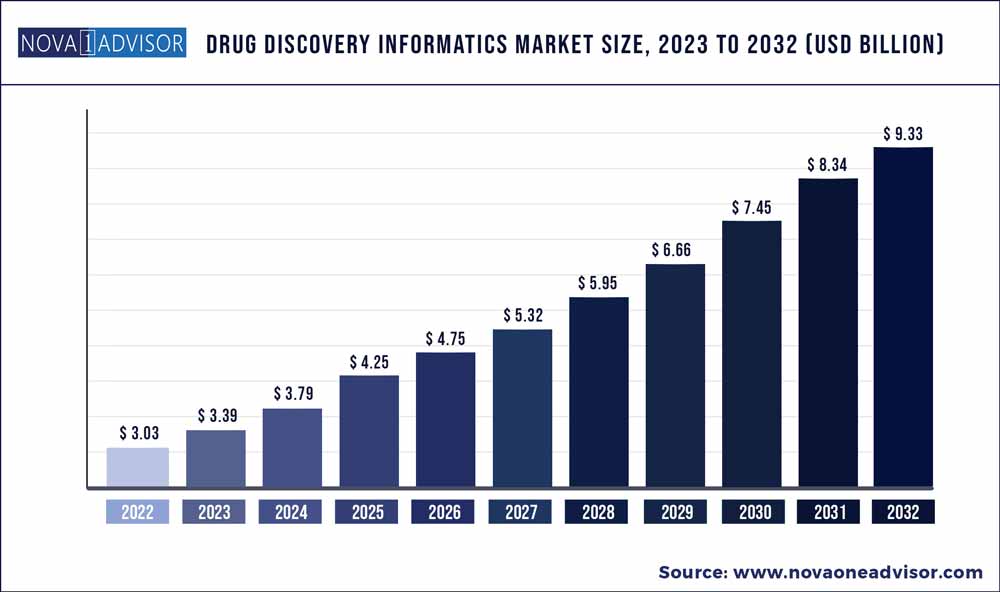

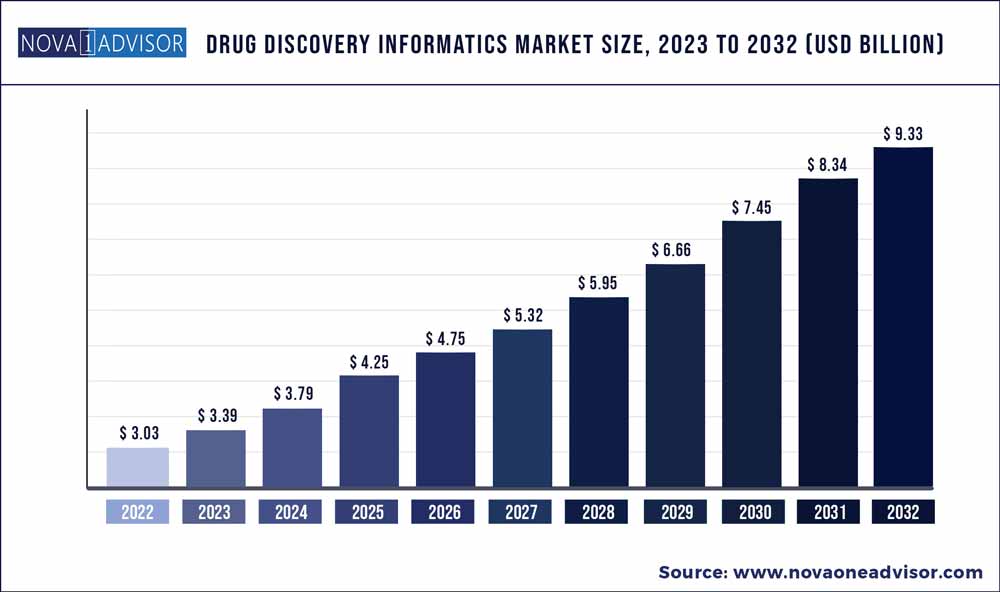

The drug discovery informatics market size accounted for USD 3.03 billion in 2022 and is estimated to achieve a market size of USD 9.33 billion by 2032, growing at a CAGR of 11.9% from 2023 to 2032.

Key Pointers:

- The sequencing and target data analysis segment accounted for the largest share of the drug discovery informatics market

- The pharmaceutical companies segment accounted for the largest share of the drug discovery informatics market

- North America accounted for the largest share of the market.

Report Scope of the Drug Discovery Informatics Market

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 3.39 Billion

|

|

Market Size by 2032

|

USD 9.33 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 11.9%

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Function, Application, Solution, End User

|

|

Geographies Covered

|

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain and RoE), APAC, and RoGeographies CoveredW

|

|

Key companies profiled

|

Jubilant Life Sciences Limited (India), Charles River Laboratories (US), IBM (US), Clarivate Analytics (US), Eurofins Scientific (Germany), Thermo Fisher Scientific (US), Accenture PLC (Ireland), PerkinElmer Inc (US), Charles River Laboratories International (US), Schrödinger, Inc. (US), Albany Molecular Research (US), Certara (US), Evotec AG (Germany), Dassault Systèmes (Germany), Infosys Limited (India), Collaborative Drug Discovery (CDD), GVK Biosciences (India), Open Eye Scientific (US), Novo Informatics (India), Selvita (Poland), Cognizant (US), Scilligence (US), WuXi AppTec (China), Asteris, IO Informatics (US), Domainex (UK)

|

The drug discovery informatics market is set to gain momentum in the coming years due to advancements in high-performance computing & web services, increasing adoption of in-silico modeling tools, the growing volume of drug discovery data, and rising demand for novel medicine moieties. The launch of advanced drug discovery information technology is set to intensify the industry competition. For instance, in January 2021, Certara, Inc. launched Simcyp Physiologically-based Pharmacokinetic (PBPK) Simulator platform version 20. The new models help in assessing and analyzing the drug action during pregnancy and lactation.

In addition, it helps the customers with critical decisions regarding optimizing medicine safety and efficacy profile. Companies are also increasingly adopting informatics solutions to shorten the long drug discovery timeline. For instance, in December 2020, Curve Therapeutics Ltd. implemented the CDD Vault platform for managing its genetically encoded Microcycle platform. It is a ubiquitous hosted platform suitable for applications across pharmaceutical, biotechnology, and academic institutes for securing and seamless sharing of data in real-time, thereby facilitating collaborative discoveries.

The sequencing and target data analysis segment accounted for the largest share of the drug discovery informatics market for the function segment of the market. The large share of this segment can be attributed to increased application for sequencing analysis for the new drug entity and ease of handling of information from different sources and different domains.

The pharmaceutical companies segment accounted for the largest share of the drug discovery informatics market; pharmaceutical companies are using this informatics software extensively for pre-clinical research & development, target identification, compound screening and lead identification, and streamlining their drug discovery process which is the major factor for driving the growth of this segment.

The drug discovery informatics market is divided into four major regions-north America, Europe, Asia Pacific, and the Rest of the World (RoW). North America accounted for the largest share of the global drug discovery informatics market, closely followed by Europe. The large share of North America in the global market can be attributed to the presence of well-established CROs, rising R&D expenditure by pharmaceutical and biopharmaceutical companies

The Asia Pacific is estimated to grow at the highest CAGR during the forecast period. Factors such as the rapid growth in the pharmaceutical and biopharmaceutical industry, rising number of CROs, and the presence of less-stringent regulations for drug discovery processes

Drug Discovery Informatics Market Segmentation

| By Function |

By Application |

By Solution |

By End User |

- Sequencing and Target Data Analysis

- Docking

- Molecular Modelling

- Library & Database Preparation

- Other functions

|

- Drug Discovery

- Drug Development

|

|

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organization

- Other End Users

|