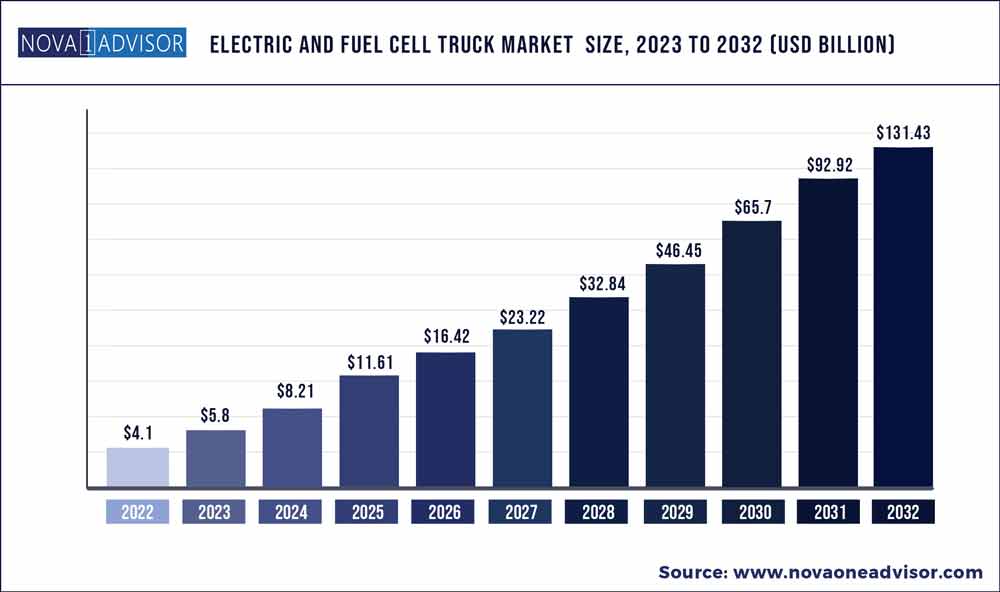

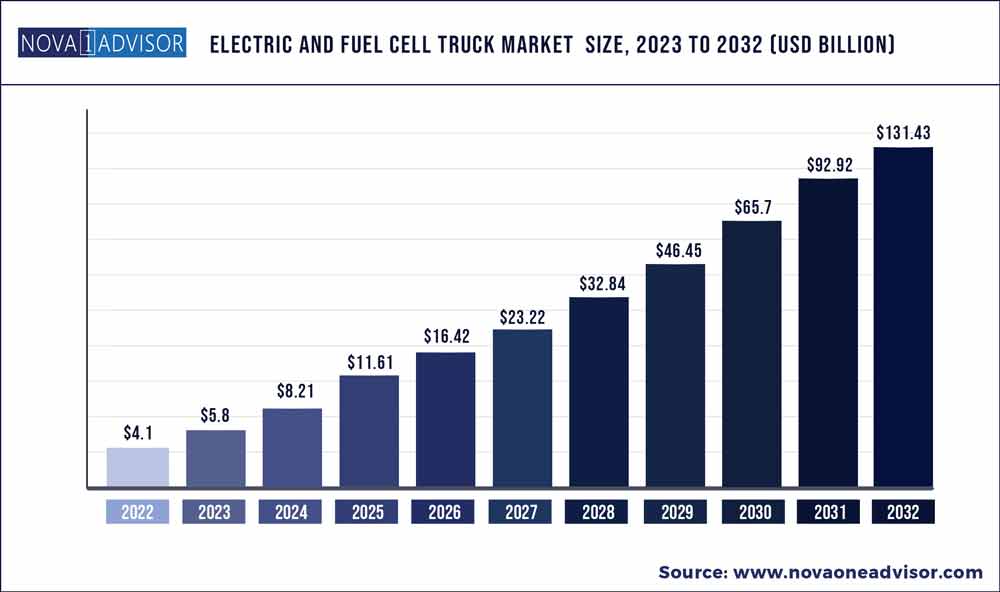

The global electric and fuel cell truck market size was exhibited at USD 4.1 billion in 2022 and is projected to hit around USD 160.7 billion by 2032, growing at a CAGR of 41.44% during the forecast period 2023 to 2032.

Key Pointers:

- The PEMFC to account for the largest share to increase the market share of electric and fuel cells truck.

- 100 - 200kW having considerable rise in the market due to zero emission of the carbondioxide may enhance the market of electric and fuel cell truck during the forecast.

- Passenger vehicle to hold the largest position, bus with the second highest position, followed by light commercial vehicles and trucks.

- Asia Pacific region to hold the top position with increased revenue share

Electric and Fuel Cell Truck Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 5.8 Billion

|

|

Market Size by 2032

|

USD 131.43 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 41.44%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Type, Power Rating, Vehicles

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Nuvera Fuel Cells, LLC, ITM Power, Delphi Technologies, Hydrogenics, Toshiba, Dialmer AG, American Honda Motor Company, Plug Power, Nedtack Fuel Cell Technology, Nissan Motor Corporation, Toyota Motor Company, Hyundai Motor Company, Ballard Power Systems, W.L. Gore and Associates, Bing Energy, Hauzer Techno Coating B.V., Sinocat Environmental Technology Co, Ltd, Wuhan Tiger FCV, Valmet Automotive, Symbio, StreetScooter, Ceres Power, AVL, Bosch, ElringKlinger, Faurecia, FEV Group GmbH, Inteligent Energy, Continental Industries, Wystrach, Wind2Gas Energy GmbH & Co KG, UQM Technologies, Umicore

|

Electric and fuel cell electric vehicles are the best developed alternatives for combustion-based automobiles. Electric and fuel cell trucks are the newly developed innovative technology which are electronics-based trucks and installed embedded systems, fuel cells, battery, capacitor to give power to the battery. In the trucks fuel cells are present which is used to produce electric power by utilizing oxygen from the air and the hydrogen.

Majorly electric and fuel cell vehicles are free from emission of carbondioxide which only involves emission of water and heat. Hydrogen is a natural gas storing and transporting also can cause pollution. Vehicles such as internal combustion vehicles, hydrogen vehicles can also create the pollution which stores the hydrogen. Increased growth of the electric and fuel cell market which majorly involves electric power for running the vehicles.

Major components in the electric and fuel cell truck include fuel cells, battery, capacitor. Due to less emission of carbondioxide gas and improved ecosystem giving rise to clean and green city with improved air quality and less pollution. Majorly fuel cells are developed with three parts such as cathode, anode, electrolyte by producing electricity and storing the power and transmitting. In fuel cell hydrogen is stored which produces electrochemical energy to drive the vehicle.

Impact of covid-19 affected the market growth rate of electric and fuel cell market due to wide spread of corona virus across various regions declined the market growth. Due to norms and regulations imposed by the governments lock down in various regions led to shut down of the doors of many industries which halted the production and manufacturing in automobile industry.

Growth Factors

- The rapidly advanced developed technologies in trucks developing new innovations with improved features in electric and fuel cell trucks.

- Rapid acceptance of the new developments from the consumers which increased the market rate of electric and fuel cell truck.

- Increased focus on developing fuel cell which stores hydrogen acts as electro chemical to drive the vehicle with decreased emission of carbon compared to another combustion vehicles.

- Considering the environment depleting natural resources largely producing number of products in concern with environment and maintaining the ecosystem.

- Increased awareness towards the environment and eco-friendly nature and maintaining the quality of the air by using hydrogen cells for driving the trucks and other vehicles have accelerated the growth of the market.

Increased government initiative for developing the electric and fuel cells truck considering the environment by zero emission of carbon and contributing for producing and manufacturing the electric and fuel cell trucks with increased demands from the consumer extended the market due to less carbon emission which helps the environment to be green and clean with developed infrastructures for refuelling the gas. Increased demand for electric and fuel trucks due fuel efficiency and low emissions and increased prices of the petrol and diesel. Which helps to boost the market to larger extent during the forecast period. Increased investments and awareness about new developed features in automobile industry have contributed for the growth of electric and fuel cells market.

Impact of covid-19 on the electric and fuel cell truck market declined the growth of the market revenue share due to decreased demands from the consumer and shutdown of the automotive industries led to shortening of manufacturing electric vehicles and others. Post pandemic situation raised the demands for thriving the market growth of electric and fuel cell truck increased demands from the consumer with improved focus on ecosystem with clean and green economy and increased rates of the fuel increased market rate of electric an fuel cell truck. The key market players involved in launching new trucks with new various features and increased research and development in electric and fuel cell trucks have expanded the market size value during the forecast period.

Segmental Insights

Type Insights

The PEMFC to account for the largest share to increase the market share of electric and fuel cells truck. Due different new innovations and technologies such as low working temperatures, less start up time, high power density are major factor that favours the PEMFC. Phosphoric acid fuel cell is the also the availibility in transport applications, with increased stability, increased power output, and many more. Which help to drive the market to grow high.

Power Rating Insights

100 - 200kW having considerable rise in the market due to zero emission of the carbondioxide may enhance the market of electric and fuel cell truck during the forecast. Power below 100kW also to hold the highest position to expand the market rate with developed technologies.

Vehicles Insights

Passenger vehicle to hold the largest position, bus with the second highest position, followed by light commercial vehicles and trucks. Increase preference to the electric fuel cell trucks with new research and development in the technology have expanded the market to grow.

Geography Insights

Asia Pacific region to hold the top position with increased revenue share due to increased transportation of goods and improving developments with new technologies in the electric and fuel cell trucks. Along with developed infrastructure and increased government support for developing the electric and fuel cells market with increased focus on zero emission and less noise pollution contributes to expand the market rate.

North America also majorly contributing to increase the demands due to increased research and development and investments by the key market players have helped to boost the market to grow. Europe, Latin America, Middle East and Africa also involved in increasing the electric and fuel cell market rate.

Recent developments

- Plug Power Inc, in October 2021 launching of the 'Renault Master Van H2- Tech prototype' that us HYVIA hydrogen. Providing solutions of turnkey hydrogen with increased environment awareness and improved global economy in the year 2021 in Plug Power Symposium. Introducing van with improved features with hydrogen fuel cell in North America.

- In the year 2021 November, Ballard Power Systems, a largest company in design and manufacturing of PE, fuel cell engines for medium and heavy- duty vehicles, introduced the acquisiion of Arcola Energy, a UK based systems engineering company specialized in hydrogen fuel cell power train and vehicle systems integration.

- In the year 2020 May, UK- based hydrogen energy manufacturer ITM power introduced the formation of H2Oz bus project and signing of an MoU with partners. Involves Transits Systems, part of the Sea-Link Travel Group, Ballard Power System, BOC Limited, Palisade Investment Partners, and ITM Power. Evaluation and performing the concept of hydrogen fuel electric buses used for public bus transport in Australia.

Some of the prominent players in the Electric and Fuel Cell Truck Market include:

- Nuvera Fuel Cells, LLC

- ITM Power

- Delphi Technologies

- Hydrogenics

- Toshiba

- Dialmer AG

- American Honda Motor Company

- Plug Power

- Nedtack Fuel Cell Technology

- Nissan Motor Corporation

- Toyota Motor Company

- Hyundai Motor Company

- Ballard Power Systems

- W.L. Gore and Associates

- Bing Energy

- Hauzer Techno Coating B.V.

- Sinocat Environmental Technology Co, Ltd

- Wuhan Tiger FCV

- Valmet Automotive

- Symbio

- StreetScooter

- Ceres Power

- AVL

- Bosch

- ElringKlinger

- Faurecia

- FEV Group GmbH

- Inteligent Energy

- Continental Industries

- Wystrach

- Wind2Gas Energy GmbH & Co KG

- UQM Technologies

- Umicore

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Electric and Fuel Cell Truck market.

By Type

- Phosphoric Acid Fuel Cell

- Proton Exchange Menbrance Fuel Cell

- Others

By Power Rating

- Below 100 kW

- 100 - 200 kW

- Above 200kW

By Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

- Bus

- Trucks

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)