DNA & Gene Chip Market Size and Growth

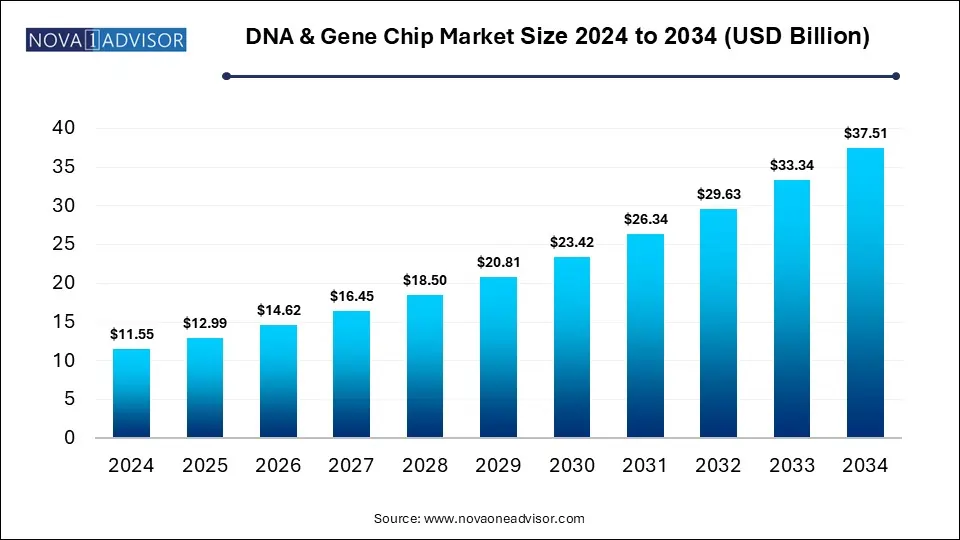

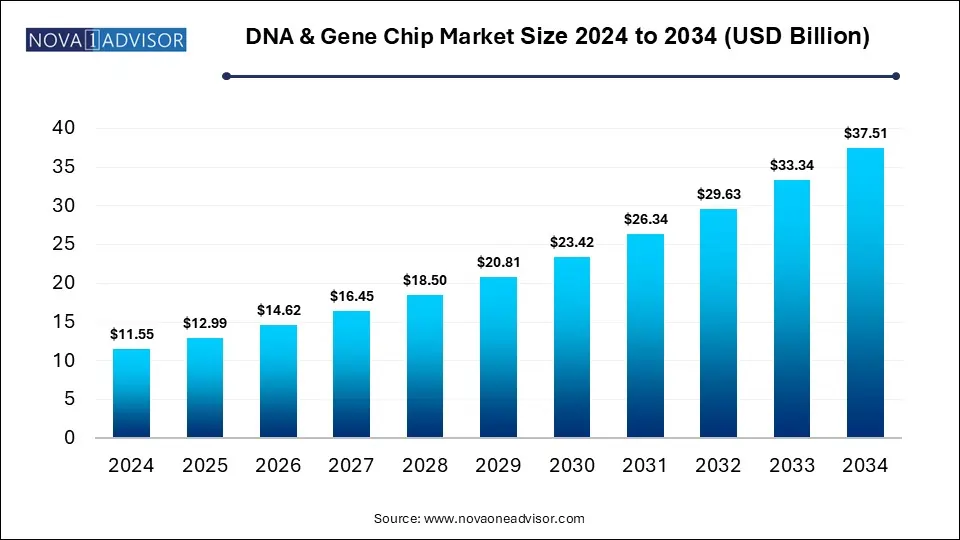

The DNA and gene chip market size was exhibited at USD 11.55 billion in 2024 and is projected to hit around USD 37.51 billion by 2034, growing at a CAGR of 12.5% during the forecast period 2025 to 2034. The growth of the DNA & gene chip market is driven by the ongoing advancements in DNA sequencing and microarray technology, increased emphasis on personalized medicine, rising chromic disease burden and focus on genomics research.

DNA And Gene Chip Market Key Takeaways:

- In 2024, North America took the lead in the global DNA and gene chip market, commanding a dominant 42% share of total revenue.

- The consumables segment emerged as the top contributor to market revenue in 2024, accounting for a substantial 79% share.

- The instrumentation category is anticipated to experience robust growth, with a projected compound annual growth rate (CAGR) of 11.9% during the forecast timeframe.

- The oligonucleotide-based DNA microarrays generated a notable portion of revenue in 2024, highlighting their importance in the market.

- The complementary DNA (cDNA) microarray segment is expected to witness significant expansion throughout the forecast period.

- Applications in cancer diagnosis and therapy led the market in 2024, contributing the largest revenue share at 29%.

- The drug discovery segment is forecasted to expand rapidly, with an estimated CAGR of 12.8% over the coming years.

- Academic and government research institutions were the primary end users in 2024, holding a dominant 71.0% share of the market.

- Hospitals and diagnostic laboratories are projected to register a strong CAGR of 12.2% during the forecast period.

Market Overview

The DNA & Gene Chip Market stands at the intersection of molecular biology and bioinformatics, offering a high-throughput, precise, and scalable platform for genetic analysis and diagnostics. DNA and gene chips—often referred to as DNA microarrays—are sophisticated tools designed to measure gene expression levels, detect mutations, and genotype multiple regions of the genome simultaneously. These chips have revolutionized biomedical research, enabling researchers to analyze thousands of genes in a single experiment, making them indispensable in genomics, cancer biology, drug development, and personalized medicine.

DNA & gene chips consist of a solid surface, typically glass or silicon, on which thousands of DNA sequences are arrayed. When hybridized with sample DNA or RNA, the chip enables the detection of specific nucleic acid sequences, facilitating rapid and detailed genetic profiling. These chips are widely employed in gene expression studies, SNP detection, epigenetic profiling, disease diagnostics, and biomarker discovery.

Over the last decade, the growth of this market has been driven by rapid advances in genomics and biotechnology, falling costs of genetic analysis, and increasing adoption of personalized medicine. Academic institutions, biotech companies, and pharmaceutical firms increasingly utilize DNA chips for preclinical research, patient stratification in clinical trials, and post-marketing surveillance.

Furthermore, the COVID-19 pandemic emphasized the value of genetic technologies for diagnostics and surveillance, indirectly boosting awareness and investment in DNA chip technologies. With rising global demand for fast, cost-effective, and large-scale genetic screening, the DNA & gene chip market is poised for expansive growth through 2034, underpinned by both technological innovation and expanding end-use applications.

How is AI Influencing the DNA & Gene Chip Market?

Artificial intelligence (AI) is enabling the designing of synthetic DNA sequences (cis-regulatory elements) offering precise control of gene expressions in desired cell types. AI algorithms can be applied for analyzing data from DNA microarrays (gene chips) for identification of patterns in gene expression, enabling better comprehension of gene regulation and disease development for researchers. Development of targeted gene therapies with AI-designed DNA sequences can potentially transform the treatment of cancer, genetic disorders and other diseases.

Major Trends in the Market

-

Rising Demand for Personalized Medicine: DNA chips are crucial tools in tailoring drug therapies based on individual genetic profiles, especially in oncology.

-

Integration with Next-Generation Sequencing (NGS): DNA chip platforms are being combined with sequencing technologies for validation and cross-platform analysis.

-

Miniaturization and High-Density Arrays: Technological advances are enabling more genes per chip and smaller sample sizes, increasing accessibility and affordability.

-

Expanding Role in Agricultural Genomics: Gene chips are increasingly used for crop improvement, pest resistance studies, and GMO detection in agri-biotech.

-

Automation and Workflow Integration: Chip readers are now integrated with automated liquid handling systems and cloud-based bioinformatics platforms for end-to-end analysis.

-

Rising Use in Infectious Disease Surveillance: Gene chips are being applied to rapidly detect viral and bacterial mutations, aiding in epidemiological tracking.

-

Increased Commercialization of Diagnostic Microarrays: Startups and established players are launching FDA-approved diagnostic kits based on DNA chip technology.

Report Scope of DNA And Gene Chip Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 12.99 Billion |

| Market Size by 2034 |

USD 37.51 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Type, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Agilent Technologies; Illumina, Inc.; Revvity; Arrayit Corporation; Macrogen, Inc.; Asper Biotech; CapitalBio Technology Co., Ltd.; Greiner Bio-One International GmbH; Microarrays Inc.; Biodiscovery LLC; Oxford Gene Technology IP Limited; TOSHIBA HOKUTO ELECTRONICS CORPORATION; Savyon Diagnostics; Applied Micro Arrays; BIOMÉRIEUX |

Market Driver: Advancements in Cancer Genomics and Companion Diagnostics

A primary driver of the DNA & gene chip market is the growing reliance on genomic data for cancer diagnosis, prognosis, and therapy selection. As oncology moves toward precision-based approaches, identifying specific gene mutations, expression profiles, and epigenetic markers has become essential for tailoring treatment. DNA chips provide a rapid and cost-effective platform to assess gene expression patterns and identify driver mutations in tumors.

For instance, microarrays are commonly used in profiling breast cancer subtypes (such as HER2-positive or triple-negative) to determine eligibility for targeted therapies. They also support companion diagnostics—tests that predict a patient’s response to specific drugs—thereby enhancing treatment efficacy while reducing adverse effects. The increasing prevalence of cancer globally and the growing adoption of genomics in clinical practice are driving demand for gene chip-based solutions in oncology and beyond.

Market Restraint: Emergence of Competitive Technologies Like NGS

Despite their advantages, DNA & gene chips face competition from next-generation sequencing (NGS), which offers higher resolution, broader coverage, and dynamic mutation detection. NGS platforms can read the entire genome or transcriptome without prior knowledge of gene sequences, whereas DNA chips rely on pre-designed probes, limiting their flexibility.

As NGS becomes more affordable and integrated into clinical workflows, particularly for rare disease diagnostics, it threatens to displace DNA chip applications in several research and diagnostic domains. While chips still offer benefits in terms of cost and simplicity for specific applications, the versatility and comprehensive nature of sequencing technologies pose a challenge to the market's expansion in the long term. Vendors must continue innovating to maintain chip-based platforms as a complementary, if not alternative, solution.

Market Opportunity: Expansion into Non-Human Genomics and Environmental Applications

One of the most promising opportunities for the DNA & gene chip market lies in expanding applications beyond human health into agriculture, animal genomics, and environmental biology. DNA microarrays are increasingly used for genotyping in livestock breeding programs, identifying traits related to milk production, disease resistance, and feed efficiency. Similarly, gene chips are aiding crop genomics, helping breeders develop climate-resilient and high-yield varieties.

In environmental monitoring, gene chips are being used to detect microbial communities in soil, water, and waste treatment facilities. These platforms support biodiversity assessments, bioremediation projects, and ecosystem health studies. By tailoring chip designs for specific species or environmental markers, companies can tap into growing global concerns over sustainability, climate change, and food security, unlocking significant cross-industry potential.

DNA And Gene Chip Market By Product Insights

Consumables dominated the market and accounted for the largest revenue share of 78.8% in 2023, Primarily driven by their recurrent demand and critical role in experimentation. Consumables include the actual DNA or gene chips, reagents, buffers, labeling kits, and washing solutions. Every experiment typically requires fresh chips and reagents, resulting in continuous revenue generation from this segment, unlike instrumentation which often involves a one-time capital investment.

Moreover, as academic institutions and diagnostics labs conduct thousands of assays each month, the volume of consumables used is significantly higher than that of instruments. The customization of gene chips for disease-specific applications, such as cancer biomarker detection or autoimmune disease profiling, further fuels consumable demand. Additionally, the rise of ready-to-use kits with pre-loaded sequences and reagents enhances accessibility and streamlines laboratory workflows.

The instrumentation is projected to grow at a CAGR of 11.9% over the forecast period. Supported by the increasing demand for advanced hybridization stations, scanners, and readers with AI-based interpretation capabilities. Modern instruments offer higher sensitivity, multiplexing abilities, and compatibility with digital platforms, making them suitable for both high-throughput research and clinical diagnostics.

Hospitals and biotech companies are increasingly investing in integrated systems that combine DNA chip processing, imaging, and data analysis. Many instruments now support cloud connectivity and real-time result sharing, further aligning with evolving healthcare IT systems. As new entrants bring compact, cost-efficient models to market and large companies upgrade existing systems, the instrumentation segment is expected to grow rapidly.

DNA And Gene Chip Market By Type Insights

The oligonucleotide DNA microarray held a significant revenue share in 2023 driven by several key factors, owing to their versatility, high sensitivity, and ability to synthesize short, specific DNA sequences directly onto the chip surface. These arrays are ideal for gene expression profiling, SNP detection, and custom target assays, making them the preferred choice across clinical, pharmaceutical, and agricultural applications.

With improved manufacturing processes and photolithographic techniques, oligonucleotide arrays now support high-density probe formats and can cover whole genomes or targeted panels. Their ability to minimize cross-hybridization and enable precise probe customization contributes to their widespread use. Several commercially available gene expression chips for cancer, cardiovascular, and neurodegenerative conditions are based on this technology.

BAC (Bacterial Artificial Chromosome) clone chips are the fastest growing type, especially in cytogenetics and comparative genomic hybridization (CGH) studies. These chips utilize large DNA fragments derived from bacterial artificial chromosomes, offering superior hybridization signals and more accurate detection of chromosomal aberrations, deletions, and duplications.

BAC clone arrays are particularly useful in diagnosing genetic syndromes, chromosomal aneuploidies, and rare inherited conditions. Their use is expanding in prenatal and postnatal diagnostics, tumor cytogenetics, and developmental biology. As personalized genomics advances and demand grows for high-resolution karyotyping, BAC clone chips are expected to witness a surge in clinical and academic usage.

DNA And Gene Chip Market By Application Insights

Cancer diagnosis and treatment dominated the market and accounted for the largest revenue share of 28.8% in 2023, fueled by the integration of genomic biomarkers into routine oncology diagnostics. Gene chips are used to detect mutations, assess gene expression signatures, and identify pathways involved in tumorigenesis, providing critical insights for treatment planning and prognosis.

For instance, the Oncotype DX test for breast cancer recurrence risk prediction is a widely cited example of commercialized gene chip-based diagnostics. DNA microarrays help classify tumors into molecular subtypes, predict drug resistance, and monitor treatment response. The growing incidence of cancer, coupled with personalized therapy approaches, ensures continued dominance of this segment.

Drug discovery is projected to grow at a CAGR of 12.8% over the forecast period. As pharmaceutical companies increasingly use gene expression profiling to understand drug mechanisms, toxicity, and therapeutic targets. Gene chips facilitate rapid screening of how different compounds affect gene pathways, enabling faster and more efficient candidate identification.

They are also instrumental in pharmacogenomics—studying how individual genetic variations influence drug response. With rising R&D spending, the push for precision medicine, and increasing regulatory pressure for predictive safety data, gene chips are becoming indispensable in drug development pipelines. The ability to run high-throughput assays at lower costs further accelerates their use in early-stage screening.

DNA And Gene Chip Market By End Use Insights

The academic & government research institutes led the market and accounted for the largest revenue share of 71.0% in 2023. As they conduct the bulk of fundamental and translational genetic research. Funded by national health agencies and global genomic initiatives, these institutions rely on DNA chips for gene mapping, functional genomics, biomarker identification, and population studies.

Initiatives like the NIH's All of Us program and the Cancer Genome Atlas have deployed microarrays extensively for cohort analysis. Academic labs prefer consumables and customizable chips for exploratory projects, while government bodies use standardized arrays for epidemiological tracking. Their role in validating biomarkers and advancing open science makes this segment critical to the market’s foundation.

Biotechnology and pharmaceutical companies represent the fastest growing end-user segment, driven by the use of gene chips in preclinical studies, patient stratification, and precision medicine development. These firms integrate gene chip data into discovery platforms, support clinical trial design with genomic stratification, and use arrays for pharmacogenomic labeling and safety assessments.

Biotech startups focusing on companion diagnostics and genetic assays are also entering the market, pushing demand for tailored microarray solutions. Additionally, collaborations between pharma companies and diagnostic firms are resulting in co-development of proprietary chips for specific disease markers or therapies, accelerating innovation and commercial use.

DNA And Gene Chip Market By Regional Insights

North America DNA and gene chip market dominated the global market with a commanding market share of 41.0% in 2023. Supported by strong biomedical research infrastructure, early adoption of genomic technologies, and substantial funding from public and private entities. The region hosts a large number of biotech companies, academic institutions, and diagnostics firms involved in gene chip development, manufacturing, and application.

Government initiatives like the Cancer Moonshot and precision medicine programs have further accelerated the adoption of microarrays in research and clinical trials. Additionally, favorable regulatory frameworks, high healthcare expenditure, and the presence of key market players drive continuous product innovation and uptake across the region.

U.S. DNA & Gene Chip Market Trends

U.S. DNA & gene chip market is witnessing robust growth in North America. Presence of robust healthcare infrastructure with advanced technologies, substantial investments in genomics research, government initiatives and strategic collaborations are boosting the market growth. Rising burden of chronic diseases such as cardiovascular diseases, cancer and neurological disorders is driving the adoption of DNA and gene chips for early detection and development of personalized treatment strategies. Innovations in computational biology and robotics applied in DNA sequencing and microarray technology are fuelling the market expansion.

Asia Pacific is the fastest growing regional market, propelled by increasing investment in genomics, growing healthcare infrastructure, and expanding biotechnology industries in countries like China, India, Japan, and South Korea. National genomics programs, rising demand for agricultural biotechnology, and a growing focus on personalized healthcare are boosting demand for gene chips in the region.

Chinese companies are also emerging as key players in array manufacturing, while Indian biotech firms are increasingly developing indigenous diagnostics based on microarray platforms. Government support for genome mapping and precision medicine initiatives further fuels regional growth. As the cost of genomic analysis continues to decline, Asia Pacific is expected to become a major contributor to global market expansion.

China DNA & Gene Chips Market Trends

China is anticipated to witness significant growth in the Asia Pacific region, owing to the factors such as rising emphasis on precision medicine, increased healthcare expenditure, investments in development of biotechnology sector and government support. Continuous innovations in DNA sequencing and microarray technology have enabled the development of enhanced chip designs with high sensitivity and improved performance.

Japan DNA & Gene Chip Market Trends

Japan is emerging as a major player in the Asia Pacific DNA & gene chip market. The market growth can be linked to the increased emphasis on precision diagnostics, demand for advanced genomic technologies, and rising collaborations between healthcare organizations and technology providers. The Society 5.0 initiative by the Japanese government which promotes the development and adoption of smart technologies across various sectors, including healthcare is fuelling the market expansion.

DNA And Gene Chip Market Recent Developments

- In April 2025, EpiCypher, a leading epigenomics innovator, launched two novel and cost-effective DNA methylation sequencing technologies, CUTANA meCUT&RUN and Multiomic CUT&RUN for high-resolution DNA methylation and multiomic epigenomic profiling.

- In October 2024, Twist Bioscience Corporation, introduce its FlexPrep Ultra-High Throughput Library Preparation Kit designed with a proprietary Twist-developed enzyme, further increasing the adoption of NGS by microarray users for applications in agricultural genomics (agrigenomics) and population genomics.

- In May 2024, Twist Bioscience Corporation, launched Twist Multiplexed Gene Fragments (MGFs) which will enable development of pools of directly synthesized double-stranded DNA (dsDNA) up to 500 base pairs in length for high throughput screening applications.

Some of the prominent players in the DNA and gene chip market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the DNA and gene chip market

By Product

- Consumables

- Instrumentation

By Type

- Oligonucleotide DNA Microarrays

- Complementary DNA Microarrays

- BAC Clone Chips

- Others

By Application

- Cancer Diagnosis & Treatment

- Gene Expression

- Genotyping

- Genomics

- Drug Discovery

- Agricultural Biotechnology

- Others

By End use

- Academic & Government Research Institutes

- Hospitals and Diagnostics Centers

- Biotechnology and Pharmaceutical Companies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)