Digital Health Market Size and Trends

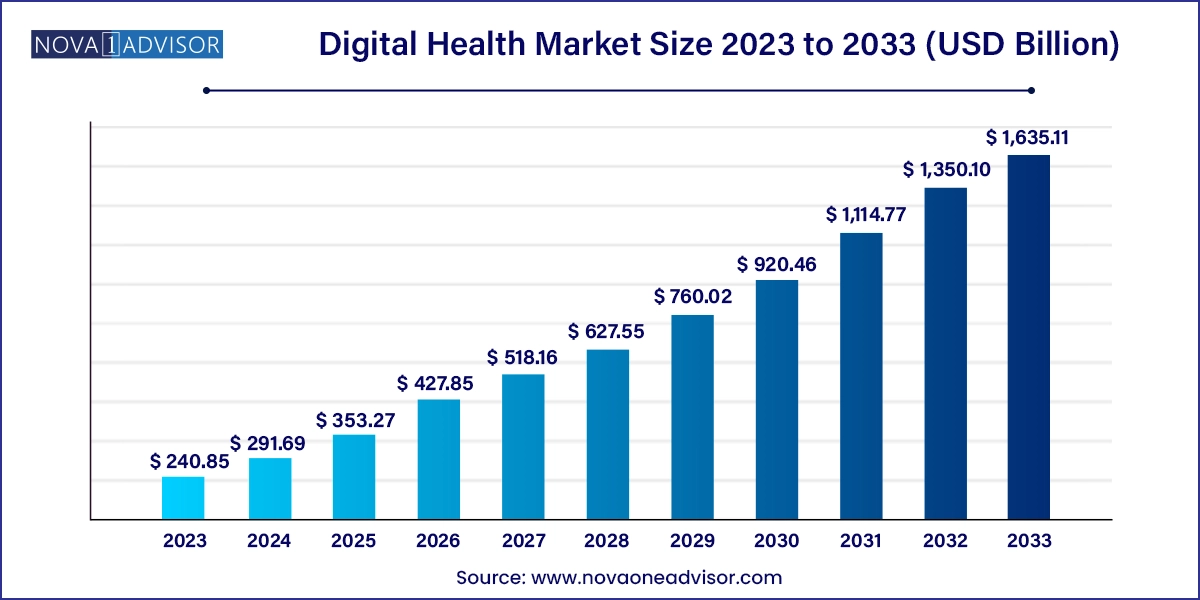

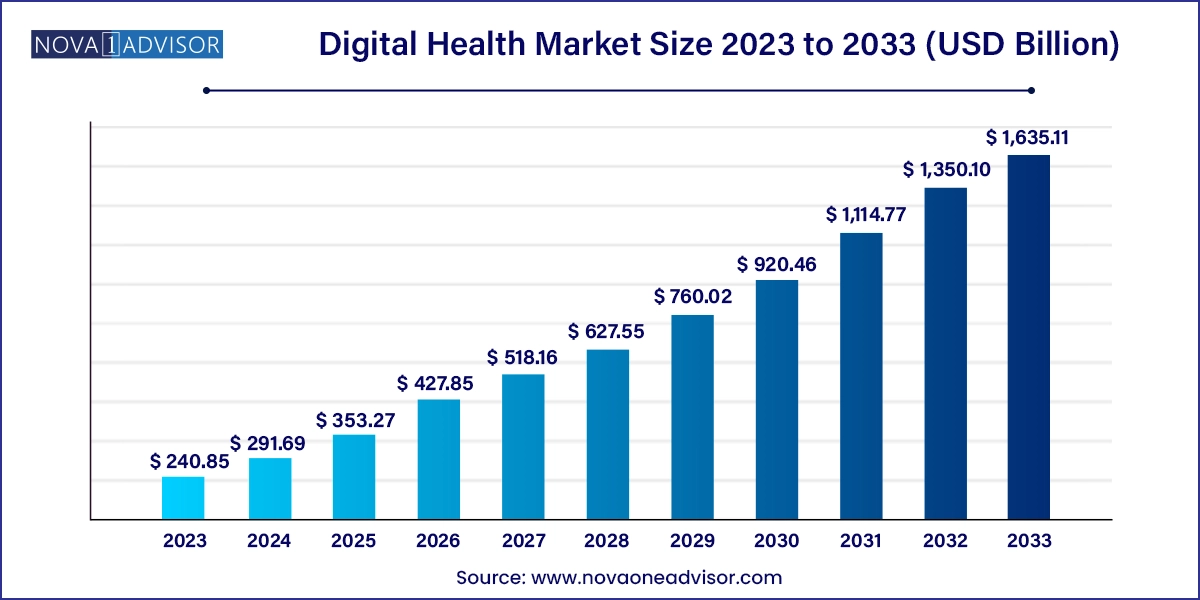

The global digital health market size was exhibited at USD 240.85 billion in 2023 and is projected to hit around USD 1,635.11 billion by 2033, growing at a CAGR of 21.11% during the forecast period 2024 to 2033.

Digital Health Market Key Takeaways:

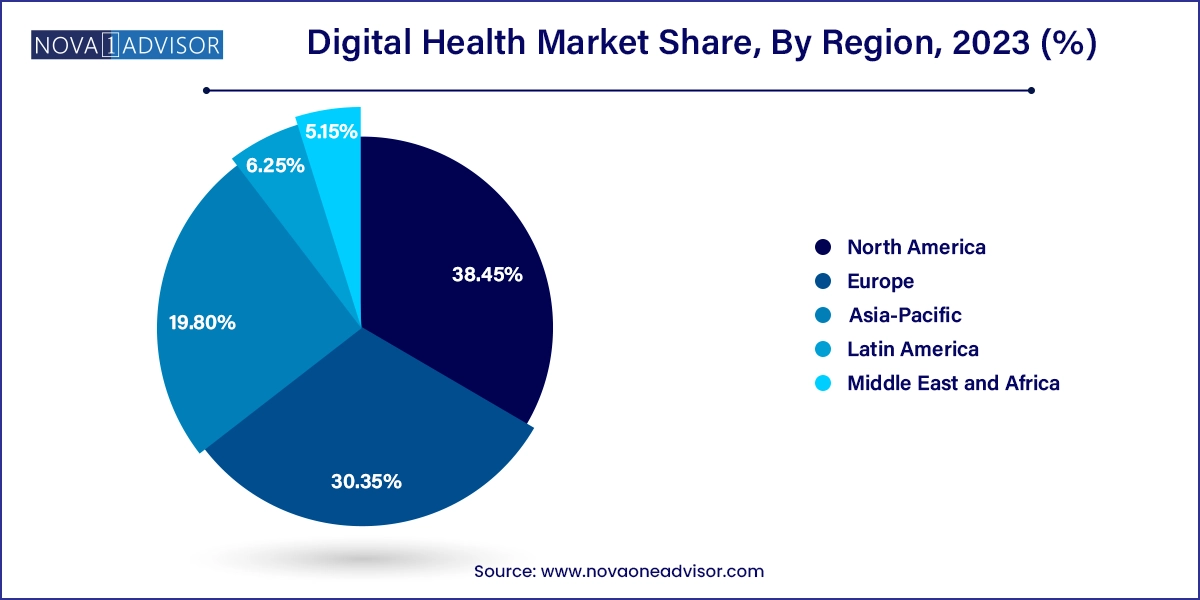

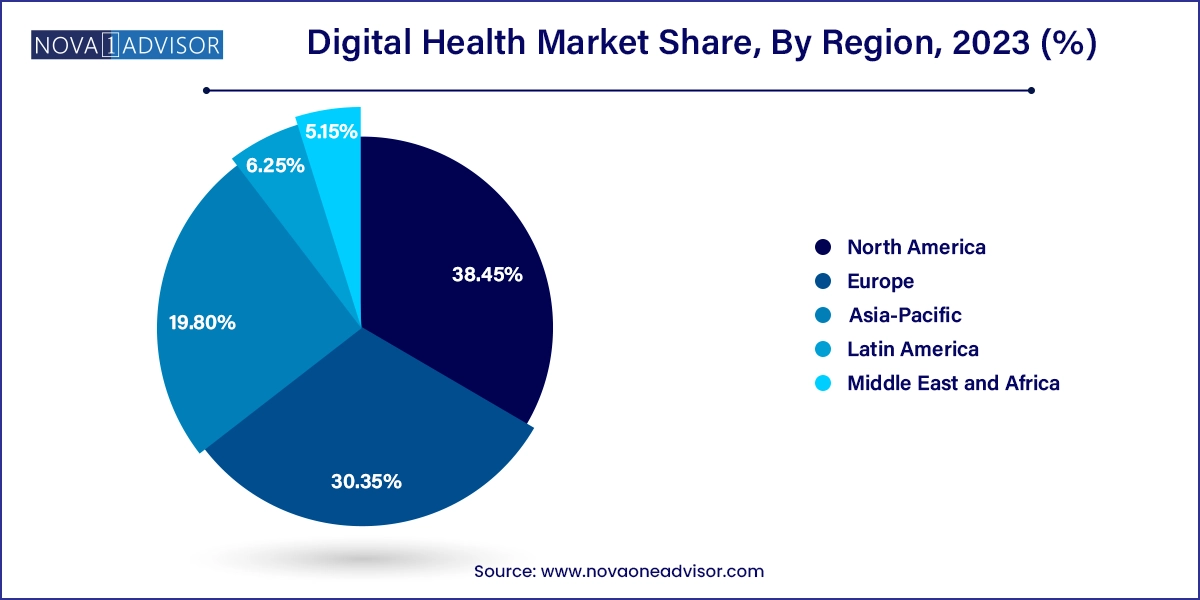

- North America dominated the market with the largest revenue share of 38.45% in 2023

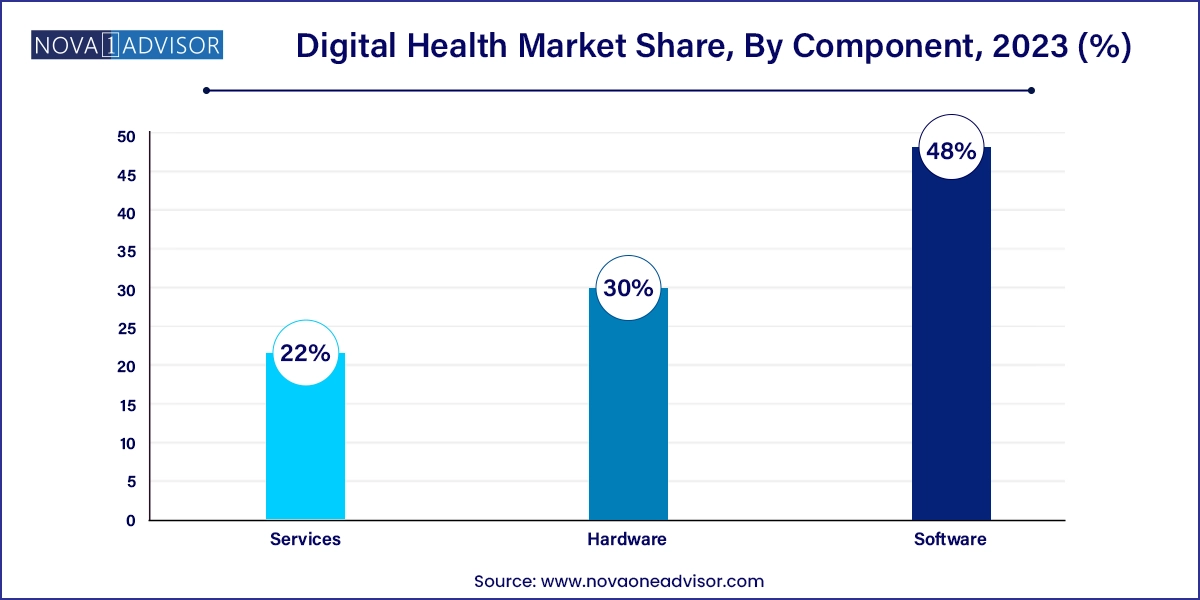

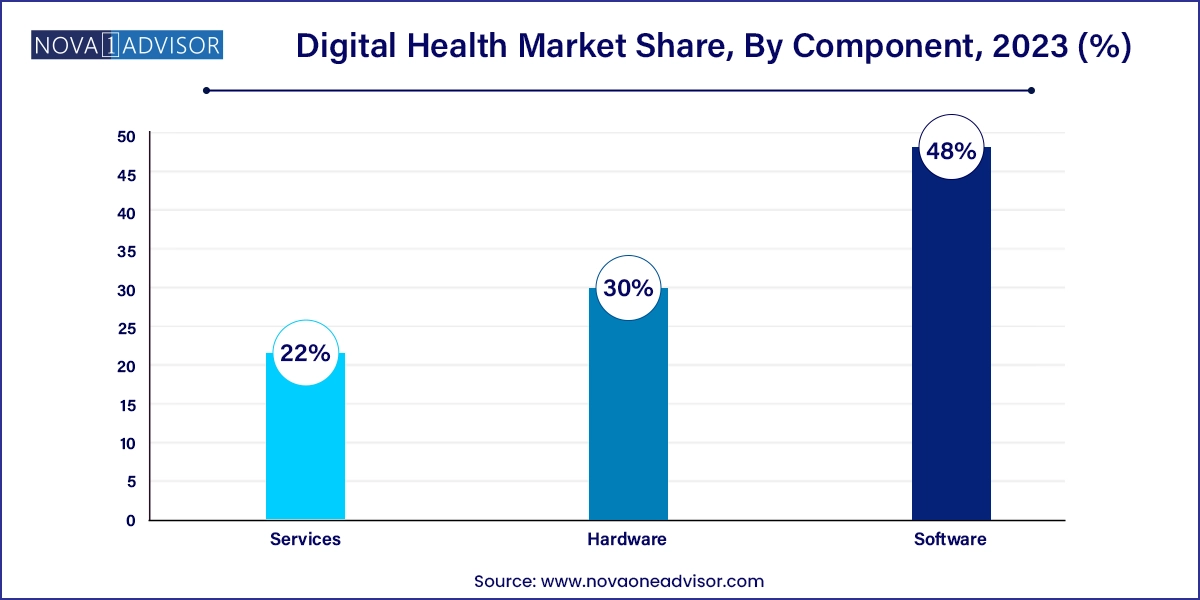

- Based on component, the services segment led the market with the largest revenue share 48.0% in 2023.

- The software segment is anticipated to register the fastest CAGR of 23.2% from 2024 to 2033.

- Based on technology, the tele healthcare segment led the market with a largest revenue share of 43.12% in 2023.

- Based on applications, the diabetes segment led the market with the largest revenue share of 24.13% in 2023.

- Based on end-use, the patient segment held the market with the largest revenue share of 34.11% in 2023.

Market Overview

The digital health market has evolved into one of the most dynamic and transformative sectors within the global healthcare industry. Encompassing a wide array of technologies including telemedicine, mobile health (mHealth), healthcare analytics, wearable devices, and digital health systems this market is reshaping the way healthcare is delivered, monitored, and managed.

Fueled by the growing need for efficient healthcare delivery, the rising prevalence of chronic diseases, increasing penetration of smartphones and wearable devices, and supportive government initiatives, the digital health market has witnessed exponential growth. The COVID-19 pandemic served as a major catalyst, fast-tracking the adoption of telehealth services, remote patient monitoring, and digital therapeutic solutions.

Healthcare providers, payers, and patients are increasingly embracing digital tools to improve clinical outcomes, enhance patient engagement, and reduce healthcare costs. In parallel, the surge in venture capital funding and strategic collaborations among tech giants, healthcare providers, and pharmaceutical companies is further accelerating innovation. The focus is shifting towards personalized healthcare, where data-driven insights enable tailored treatment regimens, predictive analytics, and preventive interventions, positioning digital health as an essential pillar of modern medicine.

Major Trends in the Market

-

Rapid Expansion of Telehealth Services: The pandemic normalized virtual consultations, and ongoing advancements are making remote healthcare mainstream.

-

Integration of AI and Machine Learning: AI algorithms are being increasingly employed for diagnostics, predictive analytics, patient monitoring, and workflow automation.

-

Growth of Wearables and Connected Devices: Devices that monitor heart rate, blood glucose levels, and physical activity are experiencing surging demand.

-

Rise of Chronic Disease Management Apps: Apps targeting diabetes, hypertension, cancer, and mental health are becoming pivotal in chronic care models.

-

Adoption of Blockchain in Healthcare: Blockchain technology is being leveraged for secure, transparent patient data management and interoperability.

-

Shift Towards Preventive and Personalized Healthcare: Data analytics, genomics, and wearable technology are converging to offer preventive and customized treatment options.

-

Regulatory Support and Reimbursement Reforms: Governments worldwide are adjusting regulations and reimbursement models to promote digital health adoption.

-

Expansion in Emerging Economies: Asia-Pacific and Latin America are witnessing significant uptake in digital health platforms driven by mobile penetration and healthcare reforms.

Report Scope of Digital Health Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 291.69 Billion |

| Market Size by 2033 |

USD 1,635.11 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 21.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Component, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Oracle Cerner; Veradigm; Apple Inc.; Telefonica S.A.; McKesson Corp.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd.; Hims & Hers Health, Inc.; Orange; Qualcomm Technologies, Inc.; Softserve; Computer Programs and Systems, Inc.; Vocera Communications; IBM Corp.; CISCO Systems, Inc. |

Driver: Growing Demand for Remote Patient Monitoring and Chronic Disease Management

One of the strongest drivers propelling the digital health market is the increasing demand for remote patient monitoring (RPM) and chronic disease management solutions. As populations age and lifestyle diseases such as diabetes, cardiovascular diseases, and respiratory conditions rise globally, the need for continuous health monitoring has become critical.

Digital health technologies, including wearable devices like smartwatches and connected vital sign monitors, enable real-time monitoring of patients’ health metrics from their homes. Healthcare providers can proactively intervene based on live data, preventing hospitalizations and reducing overall healthcare costs. For instance, Apple’s integration of ECG capabilities into its smartwatches has significantly enhanced the public's ability to monitor heart health. The trend is reinforced by healthcare systems increasingly incorporating RPM into standard care models, supported by favorable reimbursement policies.

Restraint: Concerns Around Data Security and Privacy

Despite its advantages, the digital health market faces notable challenges, particularly around data security and patient privacy. Digital health platforms generate and store vast amounts of sensitive personal health information (PHI), making them attractive targets for cyberattacks.

High-profile incidents of healthcare data breaches, ransomware attacks, and unauthorized access have heightened regulatory scrutiny. Compliance with regulations such as HIPAA in the U.S., GDPR in Europe, and other regional privacy laws necessitates robust cybersecurity measures, which can increase operational costs for digital health companies. Moreover, patients’ hesitancy to share data with apps and platforms due to privacy concerns may hinder full-scale adoption. Building trust through transparent data practices and fortified cybersecurity frameworks is thus crucial for sustained growth.

Opportunity: Integration of AI and Big Data Analytics in Healthcare

An exciting opportunity for the digital health market lies in the integration of artificial intelligence (AI) and big data analytics. By analyzing large datasets from EHRs, wearable devices, genomics, and social determinants of health, AI algorithms can uncover patterns that drive more accurate diagnoses, predictive modeling, and personalized treatments.

For example, IBM Watson Health has demonstrated how AI can support oncologists by providing evidence-based treatment recommendations. Similarly, predictive analytics platforms are being used to identify patients at risk of readmission, enabling proactive interventions. The combination of AI and big data in digital health is poised to unlock transformative efficiencies and precision medicine advancements, creating immense value for healthcare stakeholders worldwide.

Digital Health Market By Component Insights

Services dominated the digital health market in 2024. With healthcare providers increasingly outsourcing monitoring services, diagnostic services, and system integration, service providers have witnessed substantial demand. Independent aging solutions, chronic disease management, and post-acute care services have particularly seen accelerated growth as health systems transition towards value-based care models.

On the other hand, the software segment is anticipated to grow at the fastest pace. Platforms for EHRs, healthcare analytics, mHealth apps, and telemedicine software are seeing rapid adoption among both providers and patients. Cloud-based solutions, in particular, are gaining traction due to their scalability, interoperability, and cost-effectiveness, especially in small and mid-sized healthcare institutions.

Digital Health Market By Technology Insights

Tele-healthcare dominated the digital health market in 2024, thanks to its widespread adoption during the pandemic and the normalization of virtual consultations. Telehealth solutions, encompassing video consultations, remote medication management, and activity monitoring, became indispensable as in-person visits declined. Video consultation platforms like Teladoc Health saw explosive growth, and tele-care services catering to elderly patients, such as LTC monitoring, expanded rapidly.

Meanwhile, mHealth apps are expected to witness the fastest growth in the coming years. The proliferation of smartphones and mobile apps focusing on fitness, nutrition, women's health, chronic disease management, and personal health records has fueled mHealth’s rapid rise. Apps like MyFitnessPal (nutrition tracking) and Omada Health (chronic disease management) are illustrative of the increasing consumer engagement with mobile health solutions. Additionally, the integration of medical-grade monitoring features into consumer apps continues to blur the line between fitness and healthcare.

Digital Health Market By Application Insights

Based on applications, the diabetes segment led the market with the largest revenue share of 24.13% in 2023 and is expected to register the fastest CAGR of 23.7% from 2024 to 2033. The prevalence of diabetes and its associated complications has positioned it as the largest segment in the digital health space. Digital health technologies offer innovative solutions to address the needs of individuals with diabetes. Digital health tools, ranging from smartphone applications for glucose monitoring to wearable devices that track physical activity and offer real-time health data, enable patients to actively engage in managing their diabetes. Moreover, these technologies facilitate remote patient monitoring, enabling healthcare providers to receive timely data, make informed decisions, and offer timely interventions, ultimately contributing to more effective diabetes management.

The obesity segment is the second largest in application due to high global prevalence and the rising need for effective weight management solutions. Digital health technologies offer personalized interventions, ranging from mobile applications for dietary tracking to wearable devices monitoring physical activity, driving the segment's growth. Moreover, a shift beyond conventional applications in weight management is evident, with a growing number of companies adopting personalized approaches. This includes the use of metabolic testing, glucose monitoring, and innovative technologies such as Prism Lab’s body mapping and Spren’s smart mirror to customize treatment plans. Remote monitoring companies such as Qardio, and Rimidi utilize smart scales to track weight and aggregate data for risk factor assessment. Integration with medications enhances their role in stratifying appropriate care and monitoring adherence. All these factors collectively drive the growth of the obesity segment in the digital health landscape.

Digital Health Market By End-use Insights

Providers dominated the end-use segment in 2024. Hospitals, clinics, and healthcare systems are investing heavily in digital platforms to improve patient engagement, optimize operations, and deliver telehealth services. Integrated digital ecosystems, combining EHRs, remote monitoring, and teleconsultations, have become a strategic priority for provider organizations seeking to enhance quality care and achieve cost efficiencies.

Meanwhile, patients are becoming the fastest-growing end-use segment. The empowerment of patients through wearable devices, mobile apps, and remote monitoring solutions is reshaping the healthcare landscape. Patients are increasingly self-monitoring their health, scheduling virtual consultations, and using digital platforms to manage chronic conditions, signaling a major shift towards patient-centered care models.

Digital Health Market By Regional Insights

North America maintained its leadership in the digital health market in 2024, accounting for the largest market share. Factors such as the presence of major digital health companies, a highly developed healthcare infrastructure, widespread adoption of electronic health records, and strong regulatory support for telehealth services underlie the region’s dominance.

The United States, in particular, witnessed robust growth in telehealth consultations, mHealth app adoption, and remote monitoring solutions during the COVID-19 pandemic, trends that have now entrenched themselves. Companies like Teladoc Health, Amwell, and Cerner Corporation continue to innovate, and federal initiatives like the CARES Act have facilitated greater reimbursement for telehealth services, further stimulating growth.

Asia-Pacific is poised to record the fastest growth rate over the forecast period. The region's rising middle-class population, rapid smartphone penetration, growing healthcare expenditure, and government-led digital health initiatives are major contributors. Countries like China, India, and Australia are spearheading investments in telemedicine platforms, mobile health applications, and AI-driven diagnostics.

For instance, India’s "National Digital Health Mission" aims to establish a digital health ecosystem, providing a unique health ID for every citizen. China’s healthcare reforms and the expansion of online healthcare platforms like Ping An Good Doctor exemplify the momentum in digital health adoption. Local startups are also innovating aggressively, providing scalable and affordable solutions to underserved populations.

Digital Health Market Recent Developments

-

March 2025: Teladoc Health partnered with Microsoft to integrate its virtual healthcare services into Microsoft Teams, enhancing telehealth access for enterprise users.

-

January 2025: Fitbit (now part of Google) launched new health-tracking features including continuous atrial fibrillation detection and sleep apnea monitoring.

-

December 2024: Philips announced the acquisition of BioTelemetry, Inc., expanding its remote cardiac monitoring capabilities.

-

November 2024: Cerner Corporation launched "Cerner Patient Observer," a remote patient monitoring solution aimed at reducing inpatient falls and improving clinical outcomes.

-

September 2024: Babylon Health raised $200 million in a funding round to scale its AI-based telehealth platform into new global markets.

Some of the prominent players in the Digital health market include:

- Telefónica S.A.

- Epic Systems Corporation

- QSI Management, LLC

- AT&T

- AirStrip Technologies

- Google, Inc.

- Hims & Hers Health, Inc.

- Orange

- Softserve

- Computer Programs and Systems, Inc.

- Vocera Communications

- IBM Corporation

- CISCO Systems, Inc.

- Apple Inc.

- Oracle Cerner

- Veradigm

- Mckesson Corporation

- Hims & Hers Health, Inc.

- Vodafone Group

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the digital health market

Technology

-

-

- Activity Monitoring

- Remote Medication Management

-

-

- LTC Monitoring

- Video Consultation

-

- Wearables & Connected Medical Devices

-

-

- Vital Sign Monitoring Devices

-

-

-

- Heart Rate Monitors

- Activity Monitors

- Electrocardiographs

- Pulse Oximeters

- Spirometers

- Blood Pressure Monitors

- Others

-

-

-

- Sleep trackers

- Wrist Actigraphs

- Polysomnographs

- Others

-

-

- Electrocardiographs Fetal & Obstetric Devices

- Neuromonitoring Devices

-

-

-

- Electroencephalographs

- Electromyographs

- Others

-

-

-

-

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Menopause

- Disease Management

- Others

-

-

-

- Chronic Disease Management Apps

-

-

-

-

- Diabetes Management Apps

- Blood Pressure & ECG Monitoring Apps

- Mental Health Management Apps

- Cancer Management Apps

- Obesity Management Apps

- Other Chronic Disease Management Apps

-

-

-

- Personal Health Record Apps

- Medication Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

-

- Independent Aging Solutions

- Chronic Disease Management & Post-Acute Care Services

-

-

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Others

-

- EHR

- E-prescribing Systems

Component

- Software

- Hardware

- Services

Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

End-use

- Patients

- Providers

- Payers

- Others

Regional

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa