Diabetes Drugs Market Size and Growth

The global diabetes drugs market size is calculated at USD 88.66 billion in 2024, grow to USD 100.1 billion in 2025, and is projected to reach around USD 298.31 billion by 2034.exhibiting a CAGR of 12.9% during the forecast period. The market is growing due to the rising global prevalence of diabetes and increasing awareness about early diagnosis and treatment. Advancements in drug formulations and delivery methods are also boosting market expansion.

-Ibuprofen-Market.webp)

Key Takeaways

- North America dominated the diabetes drugs market in 2024.

- Asia-Pacific is expected to grow at the highest CAGR in the market during the forecast period.

- By drug class, the GLP-1 receptor agonist segment held the largest market shares.

- By drug class, the insulin segment is expected to grow at the fastest CAGR in the market during the studied years.

- By diabetes type, the type 2 segment dominated the market.

- By diabetes type, the type 1 segment is expected to grow at the fastest CAGR in the diabetes drugs market during the studied years.

- By route of administration, the subcutaneous segment led the market.

- By route of administration, the oral segment is expected to grow at the fastest CAGR in the market during the studied years.

- By distribution channel, the retail pharmacies segment held the highest market shares.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the studied years.

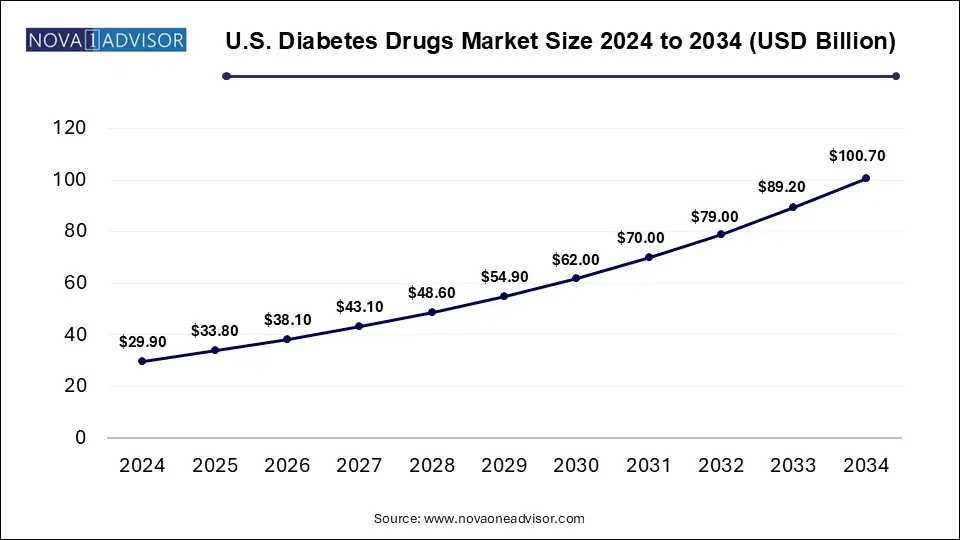

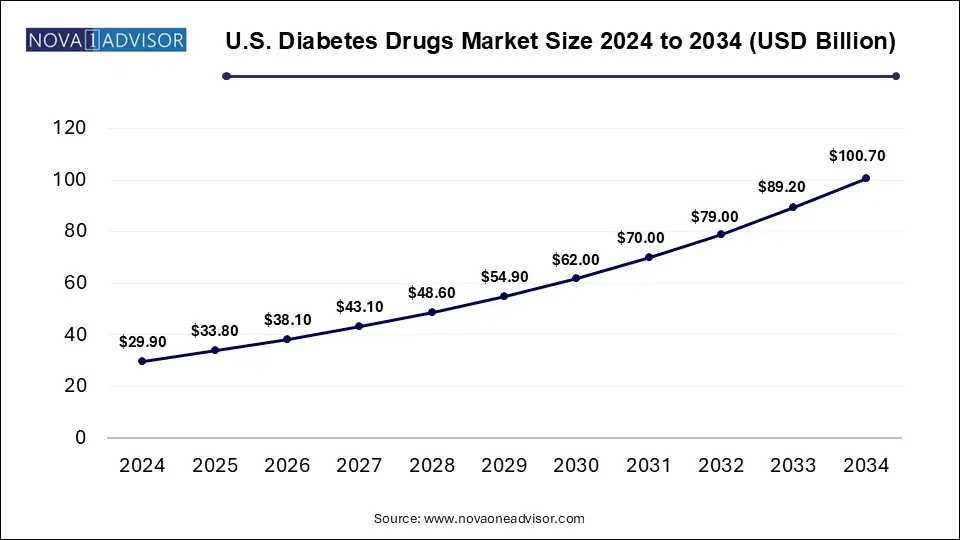

U.S. Diabetes Drugs Market Size and Growth 2025 to 2034

The U.S. diabetes drugs market size was evaluated at USD 29.9 billion in 2024 and is predicted to be worth around USD 100.7 billion by 2034, rising at a CAGR of 11.67% from 2025 to 2034

How is North America Contributing to the Expansion of the Diabetes Drugs Market?

North America dominated the market in 2024 due to its advanced healthcare infrastructure, high awareness levels, and early adoption of innovative therapies. The region has a large diabetic population, particularly in the United States, driving strong demand for effective treatments. Additionally, the strong presence of leading pharmaceutical companies, substantial investments in research and development, and favorable reimbursement policies have supported market growth. Regular screening, early diagnosis, and access to modern medications further contributed to North America’s market leadership.

- For Instance, In January 2023, Eli Lilly announced a USD 450 million investment to expand its North Carolina facility. The upgrade will increase production and packaging capacity to meet rising demand for its incretin-based diabetes treatments.

How is Asia Pacific Accelerating the Diabetes Drugs Market?

Asia Pacific is poised for the fastest CAGR in the market due to several converging factors. Rapid urbanization and lifestyle shifts are driving a surge in diabetes cases, particularly type 2. Simultaneously, improving healthcare infrastructure and rising incomes are increasing access to diagnosis and treatment. Governments across the region are launching chronic disease programs, while pharmaceutical companies expand their reach. This combination of high disease burden, expanding care access, and economic growth makes Asia Pacific a key growth hotspot.

- For Instance, In July 2024, a subject expert committee under India’s central drug authority approved tirzepatide, the active component in Eli Lilly’s widely recognized drugs, Mounjaro and Zepbound. This clearance marks a significant step toward introducing these advanced diabetes treatments to the Indian market.

How is Innovation Impacting the Diabetes Drugs Market?

Diabetes drugs are pharmaceutical agents designed to manage and regulate blood glucose levels in individuals with diabetes by enhancing insulin secretion, improving insulin sensitivity, or reducing glucose production and absorption in the body. Innovation is driving growth in the diabetes drugs market by introducing advanced therapies that offer improved blood sugar control, reduced side effects, and greater patient convenience, Developments such as GLP-1 receptor agonist, SGLT2 inhibitor, and smart insulin are transforming diabetes management. Moreover, the integration of digital health tools and personalized medicine is enhancing treatment outcomes, patient monitoring, and adherence. These innovations are meeting the rising demand for more effective and user-friendly diabetes care solutions.

- For Instance, In January 2025, the FDA approved Ozempic (semaglutide) to reduce kidney disease progression and heart-related deaths in type 2 diabetes patients with chronic kidney disease. Backed by the FLOW trial showing a 24% risk reduction, Ozempic is now the most broadly approved GLP-1 receptor agonist, expanding its cardiometabolic benefits.

What are the leading trends shaping the Diabetes Drugs Market in 2024?

- In January 2024, Glenmark introduced India’s first biosimilar of Liraglutide, a widely used treatment for type 2 diabetes in adults. Branded as Lirafit and priced at just USD 1.20, it will be available by prescription only. This launch is expected to improve patient access by reducing treatment costs by up to 70%.

- In June 2023, the FDA approved Jardiance and Synjardy for treating type 2 diabetes in children aged 10 and above. These drugs, already used in adults, showed significant HbA1C reduction in trials. They expand treatment options beyond metformin but aren’t recommended for type 1 diabetes or severe kidney issues.

How is AI enhancing advancements in the Diabetes Drugs Market?

AI is transforming the market by speeding up drug discovery, identifying new therapeutic targets, and optimizing clinical trials. It enables personalized treatment by analyzing patient data to predict responses and adjust therapies accordingly. AI also enhances early diagnosis and monitoring, helping develop more effective and targeted drugs. This leads to improved outcomes, reduced development time, and better disease management for diabetes patients.

Report Scope of Diabetes Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 100.1 Billion |

| Market Size by 2034 |

USD 298.31 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Drug Class, Diabetes Type, Route of Administration, Distribution Channel, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Novo Nordisk, Eli Lilly and Company, Sanofi, Merck & Co., Inc., AstraZeneca plc, Johnson & Johnson Services Inc., Boehringer Ingelheim, Novartis AG, Takeda Pharmaceutical Company, Bayer AG |

Market Dynamics

Driver

Rising Prevalence of Diabetes

Globally, the growing prevalence of diabetes is a major driver in the diabetes drugs market. As lifestyle changes, aging populations, and unhealthy diets contribute to a surge in type 2 diabetes cases, the demand for effective and accessible treatments continues to rise. This increase in patient numbers pushes pharmaceutical companies to develop advanced therapies that help manage blood glucose levels, reduce complications, and improve the quality of life for individuals living with diabetes.

- For Instance, In 2024 by IDF nearly 589 million adults aged 20–79 are affected, with over 90% having type 2 diabetes, mainly driven by genetic, environmental, and socio-economic factors. Notably, over 80% of diabetes cases are found in low- and middle-income countries, highlighting a growing global health challenge. By 2050, the number of adults living with diabetes is expected to reach around 853 million about 1 in 8 adults marking a 46% rise.

Restraint

Large Undiagnosed Patient Population in Emerging Countries

The high patient population in emerging countries can restrain the diabetes drug market because many individuals face financial barriers, limiting their ability to afford newer treatments. Healthcare systems in these regions often struggle with underfunding, lack of resources, and inconsistent access to medicines. Furthermore, poor awareness and limited availability of specialists can delay diagnosis and treatment, making it difficult to manage diabetes effectively and slowing market growth despite rising demand.

Opportunity

Innovation in Diabetes Treatment

Innovation in diabetes treatment offers future potential for the market by introducing next-generation therapies that simplify disease management and improve patient outcomes. Emerging technologies like AI-driven drug development, non-invasive monitoring, and longer-acting formulations can enhance convenience and effectiveness. These advancements not only expand access to care, especially in regions with growing diabetes prevalence, creating new growth pathways for pharmaceutical companies.

- For Instance, In May 2024, Sanofi India launched Soliqua, a combination of Insulin Glargine (100IU) and Lixisenatide (33mcg/ml), for adults with type 2 diabetes not adequately managed with basal insulin or GLP-1 therapy alone. Priced at ₹1,850 (around USD 22.30) per 3ml prefilled pen, it is given once daily via subcutaneous injection. Dosage is tailored to each patient based on previous treatment, blood sugar levels, and individual metabolic needs.

Segmental Insights

How GLP-1 Receptor Agonist Segment Dominate the Diabetes Drugs Market in 2024?

GlP-1 receptor agonists led the market due to their ability to offer more than just blood sugar control- they also help with weight management and heart health, which are key concerns in type 2 diabetes. Their longer-acting formulations reduce dosing frequency improving patient adherence. As more studies highlight their broader health benefits, these have become a preferred option among physicians, driving their strong presence and growth in the diabetes drugs market.

The insulin segment is projected to grow at the fastest rate due to the rising number of type 1 diabetes cases and the growing need for insulin therapy in the advanced stages of type 2 diabetes. Innovations like ultra-long-acting insulins, smart insulin pens, and biosimilars are improving treatment outcomes and accessibility. Increasing awareness, better diagnosis, and supportive government initiatives in emerging markets are further boosting the demand of the market.

Why Did the Type 2 Segment Dominate in the Diabetes Drugs Market 2024?

Type 2 diabetes leads the market largely because it affects the majority of diagnosed individuals worldwide. Unlike type 1, it develops gradually and is often linked to lifestyle factors such as poor diet, inactivity, and obesity trends that are rising globally. This has resulted in a consistent demand for medications to manage the condition over time. The wide range of available therapies also supports the dominance of the market.

- For Instance, The IMHE report (June 2023) projects global diabetes cases to rise from 529 million to 1.3 billion by 2050. This sharp increase, mainly in type 2 diabetes, is boosting demand for effective treatments, strengthening the segment’s market dominance.

The type 1 diabetes segment is witnessing rapid growth due to rising cases globally and the growing adoption of advanced treatment solutions. Increased focus on early intervention especially in younger populations, is driving demand for more efficient and user-friendly therapies. Innovation in biologics, along with better access to insulin and monitoring tools, are making disease management more effective. These factors collectively support the market growth outlook in the diabetes drugs market.

How Does the Subcutaneous Segment Dominate the Market?

The subcutaneous segment held the biggest market shares due to its effectiveness in delivering insulin and GLP-1 receptor agonists directly into the bloodstream with consistent absorption. This method supports self-administration through pens and pumps, improving patient convenience and adherence to therapy. It also reduces the need for clinical supervision, making it ideal for long-term management. The reliability, ease of use, and ability to support advanced drug formulations contribute to market dominance.

- For Instance, In August 2023, Insulet introduced the Omnipod 5 Automated Insulin Delivery System in Germany, representing a major advancement in diabetes care. The increasing use of such advanced insulin delivery technologies is anticipated to boost growth in this segment.

The oral segment is projected to grow rapidly as it offers a simpler and more user-friendly alternative to injectable treatment, especially for patients newly diagnosed with type 2 diabetes. Recent developments in oral GLP_1 therapies and other innovative formulations are expanding treatment possibilities. Awareness and diagnosis for accessible and less invasive options in increasing making oral medications an attractive choice for both patients and healthcare providers.

Why Did the Retail Pharmacies Segment Dominate in the Diabetes Drugs Market 2024?

The retail pharmacies segment dominates the market as it serves as the first point of contact for many patients seeking quick and reliable access to medications. These outlets are deeply rooted in both urban and rural areas, making them highly accessible. They also offer personalized services, including patient counseling and reminders for refills. The trust built through face-to-face interaction and the ability to purchase without prior appointments further drive their strong market presence.

- For Instance, In January 2023, the Times of India reported that Reliance Retail announced plans to launch more than 2,000 independent pharmacy outlets within a year. This move highlights the company’s strategy to expand its presence in the healthcare and pharmacy sector across India.

The online pharmacies segment is anticipated to grow at the fastest rate due to increasing digital adoption, especially post-pandemic, and the convenience of home delivery. These platforms offer competitive pricing, easy access to a wide range of diabetes medications, and subscription-based refill services. Growing smartphone and internet penetration, particularly in emerging markets, is also boosting demand. Additionally, 24/7 availability, doorstep delivery, and digital payment options make online pharmacies an increasingly preferred choice for chronic disease management.

Top Companies in the Diabetes Drugs Market

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Merck & Co., Inc.

- AstraZeneca plc

- Johnson & Johnson Services Inc.

- Boehringer Ingelheim

- Novartis AG

- Takeda Pharmaceutical Company

- Bayer AG

Recent Developments in the Diabetes Drugs Market

- In February 2025, the U.S. FDA approved Merilog (insulin-aspart-szjj), the first rapid-acting biosimilar to Novolog, for both adults and children with diabetes. Available in 3ml pens and 10ml vials, Merilog is designed to help control blood sugar during meals. Produced by Sanofi-Aventis U.S. LLC, it is the third insulin biosimilar approved in the country, aligning with the FDA’s efforts to improve insulin accessibility and promote a more competitive biosimilar market.

- In July 2024, Zydus Lifesciences received U.S. FDA approval to market Zituvimet XR, a combination of sitagliptin and extended-release metformin. The drug is intended to help improve blood sugar control in adults with type 2 diabetes, offering a new treatment option in the U.S. market.

Segments Covered in the Report

By Drug Class

- Insulin

- DPP-4Inhibitors

- GLP-1 Receptor Agonists

- SGLT-2 Inhibitors

- Others

By Diabetes Type

By Route of Administration

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

-Ibuprofen-Market.webp)