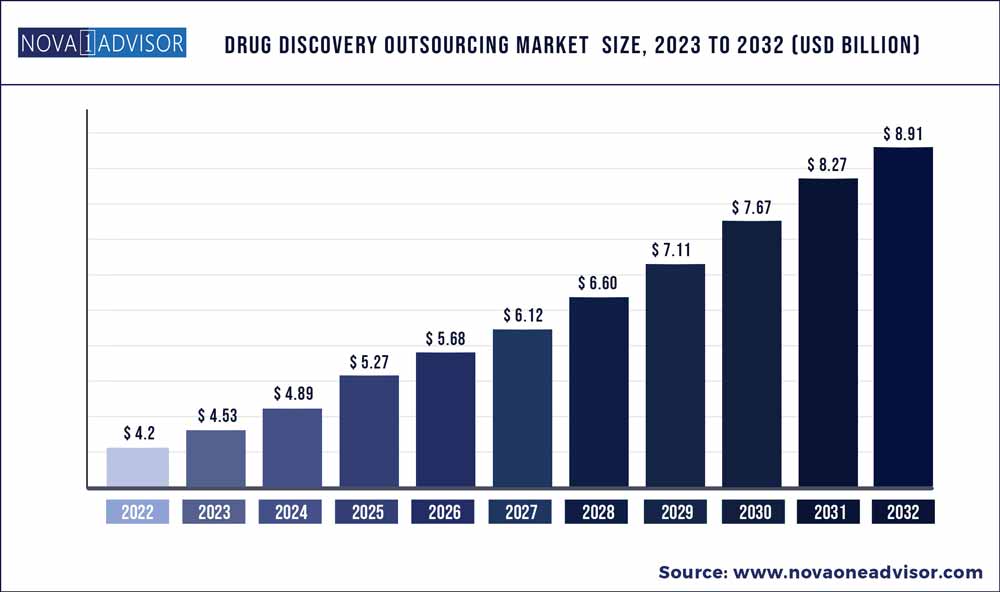

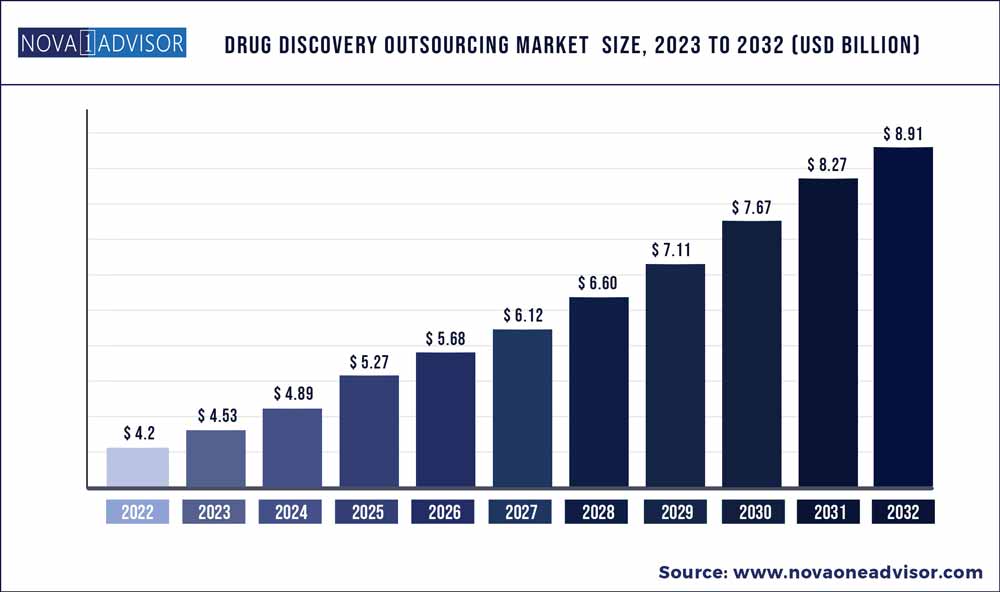

The global drug discovery outsourcing market size was exhibited at USD 4.2 billion in 2022 and is projected to hit around USD 8.91 billion by 2032, growing at a CAGR of 7.8% during the forecast period 2023 to 2032.

Key Pointers:

- Lead identification & candidate optimization dominated the workflow segment with a revenue share of more than 33.00% in 2022.

- The respiratory systems segment accounted for the largest share of over 14.9% of the global revenue in 2022.

- The small molecules/pharmaceuticals segment accounted for the largest share of over 78.3% in 2022

- North America dominated the market in 2022 and accounted for the largest share of more than 36.8%

Drug discovery outsourcing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 4.53 Billion

|

|

Market Size by 2032

|

USD 8.91 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 7.8%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Workflow, therapeutics area, drug type, type, end-user and region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Key companies profiled

|

Albany Molecular Research Inc.; EVOTEC; Laboratory Corporation of America Holdings; GenScript; Pharmaceutical Product Development, LLC; Charles River; WuXi AppTec; Merck & Co., Inc.; Thermo Fisher Scientific Inc.; Dalton Pharma Services; Oncodesign; Jubilant Biosys; DiscoverX Corp.; QIAGEN; Eurofins SE, Syngene International Limited, Dr. Reddy Laboratories Ltd., Pharmaron Beijing Co., Ltd., TCG Lifesciences Pvt Ltd., Domainex Ltd.

|

According to a survey conducted by Life Science Strategy Group of 120 clinical development decision-makers in the U. S., Europe, and China, industry professionals are undertaking major strategic changes to maintain their share in the unpredictable market scenario post the COVID-19 pandemic. The pharmaceutical industry has witnessed radical changes in the past two decades, in terms of a shift toward biologics, patent expiration, and unprecedented downsizing of internal discovery of big pharmaceuticals. All of this has accelerated the adoption of outsourcing activities.

Breaking down the different steps of drug discovery, such as hit confirmation, lead generation, lead optimization, and high-speed screening allows players to specialize in their core services. An estimated 75.0% to 80.0% of R&D spending in the biopharmaceutical industry can be outsourced, creating opportunities for Contract Research Organizations (CROs), which, in turn, is expected to boost the market growth. Pharmaceutical companies are partnering with manufacturing facilities in developing countries, which are backed by skilled manpower, low cost, and quality data. Cost-cutting, chasing innovation, gaining access to specialized knowledge and technology, and increasing speed and agility are some of the significant factors encouraging pharma companies to expand the level of outsourcing.

This, in return, is expected to increase competition among key players, leading to the emergence of various new startups across the hotspot regions, such as the U.S., China, India, South Korea, Singapore, and other southeast Asian countries. For instance, in July 2018, Syngene International Ltd., a leading CRO based in India, extended its R&D collaboration with Baxter Healthcare Corporation until 2024. In March 2018, the company formed a multi-year agreement with GlaxoSmithKline (GSK) to accelerate the discovery of new drug candidates. The COVID-19 pandemic has slowed down various drug discovery processes due to the halting of various clinical trials.

However, on a brighter note, generous incentives are expected for pharmaceutical companies to invest in developing Infectious Diseases (ID) drugs and vaccines. Public health challenges in oncology, heart disease, and many other rare conditions still exist. For these, clinical research must go on. Here, CROs are expected to utilize their creativity to the fullest. With an urgent need for an effective vaccine/drug, companies are increasingly opting for outsourcing to enhance their clinical trials, which is expected to boost market growth for several years.

Workflow Insights

Lead identification & candidate optimization dominated the workflow segment with a revenue share of more than 33.00% in 2022. Based on workflows, the market is segmented into target identification & screening, target validation & functional informatics, lead identification & candidate optimization, preclinical development, and other associated workflows. The iterative process of lead identification, also known as hit-to-lead, is a significant stage in early drug discovery. It has historically proven to have improved efficiencies and economies of scale for drug developers. The introduction of advanced in silico techniques to improve the lead identification process, such as Computer-Aided Drug Discovery (CADD) and structure-based drug designs, support segment growth.

The rising need for skilled resources with combinational knowledge of metabolism, analytical chemistry, and computer software, along with the high cost associated with the integration of the latest computation technology, is enabling higher outsourcing for lead identification services. As a result, lead identification and candidate optimization accounted for the largest share, in terms of revenue in 2022. The other associated services segment, which includes cell line development, upstream & downstream processes, analytical/bioanalytical methods, formulations & quality assessment, and regulatory assistance, is anticipated to witness rapid growth in the coming years. This is owing to the increased adoption of outsourcing services and high investments in drug discovery R&D.

Therapeutics Area Insights

The respiratory systems segment accounted for the largest share of over 14.9% of the global revenue in 2022. Based on therapeutic areas, the market is segmented into the respiratory system, pain and anesthesiaoncology, ophthalmology, hematology, cardiovascular, endocrine, gastrointestinal, immunomodulation, anti-infective, central nervous system, dermatology, and genitourinary system. High incidence of respiratory disorders, such as bronchitis, tuberculosis, Chronic Obstructive Pulmonary Diseases (COPD), and asthma, coupled with increasing cases of drug resistance, has influenced the segment growth.

Furthermore, the introduction of novel drug delivery technologies, such as nasal sprays, has been identified to be the key contributor to the segment revenue. Lung diseases are responsible for over 700,000 hospital admissions and over 6 million inpatient bed-days in the U.K. per year. An estimated 1.2 million people are living with diagnosed COPD in the U.K. In view of this, in 2018, The University of Nottingham formed a strategic research collaboration with GSK and the University of Leicester.The collaboration is aimed at accelerating the discovery and development of innovative treatments for COPD. The oncology and anti-infective segments are both projected to witness significant CAGRs over the forecast period.

Increased focus on the identification of novel targets to support cancer treatment contributes to the lucrative growth of the oncology segment.In June 2020, AstraZeneca collaborated with Accent Therapeutics to discover, develop and commercialize transformative therapeutics targeting RNA-Modifying Proteins (RMPs) for the treatment of cancer. Accent will be responsible for R&D activities for a nominated preclinical program through to the end of Phase I clinical trials. Antimicrobial resistance is projected to become a global crisis with its soaring rate of emergence and spread resulting in a high economic burden. Companies have increased R&D in anti-infective drugs, having identified the future need. This is poised to benefit the market growth.

Drug Type Insights

The small molecules/pharmaceuticals segment accounted for the largest share of over 78.3% in 2022 and is projected to expand further at the fastest CAGR during the forecast period. Based on drug types, the market is classified into small and large molecules. Small molecules play a significant role in the development of innovative treatments for patients worldwide. Sales of half of the specialty medicines are attributable to small molecule applications. Its role is also visible in the recent approval trends. In 2019, the FDA approved 48 new drugs, 79% of which were composed of small molecules. Small molecules continue to play a vital role in the innovation of treatments across four key therapeutic areas: oncology, cardiovascular, autoimmune, and respiratory diseases.

Increased significance and highly effective components add up to the potential of small molecules in the pharmaceutical portfolio. Owing to this, the small molecules segment held the largest share in the market. Furthermore, the advantages of small molecules over larger ones have increased investments in the field, especially in cancer research. Small molecules can be administered orally, especially for the treatment of chronic diseases, they are cheaper, easy to manufacture, and can be combined with intracellular targets. Ongoing studies to investigate and develop novel therapeutics for various indications are expected to further influence segment growth.

Regional Insights

North America dominated the market in 2022 and accounted for the largest share of more than 36.8% of the global revenue. The growth of the regional market can be attributed to the technological advancements, presence of well-established research infrastructure & key players, and higher investments in drug discovery R&D. With outsourcing no longer being solely about cost reduction, rising need for efficiency, quality, and innovation are expected to contribute to market growth.The Asia region is projected to register the fastest CAGR during the forecast period. The region is emerging as a hub for outsourcing drug discovery activities owing to the availability of skilled manpower, lower costs, favorable regulatory environment, and quality data.

Japan, being the second-largest pharmaceutical market at a global level, is expected to provide a robust opportunity for CROs, thus driving the market. The revised Pharmaceutical Affairs Law supports research activities regarding tissue diagnostics and cancer in Japan, which is expected to boost the market growth in this country. In 2015, the Japan Agency for Medical Research and Development (AMED) was established with an objective to manage data related to investigations and clinical trials, improve R&D infrastructure, and promote international strategies. This agency is an example of the initiatives taken to boost the market growth in Japan.

Some of the prominent players in the Drug discovery outsourcing Market include:

- Albany Molecular Research Inc.

- EVOTEC

- Laboratory Corporation of America Holdings

- GenScript

- Pharmaceutical Product Development, LLC

- Charles River

- WuXi AppTec

- Merck & Co., Inc.

- Thermo Fisher Scientific Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Dr. Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

- Domainex Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global drug discovery outsourcing market.

By Workflow

- Target Identification & Screening

- Target Validation & Functional Informatics

- Lead Identification & Candidate Optimization

- Preclinical Development

- Other Associated Workflow

By Therapeutics Area

- Respiratory System

- Pain and Anesthesia

- Oncology

- Ophthalmology

- Hematology

- Cardiovascular

- Endocrine

- Gastrointestinal

- Immunomodulation

- Anti-infective

- Central Nervous System

- Dermatology

- Genitourinary System

By Drug Type

- Small Molecules

- Large Molecules (Biopharmaceuticals)

By Type

- Chemistry Services

- Biology Services

By End-User

- Pharmaceutical & Biotechnology companies

- Academic Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)