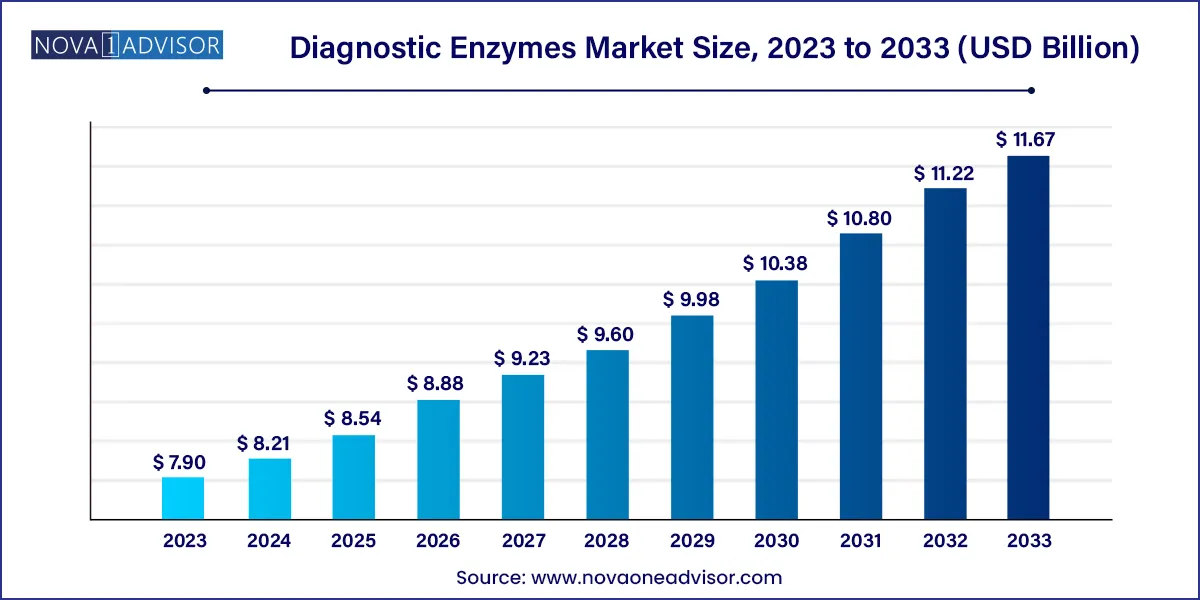

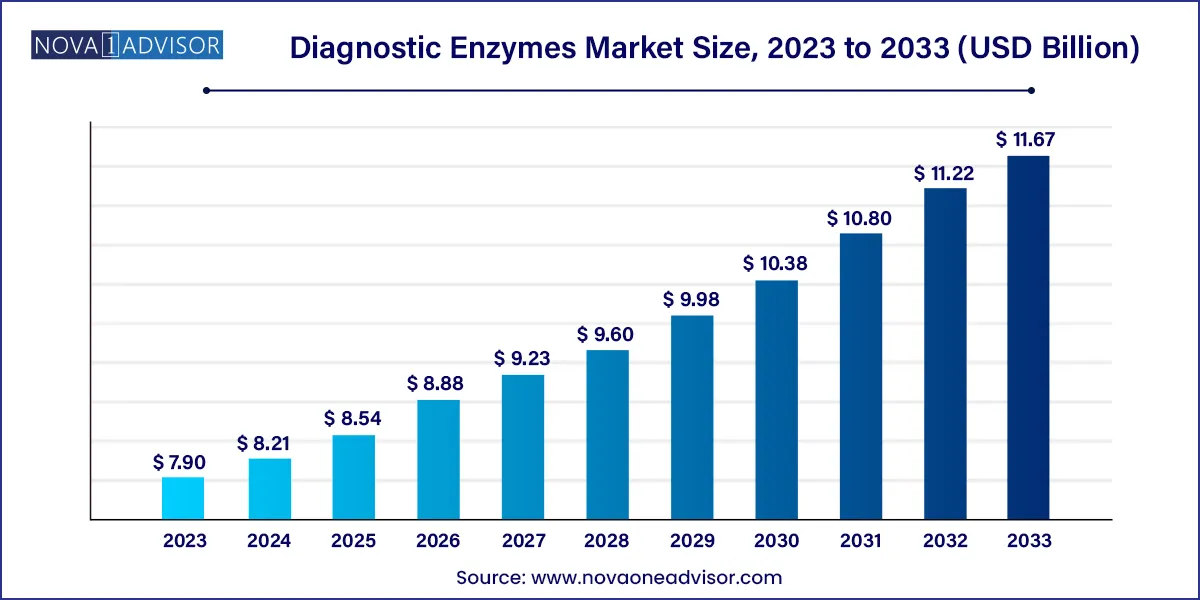

The global diagnostic enzymes market size was estimated at USD 7.90 billion in 2023 and is projected to hit around USD 11.67 billion by 2033, growing at a CAGR of 3.98% during the forecast period from 2024 to 2033.

Key Takeaways:

- The glucose oxidase/glucose dehydrogenase segment accounted for the largest revenue share of 14.67% in 2023.

- The lactate oxidase segment is expected to show the fastest growth during the forecast period.

- The infectious diseases segment held the largest market share in 2023.

- The oncology segment is expected to exhibit the fastest growth during the forecast period.

- The clinical segment accounted for the largest revenue share in the diagnostic enzymes market

- The molecular segment is expected to expand at a lucrative growth rate.

- North America dominated the diagnostic enzymes market in 2023.

- Asia Pacific is estimated to show the fastest growth during the forecast period.

Diagnostic Enzymes Market Growth

The diagnostic enzymes market is witnessing growth due to the factors such as the increasing prevalence of infectious disorders, high demand for enzymes, growing preference for novel approaches, and rising patient awareness.

Diagnostic enzymes are extensively used for the detection and quantification of various substances. Changes in biomolecule concentration serve as an indication for various abnormal metabolic activities, infections, infectious & noninfectious diseases, and inflammatory conditions. The main elements that support ideal clinical outcomes and general public health include rapid & accurate diagnosis of serious diseases and their proper treatment.

Enzymes are widely employed in the diagnosis of many diseases because of their exceptional bio-catalytic characteristics. Enzymes play a vital role in the metabolic activity of living organisms including plants, microorganisms, animals, and humans. Enzyme abnormality can lead to multiple metabolic disorders. Therefore, components of the enzyme metabolism systems have been incorporated as special markers for disease diagnostics.

The applications of appropriate diagnostic approaches are vital for the timely containment of the spread of infectious disease and for mitigating the risks to public health. Therefore, notable efforts and advancements have been made in the development of viral diagnostic methods to meet the WHO ASSURED criteria for assays. Polymerase Chain Reaction (PCR) and Enzyme-Linked Immunosorbent Assay (ELISA) are commonly used basic assays that create a platform for the development of advanced diagnostics including biosensors, Loop-mediated Isothermal Amplification (LAMP), next-generation sequencing, Polymerase Spiral Reaction (PSR), real-time RT-PCR, and microarrays.

However, diagnostic enzyme tests have witnessed an increase in the cost pressure in the past decade owing to concerns regarding healthcare expenditure and an increase in the use of diagnostic enzyme tests. The diagnostic industry also faces stringent regulations for product approvals. Initially, CE mark approval was the only requirement for the registration of diagnostic tests in the EU. However, owing to financial shortfalls, regulatory agencies also request proof of considerable test benefits and reasonable pricing.

Diagnostic Enzymes Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 8.21 Billion |

| Market Size by 2033 |

USD 11.67 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.98% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, application, product type, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Takara Bio, Inc.; Promega Corporation; Enzo Life Sciences, Inc.; Merck KGaA; Thermo Fisher Scientific, Inc.; Creative Enzyme; F. Hoffmann-La Roche Ltd.; Solis BioDyne.; Ambliqon A/S |

Segments Insights:

Type Insights

The glucose oxidase/glucose dehydrogenase segment accounted for the largest revenue share of 14.67% in 2023. An abundant endogenous oxidoreductase found in all living things is glucose oxidase (GOx). Due to its intrinsic biocompatibility, lack of toxicity, and distinctive catalysis against -d-glucose, GOx has gained interest in the biomedical field in recent years.

A variety of biosensors can use GOx to effectively accelerate the oxidation of glucose into gluconic acid and hydrogen peroxide (H2O2), which can be used to detect cancer biomarkers. The crucial role of glucose oxidase in the detection of diabetes is projected to boost demand for the enzyme.

The lactate oxidase segment is expected to show the fastest growth during the forecast period. This can be attributed to the rising adoption of molecular devices for the management of diabetes. Lactate Dehydrogenase (LDH), which catalyzes the interconversion of lactate and pyruvate with the NAD+/NADH coenzyme system, is widely distributed in the cells of diverse living systems.

The LDH isoenzymes found in blood plasma and serum of both humans and animals are directly derived from cells and tissues and produce a distinctive profile. This profile is dependent on the concentration of intracellular isoenzymes in all tissues that contribute to the pool of LDH present in plasma and serum as a result of normal cell deterioration. LDH can be used for the diagnosis of certain types of cancer. Moreover, it can also be used in the diagnosis and monitoring of the diseases that cause cell damage, for assessing the severity of certain cancers and monitoring patients during treatment, and evaluating collections of fluids in the body abnormally.

Application Insights

The infectious diseases segment held the largest market share in 2023. Early identification and treatment of infectious diseases have been made possible by the widespread application of PCR technology. Organisms that are difficult to be detected can now be identified with better precision and sensitivity. Typical pneumonia, TB, streptococcal pharyngitis, ulcerative urogenital infections, and a number of persistent illnesses are all detected by PCR in the diagnosis of infectious diseases. The Thermus thermophilus Escherichia coli's DNA polymerase gene expression enables effective reverse transcriptase activity for one-step detection of cellular mRNA expression.

The oncology segment is expected to exhibit the fastest growth during the forecast period. Large-scale adoption of ISH methods as well as the development of high-throughput technologies, such as next-generation DNA sequencing and comparative genomic hybridization, for the diagnosis of human tumors, drives the usage of diagnostic enzymes in this segment.

In February 2022, the U.S. government initiated Cancer Moonshot, which was directed towards enhancing the screening rates for cancer and for identifying the missed cases due to the COVID-19 pandemic. In the next coming 25 years, the government aims to reduce cancer deaths by 50% with early treatment and diagnosis, thereby propelling demand for cancer diagnostic enzyme tests.

Product Type Insights

The clinical segment accounted for the largest revenue share in the diagnostic enzymes market owing to the increasing use of enzymes in clinical chemistry, which is associated with the analysis of body fluids for therapeutic and diagnostic purposes. Minute changes in the levels of body fluids, such as plasma, serum, or blood may indicate the onset of a life-threatening condition. Therefore, analytical techniques involved in clinical chemistry should be rapid, specific, and highly sensitive.

Due to the enzymes selectivity and speed, they are a crucial part of clinical chemistry diagnostic procedures. Enzyme specificity can be used to either assess the substrate in an assay or remove interferents from another reaction. Additionally, enzymes are used to quantify co-factors, inhibitors, and activators. Enzymes are furthermore perfect for usage as labels in immunoassay procedures due to their catalytic activity.

The molecular segment is expected to expand at a lucrative growth rate. Various enzymes are used in molecular diagnostics mainly through the techniques such as PCR assays, NGS assays, and others. PCR is one of the most widely used molecular biology techniques. The technology has been increasingly adopted in multiple fields, including diagnostic testing, sequencing, forensic analysis, and cloning.

Other molecular biology assays that involve the utilization of enzymes include Isothermal Nucleic Acid Amplification Technology (INAAT) and Transcription Mediated Amplification (TMA). INAAT facilitates the detection of a target nucleic acid sequence in an exponential, streamlined manner. This overcomes the limitations associated with thermal cycling.

Regional Insights

North America dominated the diagnostic enzymes market in 2023. The dominance of the region is owing to the high demand for enzymes and the increasing prevalence of infectious disorders in the region. The FDA has authorized COVID-19 laboratory-developed diagnostics for emergency use to address the ongoing pandemic. Enzyme-linked immunosorbent assays and RT-PCR-based tests for the detection of SARS-CoV-2 are also used in the majority of these emergency use authorizations. Owing to the high usability of enzymes during RT-PCR, the development of such tests is expected to generate revenue in the North America market.

Asia Pacific is estimated to show the fastest growth during the forecast period. The presence of a large target population, rising healthcare expenditure, high unmet clinical needs, growing establishment of the healthcare infrastructure, rising R&D activities for advanced diagnostic techniques, increasing government initiatives, and improving healthcare infrastructure are among the factors anticipated to provide a potential growth platform in this region for key diagnostic enzymes manufacturers.

In addition, the growing prevalence of cancer and infectious diseases, such as COVID-19, HIV/AIDS & hepatitis, and other disorders, is anticipated to drive demand for histology, clinical chemistry, and molecular biology techniques during the forecast period.

Key Companies & Market Share Insights

The key players operating in the market are focusing on partnerships, strategic collaborations, and geographical expansion, in emerging and economically favorable regions. For Instance, in January 2022, Merck signed a research collaboration with Absci to produce new enzymes. This strategy is expected to enhance Merck’s biomanufacturing applications. Some of the prominent players in the global diagnostic enzymes market include:

- Takara Bio, Inc.

- Promega Corporation

- Enzo Life Sciences, Inc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Creative Enzyme

- F. Hoffmann-La Roche Ltd.

- Solis BioDyne.

- Ambliqon A/S.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Diagnostic Enzymes market.

By Type

- Taq Polymerase

- MMLV RT

- HIV RT

- Hot Start Taq Polymerase

- UNG

- RNase Inhibitors

- Bst Polymerase

- PCR Master Mix

- Lyophilized Polymerase

- T7 RNA Polymerase

- Cas9 Enzyme

- Acid Phosphatase

- Alanine Aminotransferase

- Amylase

- Angiotensin Converting Enzyme

- Aspartate Aminotransferase

- Cholinesterase

- Creatinine Kinase

- Gamma Glutamyl Transferase

- Lactate Dehydrogenase

- Renin

- Glucose Oxidase/Glucose Dehydrogenase

- Urease

- Lactate Oxidase

- Horseradish Peroxide

- Glutamate Oxidase

- Others

By Application

- Diabetes

- Oncology

- Cardiology

- Infectious Diseases

- Nephrology

- Autoimmune Diseases

- Others

By Product Type

- Molecular Enzymes

- Clinical Enzymes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)