Disposable Endoscopes Market Size and Trends

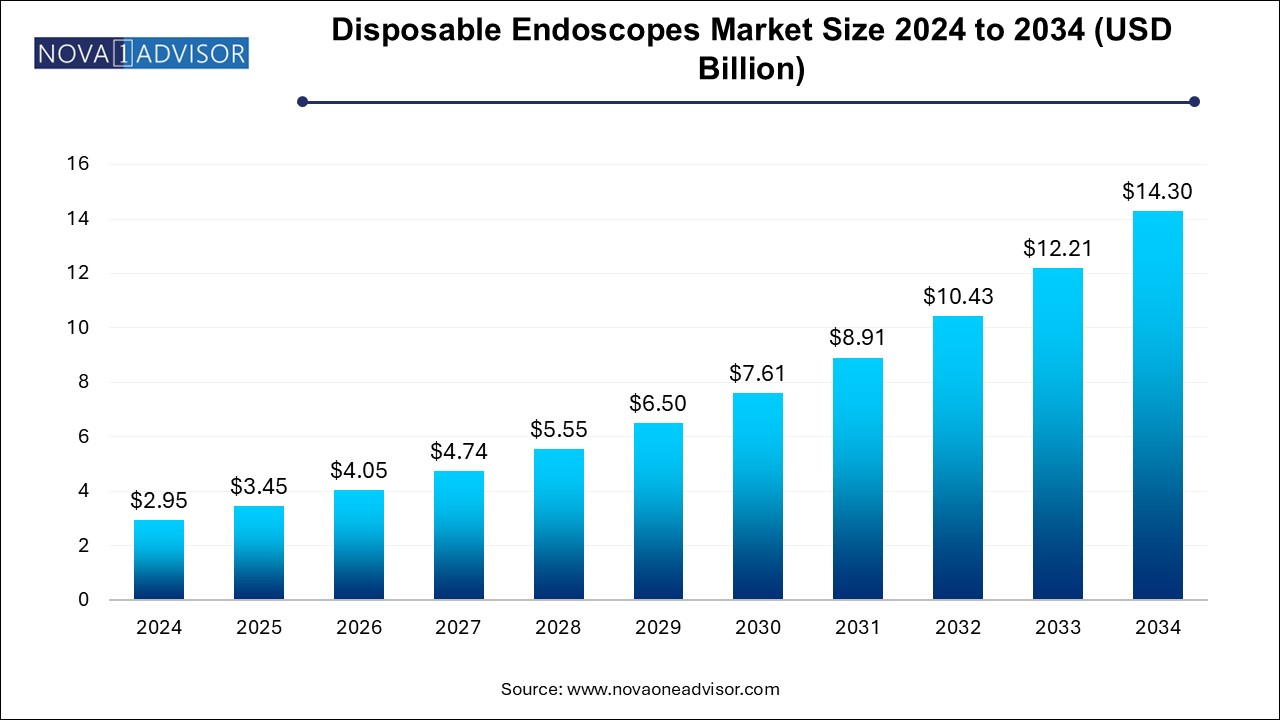

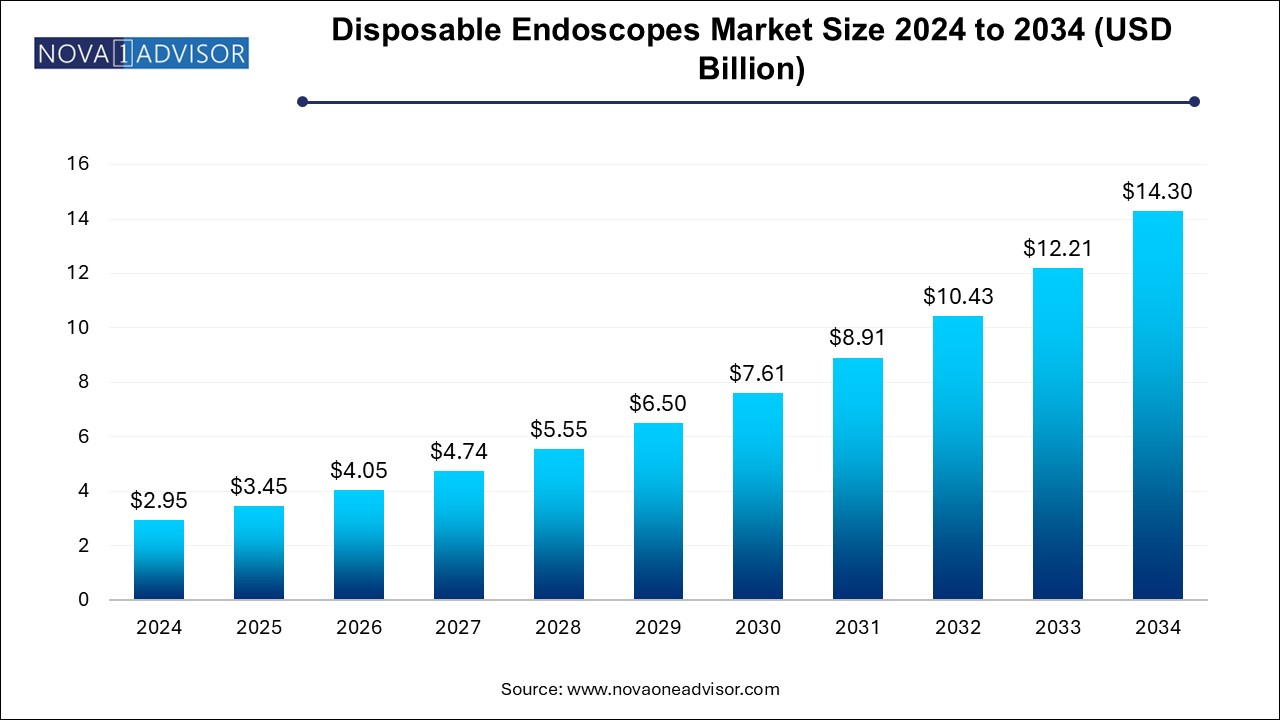

The disposable endoscopes market size was exhibited at USD 2.95 billion in 2024 and is projected to hit around USD 14.30 billion by 2034, growing at a CAGR of 17.1% during the forecast period 2024 to 2034.

Disposable Endoscopes Market Key Takeaways:

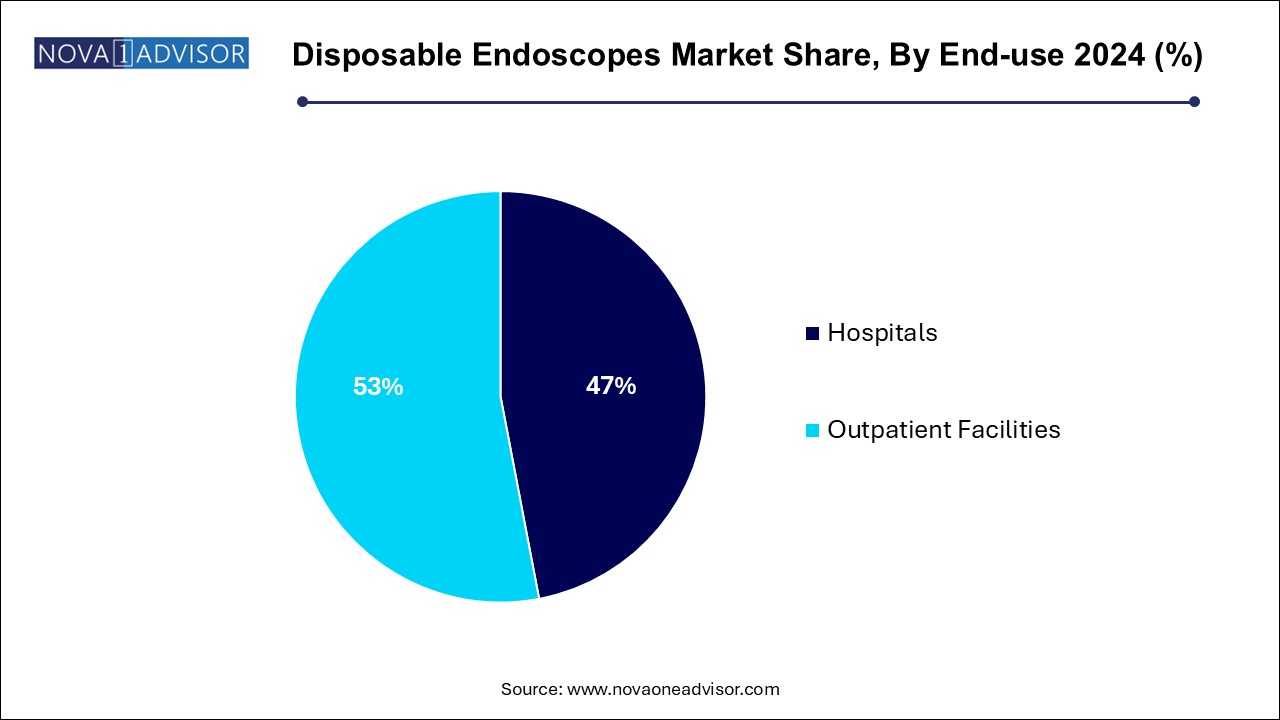

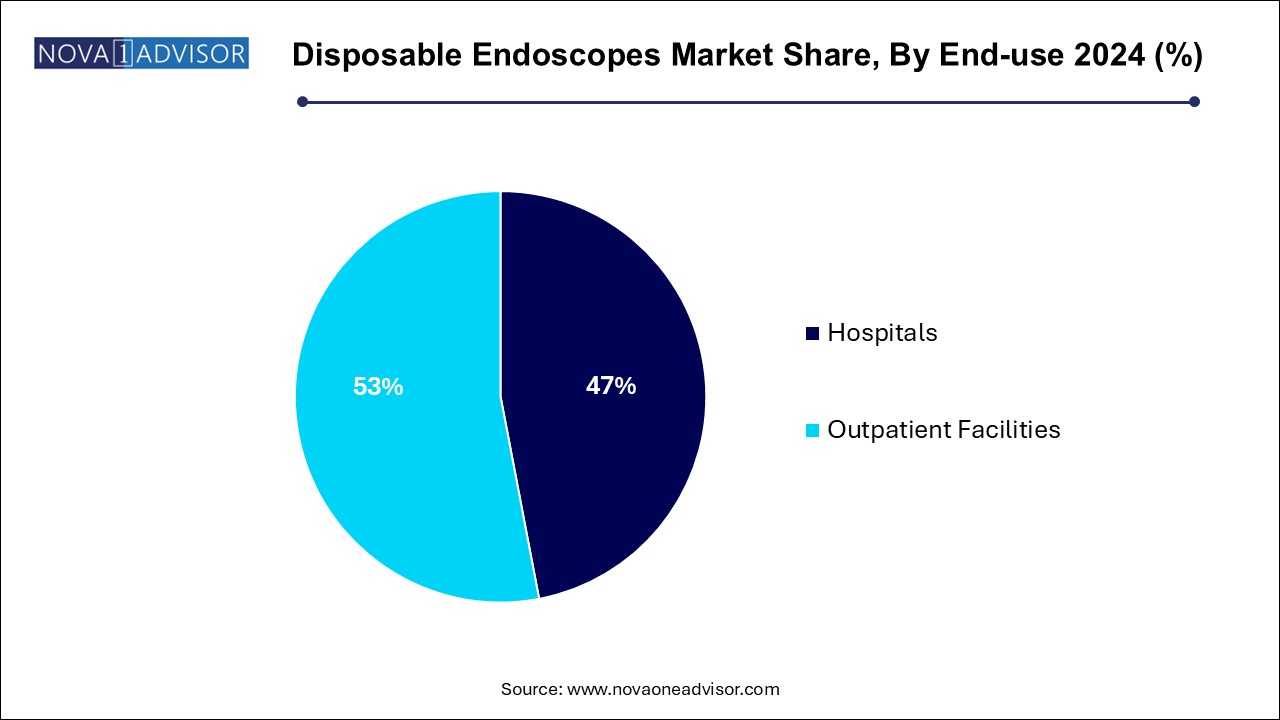

- The outpatient facilities dominated the global market share of 47.0% in 2024.

- The bronchoscopes segment held the largest share of 27.9% in 2024 and is anticipated to grow at a steady rate during the projected period.

- The outpatient facilities dominated the global market share of 47.0% in 2024.

- North America led the overall market and held the largest revenue share of 41.71% in 2024.

- Asia Pacific is anticipated to witness lucrative CAGR throughout the forecast period.

Market Overview

The disposable endoscopes market represents one of the most innovative and fast-evolving sectors within the broader endoscopy and minimally invasive surgery landscape. Disposable or single-use endoscopes are medical devices designed to be used once and then discarded, eliminating the need for reprocessing and thereby minimizing the risk of cross-contamination and hospital-acquired infections (HAIs).

Traditional reusable endoscopes, despite rigorous sterilization protocols, have been associated with infection outbreaks due to complex designs that are difficult to clean effectively. Disposable endoscopes offer a solution by ensuring a sterile instrument for each patient, thereby improving patient safety, enhancing clinical efficiency, and reducing operational costs related to cleaning and maintenance.

Growth in the disposable endoscopes market is fueled by an increasing preference for minimally invasive diagnostic and therapeutic procedures, heightened focus on infection prevention, and advancements in material science and miniaturization technologies. Healthcare providers are recognizing the value of disposable solutions not only in reducing infection risk but also in improving workflow efficiency, particularly in high-volume or resource-constrained environments.

The COVID-19 pandemic further accelerated adoption, as infection control measures became paramount across healthcare facilities. Going forward, disposable endoscopes are expected to become standard-of-care tools in many clinical settings, redefining the economics and logistics of endoscopy practice worldwide.

Major Trends in the Market

-

Rising Focus on Infection Prevention: Driving widespread adoption of single-use medical devices.

-

Technological Advancements in Imaging and Flexibility: Improved optics, navigation, and ergonomics in disposable designs.

-

Cost-effective Healthcare Delivery Models: Lower lifecycle costs compared to reusable scopes in certain settings.

-

Integration with Digital Health Platforms: Use of disposable endoscopes integrated with remote diagnostic systems and AI analysis.

-

Expansion into Non-traditional Settings: Broader use in outpatient centers, ambulatory surgery centers (ASCs), and emergency rooms.

-

Sustainability Initiatives: Development of biodegradable or recyclable disposable scopes to address environmental concerns.

-

Increased Use in Bronchoscopy and Urology: Rapid penetration into specialties prone to complex sterilization challenges.

-

Growing Preference in Emerging Markets: Due to ease of use, affordability, and minimal infrastructure requirements.

Report Scope of Disposable Endoscopes Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.45 Billion |

| Market Size by 2034 |

USD 14.30 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 17.1% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Ambu A/S; Boston Scientific Corporation; obp Surgical Corporation; COOPERSURGICAL, INC.; Flexicare medical Limited; Welch Allyn (Hill Rom); HOYA Corporation; KARL STORZ; Olympus Corporation; OTU Medical |

Key Market Driver: Rising Awareness of Cross-contamination and Hospital-acquired Infections (HAIs)

The primary driver boosting the disposable endoscopes market is the increasing awareness of cross-contamination risks and the growing burden of hospital-acquired infections (HAIs).

Multiple studies and regulatory reports have highlighted infection outbreaks linked to contaminated endoscopes, particularly duodenoscopes, which are notoriously difficult to clean effectively due to complex channel structures. According to the Centers for Disease Control and Prevention (CDC), endoscopic procedures have contributed to several multi-drug resistant organism outbreaks in hospitals.

In this context, disposable endoscopes offer an effective infection control measure by eliminating reprocessing failures and ensuring a new sterile device for every patient. Healthcare providers are increasingly prioritizing patient safety, leading to policy changes, insurance incentives, and operational shifts favoring disposable endoscopy solutions.

The strong linkage between improved patient outcomes, reduced liability risk, and lower infection treatment costs strongly positions disposable endoscopes for sustained adoption growth.

Key Market Restraint: Environmental Concerns and Waste Management Issues

Despite their benefits, environmental concerns and waste management issues act as significant restraints on the disposable endoscopes market.

The widespread use of single-use devices generates substantial medical waste, raising concerns about environmental sustainability, landfill overload, and carbon footprint implications. Unlike reusable scopes that can serve hundreds of patients with minimal waste generation, disposable endoscopes contribute directly to the growing problem of healthcare-related solid waste.

Regulatory agencies and healthcare facilities face increasing pressure to balance infection control with environmental stewardship. Without effective recycling programs or biodegradable options, disposable endoscopes risk facing criticism and pushback from sustainability advocates.

Companies that can innovate sustainable materials, closed-loop recycling systems, or carbon-offset programs will have a significant competitive advantage in overcoming this critical market restraint.

Key Market Opportunity: Expansion into Ambulatory Surgical Centers and Outpatient Settings

An emerging and significant opportunity lies in the expansion of disposable endoscope usage across ambulatory surgical centers (ASCs) and outpatient facilities.

As healthcare shifts toward decentralized, cost-effective care delivery models, ASCs and outpatient clinics are experiencing rapid growth globally. These settings often lack the specialized infrastructure required for sterilizing reusable endoscopes effectively. Disposable solutions, requiring no reprocessing, enable faster patient turnover, lower capital expenditure, and compliance with infection control mandates.

Moreover, emergency departments and military healthcare facilities are increasingly adopting disposable endoscopes to ensure readiness and operational simplicity. Companies targeting this broadening user base with affordable, rugged, and easy-to-operate devices stand to capture a significant share of the growing market.

Disposable Endoscopes Market By Type Insights

Bronchoscopes dominate the type segment, owing to the critical importance of airway management and respiratory diagnostics, particularly in intensive care units (ICUs), emergency rooms, and during the COVID-19 pandemic. Disposable bronchoscopes eliminate cross-contamination risks during procedures such as bronchoalveolar lavage, endotracheal intubation, and airway inspection.

Duodenoscopes are growing fastest, driven by high-profile infection outbreaks linked to inadequately reprocessed reusable duodenoscopes. Disposable duodenoscopes are increasingly preferred in endoscopic retrograde cholangiopancreatography (ERCP) procedures, offering a safer alternative for biliary and pancreatic duct interventions. Regulatory mandates encouraging the use of either fully disposable or disposable endcap duodenoscopes are further fueling this growth.

Disposable Endoscopes Market By End-use Insights

Hospitals dominate the end-use segment, reflecting their high patient volumes, complex procedures, and strong focus on infection control standards. Major hospitals are increasingly integrating disposable endoscopes into critical care pathways, emergency interventions, and infectious disease protocols to enhance patient safety and streamline operations.

Outpatient facilities are growing fastest, driven by the global trend toward minimally invasive procedures performed in ambulatory settings. Disposable endoscopes are particularly advantageous in these environments, offering operational simplicity, reduced costs, and compliance with stringent infection control guidelines without the need for costly sterilization infrastructure.

Disposable Endoscopes Market By Regional Insights

North America holds the largest market share, driven by high healthcare standards, strong regulatory frameworks, and widespread adoption of infection prevention technologies.

The United States, in particular, leads due to significant investments in healthcare innovation, a growing elderly population, and strong insurance reimbursement frameworks favoring safe, efficient outpatient care. Initiatives from the FDA encouraging safer endoscopic practices have accelerated disposable endoscope adoption.

Furthermore, the presence of major industry players like Ambu A/S, Boston Scientific Corporation, and Verathon Inc., combined with high awareness among healthcare providers, ensures North America’s dominance.

Asia-Pacific is the fastest-growing region, propelled by increasing healthcare expenditures, growing patient populations, and expanding hospital networks across China, India, Japan, and South Korea.

Emerging economies in the region are modernizing their healthcare infrastructures, emphasizing infection control and technology adoption. The affordability and simplicity of disposable endoscopes align perfectly with these evolving healthcare models, driving substantial market demand.

Additionally, rising medical tourism, increasing prevalence of respiratory and gastrointestinal diseases, and government initiatives supporting healthcare quality improvements contribute significantly to Asia-Pacific’s rapid market expansion.

Some of the prominent players in the disposable endoscopes market include:

- Ambu A/S

- Boston Scientific Corporation

- obp Surgical Corporation

- COOPERSURGICAL, INC.

- Flexicare medical Limited

- Welch Allyn (Hill Rom)

- HOYA Corporation

- KARL STORZ

- Olympus Corporation

- OTU Medical

Disposable Endoscopes Market Recent Developments

-

March 2025: Boston Scientific received FDA clearance for its EXALT Model D single-use duodenoscope, enhancing its disposable endoscopy product portfolio.

-

February 2025: Ambu A/S launched its aScope 5 Broncho HD, a high-definition single-use bronchoscope, targeting improved imaging for pulmonologists.

-

January 2025: Pentax Medical (HOYA Group) announced the European launch of its ONE Pulmo single-use bronchoscope, expanding its footprint in the disposable endoscope segment.

-

December 2024: Verathon introduced its GlideScope Spectrum Single-use laryngoscopes featuring integrated visualization technologies.

-

November 2024: Olympus Corporation disclosed plans to develop a new range of eco-friendly disposable endoscopes to address environmental sustainability challenges in single-use medical devices.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the disposable endoscopes market

By Type

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Otoscopes

- Sigmoidoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Colonoscopes

By End-use

- Hospitals

- Outpatient Facilities

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)