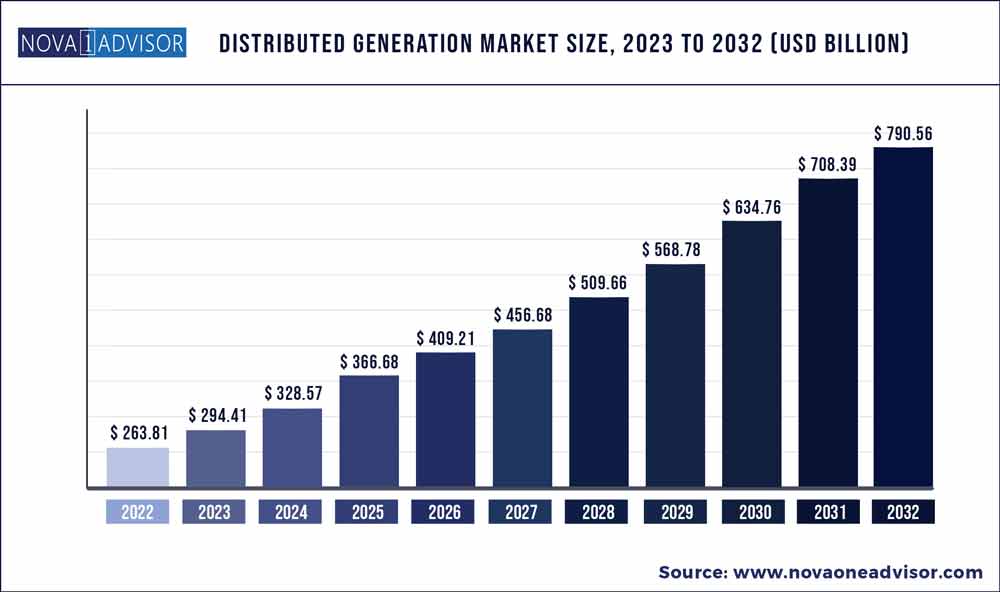

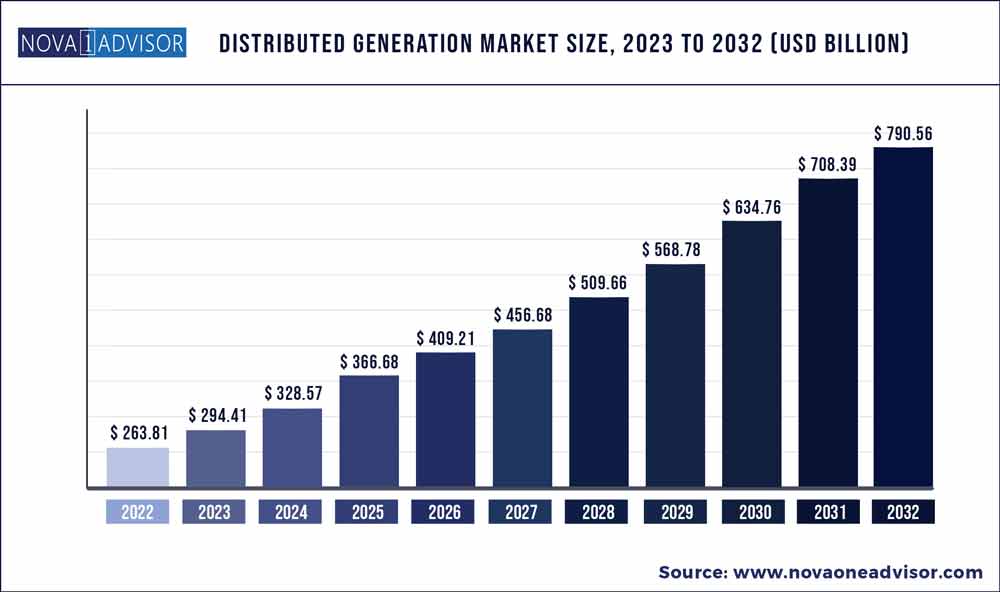

The global distributed generation market size was exhibited at USD 263.81 billion in 2022 and is projected to hit around USD 790.56 billion by 2032, growing at a CAGR of 11.6% during the forecast period of 2023–2032.

Key Pointers:

- The fuel cell segment dominated the global distributed generation market, garnering a market share of over 37.8% in 2022.

- The commercial & industrial segment garnered a market share of around 72.19% and dominated the global distributed generation market in 2022.

- Asia Pacific dominated the global distributed generation market, garnering a market share of over 47.9% in 2022.

- North America is estimated to witness a significant growth rate during the forecast period.

Market Overview

The distributed generation (DG) market is transforming the global energy landscape, marking a significant shift from traditional, centralized power production towards localized energy generation models. Distributed generation refers to electricity generation located close to the point of use, whether residential, commercial, or industrial. This decentralization of power has been fueled by the need for energy resilience, the demand for cleaner power, and advancements in renewable energy technologies.

Distributed generation systems typically include technologies such as solar photovoltaic (PV) systems, wind turbines, fuel cells, micro-turbines, and micro-hydropower systems. They can operate independently (off-grid) or be connected to the central grid (on-grid), providing both primary energy and backup support. As the demand for low-carbon energy solutions intensifies, DG has become a critical strategy for enhancing energy security, reducing transmission losses, and supporting environmental sustainability.

In 2024, the DG market is experiencing unprecedented growth driven by falling renewable technology costs, regulatory incentives, and heightened environmental awareness among consumers and industries. Businesses and households are increasingly adopting DG systems to control energy costs, achieve sustainability goals, and ensure reliability during grid failures. The integration of distributed energy resources (DERs) with smart grids and energy storage solutions further amplifies the market's potential.

Major Trends in the Market

-

Proliferation of Solar PV Installations: Solar PV technology dominates DG installations due to declining costs and government incentives.

-

Integration with Energy Storage: Combining distributed generation with battery energy storage systems (BESS) for enhanced reliability and grid stability.

-

Rise of Peer-to-Peer Energy Trading: Enabled by blockchain technology, consumers can trade excess distributed power with peers.

-

Hybrid Energy Systems: Increased adoption of hybrid systems combining multiple sources like solar, wind, and storage for optimized performance.

-

Microgrids Expansion: Growing deployment of microgrids powered by DG technologies for energy independence, especially in remote and rural areas.

-

Decentralization Push in Emerging Markets: Countries in Asia-Pacific and Africa promoting DG to electrify underserved areas.

-

Corporate Adoption of On-site Power Generation: Commercial and industrial sectors deploying DG for cost savings and sustainability commitments.

-

Technological Innovations in Fuel Cells and Micro-turbines: Enhancements improving efficiency, reducing costs, and expanding applications.

Distributed Generation Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 294.41 Billion

|

|

Market Size by 2032

|

USD 790.56 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 11.6%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Technology, End User, Application, Region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Siemens, General Electric, Mitsubishi, Schneider, Caterpillar Power Plants, Doosan Fuel Cell America, Vestas Wind Systems A/S, Rolls-Royce Power Systems AG, Toyota Turbine and Systems Inc., Capstone Turbine Corporation

|

Driver: Rising Demand for Clean and Reliable Energy

One of the key drivers propelling the distributed generation market is the rising demand for clean and reliable energy. Growing global awareness about climate change, coupled with stricter regulations targeting carbon emissions, has led to a massive push towards renewable and cleaner energy solutions.

Distributed generation, particularly from renewable sources like solar PV and wind turbines, allows consumers to generate their own electricity while minimizing environmental impact. Furthermore, localized power production enhances grid resilience by reducing dependency on centralized grids that are vulnerable to failures. During extreme weather events, DG systems, especially when combined with energy storage, can provide uninterrupted power, a feature highly valued by residential communities and critical infrastructure such as hospitals and data centers.

Restraint: High Installation and Maintenance Costs

Despite its growing appeal, high installation and maintenance costs remain a substantial restraint for the distributed generation market. Setting up DG systems often requires significant upfront investments, which can be prohibitive for small-scale users, particularly in developing economies.

Although the costs of technologies like solar panels have declined substantially, integrating components like inverters, batteries, control systems, and ensuring proper maintenance still presents a financial burden. Moreover, some DG technologies, such as fuel cells and micro-turbines, remain relatively expensive compared to conventional grid electricity. While subsidies and incentives can mitigate these costs to some extent, the financial barrier remains a critical challenge, especially in regions where financing options are limited or where grid electricity remains heavily subsidized.

Opportunity: Advancements in Energy Storage Integration

A significant opportunity emerging within the DG market is the advancement in energy storage integration. Energy storage systems, particularly battery technologies like lithium-ion and flow batteries, enable DG systems to overcome the intermittency issues associated with renewable energy sources.

By coupling DG with storage, consumers and businesses can store excess energy generated during peak production periods and use it when generation is low or demand is high. This capability not only enhances reliability but also opens up new revenue streams through demand response programs and grid services. For instance, Tesla’s Powerwall and Powerpack systems have gained significant traction among homeowners and businesses integrating rooftop solar PV systems. As battery costs continue to fall and energy management software becomes more sophisticated, the integration of DG with storage systems presents a compelling growth avenue.

Segmental Analysis

By Technology

Solar PV dominated the technology segment, holding the largest share due to its widespread adoption across residential, commercial, and industrial sectors. Solar PV's simplicity, declining installation costs, and favorable policy support, including net metering and feed-in tariffs, have propelled its dominance. Homeowners, businesses, and even governments are increasingly deploying rooftop and ground-mounted solar panels to meet their energy needs sustainably. For instance, countries like Australia, Germany, and the U.S. have witnessed a massive surge in small-scale solar PV installations over the past decade. Furthermore, technological advancements like bifacial solar panels and building-integrated photovoltaics (BIPV) continue to enhance the appeal of solar PV.

Fuel cells are emerging as the fastest-growing technology segment within distributed generation. Fuel cells offer high efficiency, low emissions, and the ability to provide continuous power, making them ideal for commercial and industrial applications. Companies like Bloom Energy have demonstrated how fuel cells can provide clean, reliable on-site power solutions, attracting interest from sectors such as healthcare, data centers, and retail. Fuel cell technology is gaining momentum not just in developed countries but also in regions where reliable grid access remains a challenge. Innovation in hydrogen production and storage is further accelerating fuel cell adoption.

By End User

The commercial segment dominated the end-user category, driven by businesses' growing emphasis on cost savings, sustainability, and energy security. Commercial establishments, including shopping malls, office buildings, hotels, and educational institutions, are increasingly installing DG systems to reduce energy expenses and hedge against grid unreliability. Moreover, companies with sustainability goals are leveraging on-site generation to achieve carbon neutrality targets. Corporate initiatives, such as Walmart’s extensive deployment of rooftop solar panels across its stores, exemplify this trend.

The residential segment is witnessing the fastest growth in distributed generation adoption. As solar panel prices have plummeted and financing options have improved, more homeowners are installing solar PV systems, often coupled with residential battery storage solutions. Governments in countries like the U.S., Germany, and Japan are offering incentives and rebates for residential solar installations, fueling this trend. The desire for energy independence, environmental consciousness, and the increasing availability of smart home energy management solutions are driving rapid residential market expansion.

By Application

The on-grid application segment dominated the distributed generation market, largely because most small and large DG installations are interconnected with the central grid. On-grid systems offer the advantage of selling excess electricity back to the grid through net metering programs, making them financially attractive. Grid-connected distributed generation supports utilities by reducing transmission losses and peak load pressures. Notably, in urban areas where grid infrastructure is robust, on-grid DG adoption is significantly higher.

The off-grid application segment is expanding at the fastest rate, particularly in remote and rural areas lacking access to central grid infrastructure. Distributed generation solutions, such as microgrids powered by solar, wind, and biomass, offer a practical and cost-effective alternative to extending grid lines over vast distances. Off-grid DG plays a crucial role in electrification efforts in Africa, South Asia, and Latin America. For example, numerous rural communities in Kenya have benefited from solar-powered microgrids established by companies like Powerhive.

Regional Analysis

North America dominated the distributed generation market, supported by strong policy frameworks, mature energy infrastructure, and high levels of technological adoption. In the United States, federal tax credits like the Investment Tax Credit (ITC) for solar systems and state-level initiatives like California's Self-Generation Incentive Program (SGIP) have propelled distributed generation deployment. Commercial and residential sectors alike have embraced DG for its economic and environmental benefits. The Canadian government’s focus on reducing greenhouse gas emissions further boosts DG projects, particularly in remote communities relying on diesel generation.

Asia-Pacific is the fastest-growing region in the distributed generation market, driven by rapid urbanization, rising energy demand, and supportive government policies. China leads the region, boasting the world's largest distributed solar PV capacity, supported by substantial subsidies and government mandates. India is another rapidly growing market, with its ambitious renewable energy targets and programs like "PM-KUSUM," which promotes distributed solar installations for farmers. Additionally, Southeast Asian countries are increasingly adopting DG solutions to electrify islands and rural areas, where grid extension remains impractical.

Some of the prominent players in the Distributed Generation Market include:

- Siemens

- General Electric

- Mitsubishi

- Schneider

- Caterpillar Power Plants

- Doosan Fuel Cell America

- Vestas Wind Systems A/S

- Rolls-Royce Power Systems AG

- Toyota Turbine and Systems Inc.

- Capstone Turbine Corporation

Recent Developments

-

April 2025: Bloom Energy announced the deployment of new high-efficiency fuel cell systems at several Fortune 500 companies' campuses, aiming to deliver resilient and clean power.

-

March 2025: SunPower Corporation introduced its next-generation residential solar + storage solution "SunVault 2.0," enhancing capacity and performance.

-

February 2025: Siemens Energy launched a new suite of microgrid solutions integrating solar PV, wind, and energy storage technologies, targeting both on-grid and off-grid applications.

-

January 2025: Tesla Energy expanded its "Virtual Power Plant" (VPP) program in California, leveraging thousands of interconnected home battery systems to support the grid during peak periods.

-

December 2024: Capstone Green Energy Corporation secured a major contract to supply microturbines for an off-grid mining operation in Australia, showcasing the growing adoption of DG in industrial sectors.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Distributed Generation market.

By Technology

- Fuel Cells

- Micro-Turbines

- Wind Turbines

- Combustion Turbines

- Micro-hydropower

- Reciprocating Engines

- Solar PV

- Others

By End User

- Commercial

- Industrial

- Residential

By Application

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)