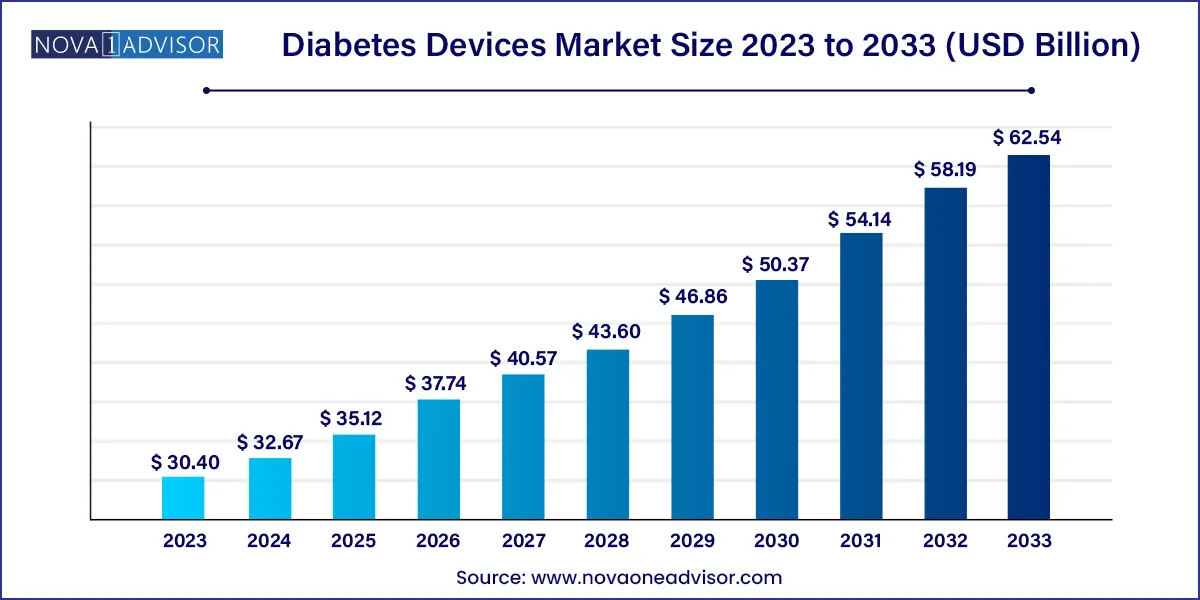

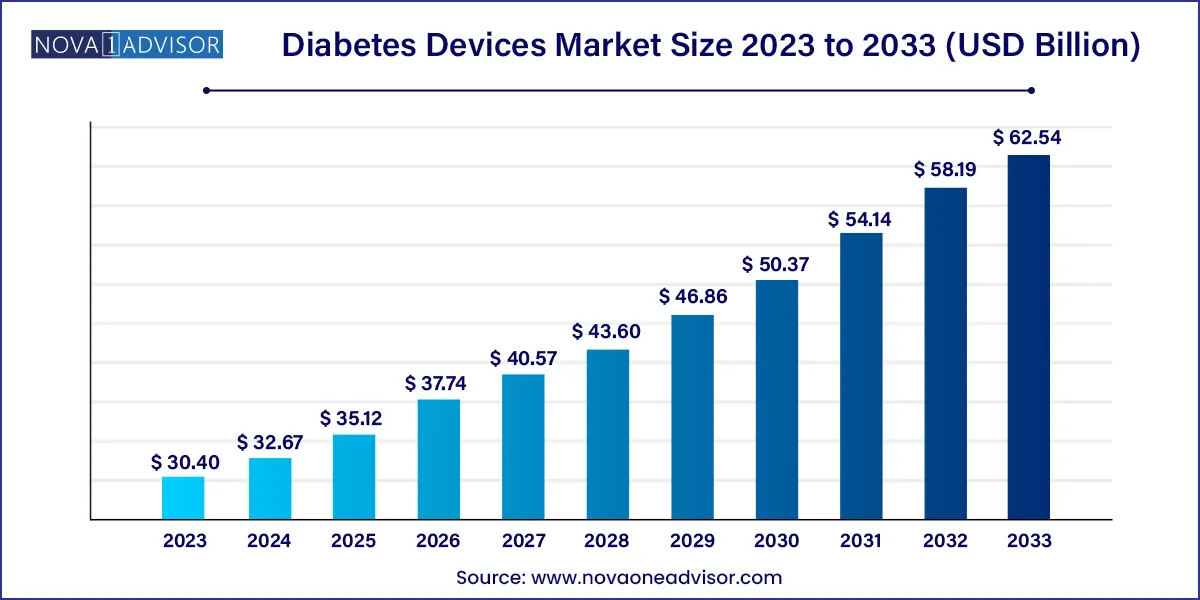

The global diabetes devices market size was exhibited at USD 30.40 billion in 2023 and is projected to hit around USD 62.54 billion by 2033, growing at a CAGR of 7.48% during the forecast period 2024 to 2033.

Key Takeaways:

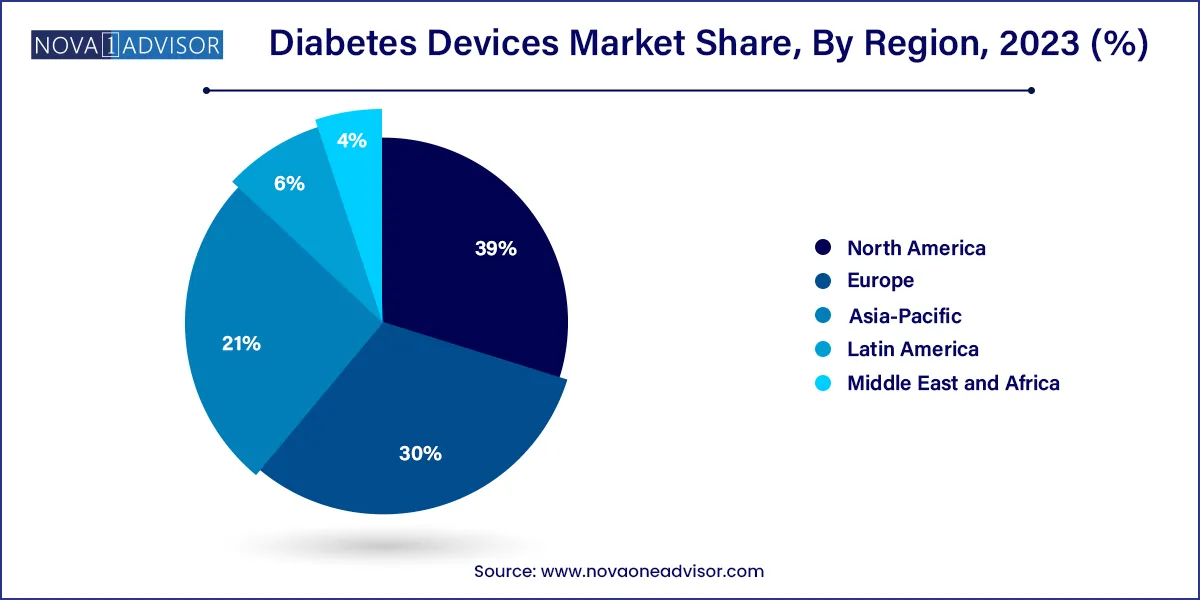

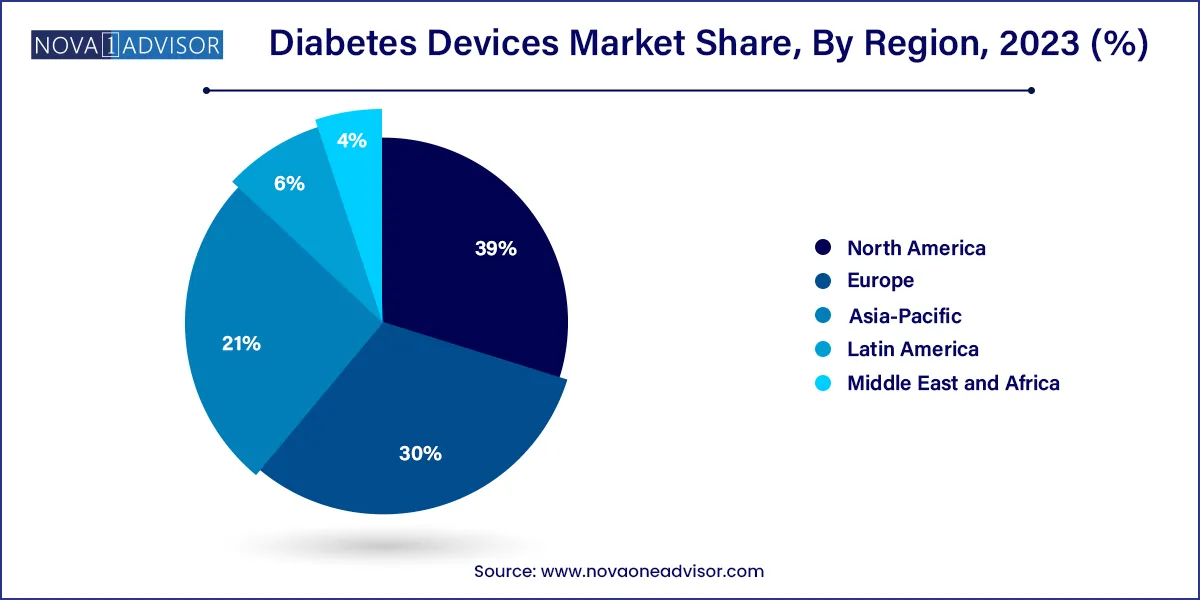

- The diabetes devices market in North America accounted for the largest revenue share of 39.0% in 2023.

- Based on distribution channel, the hospital pharmacies segment led the market with the largest revenue share of 54.13% in 2023,

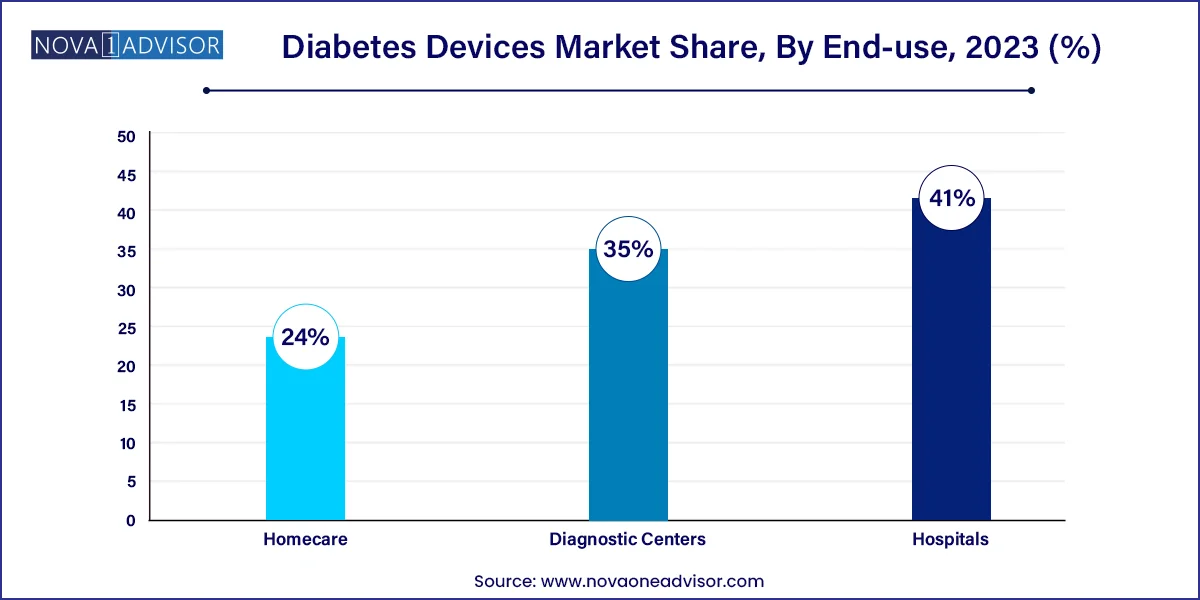

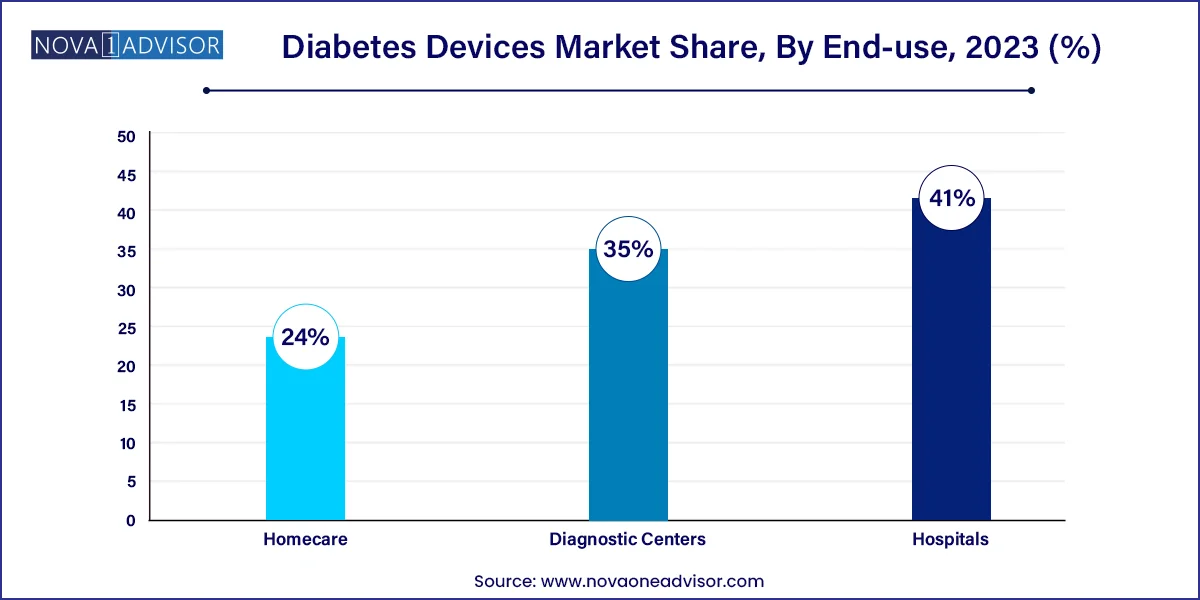

- Based on end-use, the hospital segment led the market with the largest revenue share of 41.0% in 2023.

Market Overview

The global diabetes devices market represents a vital segment within the broader medical devices industry, catering to the growing global diabetic population, currently exceeding 530 million. These devices play a crucial role in disease management, enabling accurate monitoring of blood glucose levels and the timely administration of insulin. Rising diabetes prevalence, particularly Type 2 diabetes, is largely attributed to sedentary lifestyles, poor dietary habits, and increasing obesity rates across both developed and developing nations.

The market encompasses a wide range of technologies including blood glucose monitoring (BGM) systems, continuous glucose monitoring (CGM) devices, and insulin delivery solutions such as pens, pumps, and jet injectors. With a growing focus on digital health and patient-centric care, the integration of these devices with smartphone apps and cloud-based platforms is revolutionizing diabetes management. Companies are investing in user-friendly, minimally invasive solutions to enhance patient compliance and improve outcomes. The global healthcare system, in turn, is transitioning towards preventive care, thereby propelling the demand for advanced diabetes management tools.

Major Trends in the Market

-

Increasing adoption of wearable continuous glucose monitoring (CGM) systems

-

Integration of diabetes devices with digital health platforms and mobile apps

-

Emergence of non-invasive blood glucose monitoring technologies

-

Rising use of AI and data analytics in insulin dosing and glucose prediction

-

Growing demand for smart insulin pens with Bluetooth connectivity

-

Expansion of online pharmacy distribution channels post-COVID-19

-

Development of closed-loop insulin delivery systems (artificial pancreas)

-

Miniaturization and personalization of diabetes management tools

-

Public-private partnerships promoting access in low-income countries

-

Subscription-based supply models for test strips and insulin supplies

Diabetes Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 32.67 Billion |

| Market Size by 2033 |

USD 62.54 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.48% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Distribution Channel, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medtronic plc; Abbott Laboratories; F.Hoffmann-La-Ltd.; Bayer AG; Lifescan, Inc.; B Braun Melsungen AG; Lifescan, Inc.; Dexcom Inc.; Insulet Corporation; Ypsomed Holdings; Companion Medical; Sanofi; Valeritas Holding Inc.; Novo Nordisk; Arkray, Inc. |

Key Market Driver: Rising Global Prevalence of Diabetes

The escalating global burden of diabetes, especially Type 2 diabetes, stands as the foremost driver of the diabetes devices market. According to the International Diabetes Federation (IDF), nearly 1 in 10 adults globally is living with diabetes, and the number is projected to rise to 643 million by 2030. This surge is placing immense pressure on healthcare systems to adopt effective and scalable disease management solutions.

Blood glucose monitoring and insulin delivery devices are indispensable for diabetes care. Self-monitoring of blood glucose (SMBG) empowers patients to take control of their health, while CGM systems offer continuous data that supports better glycemic control. As diabetes increasingly affects younger populations and urban centers, early detection and proactive management through medical devices are becoming critical. Governments and insurance providers are responding with reimbursement programs and incentives for advanced diabetes technologies, thereby reinforcing demand.

Key Market Restraint: High Cost and Limited Reimbursement in Developing Regions

Despite technological advancements, the high cost of diabetes devices remains a significant barrier in many low- and middle-income countries. CGM systems, insulin pumps, and even basic blood glucose meters can be prohibitively expensive without insurance or subsidies. For example, in parts of Africa and Southeast Asia, patients often rely on manual syringes and test strips due to affordability concerns.

Furthermore, inconsistent reimbursement policies across countries hinder equitable access. While Western nations offer extensive coverage for CGM and insulin delivery devices, emerging economies lag behind. This gap is exacerbated by a lack of infrastructure and trained personnel to manage and interpret data from advanced devices. Until comprehensive public health frameworks and pricing reforms are implemented, market penetration in these regions will remain limited.

Key Market Opportunity: Technological Innovation in Non-Invasive and AI-Driven Devices

A transformative opportunity lies in the development of non-invasive and AI-powered diabetes devices. Non-invasive glucose monitoring, which eliminates the need for finger pricks or implantable sensors, is a rapidly advancing frontier. Companies like Apple and various startups are exploring spectroscopic and transdermal technologies to offer pain-free solutions.

Parallelly, AI integration is redefining diabetes management. Predictive algorithms now forecast glucose fluctuations, recommend insulin doses, and provide real-time alerts. Closed-loop systems, or artificial pancreas technologies, combine CGM with insulin pumps and AI-based controllers to automate insulin delivery. These innovations promise to enhance user convenience, reduce manual errors, and drive adoption among newly diagnosed patients.

Segments Insights:

By Type Insights

Blood Glucose Monitoring (BGM) devices dominate the diabetes devices market, especially self-monitoring systems comprising meters, strips, and lancets. Their affordability, ease of use, and widespread availability make them the first choice for millions. Testing strips, in particular, are the revenue backbone, as they require regular replenishment. In both developed and developing countries, SMBG remains the mainstay for managing diabetes, especially where CGM access is limited. The familiarity and relatively low cost of BGM devices ensure their continued dominance despite technological advancements.

Continuous glucose monitoring (CGM) devices are the fastest-growing segment, driven by their superior accuracy and ability to provide real-time glucose trends. Within CGM, sensors hold the largest share due to their recurring nature and central role in tracking glucose levels. Devices like Abbott's FreeStyle Libre and Dexcom's G7 are gaining widespread adoption among Type 1 diabetics, athletes, and even pre-diabetics. The integration of transmitters and receivers with mobile apps and insulin delivery devices is reshaping diabetes care into a fully connected ecosystem.

Insulin delivery devices remain a critical category, with insulin pens dominating due to their ease of administration, portability, and affordability. Prefilled and smart pens are increasingly popular among Type 2 diabetes patients for daily use. Pens offer consistent dosage, are less intimidating than syringes, and have become the standard in outpatient settings.

Insulin pumps are the fastest-growing sub-segment, especially among young and tech-savvy patients. These devices provide continuous subcutaneous insulin infusion and, when paired with CGM, support semi-automated glycemic control. Emerging innovations in patch pumps and tubeless designs are addressing usability concerns, making pumps more accessible to a broader demographic.

By Distribution Channel Insights

Retail pharmacies dominate the distribution landscape, serving as the primary point of sale for test strips, glucose meters, insulin pens, and lancets. Their presence across urban and rural areas, combined with pharmacist consultations, enhances accessibility. In countries with established pharmacy networks, patients rely on local drugstores for immediate and affordable refills.

Online pharmacies are the fastest-growing channel, driven by the e-commerce boom and increased preference for contactless delivery post-pandemic. Platforms such as Amazon Pharmacy, 1mg, and PharmEasy offer subscription models, auto-refill services, and home delivery of diabetes devices and consumables. Digital access to diagnostic and monitoring products is particularly impactful in remote areas and for the elderly.

By End-use Insights

Hospitals remain the dominant end-use segment, as they manage complex diabetes cases, including gestational and Type 1 diabetes. Hospitals utilize both BGM and CGM systems for inpatient monitoring, as well as insulin pumps for acute glycemic control. Additionally, hospital pharmacies stock a wide range of diabetes products for discharge planning and continuity of care.

Homecare is the fastest-growing segment, reflecting a shift towards patient self-management. As healthcare moves beyond the hospital, patients and caregivers are embracing portable, user-friendly devices for day-to-day glucose and insulin management. This trend is especially prevalent among the elderly and those with limited mobility, supported by telemedicine consultations and remote monitoring.

By Regional Insights

North America dominates the global diabetes devices market, led by the United States, where diabetes affects over 37 million people. High awareness levels, strong reimbursement systems, and early adoption of CGM and insulin pump technologies contribute to this leadership. U.S.-based companies like Dexcom, Insulet, and Medtronic drive innovation, while regulatory frameworks like the FDA fast-track novel diabetes solutions. Canada also has a robust market supported by national health programs.

Asia-Pacific is the fastest-growing region, driven by a massive diabetic population, improving healthcare infrastructure, and growing digital penetration. India and China are key contributors, with rising awareness and government initiatives like India’s Ayushman Bharat scheme promoting diagnostic and device accessibility. Local manufacturers are entering the market with affordable BGM and insulin pens, while global players expand their footprint through strategic partnerships and e-commerce.

Recent Developments

-

Dexcom (March 2025) received FDA clearance for its G7 CGM system with improved sensor accuracy and shorter warm-up time.

-

Abbott (February 2025) launched its FreeStyle Libre 4, integrating real-time glucose monitoring with smart insulin pen compatibility.

-

Medtronic (January 2025) announced clinical trials for its MiniMed 900G, an AI-enabled closed-loop insulin pump system.

-

Tandem Diabetes Care (December 2024) completed the acquisition of AMF Medical, expanding its portfolio into patch pump technology.

-

Insulet Corporation (November 2024) introduced Omnipod 5 in Europe, its first tubeless, automated insulin delivery system approved for children as young as two years old.

Some of the prominent players in the Diabetes devices market include:

- Medtronic plc

- Abbott Laboratories

- F.Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Sanofi

- Valeritas Holding Inc.

- Novo Nordisk

- Arkray, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global diabetes devices market.

Type

-

-

- Blood Glucose Meters

- Testing Strips

- Lancets

-

- Continuous Glucose Monitoring Devices

-

-

- Sensors

- Transmitters

- Receiver

-

- Pumps

- Pens

- Syringes

- Jet Injectors

Distribution Channel

- Hospital pharmacies

- Retail Pharmacies

- Diabetes Clinics/Center

- Online Pharmacies

- Others

End-use

- Hospitals

- Diagnostic Centers

- Homecare

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)