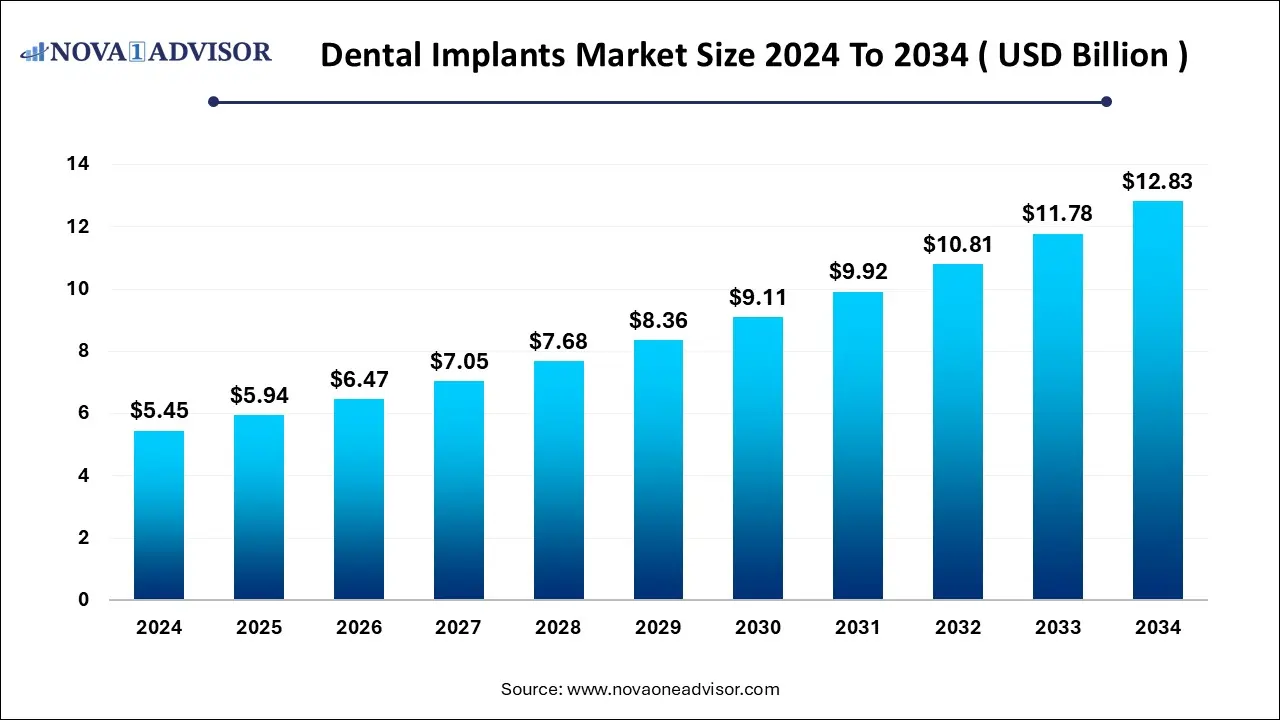

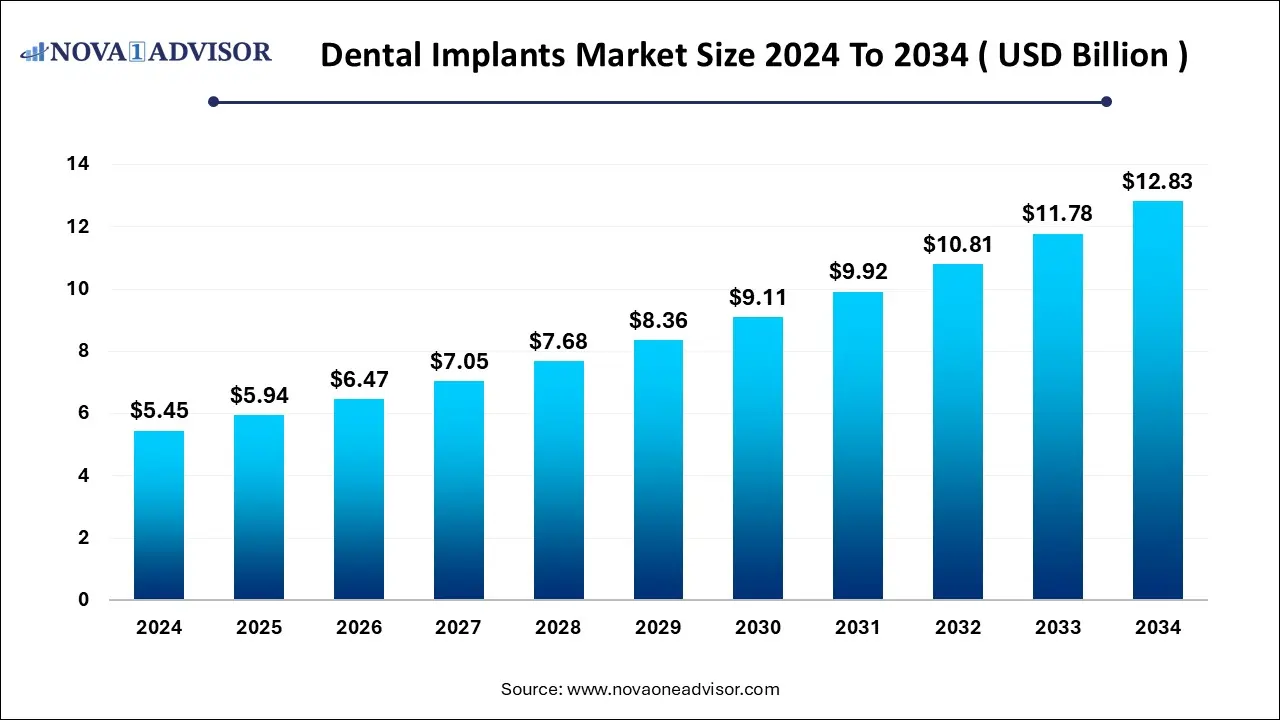

Dental Implants Market Size and Growth 2025 to 2034

The global dental implants market size was estimated at USD 5.45 billion in 2024 and is anticipated to hit around USD 12.83 billion by 2034, expanding at a CAGR of 8.94% from 2025 to 2034.

Key Takeaways

- By material, the titanium segment dominated the market in 2024.

- By material, the zirconia segment is expected to have the fastest growth rate.

- By design, the tapered design segment led the market as of this year.

- By design, parallel-walled segment is expected to grow at the fastest rate over the forecast period.

- By end user, dental clinics dominated the market as of this year in 2024.

- By end user, hospitals are seen to be the fastest growing segment in the upcoming years.

- By region, North America held the largest market share in 2024.

- By region, Asia-pacific is expected to have the fastest rate of growth throughout the forecast years.

What are Dental Implants?

Dental implants are defined as artificial structures that a dental surgeon inserts into one’s jawbone. A person may require implants if they have lost one or more teeth. Dental implants, which serve as artificial tooth roots, help to provide a permanent and reliable alternative for traditional dentures and bridges by offering improved functionality, aesthetics and also boosting the patient’s confidence. The primary applications of dental implants include single-tooth replacement, multiple-tooth restoration and even a full-mouth rehabilitation.

What are the Key Trends in the Market?

- Adoption of 3D Printing and Digital Dentistry: 3D printing technology is revolutionizing the dental implant manufacturing domain, allowing for precise customization and faster production times.

- Rise of Minimally Invasive Procedures: Advancements in guided implant surgery and flapless techniques are reducing procedure time, improving patient comfort and accelerating recovery.

- Zirconia Implants: The demand for metal-free, aesthetically appealing and biocompatible zirconia implants is gaining traction as it is an alternative to traditional titanium implants.

- Integration of Artificial Intelligence: AI-powered diagnostic tools and treatment planning softwares are improving precision, reducing surgical errors as well as optimizing patient outcomes.

- Demand for Cosmetic Dentistry: Growing awareness regarding dental aesthetics and an increasing preference for natural-looking restorations are contributing to the growth of the dental implants market.

Report Scope of Dental Implants Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.94 Billion |

| Market Size by 2034 |

USD 12.83 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.94% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Material, By Design, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Institut Straumann AG, Bicon, LLC., BioHorizons IPH, Inc., OSSTEM IMPLANT, Nobel Biocare Services AG, Dentis, Dentium Co. Ltd., Zimmer Biomet Holdings, Inc., KYOCERA Medical Corporation, Leader Italy |

Market Dynamics

Driver

The increasing global prevalence of tooth loss and various dental disorders is a key driver propelling the dental implant market forward. As populations continue to age, the chances of conditions that lead to tooth loss, such as dental caries and periodontal disease also rise. Dental implants are widely considered as the most effective and durable solution for replacing missing teeth, offering a significant improvement in function, aesthetics and quality of life than compared to traditional dentures and bridges

This demographic trend, coupled with the growing awareness about the benefits of dental implants, has fueled a consistent demand for restorative dental procedures. The high number of individuals affected by various dental conditions also ensures a steady patient pool for dental implant procedures, supporting growth and development.

Restraint

The high cost of dental implant procedures is the primary restraint hindering the market’s growth, especially in regions where dental care is not covered by any universal healthcare or private insurance plans. Unlike many other medical procedures, dental implants are considered as cosmetic, thus leading to limited or no coverage from standard dental insurance policies. This places a significant financial burden on patients, and they may opt for less expensive and less effective alternatives like bridges or dentures. This high cost coupled with the lack of comprehensive reimbursements limits access, slowing down market entry and potential.

Opportunity

The emergence and growth of dental tourism is a significant opportunity for the dental implant market. Dental tourism involves patients traveling to another country in order to receive dental care, often for procedures that can be expensive in their home country. Countries like Mexico, Costa Rica, South Korea and Thailand have become popular destinations due to the availability of high-quality dental care at a much lesser cost. A dental implant that costs thousands of dollars in one country may be available for less in a dental tourism destination, leading to popularity.

This cost-saving agenda, combined with the convenience of combining dental work with a vacation is attracting a growing number of patients. This trend is particularly beneficial for those who do not have adequate insurance coverage for dental implants, thus expanding the patient base beyond domestic borders and creating a new revenue stream for dental providers in these popular destinations.

Segmental Analysis

By Material Insights

Which material segment dominated the market in 2024?

The titanium segment dominated the market in 2024. This is due to its biocompatibility, mechanical strength and good corrosion resistance. Dental professionals all over the world widely prefer titanium implants as they offer excellent osseointegration, ensuring long-term stability and durability within the jawbone. Their proven clinical success, extensive research support and cost-effectiveness compared to newer materials have further strengthened their position.

The zirconia segment is expected to grow at the fastest rate over the forecast period. This growth is driven by the rising demand for metal-free, highly aesthetic and biocompatible alternatives than compared to traditional titanium implants. Zirconia implants offer a superior tooth-colored appearance, making them ideal for patients who have thin gingival tissue or high esthetic expectations. The advantage of this segment lies in their excellent corrosion resistance, low plaque accumulation, and non-allergenic properties, which make them suitable for people who have metal sensitivities.

By Design Insights

Which design led the market as of this year?

The tapered design segment led the market as of this year, owing to its superior primary stability and versatility in various bone conditions. Tapered implants closely mimic the natural shape of a tooth root, allowing for better adaptation in narrow ridges and extraction sockets. This enhances placement precision and load distribution. It even facilitates immediate implantation and loading, reducing treatment time and improving patient outcomes.

The parallel-walled segment is expected to grow at the fastest rate over the forecast period, driven by its predictable load distribution, ease of placement and suitability for dense bone structures. These implants offer a larger surface area for bone contact, leading to good quality osseointegration and long-term stability, especially in cases that require multiple implants or complex restorations. Their uniform shape enables greater surgical flexibility and consistency helps in reducing the risk of micro-movements and implant failure.

By End User Insights

Which end user held the largest market share in 2024?

The dental clinics segment held the largest market share in 2024. This dominance can be attributed to the increased preference for the dental clinics for the treatment of oral issues. Moreover, the availability of the specialized equipment and experienced and skilled dentists in the dental clinics has fostered this segment’s growth in these recent years. The growing adoption of the latest and digital technologies in the dental clinics is expected to drive this segment forward even more.

Hospitals are seen to be the fastest-growing segment during the forecast period. This dominance is due to the rising number of road accidents, a rapidly growing global geriatric population, and the rising penetration of the multi-specialty hospitals all across the globe. Moreover, hospitals are equipped with all the necessary resources and expertise, making the patient feel safe and secure.

By Regional Analysis

Why is North America dominating the market in 2024?

North America dominated the dental implants market in 2024, driven by the strong presence of leading manufacturers, advanced healthcare infrastructure, and high adoption of digital dentistry technologies. The region also benefits from a large pool of trained dental professionals, the widespread use of CAD/CAM systems, 3D printing and increasing patient awareness regarding aesthetic and restorative dental procedures. The region also has favorable reimbursement policies which further supports market growth.

What are the advancements in Asia-Pacific?

Asia-Pacific region is experiencing the growth throughout the forecast period, driven by rising oral health awareness, an expanding elderly population, and increasing disposable incomes across emerging economies. The growing incidence of tooth loss, dental caries and periodontal diseases is also boosting the demand for long-term restorative solutions. In addition to that, the region has a constantly improving healthcare infrastructure and a growing number of skilled dental professionals, which has led to a surge in dental tourism, particularly in countries like India and South Korea, thus strengthening market growth.

Some of The Prominent Players in The Dental Implants Market Include:

- Institut Straumann AG

- Bicon, LLC.

- BioHorizons IPH, Inc.

- OSSTEM IMPLANT

- Nobel Biocare Services AG

- Dentis

- Dentium Co. Ltd.

- Zimmer Biomet Holdings, Inc.

- KYOCERA Medical Corporation

- Leader Italy

Recent Developments

- In July 2025, ZimVie Inc. announced a strategic distribution partnership with Osstem Implant Co., Ltd., which is a prominent provider of high-quality dental implants and integrated dental technologies worldwide. This collaboration aims to strengthen ZimVie's global footprint by expanding into the rapidly growing Chinese implant market, which is estimated to boost the number of units sold annually, and will also improve customer access to its innovative range of implant solutions.

- In March 2025, Dentsply Sirona, which is the world’s largest manufacturer of diversified professional dental products and technologies, announced its participation at the Academy of Osseointegration’s (AO) Annual Meeting 2025, which is taking place from March 27 to 29 in Seattle, WA. Here, Dentsply Sirona will spotlight its latest innovation, the MIS LYNX implant alongside an engaging Corporate Forum focused on the continuous evolution of implant dentistry.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the dental implants market.

By Material

- Titanium

- Zirconium

- Ceramic

- Others

By Design

- Tapered Implants

- Parallel Wall Implants

By End User

- Dental Clinics

- Hospitals

- Research Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)