Digital Wound Care Management System Market Size, Industry Report, 2034

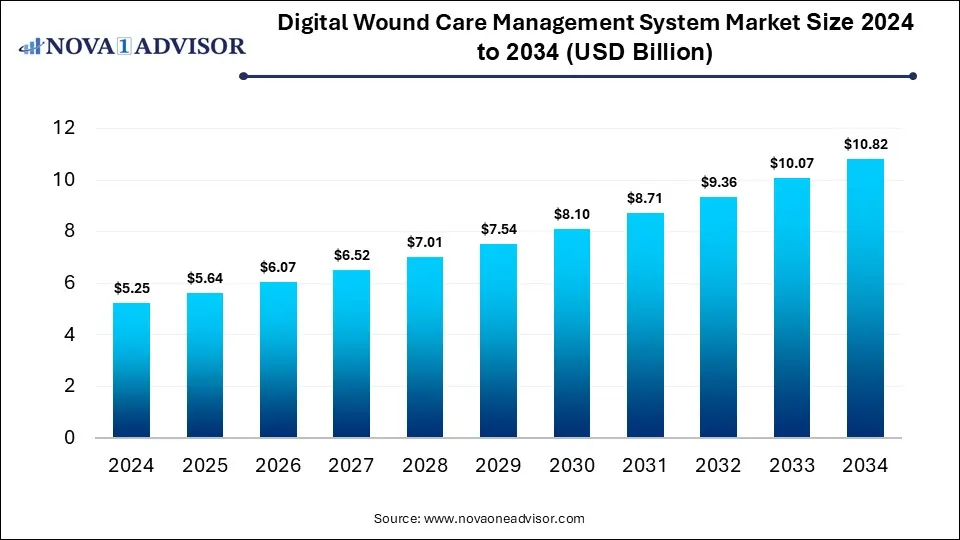

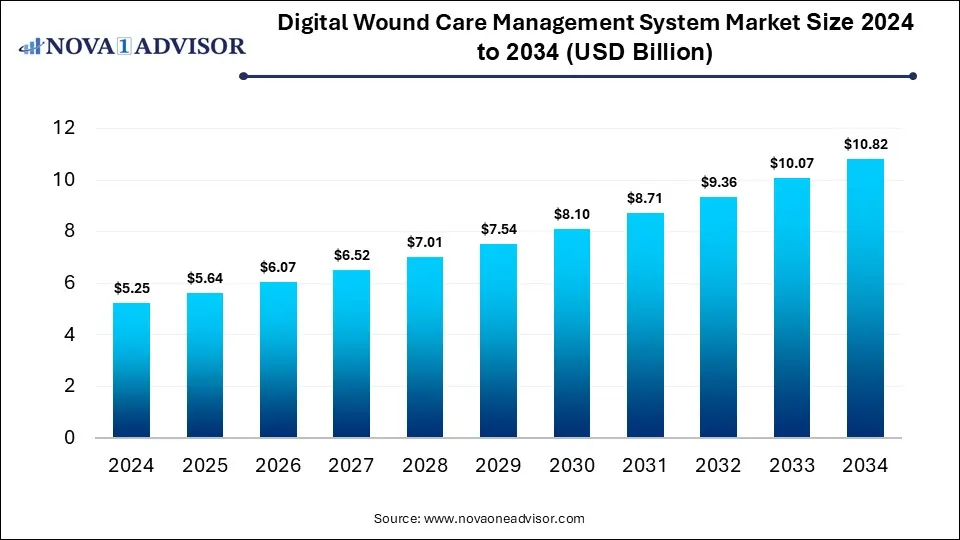

The global digital wound care management System market size was valued at USD 5.25 billion in 2024 and is anticipated to reach around USD 10.82 billion by 2034, growing at a CAGR of 7.5% from 2025 to 2034. The digital wound care management system market growth is driven by the rising adoption of AI and telemedicine platforms, innovations in wearable technologies, increasing prevalence of chronic wounds, shift towards outpatient and specialized care.

Digital Wound Care Management System Market Key Takeaways

- North America dominated the market and accounted for the largest revenue share of 34% in 2024.

- Software segment held the largest revenue share of 69% in 2024.

- The hardware segment is anticipated to grow at a significant rate over the forecast period.

- The hospital segment held the largest market share of 48% in 2024.

- The wound care clinics segment is anticipated to grow at the fastest CAGR from 2025 to 2034.

- The chronic wounds segment held the largest market share of 55% in 2024 and is anticipated to grow at the fastest CAGR from 2025 to 2034.

Market Overview

The Digital Wound Care Management System Market is undergoing a transformative evolution, integrating advanced technologies into the traditional wound care paradigm. Wound management—once reliant solely on physical dressings and visual assessments—has entered a new era where digital systems enable remote monitoring, image-based diagnostics, data-driven care planning, and artificial intelligence (AI)-enhanced predictions. These advancements are revolutionizing how chronic and acute wounds are assessed, treated, and followed up, offering enhanced precision, cost-effectiveness, and patient engagement.

The rising prevalence of chronic wounds—such as diabetic foot ulcers, venous leg ulcers, and pressure injuries—has created an urgent need for effective, standardized, and continuous wound care. The digitalization of wound care is addressing these needs through innovative software platforms and hardware devices. These systems offer capabilities like automated wound measurement, remote consultation, clinical data integration, predictive analytics, and telemedicine functionality.

As the healthcare sector shifts towards value-based care and outcome-driven reimbursement models, the demand for measurable healing outcomes and reduced hospital readmission rates is increasing. Digital wound care systems directly support these goals by enabling evidence-based, proactive intervention strategies. They provide wound care specialists, nurses, and clinicians with tools to track healing progression over time, identify complications early, and adjust treatments based on real-time analytics.

In addition, digital wound care systems offer significant benefits to patients in remote or underserved areas who lack access to specialized wound clinics. Telewound care solutions are expanding, allowing patients to receive ongoing evaluation and recommendations without frequent in-person visits. As the burden of chronic conditions continues to rise globally, the adoption of digital wound care solutions is poised for substantial growth over the next decade.

Major Trends in the Market

-

Adoption of AI and Machine Learning: AI-driven tools are being developed to automate wound assessment, predict healing times, and provide clinical decision support based on large datasets.

-

Integration with Electronic Health Records (EHRs): Digital wound care platforms are increasingly being integrated into hospital-wide EHR systems for seamless data sharing and interoperability.

-

Telewound and Remote Monitoring Expansion: Especially after COVID-19, demand for remote monitoring tools for home-based or rural patients has surged.

-

Image-Based Documentation: High-resolution imaging via smartphones, tablets, or dedicated devices allows for standardized, objective wound measurement and tracking.

-

Mobile Apps for Patient Engagement: Apps that allow patients or caregivers to document wound changes and communicate with clinicians are enhancing adherence and self-care.

-

Cloud-Based Data Management: Cloud infrastructure is enabling real-time access to patient data and collaborative care models across geographically dispersed teams.

-

Personalized Wound Treatment Algorithms: Advanced systems are now offering personalized care plans based on wound type, comorbidities, and patient history.

How Can AI Impact the Digital Wound Care Management System Market?

Artificial intelligence (AI) and machine learning in digital wound care management systems can potentially enhance wound assessment, monitoring and treatment. Automated wound assessment with AI algorithms can assist in measurement of wound dimensions, evaluation of tissue type, and identification of signs of infection or any other complications. Personalized treatment strategies for wound management and healing can be devised with AI-powered tools. The emergence of digital platforms and wearable sensors integrated with AI technologies can enable remote monitoring if wound healing progress, further allowing timely interventions.

Digital Wound Care Management System Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 5.64 Billion |

| Market Size by 2034 |

USD 10.82 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.5% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Wound Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Healogics; LLC.; WoundZoom; Smith+Nephew; WoundMatrix, Inc.; Healthy.io Ltd; Swift Medical Inc.; eKare, Inc.; Joerns Healthcare (digitalMedLab Ltd.); Net Health Systems, Inc.; Essity Aktiebolag (publ); 3M; Entec Health Ltd.; The Wound Pros, Inc.; MolecuLight Inc.; NATROX Wound Care (Inotec AMD Limited.) |

Market Driver: Increasing Incidence of Chronic Wounds

The growing prevalence of chronic wounds is the most significant driver of the digital wound care management system market. Chronic wounds—especially diabetic foot ulcers, venous leg ulcers, and pressure ulcers—affect millions globally and are associated with high morbidity, long healing times, and substantial healthcare costs. For example, the CDC estimates over 34 million Americans have diabetes, and diabetic foot ulcers are a leading complication, often resulting in amputation if not managed effectively.

These wounds require ongoing assessment, dressing changes, and patient monitoring—tasks that become resource-intensive without digital support. Digital wound care systems allow clinicians to monitor healing trends, access historical wound data, and provide timely interventions through alerts and analytics. This streamlining of care not only reduces complications but also significantly improves healing outcomes and lowers long-term costs. The rising geriatric population, a high-risk group for chronic wounds, further amplifies the need for advanced wound care tools that enable continuous, accurate monitoring.

Market Restraint: High Initial Cost and Interoperability Issues

Despite the benefits, the widespread adoption of digital wound care systems is restrained by the high initial cost of implementation and integration complexities. Acquiring specialized imaging devices, software licenses, cloud storage, and user training can be cost-prohibitive for small clinics or underfunded healthcare systems. Many healthcare providers still rely on traditional, manual methods of wound assessment due to budget constraints.

Moreover, interoperability remains a challenge. Many digital wound platforms lack standardization or compatibility with existing EHR systems, leading to siloed data and disrupted workflows. Integrating imaging data, clinician notes, and wound progression analytics into hospital records without redundancy or information loss requires custom API development or third-party integration services, adding to complexity and cost. These barriers can slow market penetration, especially in developing regions or rural hospitals.

Market Opportunity: Telemedicine and Home-Based Wound Care Expansion

The growing popularity and acceptance of telemedicine present a strong opportunity for the digital wound care market. As healthcare shifts towards decentralization, home-based care models are gaining prominence, particularly for managing chronic conditions. Patients with limited mobility or those living in remote areas face significant challenges in accessing wound care specialists. Digital wound platforms that support remote monitoring, virtual consultations, and patient-driven documentation can bridge this gap effectively.

Companies are increasingly offering solutions that integrate with tablets or smartphones, enabling nurses or caregivers to capture wound images, input data, and share reports with specialists in real-time. These systems help reduce unnecessary hospital visits, facilitate early intervention, and provide continuous care. The development of AI tools that can analyze images remotely and flag issues like infection or stalled healing further enhances the potential of telewound care. As payers begin reimbursing remote services, this segment is expected to experience exponential growth.

Digital Wound Care Management System Market By Product Insights

The Software segment currently dominates the digital wound care market, owing to its central role in wound tracking, data analytics, clinical decision support, and telecommunication. These platforms offer wound documentation, 3D imaging support, trend analysis, automated alerts, and patient management dashboards. Major providers have developed user-friendly, cloud-based platforms that integrate with existing hospital information systems. Companies like Tissue Analytics and WoundMatrix have pioneered software that allows clinicians to capture and analyze wound metrics accurately, minimizing subjective interpretation.

In contrast, the Hardware segment is the fastest-growing. This includes high-resolution imaging devices, portable scanners, tablets, and integrated diagnostic tools specifically designed for wound documentation. Newer innovations in AI-powered cameras, mobile wound imaging devices, and Bluetooth-enabled dressings that send real-time healing data are transforming hardware into an indispensable part of digital wound care. Hospitals and clinics are investing in these devices to enhance diagnostic accuracy and reduce clinician workload.

Digital Wound Care Management System Market By End Use Insights

Hospitals remain the leading end users in this market, driven by their large patient base, budget flexibility, and focus on adopting innovative technologies for better patient outcomes. Large hospitals and wound centers are increasingly adopting digital wound care platforms to reduce variability in wound assessments and improve inter-professional communication. Integration with hospital-wide EHR systems also allows for better documentation, billing, and performance tracking. Moreover, the high cost of chronic wound management has encouraged hospitals to adopt technologies that promise faster healing and reduced readmission.

Meanwhile, Wound Care Clinics represent the fastest-growing end-use segment. As outpatient care becomes more prevalent and patient expectations for efficient service increase, specialty wound clinics are adopting digital platforms to differentiate their services and improve care quality. These clinics benefit from software tools that help track multiple patients across extended treatment periods while supporting clinical research and documentation. The focus on community-based care and the expansion of private wound care chains are further fueling demand in this segment.

Digital Wound Care Management System Market By Wound Type Insights

Chronic wounds dominated the market due to their long healing periods, high recurrence rates, and need for ongoing monitoring. Diabetic foot ulcers and venous leg ulcers, in particular, demand comprehensive wound management strategies that span months or even years. Digital systems provide standardized measurements, healing trend visualization, and alerts for when a wound is not progressing, allowing clinicians to take early action. These tools have proven especially valuable in multi-disciplinary care teams and in geriatric patient management.

However, the Acute Wounds segment is gaining momentum as hospitals and trauma centers adopt digital systems to improve post-operative wound care and reduce surgical site infections (SSIs). Acute wounds, including those from surgery, trauma, and burns, require timely interventions and accurate documentation during the healing phase. Digital wound care platforms facilitate quick assessments, streamline handoffs between departments, and support better compliance with hospital accreditation standards.

Digital Wound Care Management System Market By Regional Insights

North America holds the largest share of the digital wound care management system market, owing to advanced healthcare infrastructure, early adoption of digital health technologies, and high prevalence of chronic wounds. The U.S. healthcare system, in particular, has led the transition from manual to digital wound assessment methods in hospitals and specialty clinics. Government initiatives promoting value-based care and the integration of AI in clinical settings have further supported market growth. Reimbursement for telemedicine wound care visits and the presence of key players such as Swift Medical, Tissue Analytics, and Net Health underscore the region’s leadership.

The Asia-Pacific region is witnessing the fastest growth, fueled by a growing elderly population, increasing diabetes prevalence, and expanding healthcare digitalization. Countries like China, India, and Japan are experiencing a surge in chronic diseases and surgeries, creating a large patient pool for wound management. Governments and private providers are investing in healthcare modernization, including digital health platforms. Mobile health adoption is particularly rapid in Asia, making smartphone-enabled wound care platforms an attractive solution for rural outreach. As awareness grows and infrastructure improves, this region presents strong growth opportunities for digital wound care technology providers.

China Digital Wound Care Management System Market Trends

China is experiencing significant growth in the market in Asia Pacific, driven by factors such as large and aging population with rising cases of chronic wounds, increasing prevalence of conditions like diabetes leading to diabetic foot ulcers and other type of wounds, further driving the demand for effective and specialized wound management. Increasing investments in advancing healthcare infrastructure with integration of digital technologies is contributing to the adoption of digital wound care technologies. Supportive government policies promoting the digitalization of healthcare systems, AI-integrated diagnostic platforms, increased awareness regarding early wound care intervention, and access to advanced wound care products are the factors bolstering the market growth.

India Digital Wound Care Management System Market Trends

The digital wound care management system market in India is expected to grow at a significant rate over the forecast period. The market growth can be linked to the increasing prevalence of chronic conditions such as diabetes and venous ulcer, rising geriatric population, development of digital wound measurement devices, adoption of AI-powered diagnostic platforms, and increased awareness of advanced wound care products. The expansion of telehealth platforms is enabling remote monitoring of wounds and virtual consultations, especially in rural and underserved areas. India’s poor infrastructure, particularly inadequate road designs, insufficient safety features and lack of maintenance are contributing to the increasing number of accidents and traumas, further driving the demand for digital wound management services and advanced wound care products.

Digital Wound Care Management System Market Top Key Companies:

The following are the leading companies in the digital wound care management system market. These companies collectively hold the largest market share and dictate industry trends.

- Healogics, LLC.

- WoundZoom

- Smith+Nephew

- WoundMatrix, Inc.

- Healthy.io Ltd

- Swift Medical Inc.

- eKare, Inc.

- Joerns Healthcare (digitalMedLab Ltd.)

- Net Health Systems, Inc.

- Essity Aktiebolag (publ)

- 3M

- Entec Health Ltd.

- The Wound Pros, Inc.

- MolecuLight Inc.

- NATROX Wound Care (Inotec AMD Limited.)

Digital Wound Care Management System Market Recent Developments

- In May 2025, Vital Wound Care launched a free, AI-driven, web-based Wound Assessment App as part of its broader expansion of mobile wound care services, further bringing hospital-grade care to homes across Greater Houston.

- In September 2024, ChartPath, a leading provider of electronic health record (EHR) solutions for long-term and post-acute care (LTPAC) and WoundZoom, an innovator of digital wound management solutions, entered into a strategic alliance for enhancing wound care management in LTPAC. The partnership focuses on combining ChartPath's user-friendly EHR platform with WoundZoom's advanced wound care technology to transform wound care management.

Digital Wound Care Management System Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Digital Wound Care Management System market.

By Product Mode

By Wound Type

- Chronic Wound

- Diabetic Foot Ulcers

- Pressure Ulcer (PU)

- Venous Leg Ulcers

- Others (Surgical/Trauma Wounds, Arterial ulcers)

- Acute Wound

By End Use

- Hospitals

- Wound Care Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)