DNA Diagnostics Market Size and Research 2026 to 2035

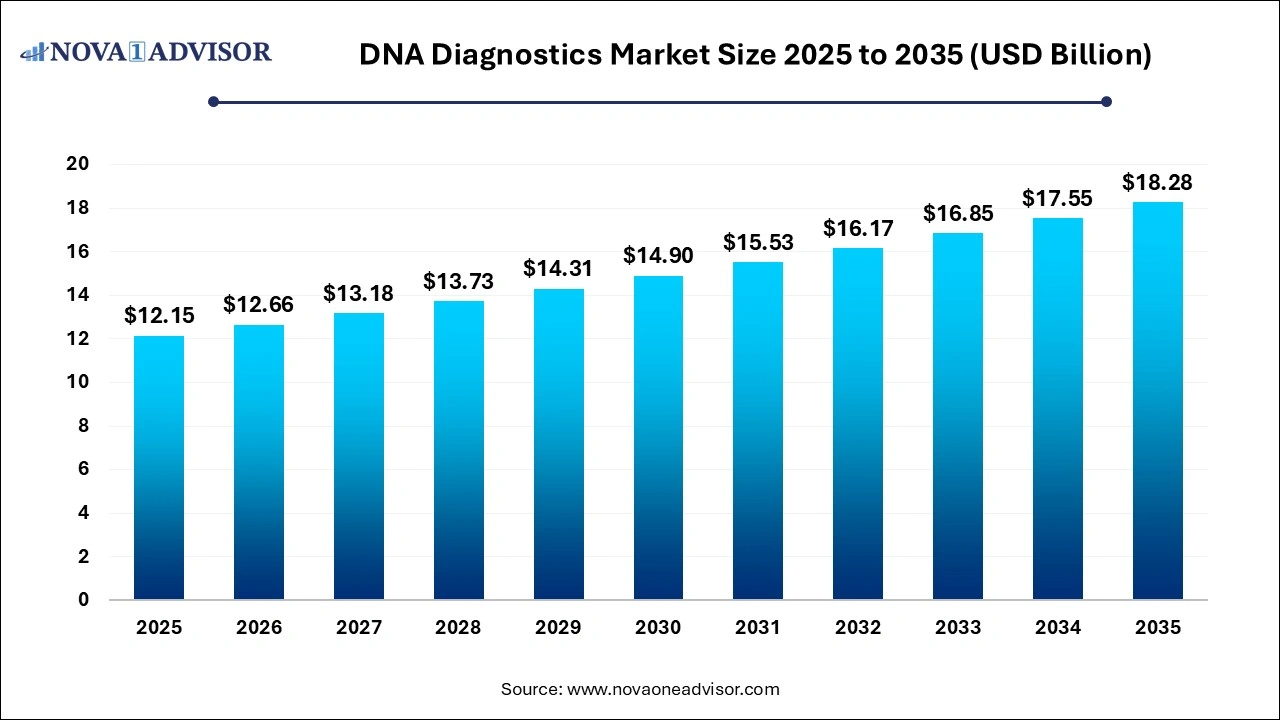

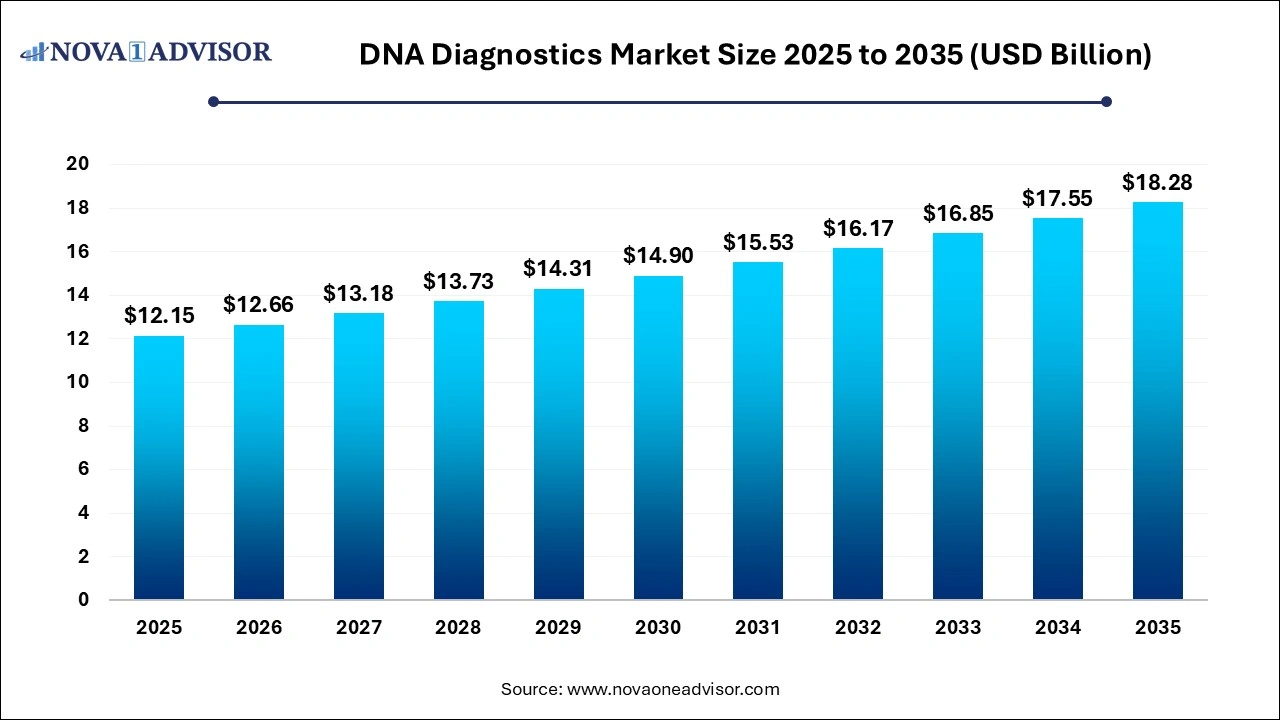

The global DNA diagnostics market size was estimated at USD 12.15 billion in 2025 and is projected to hit around USD 18.28 billion by 2035, growing at a CAGR of 4.17% during the forecast period from 2026 to 2035.

Key Takeaways:

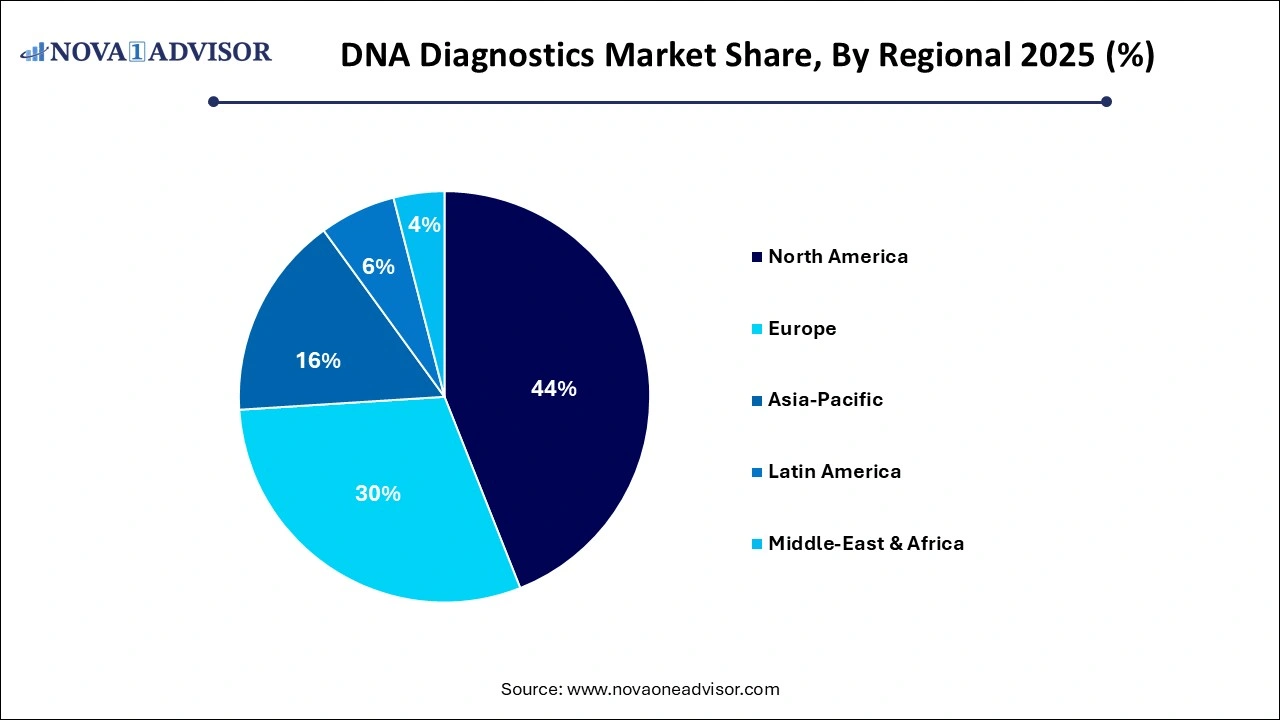

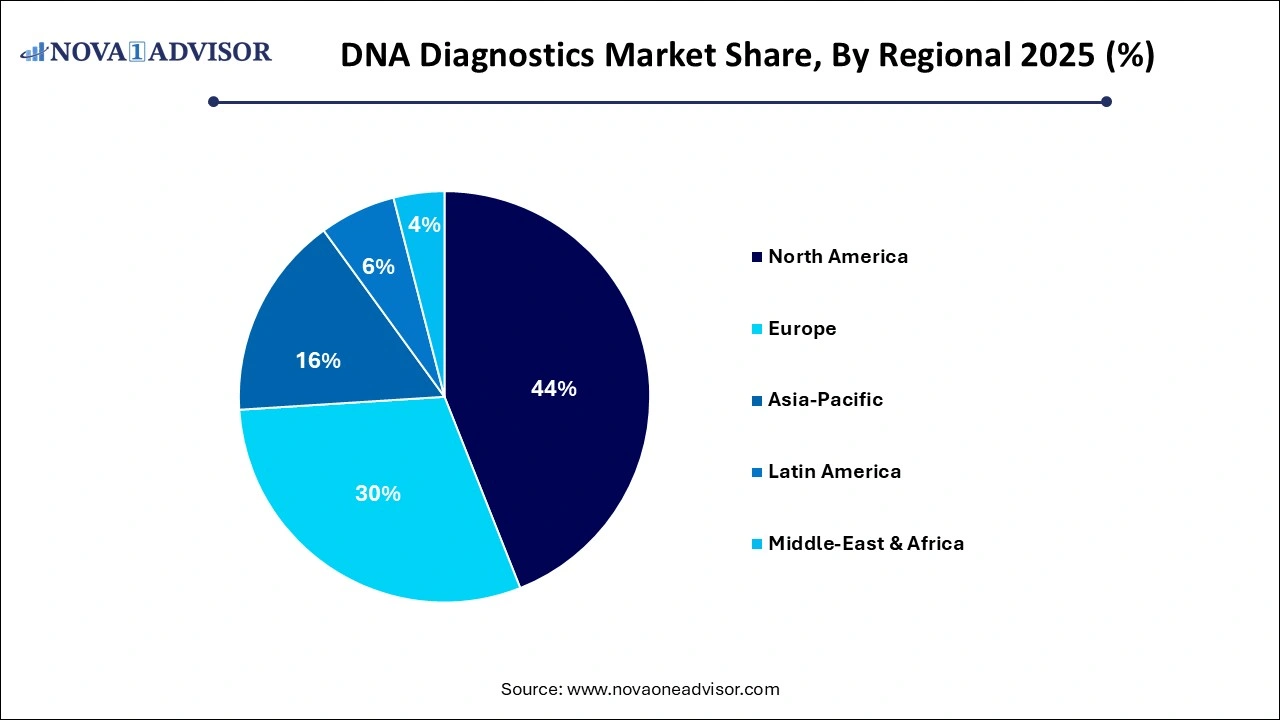

- North America dominated the DNA diagnostics market in 2025 with a revenue share of 43.45%.

- Asia Pacific is expected to witness the fastest CAGR of 6.24% from 2026 to 2035.

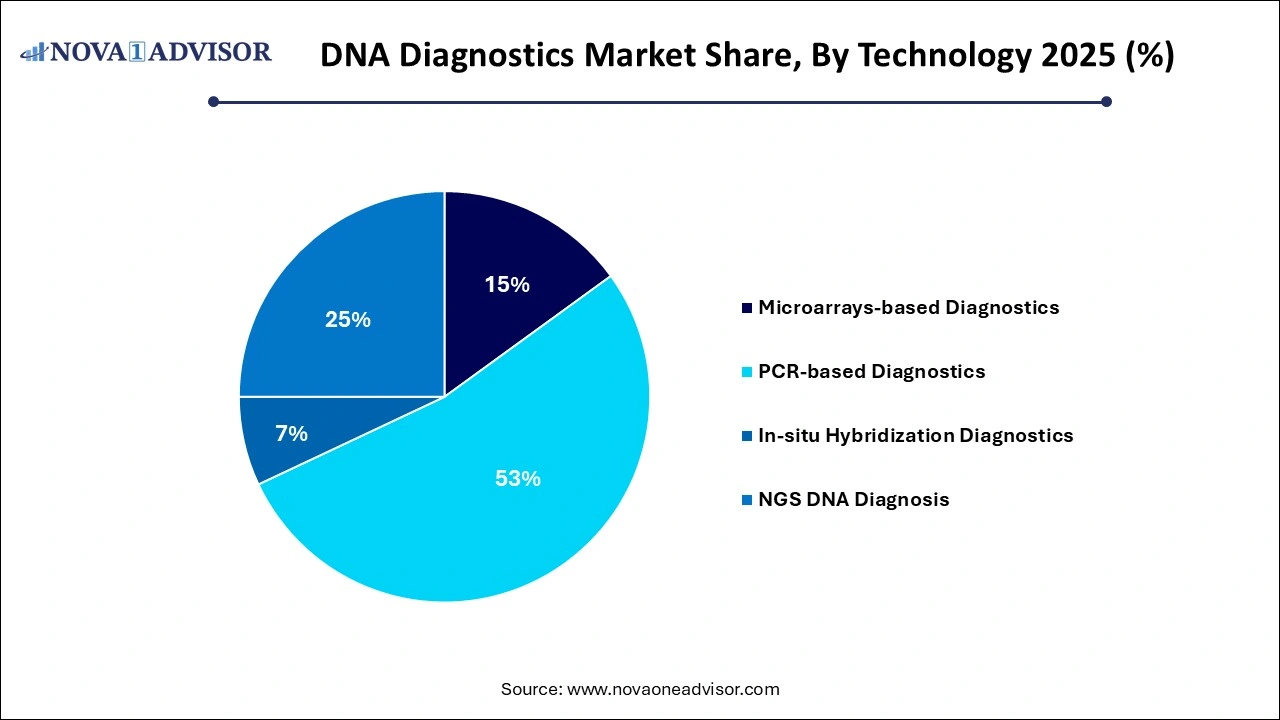

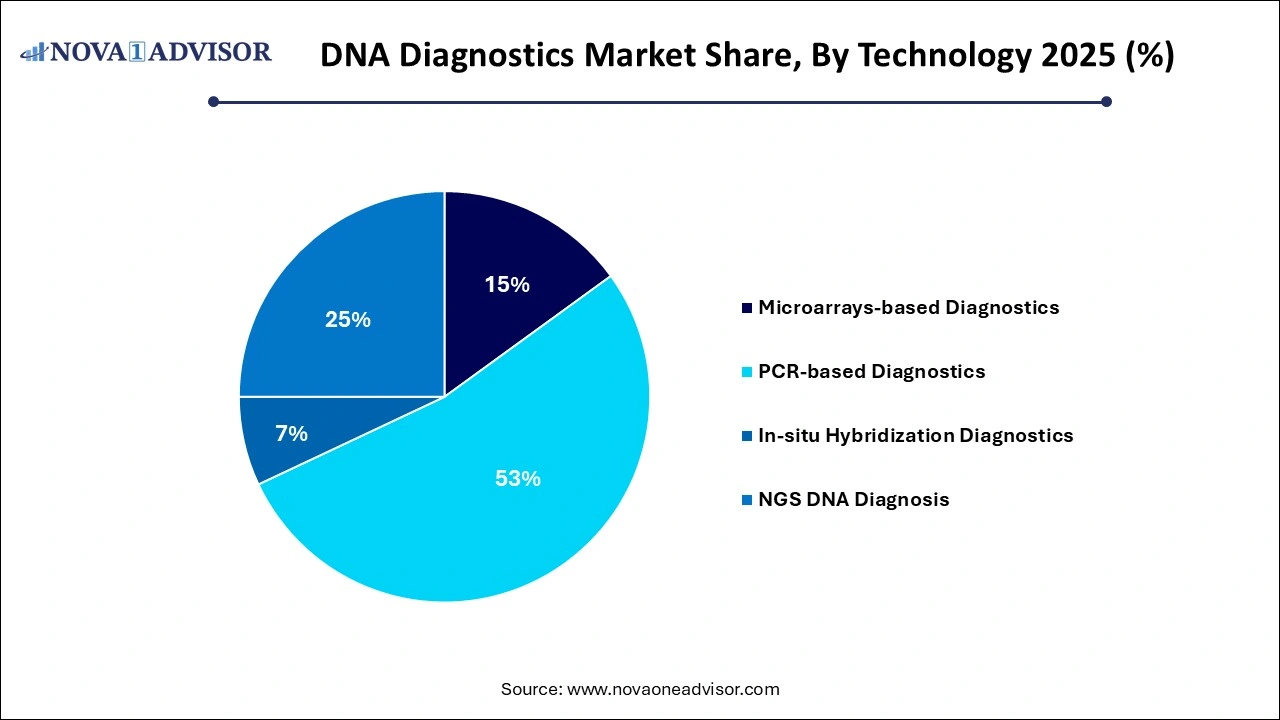

- In terms of technology, the PCR-based diagnostics segment held the largest revenue share of 52.03% in 2025.

- Next-generation sequencing (NGS)-based diagnosis is anticipated to witness the fastest CAGR of 7.98% over the forecast period

- Based on application, cancer genetics tests dominated the market in 2025 with a revenue share of 30.58% in 2025.

- Infectious diseases DNA testing is anticipated to grow at the fastest CAGR of 4.51% over the forecast period.

DNA Diagnostics Market Overview

The DNA Diagnostics Market has emerged as one of the most transformative areas within modern healthcare, revolutionizing the way diseases are detected, classified, and treated. DNA-based diagnostics leverage molecular biology techniques to detect genetic variants, pathogens, or chromosomal abnormalities at the DNA level. These diagnostics offer highly specific, sensitive, and rapid detection for a wide range of conditions, including infectious diseases, hereditary disorders, cancer, and reproductive health issues.

The expansion of this market is underpinned by the increasing global burden of chronic diseases, rising adoption of precision medicine, and technological advances in genomics and molecular diagnostics. Techniques like polymerase chain reaction (PCR), next-generation sequencing (NGS), microarrays, and in-situ hybridization are becoming integral to both routine clinical diagnostics and cutting-edge research. These tools not only support disease detection but also provide insights into prognosis, treatment response, and drug metabolism.

The integration of DNA diagnostics into clinical workflows has led to early disease detection, timely interventions, and better patient outcomes. For instance, oncologists increasingly rely on genomic testing to personalize cancer therapies, while reproductive medicine uses carrier screening to assess inherited disease risks. Additionally, widespread use of DNA diagnostics in infectious disease management (e.g., for HIV, TB, HPV) has enhanced the accuracy and speed of diagnosis, especially in resource-limited settings.

The DNA diagnostics market is competitive and innovation-driven, with leading players such as Qiagen, Thermo Fisher Scientific, Illumina, Bio-Rad Laboratories, and Roche Diagnostics driving technological advancements. Their focus is not only on delivering high-performance instruments and kits but also on integrating AI, cloud-based analytics, and multiplexing capabilities into diagnostic solutions.

Major Trends in the DNA Diagnostics Market

-

Integration of Next-Generation Sequencing (NGS) in Routine Testing: NGS is becoming a staple for oncology, rare diseases, and infectious disease screening due to its scalability and resolution.

-

Rise of At-home DNA Testing and DTC Kits: Consumer interest in ancestry, wellness, and carrier screening is driving the direct-to-consumer segment.

-

Companion Diagnostics for Personalized Medicine: DNA diagnostics are being used to identify patients who will benefit from targeted therapies.

-

Liquid Biopsy and Non-invasive Testing Expansion: Plasma-based DNA tests are gaining ground for prenatal, oncology, and infectious disease monitoring.

-

Advancements in Multiplex PCR and Microarray Platforms: Technologies that test for multiple pathogens or mutations in a single run are becoming increasingly efficient.

-

Cloud-based Genomic Data Platforms: AI and machine learning algorithms are now used to interpret complex DNA data and guide clinical decisions.

-

Growing Use in Pharmacogenomics and Drug Response Testing: Tailoring drug regimens based on genetic profiles is gaining traction in clinical practice.

-

Integration of CRISPR-based Diagnostics: Emerging CRISPR tools offer rapid, portable, and cost-effective DNA detection with point-of-care applications.

DNA Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 12.66 Billion |

| Market Size by 2035 |

USD 18.28 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.17% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, application, region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

GE Healthcare; Abbott, Beckman Coulter Inc.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific Inc.; Illumina Inc.; Cepheid; Hologic Inc.; Siemens Healthcare GmbH; F. Hoffmann-La Roche; QIAGEN; Agilent Technologies Inc. |

Segmental Insights

By Technology Insights

PCR-based Diagnostics dominated the technology segment, as PCR remains a gold standard for amplifying and detecting DNA sequences with high specificity. Real-time PCR (qPCR) and digital PCR (dPCR) are widely used in infectious disease diagnostics, hereditary disease testing, and cancer genotyping. The flexibility, scalability, and cost-effectiveness of PCR have made it the first choice in both centralized labs and point-of-care settings. Companies like Bio-Rad and Roche continue to innovate in this space with faster thermal cyclers, multiplexing capabilities, and robust reagent kits.

NGS DNA Diagnosis is the fastest-growing technology, owing to its ability to simultaneously analyze millions of DNA fragments, offering comprehensive insights into the genome. NGS is used for whole-genome sequencing (WGS), exome sequencing, and targeted panels across oncology, neurology, and rare disease diagnostics. Platforms like Illumina’s NovaSeq and Thermo Fisher’s Ion Torrent are setting new standards for throughput and affordability. The integration of AI in NGS data interpretation and the rise of clinical genomics services are further accelerating the adoption of this cutting-edge technology.

By Application Insights

Infectious Diseases DNA Testing led the application landscape, particularly during and after the COVID-19 pandemic. DNA-based PCR tests for pathogens like HBV, HCV, HIV, TB, HPV, and MRSA have become central to diagnostic and surveillance efforts. Governments and health organizations rely on rapid, accurate DNA testing to manage outbreaks, monitor antimicrobial resistance, and conduct contact tracing. The shift toward syndromic panels that detect multiple pathogens from a single sample has also contributed to the dominance of this application.

Cancer Genetic Testing is the fastest-growing application, fueled by the increasing demand for precision oncology. DNA diagnostics enable the identification of cancer-driving mutations, hereditary cancer syndromes, and tumor mutational burden. From germline testing for BRCA mutations to somatic profiling of tumor biopsies and circulating DNA, this segment has grown significantly. Companion diagnostics and tumor profiling assays are being routinely used to guide therapy decisions, especially for lung, breast, colorectal, and hematological malignancies.

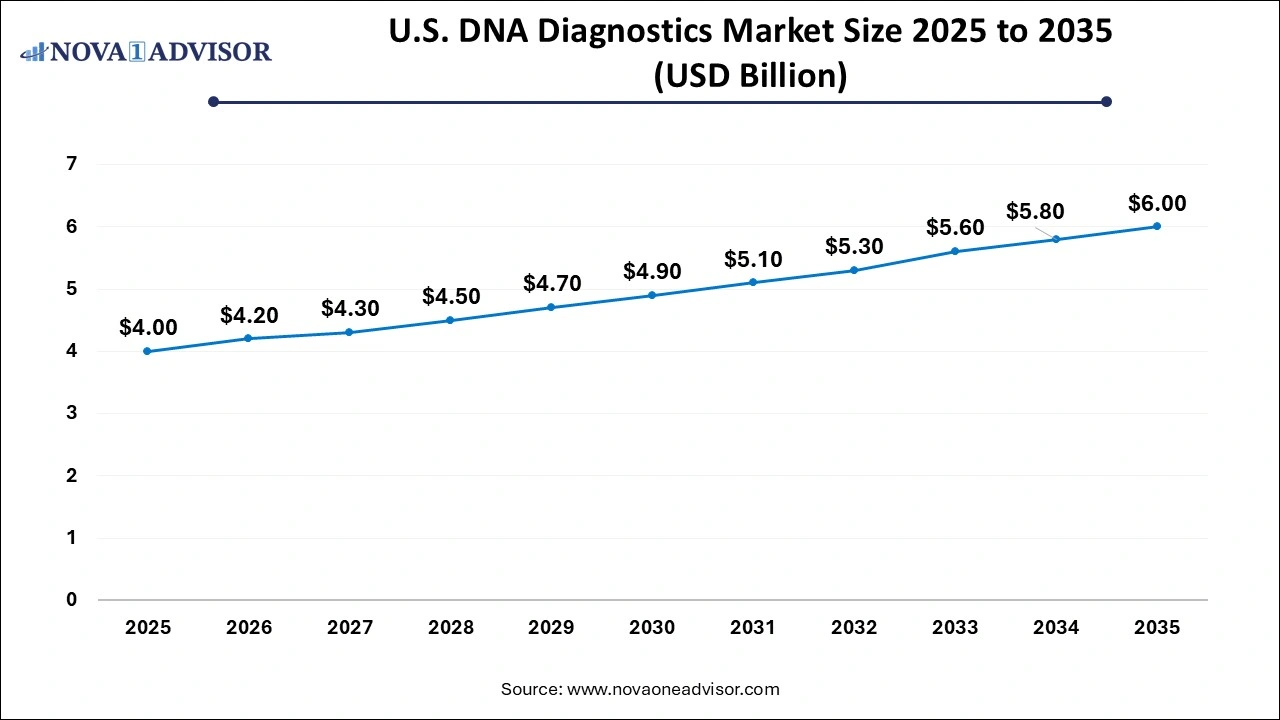

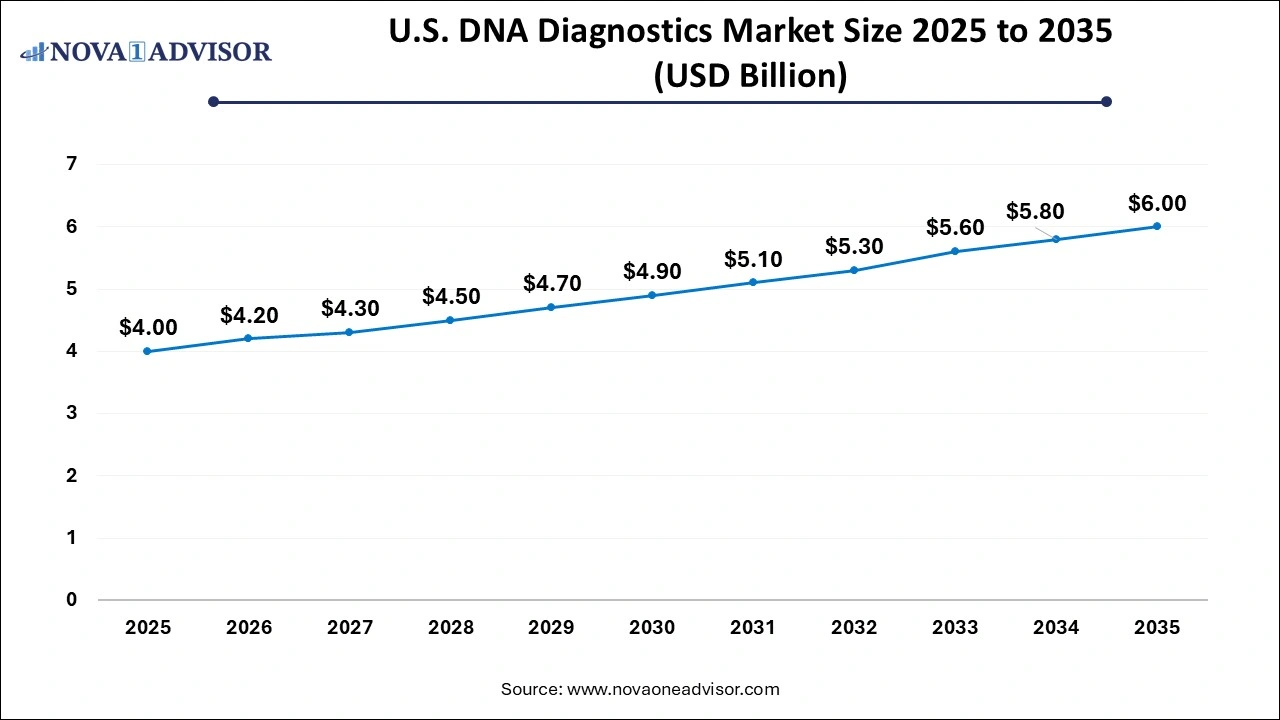

U.S. DNA Diagnostics Market Size in the U.S. 2026 to 2035

The U.S. DNA diagnostics market size was valued at USD 4 billion in 2025 and is anticipated to reach around USD 6 billion by 2035, growing at a CAGR of 6.71% from 2026 to 2035.

By Regional Insights

North America dominates the global DNA diagnostics market due to its strong healthcare infrastructure, high research investments, and early adoption of molecular diagnostics. The U.S., in particular, leads in NGS integration, pharmacogenomics, and clinical trial-based diagnostics. Regulatory agencies like the FDA have supported innovation through frameworks for companion diagnostics and Emergency Use Authorizations (EUAs). Key companies such as Thermo Fisher, Illumina, and Qiagen have established strong regional operations and partnerships with academic and clinical institutions. Reimbursement coverage for genetic testing continues to improve, making DNA diagnostics more accessible to patients.

Asia-Pacific is the fastest-growing region, driven by expanding healthcare investments, genomic medicine initiatives, and population-scale screening programs. Countries like China, India, and Japan are leading the charge with initiatives such as China’s Precision Medicine Plan and India’s GenomeIndia project. Local companies are also innovating in low-cost DNA testing kits tailored to regional diseases and genetics. The increasing prevalence of chronic diseases, government support for biotechnology, and growing partnerships with Western diagnostics firms position Asia-Pacific as a major growth engine for the future.

Key Companies and Market Share Insights

Market participants are involved in R&D for the introduction of rapid testing methods that provide reproducible and accurate results and aid in the diagnosis of genetic abnormalities. For instance, in April 2023, Agilent Technologies Inc. announced the launch of SureSelect Cancer CGP Assay, which is particularly devised for somatic variant profiling for a broad wide range of solid tumor forms. Furthermore, these entities are also engaged in developing and updating their databases for mining and comparing DNA specimens to help law enforcement in solving criminal cases. Some prominent players in the global DNA diagnostics market include:

Recent Developments

-

February 2024: Qiagen launched a new DNA diagnostics panel for neuromuscular diseases, offering expanded gene coverage for conditions like muscular dystrophy and spinal muscular atrophy. The panel supports clinical diagnosis and newborn screening, reflecting a push toward rare disease testing.

-

January 2024: Illumina introduced a rapid whole-exome sequencing workflow for use in critical care and neonatal intensive care units. The solution delivers results within 48 hours, helping clinicians make life-saving decisions in real-time.

-

December 2023: Thermo Fisher Scientific expanded its portfolio of NGS-based infectious disease panels, including a new tuberculosis detection and resistance panel optimized for low-resource settings and high-burden regions.

-

November 2023: Roche Diagnostics partnered with a U.S. hospital network to pilot a liquid biopsy-based minimal residual disease (MRD) monitoring test for colorectal and breast cancer.

-

October 2023: Bio-Rad Laboratories launched its next-gen qPCR instrument, with improved multiplexing capabilities and integrated software for faster and more accurate DNA diagnostics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the DNA Diagnostics market.

By Technology

- Microarrays-based Diagnostics

- PCR-based Diagnostics

- In-situ Hybridization Diagnostics

- NGS DNA Diagnosis

By Application

- Cancer Genetics Tests

- Infectious Diseases DNA Testing

- HBV Diagnostic

- HCV Diagnostic

- HIV Diagnostic

- TB Diagnostic

- CT/NG Diagnostic

- HPV Diagnostic

- MRSA Diagnostic

- Others

- Newborn Genetic Screening

- Preimplantation & Reproductive Diagnosis

- Non-Infectious Diseases DNA Testing

- Cardiovascular Diseases

- CNS & PNS Related

- Skeletal, Connective, Ectodermal & Dermal DNA Testing

- Lung, Kidney, Liver & GT Related

- Sensory Diseases

- Prenatal DNA Carrier Screening

- Pharmacogenomics/Drug Metabolism

- Hematology & Immunology/Identity Diagnostics & Forensics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)