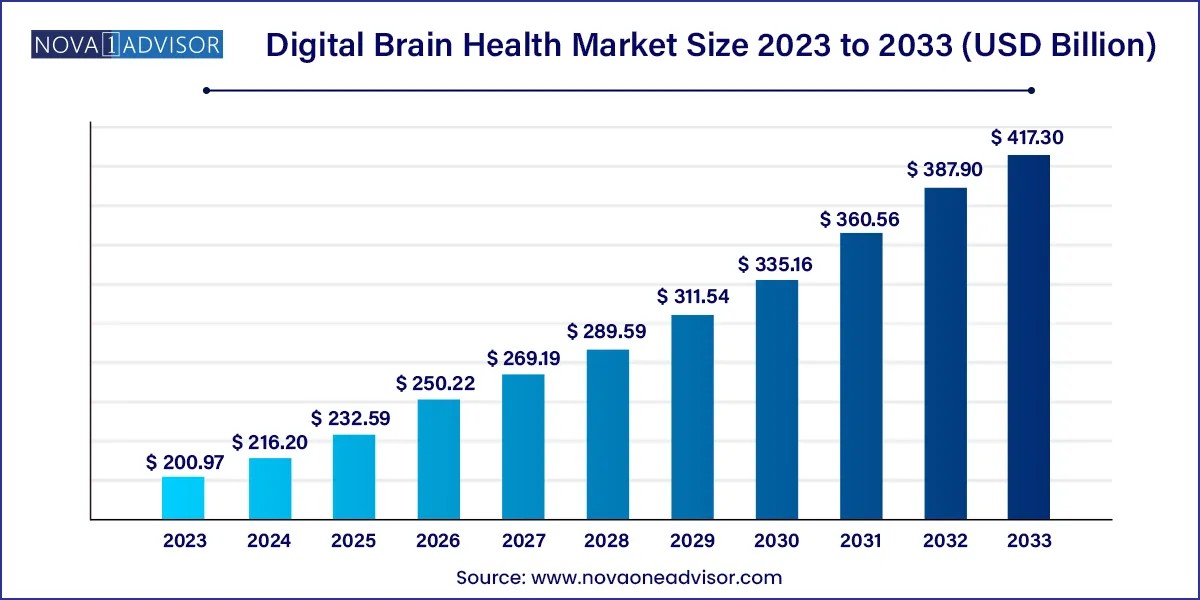

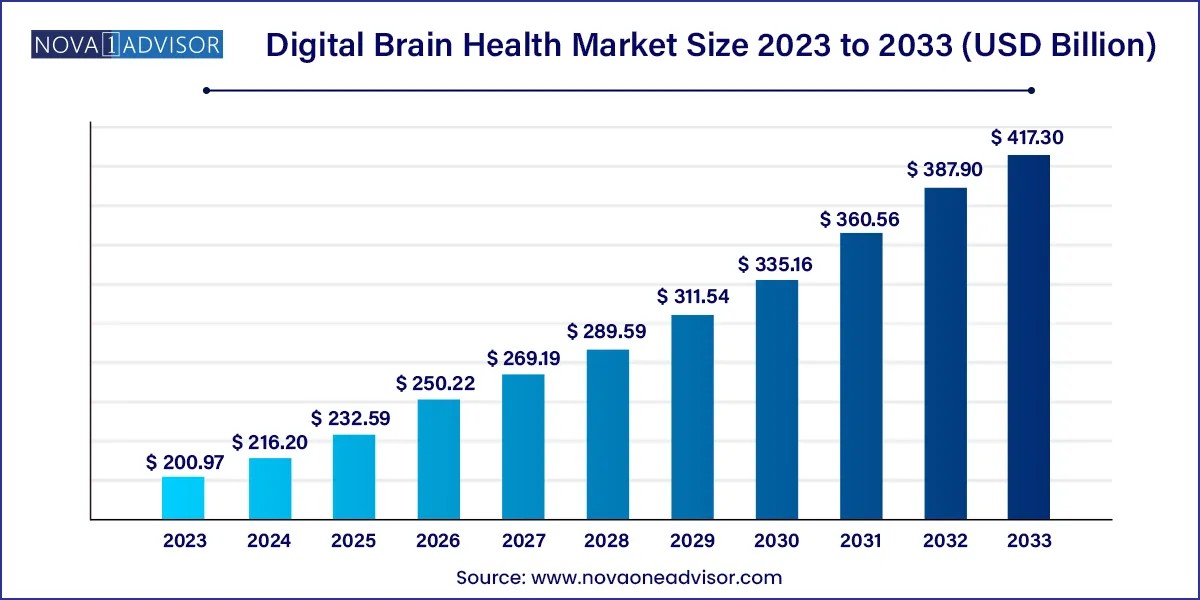

The global digital brain health market size was exhibited at USD 200.97 billion in 2023 and is projected to hit around USD 417.30 billion by 2033, growing at a CAGR of 7.58% during the forecast period of 2024 to 2033.

Key Takeaways:

- The North America region dominates the global market.

- The clinical functionality segment is predicted to generate the highest market share between 2023 and 2033.

- The software component segment is expected to rocord the maximum market share between 2023 and 2033.

- The hospitals end-user segment is projected to captured the largest market share between 2023 and 2033.

Digital Brain Health Market Overview:

The digital brain health market uses technology and digital tools to improve cognitive function and promote brain health. The market includes various digital products and services, such as brain training games, cognitive assessments, virtual reality tools, neurofeedback devices, and mobile applications that enhance memory, attention, problem-solving, and other cognitive abilities.

The digital brain health market has gained significant attention driven by the increasing prevalence of neurological disorders and mental health conditions, such as Alzheimer's disease, Parkinson's disease, depression, anxiety, and ADHD. Digital tools have the potential to offer convenient, cost-effective, and personalized solutions for individuals seeking to maintain or improve their cognitive health and performance.

The market is also expected to continue growing as more individuals seek digital solutions to support their brain health, and the technology behind these tools continues to advance. However, it's important that the effectiveness of these digital tools in improving cognitive function and preventing neurological disorders is still being researched and debated within the scientific community.

Furthermore, drivers such as the aging population and cost-effectiveness have led to a rapidly growing digital brain health market with a wide range of products and services to improve cognitive function and promote brain health. Also, there has been a growing awareness of the importance of mental health. This has increased interest in digital tools that can help individuals manage depression, anxiety, and ADHD.

However, lack of regulation, ethical concerns and limited accessibility are anticipated to impede the market growth. The digital health industry is still largely unregulated, and this can lead to concerns about the safety, efficacy, and privacy of digital brain health products and services. This may limit the adoption of digital brain health. Also, there is still some skepticism among healthcare providers and the general public regarding the effectiveness of these tools in improving cognitive function and preventing neurological disorders.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have increased awareness of the importance of mental health and cognitive function, resulting in a greater demand for digital brain health products and services. Also, The pandemic has forced many healthcare providers to adopt remote care models, including using digital tools to deliver cognitive assessments and brain training programs.

Growth Factors:

The growing demand for technologies and services to help individuals' brains propelled the market demand. The various factors are helping to drive the market are:

- Aging population

- Rising occurrence of brain diseases

- Increasing awareness of mental health

- Cost-Effectiveness

Digital Brain Health Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 216.20 Billion |

| Market Size by 2033 |

USD 417.30 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.58% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Functionality, By Component, and By End-User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Linus Health, Medibio, The Echo Group, Spring Care, Inc. Qualifacts Systems, Inc., NXGN Management, Netsmart Technologies, IBM, Holmusk, Core Solutions, Inc., Cerner Corporation and Others. |

Key Market Driver: Rising Burden of Neurological Disorders and Mental Health Conditions

The increasing prevalence of neurological and mental health disorders is a primary driver for the digital brain health market. According to the WHO, neurological disorders affect over a billion people worldwide. Alzheimer’s disease alone affects more than 55 million individuals, with this number expected to double every 20 years. Similarly, depression is the leading cause of disability globally, with anxiety disorders not far behind.

Traditional healthcare systems are ill-equipped to scale with this rising burden. Digital brain health platforms address these gaps by providing scalable, accessible, and personalized solutions. Remote monitoring tools, telepsychiatry, AI-based diagnostics, and cognitive training apps empower early intervention, reduce stigma, and improve health outcomes. As neurological diseases impose significant social and economic burdens, the demand for technology-enabled solutions will only increase.

Key Market Restraint: Data Privacy and Regulatory Challenges

Despite promising growth, the digital brain health market faces significant challenges related to data security and regulatory compliance. Digital tools often collect highly sensitive personal health information, including brain activity patterns, mental health scores, and behavioral data. Ensuring the confidentiality and ethical use of such data remains a significant concern.

Regulatory oversight is fragmented and still evolving. While frameworks like HIPAA (U.S.) and GDPR (Europe) govern data privacy, digital mental health tools often fall into regulatory gray zones, especially when used for wellness rather than medical diagnostics. Additionally, AI-based tools must be validated clinically to gain acceptance from both providers and regulators. These regulatory and ethical hurdles can hinder market expansion if not addressed proactively.

Key Market Opportunity: AI and Digital Biomarker Development for Cognitive Assessment

An exciting opportunity lies in the development of AI-powered digital biomarkers that can assess cognitive health non-invasively and in real-time. By analyzing voice patterns, typing behavior, facial expressions, eye movement, or EEG signals, AI algorithms can detect early signs of neurodegenerative diseases long before traditional clinical symptoms emerge.

Several companies are pioneering passive data collection through mobile apps and wearables, offering insights into sleep quality, stress levels, attention spans, and emotional resilience. These technologies not only aid in early diagnosis but also enable personalized interventions and continuous monitoring. The potential to conduct large-scale remote clinical trials using digital endpoints further enhances the scope of AI-enabled brain health research and commercialization.

Segmental Analysis

By Functionality

Telehealth functionality dominates the digital brain health market, as it enables real-time interaction between neurologists, psychiatrists, psychologists, and patients. It reduces geographic barriers and increases access to mental and neurological care, especially in rural or underserved areas. Post-COVID-19, tele-neurology and telepsychiatry saw exponential growth. Providers use telehealth platforms for consultations, remote assessments, medication management, and follow-up care. Integration with EHRs and e-prescription systems has further strengthened telehealth’s central role.

Clinical decision support (CDS) is the fastest-growing segment, as AI and predictive analytics become core to digital brain health innovation. CDS tools aid clinicians by analyzing patient histories, behavioral patterns, and imaging data to suggest diagnoses or therapeutic options. In neurology, CDS can assist in identifying early-stage Alzheimer’s, stroke risk, or epilepsy triggers. The growing emphasis on precision medicine and data-driven care models continues to drive this segment forward.

By Component

Software dominates the digital brain health market, encompassing mobile apps, web platforms, cloud-based data systems, and AI algorithms. These solutions offer scalability, interoperability, and cost efficiency. From digital cognitive behavioral therapy (CBT) tools to neuro-assessment dashboards and analytics suites, software solutions form the foundation of modern brain health management. Software updates and machine learning integrations continuously improve performance and personalization.

Devices are the fastest-growing component, fueled by the rise of brain-sensing wearables and neurofeedback equipment. EEG headbands, transcranial stimulators, VR headsets, and biosensors are increasingly used for real-time brain activity tracking, meditation, and training. Consumer demand for non-invasive, real-time feedback on cognitive performance and emotional state is propelling this segment. Devices also support clinical-grade applications in therapy and rehabilitation.

By End-User

Hospitals dominate the end-user segment, given their access to multidisciplinary care, infrastructure, and integration with traditional neurodiagnostic tools. Hospitals use digital brain health platforms for inpatients with traumatic brain injuries, stroke, dementia, or psychiatric conditions. Large-scale deployment of digital records, AI-assisted imaging analysis, and remote monitoring solutions make hospitals a critical growth node in the ecosystem.

Specialty clinics are the fastest-growing end-user segment, particularly in fields such as neuropsychology, geriatric psychiatry, and pediatric neurodevelopment. These clinics increasingly adopt digital platforms to enhance service efficiency, patient engagement, and follow-up compliance. Brain health startups often collaborate with these clinics for pilot deployments, feedback, and product refinement, further spurring their adoption.

By Regional Analysis

North America dominates the digital brain health market, led by the U.S., which boasts a high concentration of digital health startups, advanced healthcare infrastructure, and strong reimbursement policies for mental health services. The presence of major tech companies developing brain health solutions, alongside research institutions and funding bodies, contributes to regional leadership. The region’s regulatory agencies have also started creating pathways for digital therapeutic approvals, supporting innovation.

Asia-Pacific is the fastest-growing region, with countries like China, Japan, South Korea, and India embracing digital health to address gaps in mental healthcare access. Aging populations in Japan and South Korea are driving investments in dementia care tools, while India’s startup ecosystem is innovating scalable solutions for rural populations. Government-backed digital health missions and public-private partnerships are also accelerating the adoption of brain health technologies across the region.

Recent Developments:

-

Neurotrack (U.S.) - March 2025 launched a smartphone-based cognitive screening tool using facial tracking and reaction time to detect early Alzheimer’s risk.

-

Cognoa (U.S.) - February 2025 received FDA breakthrough designation for its autism diagnostic AI platform designed for primary care use.

-

Emotiv (Australia/U.S.) - January 2025 introduced a next-gen EEG headset for both consumer meditation tracking and clinical research.

-

Neuroglee Therapeutics (Singapore) - December 2024 opened a digital dementia clinic offering cognitive therapy through an AI-powered platform.

-

Happify Health (U.S.) - November 2024 expanded its digital therapeutics for depression and anxiety with new multilingual offerings.

Some of the prominent players in the digital brain health market include:

- Linus Health

- Medibio

- The Echo Group

- Spring Care

- Inc. Qualifacts Systems, Inc.

- NXGN Management

- Netsmart Technologies

- IBM

- Holmusk

- Core Solutions, Inc.

- Cerner Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global digital brain health market.

By Functionality

- Electronic Health Records (EHR)

- Care Plans/Health Management

- Financial Functionality

- Clinical Functionality

- Clinical Decision Support (CDS)

- E-Prescribing

- Telehealth

- Administrative Functionality

- Others

By Component

By End-User

- Specialty Clinics

- Hospitals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)