DNA Sequencing Market Size, Share and Trends 2026 to 2035

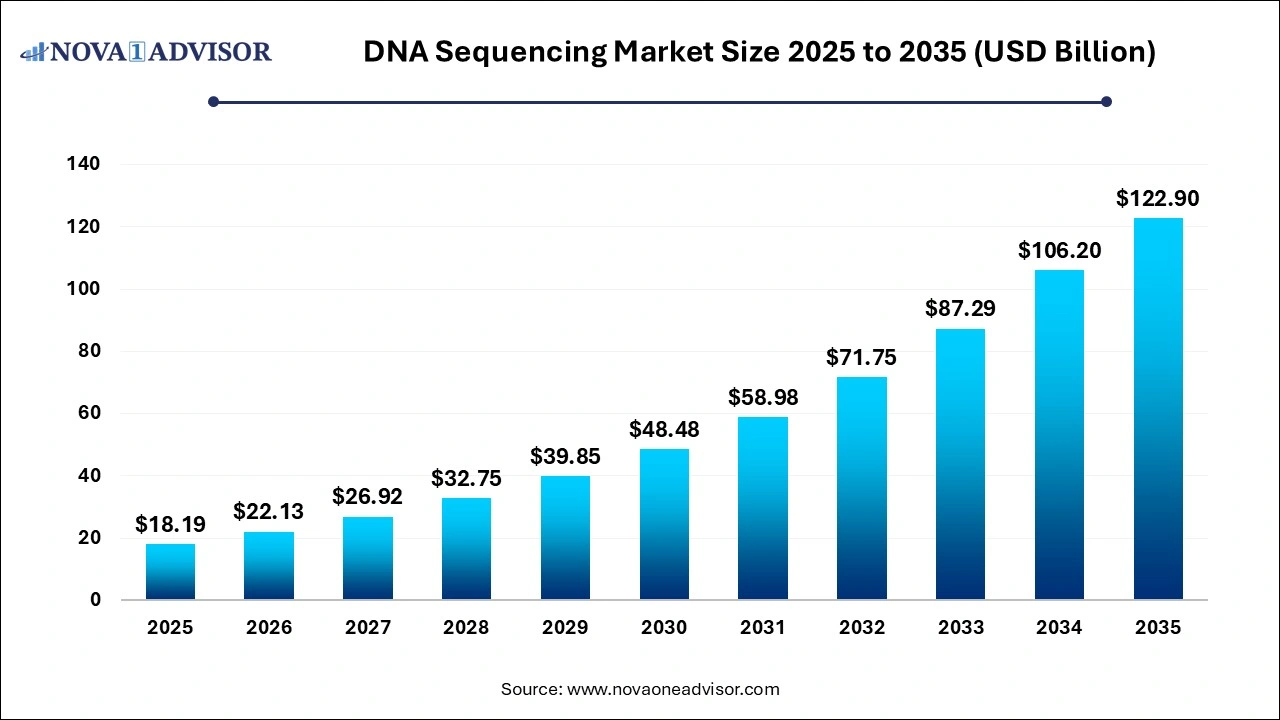

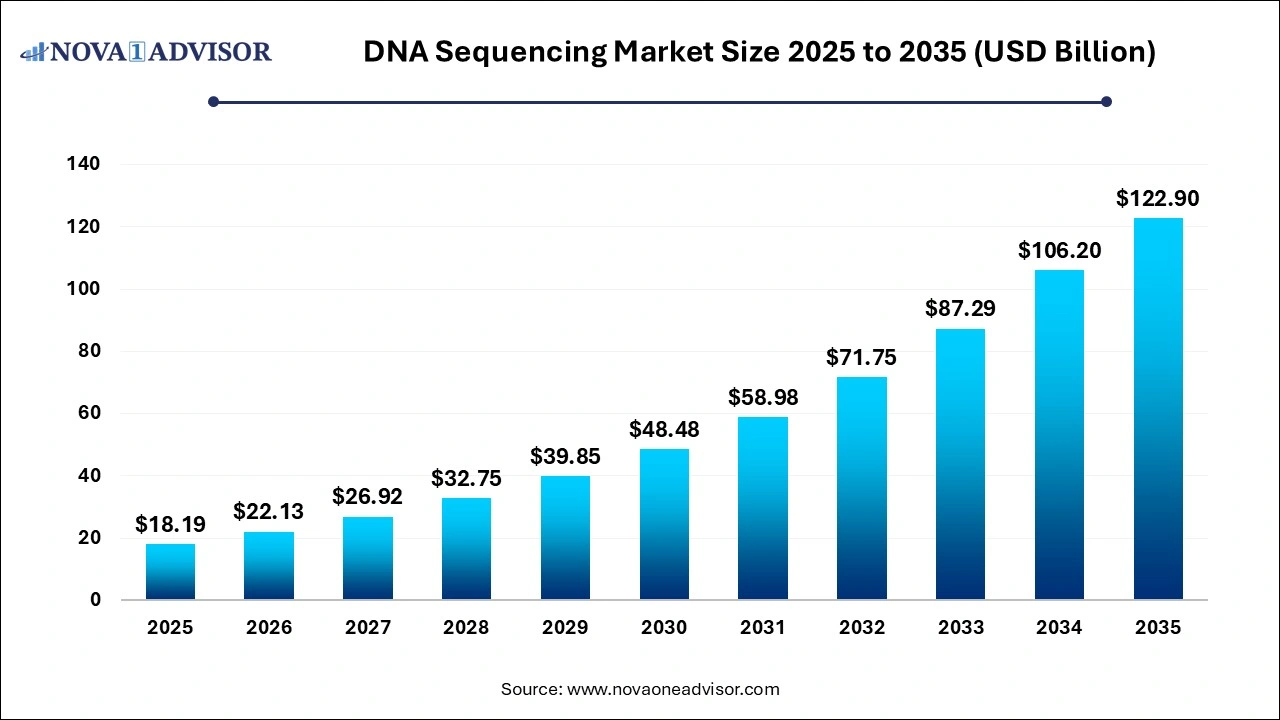

The DNA sequencing market size was exhibited at USD 18.19 billion in 2025 and is projected to hit around USD 122.9 billion by 2035, growing at a CAGR of 21.05% during the forecast period 2026 to 2035.The rapid progress in technology and bioinformatics has facilitated the detection of DNA variations, allowing for the identification of variants linked to an increased risk of disease.

DNA Sequencing Market Key Takeaways:

- Based on product & service, the consumables segment led the market for the largest revenue share of 49.12% in 2025.

- The services segment is anticipated to witness the fastest CAGR over the forecast period.

- Based on technology, the next generation sequencing segment led the market with a largest revenue share of 87.29% in 2025.

- The third-generation sequencing segment is projected to witness the fastest CAGR over the forecast period.

- Based on workflow, the sequencing segment held the market with a largest revenue share of 56.96% in 2025.

- The data analysis segment is projected to witness the fastest CAGR over the forecast period.

- In terms of application, the oncology segment led the market with a largest revenue share of 25.53% in 2025.

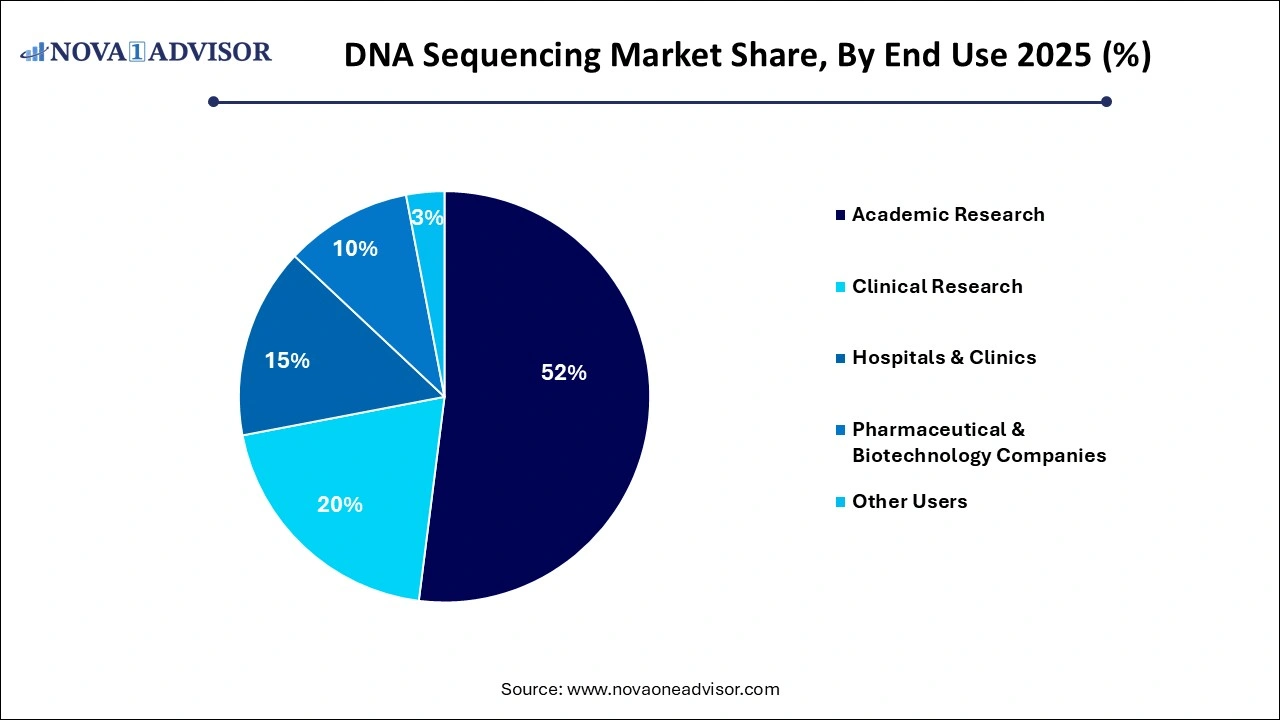

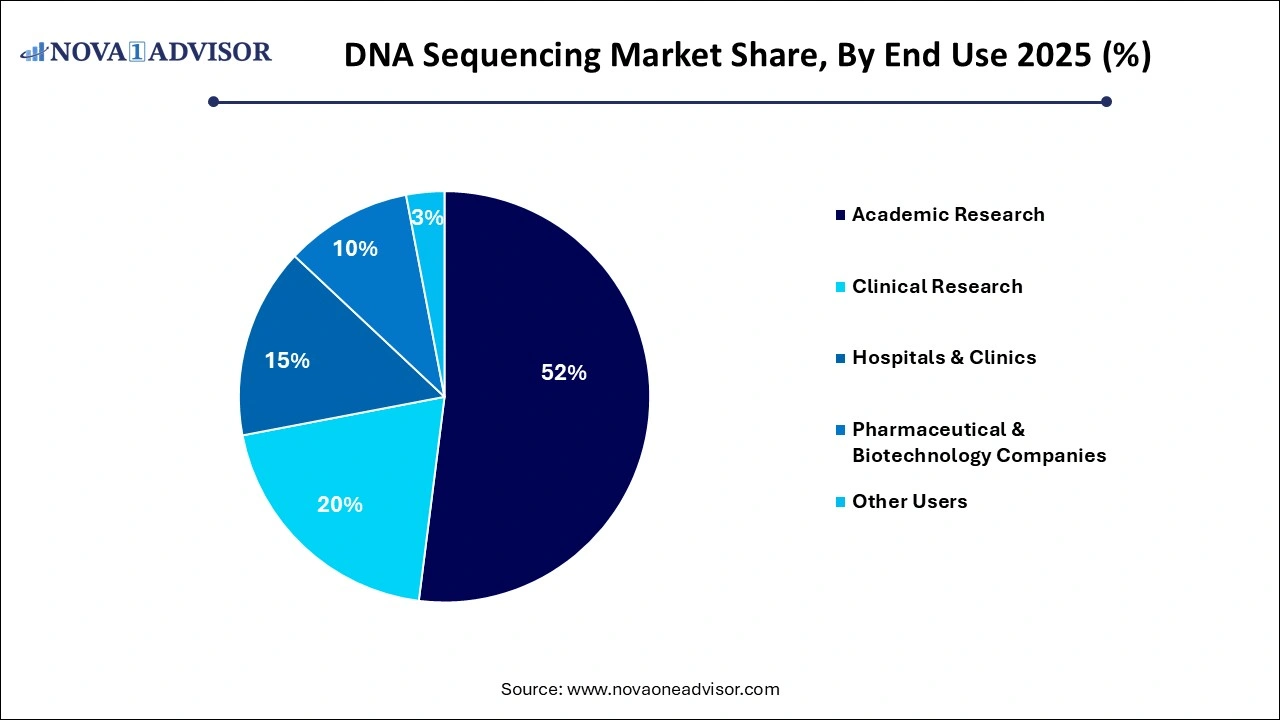

- Based on end-use, the academic research segment held the market in 2025 with the largest revenue share of 52%.

- The clinical research segment is projected to witness the fastest CAGR over the forecast period.

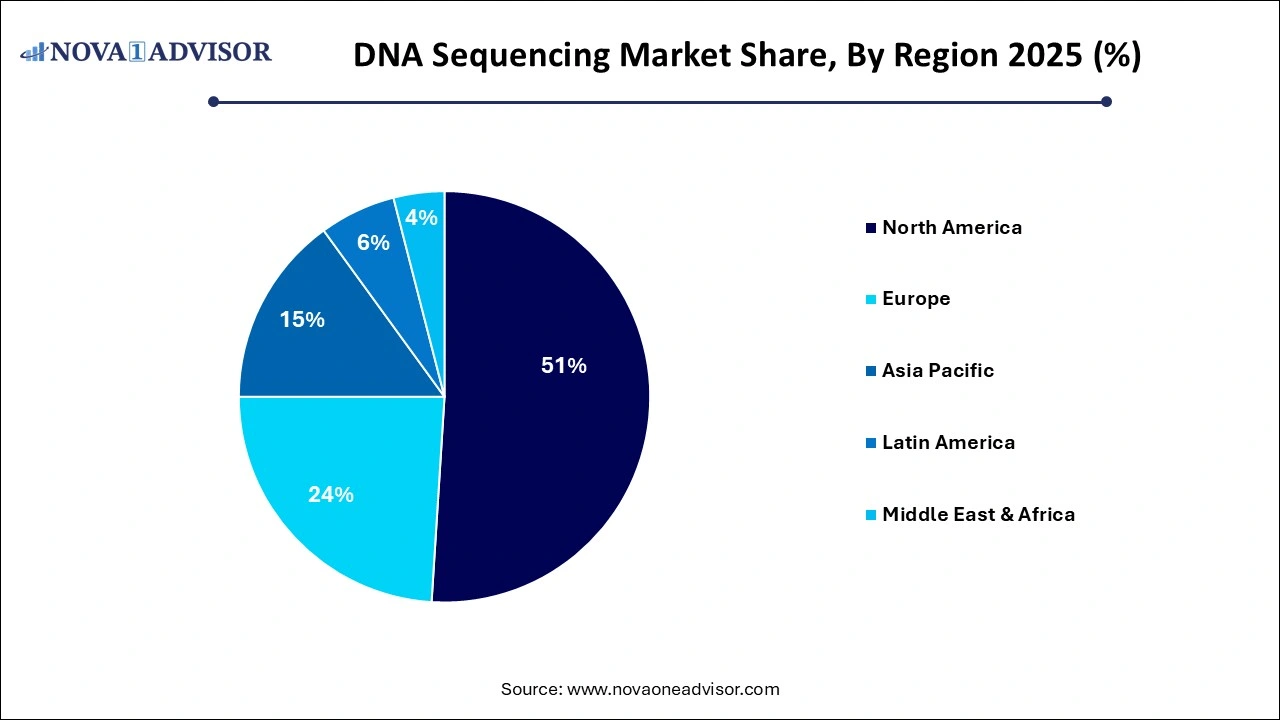

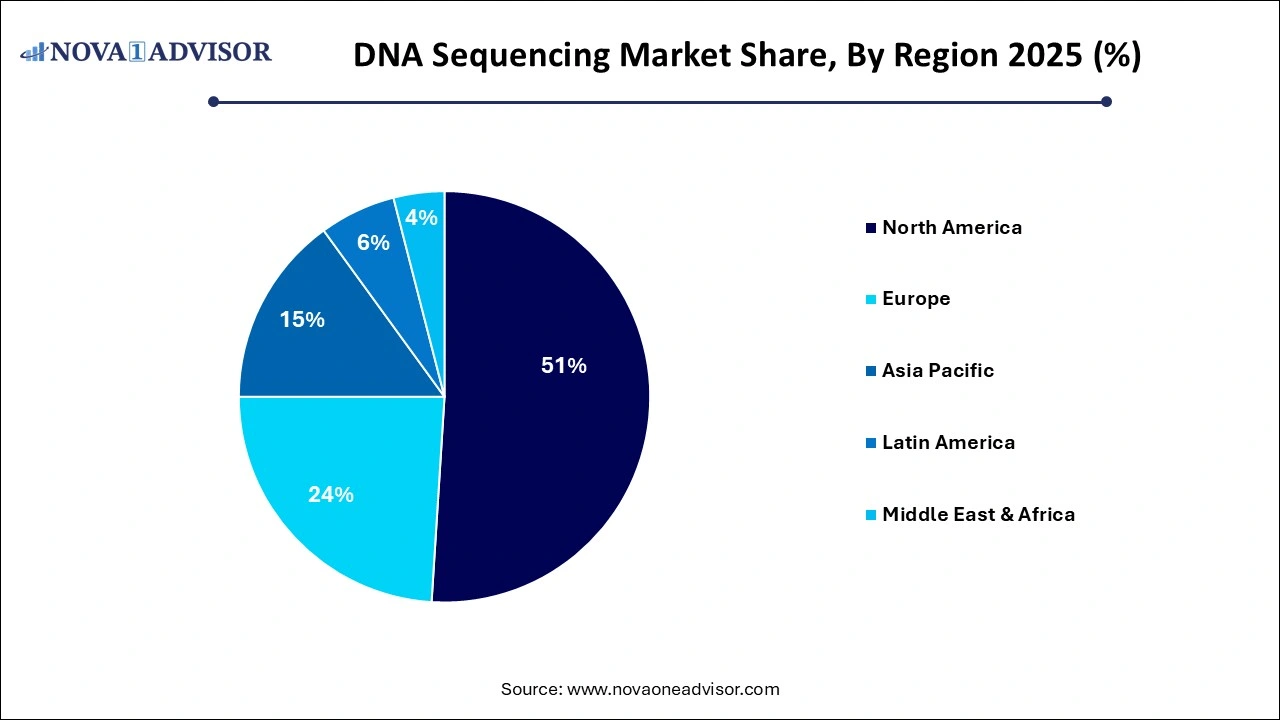

- North America dominated the market with a revenue share of 50.70% in 2025.

DNA Sequencing Market Overview

DNA sequencing has revolutionized the landscape of biological sciences by enabling the decoding of genetic information with high precision. It refers to the method of determining the precise order of nucleotides within a DNA molecule. Over the years, the DNA sequencing market has grown from niche academic and research domains into a cornerstone of clinical diagnostics, drug discovery, forensic studies, agriculture, and even consumer wellness. As global healthcare systems shift toward precision medicine, the role of DNA sequencing in identifying disease markers, genetic predispositions, and tailoring individualized treatment plans becomes irreplaceable.

The market’s evolution can be attributed to advancements in next-generation sequencing (NGS), reduction in sequencing costs, and expanding applications across diverse sectors. From its early days dominated by Sanger sequencing to the present landscape marked by single-molecule real-time sequencing and nanopore technologies, innovation has been relentless. Companies are investing heavily in platform development, bioinformatics, and service-based models to cater to both clinical and consumer demand.

For instance, the success of DNA sequencing in tracking viral mutations during the COVID-19 pandemic showcased its utility in epidemiology, further accelerating global adoption. With continuous improvements in workflow automation, sample throughput, and data analytics, the DNA sequencing market is poised for robust growth in the coming decade.

Major Trends in the DNA Sequencing Market

-

Integration of AI and Machine Learning: Advanced analytics are being integrated into sequencing workflows to improve accuracy, reduce time, and uncover complex genetic interactions.

-

Rise of Consumer Genomics: Platforms like 23andMe and AncestryDNA have introduced DNA sequencing to the consumer wellness and ancestry space, increasing public engagement.

-

Adoption in Agrigenomics: DNA sequencing is playing a vital role in crop improvement, livestock breeding, and sustainable agriculture.

-

Miniaturization and Portability: Technologies like Oxford Nanopore’s MinION offer real-time sequencing with portable devices, enabling field-based applications.

-

Increase in Clinical Application: Expanding use in oncology for companion diagnostics and precision medicine strategies.

-

Collaborations and Acquisitions: Leading firms are acquiring startups or partnering with academic institutions to accelerate innovation and expand portfolios.

-

Cloud-based Bioinformatics Platforms: A shift toward scalable, cloud-powered data analysis solutions for managing complex genomic datasets.

-

Public Genome Projects: Initiatives such as the UK Biobank and NIH’s All of Us are generating unprecedented amounts of genetic data, fueling market demand.

Report Scope of DNA Sequencing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 22.13 Billion |

| Market Size by 2035 |

USD 122.9 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 21.05% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product and Service, By Technology, By Workflow, By Application, By End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc; Agilent Technology; Illumina, Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Macrogen, Inc.; PerkinElmer Genomics; PacBio; BGI; Bio-Rad Laboratories, Inc.; Myriad Genetics; PierianDx; Partek Incorporated; Eurofins Scientific |

DNA Sequencing Market Dynamics

Booming Adoption of Precision Medicine

Precision medicine has redefined how diseases are diagnosed, treated, and prevented by considering individual variability in genes, environment, and lifestyle. DNA sequencing forms the backbone of this transformation by identifying genetic alterations that may influence response to specific therapies. In oncology, for example, NGS enables comprehensive tumor profiling, allowing oncologists to select therapies that are most likely to benefit a particular patient based on their tumor’s genetic makeup.

This paradigm shift has not only improved patient outcomes but also reduced healthcare costs by minimizing ineffective treatments. Governments and health organizations worldwide are prioritizing genomics research through funding, infrastructure development, and policy frameworks. Programs like the U.S. Precision Medicine Initiative and China’s Genomic Valley underscore the strategic importance of sequencing technologies. As healthcare continues to move toward personalized approaches, DNA sequencing will become an essential diagnostic tool, driving consistent market expansion.

Data Privacy and Ethical Concerns

Despite its transformative potential, DNA sequencing raises significant concerns regarding data security, privacy, and ethical usage. Genetic data is inherently sensitive—it reveals not only information about an individual but also about their relatives. The growing repository of genomic data, especially in cloud-based environments, increases the risk of cyber-attacks and unauthorized access. There have been instances of data breaches involving consumer genomics firms, eroding public trust.

Additionally, ethical issues around ownership of genetic information, potential misuse in insurance or employment discrimination, and lack of clear regulatory frameworks in many countries present barriers to broader adoption. These challenges necessitate robust legal, technical, and institutional safeguards. While some regions, like Europe under GDPR, have enacted stricter data protection laws, inconsistencies in global regulatory environments may limit cross-border collaboration and commercial expansion.

Expansion in Emerging Economies

Emerging markets in Asia Pacific, Latin America, and Africa represent untapped opportunities for DNA sequencing technology. These regions are witnessing increasing investment in healthcare infrastructure, research facilities, and education, driving demand for genetic testing capabilities. Furthermore, the high prevalence of infectious diseases and underdiagnosed genetic disorders creates a fertile ground for clinical adoption of sequencing tools.

In India, for instance, initiatives like GenomeIndia aim to sequence over 10,000 individuals, building a national genetic database that can inform public health policy. Similarly, Brazil’s investment in genomic surveillance for disease outbreaks reflects rising awareness of the technology’s utility. As governments in these regions roll out digital health initiatives, expand insurance coverage, and promote precision medicine, companies have an opportunity to establish early footholds through strategic partnerships, local manufacturing, and capacity building.

DNA Sequencing Market Segmental Insights

By Product and Service Insights

Consumables dominated the product segment, as they are indispensable in every DNA sequencing workflow from sample preparation and amplification to sequencing and data analysis. Consumables such as reagents, library preparation kits, and sample tubes are recurring expenditures, making them a consistent revenue stream for manufacturers. Their high consumption rate in both academic research and clinical diagnostics, coupled with improvements in reagent chemistry and sensitivity, reinforces their dominance.

Services, however, are the fastest-growing segment, fueled by the increasing trend toward outsourcing sequencing tasks. Many organizations lack the infrastructure or expertise to perform in-house sequencing, turning instead to specialized service providers. These include everything from sequencing-as-a-service to data analytics and interpretation. As demand for customized sequencing grows across agriculture, oncology, and epidemiology, service providers are scaling their capacities with high-throughput platforms and AI-based analytics to meet diverse client needs.

By Technology Insights

Next-Generation Sequencing (NGS) holds the lion’s share due to its unparalleled throughput, accuracy, and cost-efficiency. Within NGS, Whole Genome Sequencing (WGS) and Targeted Sequencing are widely used in both clinical and research settings. Companies like Illumina and Thermo Fisher Scientific have built robust NGS platforms catering to large-scale genome studies, oncology panels, and rare disease research. WGS is increasingly adopted in clinical diagnostics for its ability to identify mutations across the entire genome, while targeted panels offer focused insights at a lower cost.

Third Generation Sequencing technologies, particularly Single-Molecule Real-Time (SMRT) sequencing and nanopore sequencing, are the fastest growing. These methods offer longer read lengths, which are crucial in identifying structural variants and complex genomic regions. Oxford Nanopore’s portable devices have opened new use cases in real-time outbreak tracking and remote fieldwork. As these platforms improve in accuracy and affordability, they are expected to disrupt the traditional dominance of NGS in niche applications.

By Workflow Insights

The sequencing step remains the most revenue-generating workflow stage, as it involves the actual decoding of DNA using sophisticated machines and reagents. This phase requires advanced instrumentation, trained personnel, and consistent consumable usage, making it cost-intensive. Continuous advancements in throughput, automation, and chemistry improvements drive this segment forward.

Data analysis is emerging as the fastest-growing segment due to the exponential volume of genomic data being generated. With genome sequences running into terabytes, interpretation and visualization tools are indispensable. Bioinformatics platforms that use AI and machine learning to detect genetic variants, link them to phenotypes, and predict disease risk are in high demand. Companies are focusing on developing integrated platforms that provide seamless data management, interpretation, and reporting for both research and clinical users.

By Application Insights

Oncology leads the application segment, given its early adoption of sequencing technologies for diagnosis, prognosis, and treatment planning. Genetic profiling of tumors allows oncologists to choose targeted therapies, monitor resistance development, and predict treatment outcomes. Several cancer panels have become standard-of-care in developed markets, and the integration of sequencing into national cancer programs has accelerated global adoption.

Consumer Genomics is witnessing exponential growth, especially with rising interest in ancestry, wellness, and preventive healthcare. Direct-to-consumer (DTC) kits from companies like 23andMe and MyHeritage have democratized access to DNA testing. As consumers become more aware of their genetic predispositions, lifestyle choices, and personalized nutrition plans, this segment is expected to grow further. Data from consumer genomics is also being increasingly used in research and drug development, creating additional commercial opportunities.

By End-use Insights

Academic research institutions are currently the largest end-users of DNA sequencing, leveraging it for basic biology, evolutionary studies, and large-scale genomic projects. Universities and public research bodies form long-term collaborations with sequencing companies and drive innovation through pilot studies and trials. Funding from governments and international bodies for research-centric projects has helped sustain this segment’s growth.

Hospitals and clinics are the fastest-growing end-use segment, as sequencing becomes integrated into routine diagnostics. From prenatal testing to oncology and rare disease diagnosis, healthcare providers are adopting NGS and other methods to offer precision treatment plans. The rise of genomic medicine clinics and point-of-care testing solutions is making sequencing more accessible to clinicians, which will further strengthen this segment's trajectory.

Hospitals and clinics are the fastest-growing end-use segment, as sequencing becomes integrated into routine diagnostics. From prenatal testing to oncology and rare disease diagnosis, healthcare providers are adopting NGS and other methods to offer precision treatment plans. The rise of genomic medicine clinics and point-of-care testing solutions is making sequencing more accessible to clinicians, which will further strengthen this segment's trajectory.

DNA Sequencing Market By Regional Insights

North America, particularly the United States, dominates the DNA sequencing market due to a strong ecosystem of research institutions, biotech companies, and supportive government initiatives. Agencies like the NIH and FDA have established genomic research funding programs and regulatory pathways for sequencing-based diagnostics. The region also houses leading companies like Illumina, Thermo Fisher, and Pacific Biosciences, which continually innovate to retain market leadership.

Widespread clinical adoption, a mature healthcare system, and favorable reimbursement scenarios support commercial scalability. The region’s proactive stance on personalized medicine and genomic databases, such as the All of Us Research Program, ensures sustained growth in both research and clinical applications.

Asia Pacific is emerging as the fastest-growing region, driven by increasing healthcare expenditure, genomic research investments, and a rising burden of chronic and genetic diseases. Countries like China, India, Japan, and South Korea are making significant strides in sequencing infrastructure. China’s 14th Five-Year Plan includes genomic medicine as a strategic focus, while India’s GenomeIndia initiative is rapidly expanding local sequencing capabilities.

Growing awareness among clinicians, rising academic output, and the entry of global sequencing firms into these markets with localized solutions make Asia Pacific a hotspot for future growth. Moreover, a younger population base and increasing consumer health awareness boost demand for genetic wellness solutions.

Some of the prominent players in the DNA sequencing market include:

- Thermo Fisher Scientific, Inc

- Agilent Technology

- Illumina, Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Macrogen, Inc.

- PerkinElmer Genomics

- PacBio

- BGI

- Bio-Rad Laboratories, Inc.

- Myriad Genetics

- PierianDx

- Partek Incorporated

- Eurofins Scientific

DNA Sequencing Market Recent Developments

-

March 2025 – Illumina launched its NovaSeq X Series in India, promising higher throughput and cost efficiency for genome-wide studies.

-

February 2025 – Oxford Nanopore Technologies entered a strategic partnership with Brazil’s health ministry to deploy portable sequencing devices for pathogen surveillance.

-

January 2025 – Thermo Fisher Scientific announced a $200 million expansion of its sequencing consumables plant in North Carolina to meet rising global demand.

-

November 2024 – PacBio acquired DNA software firm Jumpcode Genomics to enhance its bioinformatics offerings.

-

October 2024 – Roche introduced a fully automated workflow solution for clinical sequencing in European hospitals.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the DNA sequencing market

By Product & Services

- Consumables

- Instruments

- Services

By Technology

- Sanger Sequencing

- Next-Generation Sequencing

-

- Whole Genome Sequencing (WGS)

- Whole Exome Sequencing (WES)

- Targeted Sequencing & Resequencing

- Third Generation DNA Sequencing

-

- Single-Molecule Real-Time Sequencing (SMRT)

- Nanopore Sequencing

By Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

By Application

- Oncology

- Reproductive Health

- Clinical Investigation

- Agrigenomics & Forensics

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Consumer Genomics

- Others

By End-use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Other Users

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Hospitals and clinics are the fastest-growing end-use segment, as sequencing becomes integrated into routine diagnostics. From prenatal testing to oncology and rare disease diagnosis, healthcare providers are adopting NGS and other methods to offer precision treatment plans. The rise of genomic medicine clinics and point-of-care testing solutions is making sequencing more accessible to clinicians, which will further strengthen this segment's trajectory.

Hospitals and clinics are the fastest-growing end-use segment, as sequencing becomes integrated into routine diagnostics. From prenatal testing to oncology and rare disease diagnosis, healthcare providers are adopting NGS and other methods to offer precision treatment plans. The rise of genomic medicine clinics and point-of-care testing solutions is making sequencing more accessible to clinicians, which will further strengthen this segment's trajectory.