Digital Pathology Market Size and Growth

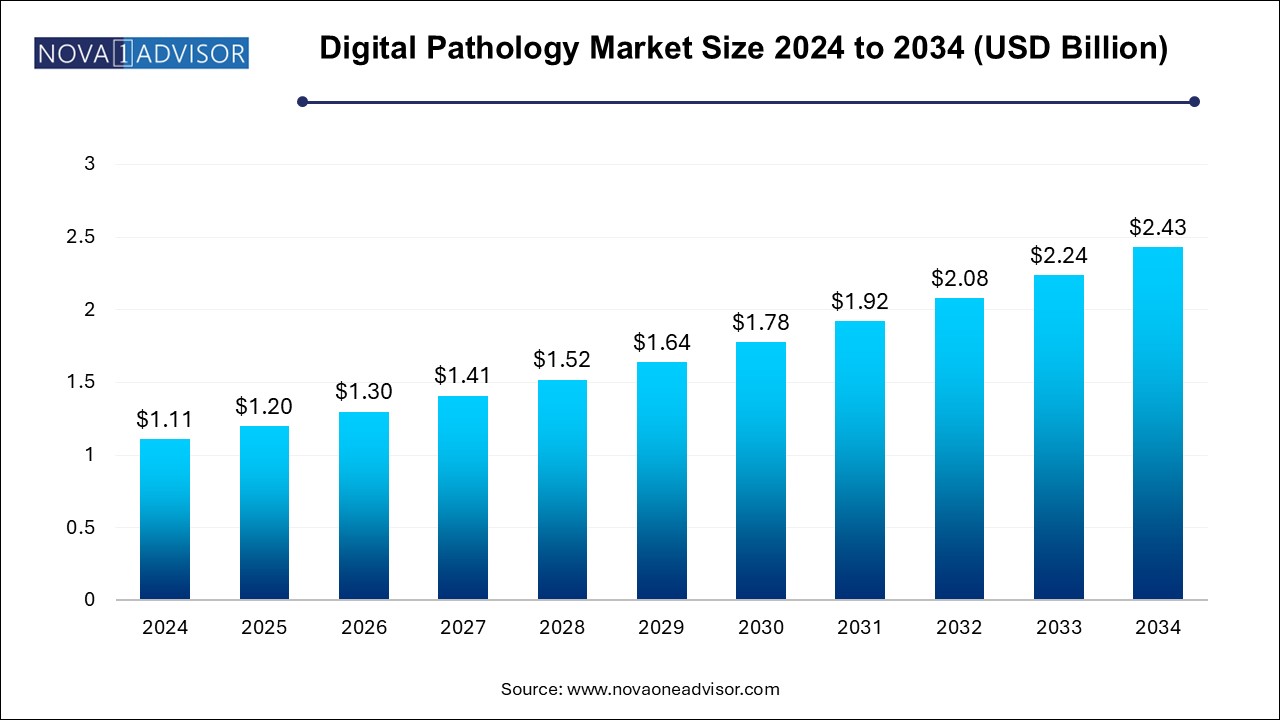

The digital pathology market size was exhibited at USD 1.11 billion in 2024 and is projected to hit around USD 2.43 billion by 2034, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. The market is growing due to the rising demand for faster cancer diagnosis and the push for faster remote diagnostics. AI integration and workflow automation are driving efficiency and adoption.

Digital Pathology Market Key Takeaways:

- North America dominated the digital pathology market in 2024.

- Asia-Pacific is anticipated to grow at the highest CAGR in the market during the forecast period.

- By type, the scanners segment dominated the market in 2024.

- By type, the software segment grew at the fastest rate in the market during the studied years.

- By application, the disease diagnosis segment held the major market share.

- By application, the drug discovery segment is projected to grow at the fastest rate between 2025 and 2034.

- By end-user, the pharma & biotech companies segment held the highest share of the market in 2024.

- By end-user, the clinical segment is projected to grow at the fastest CAGR in the market during the studied years.

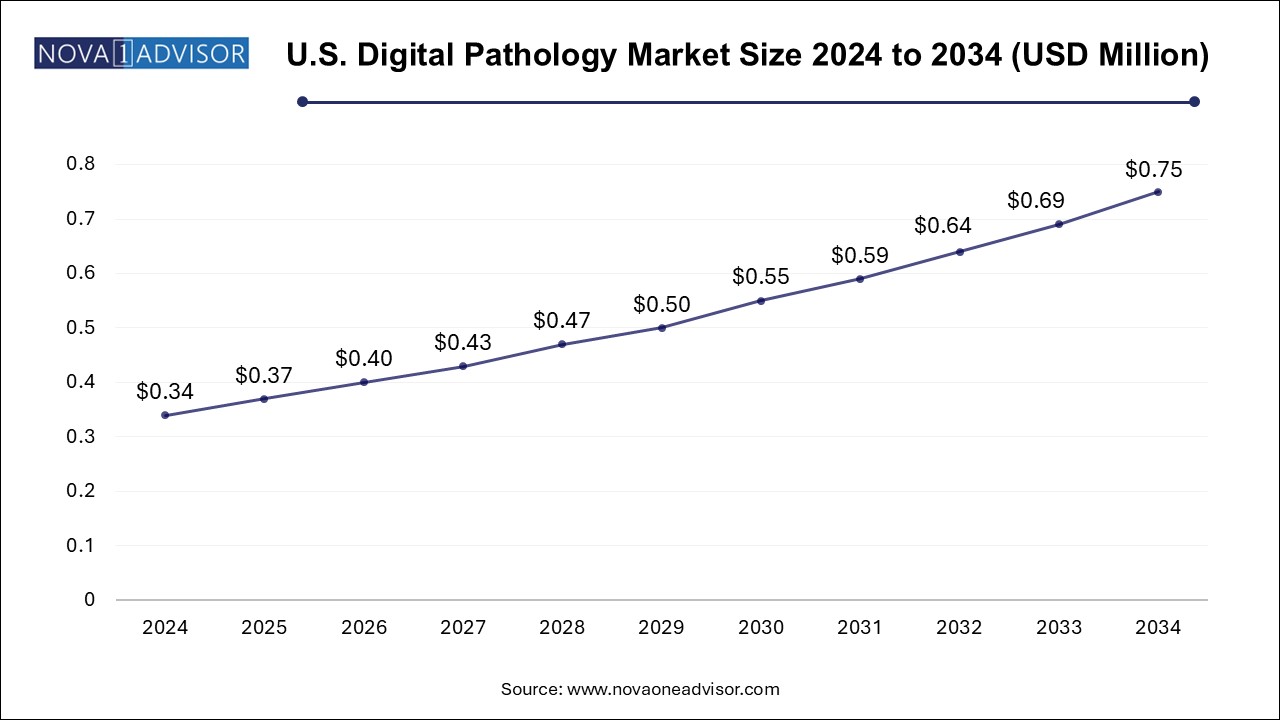

U.S. Digital Pathology Market Size and Growth 2025 to 2034

The U.S. digital pathology market size is evaluated at USD 0.340 million in 2024 and is projected to be worth around USD 0.750 million by 2034, growing at a CAGR of 7.45% from 2025 to 2034.

How is North America Contributing to the Expansion of the Digital Pathology Market?

North America dominated the digital pathology market in 2024, due to its strong healthcare infrastructure, rapid adoption of advanced technologies, and growing demand for efficient diagnostic solutions. The region also benefits from a high prevalence of chronic diseases like cancer, increased R&D spending, and favorable regulatory frameworks. Additionally, the presence of major digital pathology companies and supportive government initiatives have accelerated the integration of digital tools in clinical and research applications, solidifying its market leadership.

- For Instance, In March 2023, PathAI introduced its digital pathology platform, AISight, through an Early Access Program involving 13 prominent health systems, labs, and pathology organizations across the U.S. The launch aimed to provide early users with access to advanced digital tools for enhancing diagnostic workflows.

How is Asia-Pacific approaching the Digital Pathology Market in 2025?

Asia-Pacific is anticipated to grow at the highest CAGR in the market during the forecast period, due to increasing healthcare investments, rising prevalence of chronic diseases, and rapid adoption of advanced technologies like AI. The region is also seeing strong growth in telepathology and remote diagnostics, improving access to care in underserved areas. Government initiatives to digitize healthcare systems and modernize infrastructure further support the expansion of digital pathology across countries like India, China, and South Korea.

- For Instance, In June 2023, Aignostics, an AI-focused pathology company, partnered with China’s Virchow Laboratories to advance the use of AI in pathology. The collaboration aims to strengthen AI integration in both clinical and research settings across the country.

What are the Major Players in the Digital Pathology Market?

Digital pathology is a process of acquiring, managing sharing, and interpreting pathology information, primarily in the form of digitization glass slide images using computer technology. It enables high-resolution scanning of tissue samples for analysis, storage, and remote consultation, often enhanced by artificial intelligence and image analysis tools. The digital pathology market is growing due to increasing demand for faster and more accurate diagnostics, driven by rising cancer cases and a global shortage of skilled pathologists. Technological advancements like AI-powered image analysis, whole-slide image, and telepathology are enhancing efficiency, enabling remote collaboration, and reducing turnaround times, leading to widespread adoption across healthcare and research institutions.

- For Instance, In February 2025, The National Pathology Imaging Co-operative (NPIC) created an open-access register of AI tools in pathology to support their safe and effective use in diagnostics. While AI can aid in diagnosis and improve efficiency, pathologists are still essential for final interpretation.

What are the Major Key Trends in the Digital Pathology Market in 2025?

- In November 2023, Owkin expanded the reach of its AI tool for diagnosing colorectal cancer by partnering with Sectra. By integrating its MSIntuit CRC1 diagnostic into Sectra’s digital pathology platform, the goal is to simplify MSI screening and improve patient access to immunotherapy treatments for colorectal cancer.

- In October 2023, Pramana and Gestalt launched a unified platform that brings together digital pathology, AI, image analysis, and DICOM standards. This integrated solution offers a streamlined and comprehensive approach to digital diagnostics powered by artificial intelligence.

How is AI enhancing advancements in the Digital Pathology Market?

AI is significantly advancing the digital pathology market by enabling faster and more accurate analysis of pathology images. It automates routine tasks, supports early and precise disease detection, prioritizes critical cases, and assists pathologists in making data-driven decisions. AI also enhances workflow efficiency, reduces diagnostic errors, and enables remote collaboration ultimately improving patient outcomes and reducing healthcare costs.

- For Instance, In February 2024, Paige expanded its AppLab marketplace by adding six new AI and digital pathology providers. This update aims to help pathology labs globally develop more integrated and customized AI-powered workflows for improved diagnostic efficiency.

Report Scope of Digital Pathology Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.20 Billion |

| Market Size by 2034 |

USD 2.43 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corp.; F. Hoffmann-La Roche Ltd.; Mikroscan Technologies, Inc.; Inspirata, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Huron Technologies International Inc.; ContextVision AB; HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO); West Medica Produktions- und Handels- GmbH (West Medica); aetherAI; IBEX (IBEX MEDICAL ANALYTICS); SigTuple Technologies Private Limited; Morphle Labs, Inc; Bionovation Biotech, Inc. |

Market Dynamics

Driver

The rising prevalence of chronic diseases

The growing burden of chronic diseases like cancer is driving demand for faster and more reliable diagnostic methods, Making digital pathology increasingly essential. With rising case volumes, traditional pathology faces limitations in spread and scalability. Digital pathology offers solutions by enabling high-throughput image analysis, AI-assisted diagnostics, and remote access for pathologists. This will reduce diagnostic delays, and improve accuracy.

Restraint

High Installation Cost

High installation costs act as a major restraint in the digital pathology market because setting up the necessary infrastructure such as whole-slide scanners, secure data storage, advanced software, and high-speed networks requires, significant capital investment. Many healthcare facilities, especially in low-and middle-income regions, may struggle to afford these expenses. Additionally, the cost of training staff and maintaining the technology adds to the financial burden, slowing adoption and limiting accessibility despite the longer-term benefits of digital pathology.

Opportunity

Technological Advancement

Technological advancement presents a major future opportunity in the digital pathology market by enabling faster, more accurate, and Automated diagnostics. Innovations such as AI-powered image analysis, cloud-based data storage, and advanced whole-slide images are transforming how pathology is performed. These technologies improve workflow efficiency, support remote diagnostics, and enhance precision in disease detection and treatment planning. As these tools become more accessible treatment planning. As these tools become more accessible and integrated, they open new possibilities for personalized medicine and expanded global adoption of digital pathology.

- For Instance, In May 2024, Indica Labs unveiled the 4.0 update of its HALO, HALO AI, and HALO Link platforms, featuring advanced AI capabilities for tissue analysis. This upgrade aims to support pathologists and researchers with more powerful and efficient tools for digital pathology.

Segmental Insights

The Scanners Segment: Dominated

By type, the scanners segment dominated the market in 2024, due to the critical role scanners play in digitizing glass slides into high-resolution images for analysis. This growing adoption of whole-slide imaging, advancements in scanning technology, and the rising demand for faster, high-throughput diagnostic solutions have driven this segment's growth. Scanners are the foundation for enabling AI analysis, remote consultations, and data sharing, making them a major player in market dominance.

The Software Segment: Fastest CAGR

By type, the software segment grew at the fastest rate in the market during the studied years, driven by rising demand for advanced image analysis, AI integration, and efficient workflow management tools. As healthcare facilities transition to digital systems, robust software solutions are essential for managing large volumes of pathology data, enabling remote access, and supporting accurate diagnostics. The increasing adoption of AI-powered tools and the need for seamless data sharing have further accelerated the growth of the digital pathology market.

- For Instance, In November 2023, 4D Medical received U.S. FDA clearance for its CT LVAS software, which analyzes CT images to deliver detailed insights into lung function. The software also offers quantitative data on blood flow and visual representations, enhancing the assessment of lung health.

The Disease Diagnosis Segment: Major Shares

By application, the disease diagnosis segment held the major market share, due to the growing prevalence of chronic conditions like cancer, which require accurate and timely diagnostic solutions. Digital pathology enables high-resolution image analysis, faster case review, and AI-assisted diagnostics, significantly improving diagnostic accuracy and efficiency, This technology supports early disease detection, reduces turnaround time, and enhances treatment planning, making it highly valuable for clinical diagnosis and driving its dominance in the digital pathology market.

The Drug Discovery Segment; Fastest-Growing

By application, the drug discovery segment is projected to grow at the fastest rate between 2025 and 2034 due, to the increasing adoption of digital pathology in pharmaceutical research and development. This technology enables high-throughput analysis, precise tissue profiling, and AI-driven insights, which accelerate preclinical and clinical studies. It also improves data accuracy and reduces costs in drug testing and validation, As personalized medicine and targeted therapies gain momentum, digital pathology becomes a vital tool in streamlining and enhancing drug discovery processes.

The Pharma & Biotech Companies Segment: Highest Shares

By end-user, the pharma & biotech companies segment held the highest share of the market in 2024, due to their extensive use of digital tools in drug research, development, and clinical trials. Digital pathology enables faster, more accurate trials. Digital pathology enables faster, more accurate tissue analysis, high-throughput screening, and AI-driven insights, which are crucial for accelerating drug discovery and regulatory approvals. These companies also have the resources to invest in advanced technologies, making them early adopters and major contributors to market growth.

- For Instance, In March 2023, Ibex Medical Analytics was awarded a PathLAKE contract to deliver AI-powered diagnostic solutions across 25 NHS sites, aimed at enhancing cancer detection and diagnosis.

The Clinical Segment: Fastest CAGR

By end-user, the clinical segment is projected to grow at the fastest CAGR in the market during the studied years. The increasing prevalence of chronic diseases, such as cancer and cardiovascular conditions, has heightened the demand for accurate and timely diagnostics. Digital pathology offers enhanced diagnostics capabilities, including high-resolution imaging and AI-driven analysis, which improves diagnostics accuracy and efficiency. Additionally, the integration of digital pathology systems in clinical settings facilitates streamlined workflows and better patient management, contributing to the digital pathology market acceleration.

Some of the prominent players in the digital pathology market include:

Digital Pathology Market Recent Developments

-

In February 2025, Charles River Laboratories partnered with Deciphex to enhance AI-driven digital pathology, emphasizing advanced image management and innovative AI tools for toxicologic pathology. The goal of this collaboration is to create a streamlined, accurate, and scalable pathology workflow.

-

In January 2025, Dublin-based medtech startup Deciphex announced that its AI-powered digital pathology platform allows pathologists to work up to 40% more efficiently without compromising accuracy. The company also raised €31 million in Series C funding to support its growth and innovation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the digital pathology market

By Product

-

- Scanners

- Slide Management System

By Type

- Human Pathology

- Veterinary Pathology

By Application

- Drug Discovery & Development

- Academic Research

- Disease Diagnosis

-

- Cancer Cell Detection

- Others

By End-use

- Hospitals

- Biotech & Pharma Companies

- Diagnostic Labs

- Academic & Research Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)