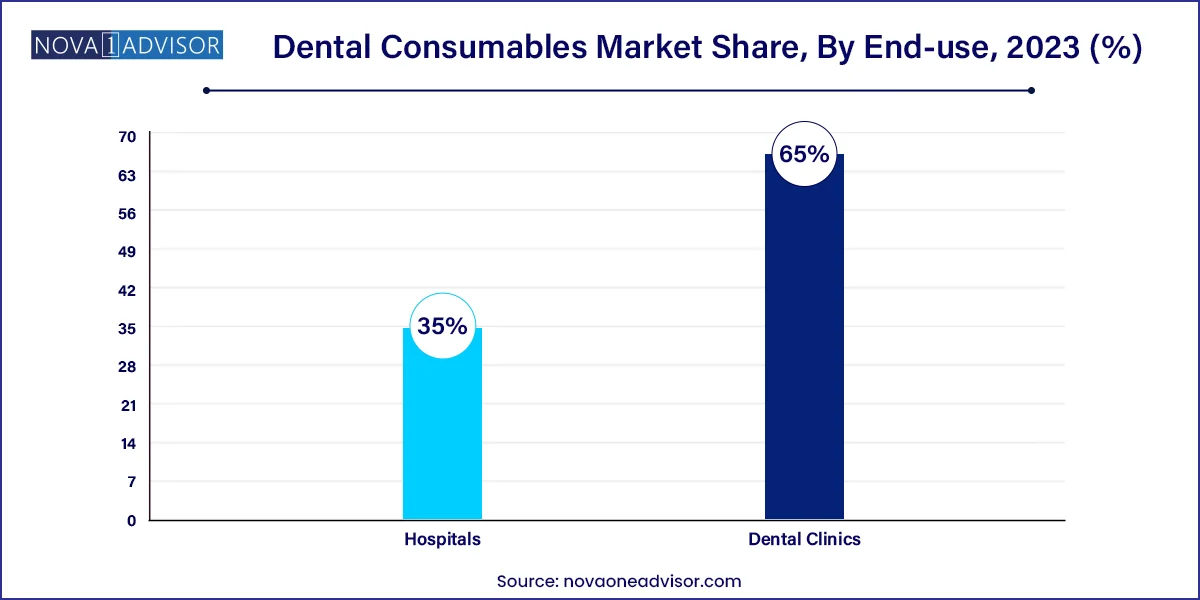

- The dental clinic segment held the largest revenue share in 2023 and is likely to grow at a significant CAGR of 8.4% from 2024 to 2033.

- The increasing prevalence of dental caries is a key driver affecting demand for oral care products.

Market Overview

The global dental consumables market encompasses a diverse array of products essential for daily clinical dental practice. These include materials and tools used in restorative, preventive, diagnostic, orthodontic, endodontic, periodontic, and prosthodontic treatments. As oral health awareness continues to rise and the prevalence of dental conditions such as caries, periodontitis, tooth loss, and malocclusion increases, the demand for reliable, high-quality consumables has surged globally.

Factors such as aging populations, increasing dental insurance coverage, technological advancements in dental materials, and a growing cosmetic dentistry trend have further amplified market growth. Patients across all demographics are seeking faster, more aesthetic, and minimally invasive dental treatments, driving innovations in materials such as CAD/CAM restorations, nanocomposites, bioactive biomaterials, and self-healing resins.

The dental consumables market is also witnessing a paradigm shift with digital dentistry. The adoption of chairside CAD/CAM, 3D printing, and intraoral scanning is transforming how consumables are manufactured, distributed, and applied. With strong tailwinds from public health campaigns, dental tourism, and expanding access to private dental care, the market outlook remains robust.

Dental Consumables Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 37.76 Billion |

| Market Size by 2033 |

USD 78.68 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Dentsply Sirona; Straumann Holding; 3M; Henry Schein, Inc.; Patterson Companies, Inc.; Envista (Danaher Corp.); Zimmer Biomet; Ivoclar; Align Technology, Inc.; Benco Dental. |

Key Market Driver: Increasing Demand for Aesthetic and Restorative Dentistry

One of the primary drivers fueling the dental consumables market is the growing preference for aesthetic and restorative dental procedures. Patients today prioritize dental treatments that not only restore function but also enhance appearance. Whether it's tooth-colored fillings, all-ceramic crowns, or implant-supported dentures, there is a clear shift towards high-performance, aesthetic solutions.

This shift is especially visible in urban centers and among younger demographics who consider dental appearance a key aspect of personal grooming. Media influence and social media have normalized cosmetic dentistry as a routine self-care measure. Consequently, dental clinics are adopting advanced consumables such as translucent zirconia, lithium disilicate ceramics, and nanohybrid composites to meet patient expectations.

Key Market Restraint: High Cost of Advanced Dental Procedures and Consumables

Despite technological progress, the high cost of dental consumables, particularly those used in aesthetic and implant dentistry, poses a challenge to widespread adoption. Advanced crowns, CAD/CAM blocks, bone grafting materials, and precision orthodontic devices are often not fully covered by insurance and can be financially prohibitive for many patients.

In regions with limited healthcare coverage or where dental insurance is not widely available, out-of-pocket expenses for premium treatments remain high. This is particularly true in developing economies where public dental infrastructure is underfunded. The financial barrier is further compounded by the need for repeated visits, lab fees, and the use of high-end digital technology by dental professionals.

Key Market Opportunity: Growth in Dental Tourism and Emerging Economies

An outstanding opportunity in the dental consumables market lies in the expanding dental tourism sector and the rising demand from emerging economies. Countries like India, Mexico, Turkey, and Thailand have become global hubs for cost-effective, high-quality dental treatments, attracting patients from the U.S., U.K., and Australia, where dental procedures are comparatively expensive.

These nations are investing in dental education, infrastructure, and material accessibility, creating a favorable ecosystem for the dental consumables market. As more patients travel for complex procedures like full-mouth restorations and implantology, the volume of consumables used grows significantly. Additionally, emerging markets with growing middle-class populations are demanding modern dental services, which bodes well for manufacturers offering affordable, efficient consumable solutions.

Segments Insights:

By End-use Insights

Dental clinics dominate the end-use segment, accounting for the largest share due to their ubiquity and direct patient access. Clinics range from solo practices to multi-specialty chains, all of which require a consistent supply of consumables. These settings use a diverse portfolio of products across specialties such as prosthodontics, endodontics, and periodontics, creating sustained demand. Clinics are also more agile in adopting new technologies and materials due to lower bureaucratic overhead compared to hospital systems.

Hospitals are the fastest-growing end-use segment, particularly in emerging economies where public and corporate healthcare systems are expanding dental services. Large hospitals and teaching institutions are investing in comprehensive dental departments, often offering specialized services like maxillofacial surgery, implantology, and trauma care. These high-complexity procedures demand advanced consumables, making hospitals an increasingly important consumer base.

By Product Type Insights

Dental implants dominate the dental consumables market, owing to the growing global acceptance of implantology as the gold standard for tooth replacement. Modern dental implants offer improved osseointegration, longer life spans, and better aesthetics. With innovations like mini implants and immediate load options, patients are increasingly opting for implant-supported crowns and bridges. Developed countries have led the charge, but implants are also gaining traction in urban areas of developing nations where discretionary income is rising.

Orthodontic materials are the fastest-growing product category, driven by the explosion of demand for aesthetic aligners and braces. The emergence of direct-to-consumer orthodontic brands, combined with the popularity of clear aligner therapy among teens and adults, is reshaping the orthodontic materials market. 3D printed aligners, ceramic brackets, and shape-memory archwires are being rapidly adopted, with practices investing in digital scanning and in-house manufacturing to meet patient expectations.

CAD/CAM devices are gaining momentum, especially in restorative dentistry. Dentists are increasingly using CAD/CAM blocks, inlays, and onlays for same-day restorations, minimizing turnaround time. The ability to precisely mill crowns, bridges, and veneers in-office has significantly reduced dependency on dental labs, thus streamlining workflow and reducing patient visits. This segment is expected to continue growing as the cost of CAD/CAM systems declines and software becomes more intuitive.

Retail dental hygiene essentials remain critical, especially as preventive care gains prominence. Toothpaste, floss, whitening kits, and mouthwashes form a high-volume, recurring revenue stream. While largely commoditized, the segment has seen premiumization through herbal, sensitivity-specific, and cosmetic offerings. DTC brands with subscription models are also changing retail dynamics, especially in North America and Europe.

By Regional Insights

Europe dominates the global dental consumables market, underpinned by well-established dental infrastructure, high per capita dental expenditure, and widespread access to oral care. Germany, France, and the U.K. are key contributors, with strong adoption of digital technologies and a robust network of public and private dental practices. European regulations also favor biocompatible and sustainable materials, pushing innovation in consumable formulations.

Asia-Pacific is the fastest-growing region, fueled by increasing disposable income, urbanization, and awareness about oral health. China and India lead the growth, supported by growing numbers of dental schools, improved insurance coverage, and international dental tourism. Japan and South Korea are witnessing high demand for cosmetic and restorative procedures, with a cultural focus on aesthetic smiles and preventive care. Regional manufacturers are also producing cost-effective consumables to cater to local and export markets.

Some of the prominent players in the Dental consumables market include:

- Dentsply Sirona

- Straumann Holding

- 3M

- Henry Schein, Inc.

- Patterson Companies, Inc.

- Envista (Danaher Corporation)

- CompZimmer Biomet7

- Ivoclar

- Align Technology, Inc.

- Benco Dental

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global dental consumables market.

Product Type

- Dental Implants

- Crowns & Bridges

- Dental Biomaterials

- Orthodontic Materials

- Endodontic Materials

- Periodontic Materials

- Dentures

- CAD/CAM Devices

- Retail Dental Hygiene Essentials

- Others

End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)