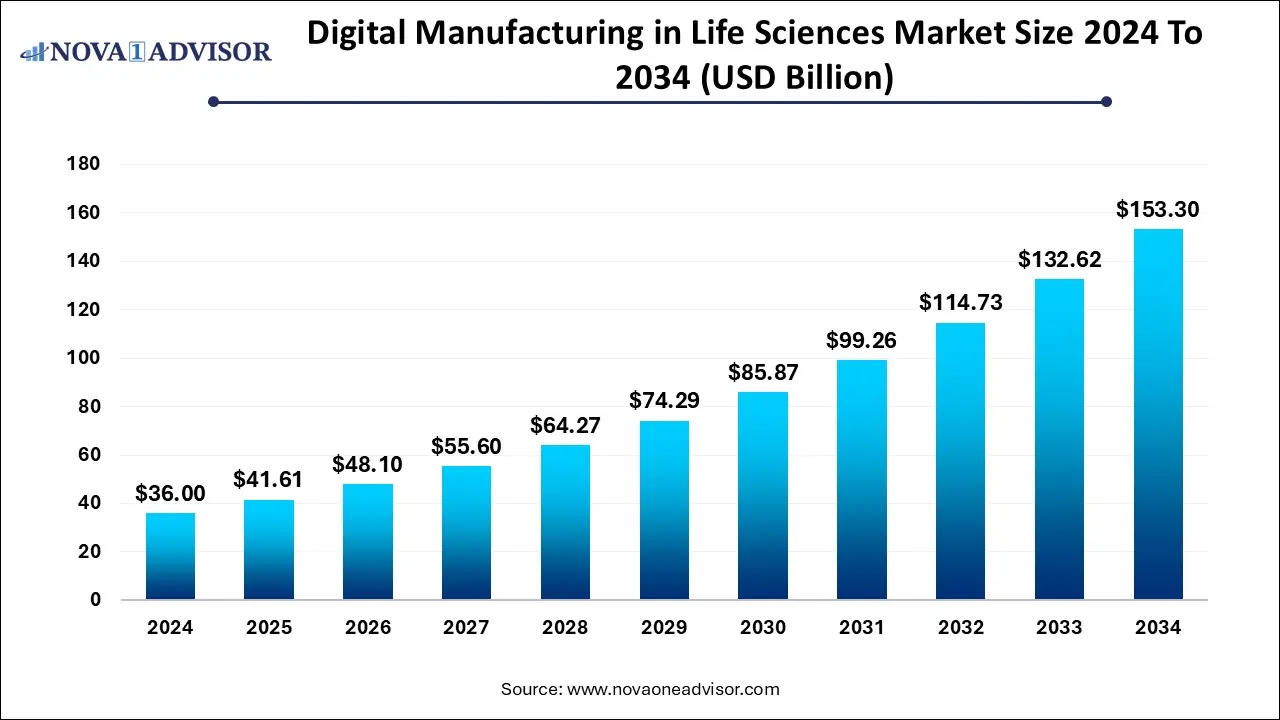

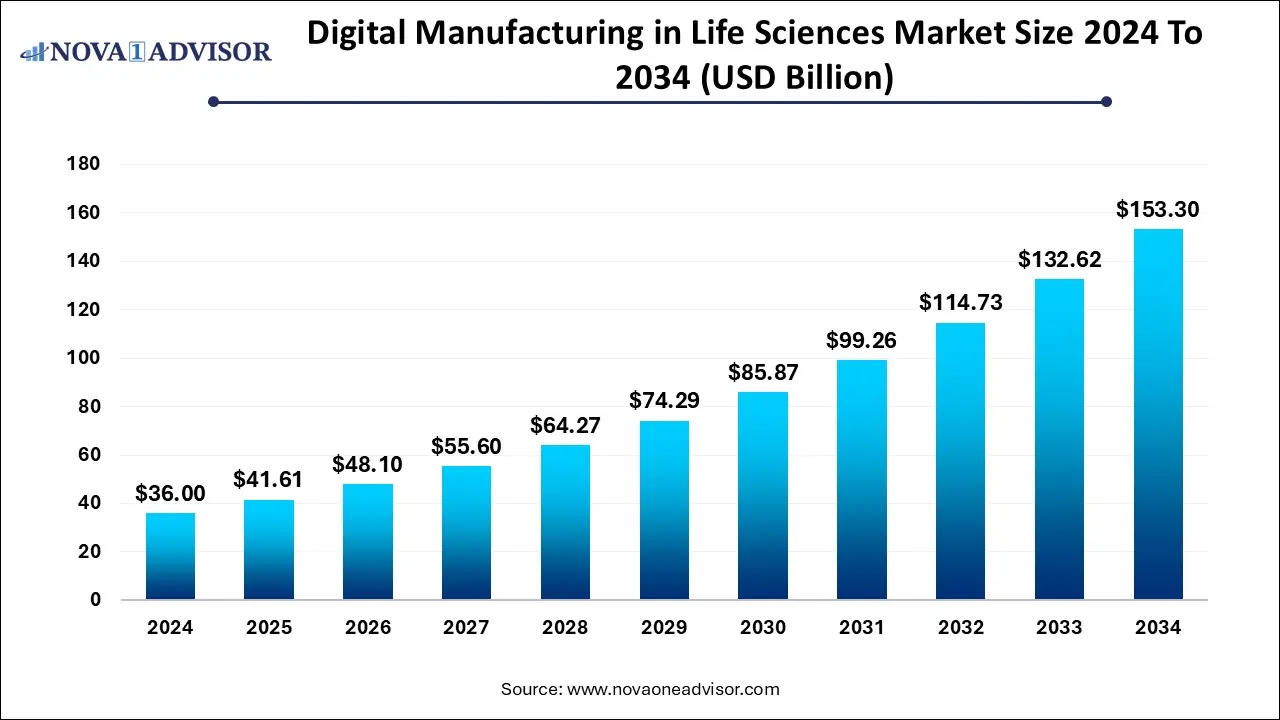

Digital Manufacturing in Life Sciences Market Size and Growth 2025 to 2034

The global digital manufacturing in life sciences market size was estimated at USD 36.0 billion in 2024, and it is expected to surpass around USD 153.3 billion by 2034, poised to grow at a CAGR of 15.59% from 2025 to 2034.

Market Overview

The digital manufacturing in life sciences market is witnessing strong growth as pharmaceutical, biotechnology, and medical device companies increasingly embrace digital transformation to enhance efficiency, quality, and compliance. The integration of digital tools such as artificial intelligence (AI), Industrial Internet of Things (IIoT), robotics, and advanced analytics is revolutionizing how life sciences organizations design, produce, and monitor their products. By enabling real-time data exchange, predictive maintenance, and automation, digital manufacturing improves process reliability while reducing costs and time-to-market. Furthermore, regulatory agencies are encouraging the adoption of data-driven systems to ensure transparency and traceability across the production lifecycle. With rising demand for personalized medicine and complex biologics, digital manufacturing technologies are becoming indispensable for maintaining competitiveness and ensuring operational agility in the life sciences sector.

Latest Trends in the Market

- AI-Powered Process Optimization: Companies are using AI algorithms to optimize production workflows, predict equipment failures, and enhance product consistency.

- Digital Twins: Virtual replicas of manufacturing environments are being adopted for simulation, testing, and process validation without disrupting live operations.

- Smart Manufacturing and IIoT: Connected devices and sensors enable real-time monitoring of manufacturing parameters, improving precision and traceability.

- Cloud-Based Manufacturing Platforms: Cloud solutions facilitate data sharing, remote access, and integration across multi-site operations.

- Adoption of Paperless Manufacturing: Digital batch records and electronic documentation are replacing traditional paper-based systems, improving compliance and efficiency.

- Additive Manufacturing (3D Printing): Used for rapid prototyping of medical devices and custom components, enhancing innovation speed.

- Advanced Robotics and Automation: Automated systems are improving throughput, reducing human error, and ensuring sterile production environments.

Report Scope of Digital Manufacturing in Life Sciences Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 41.61 Billion |

| Market Size by 2034 |

USD 153.3 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.59% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Technology/Solution Type, By End-User / Vertical, By Deployment Mode, By Component, By Application / Use Case, By Technology/Solution Type, By Region |

Market Driver – Increasing Demand for Operational Efficiency and Quality Control

Life sciences companies are under growing pressure to reduce costs while maintaining stringent quality and regulatory standards. Digital manufacturing enables real-time process control, predictive maintenance, and data-driven decision-making, resulting in higher production efficiency and consistent product quality. This technological shift is helping companies streamline complex workflows and meet global compliance requirements effectively.

Market Restraint – High Implementation Costs and Integration Challenges

The adoption of digital manufacturing technologies often requires significant capital investment, infrastructure upgrades, and workforce training. Integration with legacy systems and ensuring cybersecurity of sensitive production data pose additional challenges. These factors can slow down digital adoption, especially among small and mid-sized life sciences manufacturers.

Market Opportunity – Growth of Personalized and Precision Medicine

The rapid expansion of personalized and precision medicine presents a significant opportunity for digital manufacturing in the life sciences sector. Digital tools enable flexible, small-batch production tailored to individual patient needs while maintaining high quality and traceability. This capability positions digital manufacturing as a key enabler in the next generation of biopharmaceutical and medical device production.

Segmental Insights:

By Technology and Solution Type

The market integrates advanced technologies that transform production efficiency, quality, and compliance. Core systems like Manufacturing Execution Systems (MES), Electronic Batch Records (EBR), and Quality Management Systems (QMS) digitize and streamline manufacturing operations, ensuring precision, traceability, and regulatory adherence. Alongside these, Enterprise Asset Management (EAM) and Asset Performance Management (APM) solutions enhance equipment reliability through predictive maintenance, calibration, and optimization, reducing downtime and improving productivity.

Emerging technologies such as the Industrial Internet of Things (IIoT), AI, and Machine Learning (ML) enable real-time monitoring, predictive analytics, and process optimization. Automation and Control Systems (DCS, SCADA, PLC) provide accuracy and consistency in production, while Digital Twins and Simulation tools allow virtual testing and process improvement. Additionally, Augmented Reality (AR) and Virtual Reality (VR) support remote training and digital work guidance. Together, these technologies create a connected, intelligent manufacturing ecosystem that enhances agility, innovation, and operational excellence in life sciences.

By End-user

The digital manufacturing in life sciences market serves a diverse range of end-users, each leveraging digital technologies to enhance precision, compliance, and productivity. In the pharmaceutical sector, encompassing small molecule drugs, generics, and OTC products, digital tools such as MES, EBR, and automation systems streamline large-scale production, improve quality assurance, and ensure adherence to regulatory standards. Biotechnology and biopharma companies, producing monoclonal antibodies (mAbs), recombinant proteins, and vaccines, rely on digital platforms for real-time data monitoring, process optimization, and scale-up of complex biologics manufacturing, ensuring high yields and product consistency.

The cell and gene therapy (CGT) segment is rapidly adopting digital manufacturing for autologous and allogeneic therapy production, where digital twins and AI-driven analytics help manage highly personalized and sensitive manufacturing workflows. In the medical devices sector, covering Class I–III devices, diagnostic equipment, and implantables, digital manufacturing enables precision engineering, regulatory traceability, and design validation through simulation and automation. Meanwhile, Contract Manufacturing and Development Organizations (CMOs/CDMOs) are deploying digital systems to enhance operational flexibility, accelerate client project delivery, and maintain strict compliance. Collectively, these end-user segments demonstrate how digital transformation is optimizing efficiency, quality, and innovation across the life sciences value chain.

By Deployment Mode

The market offers multiple deployment modes to suit diverse operational needs. On-premise solutions provide organizations with full control over data, infrastructure, and security, making them ideal for highly regulated environments where compliance and internal oversight are critical.

Cloud-based solutions, including private and public cloud options, enable scalability, remote access, and real-time collaboration across multiple sites, supporting faster implementation and cost efficiency. Hybrid deployment combines on-premise and cloud capabilities, allowing companies to balance data security with flexibility and leverage the benefits of both environments for optimized digital manufacturing operations.

By Component

The market is structured around three key components: software, services, and hardware. Software solutions, delivered via SaaS or license-based models, enable process automation, data analytics, and real-time monitoring, providing the backbone for digital manufacturing operations.

Services, including implementation and integration, consulting and training, and maintenance and support—help organizations deploy, optimize, and sustain digital manufacturing systems effectively. Hardware components, such as control systems and sensors/field devices, form the physical infrastructure required for automation, data acquisition, and connectivity, ensuring seamless interaction between digital platforms and manufacturing processes. Together, these components create a complete ecosystem for efficient, compliant, and flexible life sciences manufacturing.

North America Leads the Market

North America dominated the digital manufacturing in life sciences market, driven by the strong presence of leading pharmaceutical, biotechnology, and medical device companies, as well as advanced digital infrastructure and high R&D spending. The region’s well-established regulatory framework encourages innovation and the adoption of Industry 4.0 technologies to ensure product quality and compliance. Companies across the United States and Canada are actively leveraging digital manufacturing solutions such as AI-driven analytics, cloud-based manufacturing systems, and digital twins to improve operational efficiency and accelerate time-to-market. The emphasis on data integrity, automation, and smart manufacturing across FDA-regulated environments has positioned North America as a pioneer in implementing digital transformation across the life sciences value chain.

U.S. Market Trends

- In the United States, the adoption of digital manufacturing technologies is being driven by the need for greater production flexibility, faster drug development, and improved regulatory compliance.

- Major pharmaceutical firms and contract manufacturing organizations (CMOs) are increasingly integrating digital twins and predictive analytics to optimize processes and reduce operational risks.

- The U.S. market is also witnessing a surge in AI-based quality assurance systems, real-time data monitoring, and cloud-based collaboration platforms that enhance transparency across global supply networks.

- Moreover, government initiatives supporting smart manufacturing and the rise of personalized medicine are fueling investment in digital infrastructure and workforce upskilling.

Asia-Pacific Emerges as the Fastest-Growing Region

The Asia-Pacific region is projected to be the fastest-growing market for digital manufacturing in life sciences, fueled by rapid industrial digitalization, expanding pharmaceutical production, and increasing government support for advanced technologies. Countries such as China, Japan, South Korea, and India are actively investing in smart factory initiatives and digital healthcare ecosystems. The region’s growing biopharmaceutical sector and cost-effective manufacturing capabilities make it a prime location for digital transformation in production processes. Furthermore, the adoption of cloud-based and AI-driven systems is helping companies in Asia-Pacific meet international quality and regulatory standards while improving scalability and efficiency.

India’s Market Trends

- In India, the digital manufacturing landscape in life sciences is evolving quickly as domestic pharmaceutical and biotech companies modernize their operations to meet global export demands.

- The government’s “Digital India” and “Make in India” programs are accelerating the integration of automation, data analytics, and IoT technologies in manufacturing facilities.

- Indian life sciences firms are increasingly deploying electronic batch records, MES (Manufacturing Execution Systems), and AI-powered quality control tools to enhance compliance with global standards such as those set by the U.S. FDA and EMA.

Segments Covered in the Report:

By Technology/Solution Type

- Manufacturing Execution Systems (MES)

-

- Electronic Batch Records (EBR)

- Recipe and Formulation Management

- Production Scheduling and Dispatching

- Quality and Compliance Management (Integrated QMS)

- Enterprise Asset Management (EAM) / Asset Performance Management (APM)

-

- Predictive and Prescriptive Maintenance

- Calibration and Maintenance Management

- Asset Reliability and Optimization

- Work Order Management

- Industrial Internet of Things (IIoT) and Data Platforms

-

- Sensors and Edge Devices

- IIoT Platforms/Gateways

- Data Historians

- Data Analytics, Artificial Intelligence (AI), and Machine Learning (ML)

-

- Process Data Analytics (PDA)

- Predictive Modeling and Forecasting

- Real-Time Monitoring and Alerting

- ML for Process Optimization Automation and Control Systems

- Distributed Control Systems (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Programmable Logic Controllers (PLC)

- Digital Twin and Simulation

-

- Process Modeling and Simulation

- Facility and Equipment Digital Twins

- Augmented Reality (AR) and Virtual Reality (VR)

-

- Remote Assistance and Training

- Digital Work Instructions

By End-User / Vertical

-

- Small Molecule Drugs

- Generics

- Over-the-Counter (OTC) Drugs

- Biotechnology (Biotech) / Biopharma

-

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines and Therapeutics

- Cell and Gene Therapies (CGT)

-

- Autologous Cell Therapy Manufacturing

- Allogeneic Cell Therapy Manufacturing

-

- Class I/II/III Devices

- Diagnostic Devices

- Implantables

- Contract Manufacturing/Development Organizations (CMOs/CDMOs)

By Deployment Mode

-

- Private Cloud

- Public Cloud

By Component

-

- Software as a Service (SaaS)

- License-Based

-

- Implementation and Integration Services

- Consulting and Training Services

- Maintenance and Support Services

-

- Control Systems Hardware

- Sensors and Field Devices

By Application / Use Case

- Production Planning and Scheduling

- Quality and Compliance Management

-

- Deviation and Investigation Management

- Audit Trail Management

- Asset Maintenance and Reliability

- Process Performance and Optimization

- Supply Chain Integration

By Technology/Solution Type

- Manufacturing Execution Systems (MES)

-

-

- Small Molecule Drugs

- Generics

- Over-the-Counter (OTC) Drugs

-

- Biotechnology (Biotech) / Biopharma

-

-

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines and Therapeutics

-

- Cell and Gene Therapies (CGT)

-

-

- Autologous Cell Therapy Manufacturing

- Allogeneic Cell Therapy Manufacturing

-

-

- Class I/II/III Devices

- Diagnostic Devices

- Implantables

-

- Contract Manufacturing/Development Organizations (CMOs/CDMOs)

- Enterprise Asset Management (EAM) / Asset Performance Management (APM)

-

-

- Small Molecule Drugs

- Generics

- Over-the-Counter (OTC) Drugs

-

- Biotechnology (Biotech) / Biopharma

-

-

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines and Therapeutics

-

- Cell and Gene Therapies (CGT)

-

-

- Autologous Cell Therapy Manufacturing

- Allogeneic Cell Therapy Manufacturing

- Industrial Internet of Things (IIoT) and Data Platforms

-

-

- Small Molecule Drugs

- Generics

- Over-the-Counter (OTC) Drugs

-

- Biotechnology (Biotech) / Biopharma

-

-

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines and Therapeutics

-

- Cell and Gene Therapies (CGT)

-

-

- Autologous Cell Therapy Manufacturing

- Allogeneic Cell Therapy Manufacturing

-

-

- Class I/II/III Devices

- Diagnostic Devices

- Implantables

-

- Contract Manufacturing/Development Organizations (CMOs/CDMOs)

- Data Analytics, Artificial Intelligence (AI), and Machine Learning (ML)

-

-

- Small Molecule Drugs

- Generics

- Over-the-Counter (OTC) Drugs

-

- Biotechnology (Biotech) / Biopharma

-

-

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines and Therapeutics

-

- Cell and Gene Therapies (CGT)

-

-

- Autologous Cell Therapy Manufacturing

- Allogeneic Cell Therapy Manufacturing

-

-

- Class I/II/III Devices

- Diagnostic Devices

- Implantables

-

- Contract Manufacturing/Development Organizations (CMOs/CDMOs)

- Automation and Control Systems

-

-

- Small Molecule Drugs

- Generics

- Over-the-Counter (OTC) Drugs

-

- Biotechnology (Biotech) / Biopharma

-

-

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines and Therapeutics

-

- Cell and Gene Therapies (CGT)

-

-

- Autologous Cell Therapy Manufacturing

- Allogeneic Cell Therapy Manufacturing

-

-

- Class I/II/III Devices

- Diagnostic Devices

- Implantables

-

- Contract Manufacturing/Development Organizations (CMOs/CDMOs)

- Digital Twin and Simulation

Ph

-

-

- Small Molecule Drugs

- Generics

- Over-the-Counter (OTC) Drugs

-

- Biotechnology (Biotech) / Biopharma

-

-

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines and Therapeutics

-

- Cell and Gene Therapies (CGT)

-

-

- Autologous Cell Therapy Manufacturing

- Allogeneic Cell Therapy Manufacturing

-

-

- Class I/II/III Devices

- Diagnostic Devices

- Implantables

-

- Contract Manufacturing/Development Organizations (CMOs/CDMOs)

- Augmented Reality (AR) and Virtual Reality (VR)

-

-

- Small Molecule Drugs

- Generics

- Over-the-Counter (OTC) Drugs

-

- Biotechnology (Biotech) / Biopharma

-

-

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines and Therapeutics

-

- Cell and Gene Therapies (CGT)

-

-

- Autologous Cell Therapy Manufacturing

- Allogeneic Cell Therapy Manufacturing

-

-

- Class I/II/III Devices

- Diagnostic Devices

- Implantables

-

- Contract Manufacturing/Development Organizations (CMOs/CDMOs)

By Region

-

- U.S.

- Canada

- Mexico

- Rest of North America

-

- Western Europe

- Germany

- Italy

- France

- Spain

- Ireland

- UK

- Iceland

- Poland

- Nordic Countries

- Rest of Western Europe

-

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries

- South Korea

- Rest of APAC

-

- Brazil

- Argentina

- Rest of SA

- Middle East and Africa (MEA)