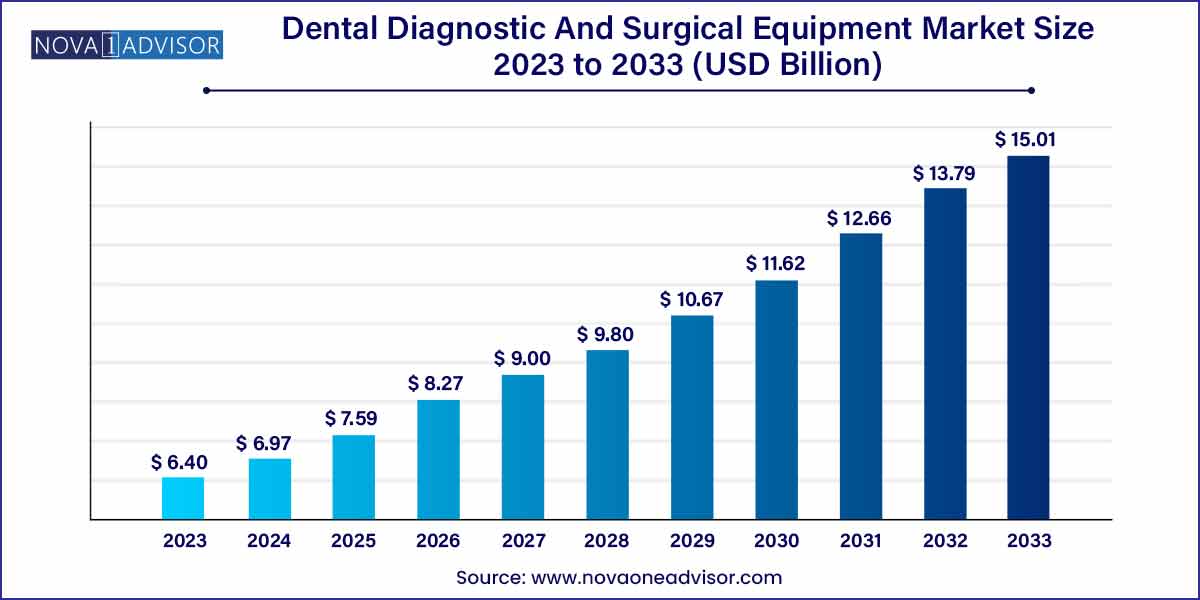

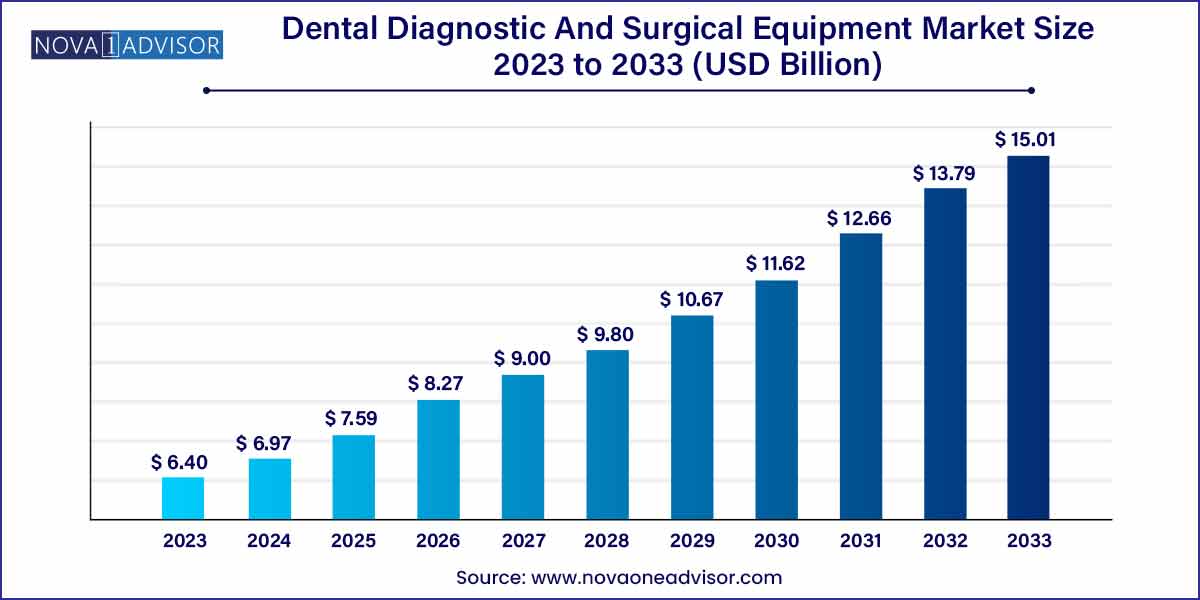

The global dental diagnostic and surgical equipment market size was exhibited at USD 6.40 billion in 2023 and is projected to hit around USD 15.01 billion by 2033, growing at a CAGR of 8.9% during the forecast period of 2024 to 2033.

Key Takeaways:

- The dental surgical equipment segment dominated the market for dental diagnostic and surgical equipment and held the largest revenue share of 53.0% in 2023.

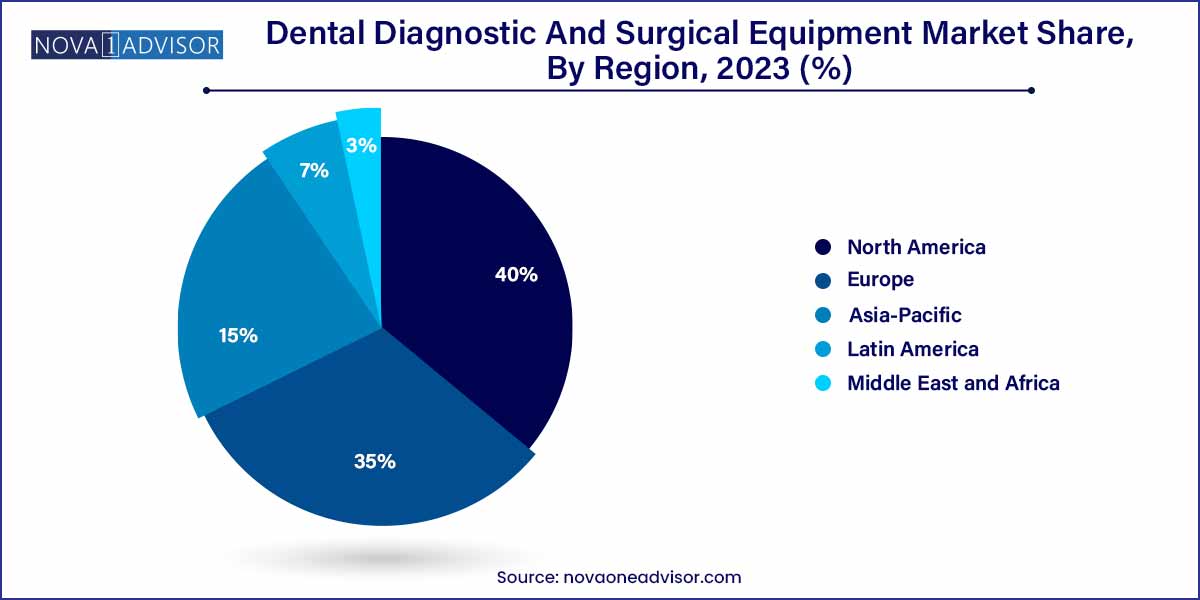

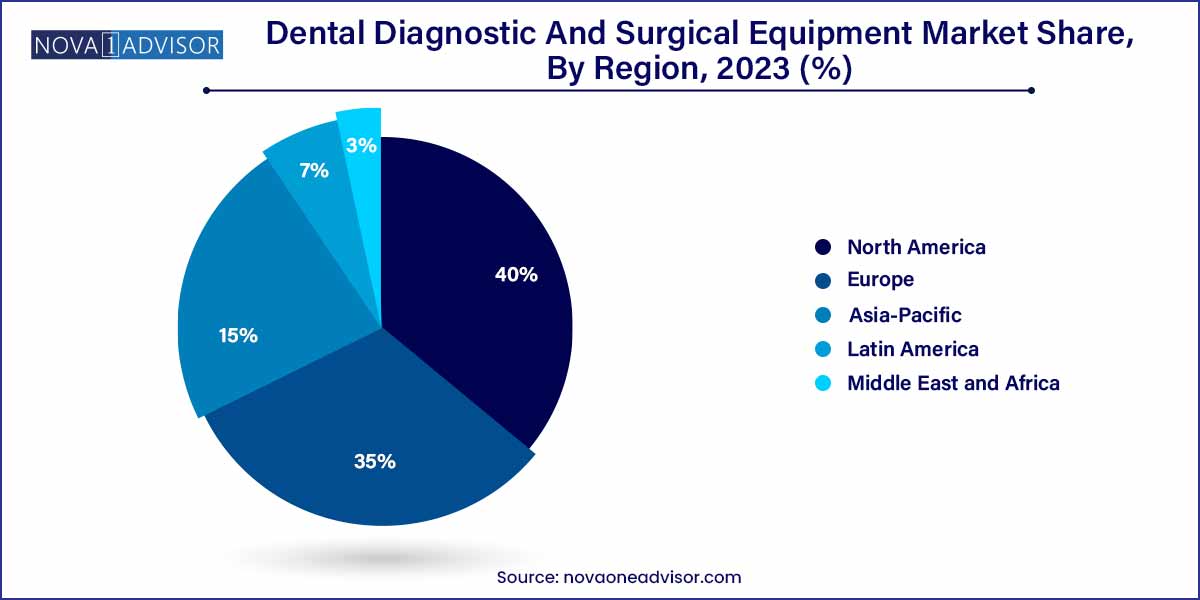

- North America dominated the dental diagnostic and surgical equipment market and accounted for the largest revenue share of over 40.0% in 2023.

Market Overview

The dental diagnostic and surgical equipment market has become an essential pillar of the modern dental care industry, integrating advanced technologies and precision tools to improve diagnosis, treatment planning, and surgical outcomes. Dental professionals rely on a wide array of equipment, ranging from intraoral radiology devices to highly specialized surgical instruments, to enhance patient experiences and deliver superior clinical results.

As the prevalence of dental diseases such as caries, periodontal conditions, and oral cancers rises, the demand for sophisticated diagnostic tools and effective surgical devices intensifies. Moreover, consumer expectations for minimally invasive, painless, and aesthetic treatments are steering dental practices toward adopting cutting-edge technologies. The market is further fueled by demographic shifts—particularly aging populations—and increasing dental insurance penetration, making dental care more accessible.

Innovations such as Cone Beam Computed Tomography (CBCT), CAD/CAM systems, and laser-based surgical solutions are reshaping the landscape. With the rise of cosmetic dentistry, dental implantology, and preventive care, the dental diagnostic and surgical equipment market is poised for robust expansion in the foreseeable future.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI) in diagnostics: AI-powered imaging tools are enhancing early disease detection and treatment planning.

-

Growing adoption of CBCT imaging: CBCT systems are increasingly used for 3D visualization in implantology, orthodontics, and endodontics.

-

Expansion of minimally invasive laser surgery: Dental lasers offer precise, bloodless surgeries, leading to faster patient recovery.

-

Rise of chairside CAD/CAM systems: Real-time restorations using CAD/CAM technology are reducing treatment times and improving prosthetic accuracy.

-

Increased demand for portable and handheld diagnostic devices: Mobility solutions are enabling better access to dental care, especially in rural and underserved regions.

-

Eco-friendly and energy-efficient equipment: Manufacturers are focusing on sustainable materials and energy-saving technologies.

-

Shift towards digital workflows: Fully integrated digital dental clinics are becoming the new norm, connecting diagnostics, planning, and surgery seamlessly.

Dental Diagnostic And Surgical Equipment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.40 Billion |

| Market Size by 2033 |

USD 15.01 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Carestream Health; Danaher Corporation; KaVo Kerr; Biolase Technologies; Zolar Dental Laser; 3M Company; Ivoclar Vivadent AG; American Medicals; Henry Schein; Midmark Diagnostic Group. |

Product Insights

Dental Diagnostic Equipment dominated the product segment in 2024. Dental diagnostic equipment, particularly intraoral and extraoral radiology devices, forms the backbone of modern dental practices. Tools like CBCT systems, digital sensors, and panoramic X-rays are essential for accurate diagnosis, treatment planning, and monitoring. The rapid adoption of 3D imaging technologies has revolutionized areas such as implantology and orthodontics, enhancing precision and patient safety.

Dental Surgical Equipment is projected to be the fastest-growing product segment. Surgical devices, including dental lasers, handpieces, electrosurgical equipment, and specialized instruments like curettes and forceps, are witnessing significant demand due to the shift towards minimally invasive surgeries and rising surgical procedure volumes. Technological innovations offering ergonomic designs, enhanced safety, and multi-functionality are contributing to the robust growth of surgical equipment.

CBCT systems dominated the dental diagnostic equipment sub-segment in 2024. CBCT imaging provides unparalleled 3D visualization of oral structures, aiding in accurate diagnosis and precise surgical planning, especially for complex procedures such as orthognathic surgeries and dental implant placements.

Intraoral radiology equipment is expected to be the fastest-growing. Intraoral sensors and handheld X-ray devices are increasingly popular among general practitioners for their ease of use, reduced radiation exposure, and enhanced image quality, supporting fast and efficient chairside diagnostics.

Dental lasers dominated the dental surgical equipment sub-segment in 2024. Laser-assisted surgeries are becoming more common for procedures like frenectomies, periodontal therapies, and soft tissue surgeries due to their precision, minimal bleeding, and faster recovery times.

Dental burs are anticipated to grow rapidly. Advances in material science are producing more durable and efficient burs for restorative and prosthetic procedures, driving higher replacement rates and procedural volumes.

Regional Insights

North America dominated the dental diagnostic and surgical equipment market in 2024. The region benefits from a mature healthcare infrastructure, high awareness about dental health, and rapid adoption of advanced technologies. The U.S. leads the market with a strong network of dental clinics, robust insurance coverage for dental treatments, and a highly trained dental workforce. Key players headquartered in North America, such as Dentsply Sirona and Envista Holdings, continually innovate to maintain the region's competitive edge. Furthermore, increased spending on cosmetic dentistry procedures and the growing geriatric population contribute to sustained market dominance.

Asia-Pacific is poised to be the fastest-growing region. Rising disposable incomes, expanding middle-class populations, and increased awareness about oral health are driving the growth of dental services and equipment demand across China, India, Japan, and Southeast Asian countries. Governments in several Asia-Pacific countries are investing heavily in healthcare infrastructure, including dental care services. The proliferation of dental tourism, particularly in Thailand and India, further boosts equipment demand. Local and global manufacturers are also focusing on the region by offering affordable, technologically advanced products to tap into this burgeoning market.

Some of the prominent players in the dental diagnostic and surgical equipment market include:

- Carestream Health

- Danaher Corporation

- KaVo Kerr

- Biolase Technologies

- Zolar Dental Laser

- 3M Company

- Ivoclar Vivadent AG

- American Medicals

- Henry Schein

- Midmark Diagnostic Group

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global dental diagnostic and surgical equipment market.

Product

- Dental Diagnostic Equipment

-

- CAD/CAM Systems

- Instrument Delivery systems

- Extra oral Radiology Equipment

- Intra Oral Radiology Equipment

- Cone Beam Computed Tomography (CBCT)

- Dental Surgical Equipment

-

- Dental Laser

- Dental handpieces

- Dental Forceps & Pliers

- Curettes and Scalers

- Dental Probes

- Dental Burs

- Electrosurgical Equipment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)