Drug Screening Market Size and Forecast 2026 to 2035

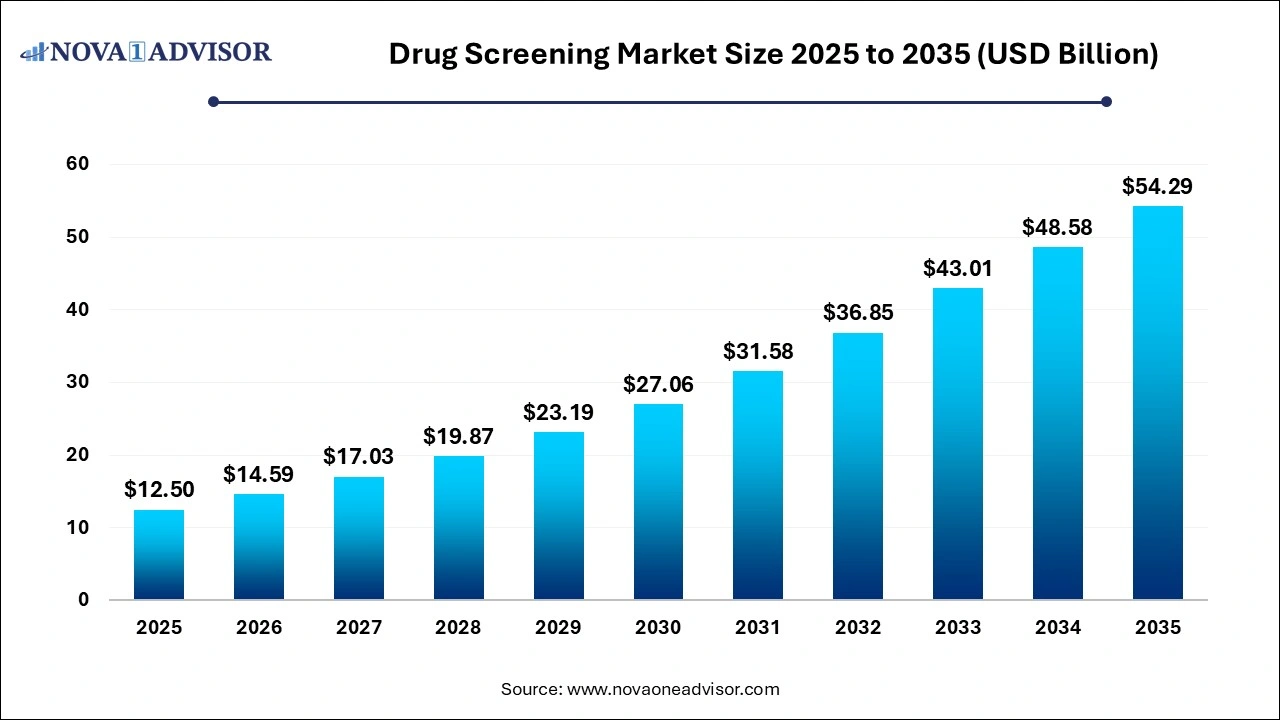

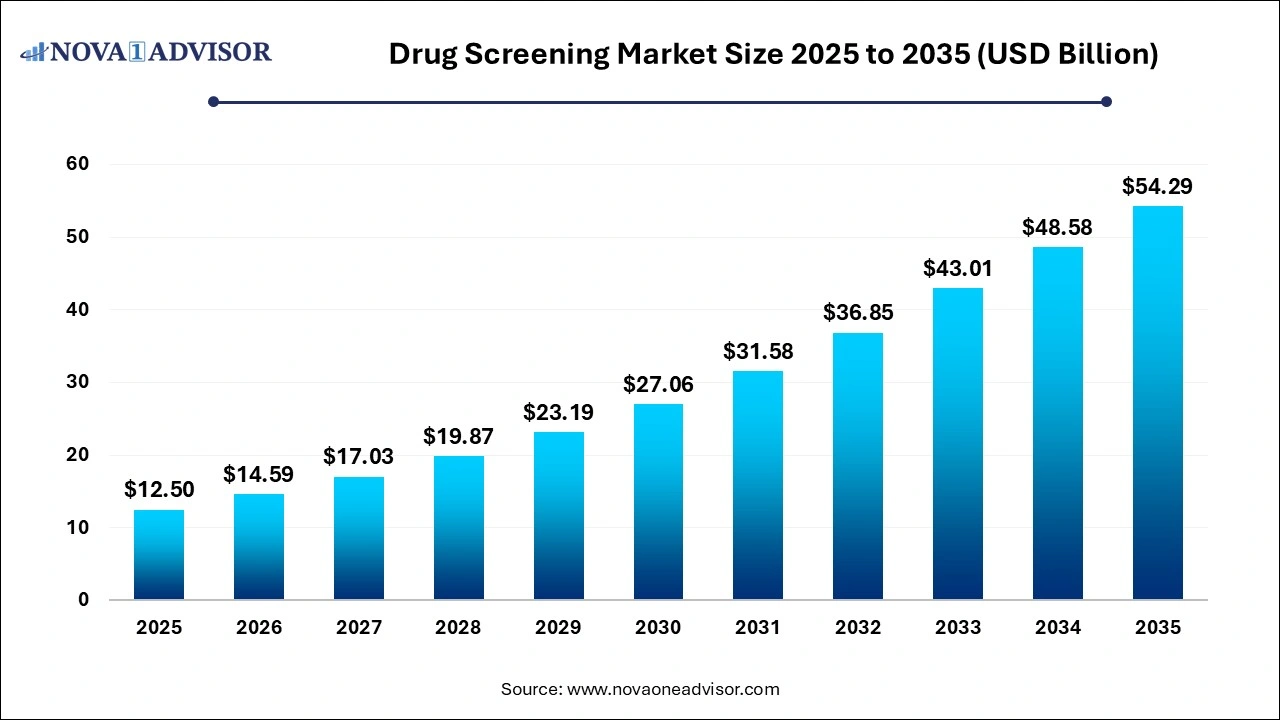

The global drug screening market size was valued at USD 12.5 billion in 2025 and is anticipated to reach around USD 54.29 billion by 2035, growing at a CAGR of 15.82% from 2026 to 2035.

Drug Screening Market Key Takeaways

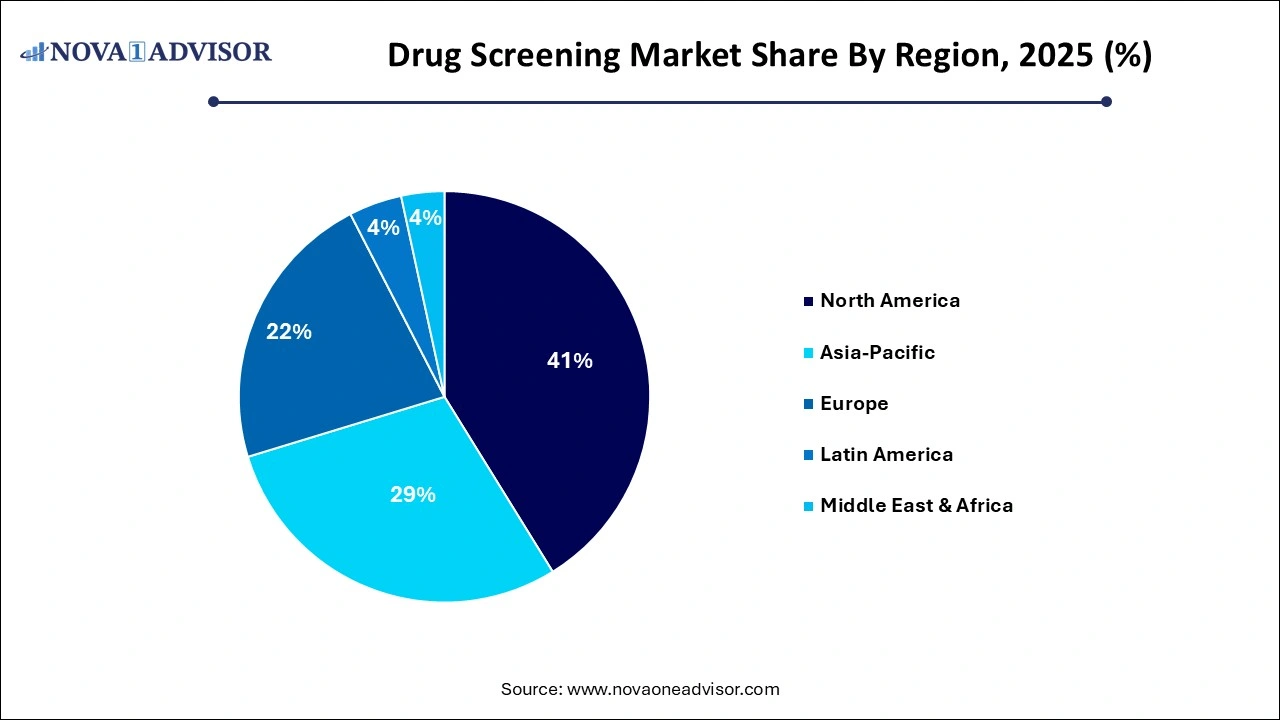

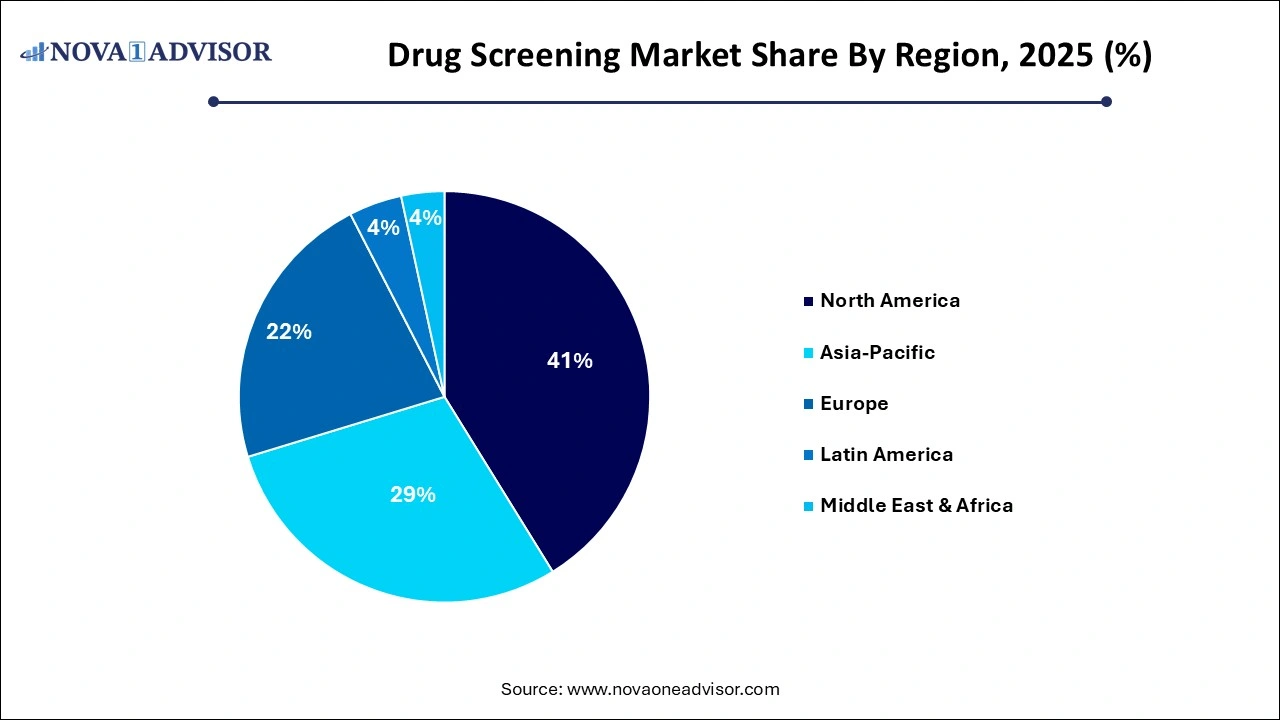

- North America drug screening market accounted for a 41% share in 2025.

- The drug screening market in Asia Pacific is anticipated to witness fastest growth over the forecast period.

- Consumables led the market and accounted for 35.18% of the global revenue in 2025 and is anticipated to grow at the fastest CAGR over the forecast period.

- Services and others held the second-largest market share in 2025.

- Drug treatment centers led the market with a market share of 27.22% in 2025.

- Pain management centers is projected to witness fastest growth rate over the forecast period.

- Urine Samples led the market with a market share of 42.16% in 2025.

- Oral fluid samples held the second-largest market share in the market in 2025.

Drug Screening Market Overview

The drug screening market has evolved into a crucial segment of the healthcare, workplace safety, law enforcement, and educational sectors. Drug screening encompasses testing for illicit drugs, prescription medications, and substances of abuse to ensure public safety, workplace productivity, and patient compliance. Originally confined to forensic and criminal investigations, drug testing has now permeated corporate, clinical, and even academic settings.

Key drivers fueling this market include the global rise in substance abuse disorders, strict regulatory mandates for workplace drug testing, and technological advances making drug testing faster, cheaper, and more reliable. The COVID-19 pandemic further highlighted the importance of maintaining a drug-free workforce, especially among healthcare and essential service providers, leading to expanded testing programs.

Modern drug screening techniques leverage immunoassays, chromatography, and mass spectrometry for highly sensitive and specific results. Rapid testing devices and point-of-collection testing (POCT) systems have dramatically increased the accessibility of drug screening, empowering even small businesses and individual users. As the stigma around mental health and addiction treatment diminishes, drug screening is increasingly viewed as part of broader wellness and safety initiatives, enhancing its adoption globally.

Major Trends in the Drug Screening Market

-

Rise of Rapid Testing Devices: Urine and oral fluid rapid tests are gaining traction due to quick results and on-site usability.

-

Expansion of Hair and Oral Fluid Testing: Long detection windows and non-invasive sample collection methods are expanding application areas.

-

Technological Innovations in Breath Analyzers: Fuel-cell and semiconductor technology advancements improve accuracy and portability.

-

Growing Adoption of Random Workplace Testing: Organizations are adopting unannounced drug tests to deter substance abuse proactively.

-

Integration of AI and Automation in Laboratory Testing: Faster data analysis, reduced manual errors, and predictive analytics for risk assessment.

-

Legalization of Cannabis Prompting Policy Revisions: Employers are revisiting drug policies in regions where marijuana is legalized, fueling demand for more nuanced tests.

-

Rising Use in Schools and Colleges: Growing concerns about teenage substance abuse are leading educational institutions to implement screening programs.

-

Home Testing Kits and Individual Users: Increased accessibility of home drug testing kits for personal or parental use.

Drug Screening Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 14.59 Billion |

| Market Size by 2035 |

USD 54.29 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 15.82% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product type, By sample type, By end-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott; Quest Diagnostics Incorporated; F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific Inc.; Siemens Healthcare AG; Laboratory Corporation of America Holdings; Alfa Scientific Designs, Inc.; OraSure Technologies, Inc.; Omega Laboratories, Inc.; Drägerwerk AG & Co. KGaA; Bio-Rad Laboratories, Inc. |

Drug Screening Market Dynamics

Driver: Growing Substance Abuse and Need for Workplace Safety

The most critical driver of the drug screening market is the rising global incidence of substance abuse and the parallel emphasis on workplace safety. According to reports by the UNODC (United Nations Office on Drugs and Crime), over 296 million people globally used drugs at least once in 2021 a figure that continues to grow.

In response, employers, especially in sectors like construction, healthcare, transportation, and manufacturing, are instituting regular drug testing programs to minimize accidents, improve productivity, and safeguard company reputations. Laws such as the U.S. Department of Transportation (DOT) regulations mandate routine drug screening for safety-sensitive positions. This necessity fuels continuous, predictable demand for drug screening services and equipment across multiple sectors.

Restraint: Ethical and Privacy Concerns

Despite its widespread acceptance, ethical and privacy concerns present significant restraints for the drug screening market. Critics argue that mandatory drug testing may infringe upon individual rights, particularly when conducted without probable cause. The collection of biological samples urine, hair, or blood raises apprehensions about personal dignity and data misuse.

Moreover, false positives, especially from immunoassays, can lead to wrongful employment termination or legal action, further complicating the ethical landscape. Organizations are increasingly required to ensure that their testing protocols comply with regulations like the Americans with Disabilities Act (ADA) and respect confidentiality, adding layers of complexity to deployment.

Opportunity: Integration with Digital Health Platforms

A notable opportunity lies in the integration of drug screening results with digital health and wellness platforms. With telemedicine, wearable health monitoring, and electronic health records (EHR) becoming mainstream, drug screening data can provide valuable insights for preventive healthcare, treatment adherence monitoring, and rehabilitation management.

Digital integration allows for seamless tracking of recovery in substance abuse programs, risk stratification in workplaces, and improved personalization of pain management therapies. Companies offering drug screening solutions bundled with cloud-based dashboards, analytics, and reporting tools stand to gain a competitive advantage in this increasingly connected healthcare ecosystem.

Drug Screening Market Segmental Insights

By Product Type Insights

Rapid testing devices dominate the product type segment, largely due to their portability, cost-effectiveness, and quick turnaround time. Urine testing devices such as cups, dip cards, and cassettes are extensively used in workplaces, schools, and home settings. Their ability to deliver results within minutes without the need for laboratory infrastructure makes them extremely popular for mass screening programs.

Consumables are the fastest-growing segment, propelled by the recurring nature of their use. Assay kits, sample collection devices, calibrators, and controls are critical components of both rapid and laboratory-based drug testing workflows. As testing volumes rise, especially post-pandemic, the demand for high-accuracy, ready-to-use consumables has surged. Innovations in multi-panel assay kits capable of detecting multiple drugs simultaneously are driving consumables' market growth further.

By End-use Insights

Criminal justice and law enforcement agencies dominate the end-use segment, given the essential role of drug screening in probation monitoring, court-mandated testing, pretrial drug testing, and DUI investigations. Breath analyzers, rapid urine tests, and advanced chromatography systems are critical tools in maintaining judicial compliance and ensuring community safety.

Schools and colleges represent the fastest-growing end-use, propelled by increasing concerns about rising drug use among teenagers and young adults. Random drug testing programs in high schools, athletic departments, and university dormitories are becoming more commonplace. Educational institutions aim to create drug-free environments, prevent early addiction, and support students through early interventions.

By Technology Insights

Urine sample testing dominates the market, maintaining its position as the most widely used method for drug screening. Urine tests are highly sensitive, cost-effective, and have established legal acceptability in workplaces, law enforcement, and treatment centers. Technology innovations continue to refine urine testing with better sample integrity checks and expanded drug panels.

Oral fluid testing is the fastest-growing technology, driven by the non-invasive, observed sample collection, reducing the risk of adulteration. It offers a shorter detection window, making it ideal for identifying recent drug use, which is particularly valuable in accident investigations and random workplace testing. Emerging oral fluid analyzers are now achieving sensitivity levels close to urine tests, expanding their applicability.

U.S. Drug Screening Market Size, Industry Report 2026 to 2035

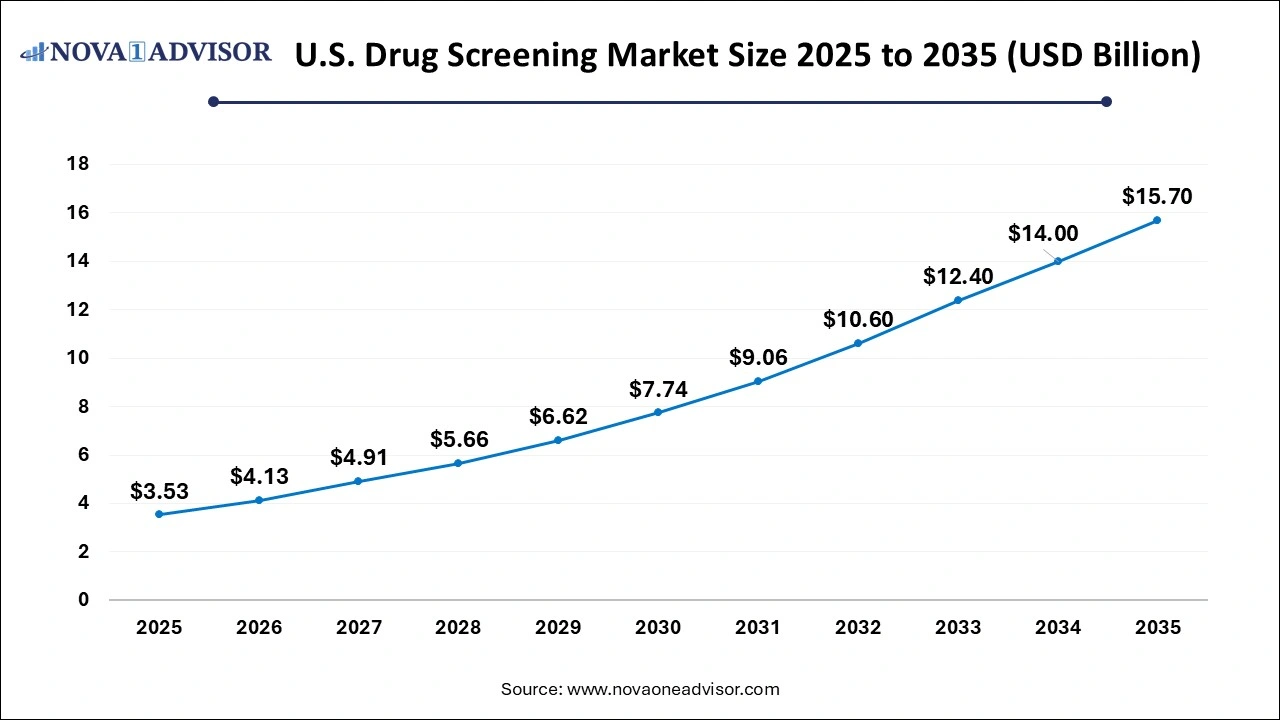

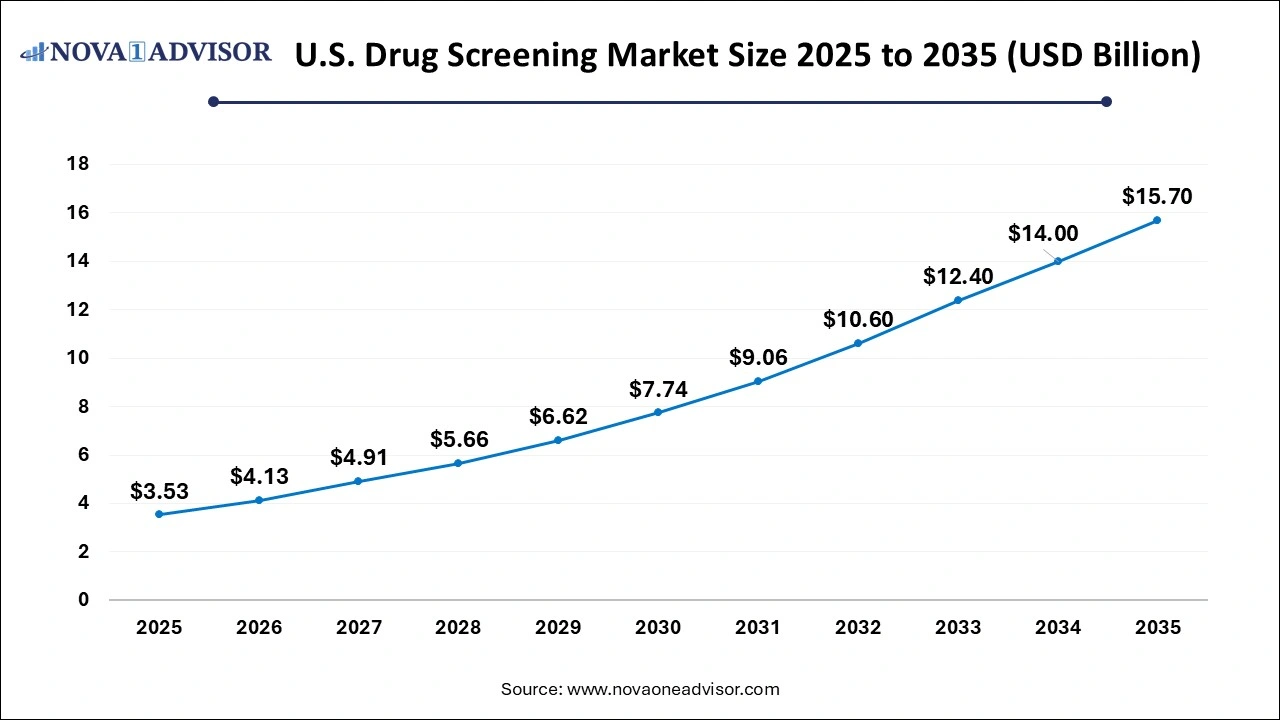

The U.S. drug screening market size is projected to be worth around USD 15.7 billion by 2035 from USD 3.53 billion in 2025, at a CAGR of 16.09% from 2026 to 2035.

North America dominates the global drug screening market, driven by stringent workplace safety regulations, the high prevalence of substance abuse, and a proactive law enforcement culture. The U.S. Department of Transportation’s mandated testing for commercial drivers, pilots, and railroad workers alone generates significant demand. Furthermore, the corporate sector has embraced pre-employment and random drug testing as standard HR practices.

Additionally, opioid misuse in the U.S. has triggered enhanced drug screening in healthcare settings, pain management centers, and rehabilitation programs. Major players such as Quest Diagnostics, Abbott Laboratories, and Thermo Fisher Scientific maintain robust service and distribution networks in the region.

Asia-Pacific is the fastest-growing region, fueled by increasing substance abuse rates, urbanization, and strengthening government initiatives to curb drug use. Countries like China, India, and Australia are investing in national drug monitoring programs, workplace testing regulations, and healthcare reforms.

Asia-Pacific’s growing industrial base, coupled with rising cross-border transportation and logistics industries, necessitates routine employee drug screening. Furthermore, cultural shifts toward greater acceptance of wellness and safety initiatives are opening the door for rapid testing device adoption, especially in emerging markets.

Drug Screening Market Top Key Companies:

The following are the leading companies in the drug screening market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Quest Diagnostics Incorporated

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Siemens Healthcare AG

- Laboratory Corporation of America Holdings

- Alfa Scientific Designs, Inc.

- OraSure Technologies, Inc.

- Omega Laboratories, Inc.

- Drägerwerk AG & Co. KGaA

- Bio-Rad Laboratories, Inc.

Drug Screening Market Recent Developments

-

March 2025: Abbott Laboratories introduced an AI-powered mobile app linked to its workplace drug testing devices, enhancing real-time result tracking and reporting.

-

February 2025: Thermo Fisher Scientific expanded its toxicology solutions with new oral fluid testing kits featuring improved sensitivity for THC and opioids.

-

January 2025: Omega Laboratories opened a new hair drug testing laboratory in Europe to meet rising demand from corporate clients.

-

December 2024: Quest Diagnostics announced a partnership with a telemedicine platform to integrate at-home drug screening kits with virtual recovery programs.

-

November 2024: Intoximeters Inc. launched a next-generation handheld fuel cell breathalyzer with Bluetooth connectivity for law enforcement applications.

Drug Screening Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the Drug Screening market.

By Product Type

- Instruments

- Immunoassays Analyzers

- Chromatography Instruments

- Breath Analyzer

- Fuel Cell Breath Analyzer

- Semi-conductor Breath Analyzer

- Others Breath Analyzer

- Rapid Testing Devices

- Urine Testing Devices

- Drug Testing Cups

- Dip Cards

- Drug Testing Cassettes

- Oral Fluid Testing Devices

- Consumables

- Assay Kits

- Sample Collection Devices

- Calibrators & Controls

- Other Consumables

- Services and Others

By Technology

- Urine Samples

- Breath Samples

- Oral Fluid Samples

- Hair Samples

- Other Samples

By End-use

- Hospitals

- Criminal Justice & Law Enforcement Agencies

- Workplaces

- Drug Treatment Centers

- Individual Users

- Pain Management Centers

- Schools & Colleges

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)