Downstream Processing Market Size and Trends

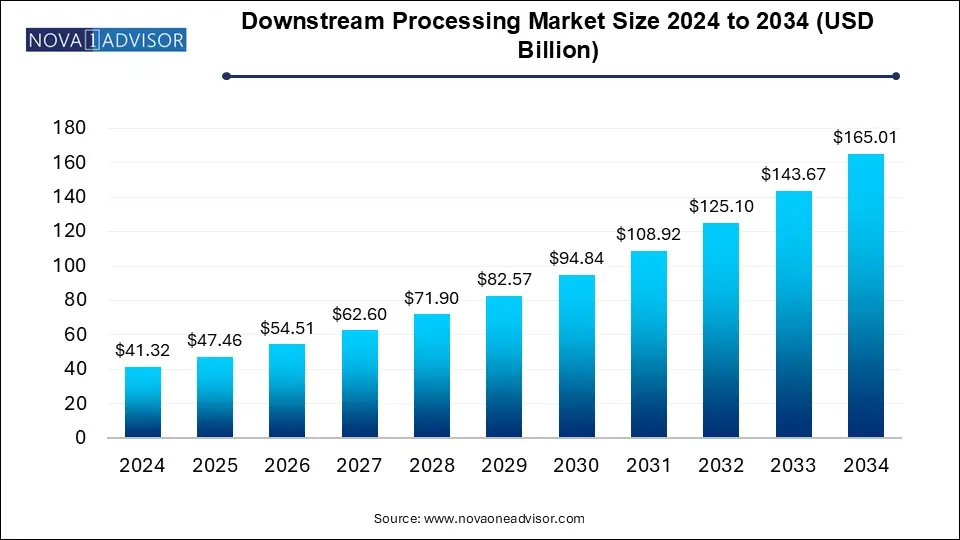

The downstream processing market size was exhibited at USD 41.32 billion in 2024 and is projected to hit around USD 165.01 billion by 2034, growing at a CAGR of 14.85% during the forecast period 2025 to 2034.

Downstream Processing Market Key Takeaways:

- North America dominated the market for downstream processing with the largest revenue share of 35.0% in 2024

- In the Asia Pacific, the market for downstream processing is expected to register the highest growth rate of 15.67% during 2023-2034

- The chromatography systems segment dominated the market for downstream processing and accounted for the largest revenue share of 41.29% in 2024.

- The filters segment is expected to register the fastest CAGR of 16.10% from 2025 to 2034.

- The purification by chromatography segment dominated the downstream processing market and accounted for the largest revenue share of 40.98% in 2024.

- Solid-liquid separation is expected to witness the highest CAGR of 16.03% from 2025 to 2034.

- The antibiotic production segment dominated the market for downstream processing and generated the largest revenue share of 33.0% in 2024

- Antibodies production is expected to grow at the fastest CAGR of 15.62% by 2034

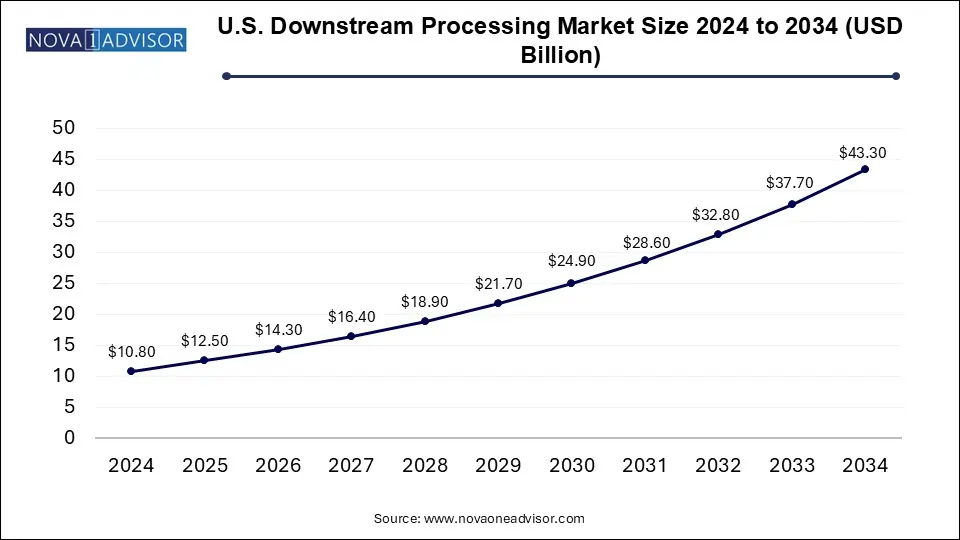

U.S. Downstream Processing Market Size and Growth 2025 to 2034

The U.S. downstream processing market size reached USD 10.8 billion in 2024 and is anticipated to be worth around USD 43.3 billion by 2034, poised to grow at a CAGR of 13.45% from 2025 to 2034.

North America dominates the downstream processing market, owing to its leadership in biopharmaceutical innovation, strong R&D investment, and established manufacturing infrastructure. The U.S. accounts for the majority of global biologics approvals and has a rich ecosystem of biotech startups, academic research centers, and pharmaceutical giants.

Moreover, government initiatives like "Operation Warp Speed" during the COVID-19 pandemic accelerated investment into manufacturing capacities, including downstream capabilities. Leading companies such as Thermo Fisher Scientific, GE HealthCare, and Danaher Corporation are headquartered or heavily invested in North America, ensuring continued technological advancement and adoption.

Asia-Pacific is the fastest-growing region, fueled by an expanding biopharma sector in countries like China, India, South Korea, and Japan. Governments across Asia are actively supporting biomanufacturing capabilities through funding, incentives, and partnerships, particularly for biosimilars and vaccines.

China's "Made in China 2025" strategy includes biologics as a key focus area, and numerous biotech parks and manufacturing hubs are being developed. Additionally, lower production costs, growing regulatory harmonization, and a large patient pool make Asia-Pacific an attractive destination for biopharmaceutical investment. As local biotechs expand pipelines into biologics, the need for efficient downstream processing solutions is skyrocketing.

Market Overview

The downstream processing market plays a pivotal role in the biopharmaceutical manufacturing value chain, representing all the steps involved after fermentation to isolate, purify, and prepare biological products for final use. From therapeutic proteins, enzymes, and vaccines to antibiotics and hormones, downstream processing ensures that these biologics are purified to the highest standards for human and animal use.

Downstream processing typically involves several intricate steps, including cell disruption, solid-liquid separation, concentration, purification, and final formulation. Its complexity arises from the delicate nature of biologics, requiring stringent protocols to maintain product stability, bioactivity, and regulatory compliance. As biologics, biosimilars, and cell and gene therapies continue to dominate new drug pipelines, the importance of efficient downstream processing systems has never been more pronounced.

The COVID-19 pandemic provided a massive boost to the downstream processing sector as biopharma companies raced to develop vaccines and antibody therapies. Companies had to quickly scale up their purification capacities without compromising quality. Today, the emphasis remains on increasing process efficiency, scalability, and flexibility, making downstream processing one of the most dynamic sectors within biomanufacturing.

Major Trends in the Market

-

Shift Toward Single-use Technologies: Increased use of disposable chromatography systems, filters, and centrifuges to enhance flexibility and reduce cross-contamination.

-

Integration of Automation and Digitalization: Smart sensors, AI-driven process controls, and real-time analytics are being integrated into purification systems.

-

Growing Preference for Continuous Processing: Transition from batch-based downstream processing to continuous purification for improved yield and scalability.

-

Customization of Chromatography Resins: Demand for specialized resins tailored to complex biomolecules like monoclonal antibodies and gene therapy vectors.

-

Expansion of Contract Manufacturing Services: Outsourcing of downstream activities to CDMOs (Contract Development and Manufacturing Organizations) to manage demand peaks.

-

Development of High-performance Membrane Technologies: Innovations in membrane filtration and tangential flow filtration for higher throughput and selectivity.

-

Environmental Sustainability Focus: Emergence of green downstream processing techniques that minimize solvent use and energy consumption.

-

Rise in Vaccine and Antibody Purification: COVID-19 aftermath driving investments in viral vector purification, mRNA vaccines, and monoclonal antibody production.

Report Scope of Downstream Processing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 47.46 Billion |

| Market Size by 2034 |

USD 165.01 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 14.85% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Technique, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Merck KGaA; Sartorius Stedim Biotech S.A; GE Healthcare; Thermo Fisher Scientific Inc.; Danaher Corporation; Repligen; 3M Company; Boehringer Ingelheim International GmbH; Corning Corporation; Lonza Group Ltd; Dover Corporation; Ashai Kasei; Ferner PLC; Eppendorf AG |

Key Market Driver: Growing Demand for Biopharmaceuticals

The unprecedented rise in biopharmaceuticals serves as the core driver for the downstream processing market. Unlike traditional small-molecule drugs, biologics such as monoclonal antibodies, vaccines, and recombinant proteins are large, complex molecules that require sophisticated purification processes to ensure safety and efficacy.

Biopharmaceuticals now represent over 40% of the pharmaceutical pipeline, with many blockbuster drugs like Humira, Keytruda, and various biosimilars being biologics. Moreover, novel therapies like CAR-T cell therapies and mRNA-based vaccines demand highly specialized downstream processes to preserve functionality. As R&D pipelines grow richer in biologics, the demand for robust, scalable, and regulatory-compliant downstream processing systems intensifies, creating a positive feedback loop driving market expansion.

Key Market Restraint: High Cost and Complexity of Downstream Operations

Despite technological advancements, the high cost and operational complexity associated with downstream processing remain major challenges. Downstream operations often account for up to 50-80% of the overall biomanufacturing costs, mainly due to expensive resins, filters, and specialized equipment required for purification and polishing stages.

Additionally, developing optimized purification protocols for novel molecules often takes years and significant financial investment. Small biotech companies, particularly those working on rare disease biologics, frequently struggle with downstream scalability and cost management. Furthermore, regulatory pressures demand rigorous validation and quality control for downstream processes, adding further financial burden.

Key Market Opportunity: Emergence of Cell and Gene Therapies

A major opportunity for the downstream processing market lies in the emergence of cell and gene therapies (CGTs). These next-generation therapies, which offer potential cures rather than symptom management, require highly specialized downstream processes to ensure the integrity and potency of living cells or genetic material.

Unlike traditional biologics, CGTs demand gentler purification techniques, customized separation technologies, and stringent sterility protocols. Given the explosive growth of the CGT sector—with over 2,000 clinical trials ongoing globally—there is a huge unmet need for downstream technologies tailored to viral vectors, plasmid DNA, and engineered cell purification. Companies that innovate in these areas will be at the forefront of a transformative wave in biomanufacturing.

Downstream Processing Market By Products Insights

Chromatography systems dominate the downstream processing product landscape, owing to their indispensable role in the purification of biomolecules. Techniques such as affinity chromatography, ion-exchange chromatography, and size exclusion chromatography are critical in isolating proteins, antibodies, and nucleic acids with high purity and yield. Leading companies offer chromatography systems with customizable resins and automated platforms that enhance scalability and reproducibility.

The filters segment is growing fastest, reflecting the increasing adoption of filtration technologies in solid-liquid separation, clarification, and virus removal steps. Innovations like high-capacity depth filters, single-use sterile filters, and tangential flow filtration (TFF) systems enable higher productivity with reduced footprint. As regulatory agencies tighten sterility and contamination standards, the role of filtration in downstream workflows becomes ever more central.

Downstream Processing Market By Technique Insights

Purification by chromatography continues to dominate, underscoring its gold-standard status for achieving the necessary purity and bioactivity of complex biologics. Despite the rise of alternative techniques, chromatography remains critical, particularly for high-value therapeutics like monoclonal antibodies and vaccines. Innovations like multi-column continuous chromatography and resin recycling further enhance its prominence.

Meanwhile, membrane filtration is witnessing rapid growth, especially in the concentration and ultrafiltration/diafiltration steps. Membrane systems offer scalable, flexible, and relatively lower-cost solutions compared to traditional centrifugation and evaporation methods. Microfiltration and ultrafiltration membranes are extensively used in viral vector manufacturing, and new high-retention TFF modules are driving even greater efficiency gains.

Downstream Processing Market By Application Insights

Antibody production dominates the application segment, largely due to the explosion in monoclonal antibody (mAb) therapeutics for oncology, immunology, and infectious diseases. Downstream processes tailored for antibodies including Protein A chromatography, polishing steps, and virus filtration represent a mature and critical segment of the market. The global success of blockbuster antibodies has ensured consistent investment in downstream capacity expansion for mAb manufacturing.

Vaccine production is the fastest-growing application area, driven by COVID-19, resurgence of diseases like measles, and new mRNA vaccine developments. The pandemic revealed the global need for rapid, large-scale vaccine purification solutions. Technologies optimized for lipid nanoparticle purification, viral vector purification, and protein subunit vaccines are experiencing surging demand. This trend is expected to persist, fueled by continued pandemic preparedness and emerging infectious disease threats.

Some of the prominent players in the Downstream Processing Market include:

- Merck KGaA

- Sartorius Stedim Biotech S.A

- GE Healthcare

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Repligen

- 3M Company

- Boehringer Ingelheim International GmbH

- Corning Corporation

- Lonza Group Ltd

- Dover Corporation

- Ashai Kasei

- Ferner PLC

- Eppendorf AG

Recent Developments

-

March 2025: Thermo Fisher Scientific announced the launch of its new single-use chromatography system tailored for mRNA vaccine production.

-

February 2025: Sartorius Stedim Biotech acquired a membrane filtration startup specializing in viral vector purification technologies.

-

January 2025: Cytiva unveiled its high-capacity Protein A resin, offering a 30% increase in throughput for monoclonal antibody purification.

-

December 2024: Repligen Corporation expanded its bioprocessing facility in Massachusetts to meet rising demand for TFF membrane systems.

-

November 2024: Merck KGaA (MilliporeSigma) introduced a new continuous chromatography platform to support multi-product facility operations.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Downstream Processing Market

By Product

- Chromatography Systems

- Filters

- Evaporators

- Centrifuges

- Dryers

- Others

By Technique

- Cell Disruption

- Solid-liquid separation

-

- Filtration

- Centrifugation

-

- Evaporation

- Membrane filtration

- Purification by Chromatography

- Formulation

By Application

- Antibiotic Production

- Hormone Production

- Antibodies Production

- Enzyme Production

- Vaccine Production

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)