Dental Microsurgery Market Size and Research

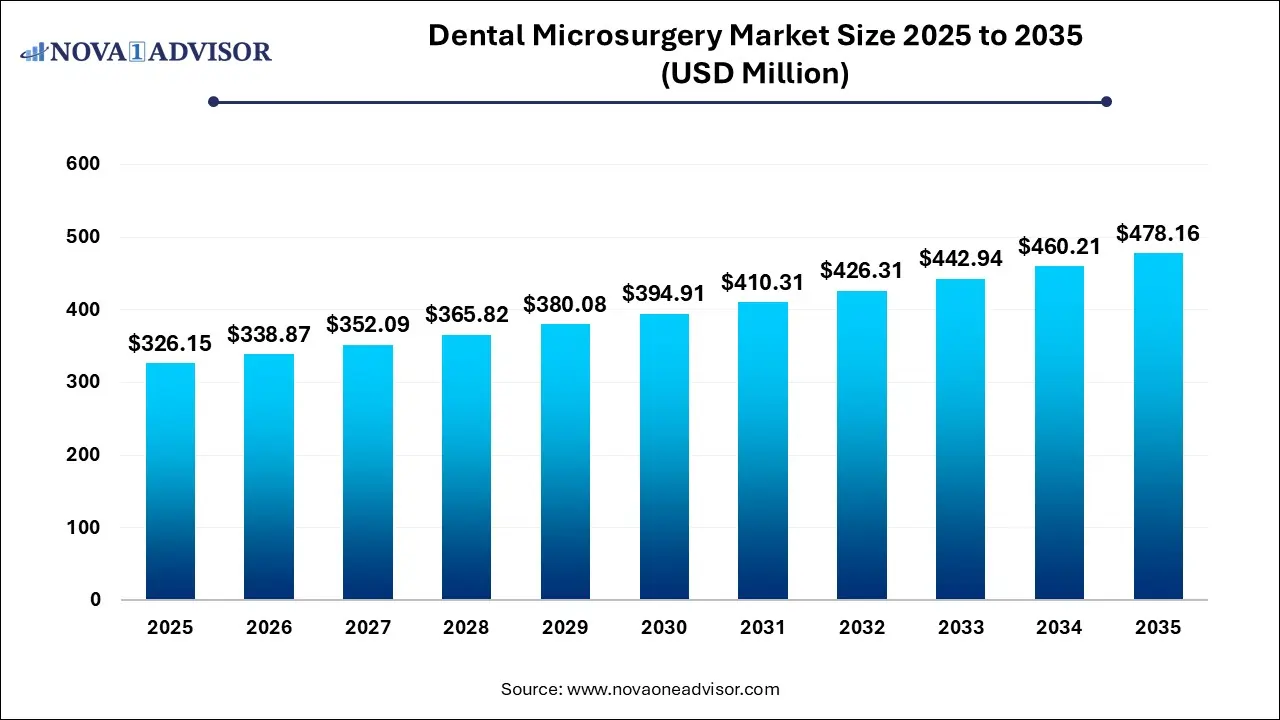

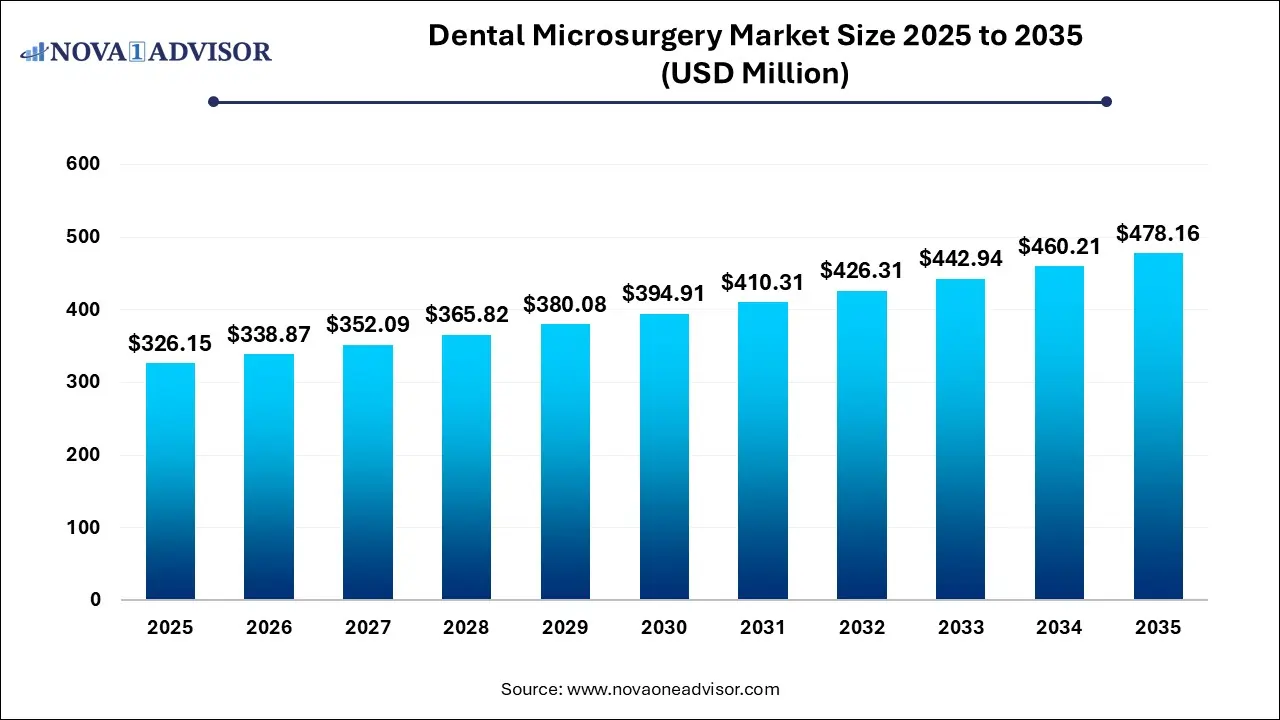

The Dental microsurgery market size was exhibited at USD 326.15 million in 2025 and is projected to hit around USD 478.16 million by 2035, growing at a CAGR of 3.9% during the forecast period 2026 to 2035.

Key Takeaways:

- The optical/viewing instruments segment dominated the dental microsurgery market with the largest revenue share of 74% in 2025.

- The endodontic procedures led the dental microsurgery industry, with the largest revenue share of 30% in 2025.

- The North America dental microsurgery market dominated the global market with the largest revenue share of 39% in 2025.

Market Overview

The Dental Microsurgery Market is an evolving segment within the broader dental healthcare industry that incorporates advanced magnification technologies and precision instruments for complex oral procedures. Dental microsurgery offers enhanced visibility, precision, and minimally invasive techniques, which improve outcomes in restorative, endodontic, periodontic, and implant procedures. The growing demand for aesthetic dentistry, increasing prevalence of dental disorders, and rising awareness about oral hygiene are collectively accelerating the adoption of microsurgical methods in dental care.

Technological advancements such as dental operating microscopes (DOMs), enhanced microsurgical instrumentation, and 3D imaging systems have contributed significantly to this market's expansion. Dental microsurgery minimizes patient discomfort, reduces healing time, and improves success rates of intricate procedures such as apicoectomy and microsurgical periodontal interventions. These benefits are fostering its popularity among both patients and practitioners.

Globally, the rising disposable income levels and the increasing trend of dental tourism in emerging economies are also pushing the demand for quality dental services, thereby positively impacting the microsurgery domain. In addition, favorable government initiatives supporting dental health and an increase in the number of dental professionals trained in microsurgery techniques are facilitating market growth.

Major Trends in the Market

-

Rising adoption of dental operating microscopes (DOMs): Clinics and hospitals are increasingly equipping their dental chairs with high-definition microscopes to enable better visualization during surgeries.

-

Technological integration in microsurgical tools: Introduction of ergonomically designed and lightweight microsurgical instruments that enhance precision and reduce hand fatigue.

-

Growing popularity of minimally invasive procedures: Patients are showing a marked preference for less painful procedures with faster recovery, supporting the use of microsurgery.

-

Expansion of dental tourism: Countries such as India, Thailand, and Hungary are witnessing increased dental tourism, where microsurgical interventions are offered at competitive prices.

-

Customized dental implant systems: Manufacturers are focusing on developing patient-specific microsurgical implant kits, increasing the success rates and comfort levels.

-

Increased collaboration between dental clinics and academic institutions: These partnerships aim to standardize microsurgical practices and promote research and development.

-

Growing demand for aesthetic and cosmetic dental procedures: Microsurgery is becoming central in aesthetic periodontal and endodontic treatments due to its precision.

Report Scope of Dental Microsurgery Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 338.87 Million |

| Market Size by 2035 |

USD 478.16 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 3.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Procedure, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Carl Zeiss Meditec AG; Global Surgical Corporation; Albert Waeschle.; SYNOVIS MICRO COMPANIES ALLIANCE, INC.; Hu-Friedy Mfg. Co., LLC. |

One of the most influential drivers of the dental microsurgery market is the advancement in dental imaging and visualization tools, particularly the use of dental operating microscopes (DOMs) and cone-beam computed tomography (CBCT). These tools allow for high-definition imaging and magnification of treatment sites, enabling clinicians to perform delicate procedures with greater accuracy and efficiency.

For instance, during an apicoectomy a surgical removal of the apex of a tooth root DOMs can enhance visualization of the treatment area, ensuring precise incisions and minimal tissue damage. Such advancements have not only improved treatment outcomes but also made the procedures safer and more predictable. Additionally, digital visualization platforms support real-time video recording and playback, which is useful for both diagnostics and education, further reinforcing the demand for dental microsurgery.

Market Restraint: High Cost of Equipment and Training

Despite its benefits, the high cost of dental microsurgical equipment and the extensive training required for effective usage remain significant barriers. Microsurgical instruments and imaging tools like dental microscopes and endoscopes are expensive and often unaffordable for small clinics, especially in developing regions. Moreover, performing microsurgery requires substantial expertise, which mandates extensive training programs.

For example, practitioners must undergo specialized courses to master the use of microsurgical sutures, flaps, and micro-instruments. The training, combined with equipment costs, significantly increases the overall investment, deterring small and medium dental practices from adopting such technologies. This creates an uneven distribution in access to advanced care, especially across rural and underdeveloped healthcare infrastructures.

Market Opportunity: Integration of Artificial Intelligence in Microsurgery

The integration of artificial intelligence (AI) into dental microsurgery workflows presents a promising opportunity. AI can be harnessed for diagnostic imaging, treatment planning, and surgical guidance, thereby enhancing clinical accuracy. When integrated with computer-aided design (CAD) systems and robotics, AI can facilitate real-time decision-making, automate routine surgical tasks, and help predict procedural outcomes.

For instance, AI-driven platforms can identify dental root fractures or hidden canals using CBCT imaging before a microsurgical endodontic procedure, allowing for better preoperative planning. Startups and established players are exploring the use of machine learning algorithms to create predictive models that reduce surgical errors. These innovations not only improve patient outcomes but also help in reducing chairside time and costs, encouraging wider adoption.

Segmental Analysis

By Product

The Optical/Viewing Instruments segment, which includes dental operating microscopes, endoscopes, and loupes, holds the largest share of the dental microsurgery market. These tools are crucial for enhancing visibility and precision during surgical procedures. Dental operating microscopes are now considered a standard in endodontic surgeries, facilitating detailed examination of tooth structures. Leading manufacturers like Carl Zeiss Meditec and Leica Microsystems are continuously innovating their optical tools with ergonomic designs, 3D capabilities, and augmented reality interfaces.

The fastest-growing segment, however, is Microsurgical Instrumentation, driven by increasing demand for delicate procedures such as periodontal regeneration and root-end resections. These instruments include micro forceps, scalers, scissors, and sutures designed specifically for high-precision surgeries. With innovations focused on durability, reduced glare, and ease of sterilization, microsurgical tools are seeing high adoption rates in premium dental clinics globally. Moreover, training centers are actively incorporating these instruments in microsurgical courses, supporting their rapid market growth.

By Procedure

The Dental Implants segment is the largest in terms of revenue, attributed to the rising number of implant procedures globally and the critical role of microsurgery in ensuring successful implantation. Microsurgical techniques enable better flap design, improved osseointegration, and minimized tissue trauma. In implantology, microsurgery helps preserve bone structures and soft tissues, leading to aesthetically pleasing and functionally effective outcomes. Dental implants have become the go-to solution for tooth loss, further driving demand.

Meanwhile, the fastest-growing procedure segment is Apicoectomy, especially in North America and Europe, where endodontic retreatment is common. Apicoectomy requires precise excision of the tooth root apex and sealing of the root canal end, which is best performed under magnification. With increased awareness about tooth preservation and the risks of systemic infections from untreated periapical abscesses, apicoectomy is gaining traction. Dental clinics are equipping their surgical suites with microsurgical kits and DOMs to perform these procedures with higher success rates and lower recurrence.

By Regional Analysis

North America, particularly the United States, leads the dental microsurgery market due to advanced healthcare infrastructure, a high concentration of trained dental surgeons, and early adoption of technology. The U.S. dental market is well-regulated, with significant investments in R&D and professional training. Dental professionals in the region frequently attend microsurgical workshops and certification programs, which further strengthens the demand for specialized tools and procedures.

Insurance coverage for dental procedures, growing awareness of oral health, and increasing cosmetic dental surgeries add to the momentum. Additionally, companies like Dentsply Sirona, Global Surgical Corporation, and Seiler Instrument are headquartered or have significant operations in North America, contributing to product accessibility and innovation in the region.

The Asia Pacific region is witnessing the fastest growth due to rising dental tourism, a growing middle-class population, and expanding dental infrastructure. Countries like India, China, and South Korea are investing in modernizing their dental clinics, incorporating high-end equipment and offering specialized microsurgical procedures at competitive costs. This attracts international patients, particularly from the U.S., Canada, and Europe.

Additionally, government programs promoting oral health awareness and subsidies for dental equipment purchases in certain nations are further stimulating the market. Medical tourism hubs such as Bangkok and Mumbai are offering bundled dental microsurgery packages, making these procedures more accessible and affordable. Increasing academic collaborations with Western universities are also helping in the training of local dental professionals in advanced microsurgical techniques.

Some of The Prominent Players in The Dental microsurgery market Include:

Recent Developments

-

April 2025: Dentsply Sirona announced a strategic partnership with the American Association of Endodontists to develop AI-powered tools for precision in root canal microsurgeries.

-

March 2025: Carl Zeiss Meditec launched a new range of ergonomic dental microscopes under the EXTARO series with built-in AR-enhanced visualization features tailored for microsurgery.

-

January 2025: Seiler Instrument introduced a modular microscope upgrade kit designed to convert traditional dental setups into microsurgical stations with real-time imaging and 4K recording capabilities.

-

November 2024: Global Surgical Corporation expanded its Missouri production facility to meet the rising demand for DOMs in emerging markets, particularly in Southeast Asia.

-

September 2024: Leica Microsystems partnered with several European universities to provide training programs on minimally invasive dental surgery using their advanced microscopes.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Optical/Viewing Instruments

- Microsurgical Instrumentation

- Others

By Procedure

- Dental Implants

- Diagnostic Procedures

- Apicoectomy

- Periodontal Surgery

- Endodontic Procedures

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)